- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

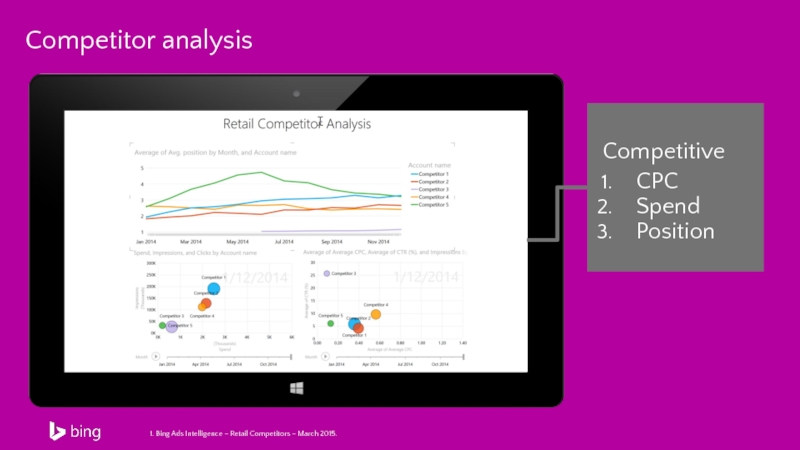

- Менеджмент

- Музыка

- МХК

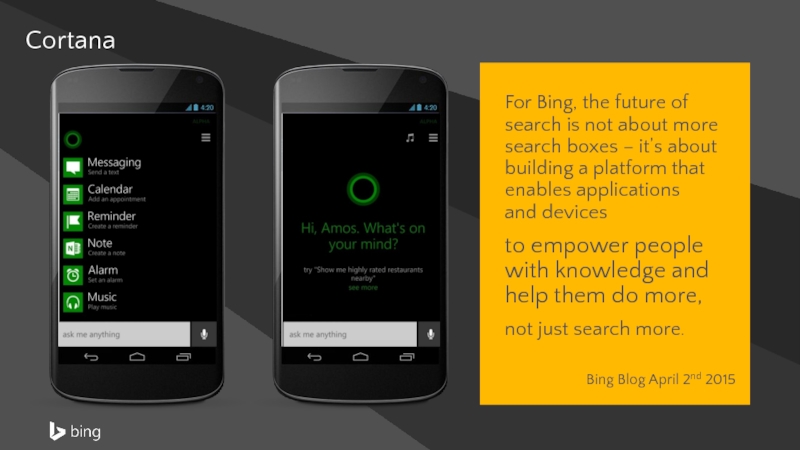

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Retail vertical insightsbing AustraliaLandscape, key trends and recommendations презентация

Содержание

- 1. Retail vertical insightsbing AustraliaLandscape, key trends and recommendations

- 2. Top trends Customer expectations Opportunities for SEM

- 3. Australian retail industry Overview

- 4. FY 2014 saw Food and Household

- 5. Retail online

- 6. How big is the online retail

- 7. Ama in page views, sessions and audience

- 8. Ama Retail online: international

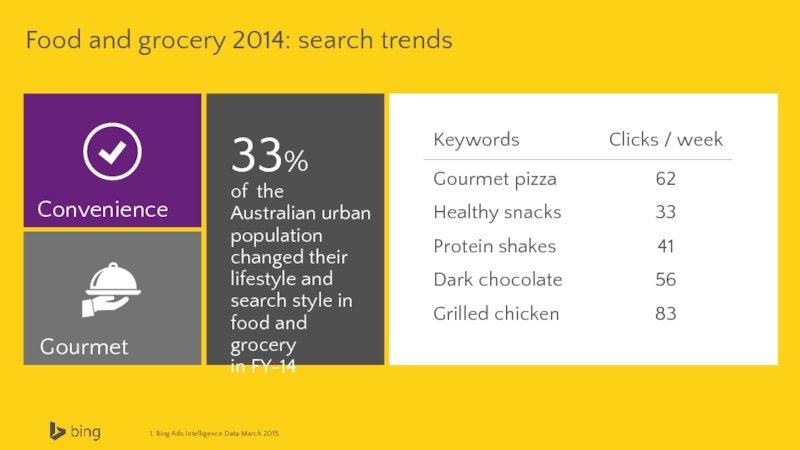

- 9. 1. Bing Ads Intelligence Data March 2015. Food and grocery 2014: search trends

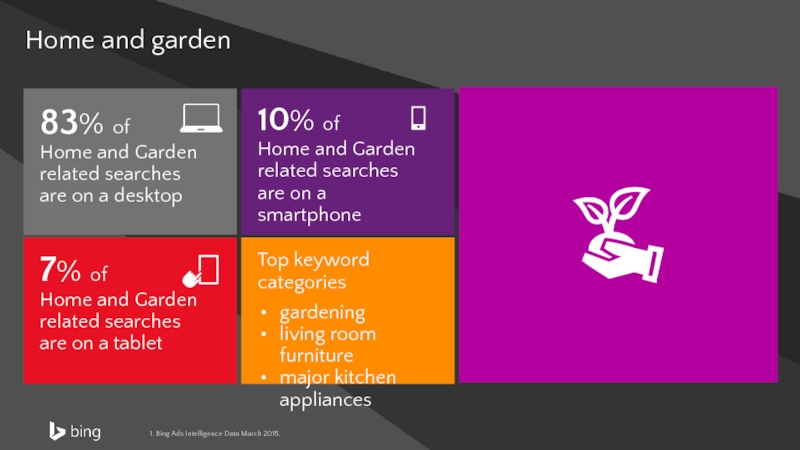

- 10. 1. Bing Ads Intelligence Data March 2015. Home and garden 2014: search trends

- 11. Personal From mass merchandise to personal merchandise

- 12. The numbers do not add up to

- 13. Seasons Apparel Seasons Spring: Women Aug

- 14. Online: by retail generic

- 15. Online:

- 16. How can Bing help? Retailers provide a

- 17. Seamless Meet consumer demand by seamlessly connecting

- 18. Social Search Web Site Visit Contact

- 19. Now Available: App Extensions

- 20. Home and garden 1. Bing Ads Intelligence Data March 2015.

- 21. Toys and hobbies 1. Bing Ads Intelligence Data March 2015.

- 22. Apparel and accessories 1. Bing Ads Intelligence Data March 2015.

- 23. Differentiated From standard to standout

- 24. Occasions are driving increased sales

- 25. In clothing over the past 20 years:

- 26. Emerging new business model - “click &

- 27. Everyday Rewards customer loyalty program

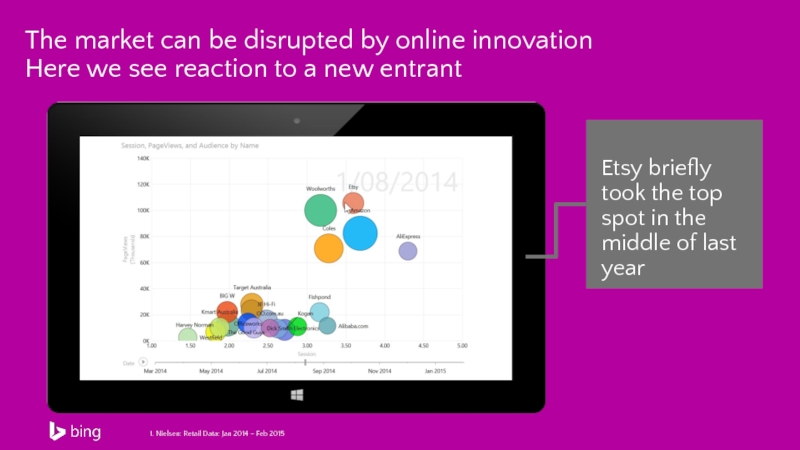

- 28. 1. Nielsen: Retail Data: Jan 2014

- 29. 1. The Guardian. The market can be

- 30. 1. Bing Ads Intelligence – Retail Competitors – March 2015. Competitor analysis

- 32. 1. The Global Innovation 1000: Top 20 R&D Spenders 2005-2014.

- 33. Cortana

- 34. Personal Seamless Differentiated

- 35. Thank you

Слайд 2Top trends

Customer expectations

Opportunities for SEM

From mass merchandise to personal merchandise

Context

From the company’s channel to “my channel”

Consistent Device responsive

From standard to standout

Innovation Competition

Australian retail industry Australian retail online

ABS & Citi analysis Nielsen & Bing

Retail industry overview and trends

Слайд 4

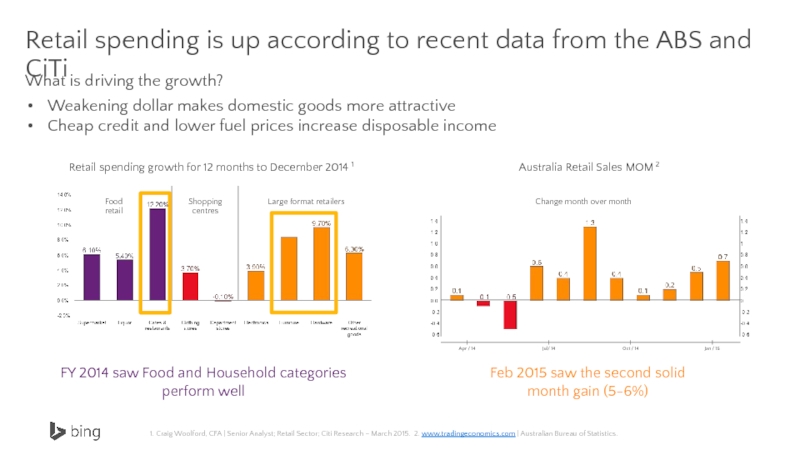

FY 2014 saw Food and Household categories perform well

What is driving

Weakening dollar makes domestic goods more attractive

Cheap credit and lower fuel prices increase disposable income

Feb 2015 saw the second solid month gain (5-6%)

1. Craig Woolford, CFA | Senior Analyst; Retail Sector; Citi Research – March 2015. 2. www.tradingeconomics.com | Australian Bureau of Statistics.

Retail spending is up according to recent data from the ABS and CiTi

Слайд 6How big is the

online retail market?

Online retailers are actively reclaiming

1. NAB Online Retail sales Index Survey. 2: Hitwise Paid v Organic traffic Feb 2015 3: CiTi research Feb 2015

Retail online

Слайд 7Ama

in page views, sessions and audience

Brand retailers are in the second

3

Clear leaders

8

Big

names

Amazon Coles Woolworths

1. Nielsen trend Report March 2015 “Retail Sector”.

Retail online: dominated by the top 3

Слайд 8Ama

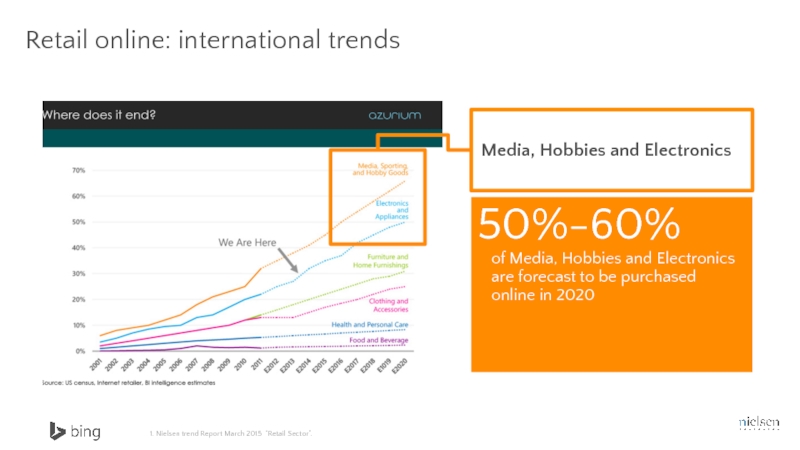

Retail online: international trends

50%-60%

of Media, Hobbies and Electronics are forecast to

Media, Hobbies and Electronics

1. Nielsen trend Report March 2015 “Retail Sector”.

Слайд 12The numbers do not add up to 100% as an individual

1. American Express Pattern Spending Report, conducted in February 2015, polling 1,993 Australian consumers.

There is no “typical retail customer”

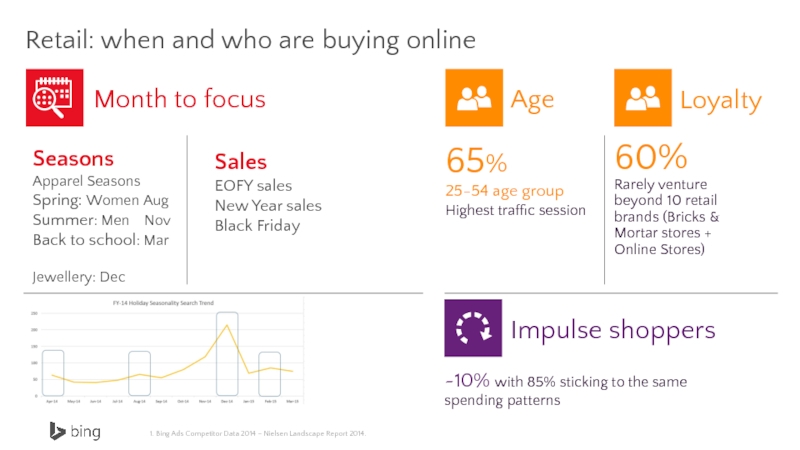

Слайд 13

Seasons

Apparel Seasons

Spring: Women Aug

Summer: Men Nov

Back to school: Mar

Jewellery:

Impulse shoppers

Sales

EOFY sales

New Year sales

Black Friday

65%

25-54 age group

Highest traffic session

60%

Rarely venture beyond 10 retail brands (Bricks & Mortar stores + Online Stores)

~10% with 85% sticking to the same spending patterns

1. Bing Ads Competitor Data 2014 – Nielsen Landscape Report 2014.

Retail: when and who are buying online

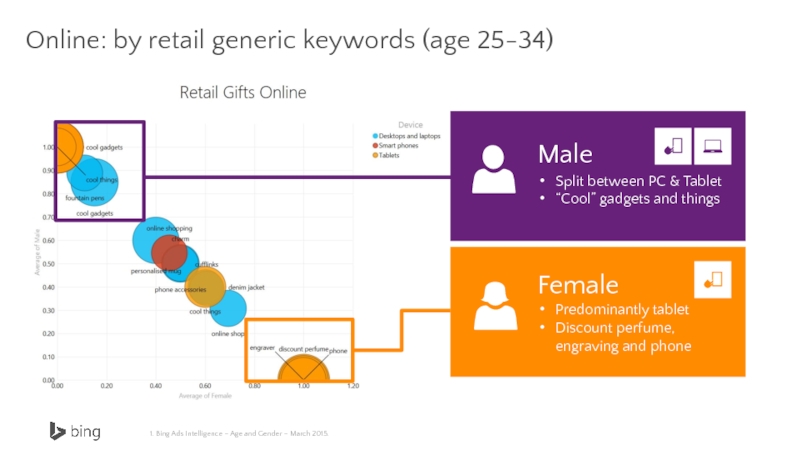

Слайд 14

Online: by retail generic keywords (age 25-34)

1. Bing Ads Intelligence –

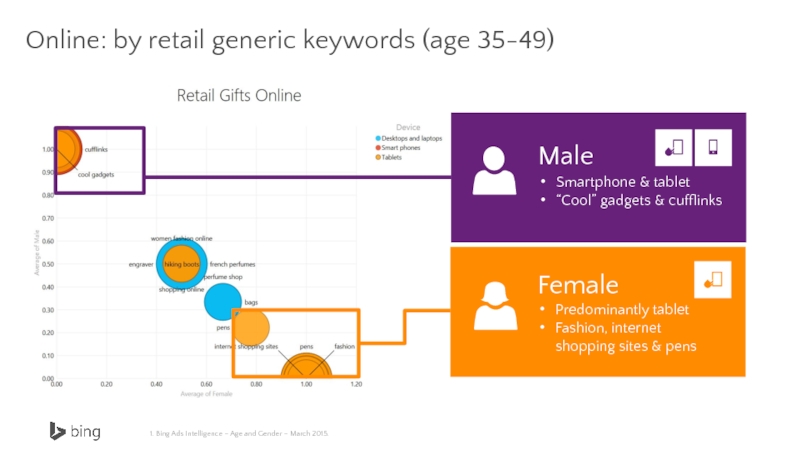

Слайд 15

Online: by retail generic keywords (age 35-49)

1. Bing Ads Intelligence –

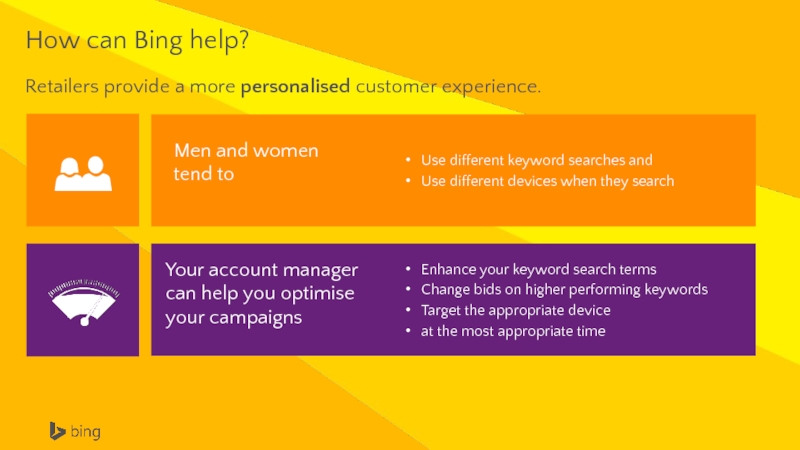

Слайд 16How can Bing help?

Retailers provide a more personalised customer experience.

Use different

Use different devices when they search

Enhance your keyword search terms

Change bids on higher performing keywords

Target the appropriate device

at the most appropriate time

Слайд 17Seamless

Meet consumer demand by seamlessly connecting the brick-and-mortar and online experience

Слайд 18Social

Search

Web Site

Visit

Contact Centre

In Person “Bricks & Mortar”

Australian retail customer journey

1.

3. Online Retail Sales Index: In depth report – January 2015. 4. SMH march 2014; 'Click and collect' boost Australian online retailers.

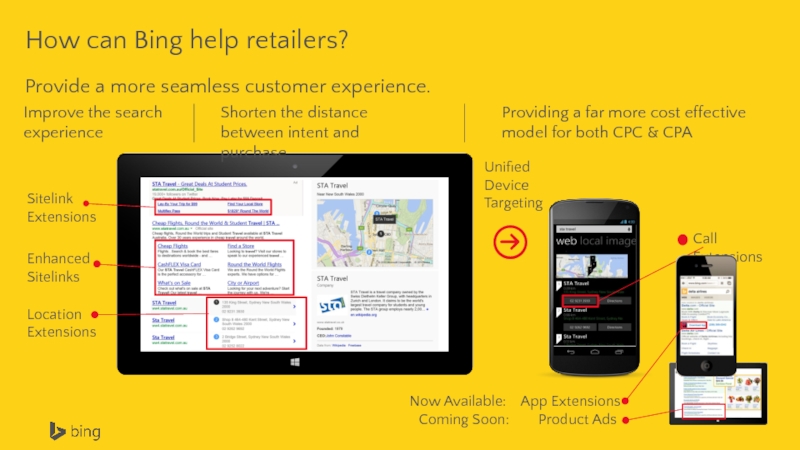

Слайд 19Now Available: App Extensions

Coming Soon:

Call Extensions

Improve the search experience

Sitelink

Extensions

Enhanced

Sitelinks

Location Extensions

Shorten the distance between intent and purchase

Providing a far more cost effective model for both CPC & CPA

Unified Device

Targeting

How can Bing help retailers?

Provide a more seamless customer experience.

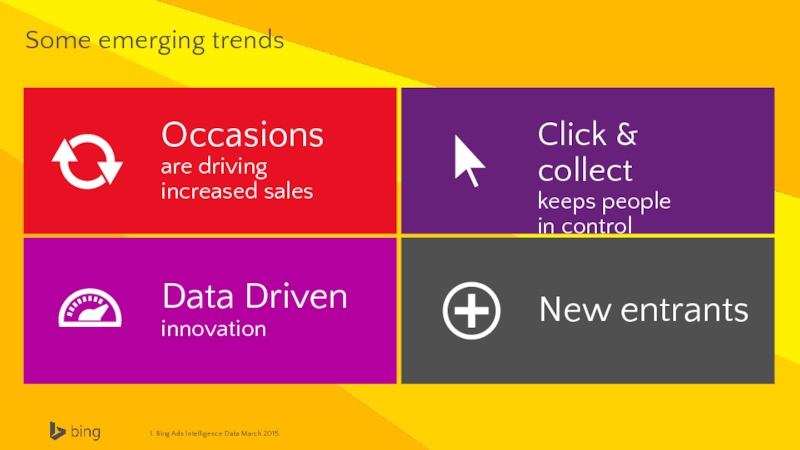

Слайд 24

Occasions

are driving increased sales

Click & collect

keeps people

in control

Data Driven

innovation

New

Some emerging trends

1. Bing Ads Intelligence Data March 2015.

Слайд 25In clothing over the past 20 years:

Per capita spending is up

Prices are up 2%

Per capita volume is up 74%

How much bigger is the wardrobe?

When retail increase the “occasions” to purchase we tend to buy more often

Innovation needs to return to lift retail spending

Weaker retail innovation globally is stunting retail sales growth

1:: CiTi research Feb 2015

Слайд 26Emerging new business model - “click & collect”

Where the store and

Click & collect keeps people in control.

Humans when you need them. Technology when you don't.

Myer David Jones

Woolworths Coles

1. SMH; March 2014.

Слайд 27

Everyday Rewards customer loyalty program

Use patterns of aggregated customer behaviour

1. http://www.adnews.com.au/news/woolies-and-quantium-to-launch-dsp-with-australian-first

2. http://www.cmo.com.au/article/553618/quantium_helps_woolworths_get_personal_customers_ceo_says/

Woolworths – innovating with customer analytics

Слайд 28

1. Nielsen: Retail Data: Jan 2014 – Feb 2015

The market can

Слайд 291. The Guardian.

The market can be disrupted by online innovation

Here we

Слайд 34

Personal

Seamless

Differentiated

Top 3 trends

From mass merchandise to personal merchandise

From the company’s channel

From standard to standout

Customer expectations

How can Bing help?

Conclusion