- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Distressed Market Trends презентация

Содержание

- 1. Distressed Market Trends

- 2. Foreclosure trends Distressed sale trends Single family

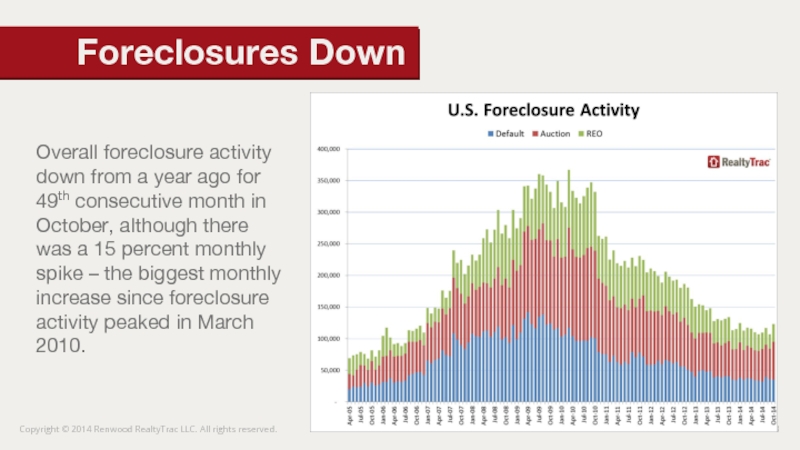

- 3. Overall foreclosure activity down from a year

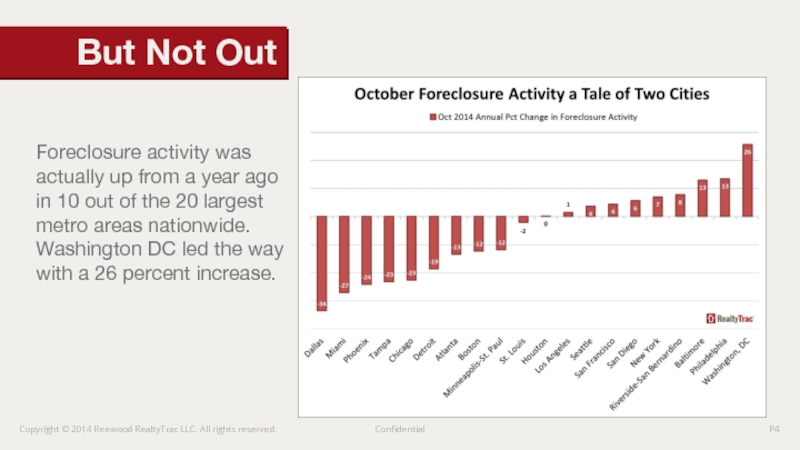

- 4. Foreclosure activity was actually up from a

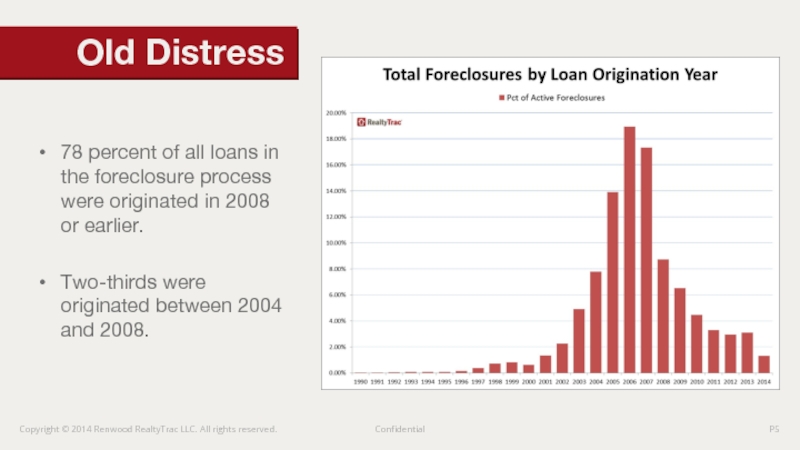

- 5. 78 percent of all loans in the

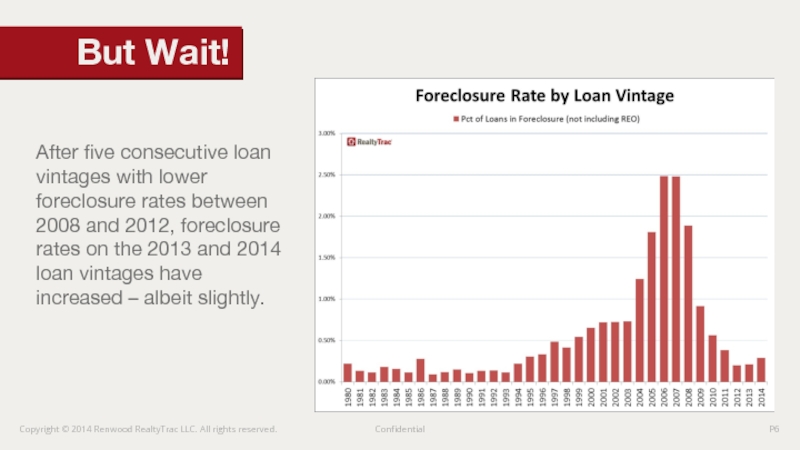

- 6. After five consecutive loan vintages with lower

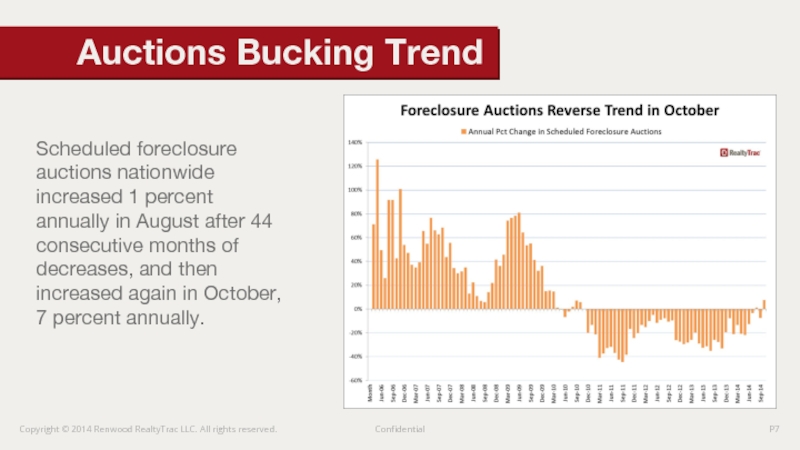

- 7. Scheduled foreclosure auctions nationwide increased 1 percent

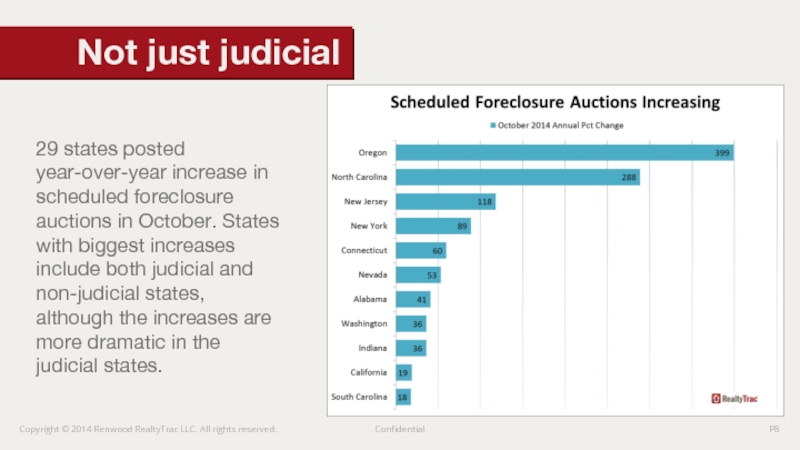

- 8. 29 states posted year-over-year increase in scheduled

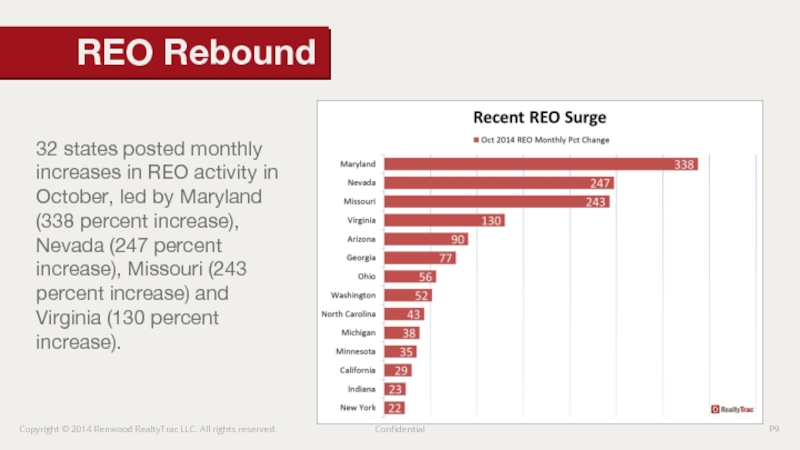

- 9. 32 states posted monthly increases in REO

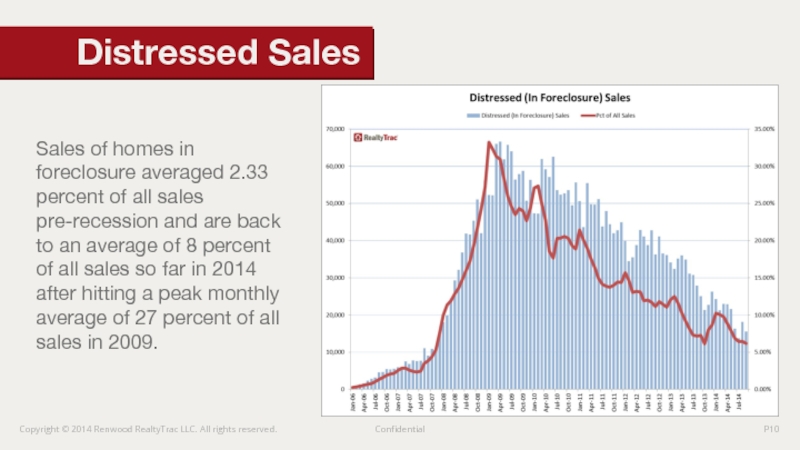

- 10. Sales of homes in foreclosure averaged 2.33

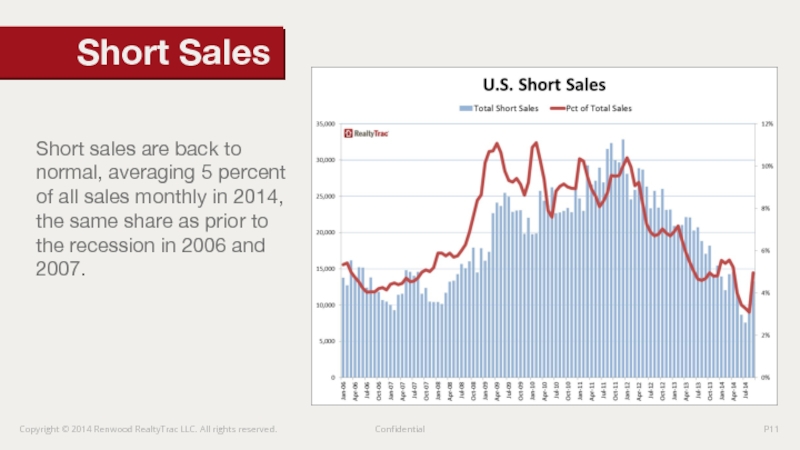

- 11. Short sales are back to normal, averaging

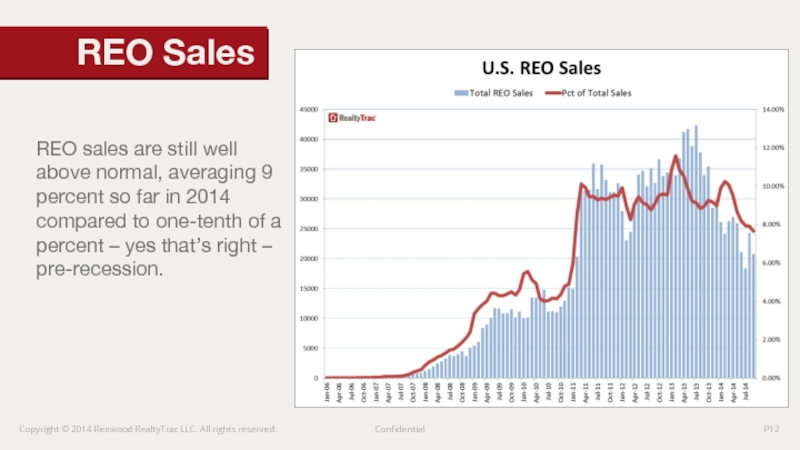

- 12. REO sales are still well above normal,

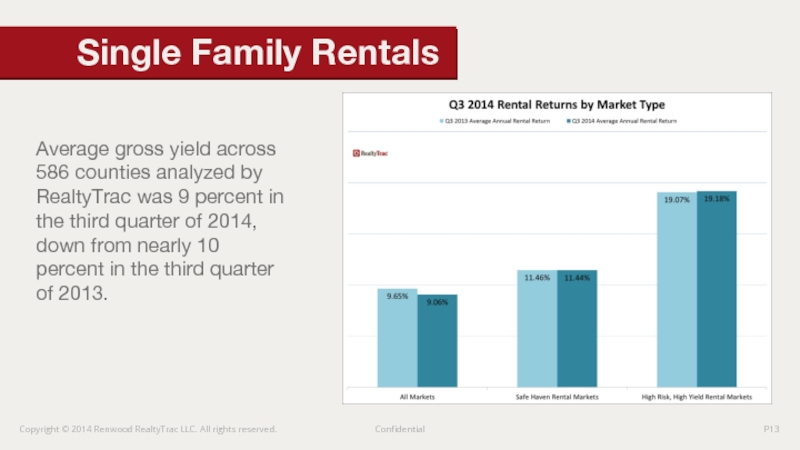

- 13. Average gross yield across 586 counties analyzed

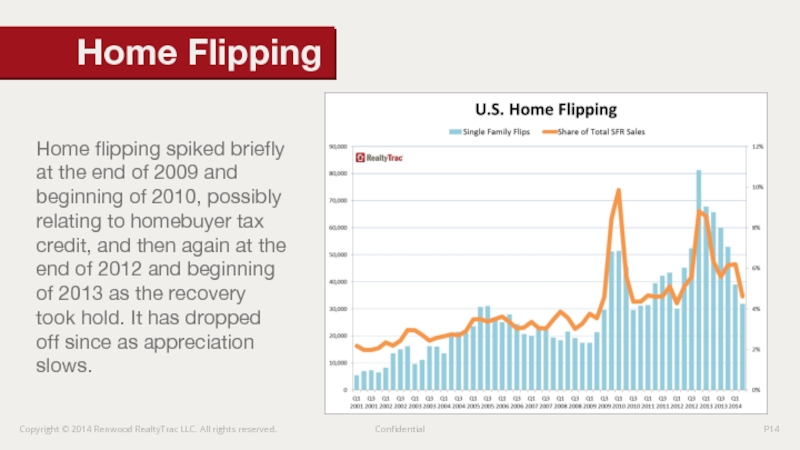

- 14. Home flipping spiked briefly at the end

- 15. Flippers are operating much more shrewdly in

- 16. Flippers are operating much more shrewdly in

- 17. Since 2006 average: Non-distressed buyers pay 91

- 18. Google “best real estate deals” to find

- 19. Local market stats and trends down to

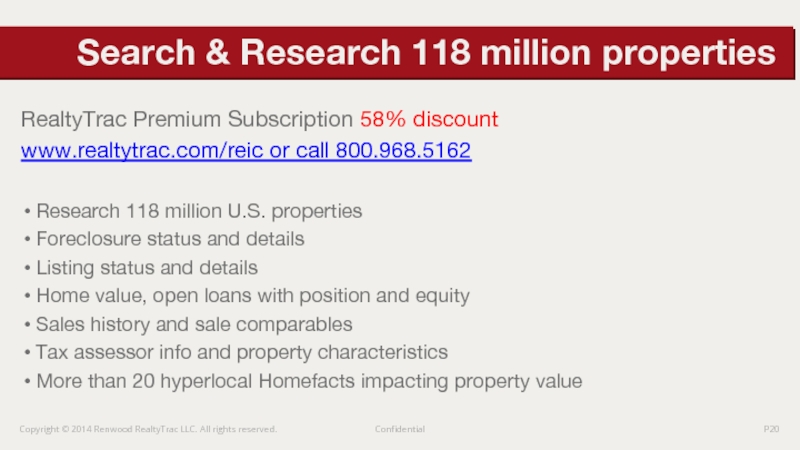

- 20. RealtyTrac Premium Subscription 58% discount www.realtytrac.com/reic or

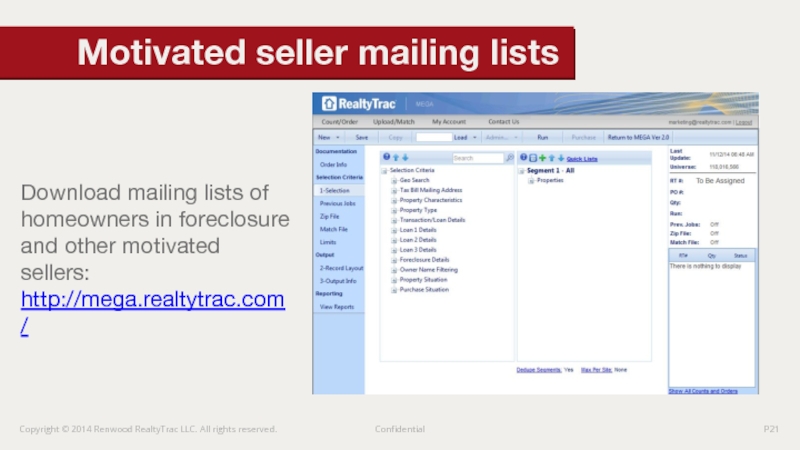

- 21. Download mailing lists of homeowners in foreclosure

- 22. Thank You! Daren Blomquist darenb@realtytrac.com

Слайд 2Foreclosure trends

Distressed sale trends

Single family rentals and flipping

Where are biggest discounts?

Investor

Buying with Auction.com

AGENDA

Слайд 3Overall foreclosure activity down from a year ago for 49th consecutive

Foreclosures Down

Слайд 4Foreclosure activity was actually up from a year ago in 10

But Not Out

Слайд 578 percent of all loans in the foreclosure process were originated

Two-thirds were originated between 2004 and 2008.

Old Distress

Слайд 6After five consecutive loan vintages with lower foreclosure rates between 2008

But Wait!

Слайд 7Scheduled foreclosure auctions nationwide increased 1 percent annually in August after

Auctions Bucking Trend

Слайд 829 states posted year-over-year increase in scheduled foreclosure auctions in October.

Not just judicial

Слайд 932 states posted monthly increases in REO activity in October, led

REO Rebound

Слайд 10Sales of homes in foreclosure averaged 2.33 percent of all sales

Distressed Sales

Слайд 11Short sales are back to normal, averaging 5 percent of all

Short Sales

Слайд 12REO sales are still well above normal, averaging 9 percent so

REO Sales

Слайд 13Average gross yield across 586 counties analyzed by RealtyTrac was 9

Single Family Rentals

Слайд 14Home flipping spiked briefly at the end of 2009 and beginning

Home Flipping

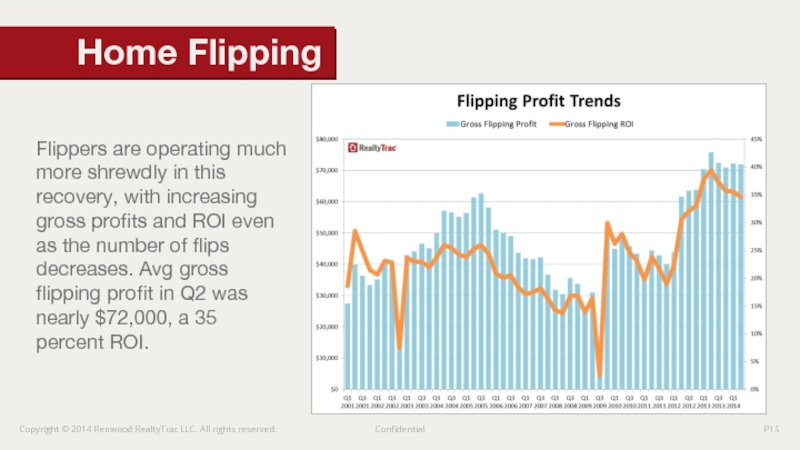

Слайд 15Flippers are operating much more shrewdly in this recovery, with increasing

Home Flipping

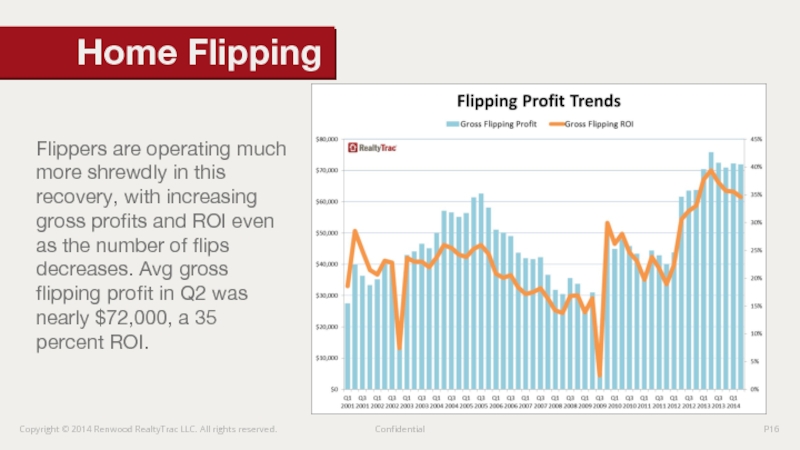

Слайд 16Flippers are operating much more shrewdly in this recovery, with increasing

Home Flipping

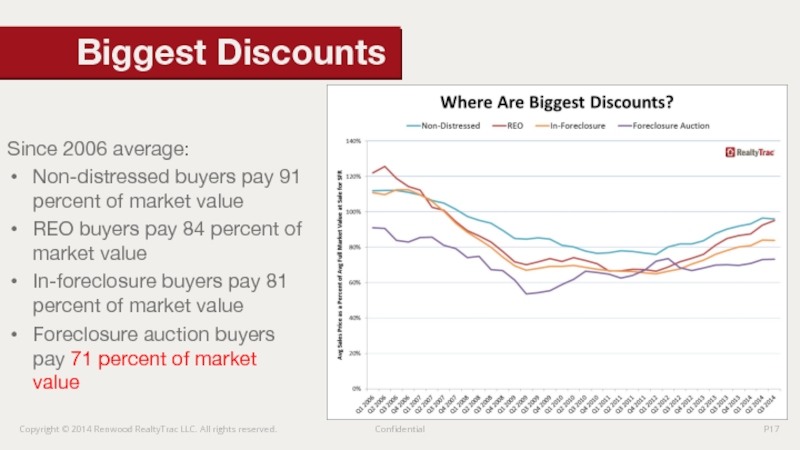

Слайд 17Since 2006 average:

Non-distressed buyers pay 91 percent of market value

REO buyers

In-foreclosure buyers pay 81 percent of market value

Foreclosure auction buyers pay 71 percent of market value

Biggest Discounts

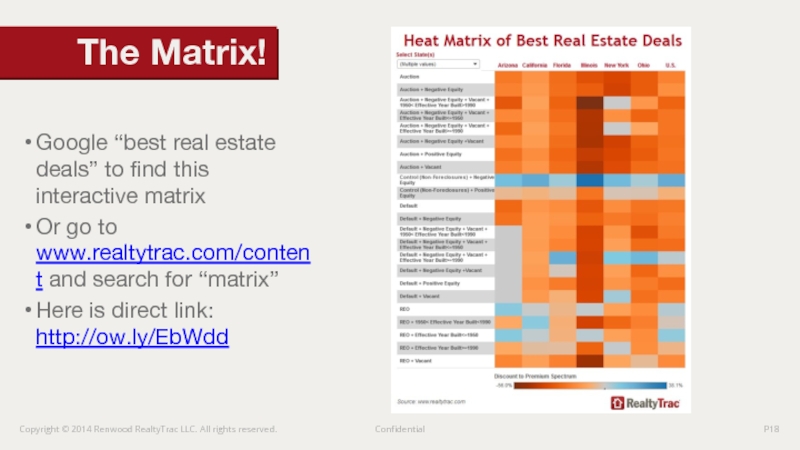

Слайд 18Google “best real estate deals” to find this interactive matrix

Or go

Here is direct link: http://ow.ly/EbWdd

The Matrix!

Слайд 19Local market stats and trends down to county, city, zip level:

Local Market Trends

Слайд 20RealtyTrac Premium Subscription 58% discount

www.realtytrac.com/reic or call 800.968.5162

Research 118 million U.S.

Foreclosure status and details

Listing status and details

Home value, open loans with position and equity

Sales history and sale comparables

Tax assessor info and property characteristics

More than 20 hyperlocal Homefacts impacting property value

Search & Research 118 million properties

Слайд 21Download mailing lists of homeowners in foreclosure and other motivated sellers:

Motivated seller mailing lists