- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Bermuda Triangle презентация

Содержание

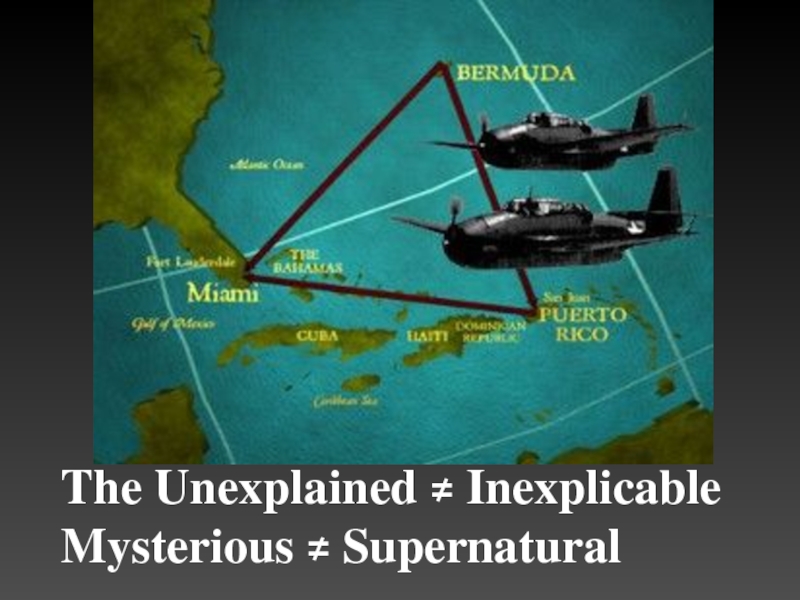

- 13. The Unexplained ≠ Inexplicable Mysterious ≠ Supernatural

- 14. 1.

- 15. 500-page Navy board of investigation report:

- 16. 500-page Navy board of investigation report:

- 25. The

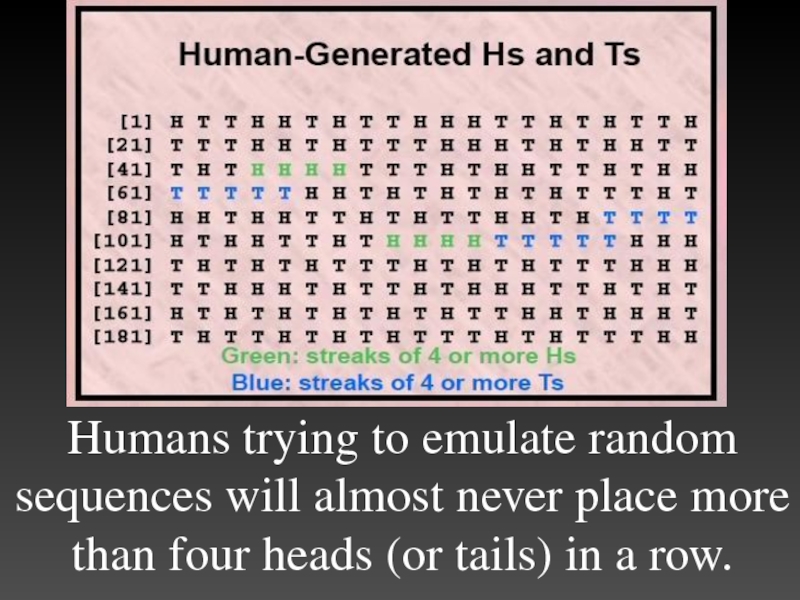

- 29. Humans trying to emulate random sequences will

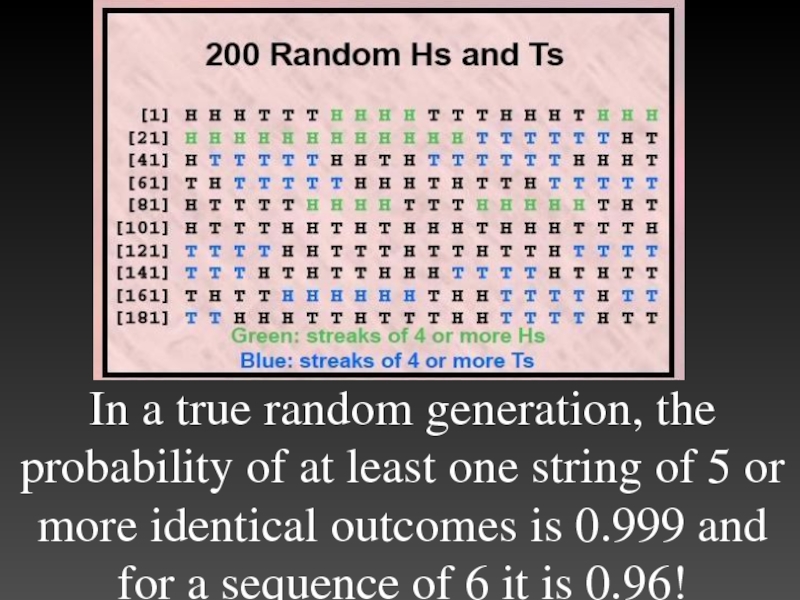

- 30. In a true random generation, the probability

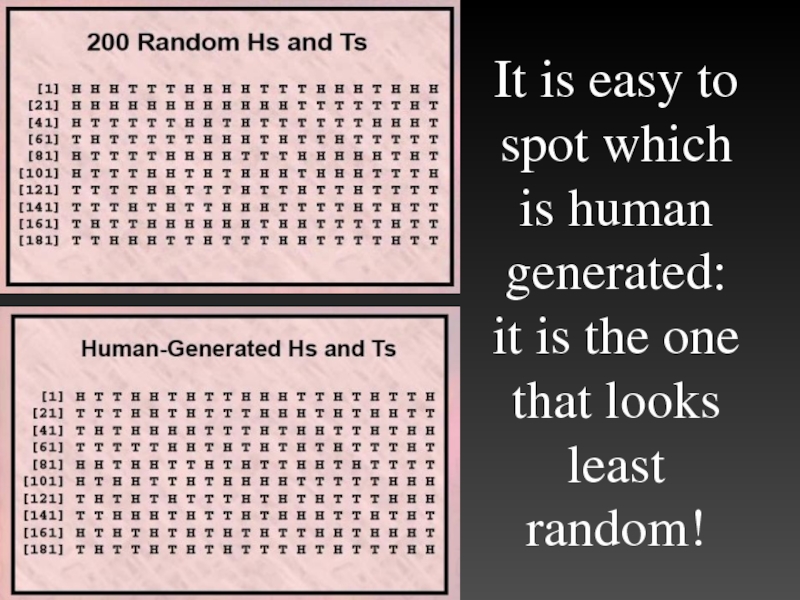

- 31. It is easy to spot which is

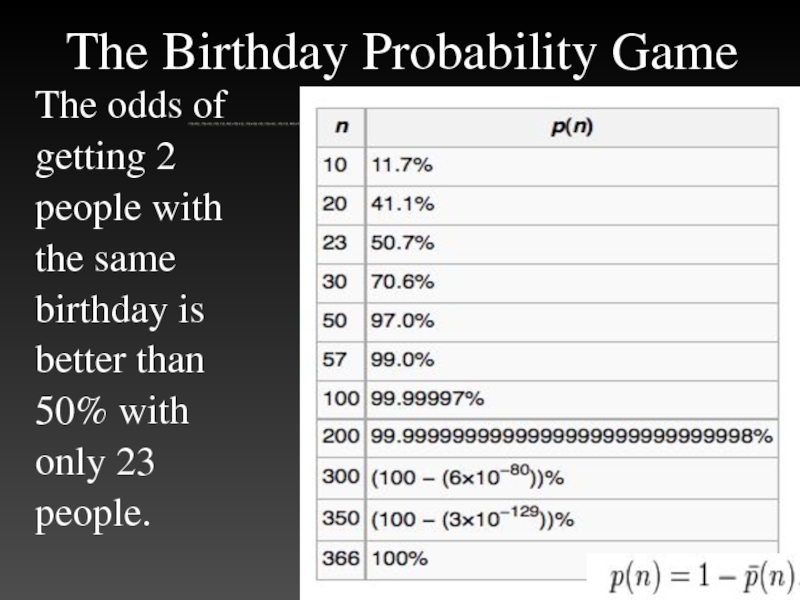

- 32. The Birthday Probability Game The odds of

- 34. The Monty Hall Problem Let’s Make

- 35. The Monty Hall Problem At the

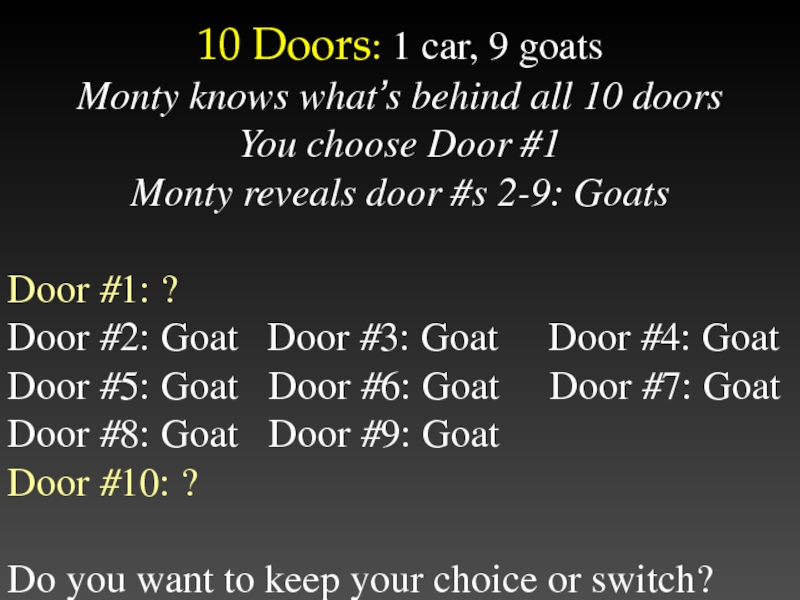

- 36. 10 Doors: 1 car, 9 goats

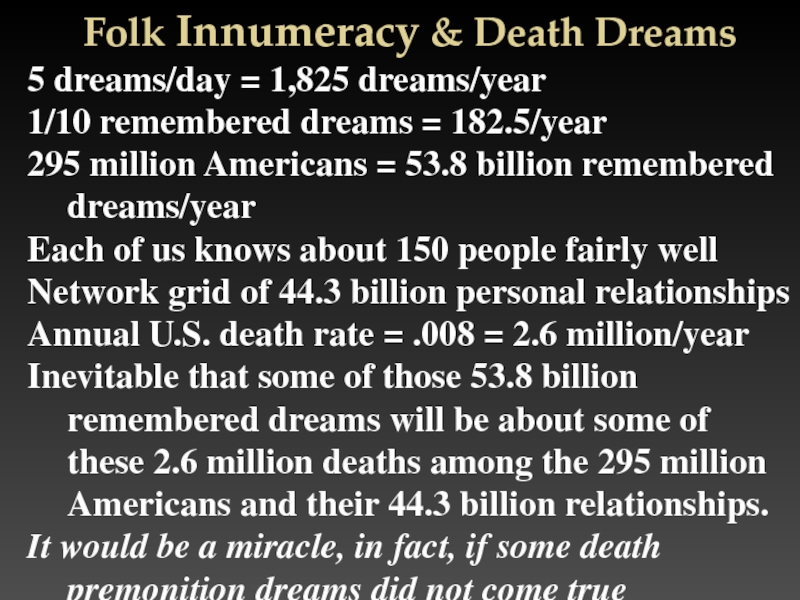

- 37. Folk Innumeracy & Death Dreams 5

- 38. The “hot hand” Illusion

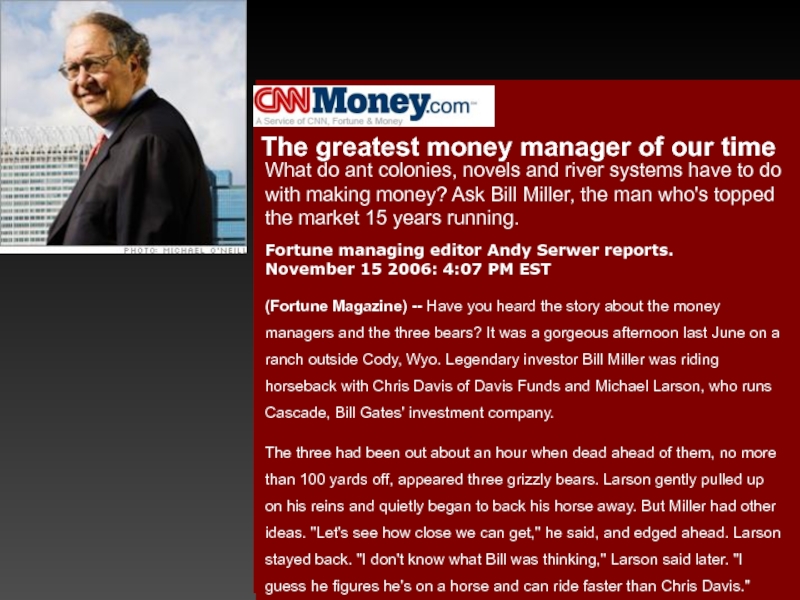

- 39. The greatest money manager of our

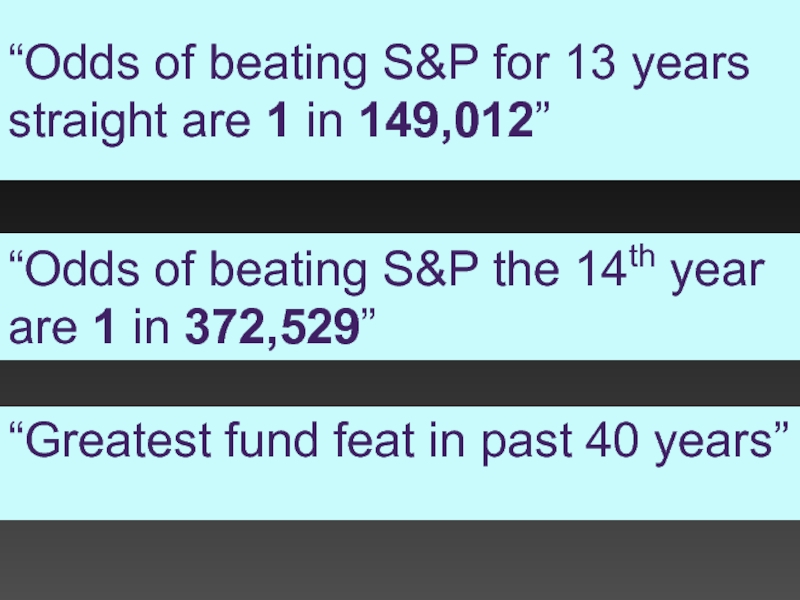

- 40. “Odds of beating S&P for 13 years

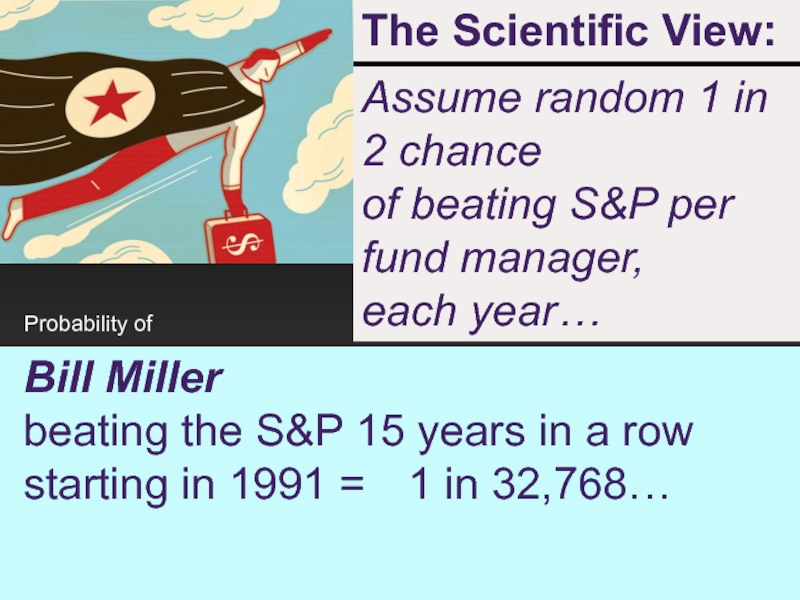

- 41. The Scientific View: Assume random 1

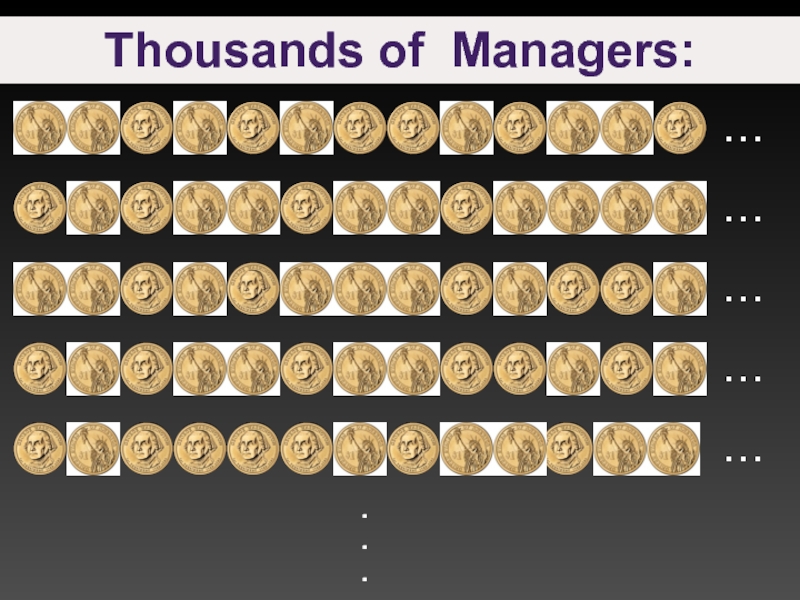

- 42. . . . Thousands of Managers:

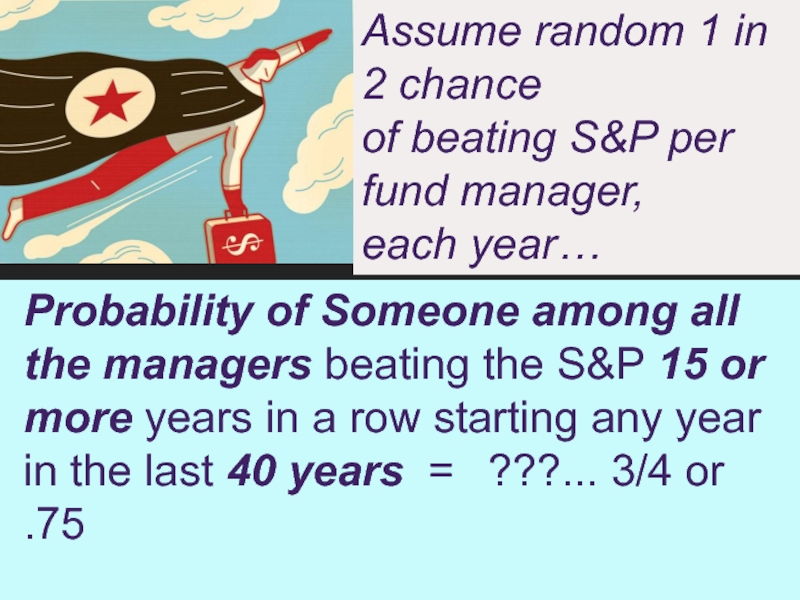

- 43. Probability of Someone among all the managers

- 44. Expected 15-year run finally occurs

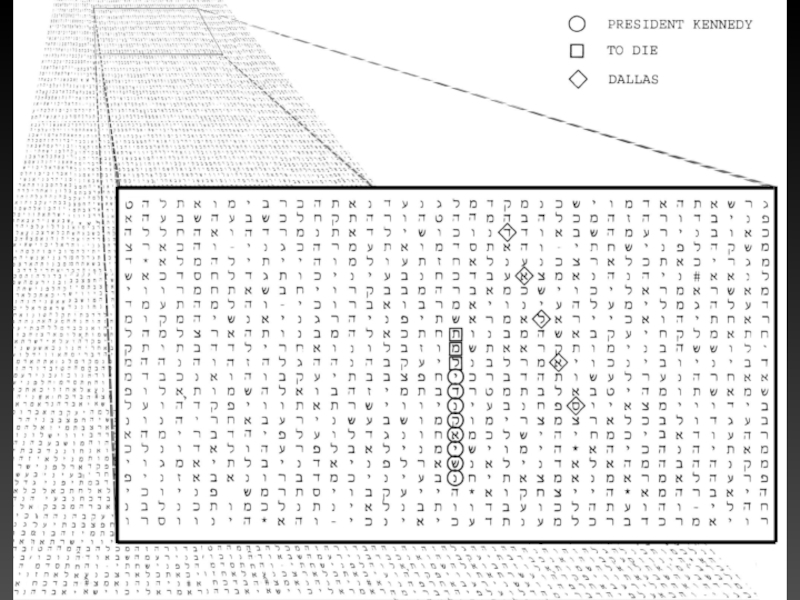

- 49. Reading Michael Drosnin’s response to Michael

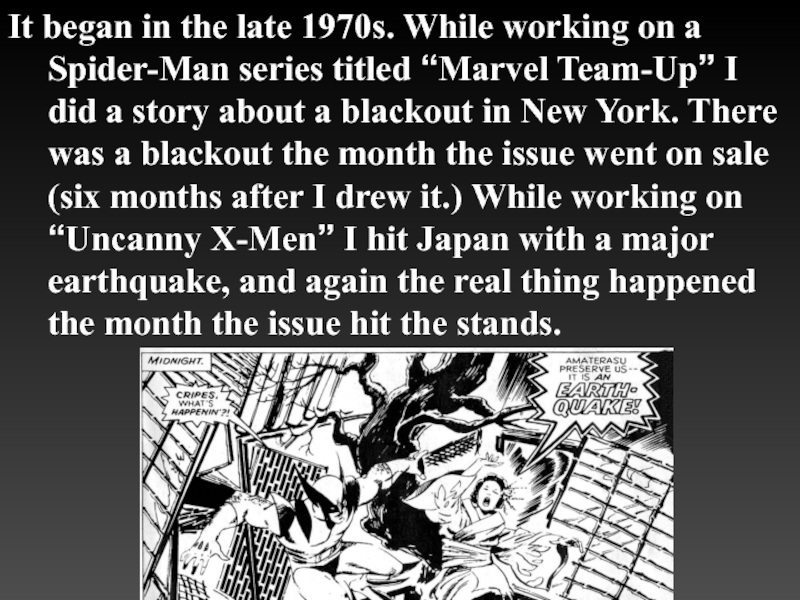

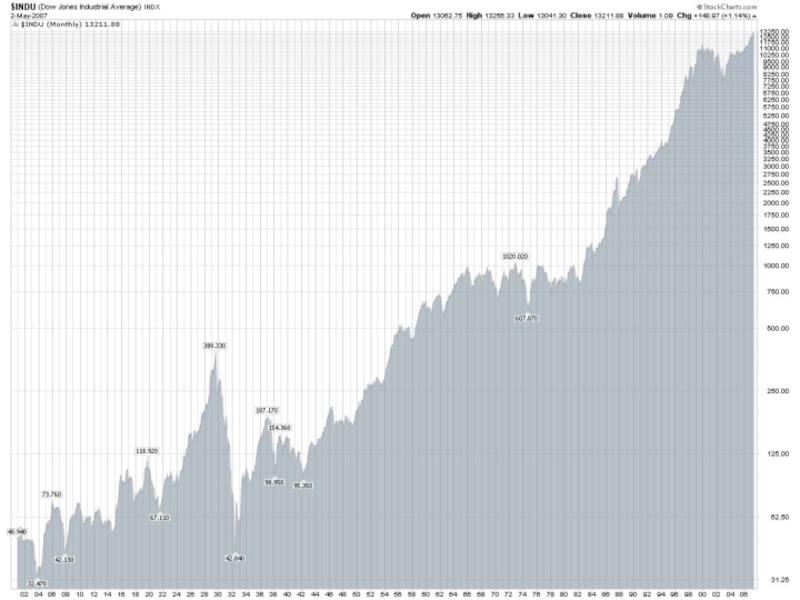

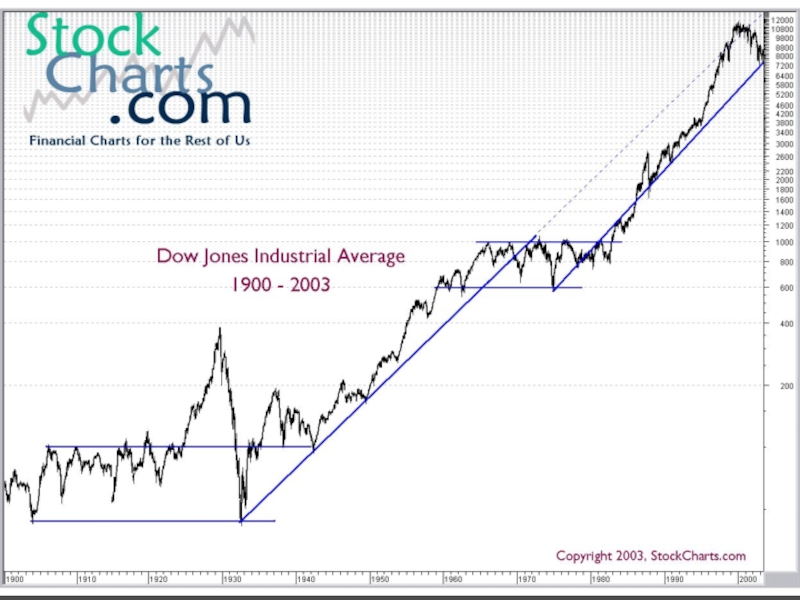

- 50. It began in the late 1970s.

- 51. Now, those things are fairly easy

- 52. Most recent, and chilling, came when

- 53. The cover for that issue was

- 54. My ability as a prognisticator, like

- 55. The Wisdom of the Crowd Averaging

- 56. Change Blindness We look for meaning and miss details

- 57. Change Blindness We look for meaning and miss details

- 59. PROPHESY FROM PLANET CLARION CALL

- 60. Festinger and had infiltrated the Seekers,

- 61. Cognitive dissonance, or the uncomfortable tension

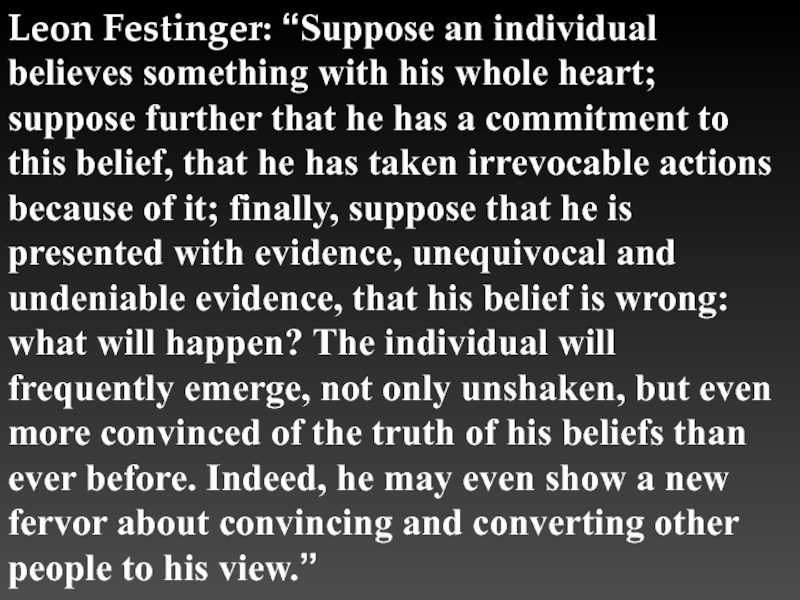

- 62. Leon Festinger: “Suppose an individual believes

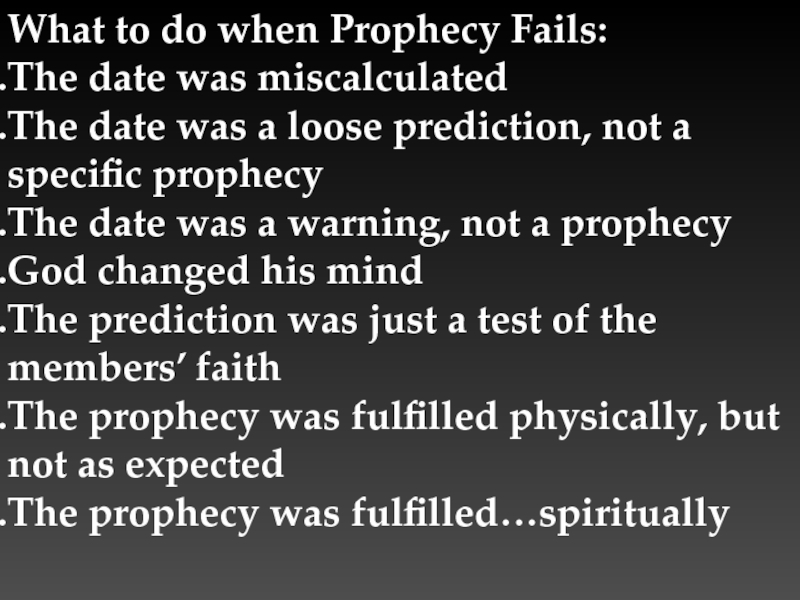

- 63. What to do when Prophecy Fails:

- 71. Situational attribution bias: We identify the

- 72. Intellectual attribution bias: We consider our

- 73. Lisa Farwell and Bernard Weiner discovered

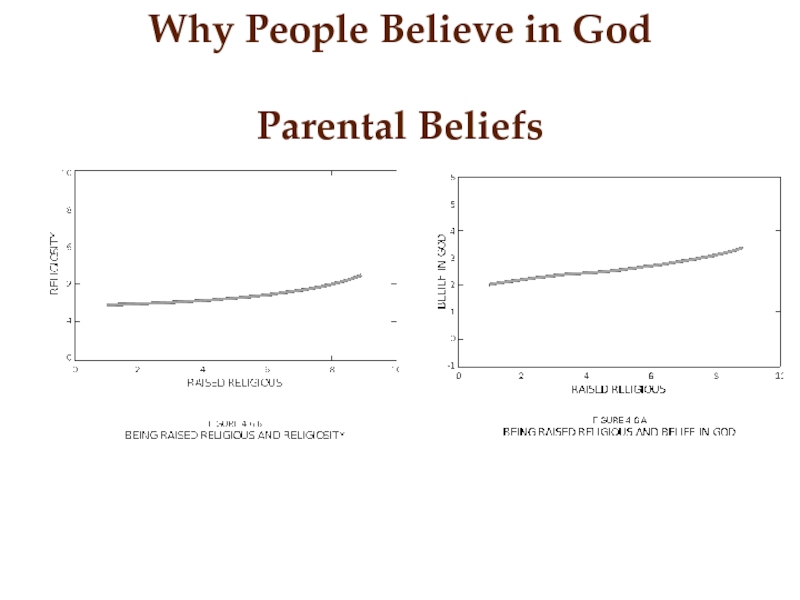

- 74. Why People Believe in God Parental Beliefs

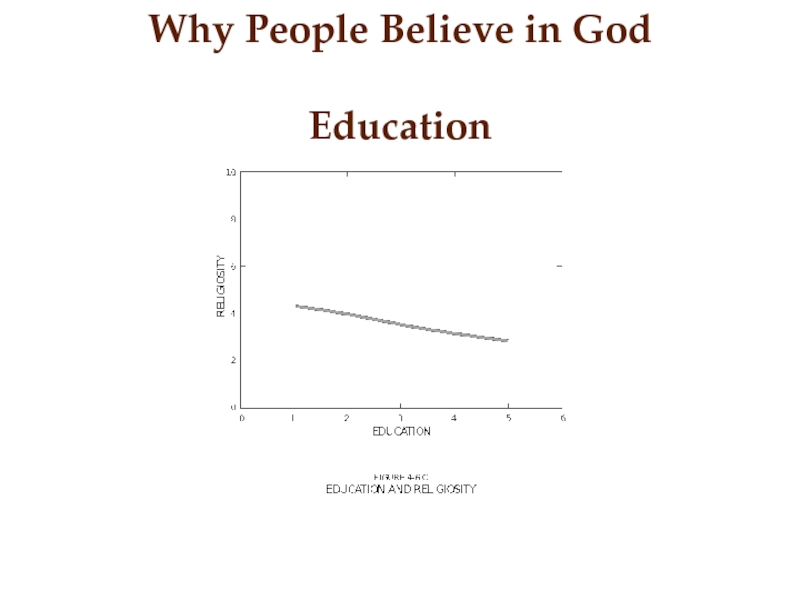

- 75. Why People Believe in God Education

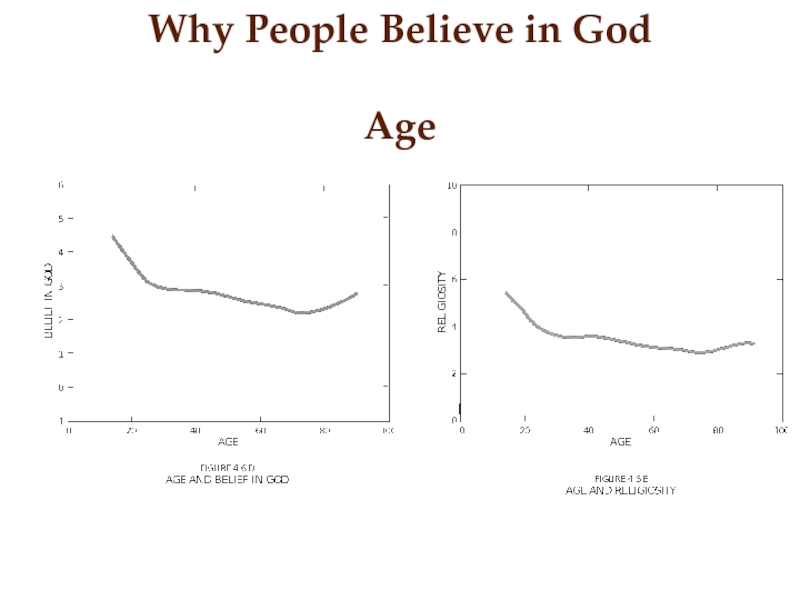

- 76. Why People Believe in God Age

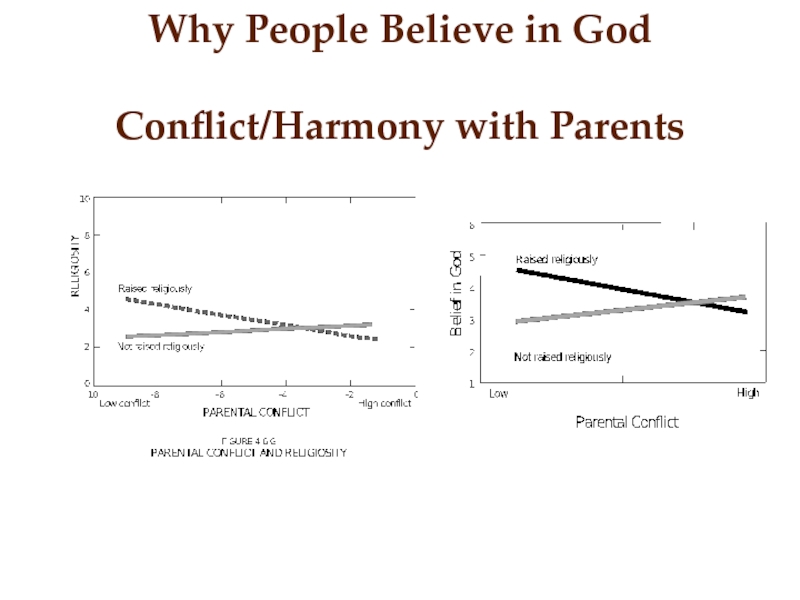

- 77. Why People Believe in God Conflict/Harmony with Parents

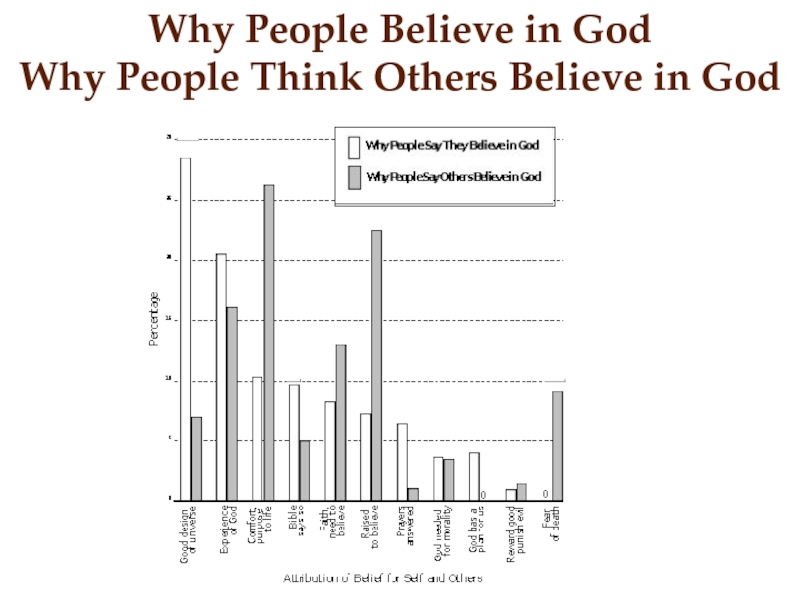

- 78. Why People Believe in God Why

- 92. Loss Aversion

- 93. Loss Aversion

- 94. Trial #2:

- 95. Question: Why

- 96. Risk Aversion

- 97. How Financial

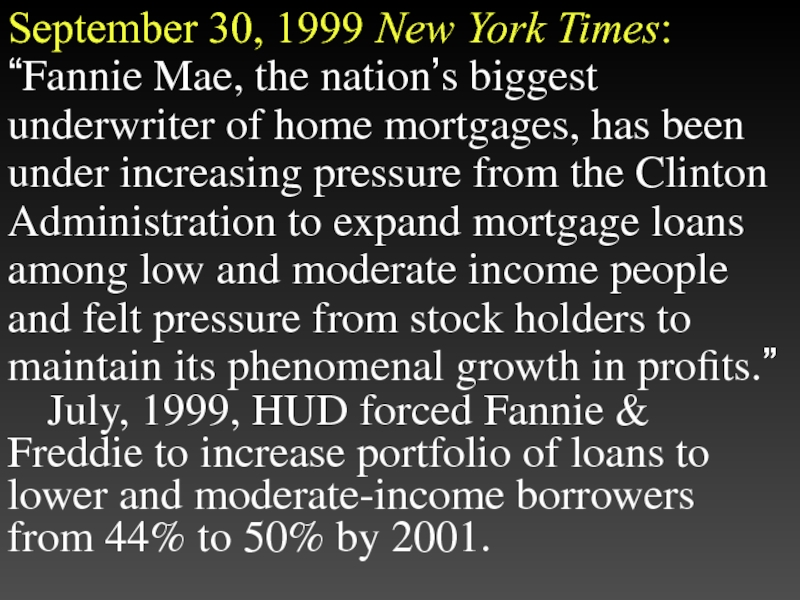

- 98. September 30,

- 99. September 30,

- 100. There’s nothing

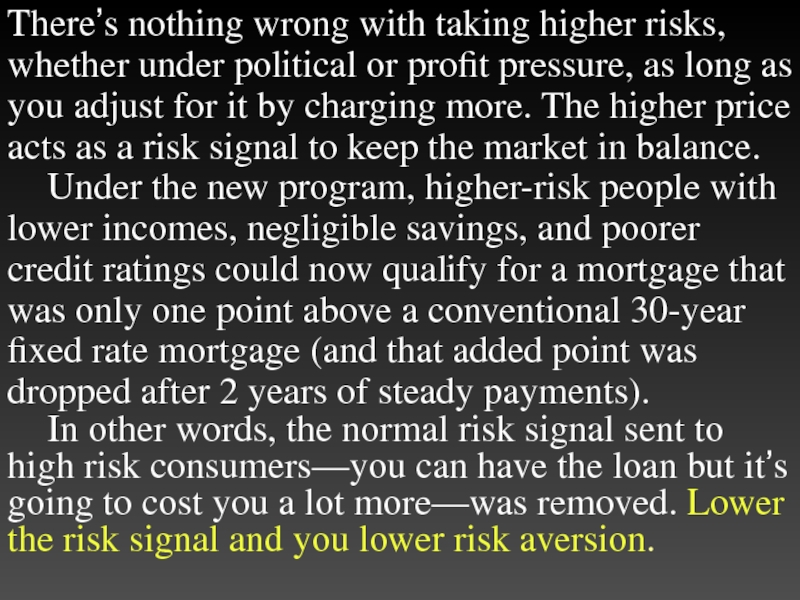

- 101. Entrepreneurial Error

- 102. Entrepreneurial Error

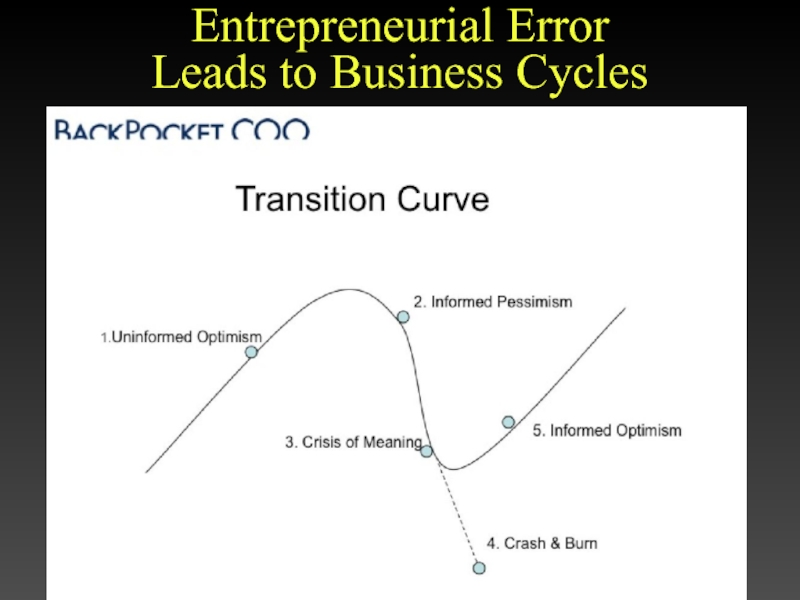

- 103. Entrepreneurial Error Leads to Business Cycles

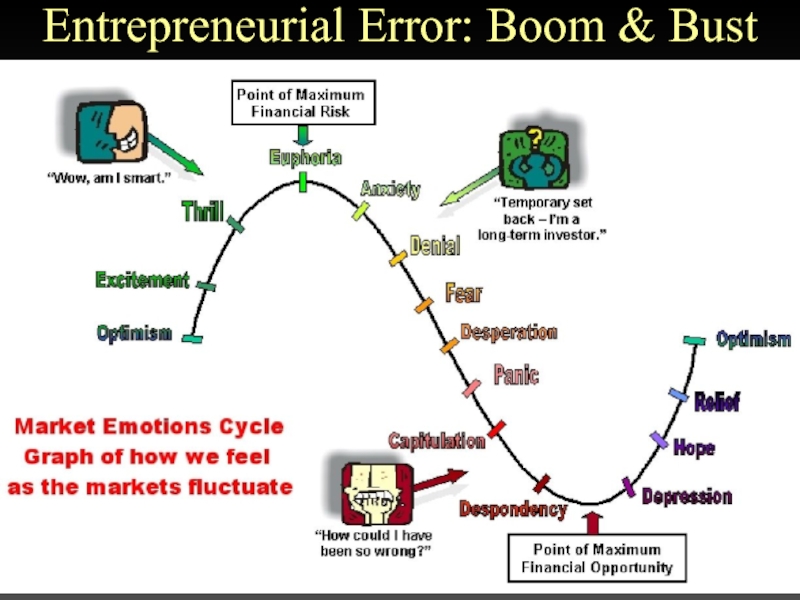

- 104. Entrepreneurial Error: Boom & Bust

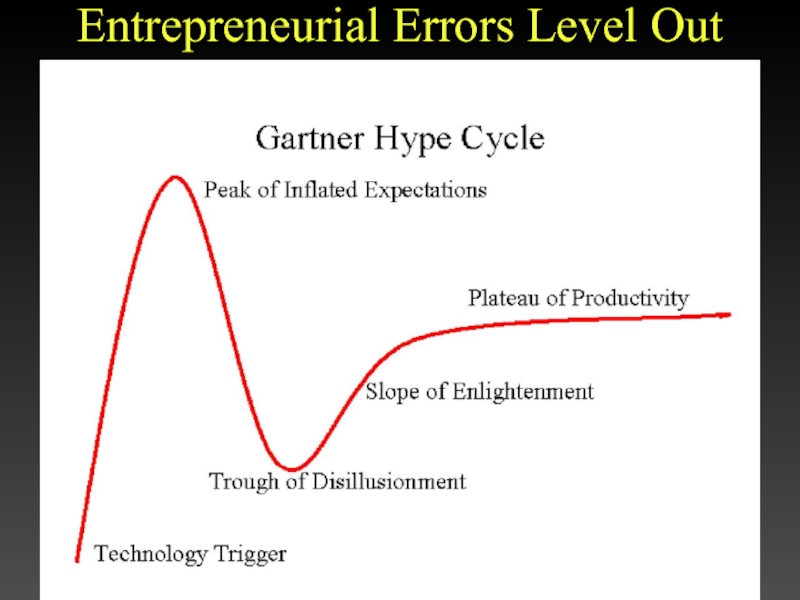

- 105. Entrepreneurial Errors Level Out

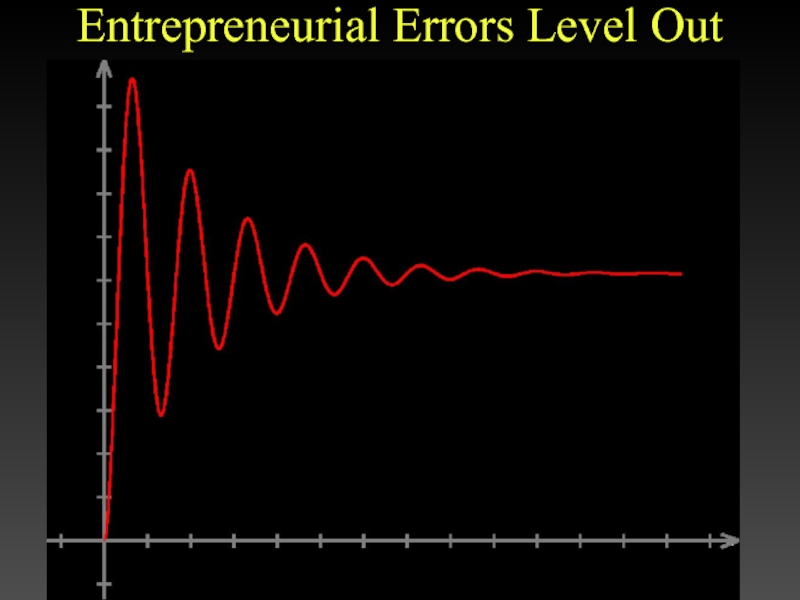

- 106. Entrepreneurial Errors Level Out

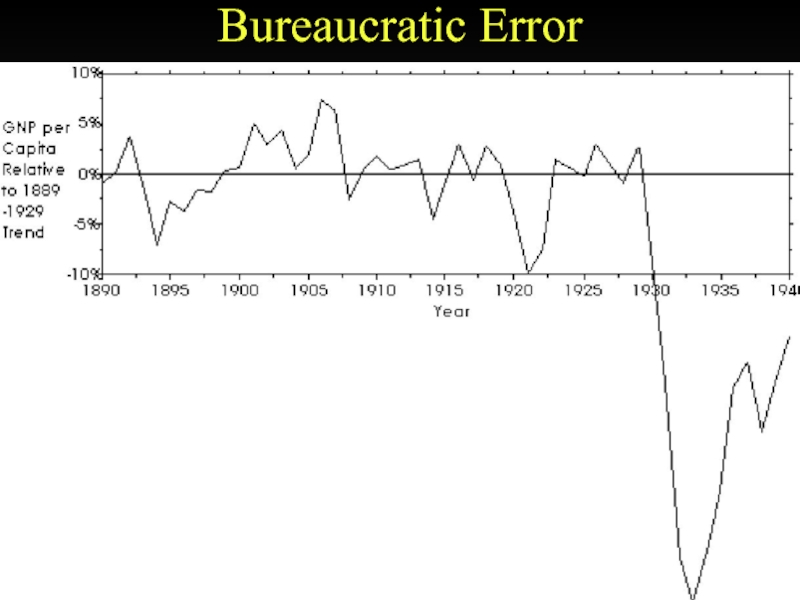

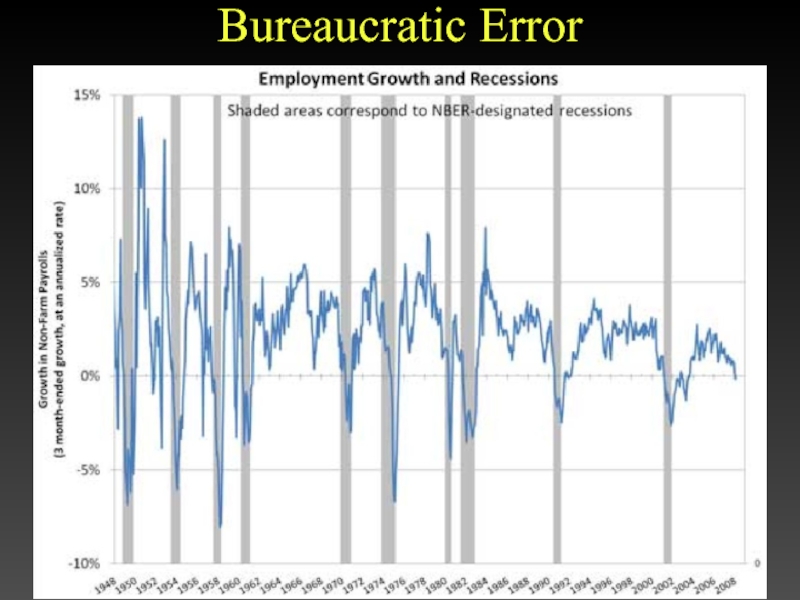

- 107. Bureaucratic Error

- 108. Bureaucratic Error

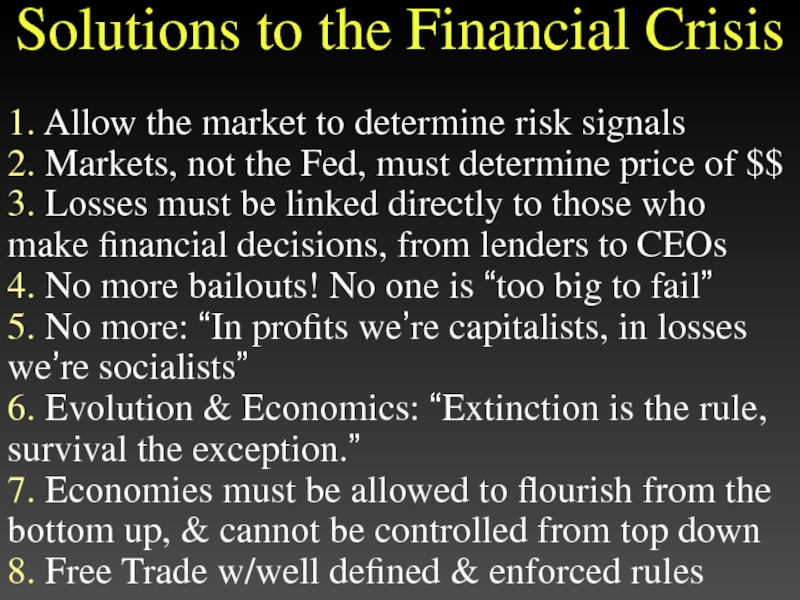

- 109. Solutions to

- 110. Bureaucratic Commandments

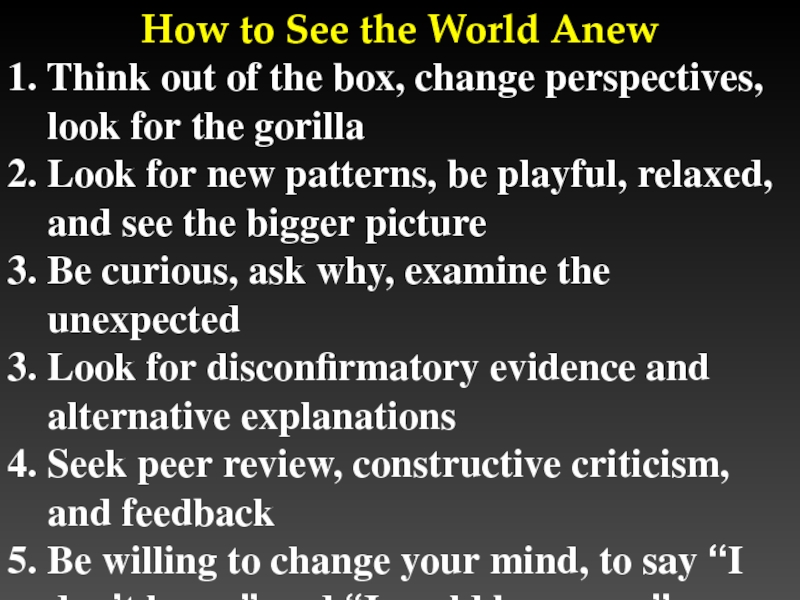

- 111. How to See the World Anew

Слайд 4

Supernatural Explanations

—Leftover technology from the lost continent of Atlantis;

—UFOs & Aliens (Steven Spielberg) ends Close Encounters with the revelation that Flight 19 was abducted by the mothership.

Слайд 12

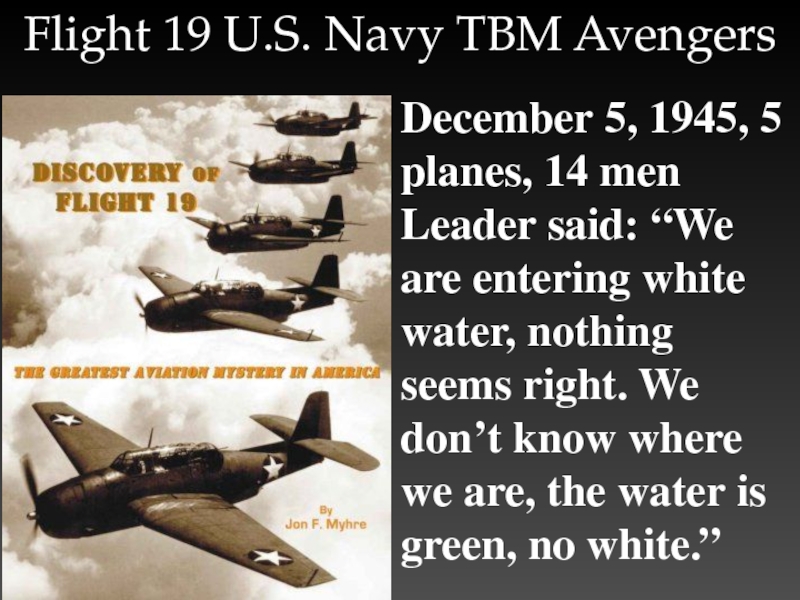

Flight 19 U.S. Navy TBM Avengers

December 5, 1945, 5

Слайд 14

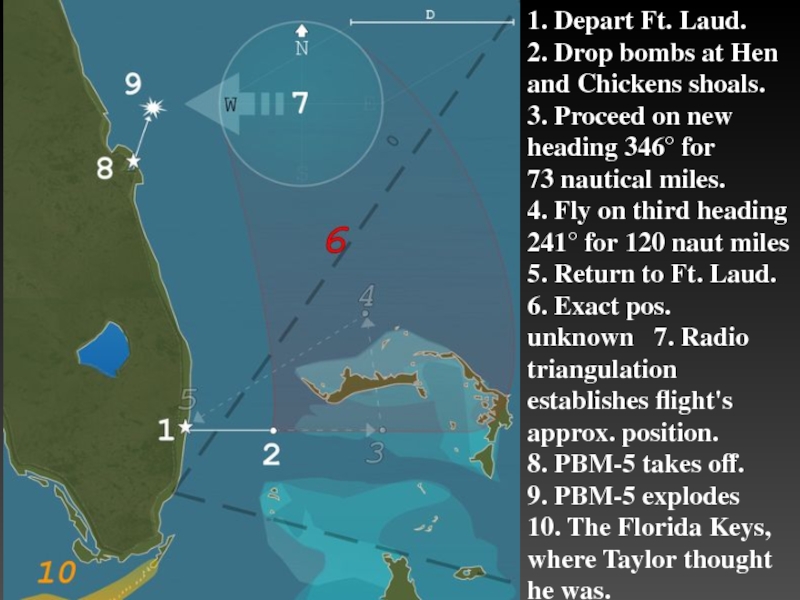

1. Depart Ft. Laud.

2. Drop bombs at Hen and Chickens shoals.

3. Proceed on new heading 346° for 73 nautical miles.

4. Fly on third heading 241° for 120 naut miles 5. Return to Ft. Laud. 6. Exact pos. unknown 7. Radio triangulation establishes flight's approx. position.

8. PBM-5 takes off.

9. PBM-5 explodes

10. The Florida Keys, where Taylor thought he was.

Слайд 15

500-page Navy board of investigation report:

—Taylor had mistakenly believed that the

—It was determined that Taylor had passed over the Bahamas as scheduled, and he did in fact lead his flight to the northeast over the Atlantic.

—Some subordinate officers did likely know their approximate position as indicated by radio transmissions stating that flying west would result in reaching the mainland.

Слайд 16

500-page Navy board of investigation report:

—Taylor, although an excellent combat pilot

—It wasn't Taylor's fault because the compasses stopped working.

—This report was subsequently amended "cause unknown" by the Navy after Taylor's mother contended that the Navy was unfairly blaming her son for the loss of five aircraft and 14 men when the Navy had neither the bodies nor the airplanes as.

Слайд 17

Natural Explanations

—Compass Variations

—Hurricanes

—Gulf Stream anomalies

—Methane Eruptions

—Rogue Waves

—Deliberate Acts

—Human Error

Слайд 18

Larry Kusche’s 1976

Bermuda Triangle Mystery: Solved

Revealed inaccuracies and

Слайд 19

Kusche’s Explanation

—The number of ships and aircraft reported missing

—In an area frequented by tropical storms, the number of disappearances that did occur were neither disproportionate, unlikely, nor mysterious; furthermore, Berlitz and other writers would often fail to mention such storms.

Слайд 20

Kusche’s Explanation

—The numbers themselves were exaggerated by sloppy research.

—Some disappearances had, in fact, never happened. One plane crash was said to have taken place in 1937 off Daytona Beach FL, in front of hundreds of witnesses; a check of the local papers revealed nothing.

Слайд 21

Kusche & the Burden of Proof

"Say I claim that

Слайд 22

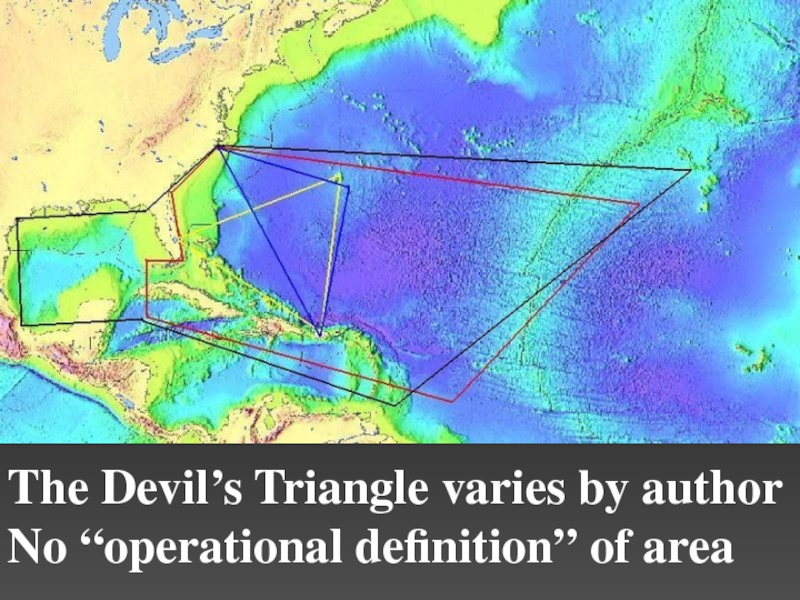

Baseline Rate Explanation

The Bermuda Triangle is one of the

—Cruise ships, pleasure craft regularly go back and forth between Florida and the islands.

—Also a heavily flown route for commercial and private aircraft heading towards Florida, the Caribbean, and South America from points north.

Слайд 23

Lloyd’s of London, who keeps detailed records of all

Слайд 24

U.S. Coast Guard Investigation

Concluded that the number of supposed

Слайд 28

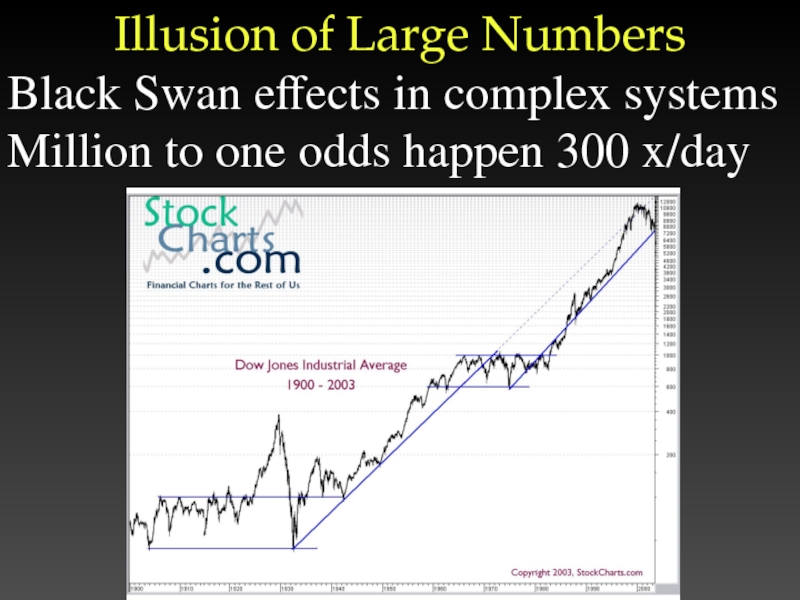

Illusion of Large Numbers

Black Swan effects in complex systems

Million

Слайд 29Humans trying to emulate random sequences will almost never place more

Слайд 30In a true random generation, the probability of at least one

Слайд 32The Birthday Probability Game

The odds of

getting 2

people with

the same

birthday is

better than

50%

only 23

people.

Слайд 33

“Regression to the Mean”

Height (2 tall parents: for every

2. I.Q. (2 smart parents: for every 4 children, 3 will be dumber for every one smarter)

3. Hollywood films (producers and directors get fired after one bad film, even though their films under production go on to success)

4. Sports Illustrated Cover Curse (to get on the cover an athlete has to have a statistically extraordinary game or season, which is unlikely to happen again)

Слайд 34

The Monty Hall Problem

Let’s Make a Deal!

3 Doors: 1 car, 2

Monty knows what’s behind all 3 doors

Monty will not reveal what’s behind your door

Monty can only show you a goat

You choose Door #1

Monty shows you what’s behind door #2: Goat

Door #1: ? Door #2: Goat Door #3: ?

Do you want to keep your choice or switch?

Слайд 35

The Monty Hall Problem

At the start: 1/3rd chance of picking the

Switching doors is bad only if you 1st chose the car, which happens only 1/3rd of the time.

Switching doors is good if you 1st chose a goat, which happens 2/3rds of the time.

Thus, the probability of winning by switching is 2/3rds, or double the odds of not switching.

Слайд 36

10 Doors: 1 car, 9 goats

Monty knows what’s behind all 10

You choose Door #1

Monty reveals door #s 2-9: Goats

Door #1: ?

Door #2: Goat Door #3: Goat Door #4: Goat

Door #5: Goat Door #6: Goat Door #7: Goat

Door #8: Goat Door #9: Goat

Door #10: ?

Do you want to keep your choice or switch?

Слайд 37

Folk Innumeracy & Death Dreams

5 dreams/day = 1,825 dreams/year

1/10 remembered dreams

295 million Americans = 53.8 billion remembered dreams/year

Each of us knows about 150 people fairly well

Network grid of 44.3 billion personal relationships

Annual U.S. death rate = .008 = 2.6 million/year

Inevitable that some of those 53.8 billion remembered dreams will be about some of these 2.6 million deaths among the 295 million Americans and their 44.3 billion relationships.

It would be a miracle, in fact, if some death premonition dreams did not come true

Слайд 39

The greatest money manager of our time

What do ant colonies, novels

Fortune managing editor Andy Serwer reports.

November 15 2006: 4:07 PM EST

(Fortune Magazine) -- Have you heard the story about the money managers and the three bears? It was a gorgeous afternoon last June on a ranch outside Cody, Wyo. Legendary investor Bill Miller was riding horseback with Chris Davis of Davis Funds and Michael Larson, who runs Cascade, Bill Gates' investment company.

The three had been out about an hour when dead ahead of them, no more than 100 yards off, appeared three grizzly bears. Larson gently pulled up on his reins and quietly began to back his horse away. But Miller had other ideas. "Let's see how close we can get," he said, and edged ahead. Larson stayed back. "I don't know what Bill was thinking," Larson said later. "I guess he figures he's on a horse and can ride faster than Chris Davis."

Слайд 40“Odds of beating S&P for 13 years straight are 1 in

“Odds of beating S&P the 14th year are 1 in 372,529”

“Greatest fund feat in past 40 years”

Слайд 41The Scientific View:

Assume random 1 in 2 chance

of beating

Bill Miller

beating the S&P 15 years in a row starting in 1991 = 1 in 32,768…

Probability of

Слайд 43Probability of Someone among all the managers beating the S&P 15

Assume random 1 in 2 chance

of beating S&P per fund manager,

each year…

Слайд 44

Expected 15-year run finally occurs

Bill Miller lucky beneficiary!!

The greatest money

Headline should NOT be:

But rather…

Слайд 45

Hindsight Bias

Monday Morning Quarterbacking

—9/11 conspiracy theories

—Stock market causal explanations

—Authorized

autobiography

Слайд 46

Confirmation Bias

The tendency to seek & find confirming evidence

Слайд 49

Reading Michael Drosnin’s response to Michael Shermer’s column on the Bible

Слайд 50

It began in the late 1970s. While working on a Spider-Man

Слайд 51

Now, those things are fairly easy to “predict,” but consider these:

Слайд 52

Most recent, and chilling, came when I was writing and drawing

Слайд 53

The cover for that issue was done as a newspaper front

Слайд 54

My ability as a prognisticator, like Drosnin's, would seem assured—provided, of

—John Byrne

Слайд 58

Cognitive Dissonance

“What we obtain too cheap we esteem too

—Thomas Paine

Discovered by Leon Festinger in 1954 in his investigation of a UFO cult.

Слайд 59

PROPHESY FROM PLANET CLARION

CALL TO CITY: FLEE THAT FLOOD.

IT'LL

OUTER SPACE TELLS SUBURBANITE

Слайд 60

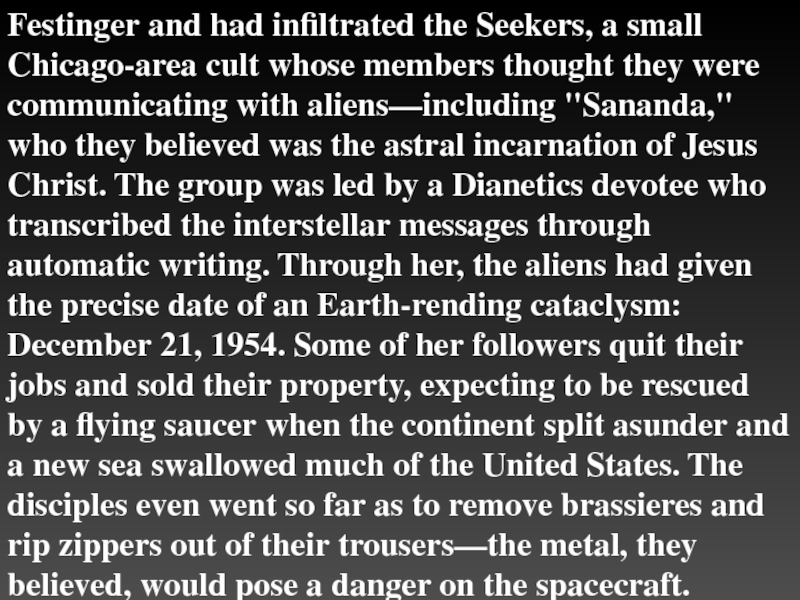

Festinger and had infiltrated the Seekers, a small Chicago-area cult whose

Слайд 61

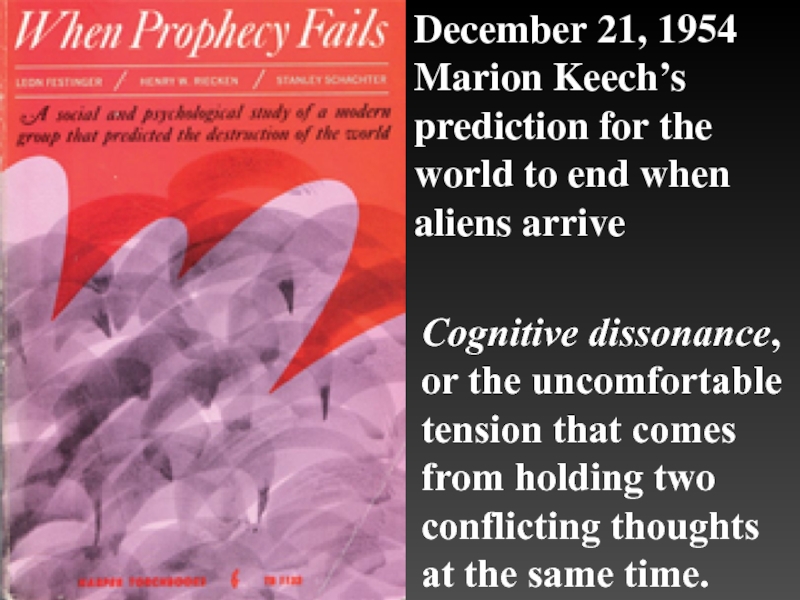

Cognitive dissonance, or the uncomfortable tension that comes from holding two

December 21, 1954 Marion Keech’s prediction for the world to end when aliens arrive

Слайд 62

Leon Festinger: “Suppose an individual believes something with his whole heart;

Слайд 63

What to do when Prophecy Fails:

The date was miscalculated

The date was

The date was a warning, not a prophecy

God changed his mind

The prediction was just a test of the members’ faith

The prophecy was fulfilled physically, but not as expected

The prophecy was fulfilled…spiritually

Слайд 64

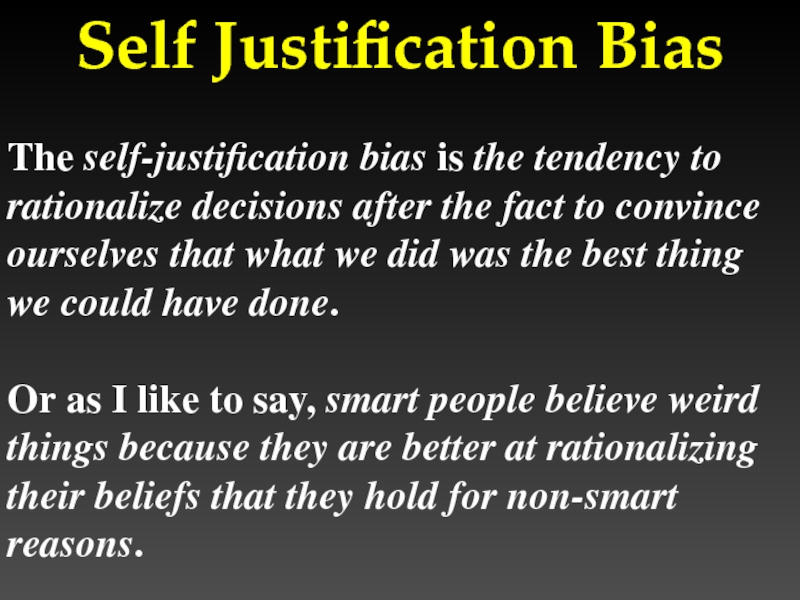

Self Justification Bias

The self-justification bias is the tendency to

Or as I like to say, smart people believe weird things because they are better at rationalizing their beliefs that they hold for non-smart reasons.

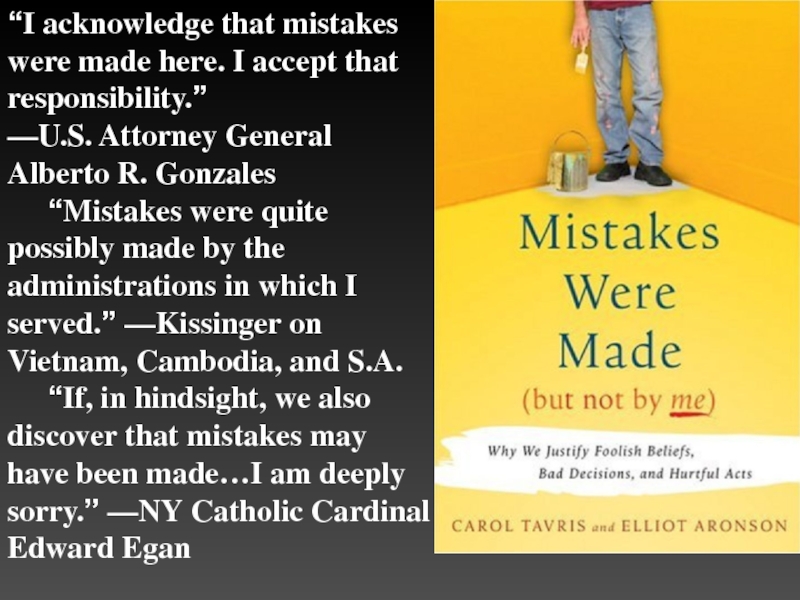

Слайд 65

“I acknowledge that mistakes were made here. I accept

—U.S. Attorney General Alberto R. Gonzales

“Mistakes were quite possibly made by the administrations in which I served.” —Kissinger on Vietnam, Cambodia, and S.A.

“If, in hindsight, we also discover that mistakes may have been made…I am deeply sorry.” —NY Catholic Cardinal Edward Egan

Слайд 66

Confirmation Bias

The tendency to seek & find confirming evidence

Слайд 67

Social psychologist Geoffrey Cohen quantified this effect in a

Слайд 68

“You get in the system and you become very

Слайд 69

Self-Serving Bias

In one College Entrance Examination Board survey of

1997 U.S. News and World Report study on who Americans believe are most likely to go to heaven: 52 percent said Bill Clinton, 60 percent thought Princess Diana, 65 percent chose Michael Jordan, 79 percent selected Mother Teresa, and, at 87 percent, the person most likely to go to heaven was the survey taker!

Слайд 70

Attribution Bias

The tendency to attribute different causes for our

Слайд 71

Situational attribution bias: We identify the cause of someone’s belief or

“Her success is a result of luck, circumstance, and having connections”.

Dispositional attribution bias: We identify the cause of our own belief or behavior in our disposition

“I am successful because I’m hard working, intelligent, and creative” .

Слайд 72

Intellectual attribution bias: We consider our own beliefs as being rationally

Emotional attribution bias: We see the beliefs of others as being emotionally driven.

“I am for gun control because statistics show that crime decreases when gun ownership decreases”

“He is for gun control because he is a bleeding-heart liberal who needs to identify with the victim” or “he is against gun control because he’s a heartless conservative who needs to feel emboldened by a weapon”

Слайд 73

Lisa Farwell and Bernard Weiner discovered in their study on the

Farwell, Lisa and Bernard Weiner. 2000. “Bleeding Hearts and the Heartless: Popular Perceptions of Liberal and Conservative Ideologies.” Personality and Social Psychology Bulletin, 26, 845-52.

Слайд 79

Availability Fallacy

The tendency to assign probabilities of potential outcomes

Слайд 80

Availability Fallacy

In the run up to the 1976 United

Слайд 81

When subsequently asked to estimate the probably of each

Слайд 82

Conjunction Fallacy

Imagine that you are looking to hire someone

Linda is 31 years old, single, outspoken, and very bright. She majored in philosophy. As a student, she was deeply concerned with issues of discrimination and social justice, and also participated in anti-nuclear demonstrations.

Which is more likely? 1. Linda is a bank teller.

2. Linda is a bank teller and is active in the feminist movement.

Слайд 83

Bias Blind Spot

The tendency to recognize the power of

Princeton University psychologist Emily Pronin and her colleagues, subjects were randomly assigned high or low scores on a “social intelligence” test. Those given the high marks rated the test fairer and more useful than those receiving low marks. When asked if it was possible that they had been influenced by the score on the test, subjects responded that other participants had been far more biased than they were.

Слайд 84

Bias Blind Spot

Even when subjects admit to having such

Слайд 85

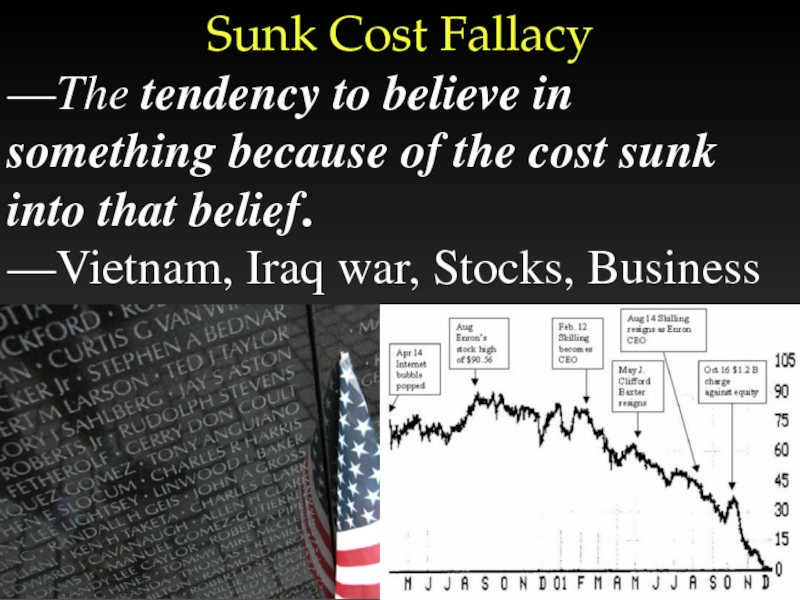

Sunk Cost Fallacy

—The tendency to believe in something because

—Vietnam, Iraq war, Stocks, Business

—Failing businesses & relationships

Слайд 86

Sunk Cost Fallacy

Leo Tolstoy: “I know that most men,

Слайд 87

Endowment Effect

Owners of an item value it roughly twice

Слайд 88

Endowment Effect Experiment

Subjects given a coffee mug worth $6

Asked the lowest price they would take: $5.25.

Other subjects asked how much they would pay for the same mug: $2.75

Слайд 90

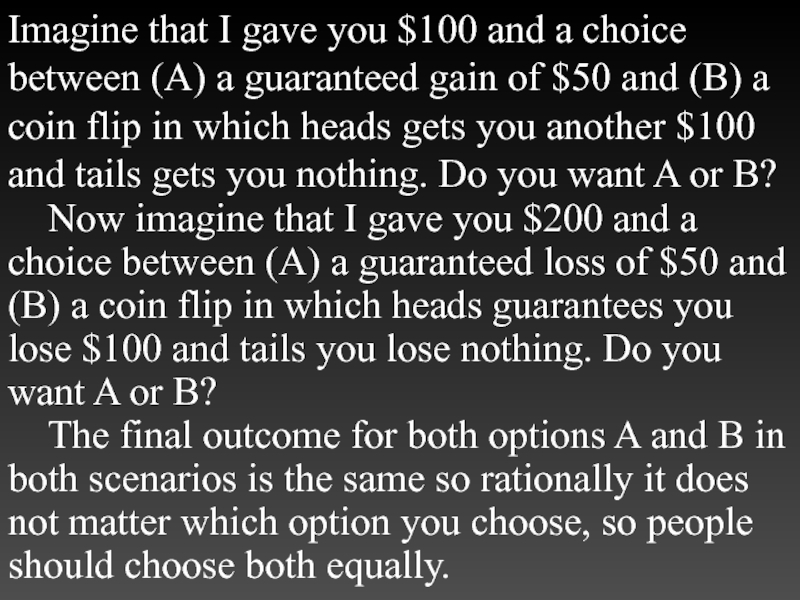

Imagine that I gave you $100 and a choice

Now imagine that I gave you $200 and a choice between (A) a guaranteed loss of $50 and (B) a coin flip in which heads guarantees you lose $100 and tails you lose nothing. Do you want A or B?

The final outcome for both options A and B in both scenarios is the same so rationally it does not matter which option you choose, so people should choose both equally.

Слайд 91

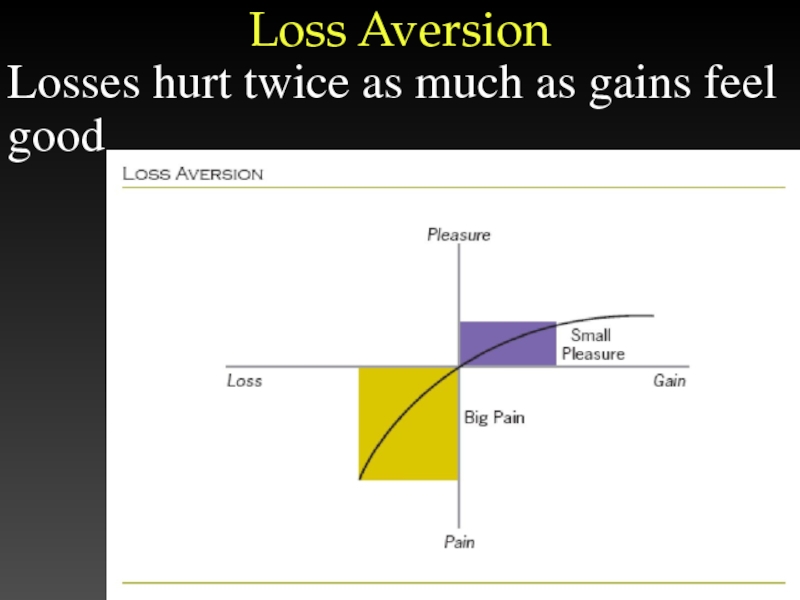

Most people choose A in the first scenario (a

Even though there is no difference between having $100 and a sure or potential gain of $50, and having $200 and a sure or potential loss of $50, emotionally there is a difference. That emotion is called loss aversion, or risk aversion.

On average most people will reject the prospect of a 50/50 probability of gaining or losing money unless the amount to be gained is at least double the amount to be lost, because losses hurt twice as much as gains feel good.

Слайд 92

Loss Aversion in the Brain

Neuroeconomists using fMRI brain scans found areas

Слайд 93

Loss Aversion in Monkeys

Capuchin monkeys were given 12 tokens that they

In one trial, the monkeys were given the opportunity to trade tokens with one experimenter for grapes and with another experimenter for apple slices. One monkey, for example, traded 7 tokens for grapes and 5 tokens for apple slices. A baseline like this was established for each monkey so that the scientists knew each monkey’s preferences.

Слайд 94

Trial #2: monkeys were given additional tokens to trade for food,

According to the law of supply and demand, the monkeys should now purchase more of the relatively cheap food and less of the relatively expensive food, and that is precisely what they did.

In another trial in which the experimental conditions were manipulated in such a way that the monkeys had a choice of a 50% chance of a gain or a 50% chance of a loss, the monkeys were twice as averse to the loss as they were motivated by the gain.

Слайд 95

Question: Why Didn’t Risk Aversion Prevent the Financial Meltdown?

Answer: Risk Signals

Слайд 96

Risk Aversion & the Financial Meltdown

Federal Reserve Intervention into the price

Interest Rate manipulation

Price & Wage Controls

Bailouts (signals that losses will be recovered by someone else, thereby removing loss aversion)

Moral Hazards (government insulates investors and corporations from risk, thereby removing risk aversion): GM, Crystler, AIG

Example: Community Reinvestment Act, 1977, to prevent “redlining” against minorities, led to government intervention into the housing market

Слайд 97

How Financial Institutions

Lost Risk Aversion

(“Toxic”) Mortgage Backed Securities

Credit Default Swaps

Derivatives

Lending agencies passing paper down the line:

A mortgage is given by a loan officer.

A thousand mortgages are bundled and sold as a mortgage-backed security.

A thousand mortgage-back securities packaged and sold as a collateral debt obligation (CDO).

A thousand CDOs packaged, sold, and secured with credit default swaps.

Слайд 98

September 30, 1999 New York Times: “Fannie Mae Eases Credit To

Fannie Mae began a program that spring to encourage banks “to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans.”

Why?

Слайд 99

September 30, 1999 New York Times: “Fannie Mae, the nation’s biggest

July, 1999, HUD forced Fannie & Freddie to increase portfolio of loans to lower and moderate-income borrowers from 44% to 50% by 2001.

Слайд 100

There’s nothing wrong with taking higher risks, whether under political or

Under the new program, higher-risk people with lower incomes, negligible savings, and poorer credit ratings could now qualify for a mortgage that was only one point above a conventional 30-year fixed rate mortgage (and that added point was dropped after 2 years of steady payments).

In other words, the normal risk signal sent to high risk consumers—you can have the loan but it’s going to cost you a lot more—was removed. Lower the risk signal and you lower risk aversion.

Слайд 101

Entrepreneurial Error

Investors buy the wrong stock

Businessmen produce the wrong products

Consumers over-spend, especially during holidays.

Drivers have accidents.

Ships sink.

Builders don’t meet deadlines.

Economists make false predictions.

Entrepreneurs cut corners, deceive customers, & embezzle funds.

Economic failure, stupidity, & incompetence are too common.

Слайд 102

Entrepreneurial Error

“To make mistakes in pursuing one’s ends is a widespread

“As a rule only some businessmen suffer losses at any one time; the bulk either break even or earn profits.”

—Murray Rothbard

Слайд 109

Solutions to the Financial Crisis

1. Allow the market to determine risk

2. Markets, not the Fed, must determine price of $$

3. Losses must be linked directly to those who make financial decisions, from lenders to CEOs

4. No more bailouts! No one is “too big to fail”

5. No more: “In profits we’re capitalists, in losses we’re socialists”

6. Evolution & Economics: “Extinction is the rule, survival the exception.”

7. Economies must be allowed to flourish from the bottom up, & cannot be controlled from top down

8. Free Trade w/well defined & enforced rules

Слайд 111

How to See the World Anew

1. Think out of the box,

2. Look for new patterns, be playful, relaxed, and see the bigger picture

3. Be curious, ask why, examine the unexpected

3. Look for disconfirmatory evidence and alternative explanations

4. Seek peer review, constructive criticism, and feedback

5. Be willing to change your mind, to say “I don’t know” and “I could be wrong”

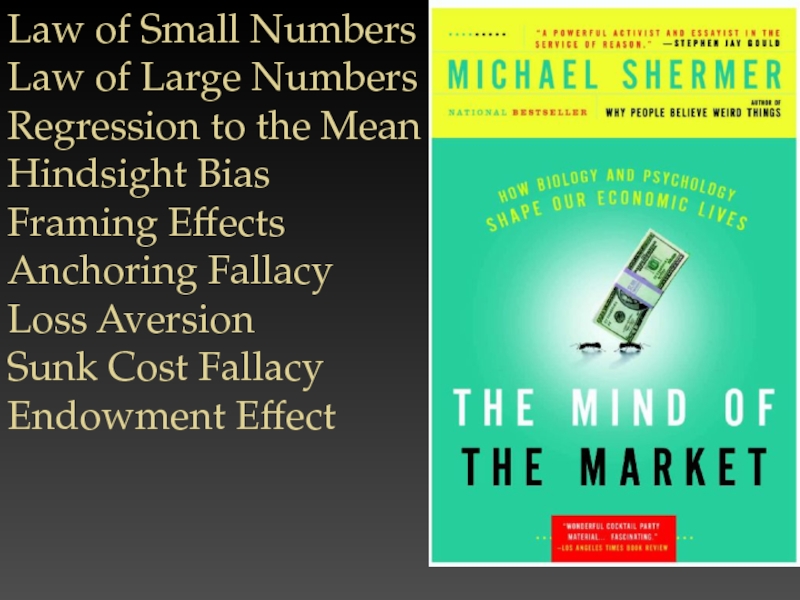

Слайд 117

Law of Small Numbers

Law of Large Numbers

Regression to

Hindsight Bias

Framing Effects

Anchoring Fallacy

Loss Aversion

Sunk Cost Fallacy

Endowment Effect