- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Financial Econometrics II презентация

Содержание

- 1. Financial Econometrics II

- 2. Up to now: Event study analysis:

- 3. Plan for today: Advanced topic: event

- 4. How to measure average reaction to the

- 5. What if the event date is uncertain?

- 6. Example: reaction to earnings announcements CLM, Table

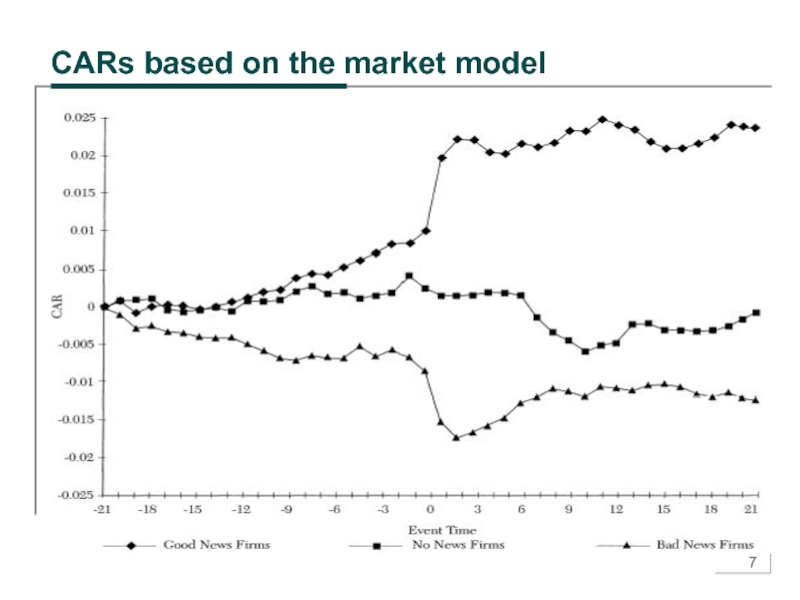

- 7. CARs based on the market model

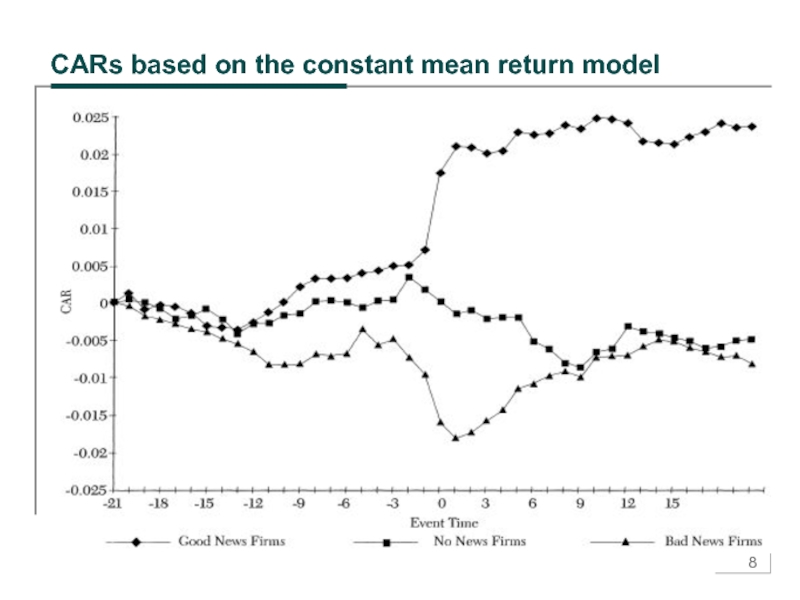

- 8. CARs based on the constant mean return model

- 9. Methodology: explaining abnormal returns Relation between

- 10. Other potential issues How to measure

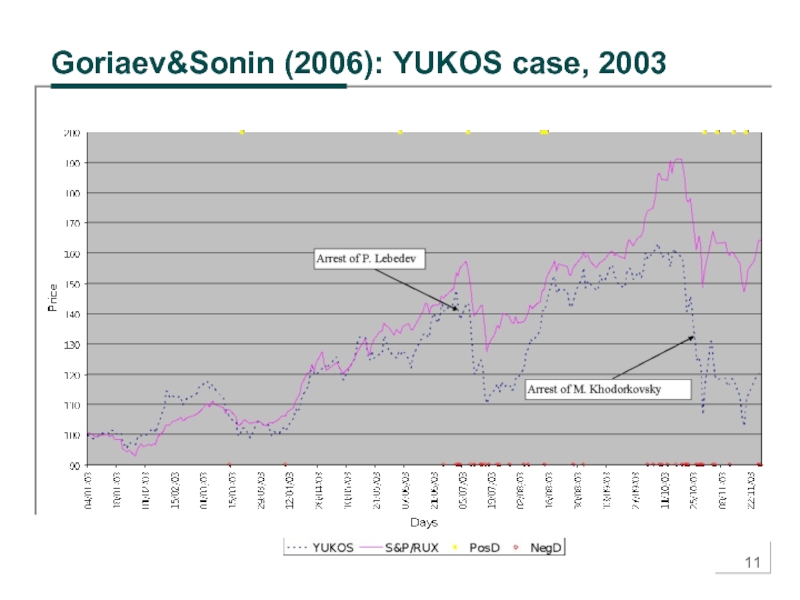

- 11. Goriaev&Sonin (2006): YUKOS case, 2003

- 12. Data Daily returns on YUKOS Sample period:

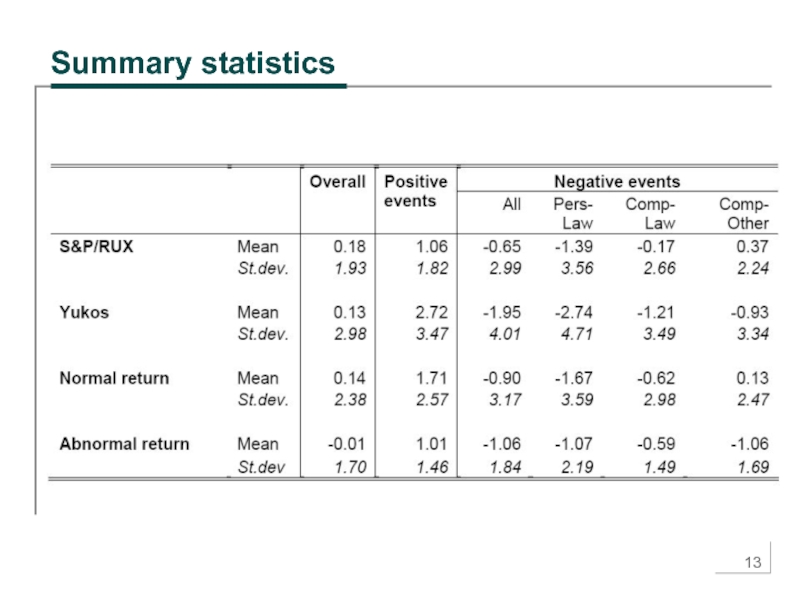

- 13. Summary statistics

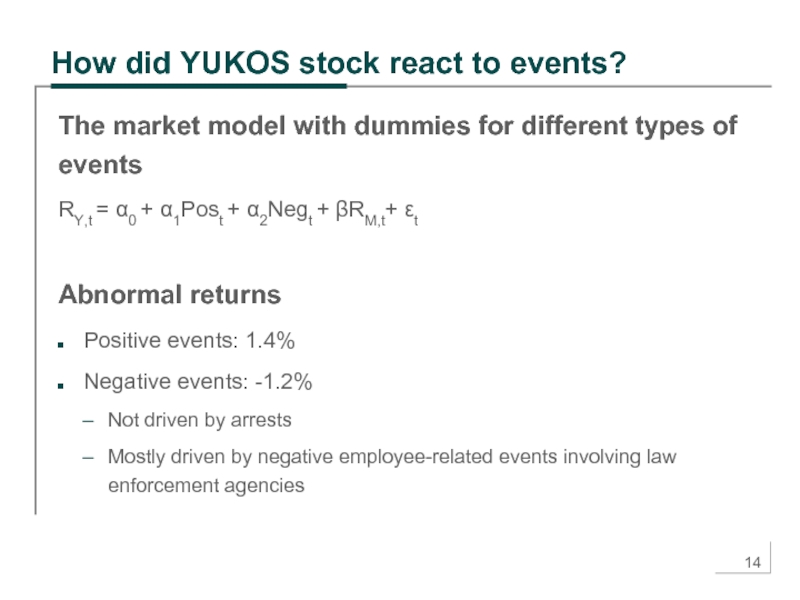

- 14. How did YUKOS stock react to events?

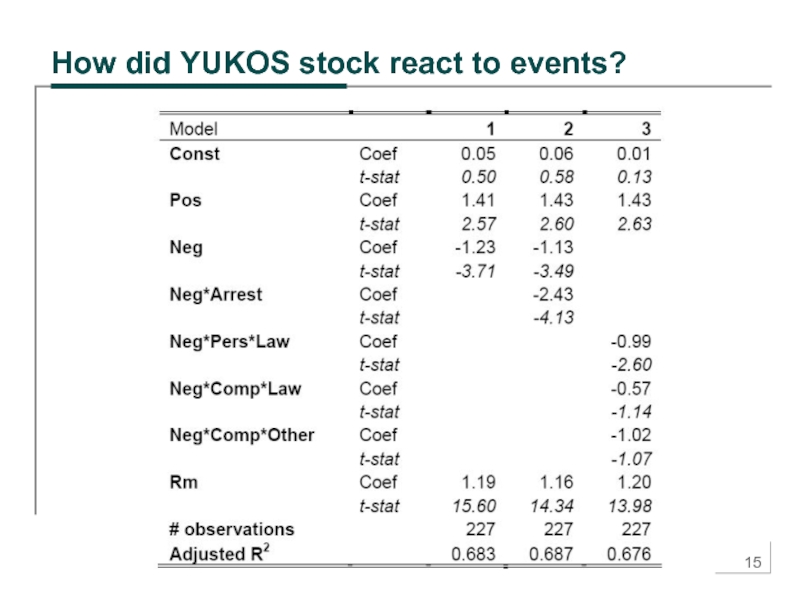

- 15. How did YUKOS stock react to events?

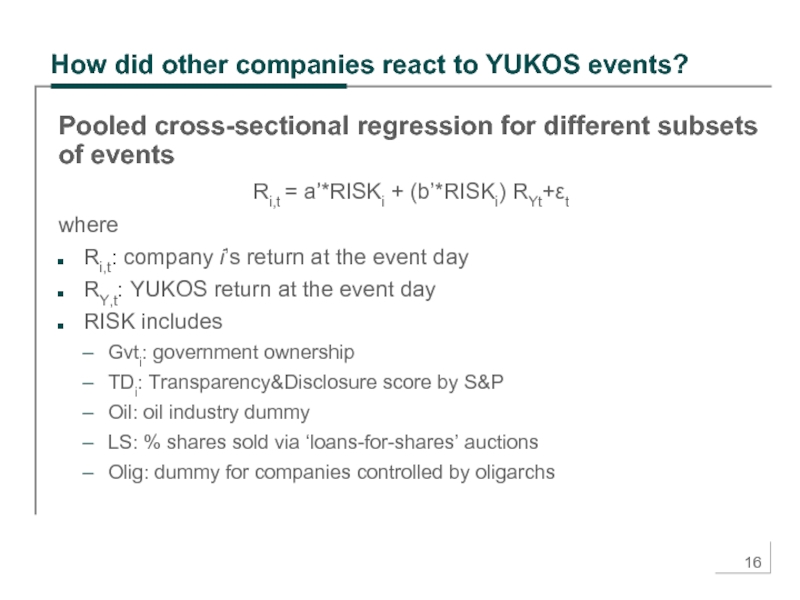

- 16. How did other companies react to YUKOS

- 17. How did other companies react to YUKOS events?

- 18. Conclusions Russian firms were very sensitive to

- 19. Other examples of event studies Security offerings

- 20. Strengths of the event study analysis Direct

- 21. Why beta? Main conclusion from tests of

- 22. CAPM vs. the market model Time series

- 23. Use of the market model Ri,t =

- 24. Estimating beta β=cov(Ri, RM)/var(RM) In Excel (see

- 25. Is historical beta a good predictor of

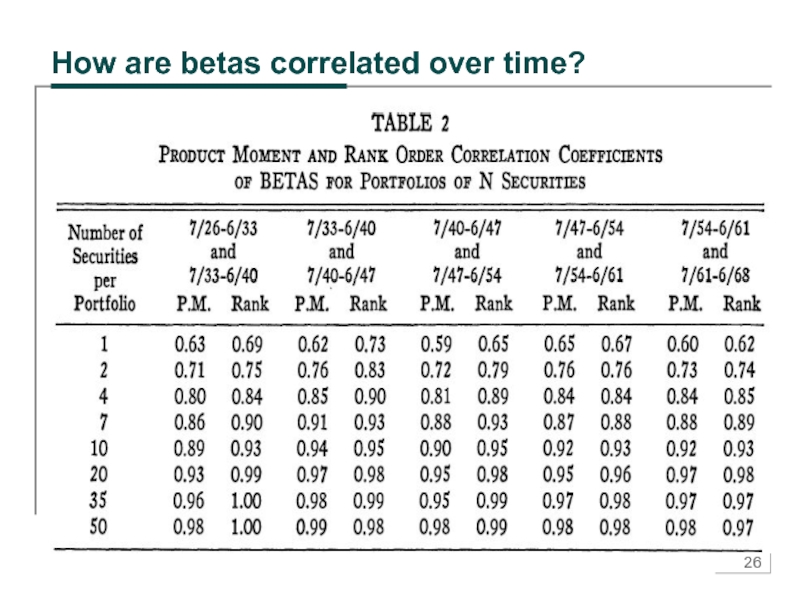

- 26. How are betas correlated over time?

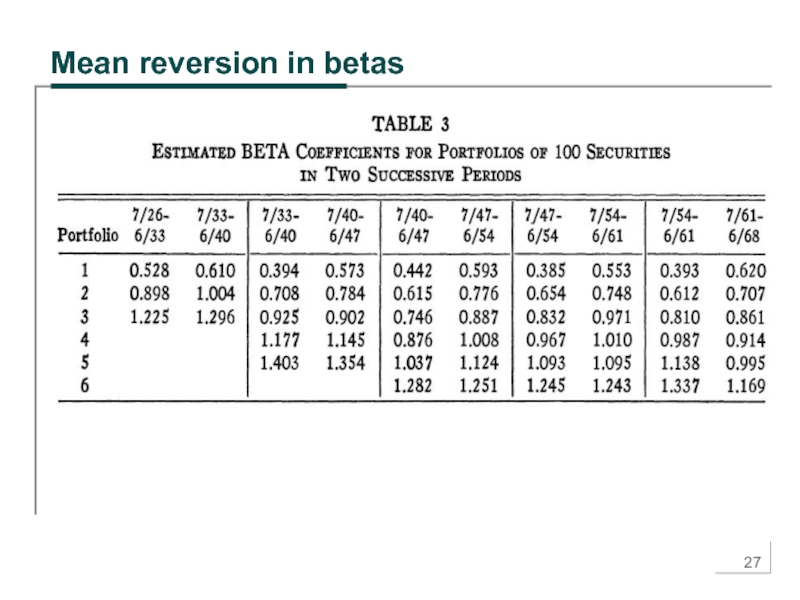

- 27. Mean reversion in betas

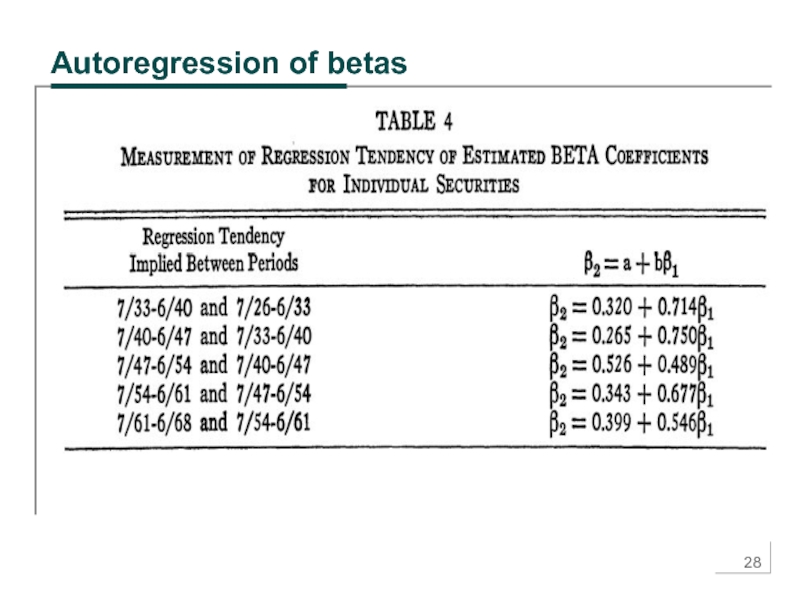

- 28. Autoregression of betas

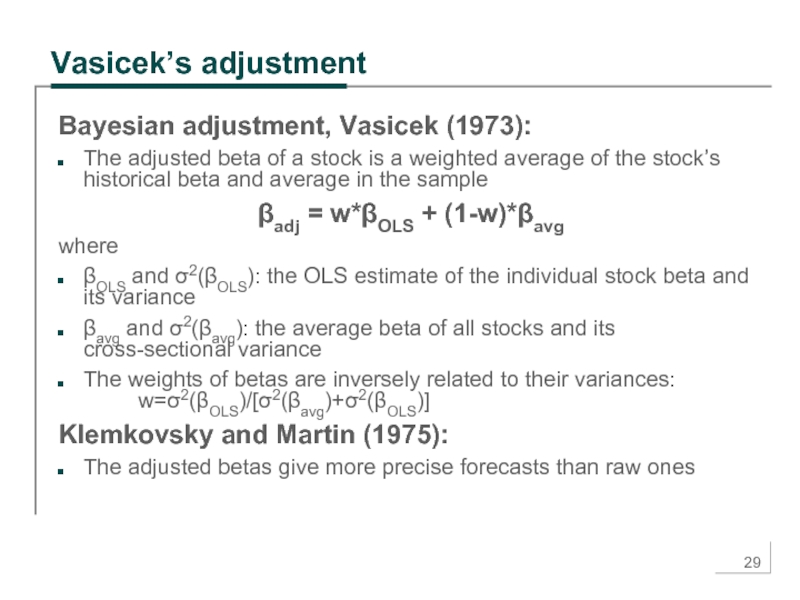

- 29. Vasicek’s adjustment Bayesian adjustment, Vasicek (1973): The

- 30. Estimating beta for illiquid stocks Assume that

- 31. Estimating beta for illiquid stocks The “trade-to-trade”

- 32. What if the stock has a large

- 33. Fundamental beta Can we explain betas by

- 34. Next class Advanced topic: testing CAPM Is

Слайд 2Up to now:

Event study analysis: effective test of SSFE

Measuring the

magnitude and speed of market reaction to events

Methodology: abnormal return and its variance

Do we suffer from the joint hypothesis problem?

How to measure average reaction accounting for the differences across firms and across time?

Methodology: abnormal return and its variance

Do we suffer from the joint hypothesis problem?

How to measure average reaction accounting for the differences across firms and across time?

Слайд 3Plan for today:

Advanced topic: event study analysis

How to solve potential

issues

Examples of event studies

New topic: beta and the market model

Interpretation of beta (CAPM!)

How to measure and predict beta

Adjustments for the measurement error and illiquidity

Examples of event studies

New topic: beta and the market model

Interpretation of beta (CAPM!)

How to measure and predict beta

Adjustments for the measurement error and illiquidity

Слайд 4How to measure average reaction to the event?

Aggregating the results across

firms

Average abnormal return: AARt = (1/N) Σi ARi,t

Its variance: var(AARt) = (1/N2) Σi var(ARi,t)

Using the estimated variances of individual ARs and assuming zero correlation between them

Or cross-sectional: var(AARt) = (1/N) σ2

Assuming that each AR has the same variance σ2, which is measured on the basis of N observed ARs: σ2 = (1/N2) Σi (ARi,t - AARt)2

Average abnormal return: AARt = (1/N) Σi ARi,t

Its variance: var(AARt) = (1/N2) Σi var(ARi,t)

Using the estimated variances of individual ARs and assuming zero correlation between them

Or cross-sectional: var(AARt) = (1/N) σ2

Assuming that each AR has the same variance σ2, which is measured on the basis of N observed ARs: σ2 = (1/N2) Σi (ARi,t - AARt)2

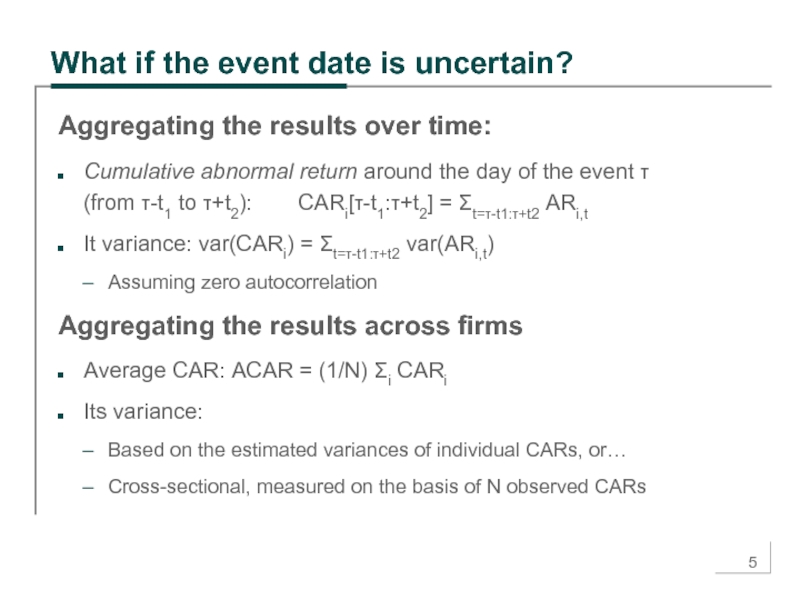

Слайд 5What if the event date is uncertain?

Aggregating the results over time:

Cumulative abnormal return around the day of the event τ (from τ-t1 to τ+t2): CARi[τ-t1:τ+t2] = Σt=τ-t1:τ+t2 ARi,t

It variance: var(CARi) = Σt=τ-t1:τ+t2 var(ARi,t)

Assuming zero autocorrelation

Aggregating the results across firms

Average CAR: ACAR = (1/N) Σi CARi

Its variance:

Based on the estimated variances of individual CARs, or…

Cross-sectional, measured on the basis of N observed CARs

Слайд 6Example: reaction to earnings announcements

CLM, Table 4.1, Fig 4.2: 30 US

companies, 1989-93

Positive (negative) reaction to good (bad) news at day 0

No significant reaction for no-news

The constant mean return model produces noisier estimates than the market model

Positive (negative) reaction to good (bad) news at day 0

No significant reaction for no-news

The constant mean return model produces noisier estimates than the market model

Слайд 9Methodology: explaining abnormal returns

Relation between CARs and company characteristics:

Cross-sectional regressions:

CARi = a + b*Capi + c*Transpi +…

OLS with White (heteroscedasticity-consistent) standard errors

WLS with weights proportional to var(CAR)

Account for potential selection bias

The characteristics may be related to the extent to which the event is anticipated

OLS with White (heteroscedasticity-consistent) standard errors

WLS with weights proportional to var(CAR)

Account for potential selection bias

The characteristics may be related to the extent to which the event is anticipated

Слайд 10Other potential issues

How to measure AR for a stock after

IPO?

How to construct a control portfolio?

Why are tests usually based on CARs rather than ARs?

How to control for the event-induced volatility?

How to control for the heteroscedasticity in ARs?

What are the problems with long-run event studies?

What if we have several events for the same company in a short period of time?

How to construct a control portfolio?

Why are tests usually based on CARs rather than ARs?

How to control for the event-induced volatility?

How to control for the heteroscedasticity in ARs?

What are the problems with long-run event studies?

What if we have several events for the same company in a short period of time?

Слайд 12Data

Daily returns on YUKOS

Sample period: 1/1/2003-27/11/2003

Before YUKOS received official charges

Events: publications

mentioning YUKOS and one of the state agencies

10 positive events

37 negative events

16 employee-related events, law enforcement agencies

16 company-related events, law enforcement agencies

12 company-related events, other state agencies

10 positive events

37 negative events

16 employee-related events, law enforcement agencies

16 company-related events, law enforcement agencies

12 company-related events, other state agencies

Слайд 14How did YUKOS stock react to events?

The market model with dummies

for different types of events

RY,t = α0 + α1Post + α2Negt + βRM,t+ εt

Abnormal returns

Positive events: 1.4%

Negative events: -1.2%

Not driven by arrests

Mostly driven by negative employee-related events involving law enforcement agencies

RY,t = α0 + α1Post + α2Negt + βRM,t+ εt

Abnormal returns

Positive events: 1.4%

Negative events: -1.2%

Not driven by arrests

Mostly driven by negative employee-related events involving law enforcement agencies

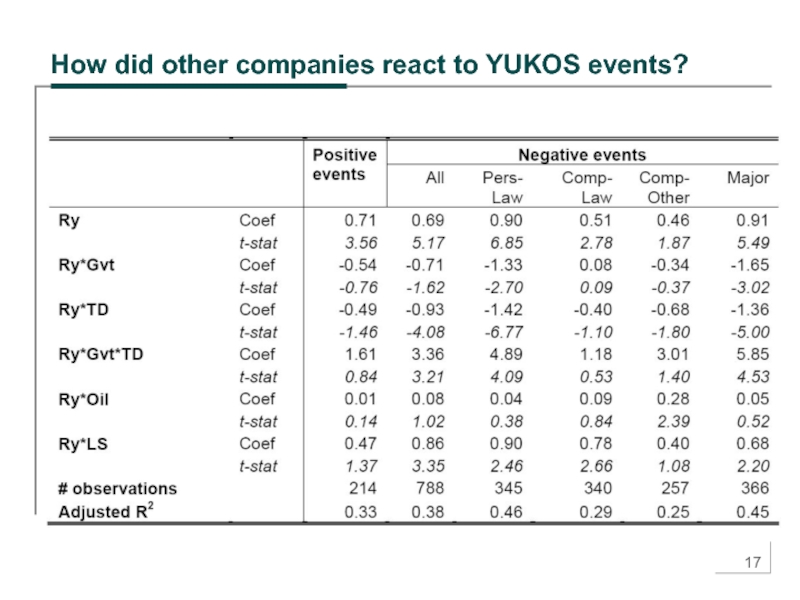

Слайд 16How did other companies react to YUKOS events?

Pooled cross-sectional regression

for different subsets of events

Ri,t = a’*RISKi + (b’*RISKi) RYt+εt

where

Ri,t: company i’s return at the event day

RY,t: YUKOS return at the event day

RISK includes

Gvti: government ownership

TDi: Transparency&Disclosure score by S&P

Oil: oil industry dummy

LS: % shares sold via ‘loans-for-shares’ auctions

Olig: dummy for companies controlled by oligarchs

Ri,t = a’*RISKi + (b’*RISKi) RYt+εt

where

Ri,t: company i’s return at the event day

RY,t: YUKOS return at the event day

RISK includes

Gvti: government ownership

TDi: Transparency&Disclosure score by S&P

Oil: oil industry dummy

LS: % shares sold via ‘loans-for-shares’ auctions

Olig: dummy for companies controlled by oligarchs

Слайд 18Conclusions

Russian firms were very sensitive to political risk

Especially non-transparent private companies,

transparent state-controlled companies, oil companies and those privatized via shady schemes

Consistent with the “oil rent,” “tax review,” “privatization review,” and “visible hand” hypotheses

The “politics” hypothesis cannot fully explain the market reaction

Consistent with the “oil rent,” “tax review,” “privatization review,” and “visible hand” hypotheses

The “politics” hypothesis cannot fully explain the market reaction

Слайд 19Other examples of event studies

Security offerings

Neutral reaction to bond offerings

Negative reaction

to public equity offerings

Dividends

Negative reaction to dividend cuts

M&A

Positive reaction for the target

Neutral reaction for the acquirer

Dividends

Negative reaction to dividend cuts

M&A

Positive reaction for the target

Neutral reaction for the acquirer

Слайд 20Strengths of the event study analysis

Direct and powerful test of SSFE

Shows

whether new info is fully and instantaneously incorporated in stock prices

The joint hypothesis problem is overcome

At short horizon, the choice of the model usually does not matter

In general, strong support for ME

Testing whether market reacted significantly to a certain event

Useful for asset management and corporate finance

The joint hypothesis problem is overcome

At short horizon, the choice of the model usually does not matter

In general, strong support for ME

Testing whether market reacted significantly to a certain event

Useful for asset management and corporate finance

Слайд 21Why beta?

Main conclusion from tests of return predictability

Need a better model

than constant expected return…

To explain cross-sectional differences in returns due to risks

CAPM: Et-1[Ri,t] - RF = βi (Et-1[RM,t] – RF)

This equation is valid if the market portfolio is efficient

Higher beta implies higher expected return

Can we test/apply this model empirically?

Expectations

One period

Market portfolio

To explain cross-sectional differences in returns due to risks

CAPM: Et-1[Ri,t] - RF = βi (Et-1[RM,t] – RF)

This equation is valid if the market portfolio is efficient

Higher beta implies higher expected return

Can we test/apply this model empirically?

Expectations

One period

Market portfolio

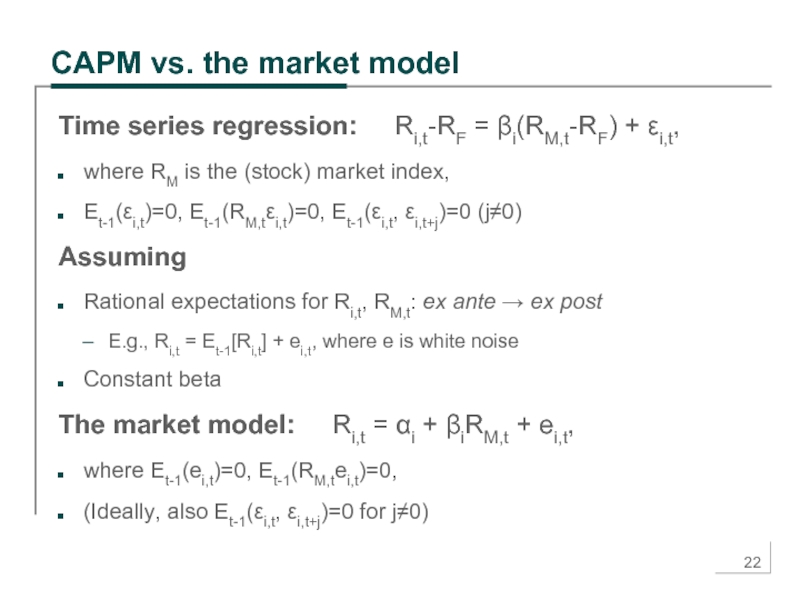

Слайд 22CAPM vs. the market model

Time series regression: Ri,t-RF =

βi(RM,t-RF) + εi,t,

where RM is the (stock) market index,

Et-1(εi,t)=0, Et-1(RM,tεi,t)=0, Et-1(εi,t, εi,t+j)=0 (j≠0)

Assuming

Rational expectations for Ri,t, RM,t: ex ante → ex post

E.g., Ri,t = Et-1[Ri,t] + ei,t, where e is white noise

Constant beta

The market model: Ri,t = αi + βiRM,t + ei,t,

where Et-1(ei,t)=0, Et-1(RM,tei,t)=0,

(Ideally, also Et-1(εi,t, εi,t+j)=0 for j≠0)

where RM is the (stock) market index,

Et-1(εi,t)=0, Et-1(RM,tεi,t)=0, Et-1(εi,t, εi,t+j)=0 (j≠0)

Assuming

Rational expectations for Ri,t, RM,t: ex ante → ex post

E.g., Ri,t = Et-1[Ri,t] + ei,t, where e is white noise

Constant beta

The market model: Ri,t = αi + βiRM,t + ei,t,

where Et-1(ei,t)=0, Et-1(RM,tei,t)=0,

(Ideally, also Et-1(εi,t, εi,t+j)=0 for j≠0)

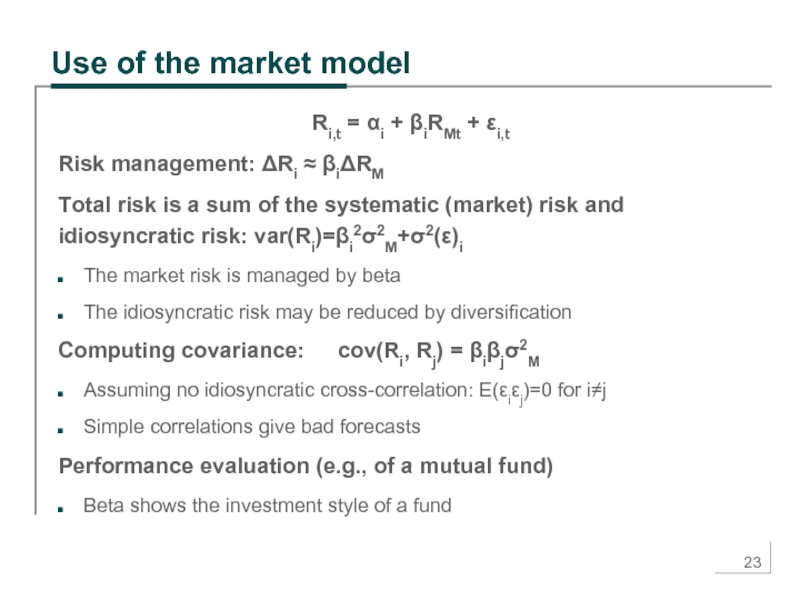

Слайд 23Use of the market model

Ri,t = αi + βiRMt + εi,t

Risk

management: ΔRi ≈ βiΔRM

Total risk is a sum of the systematic (market) risk and idiosyncratic risk: var(Ri)=βi2σ2M+σ2(ε)i

The market risk is managed by beta

The idiosyncratic risk may be reduced by diversification

Computing covariance: cov(Ri, Rj) = βiβjσ2M

Assuming no idiosyncratic cross-correlation: E(εiεj)=0 for i≠j

Simple correlations give bad forecasts

Performance evaluation (e.g., of a mutual fund)

Beta shows the investment style of a fund

Total risk is a sum of the systematic (market) risk and idiosyncratic risk: var(Ri)=βi2σ2M+σ2(ε)i

The market risk is managed by beta

The idiosyncratic risk may be reduced by diversification

Computing covariance: cov(Ri, Rj) = βiβjσ2M

Assuming no idiosyncratic cross-correlation: E(εiεj)=0 for i≠j

Simple correlations give bad forecasts

Performance evaluation (e.g., of a mutual fund)

Beta shows the investment style of a fund

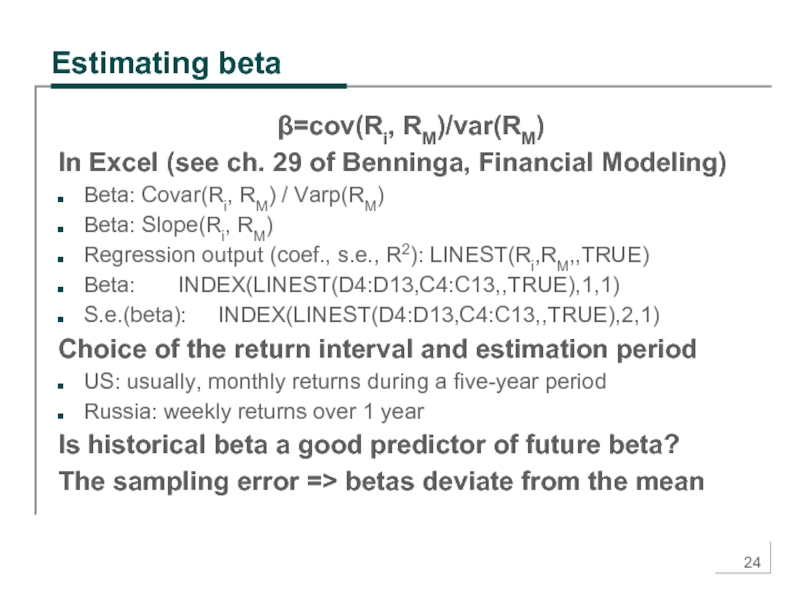

Слайд 24Estimating beta

β=cov(Ri, RM)/var(RM)

In Excel (see ch. 29 of Benninga, Financial Modeling)

Beta:

Covar(Ri, RM) / Varp(RM)

Beta: Slope(Ri, RM)

Regression output (coef., s.e., R2): LINEST(Ri,RM,,TRUE)

Beta: INDEX(LINEST(D4:D13,C4:C13,,TRUE),1,1)

S.e.(beta): INDEX(LINEST(D4:D13,C4:C13,,TRUE),2,1)

Choice of the return interval and estimation period

US: usually, monthly returns during a five-year period

Russia: weekly returns over 1 year

Is historical beta a good predictor of future beta?

The sampling error => betas deviate from the mean

Beta: Slope(Ri, RM)

Regression output (coef., s.e., R2): LINEST(Ri,RM,,TRUE)

Beta: INDEX(LINEST(D4:D13,C4:C13,,TRUE),1,1)

S.e.(beta): INDEX(LINEST(D4:D13,C4:C13,,TRUE),2,1)

Choice of the return interval and estimation period

US: usually, monthly returns during a five-year period

Russia: weekly returns over 1 year

Is historical beta a good predictor of future beta?

The sampling error => betas deviate from the mean

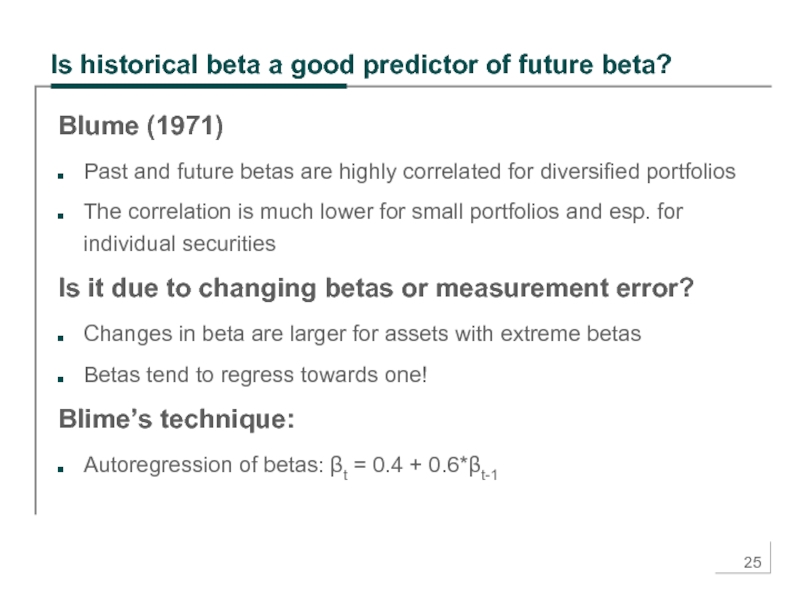

Слайд 25Is historical beta a good predictor of future beta?

Blume (1971)

Past and

future betas are highly correlated for diversified portfolios

The correlation is much lower for small portfolios and esp. for individual securities

Is it due to changing betas or measurement error?

Changes in beta are larger for assets with extreme betas

Betas tend to regress towards one!

Blime’s technique:

Autoregression of betas: βt = 0.4 + 0.6*βt-1

The correlation is much lower for small portfolios and esp. for individual securities

Is it due to changing betas or measurement error?

Changes in beta are larger for assets with extreme betas

Betas tend to regress towards one!

Blime’s technique:

Autoregression of betas: βt = 0.4 + 0.6*βt-1

Слайд 29Vasicek’s adjustment

Bayesian adjustment, Vasicek (1973):

The adjusted beta of a stock is

a weighted average of the stock’s historical beta and average in the sample

βadj = w*βOLS + (1-w)*βavg

where

βOLS and σ2(βOLS): the OLS estimate of the individual stock beta and its variance

βavg and σ2(βavg): the average beta of all stocks and its cross-sectional variance

The weights of betas are inversely related to their variances: w=σ2(βOLS)/[σ2(βavg)+σ2(βOLS)]

Klemkovsky and Martin (1975):

The adjusted betas give more precise forecasts than raw ones

βadj = w*βOLS + (1-w)*βavg

where

βOLS and σ2(βOLS): the OLS estimate of the individual stock beta and its variance

βavg and σ2(βavg): the average beta of all stocks and its cross-sectional variance

The weights of betas are inversely related to their variances: w=σ2(βOLS)/[σ2(βavg)+σ2(βOLS)]

Klemkovsky and Martin (1975):

The adjusted betas give more precise forecasts than raw ones

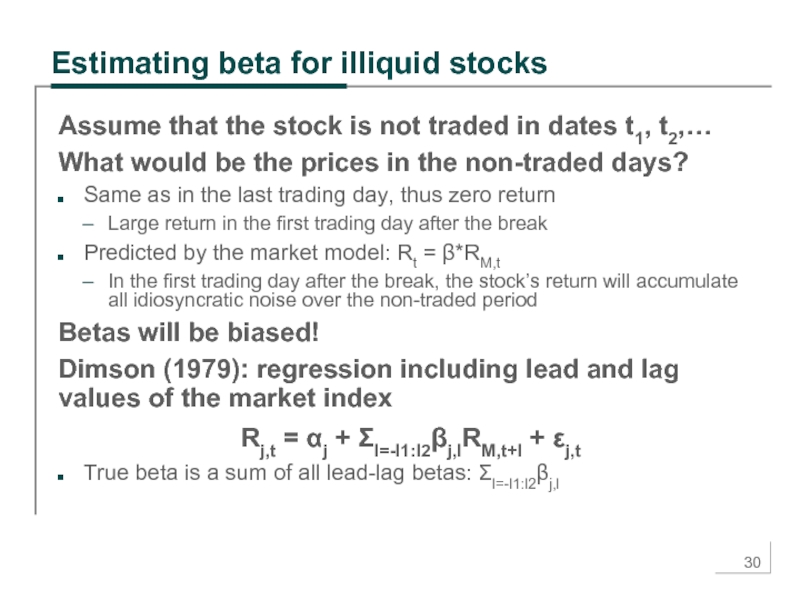

Слайд 30Estimating beta for illiquid stocks

Assume that the stock is not traded

in dates t1, t2,…

What would be the prices in the non-traded days?

Same as in the last trading day, thus zero return

Large return in the first trading day after the break

Predicted by the market model: Rt = β*RM,t

In the first trading day after the break, the stock’s return will accumulate all idiosyncratic noise over the non-traded period

Betas will be biased!

Dimson (1979): regression including lead and lag values of the market index

Rj,t = αj + Σl=-l1:l2βj,lRM,t+l + εj,t

True beta is a sum of all lead-lag betas: Σl=-l1:l2βj,l

What would be the prices in the non-traded days?

Same as in the last trading day, thus zero return

Large return in the first trading day after the break

Predicted by the market model: Rt = β*RM,t

In the first trading day after the break, the stock’s return will accumulate all idiosyncratic noise over the non-traded period

Betas will be biased!

Dimson (1979): regression including lead and lag values of the market index

Rj,t = αj + Σl=-l1:l2βj,lRM,t+l + εj,t

True beta is a sum of all lead-lag betas: Σl=-l1:l2βj,l

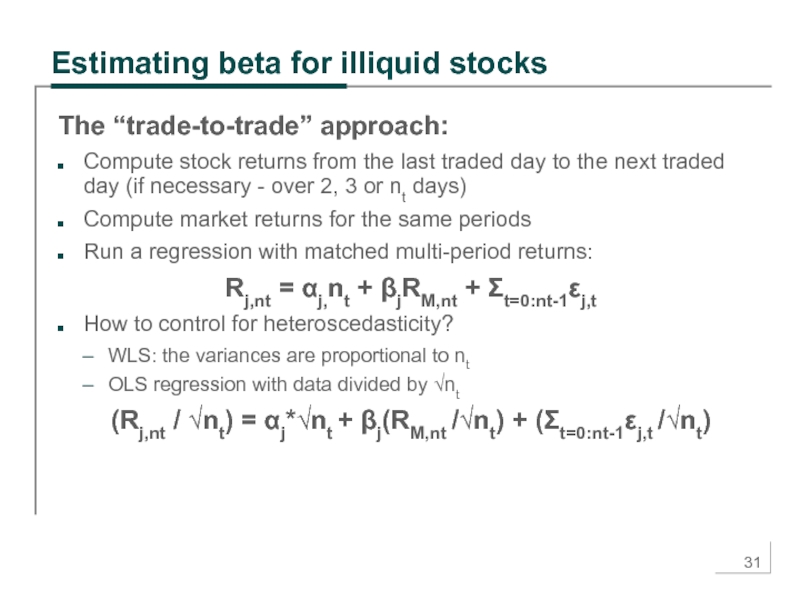

Слайд 31Estimating beta for illiquid stocks

The “trade-to-trade” approach:

Compute stock returns from

the last traded day to the next traded day (if necessary - over 2, 3 or nt days)

Compute market returns for the same periods

Run a regression with matched multi-period returns:

Rj,nt = αj,nt + βjRM,nt + Σt=0:nt-1εj,t

How to control for heteroscedasticity?

WLS: the variances are proportional to nt

OLS regression with data divided by √nt

(Rj,nt / √nt) = αj*√nt + βj(RM,nt /√nt) + (Σt=0:nt-1εj,t /√nt)

Compute market returns for the same periods

Run a regression with matched multi-period returns:

Rj,nt = αj,nt + βjRM,nt + Σt=0:nt-1εj,t

How to control for heteroscedasticity?

WLS: the variances are proportional to nt

OLS regression with data divided by √nt

(Rj,nt / √nt) = αj*√nt + βj(RM,nt /√nt) + (Σt=0:nt-1εj,t /√nt)

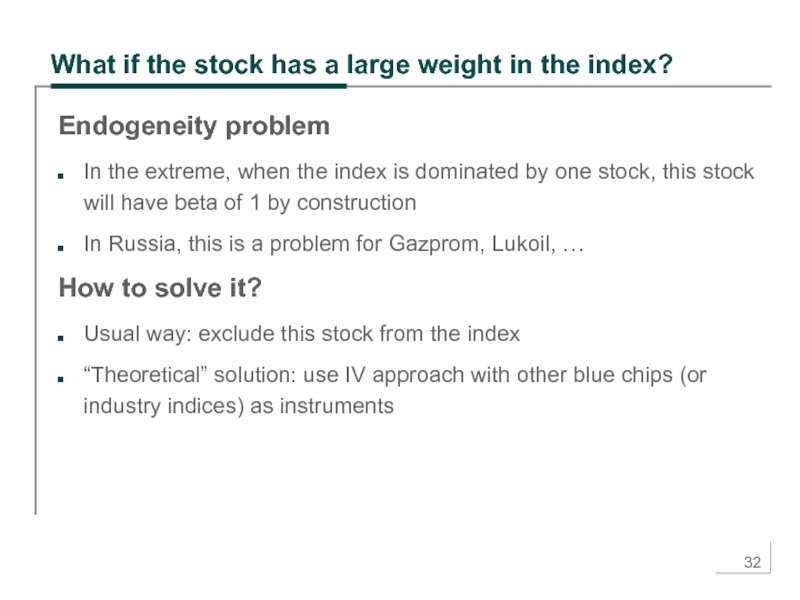

Слайд 32What if the stock has a large weight in the index?

Endogeneity

problem

In the extreme, when the index is dominated by one stock, this stock will have beta of 1 by construction

In Russia, this is a problem for Gazprom, Lukoil, …

How to solve it?

Usual way: exclude this stock from the index

“Theoretical” solution: use IV approach with other blue chips (or industry indices) as instruments

In the extreme, when the index is dominated by one stock, this stock will have beta of 1 by construction

In Russia, this is a problem for Gazprom, Lukoil, …

How to solve it?

Usual way: exclude this stock from the index

“Theoretical” solution: use IV approach with other blue chips (or industry indices) as instruments

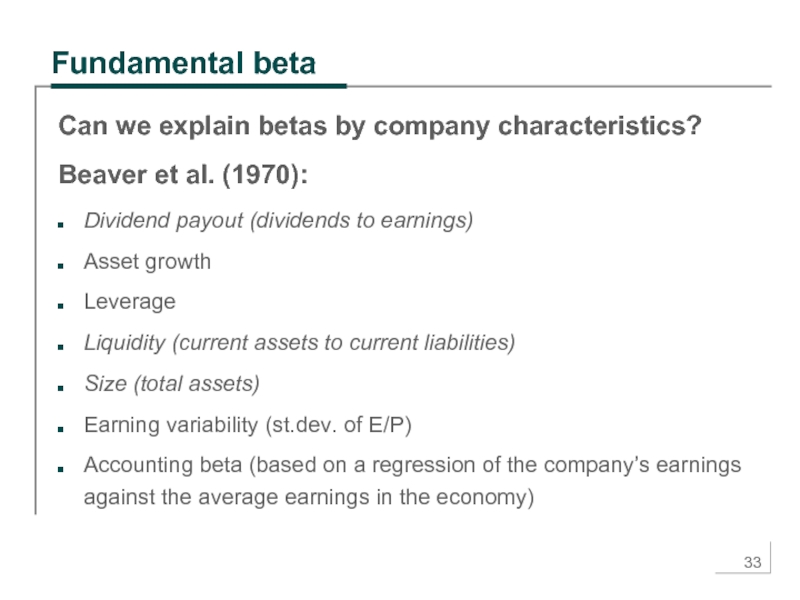

Слайд 33Fundamental beta

Can we explain betas by company characteristics?

Beaver et al. (1970):

Dividend payout (dividends to earnings)

Asset growth

Leverage

Liquidity (current assets to current liabilities)

Size (total assets)

Earning variability (st.dev. of E/P)

Accounting beta (based on a regression of the company’s earnings against the average earnings in the economy)

Слайд 34Next class

Advanced topic: testing CAPM

Is beta sufficient to describe systematic risks?

Time

series and cross-sectional tests

Market anomalies

New topic: multi-factor models

How to construct and interpret risk factors?

Most popular models: Fama-French, Carhart,…

Market anomalies

New topic: multi-factor models

How to construct and interpret risk factors?

Most popular models: Fama-French, Carhart,…