- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

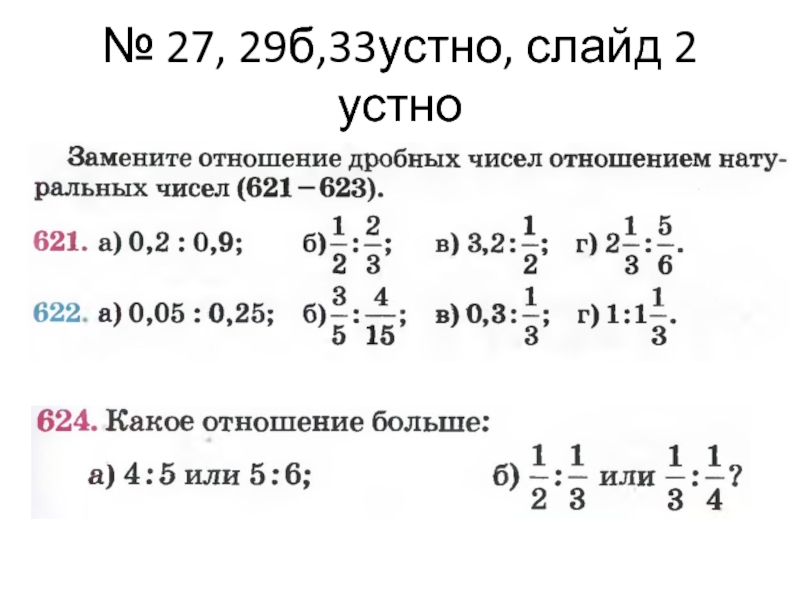

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The binomial model for option pricing презентация

Содержание

- 1. The binomial model for option pricing

- 2. Gurzuf, Crimea, June 2001 Contents European

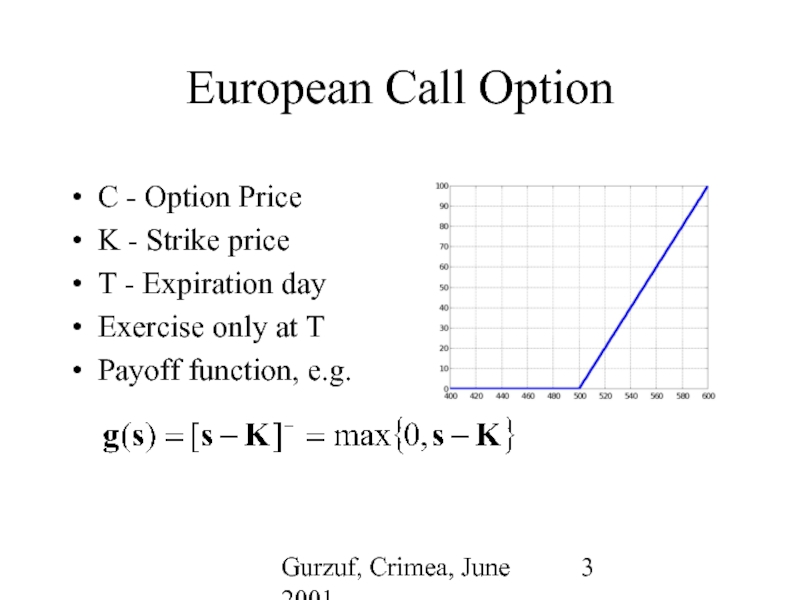

- 3. Gurzuf, Crimea, June 2001 European Call Option

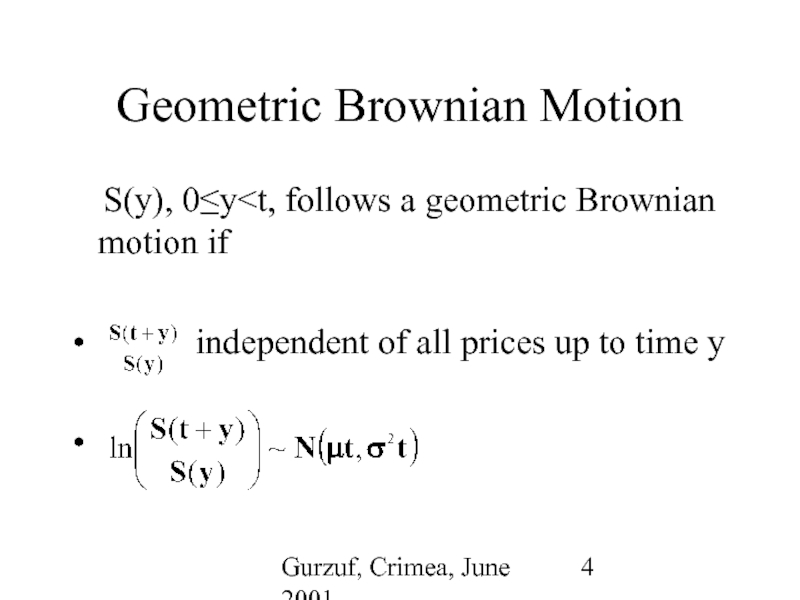

- 4. Gurzuf, Crimea, June 2001 Geometric Brownian Motion S(y), 0≤y

- 5. Gurzuf, Crimea, June 2001 Black-Scholes Formula The

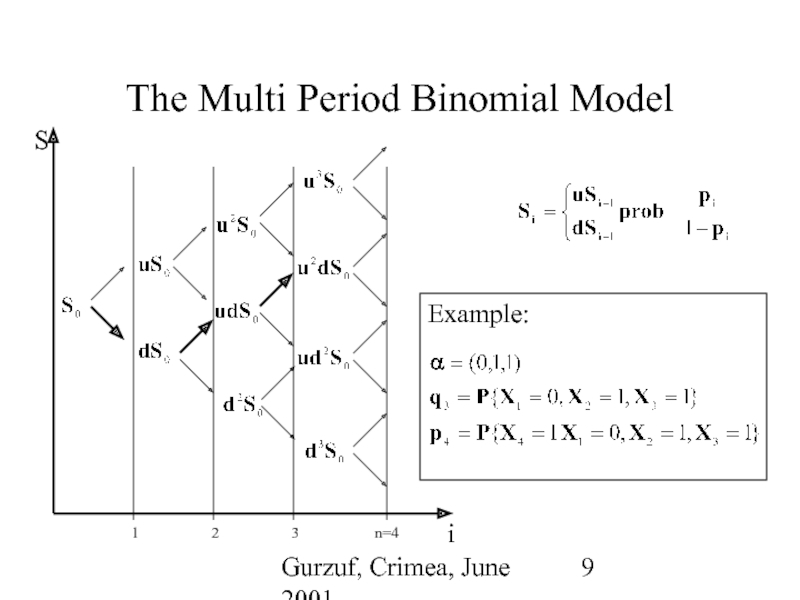

- 6. Gurzuf, Crimea, June 2001 The Multi Period

- 7. Gurzuf, Crimea, June 2001 The Multi Period

- 8. Gurzuf, Crimea, June 2001 The Multi Period

- 9. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model

- 10. Gurzuf, Crimea, June 2001 The Multi Period

- 11. Gurzuf, Crimea, June 2001 The Multi Period

- 12. Gurzuf, Crimea, June 2001 The Multi Period

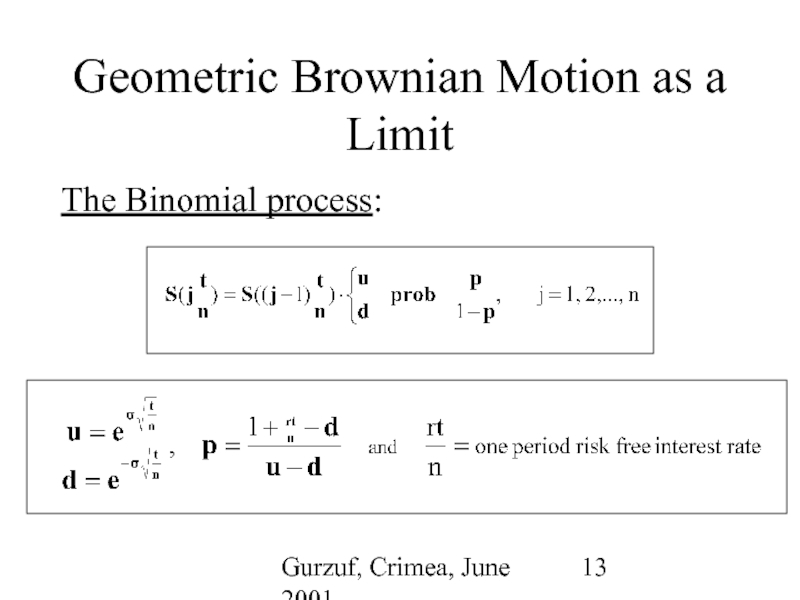

- 13. Gurzuf, Crimea, June 2001 Geometric Brownian Motion

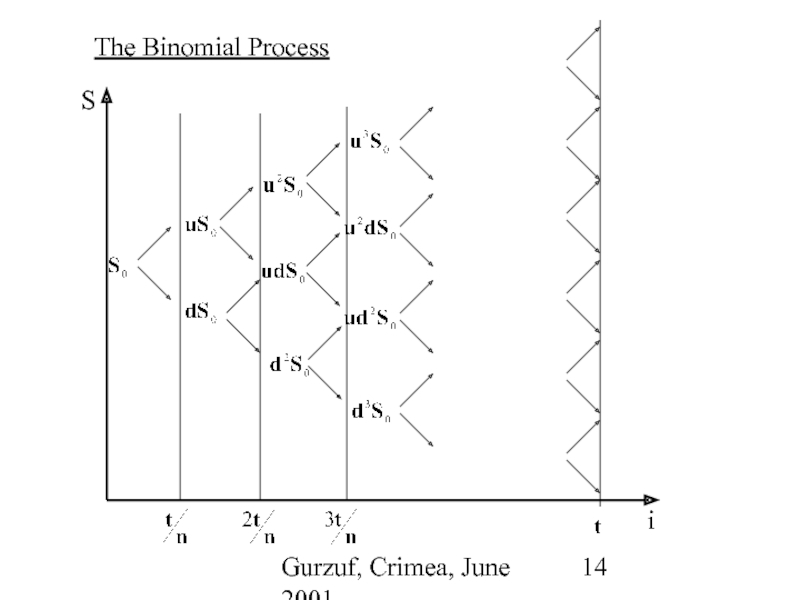

- 14. Gurzuf, Crimea, June 2001 The Binomial Process

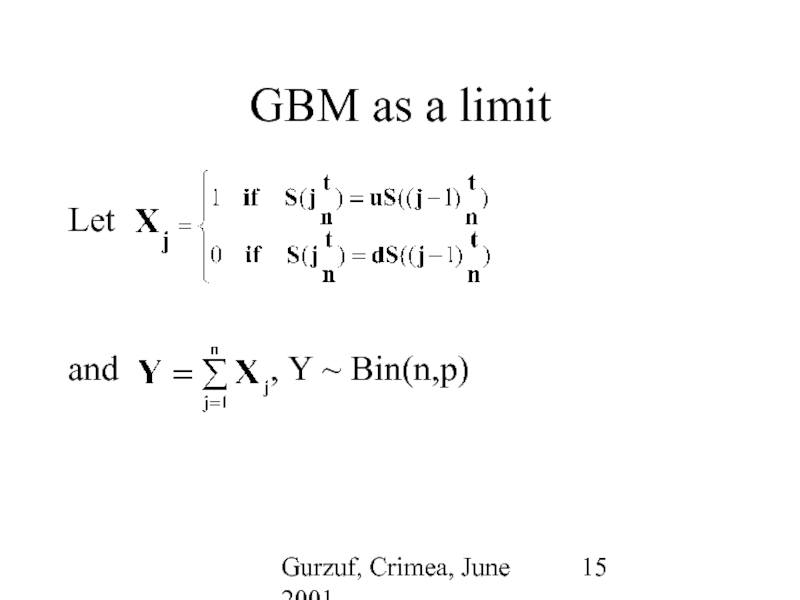

- 15. Gurzuf, Crimea, June 2001 GBM as a

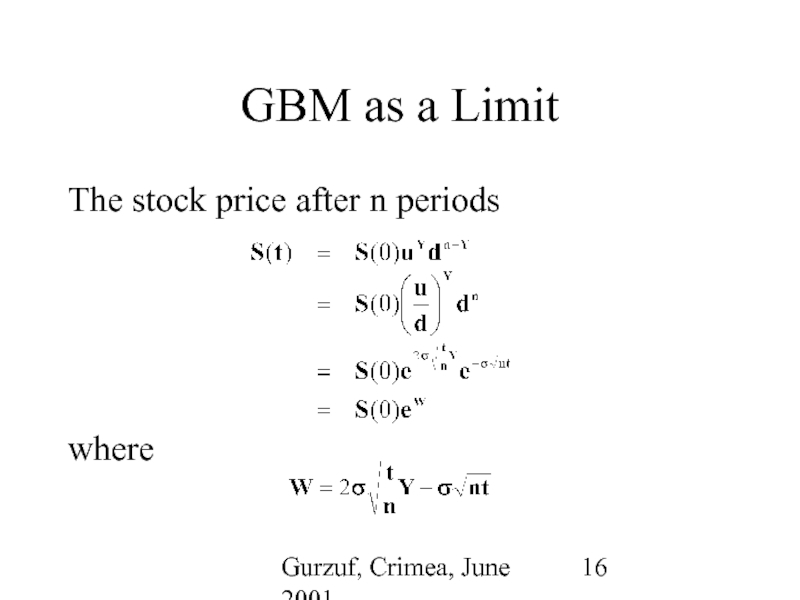

- 16. Gurzuf, Crimea, June 2001 GBM as a

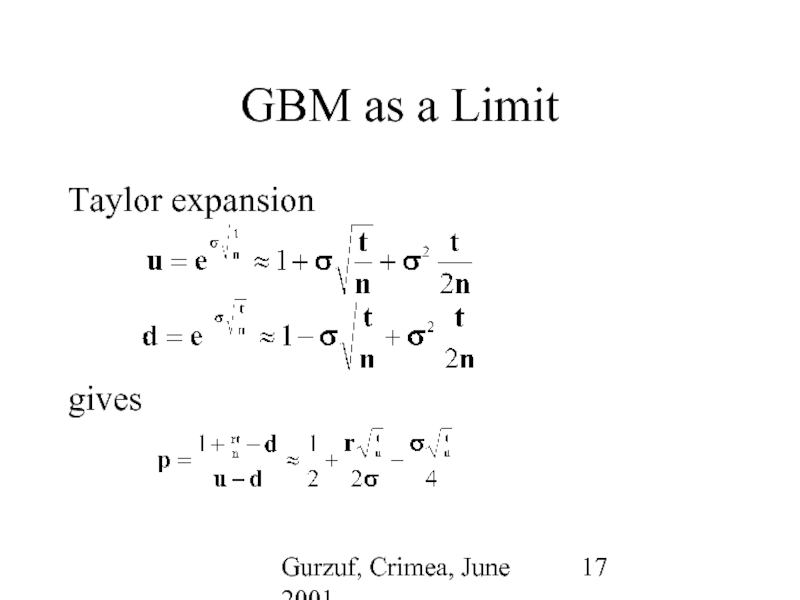

- 17. Gurzuf, Crimea, June 2001 GBM as a

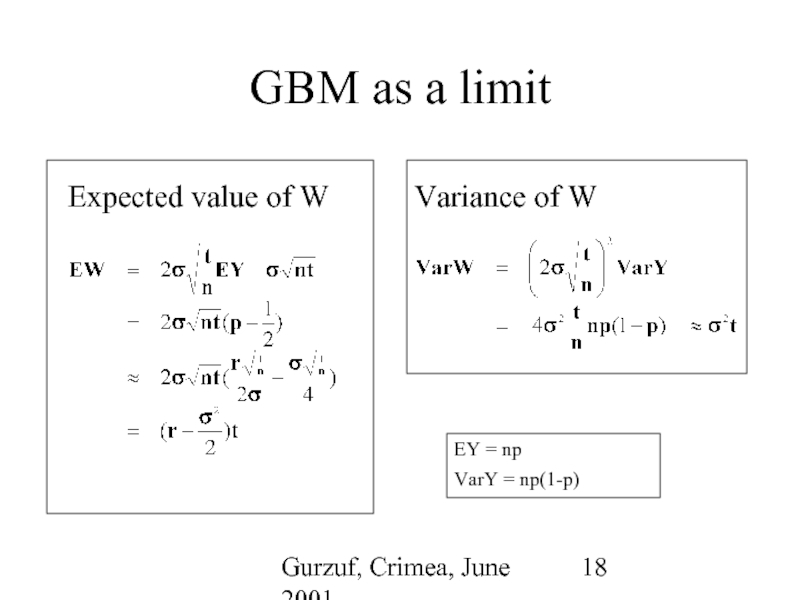

- 18. Gurzuf, Crimea, June 2001 GBM as a

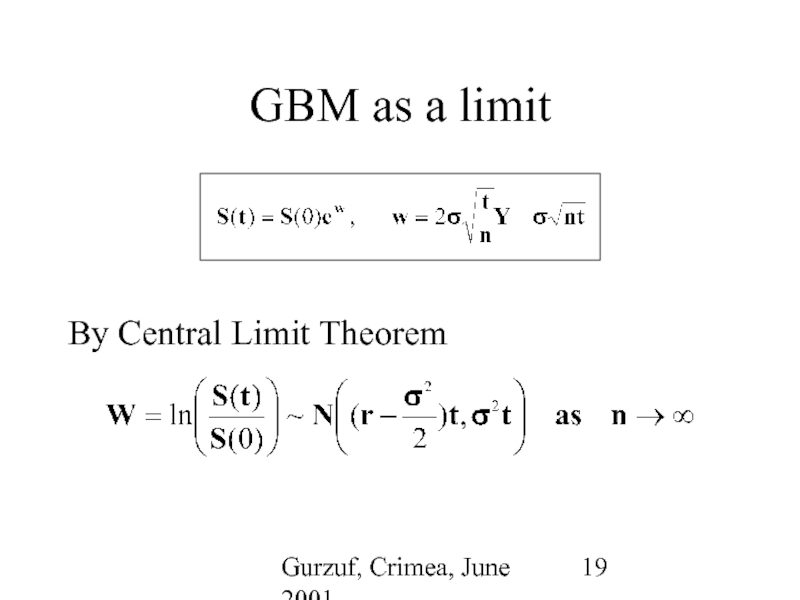

- 19. Gurzuf, Crimea, June 2001 GBM as a limit By Central Limit Theorem

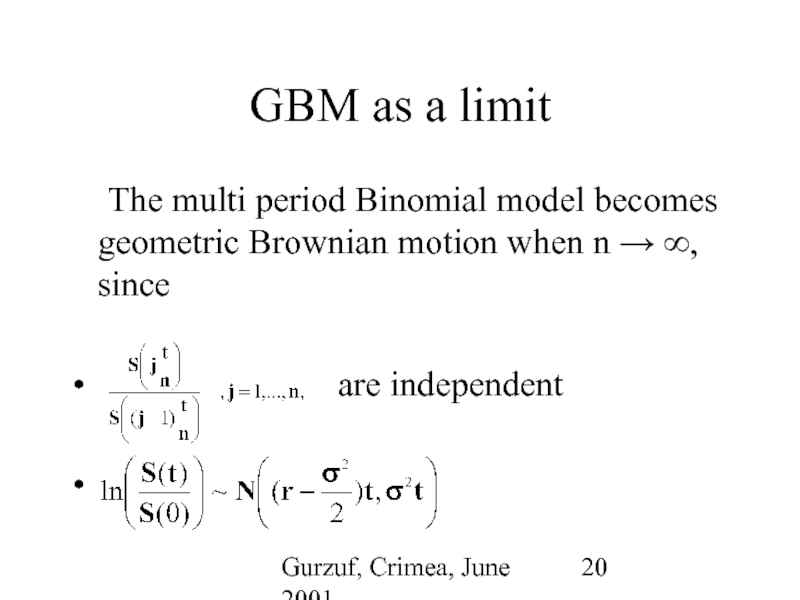

- 20. Gurzuf, Crimea, June 2001 GBM as a

- 21. Gurzuf, Crimea, June 2001 B-S Formula as

- 22. Gurzuf, Crimea, June 2001 B-S formula as

- 23. Gurzuf, Crimea, June 2001 B-S formula as

- 24. Gurzuf, Crimea, June 2001 B-S formula as a limit

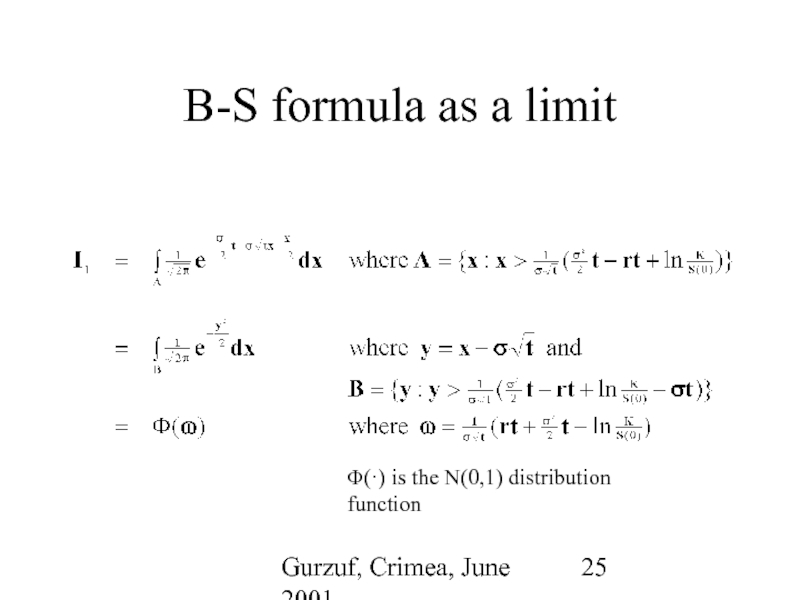

- 25. Gurzuf, Crimea, June 2001 B-S formula as a limit Φ(·) is the N(0,1) distribution function

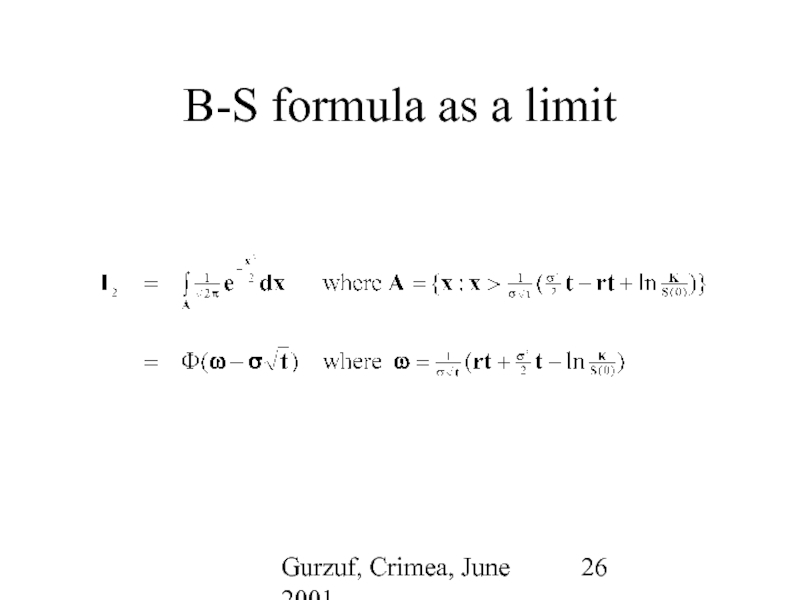

- 26. Gurzuf, Crimea, June 2001 B-S formula as a limit

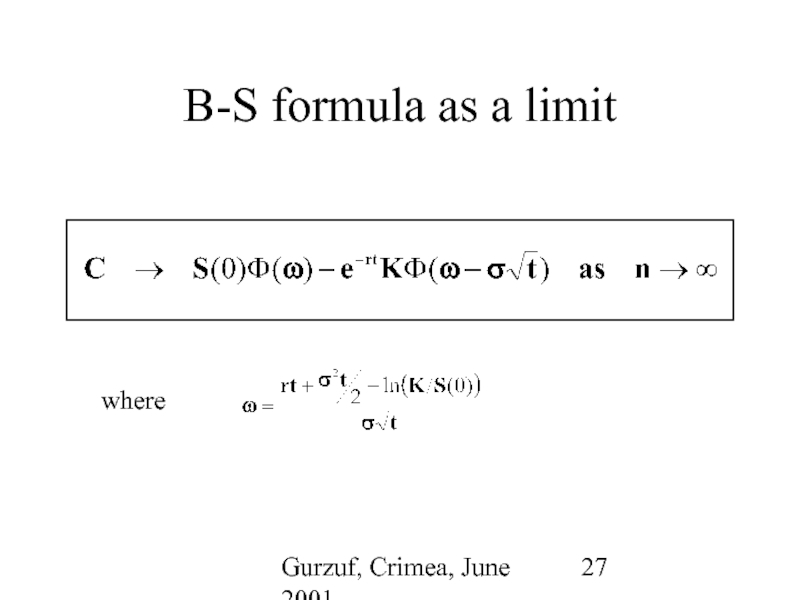

- 27. Gurzuf, Crimea, June 2001 B-S formula as a limit where

Слайд 1Gurzuf, Crimea, June 2001

Option Pricing:

The Multi Period Binomial Model

Henrik Jönsson

Mälardalen University

Sweden

Слайд 2Gurzuf, Crimea, June 2001

Contents

European Call Option

Geometric Brownian Motion

Black-Scholes Formula

Multi period

GBM as a limit

Black-Scholes Formula as a limit

Слайд 3Gurzuf, Crimea, June 2001

European Call Option

C - Option Price

K - Strike

T - Expiration day

Exercise only at T

Payoff function, e.g.

Слайд 4Gurzuf, Crimea, June 2001

Geometric Brownian Motion

S(y), 0≤y

independent of all prices up to time y

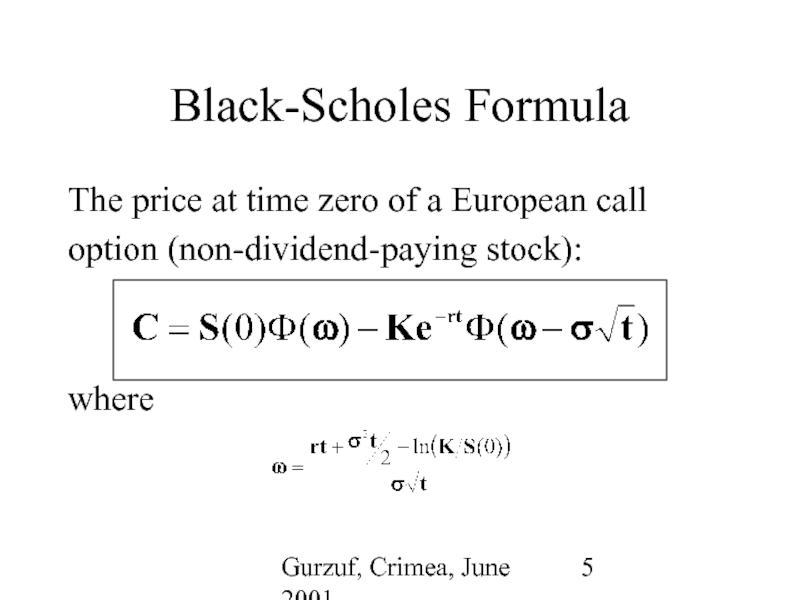

Слайд 5Gurzuf, Crimea, June 2001

Black-Scholes Formula

The price at time zero of a

option (non-dividend-paying stock):

where

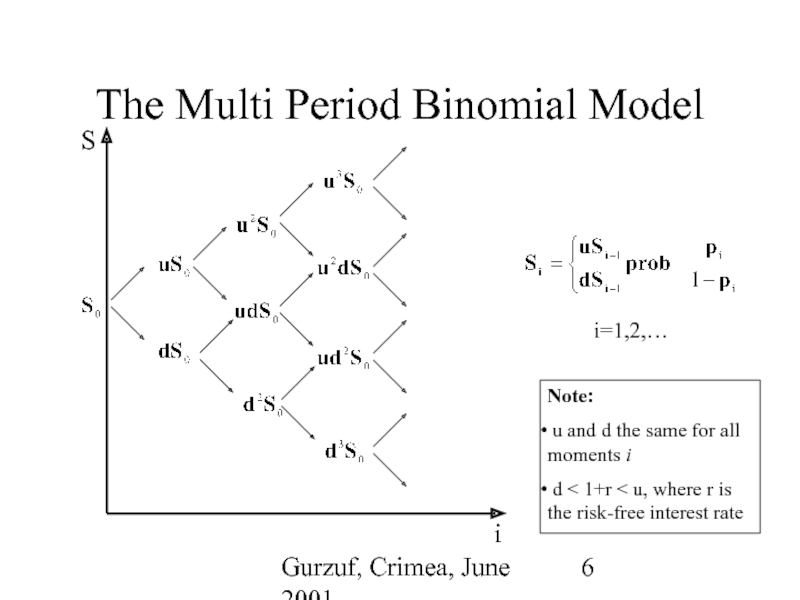

Слайд 6Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

i

S

i=1,2,…

Note:

u and

d < 1+r < u, where r is the risk-free interest rate

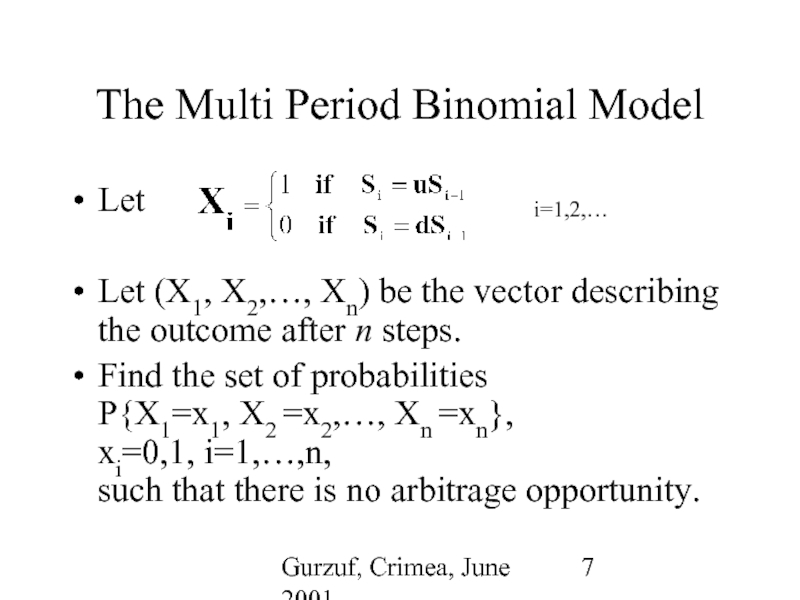

Слайд 7Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

Let

Let (X1, X2,…,

Find the set of probabilities P{X1=x1, X2 =x2,…, Xn =xn}, xi=0,1, i=1,…,n, such that there is no arbitrage opportunity.

i=1,2,…

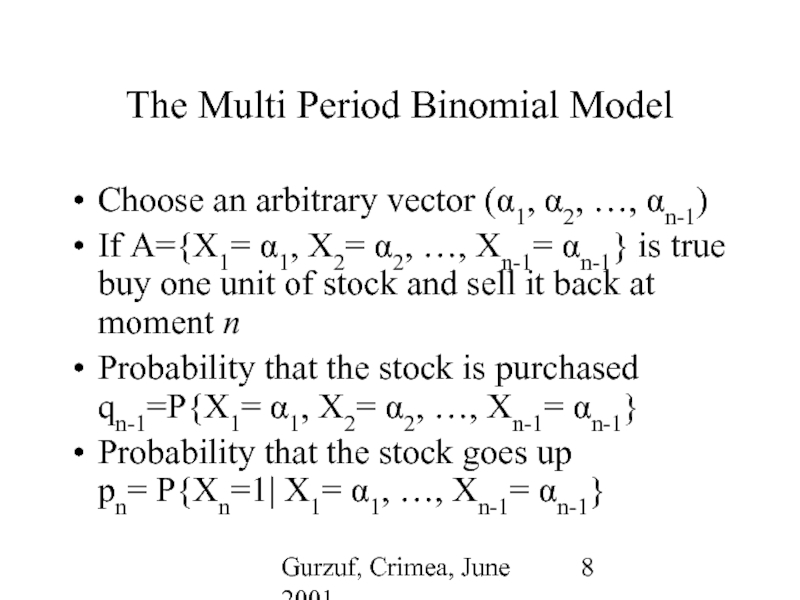

Слайд 8Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

Choose an arbitrary vector

If A={X1= α1, X2= α2, …, Xn-1= αn-1} is true buy one unit of stock and sell it back at moment n

Probability that the stock is purchased qn-1=P{X1= α1, X2= α2, …, Xn-1= αn-1}

Probability that the stock goes up pn= P{Xn=1| X1= α1, …, Xn-1= αn-1}

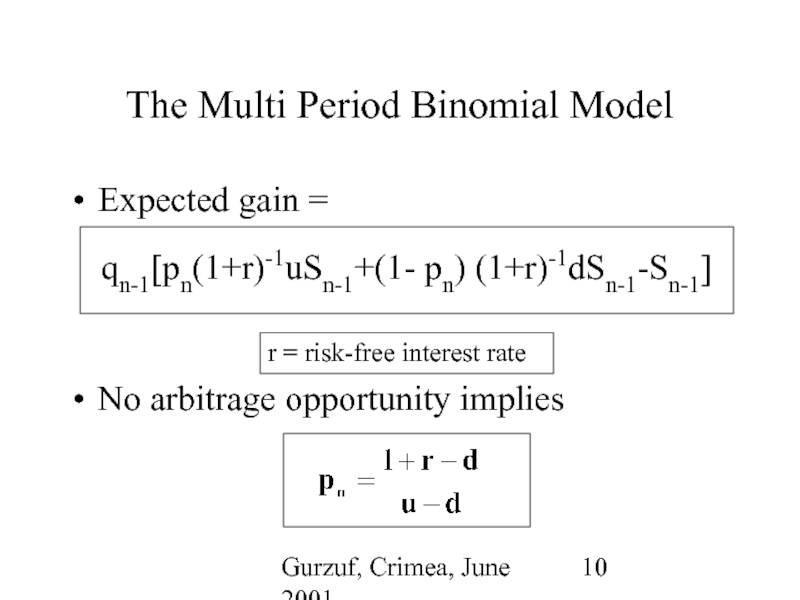

Слайд 10Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

Expected gain =

No

qn-1[pn(1+r)-1uSn-1+(1- pn) (1+r)-1dSn-1-Sn-1]

r = risk-free interest rate

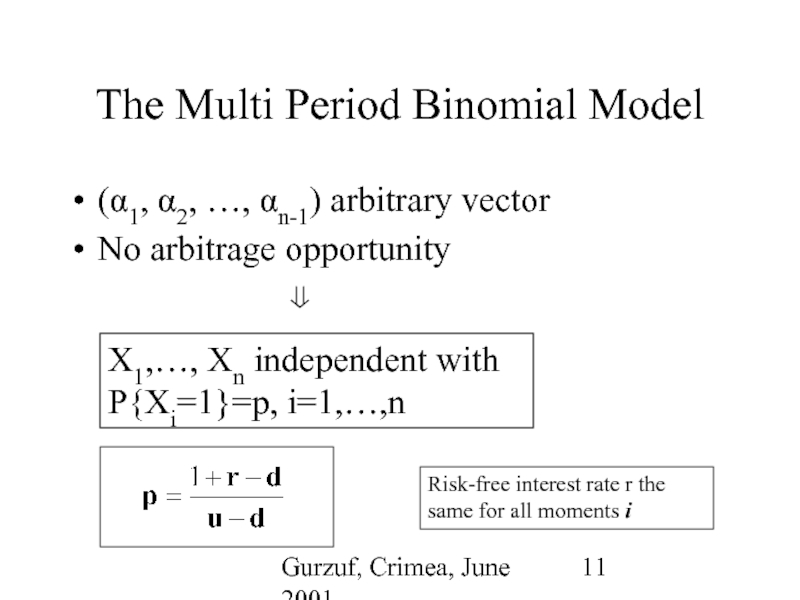

Слайд 11Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

(α1, α2, …, αn-1)

No arbitrage opportunity

⇓

X1,…, Xn independent with P{Xi=1}=p, i=1,…,n

Risk-free interest rate r the same for all moments i

Слайд 12Gurzuf, Crimea, June 2001

The Multi Period Binomial Model

Limitations:

Two outcomes only

The

The same probabilities

Qualities:

Simple mathematics

Arbitrage pricing

Easy to implement

Слайд 18Gurzuf, Crimea, June 2001

GBM as a limit

Expected value of W

Variance of

EY = np

VarY = np(1-p)

Слайд 20Gurzuf, Crimea, June 2001

GBM as a limit

The multi period Binomial model

are independent

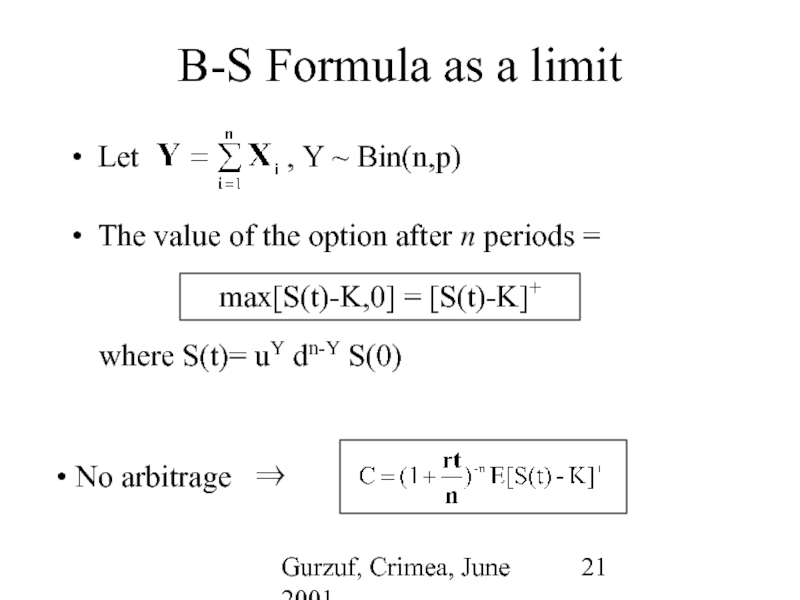

Слайд 21Gurzuf, Crimea, June 2001

B-S Formula as a limit

Let

The value of the option after n periods =

where S(t)= uY dn-Y S(0)

max[S(t)-K,0] = [S(t)-K]+

No arbitrage ⇒

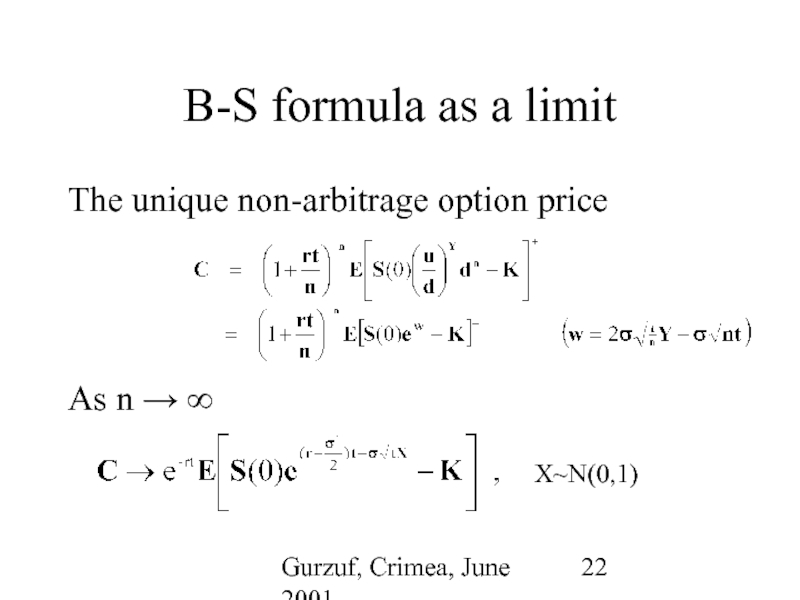

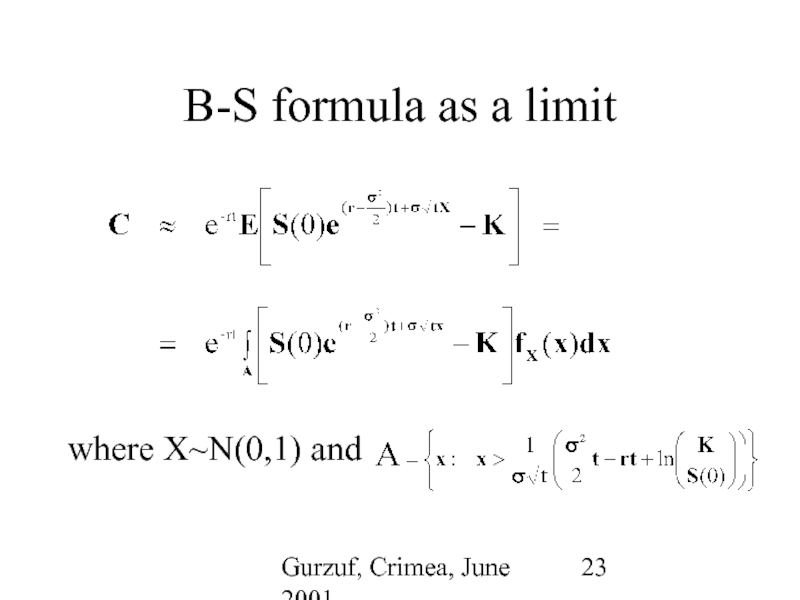

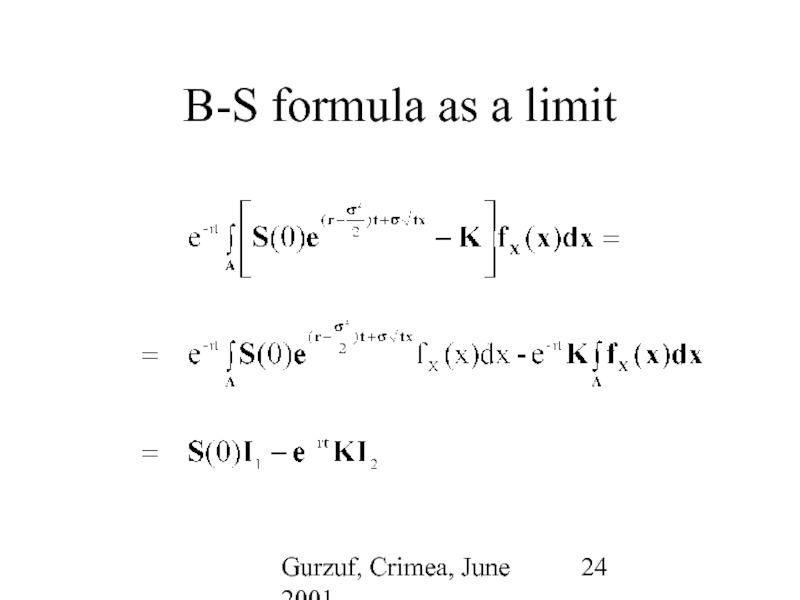

Слайд 22Gurzuf, Crimea, June 2001

B-S formula as a limit

The unique non-arbitrage option

As n → ∞

X~N(0,1)