- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Retail Scorecards StudySummary ChartsJanuary – June 2014 презентация

Содержание

- 1. Retail Scorecards StudySummary ChartsJanuary – June 2014

- 2. Agenda Study Overview Retail Scorecard Overview Primary Scorecard Relationship Suppliers/Manufacturers Retailers

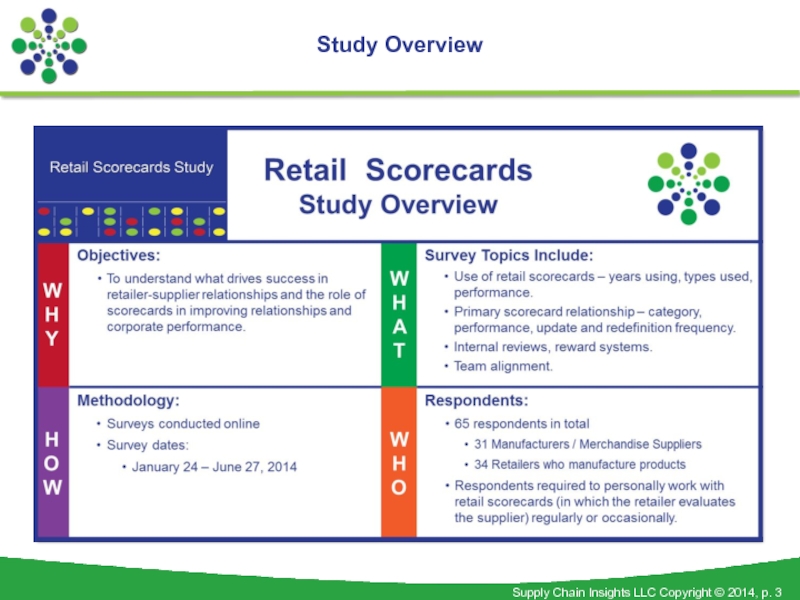

- 3. Study Overview

- 4. Definition Given to Respondents

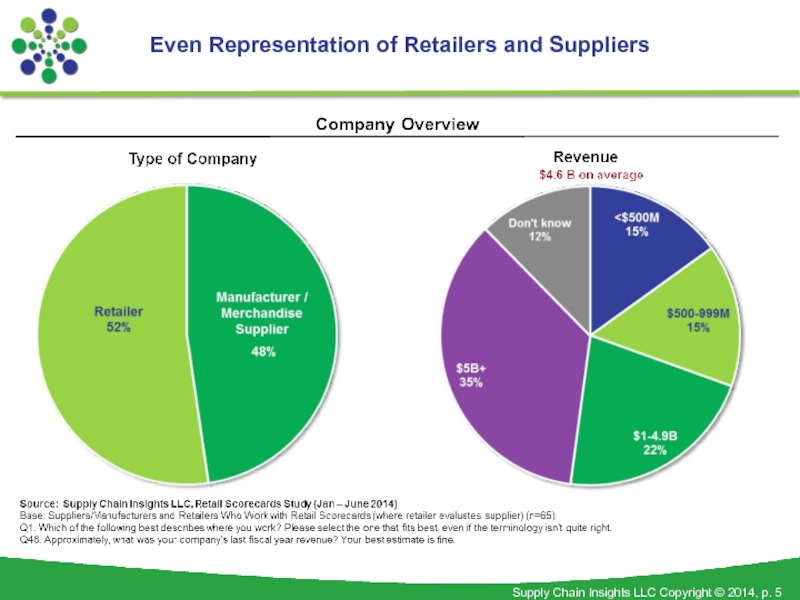

- 5. Even Representation of Retailers and Suppliers

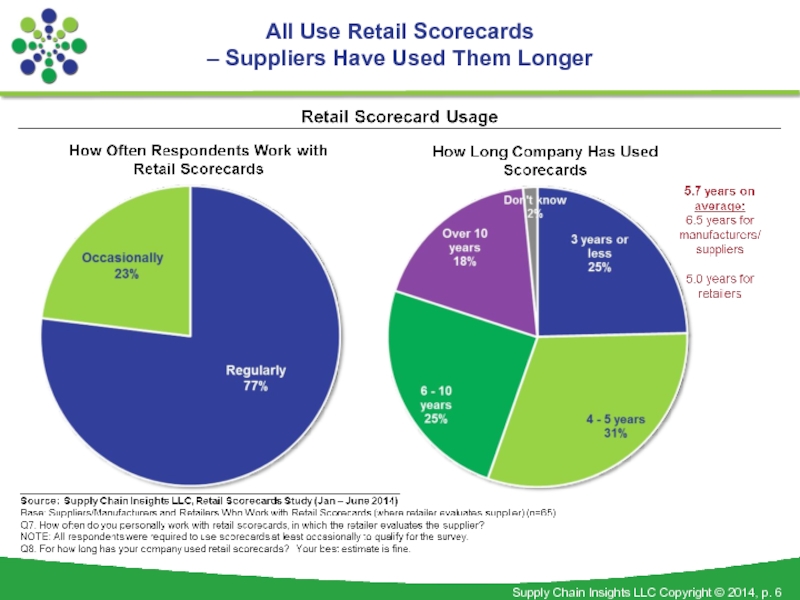

- 6. All Use Retail Scorecards – Suppliers Have Used Them Longer

- 7. One-Third in Supply Chain Role

- 8. Agenda Study Overview Retail Scorecard Overview Primary Scorecard Relationship Suppliers/Manufacturers Retailers

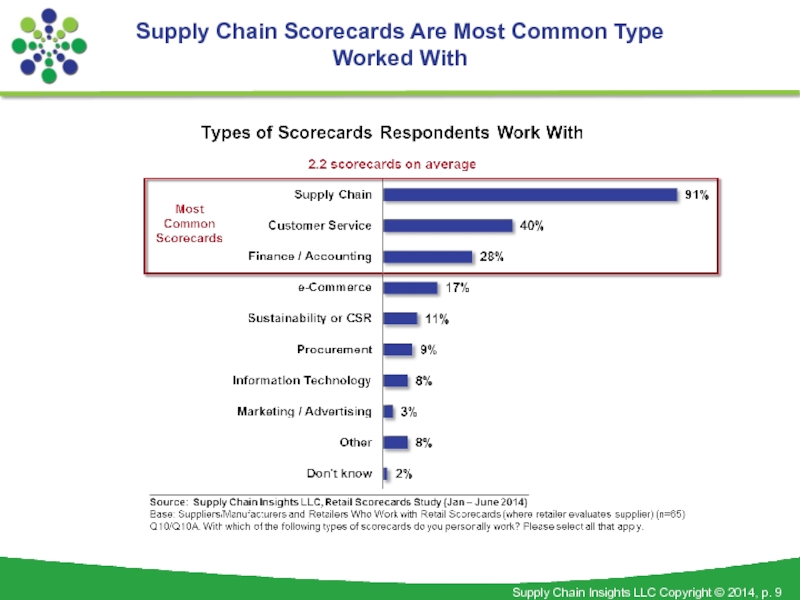

- 9. Supply Chain Scorecards Are Most Common Type Worked With

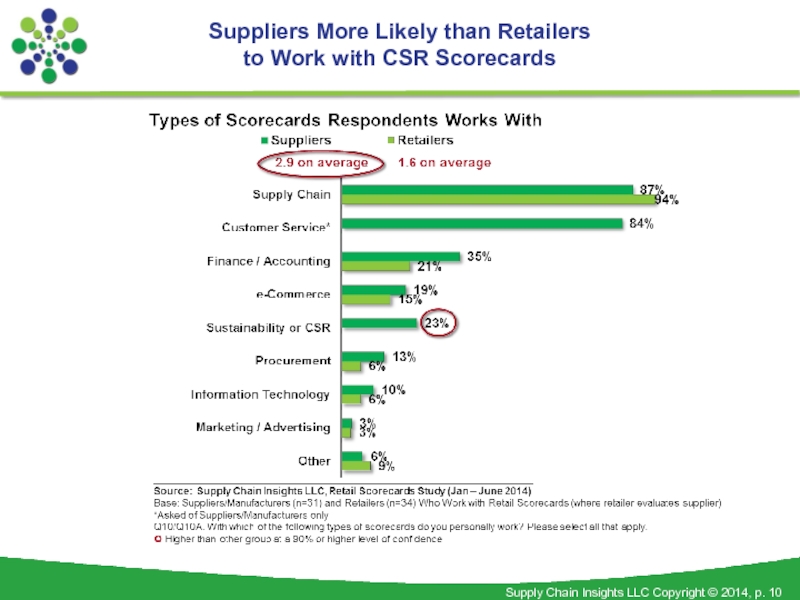

- 10. Suppliers More Likely than Retailers to Work with CSR Scorecards

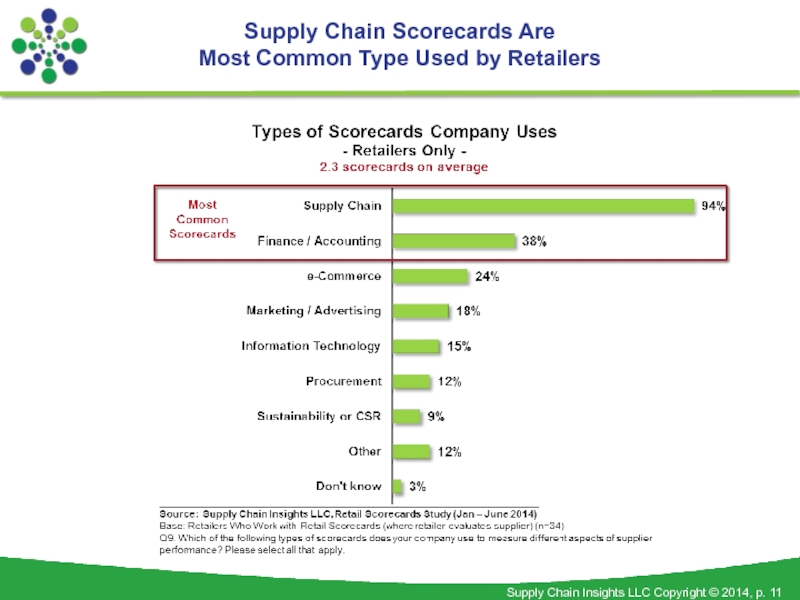

- 11. Supply Chain Scorecards Are Most Common Type Used by Retailers

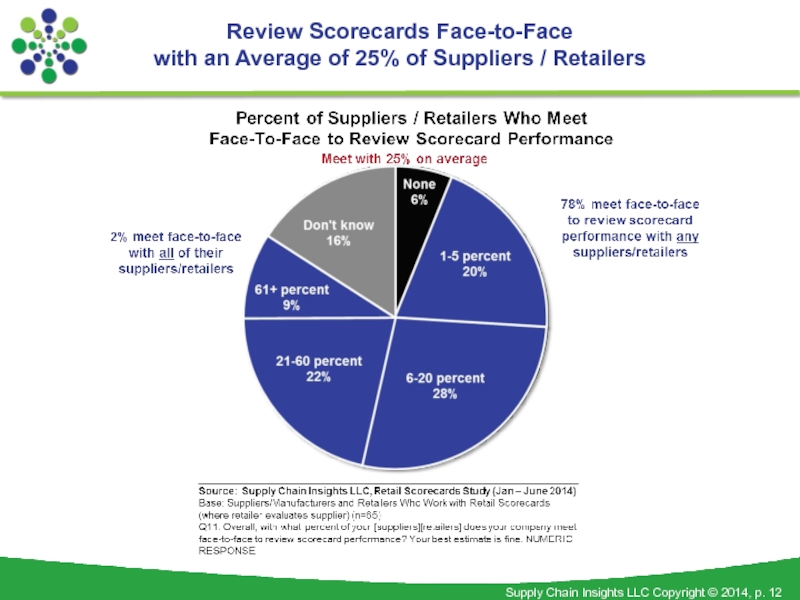

- 12. Review Scorecards Face-to-Face with an Average of 25% of Suppliers / Retailers

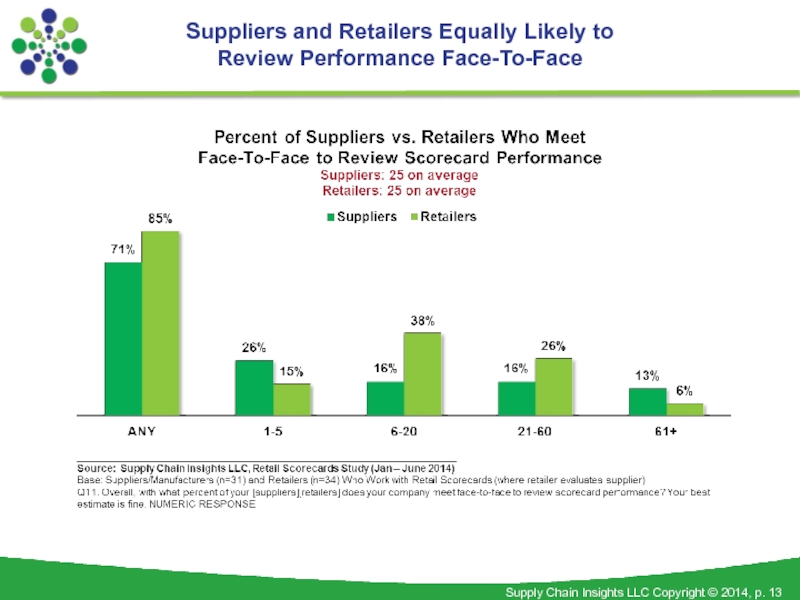

- 13. Suppliers and Retailers Equally Likely to Review Performance Face-To-Face

- 14. Most Common Criteria for Meeting Face-To-Face Are Volume and Impact on Business

- 15. Agenda Study Overview Retail Scorecard Overview Primary Scorecard Relationship Suppliers/Manufacturers Retailers

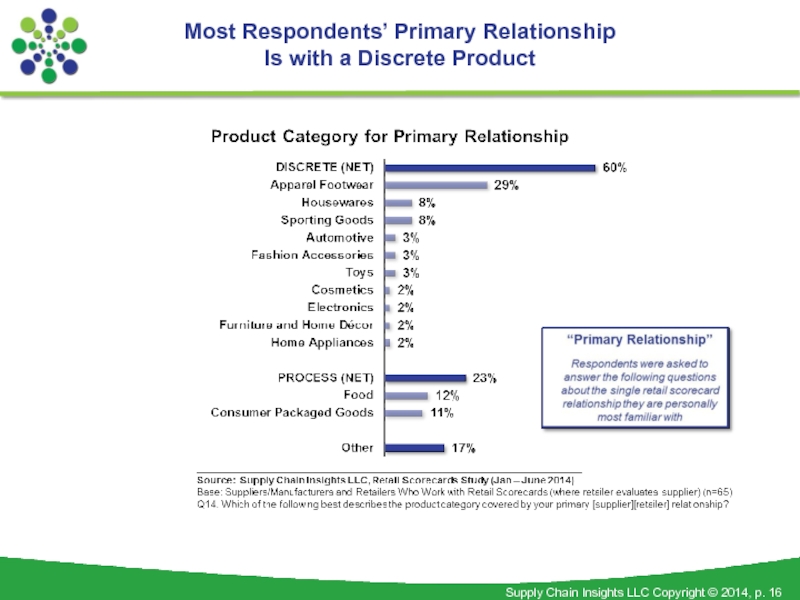

- 16. Most Respondents’ Primary Relationship Is with a Discrete Product

- 17. For Both Suppliers and Retailers, Most Respondents’ Primary Relationship Is with a Discrete Product

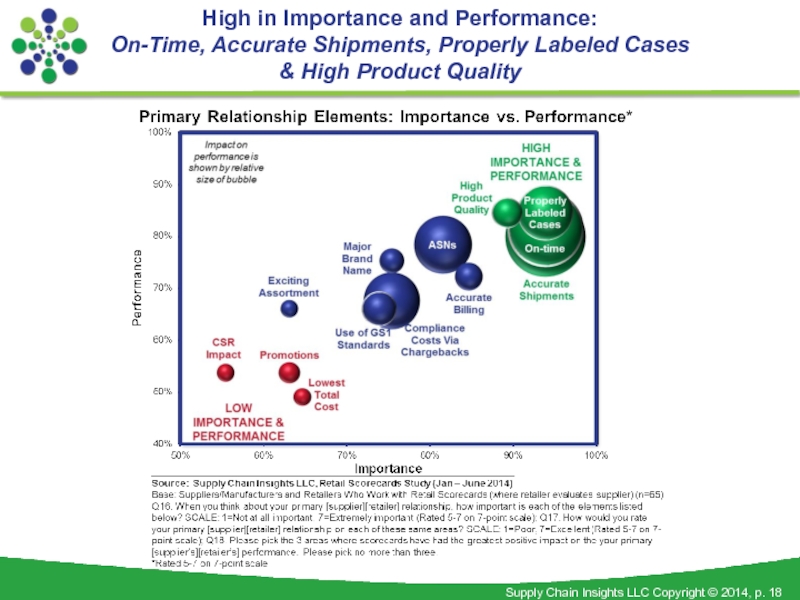

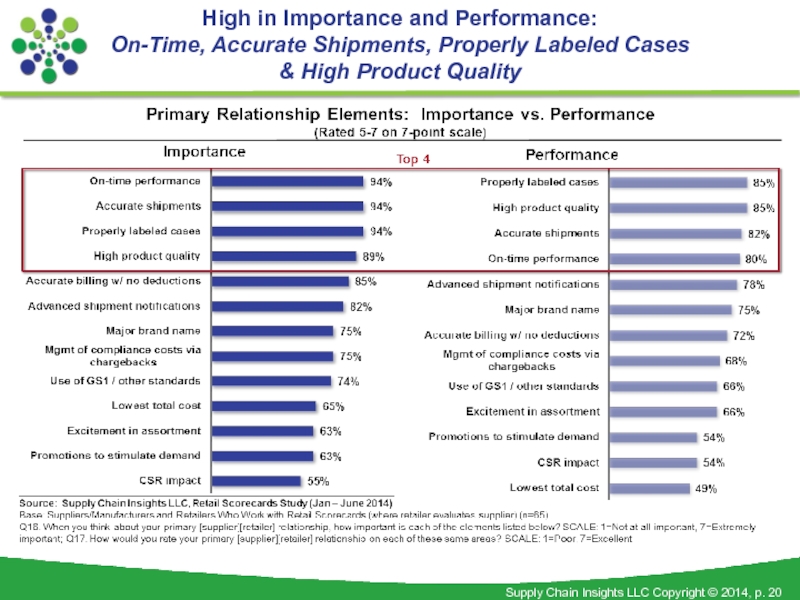

- 18. High in Importance and Performance: On-Time, Accurate

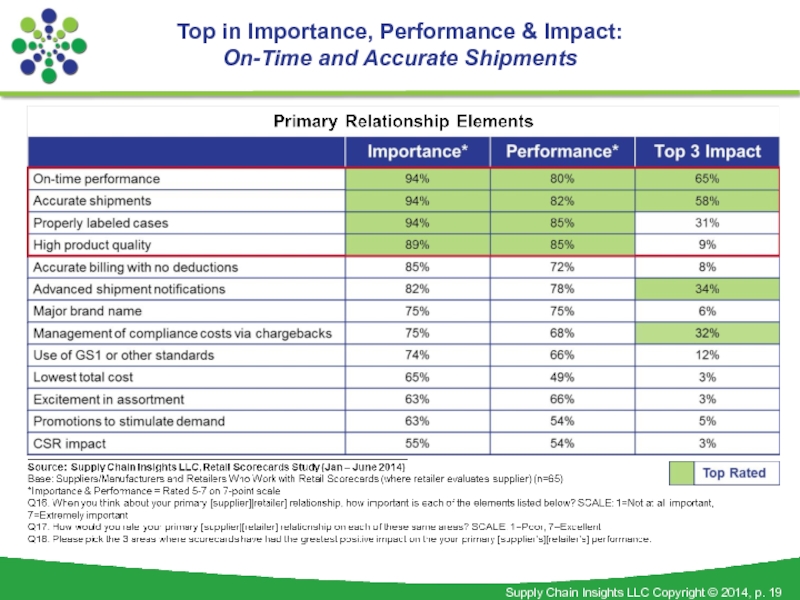

- 19. Top in Importance, Performance & Impact: On-Time and Accurate Shipments

- 20. High in Importance and Performance: On-Time, Accurate

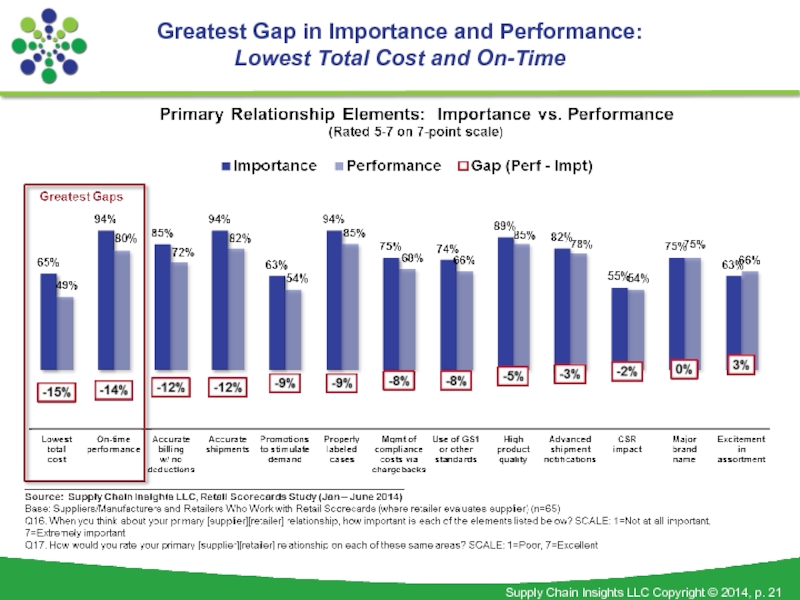

- 21. Greatest Gap in Importance and Performance: Lowest Total Cost and On-Time

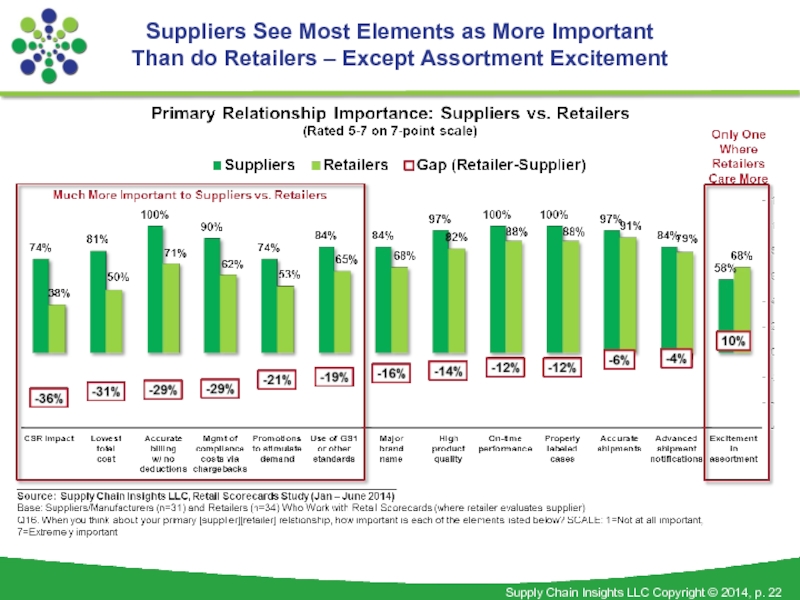

- 22. Suppliers See Most Elements as More Important Than do Retailers – Except Assortment Excitement

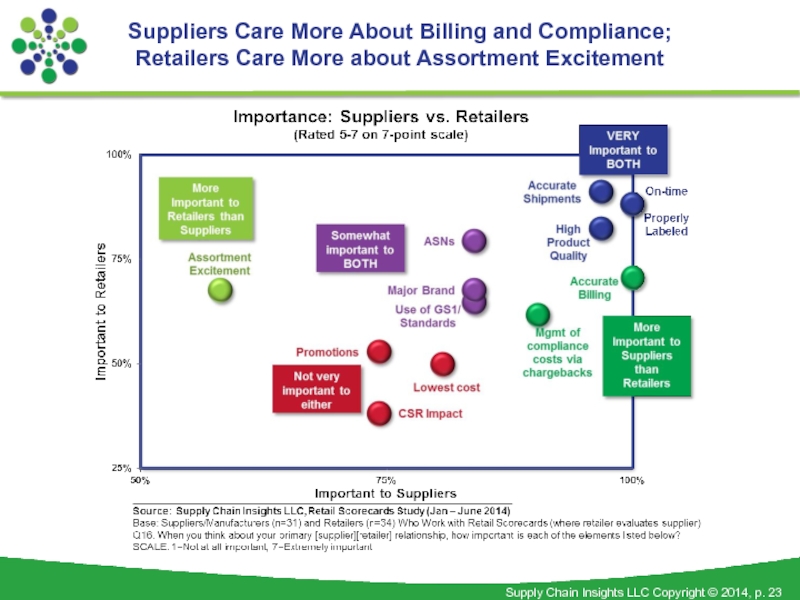

- 23. Suppliers Care More About Billing and Compliance; Retailers Care More about Assortment Excitement

- 24. Suppliers Rate Most Elements as Higher Performing Than do Retailers – Except Assortment and ASNs

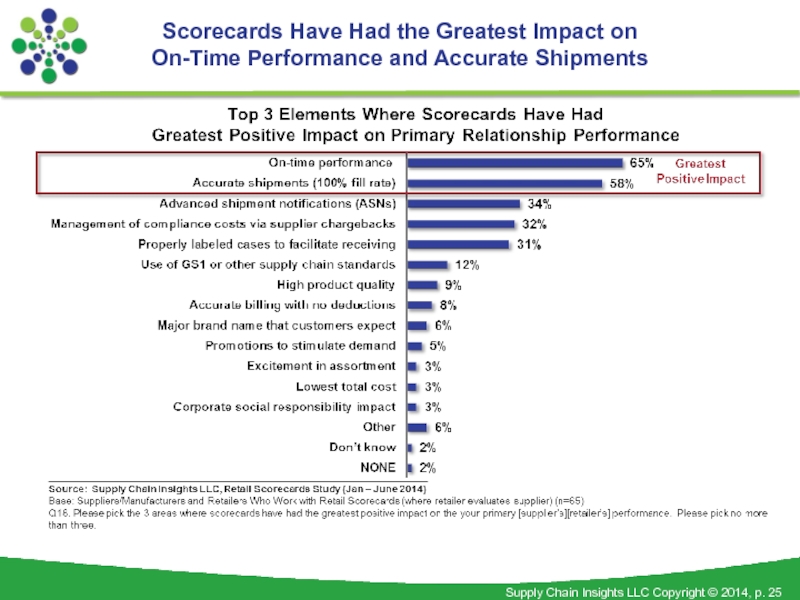

- 25. Scorecards Have Had the Greatest Impact on On-Time Performance and Accurate Shipments

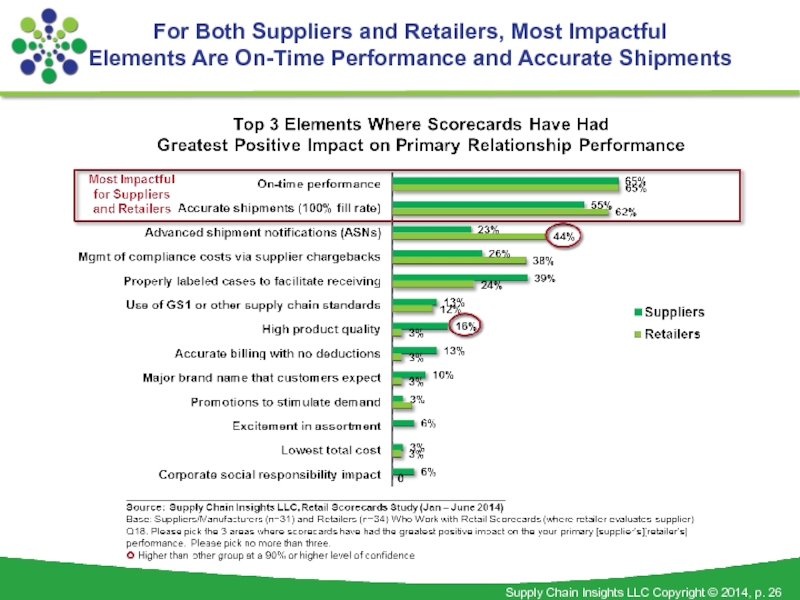

- 26. For Both Suppliers and Retailers, Most Impactful Elements Are On-Time Performance and Accurate Shipments

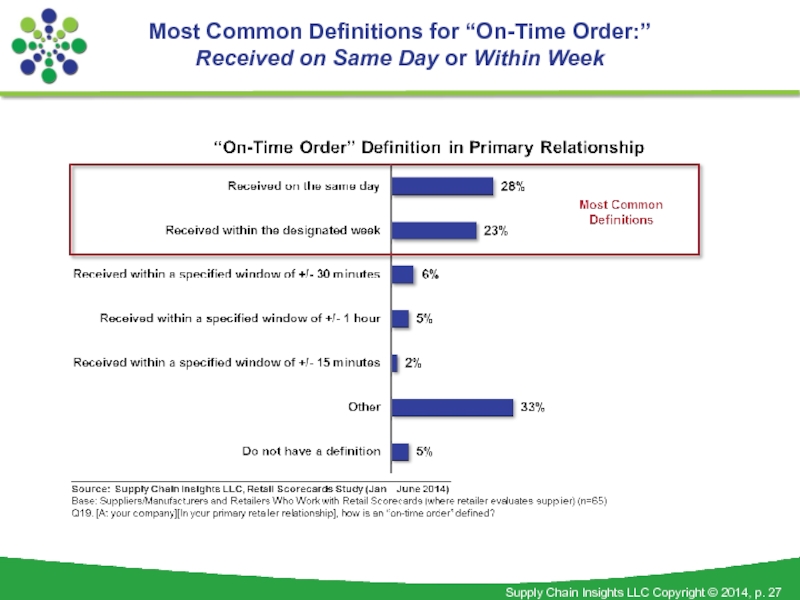

- 27. Most Common Definitions for “On-Time Order:” Received on Same Day or Within Week

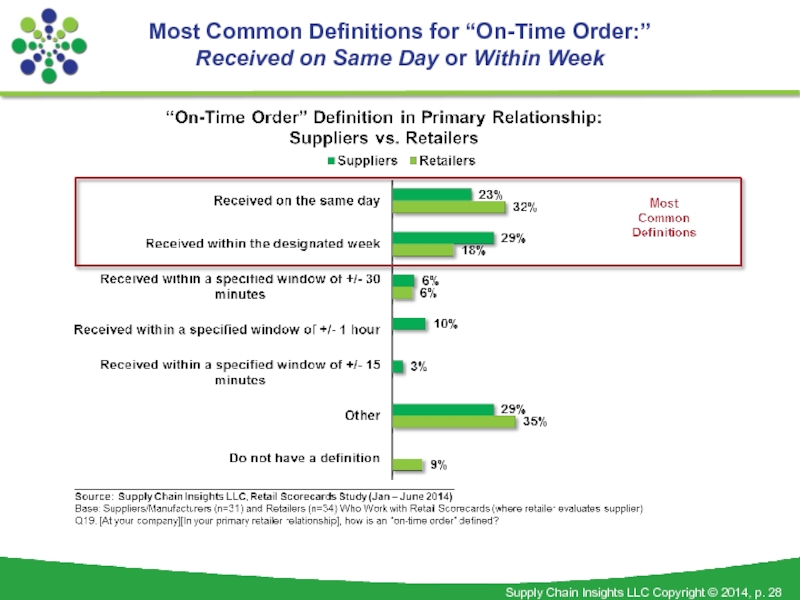

- 28. Most Common Definitions for “On-Time Order:” Received on Same Day or Within Week

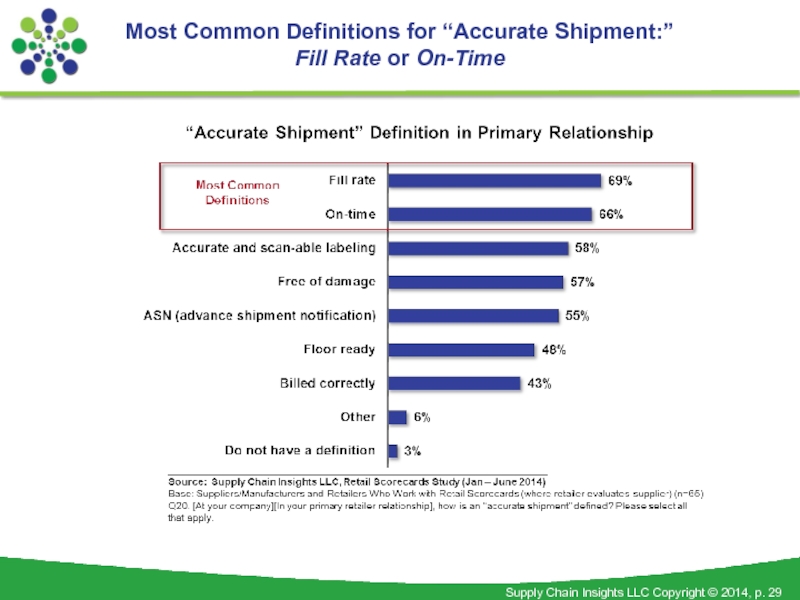

- 29. Most Common Definitions for “Accurate Shipment:” Fill Rate or On-Time

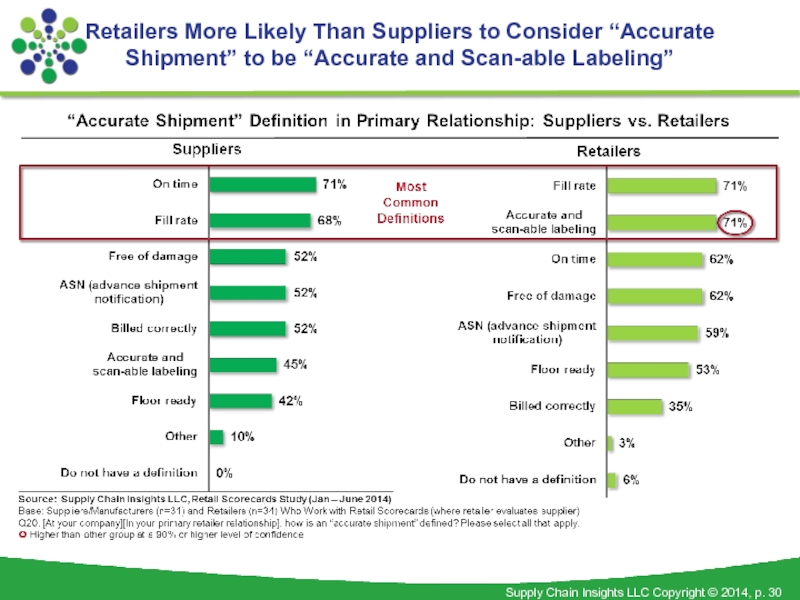

- 30. Retailers More Likely Than Suppliers to Consider

- 31. In the Primary Relationship, Scorecards Are Updated 37 Times per Year on Average

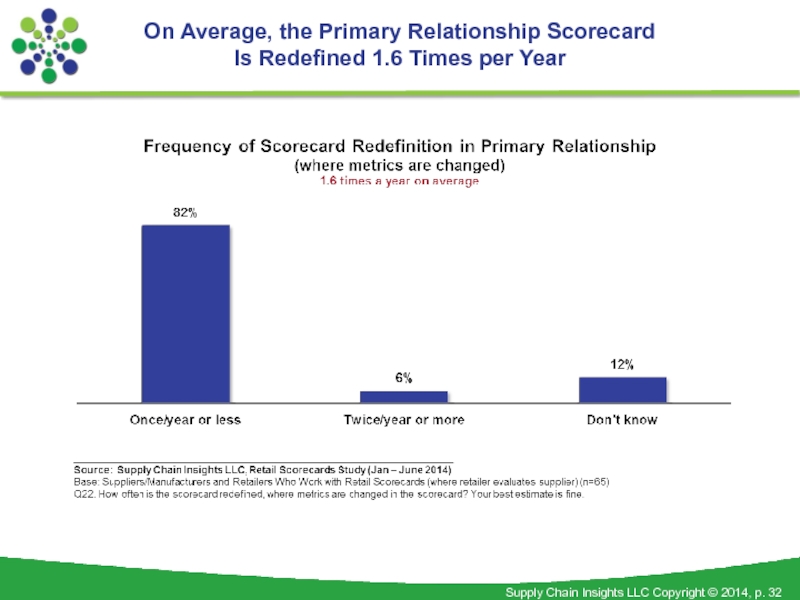

- 32. On Average, the Primary Relationship Scorecard Is Redefined 1.6 Times per Year

- 33. Agenda Study Overview Retail Scorecard Overview Primary Scorecard Relationship Suppliers/Manufacturers Retailers

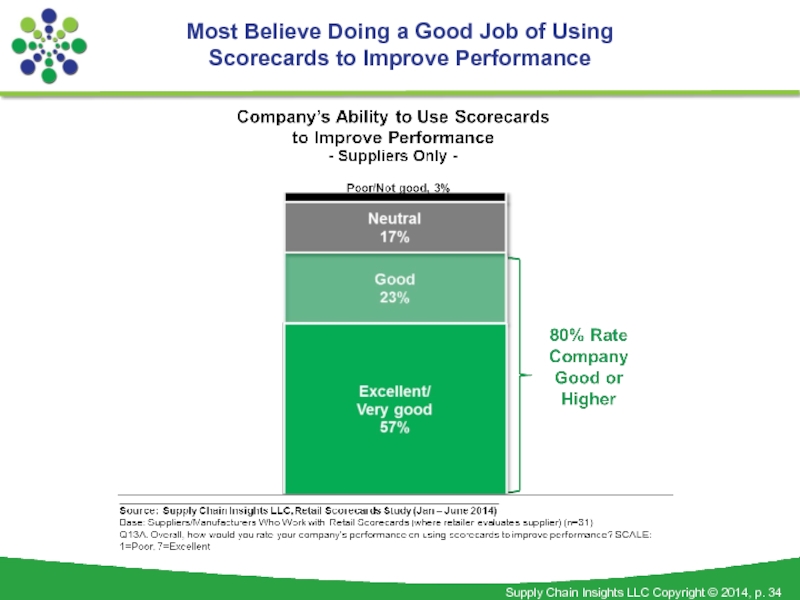

- 34. Most Believe Doing a Good Job of Using Scorecards to Improve Performance

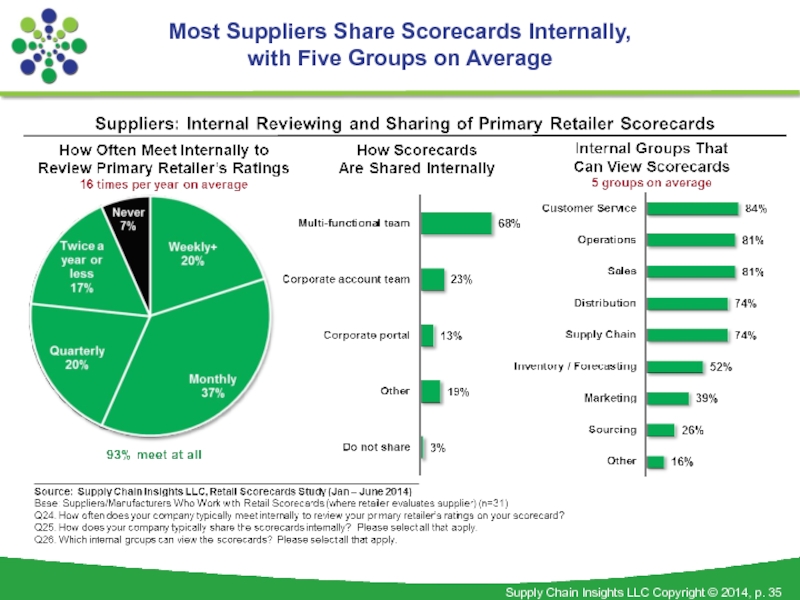

- 35. Most Suppliers Share Scorecards Internally, with Five Groups on Average

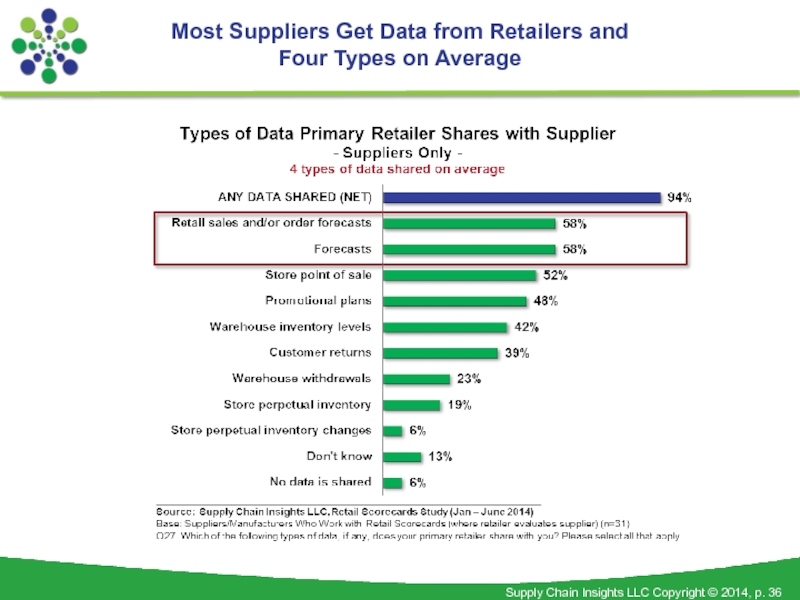

- 36. Most Suppliers Get Data from Retailers and Four Types on Average

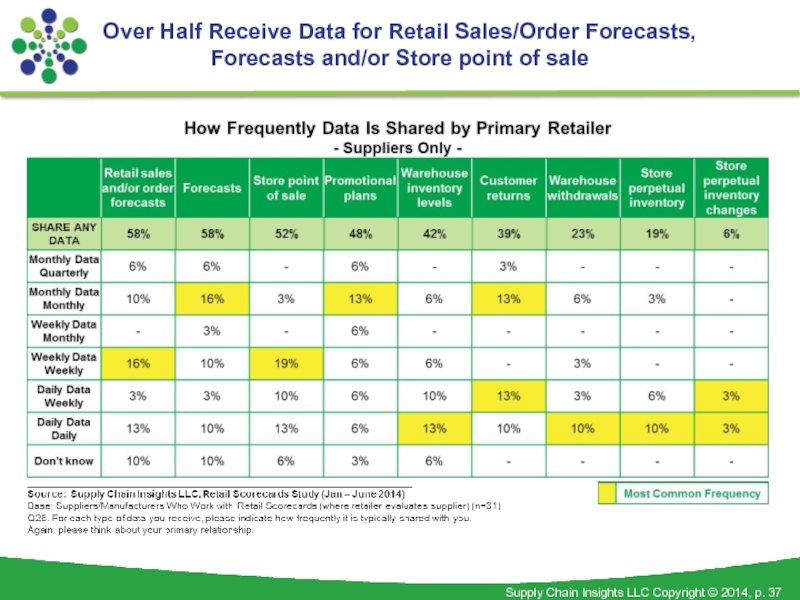

- 37. Over Half Receive Data for Retail Sales/Order Forecasts, Forecasts and/or Store point of sale

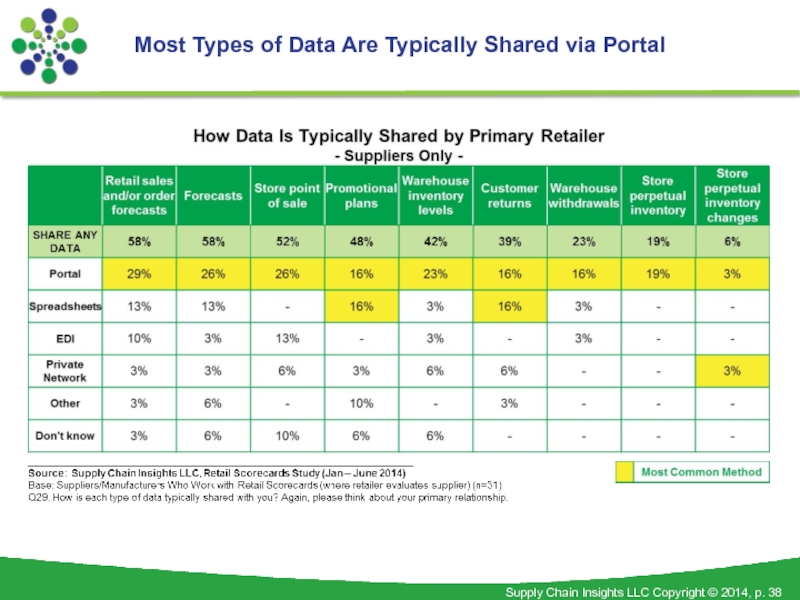

- 38. Most Types of Data Are Typically Shared via Portal

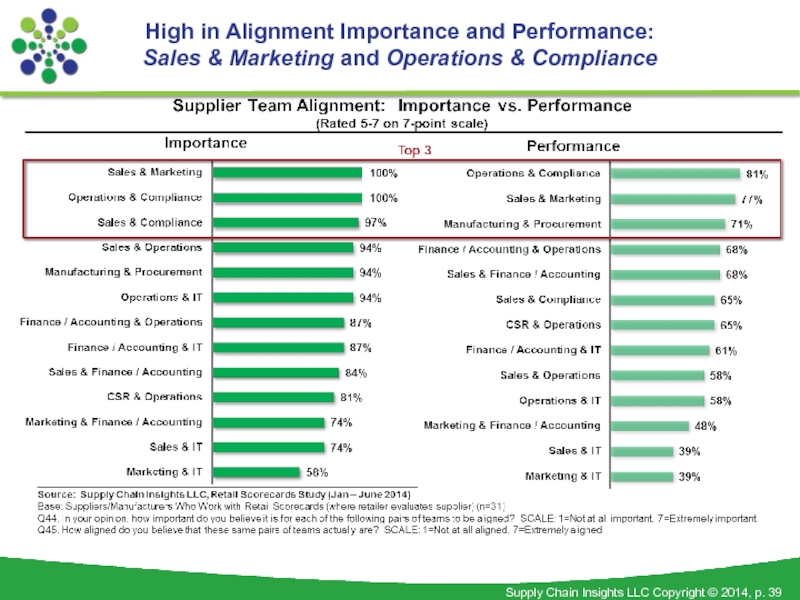

- 39. High in Alignment Importance and Performance: Sales & Marketing and Operations & Compliance

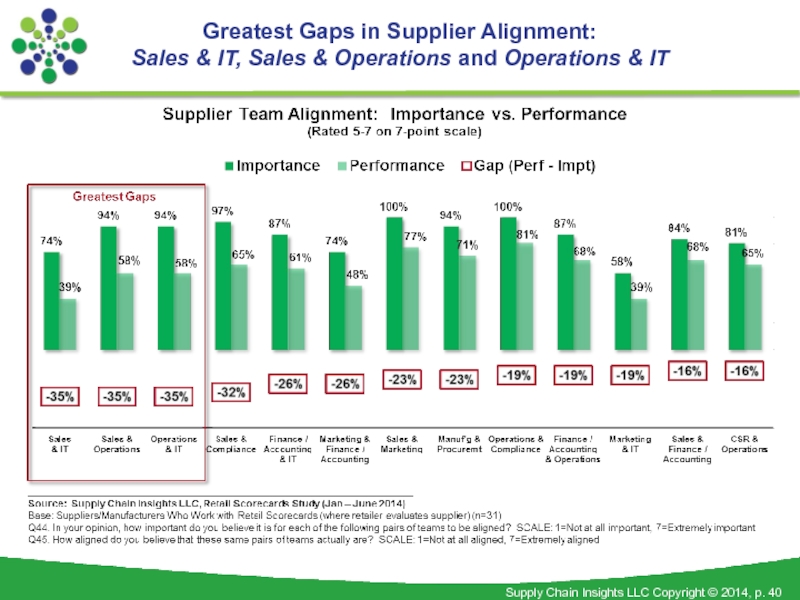

- 40. Greatest Gaps in Supplier Alignment: Sales & IT, Sales & Operations and Operations & IT

- 41. Agenda Study Overview Retail Scorecard Overview Primary Scorecard Relationship Suppliers/Manufacturers Retailers

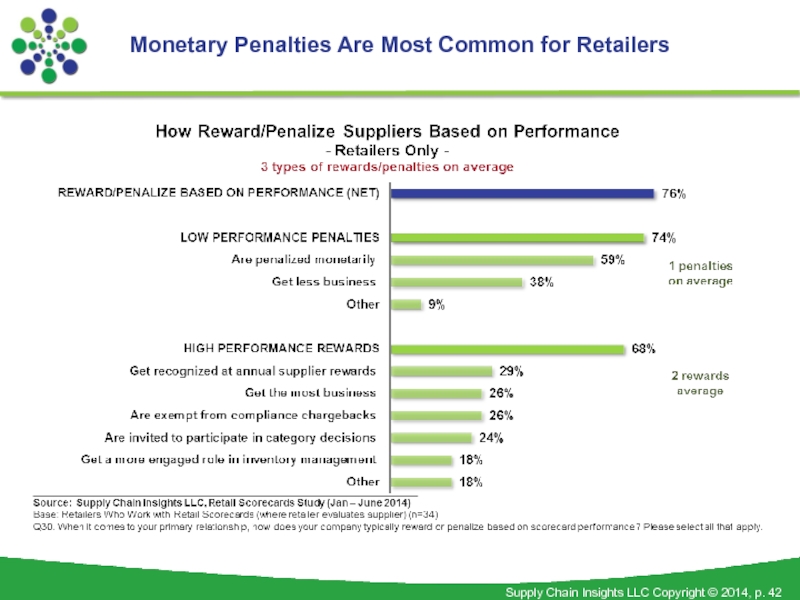

- 42. Monetary Penalties Are Most Common for Retailers

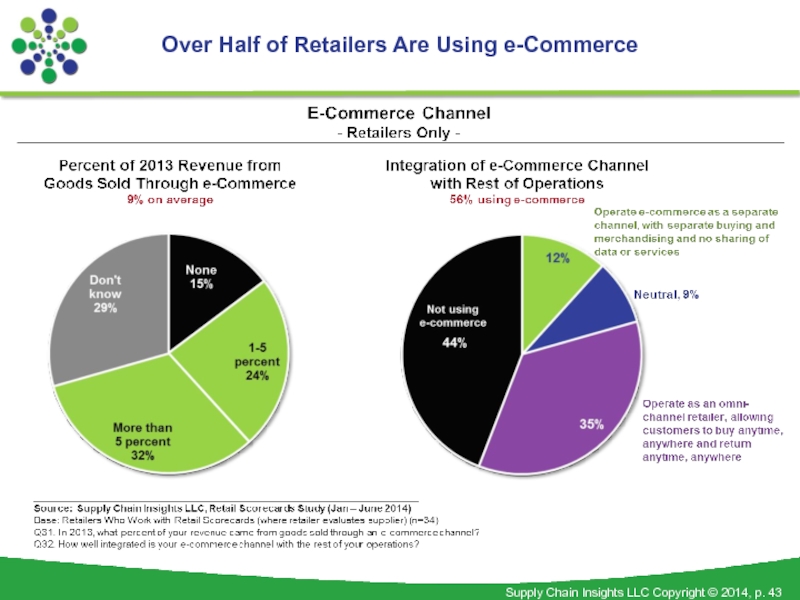

- 43. Over Half of Retailers Are Using e-Commerce

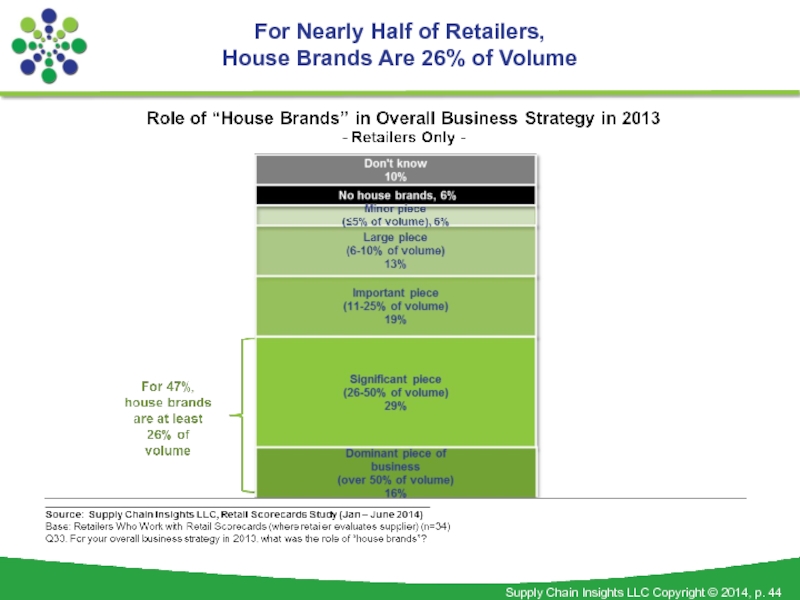

- 44. For Nearly Half of Retailers, House Brands Are 26% of Volume

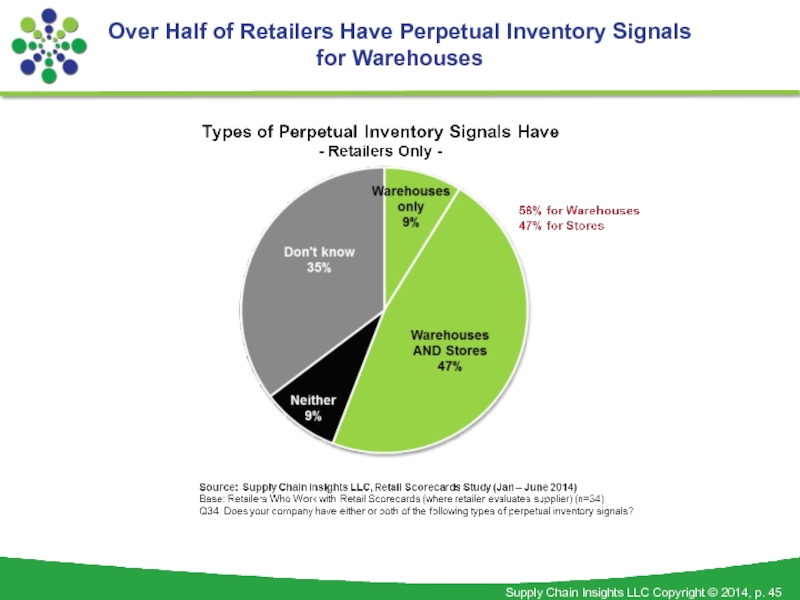

- 45. Over Half of Retailers Have Perpetual Inventory Signals for Warehouses

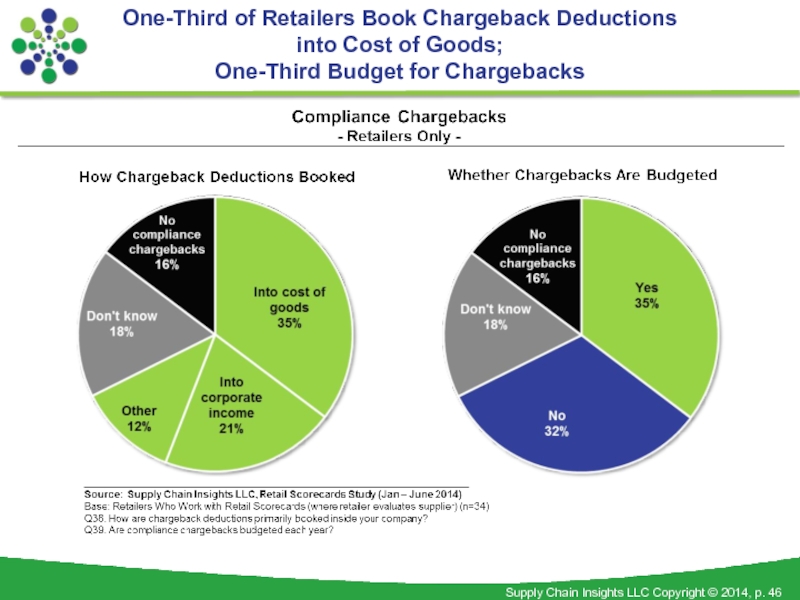

- 46. One-Third of Retailers Book Chargeback Deductions

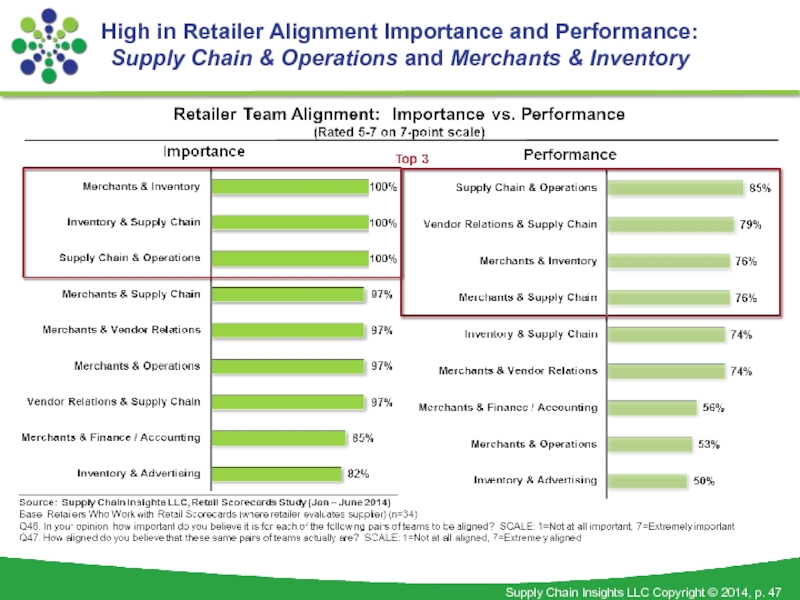

- 47. High in Retailer Alignment Importance and Performance: Supply Chain & Operations and Merchants & Inventory

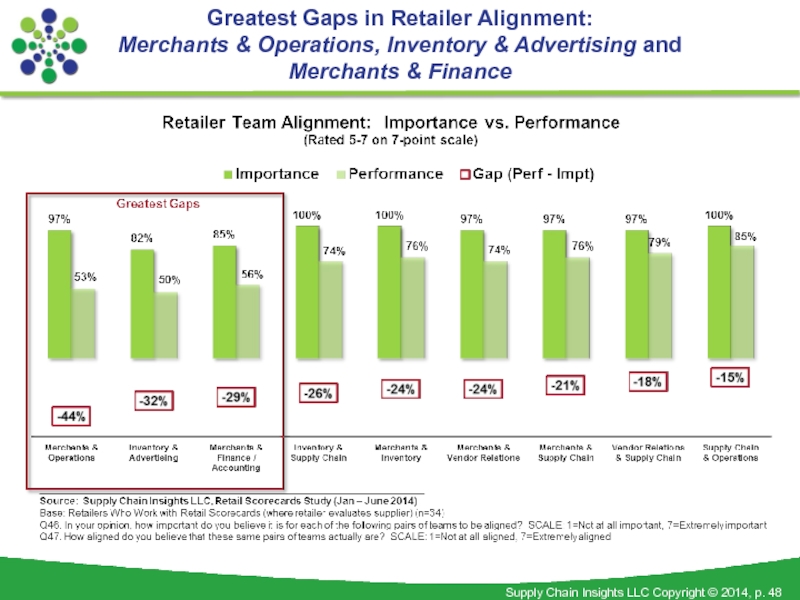

- 48. Greatest Gaps in Retailer Alignment: Merchants &

Слайд 2Agenda

Study Overview

Retail Scorecard Overview

Primary Scorecard Relationship

Suppliers/Manufacturers

Retailers

Слайд 8Agenda

Study Overview

Retail Scorecard Overview

Primary Scorecard Relationship

Suppliers/Manufacturers

Retailers

Слайд 15Agenda

Study Overview

Retail Scorecard Overview

Primary Scorecard Relationship

Suppliers/Manufacturers

Retailers

Слайд 17For Both Suppliers and Retailers, Most Respondents’ Primary Relationship Is with

a Discrete Product

Слайд 18High in Importance and Performance: On-Time, Accurate Shipments, Properly Labeled Cases &

High Product Quality

Слайд 20High in Importance and Performance: On-Time, Accurate Shipments, Properly Labeled Cases &

High Product Quality

Слайд 22Suppliers See Most Elements as More Important Than do Retailers –

Except Assortment Excitement

Слайд 23Suppliers Care More About Billing and Compliance; Retailers Care More about Assortment

Excitement

Слайд 24Suppliers Rate Most Elements as Higher Performing Than do Retailers – Except

Assortment and ASNs

Слайд 26For Both Suppliers and Retailers, Most Impactful Elements Are On-Time Performance

and Accurate Shipments

Слайд 30Retailers More Likely Than Suppliers to Consider “Accurate Shipment” to be

“Accurate and Scan-able Labeling”

Слайд 33Agenda

Study Overview

Retail Scorecard Overview

Primary Scorecard Relationship

Suppliers/Manufacturers

Retailers

Слайд 37Over Half Receive Data for Retail Sales/Order Forecasts, Forecasts and/or Store

point of sale

Слайд 41Agenda

Study Overview

Retail Scorecard Overview

Primary Scorecard Relationship

Suppliers/Manufacturers

Retailers

Слайд 46One-Third of Retailers Book Chargeback Deductions into Cost of Goods; One-Third

Budget for Chargebacks

Слайд 47High in Retailer Alignment Importance and Performance: Supply Chain & Operations and

Merchants & Inventory

Слайд 48Greatest Gaps in Retailer Alignment: Merchants & Operations, Inventory & Advertising and

Merchants & Finance