Corporation

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Will Starbucks Raise Its Dividend in 2016? презентация

Содержание

- 1. Will Starbucks Raise Its Dividend in 2016?

- 2. Starbucks Is Exhibiting Operational Strength Fiscal 2015

- 3. “In fiscal 2015, we returned a record

- 4. Cash Returns:

- 5. Dividends + Share Buybacks 2015 Dividends: $0.92

- 6. Starbucks Is Projecting Another Impressive Year Management

- 7. The Point: Starbucks should again see

- 8. Management MUST Consider: Capital Expenditures Each year

- 9. Management MUST Consider: 2016 CAP-EX Starbucks projects

- 10. Other Management Considerations: Payout ratio: This

- 11. Going Forward Starbucks’ recent stock appreciation is

- 12. The next billion-dollar iSecret The world's

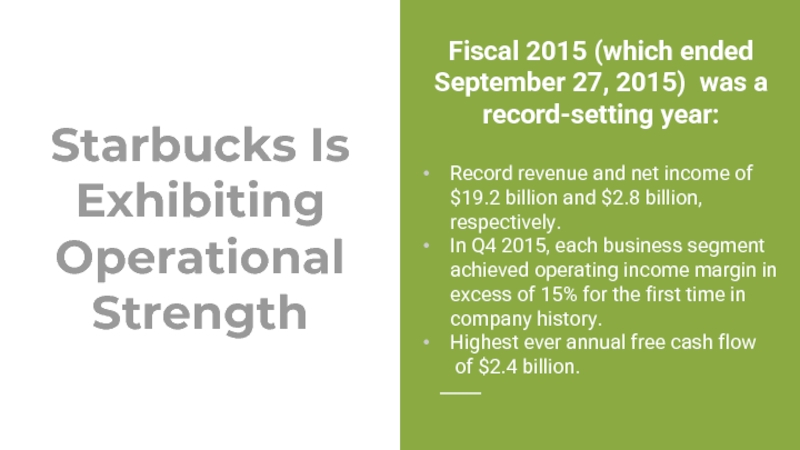

Слайд 2Starbucks Is Exhibiting Operational Strength

Fiscal 2015 (which ended September 27, 2015)

was a record-setting year:

Record revenue and net income of $19.2 billion and $2.8 billion, respectively.

In Q4 2015, each business segment achieved operating income margin in excess of 15% for the first time in company history.

Highest ever annual free cash flow

of $2.4 billion.

Record revenue and net income of $19.2 billion and $2.8 billion, respectively.

In Q4 2015, each business segment achieved operating income margin in excess of 15% for the first time in company history.

Highest ever annual free cash flow

of $2.4 billion.

Слайд 3“In fiscal 2015, we returned a record $2.4 billion of cash

to our shareholders through a combination of dividends and share buybacks, up over 50% from 2014 levels. And today, we announced that our board has approved a 25% increase in our quarterly dividend to $0.20 per share.”

--Starbucks CFO Scott Maw, Fiscal Q4 2015 Earnings Conference Call

--Starbucks CFO Scott Maw, Fiscal Q4 2015 Earnings Conference Call

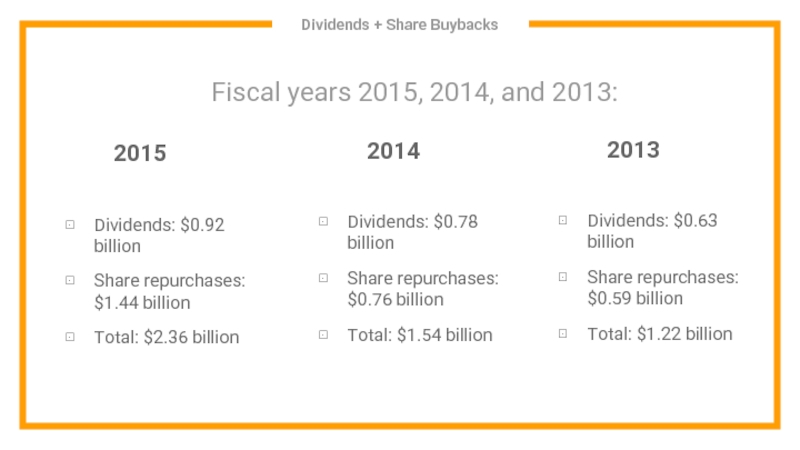

Слайд 4 Cash Returns:

Going back to 2013, Starbucks

has been even more aggressive in returning excess cash than CFO Maw indicated. During the three-year period, it’s nearly doubled payouts to shareholders:

Mermaid image: Starbucks Corporation

Слайд 5Dividends + Share Buybacks

2015

Dividends: $0.92 billion

Share repurchases: $1.44 billion

Total: $2.36 billion

2014

Dividends:

$0.78 billion

Share repurchases: $0.76 billion

Total: $1.54 billion

Share repurchases: $0.76 billion

Total: $1.54 billion

2013

Dividends: $0.63 billion

Share repurchases: $0.59 billion

Total: $1.22 billion

Fiscal years 2015, 2014, and 2013:

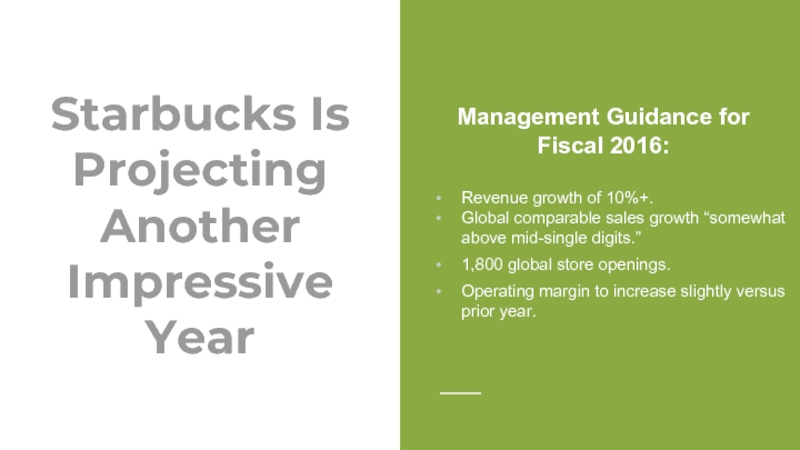

Слайд 6Starbucks Is Projecting Another Impressive Year

Management Guidance for Fiscal 2016:

Revenue growth

of 10%+.

Global comparable sales growth “somewhat above mid-single digits.”

1,800 global store openings.

Operating margin to increase slightly versus prior year.

Global comparable sales growth “somewhat above mid-single digits.”

1,800 global store openings.

Operating margin to increase slightly versus prior year.

Слайд 7

The Point:

Starbucks should again see excellent operational and free cash flows

in 2016. Any dividend increase will be at the discretion of management and the company's board of directors.

Слайд 8Management MUST Consider:

Capital Expenditures

Each year the company must pay for property

and equipment, which includes fixed assets tied to store expansion, before making payments to shareholders. Capital expenditures, or “CAP-EX,” come before cash shareholder returns in priority.

Слайд 9Management MUST Consider:

2016 CAP-EX

Starbucks projects a 2016 CAP-EX total of $1.4

billion. If the company generates similar operating cash flow to fiscal 2015 ($3.7 billion), it will have ample cash left after CAP-EX to fund the roughly $1.16 billion in dividends declared for next year. This also bodes well for the announcement of a dividend increase in calendar year 2016.

Слайд 10Other Management Considerations:

Payout ratio: This is the total dividend payout expressed

as a percentage of net income. Starbucks’ recent payout ratio calculates to a quite manageable 35%.

Yield: Starbucks’ increasing stock price keeps depressing its dividend yield, which is currently at 1.33%. A 2016 increase in dividend will help the yield keep pace with a rising share price.

Yield: Starbucks’ increasing stock price keeps depressing its dividend yield, which is currently at 1.33%. A 2016 increase in dividend will help the yield keep pace with a rising share price.

Слайд 11Going Forward

Starbucks’ recent stock appreciation is no fluke; the company’s financial

underpinnings are currently quite solid.

There are ample resources for another dividend increase to be declared during the latter part of calendar year 2016, which will be effective for fiscal 2017.

Thus, it’s highly likely that, barring unforeseen issues, Starbucks Corporation will continue to share its spoils with shareholders, and declare another dividend increase next year.

There are ample resources for another dividend increase to be declared during the latter part of calendar year 2016, which will be effective for fiscal 2017.

Thus, it’s highly likely that, barring unforeseen issues, Starbucks Corporation will continue to share its spoils with shareholders, and declare another dividend increase next year.

Слайд 12The next billion-dollar iSecret

The world's biggest tech company forgot to

show you something at its recent event, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early-in-the-know investors! To be one of them, just click here.