- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The ACA: What Could Go Wrong? презентация

Содержание

- 1. The ACA: What Could Go Wrong?

- 2. Major Potholes to Avoid and the Road

- 3. © Copyright 2015 ADP, LLC.

- 4. Pothole #2 - IRS Employer Mandate Reporting

- 5. © Copyright 2015 ADP, LLC. New

- 6. Form Penalties Penalties up to $100/Form 1095-C

- 7. © Copyright 2015 ADP, LLC. Pothole

- 8. Stop #1 on the Road Ahead

- 9. State Health Insurance Marketplace Types © Copyright 2015 ADP, LLC.

- 10. © Copyright 2015 ADP, LLC. Stop

- 11. © Copyright 2015 ADP, LLC. Thank

Слайд 2Major Potholes to Avoid and the Road Ahead

Three Potholes to Avoid

Notice of Coverage Options Misunderstandings

IRS Reporting Requirements by Employer Size

The Biggest Pothole of All – the 4980H(a) Penalty

Two Stops on the Road Ahead

Exchange Notices

Excise Tax on High Cost Health Plans (Effective 2018)

© Copyright 2015 ADP, LLC.

Слайд 3

© Copyright 2015 ADP, LLC.

Pothole #1 – The Notice of

Employers

Who Offer a Health Plan:

Employers

Who Do Not Offer a Health Plan:

Слайд 4Pothole #2 - IRS Employer Mandate Reporting Applies to Employers with

Reporting required for all ALEs with 50+ full-time employees

Penalties apply if you have 100 or more employees

Employers – regardless of size – that offer self-insured plans must do Minimum Essential Coverage Reporting

© Copyright 2015 ADP, LLC.

Слайд 5© Copyright 2015 ADP, LLC.

New IRS Forms

Are You Ready

Form 1094-C to the IRS

Filing electronically (>250 Forms 1095-C)

by March 31 of the next year

Filing paper (<250 Forms 1095-C)

by February 28 of the next year

Form 1095-C to IRS, Full-Time Employees

and COBRA Participants and Retirees

Mail paper forms to last known address

or electronic delivery (with consent)

By January 31 of the next year

First filing in 2016 for 2015 information

Слайд 6Form Penalties

Penalties up to $100/Form 1095-C

may apply for missing/incorrect taxpayer

No penalties in 2015 for missing or incorrect information for employers that demonstrate a good faith effort to comply.

© Copyright 2015 ADP, LLC.

Слайд 7© Copyright 2015 ADP, LLC.

Pothole #3

Perhaps, the Biggest Pothole of

Not offering coverage to at least 70% of full-time employees and being subject to Section 4980H(a) penalty!

$2,000 times the number of full-time employees

For 2016 and after, an Offer of Health Coverage must be made to at least 95% of full-time employees

Слайд 8

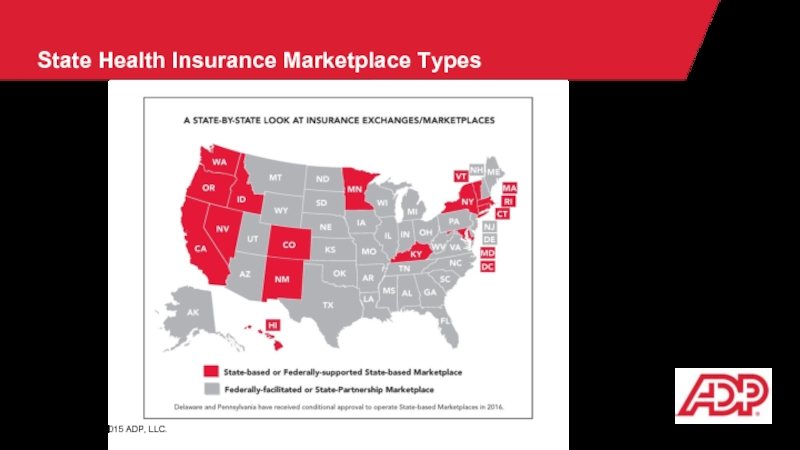

Stop #1 on the Road Ahead

Employer Exchange Notices

© Copyright 2015

The Exchange must notify the employer when an employee is deemed eligible for a premium tax credit and provide the employer the right to appeal

Most state exchanges and the FFE are not yet sending notices

Are you prepared to respond?

Слайд 10© Copyright 2015 ADP, LLC.

Stop #2 on the Road Ahead

Excise

Have you calculated your penalty risk? Most plans will be effected.

Employer is responsible for calculating.

Слайд 11© Copyright 2015 ADP, LLC.

Thank You and Stay Tuned

To ADP’s

Please visit www.adp.com/acafaqs for a list of ACA Frequently Asked Questions or www.adp.com/health-care-reform for additional ACA insights.

Before taking any actions on the information contained in this presentation, employers and plan sponsors should review this material with internal This material is subject to change and is provided for informational purposes only and nothing contained herein should be taken as legal opinion, legal advice, or a comprehensive compliance review. The ADP Logo, ADP, ADP Research Institute, and In the Business of Your Success are registered trademarks of ADP, LLC. All other trademarks and service marks are the property of their respective owners. Copyright © 2015 ADP, LLC. ALL RIGHTS RESERVED.

@Ellen_Feeney

#SHRM15