Astana September 30 2015

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

European energy transition презентация

Содержание

- 1. European energy transition

- 2. Table of contents ▶ Status of natural gas

- 3. European Natural Gas Infrastructure © World Energy

- 4. European Natural Gas Demand/Supply © World Energy Council 2014

- 5. EU sets ambitious targets for 2030

- 6. Natural Gas Contract Duration Changes There is

- 7. Table of contents ▶ Status of natural

- 8. Despite the recent turmoil, the outlook for

- 9. orld Energy Council 2014

- 10. 10 Energy transition is happening in a

- 11. EU places high priority on improving energy

- 12. Dynamic innovation and technology are driving changes

- 13. Table of contents ▶ Status of natural

- 15. LNG Capacity 2008, 2014, and expected 2020

Слайд 1© World Energy Council 2014

European Energy Transition: challenges to suppliers

Ged Davis

Executive

Слайд 2Table of contents

▶ Status of natural gas in Europe

© World Energy Council

▶ Forces for change

▶ Challenges for natural gas suppliers

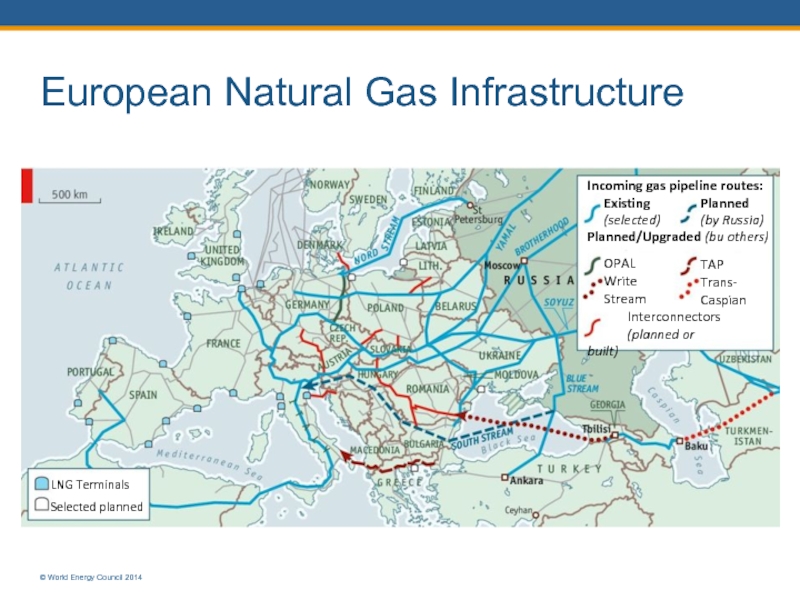

Слайд 3European Natural Gas Infrastructure

© World Energy Council 2014

LNG Terminals

Selected planned

Incoming gas

Existing

(selected)

Planned

(by Russia)

TAP

Trans-

Caspian

Interconnectors

(planned or built)

Planned/Upgraded (bu others)

OPAL

Write

Stream

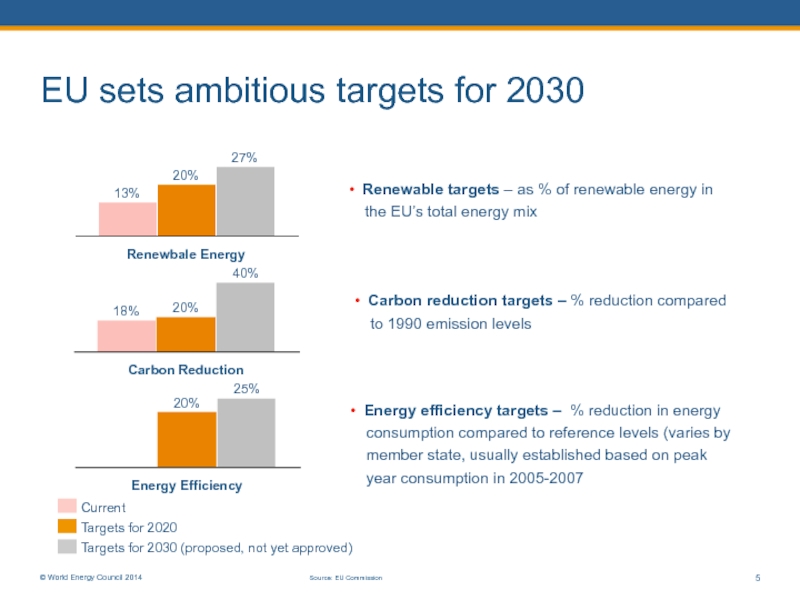

Слайд 5EU sets ambitious targets for 2030

Renewbale Energy

40%

27%

20%

13%

Current

Targets for 2020

Targets for 2030

20%

Carbon Reduction

25%

© World Energy Council 2014

5

Source: EU Commission

18%

20%

Energy Efficiency

• Renewable targets – as % of renewable energy in the EU’s total energy mix

• Carbon reduction targets – % reduction compared to 1990 emission levels

• Energy efficiency targets – % reduction in energy consumption compared to reference levels (varies by member state, usually established based on peak year consumption in 2005-2007

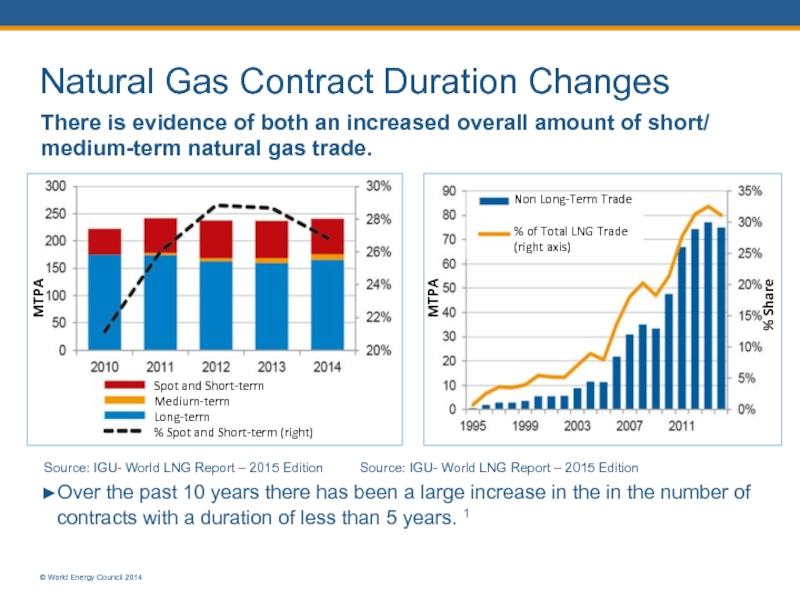

Слайд 6Natural Gas Contract Duration Changes

There is evidence of both an increased

Source: IGU- World LNG Report – 2015 Edition Source: IGU- World LNG Report – 2015 Edition

►Over the past 10 years there has been a large increase in the in the number of contracts with a duration of less than 5 years. 1

© World Energy Council 2014

Spot and Short-term

Medium-term

Long-term

% Spot and Short-term (right)

MTPA

MTPA

% Share

Non Long-Term Trade

% of Total LNG Trade

(right axis)

Слайд 7Table of contents

▶ Status of natural gas in Europe

© World Energy Council

▶ Forces for change

▶ Challenges for natural gas suppliers

Слайд 8Despite the recent turmoil, the outlook for the world economy in

© World Energy Council 2014

▶ The current recovery continues to lack momentum …

▶ Recent indicators point to tepid economic growth in most advanced economies

Confidence indicators and order books are up

Monetary conditions are still loose, investment is picking up

« Austerity » stances are giving way to more neutral policy stances

Some concerns about possible recession before 2020

▶ Yet, several emerging markets are in difficulty

Overemphasis on commodities, lack of reforms, socio-political mismanagement ?

8

Слайд 9orld Energy Council 2014

Will national regulation become more predictable in a

© W

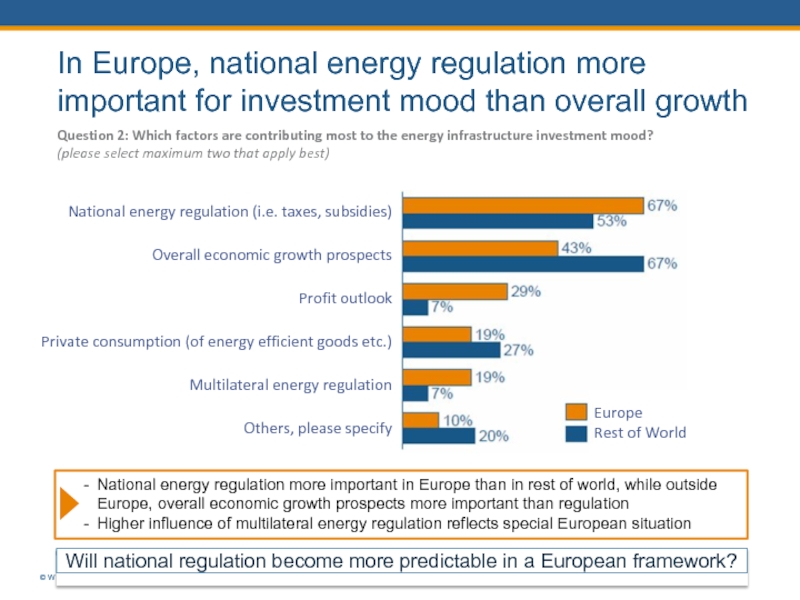

In Europe, national energy regulation more important for investment mood than overall growth

Question 2: Which factors are contributing most to the energy infrastructure investment mood?

(please select maximum two that apply best)

National energy regulation (i.e. taxes, subsidies)

Overall economic growth prospects

Profit outlook

Private consumption (of energy efficient goods etc.)

Multilateral energy regulation

Others, please specify

National energy regulation more important in Europe than in rest of world, while outside

Europe, overall economic growth prospects more important than regulation

Higher influence of multilateral energy regulation reflects special European situation

Europe

Rest of World

Слайд 1010

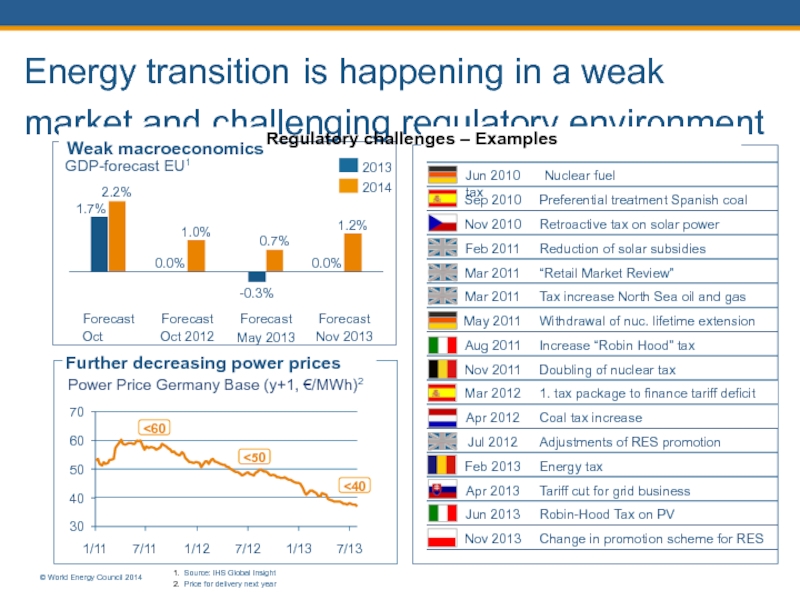

Energy transition is happening in a weak market and challenging regulatory environment

GDP-forecast

2.2%

Forecast Nov 2013

1.2%

0.0%

-0.3%

Forecast May 2013

0.7%

Forecast Oct 2012

1.0%

0.0%

Forecast Oct 2011

1.7%

2013

2014

Weak macroeconomics Regulatory challenges – Examples

30

40

50

60

70

7/11

1/11

7/13

1/13

7/12

1/12

Power Price Germany Base (y+1, €/MWh)2

<60

<50

<40

Further decreasing power prices

Jun 2010 Nuclear fuel tax

Sep 2010

Preferential treatment Spanish coal

Nov 2010

Retroactive tax on solar power

Feb 2011

Reduction of solar subsidies

Mar 2011

“Retail Market Review”

Mar 2011

Tax increase North Sea oil and gas

May 2011

Withdrawal of nuc. lifetime extension

Aug 2011

Increase “Robin Hood” tax

Nov 2011

Doubling of nuclear tax

Mar 2012

1. tax package to finance tariff deficit

Apr 2012

Coal tax increase

Jul 2012

Adjustments of RES promotion

Feb 2013

Energy tax

Apr 2013

Tariff cut for grid business

Jun 2013

Robin-Hood Tax on PV

Nov 2013

Change in promotion scheme for RES

1. Source: IHS Global Insight

2. Price for delivery next year

© World Energy Council 2014

Слайд 11EU places high priority on improving energy security

© World Energy Council

▶ Increasing energy efficiency and reaching the proposed 2030 energy and climate goals.

▶ Increasing energy production in the EU and diversifying supplier countries and routes. This includes further deployment of renewables, sustainable production of fossil fuels, and safe nuclear where the option is chosen. It also entails working effectively with current major energy partners, as well as developing new partners such as countries in the Caspian Basin region.

▶ Completing the internal energy market and building missing infrastructure links to quickly respond to supply disruptions

▶ Strengthening emergency and solidarity mechanisms and protecting critical infrastructure.

▶ Speaking with one voice in external energy policy

11

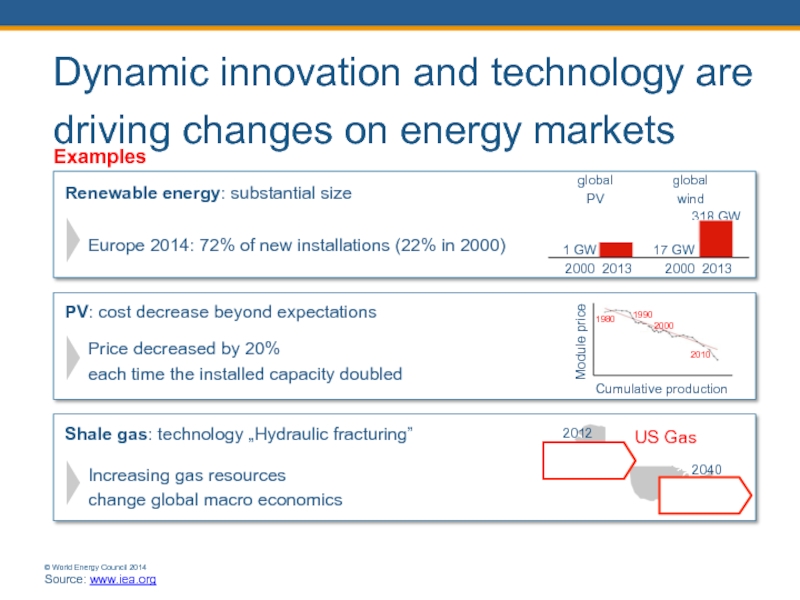

Слайд 12Dynamic innovation and technology are driving changes on energy markets

Examples

US Gas

2040

Net

2012

Net importer with 42 bcm

Price decreased by 20%

each time the installed capacity doubled

139 GW

Europe 2014: 72% of new installations (22% in 2000)

Renewable energy: substantial size

2000 2013

global wind

318 GW

2000 2013

global PV

Module price

1980

1990

2000

2010

Cumulative production

Shale gas: technology „Hydraulic fracturing”

Increasing gas resources change global macro economics

PV: cost decrease beyond expectations

© World Energy Council 2014

Слайд 13Table of contents

▶ Status of natural gas in Europe

▶ Forces for change

© World

▶ Challenges for natural gas suppliers

Слайд 14

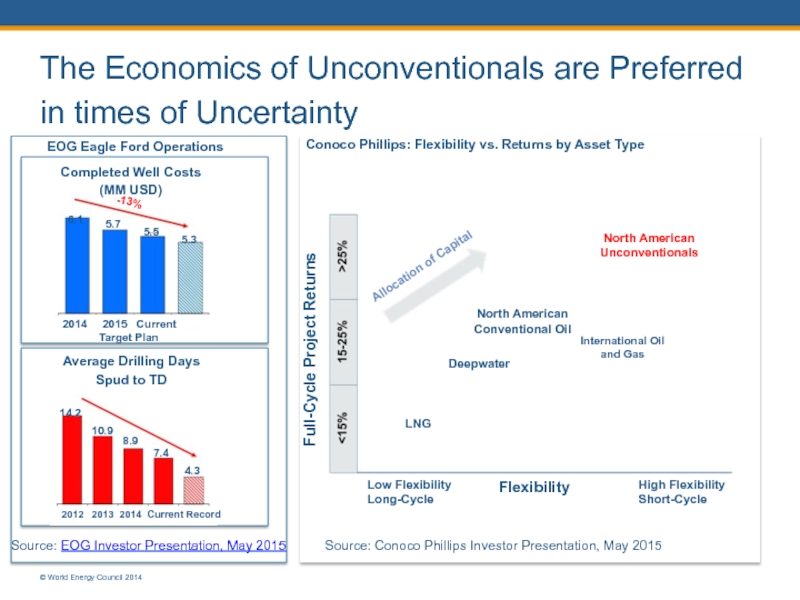

The Economics of Unconventionals are Preferred in times of Uncertainty

Conoco Phillips:

EOG Eagle Ford Operations

Completed Well Costs (MM USD)

6.1

5.7

5.5

5.3

-13%

2014 2015 Current Target Plan

Average Drilling Days Spud to TD

14.2

10.9

8.9

7.4

4.3

2012 2013 2014 Current Record

Source: EOG Investor Presentation, May 2015

© World Energy Council 2014

Source: Conoco Phillips Investor Presentation, May 2015

Слайд 15LNG Capacity 2008, 2014, and

expected 2020 (bcm)

15

© World Energy Council 2014

Legend

*Anticipated

Under Construction Only