- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Health Care Stocks With 36 or More Years of Dividend Increases презентация

Содержание

- 1. 5 Health Care Stocks With 36 or More Years of Dividend Increases

- 2. A Rare Feat Out of more than

- 3. Medtronic By the Numbers Graph by author,

- 4. How Medtronic Grows Its Dividend Source: Steve

- 5. Walgreen By the Numbers Graph by author,

- 6. How Walgreen Grows Its Dividend One area

- 7. Abbott Laboratories By the Numbers Graph by

- 8. How Abbott Laboratories Grows Its Dividend Source:

- 9. Becton, Dickinson By the Numbers Graph by

- 10. How Becton, Dickinson Grows Its Dividend Source:

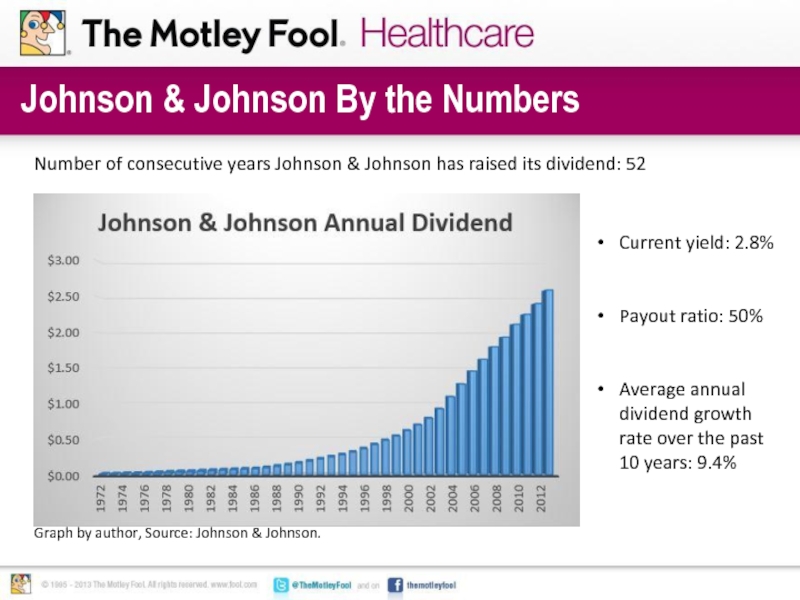

- 11. Johnson & Johnson By the Numbers Graph

- 12. How Johnson & Johnson Grows Its Dividend

- 13. Your search for high-yielding dividends doesn’t have

Слайд 2A Rare Feat

Out of more than 600 companies in the health

A Dividend Aristocrat is a company that’s raised its annual payout at least once in each of the past 25 years. Among income-seeking investors, Dividend Aristocrats represents some of the most prized and safest investments.

Within the health care sector there are just five companies which belong to this exclusive club of Dividend Aristocrats. In this case, all five have raised their payouts in at least each of the past 36 years!

Let’s take a closer look at these five health care dividend divas…

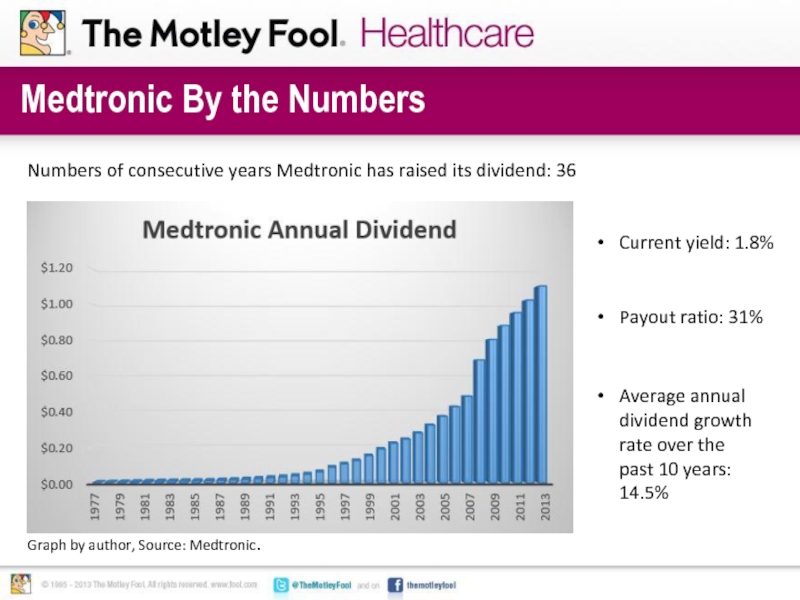

Слайд 3Medtronic By the Numbers

Graph by author, Source: Medtronic.

Numbers of consecutive years

Current yield: 1.8%

Payout ratio: 31%

Average annual dividend growth rate over the past 10 years: 14.5%

Слайд 4How Medtronic Grows Its Dividend

Source: Steve Winton, Flickr.

As announced in 2013,

New product innovation is going to be a key for Medtronic’s dividend growth. The recent introduction of the MiniMed 530G, the first artificial pancreas insulin pump, as well as its Resolute Integrity drug-eluting stent, are simply two of the numerous high-growth innovative medical devices Medtronic has up its sleeve.

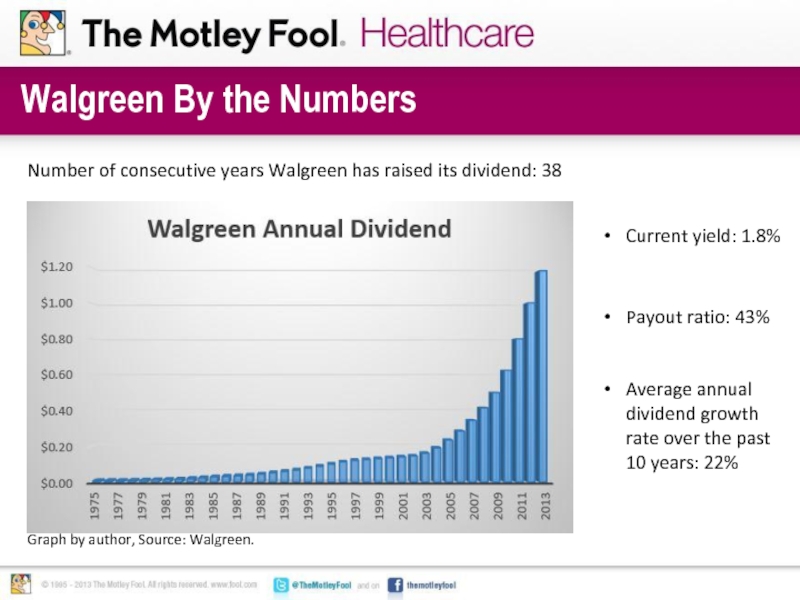

Слайд 5Walgreen By the Numbers

Graph by author, Source: Walgreen.

Number of consecutive years

Current yield: 1.8%

Payout ratio: 43%

Average annual dividend growth rate over the past 10 years: 22%

Слайд 6How Walgreen Grows Its Dividend

One area Walgreen is expecting a sizable

Acquisitions and investments could be another growth proponent. In 2012 Walgreen made a $6.7 billion investment overseas in Alliance Boots, making it the world’s first pharmacy-driven health and wellness retailer. These investments help expand its geographic reach and could continue to fuel its rapid dividend growth.

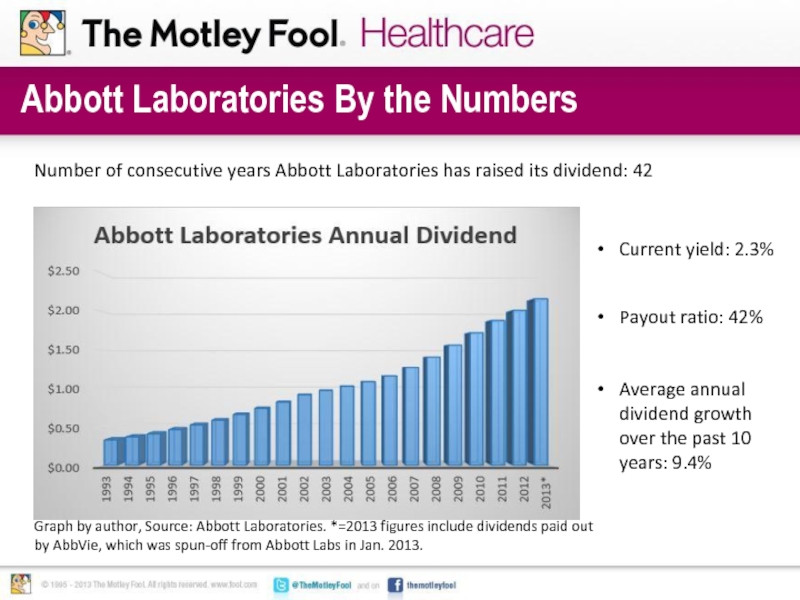

Слайд 7Abbott Laboratories By the Numbers

Graph by author, Source: Abbott Laboratories. *=2013

Number of consecutive years Abbott Laboratories has raised its dividend: 42

Current yield: 2.3%

Payout ratio: 42%

Average annual dividend growth over the past 10 years: 9.4%

Слайд 8How Abbott Laboratories Grows Its Dividend

Source: Abbott Laboratories.

Overseas growth opportunities represent

Don’t overlook the spin-off of AbbVie, either, which allows investors better earnings visibility, and gives investors the chance to benefit from ex. U.S. growth opportunities.

Diversity is also important for Abbott, with generic drugs and medical devices, as well as its nutrition and diagnostics segments all delivering more than $1.1 billion in sales in the first quarter.

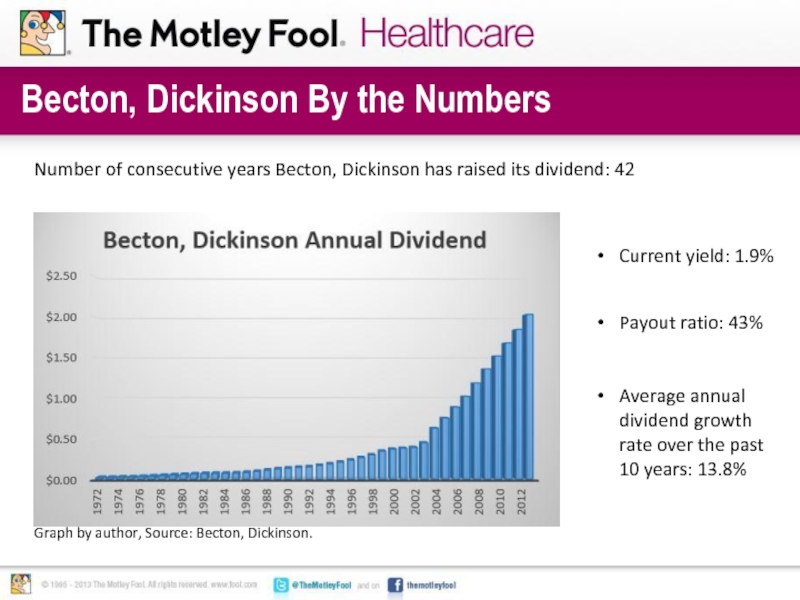

Слайд 9Becton, Dickinson By the Numbers

Graph by author, Source: Becton, Dickinson.

Number

Current yield: 1.9%

Payout ratio: 43%

Average annual dividend growth rate over the past 10 years: 13.8%

Слайд 10How Becton, Dickinson Grows Its Dividend

Source: Becton, Dickinson.

Not to sound like

Time is another factor working in Becton, Dickinson’s favor. As a medical device and diagnostics company the assumption is that as people around the world are living longer, and as baby boomers begin to retire in the U.S., the need for personalized diagnostic and medical care is only going to increase. This would bode well toward continued dividend growth for the company as long as its spending remains under control.

Слайд 11Johnson & Johnson By the Numbers

Graph by author, Source: Johnson &

Number of consecutive years Johnson & Johnson has raised its dividend: 52

Current yield: 2.8%

Payout ratio: 50%

Average annual dividend growth rate over the past 10 years: 9.4%

Слайд 12How Johnson & Johnson Grows Its Dividend

Product and geographic diversity have

Acquisitions have also played a key role. Johnson & Johnson’s $19.7 billion purchase of Synthes, which closed in 2012, will give the company significantly more exposure to faster growing emerging markets and give income investors plenty of hope for further upside in its payout.