- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How to Navigate the ACA Employer Mandate презентация

Содержание

- 2. What is the Employer Mandate? “Employer Shared Responsibility Provision” “Pay or Play Provision”

- 3. Coverage Requirement “Under the Affordable Care Act’s

- 4. Provide qualifying health coverage to your full time employees or pay a big fine.

- 5. Reporting Requirement “The same employers that are

- 6. Submit 1095-C and 1094-C forms to the IRS. Provide 1095-C to employees.

- 8. Average of 50 or more full-time employees

- 9. Average of 30 or more hours per

- 10. Sum of full-time employees + equivalents (for

- 11. Transition relief may apply to your company if you had 50-99 employees in 2014.

- 13. One per company Summary of ACA

- 14. One per employee - like a W-2

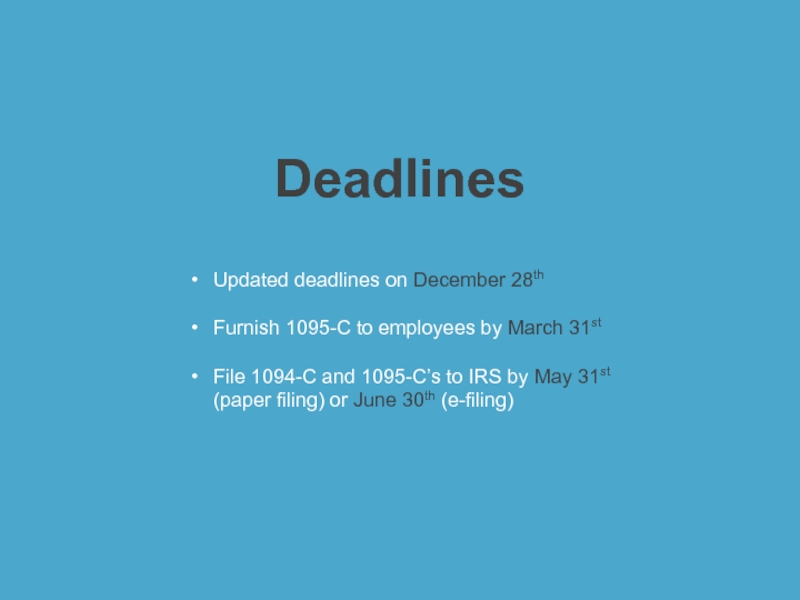

- 15. Updated deadlines on December 28th

- 17. We're not ACA consultants, but we are

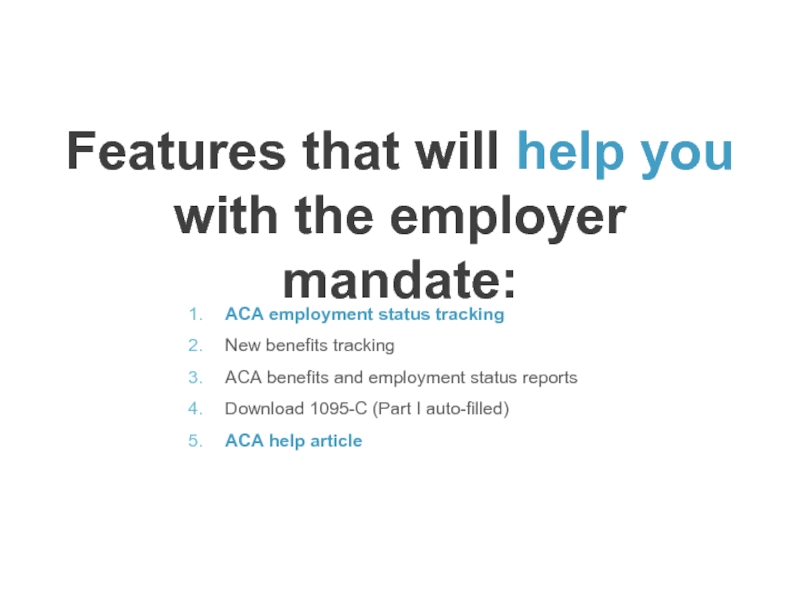

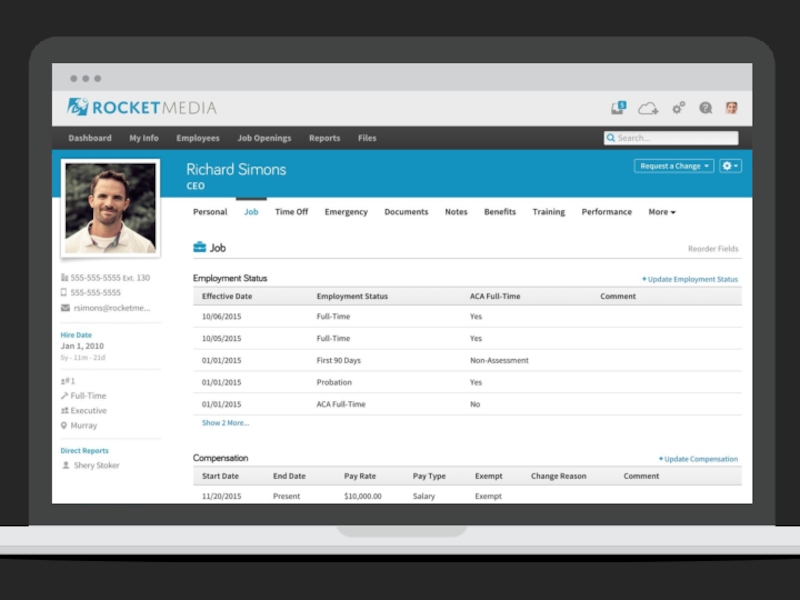

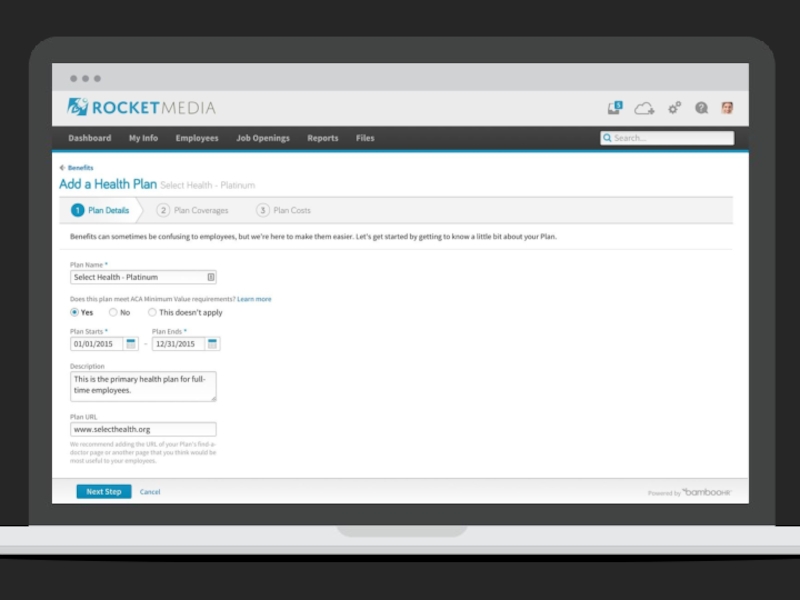

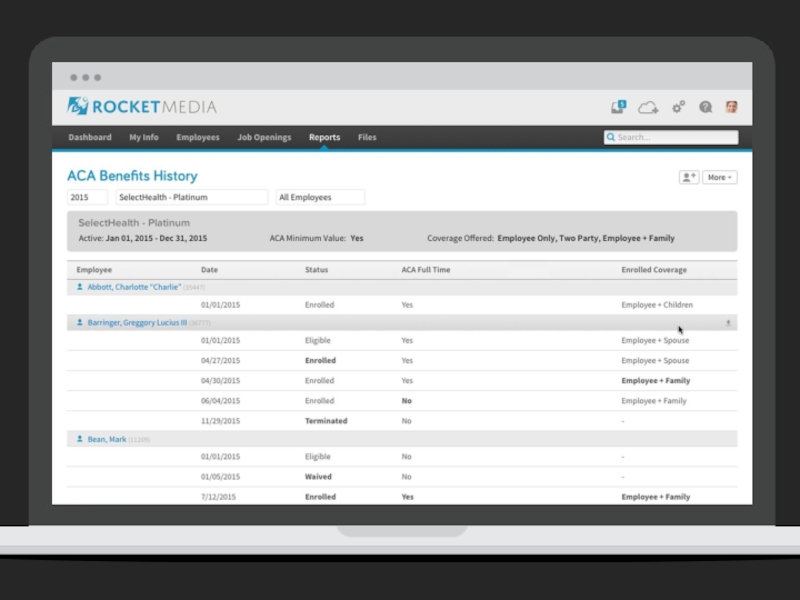

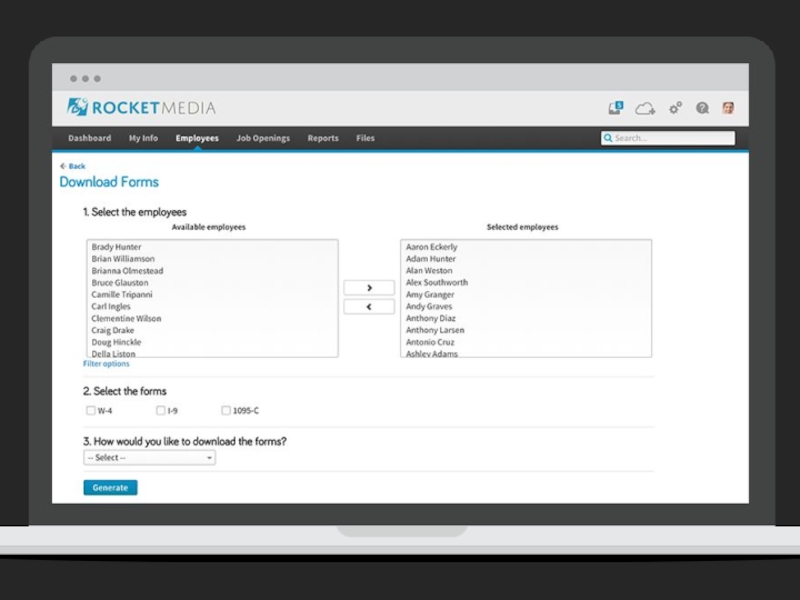

- 18. Features that will help you with the employer mandate:

- 23. Check out our help article for more information and links to official ACA resources.

- 24. Follow BambooHR on social media:

Слайд 2What is the

Employer Mandate?

“Employer Shared Responsibility Provision”

“Pay or Play Provision”

Слайд 3Coverage Requirement

“Under the Affordable Care Act’s employer shared responsibility provisions, certain

—IRS.gov

Слайд 5Reporting Requirement

“The same employers that are subject to the employer shared

—IRS.gov

Слайд 8Average of 50 or more full-time employees per month

Includes full-time equivalents

Based on the prior calendar year

Definition of ALE

Слайд 9Average of 30 or more hours per week (or 130 hours

Full time equivalent = total number of non-full time hours/120

May not match your company’s definition of full time

Definition of full time

Слайд 10Sum of full-time employees + equivalents (for the year) / 12

Round

New company and seasonal worker exceptions

How to calculate

Слайд 13One per company

Summary of ACA methods (including transition relief)

Monthly % of

1094-C

Слайд 14One per employee - like a W-2 for benefits

Monthly codes based

Dependents enrollment information (self-insured only)

1095-C

Слайд 15Updated deadlines on December 28th

Furnish 1095-C to employees by March

File 1094-C and 1095-C’s to IRS by May 31st (paper filing) or June 30th (e-filing)

Deadlines