Rolled -- This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Raytheon Surged, Boeing Slumped, and Lockheed Martin Rocked -- then Rolled -- This Week презентация

Содержание

- 1. Why Raytheon Surged, Boeing Slumped, and Lockheed Martin Rocked -- then Rolled -- This Week

- 2. A Tale of Three Defense Contractors Three

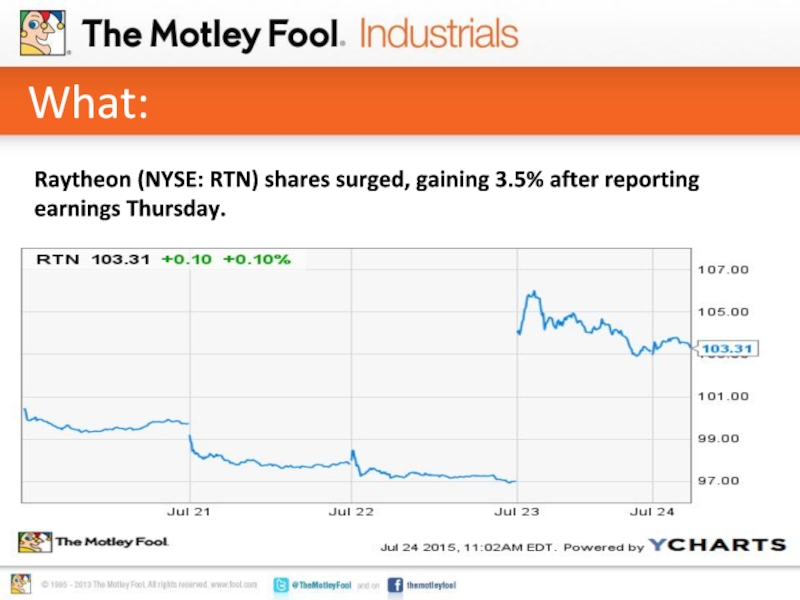

- 3. What: Raytheon (NYSE: RTN) shares surged, gaining 3.5% after reporting earnings Thursday.

- 4. So What: Raytheon sales of $5.8 billion

- 5. Now What: Whether Raytheon’s acquisition of Websense

- 6. What: Text Boeing (NYSE: BA) shares popped

- 7. So What: Boeing grew its Q2 2015

- 8. Now What: Trading for just 14.5

- 9. What: Lockheed Martin (NYSE: LMT) popped

- 10. So What: Q2 sales grew 3%, to

- 11. Now What: Of course, the big news

- 12. This $19 trillion industry could destroy the

Слайд 2A Tale of Three Defense Contractors

Three of America’s biggest names in

defense contracting reported earnings this week – with very different results for their share prices.

Слайд 4So What:

Raytheon sales of $5.8 billion increased only 3% in comparison

to last year's Q2, but beat analyst estimates by 5%

Earnings from continuing operations grew 4%, to $1.65, or $0.03 ahead of estimates

Best of all, Raytheon generated free cash flow of $288 million during the quarter -- three times as much cash profit as Raytheon generated in Q2 2014

Earnings from continuing operations grew 4%, to $1.65, or $0.03 ahead of estimates

Best of all, Raytheon generated free cash flow of $288 million during the quarter -- three times as much cash profit as Raytheon generated in Q2 2014

Слайд 5Now What:

Whether Raytheon’s acquisition of Websense will pay off in the

long run (the purchase forced Raytheon to reduce earnings estimates for this year by $0.20) remains an open question.

But Raytheon’s doing a bang-up job of growing the rest of its business, with new orders received exceeding old orders fulfilled (sales) by a factor of 1.3 in the quarter.

But Raytheon’s doing a bang-up job of growing the rest of its business, with new orders received exceeding old orders fulfilled (sales) by a factor of 1.3 in the quarter.

Слайд 6What:

Text

Boeing (NYSE: BA) shares popped initially after earnings came out Wednesday,

then slumped.

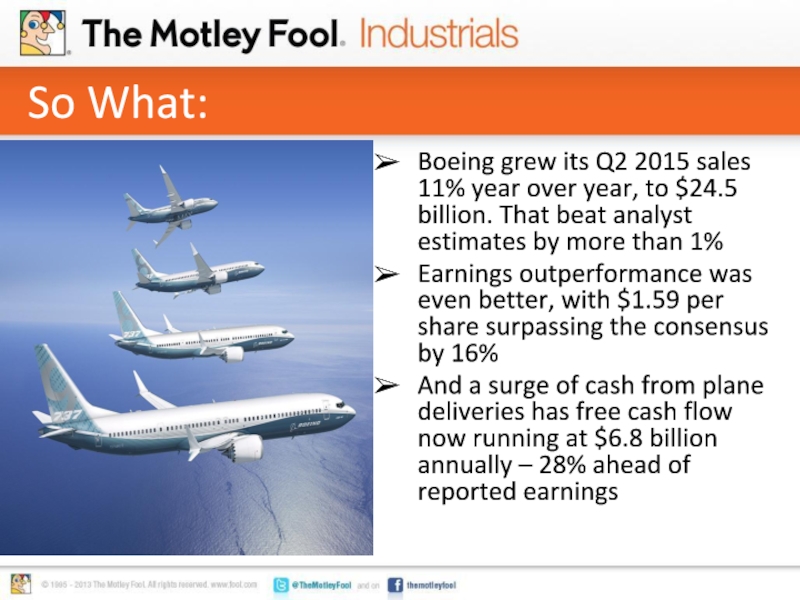

Слайд 7So What:

Boeing grew its Q2 2015 sales 11% year over year,

to $24.5 billion. That beat analyst estimates by more than 1%

Earnings outperformance was even better, with $1.59 per share surpassing the consensus by 16%

And a surge of cash from plane deliveries has free cash flow now running at $6.8 billion annually – 28% ahead of reported earnings

Earnings outperformance was even better, with $1.59 per share surpassing the consensus by 16%

And a surge of cash from plane deliveries has free cash flow now running at $6.8 billion annually – 28% ahead of reported earnings

Слайд 8Now What:

Trading for just 14.5 times free cash flow today, and

projected to grow profits at nearly 12% as the company’s 787 Dreamliner program continues to scale up, Boeing shares are starting to look attractive after the week’s slump.

Text

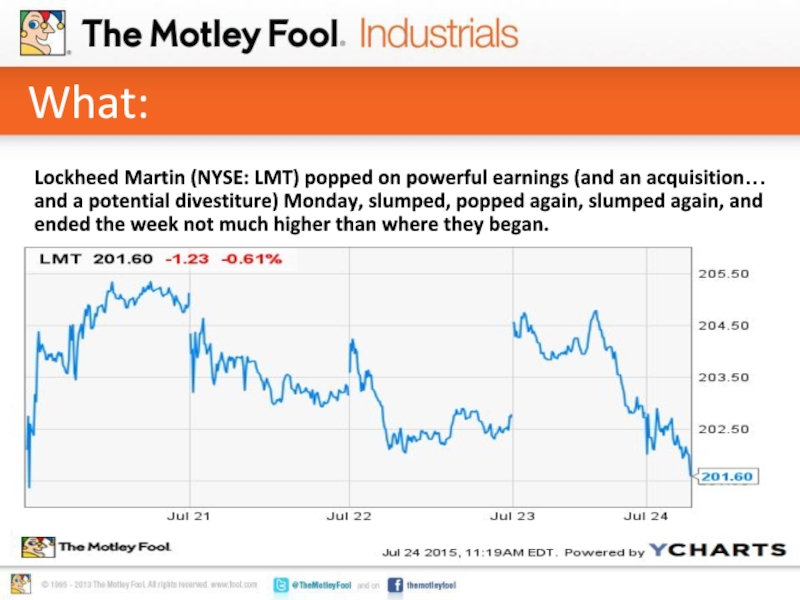

Слайд 9What:

Lockheed Martin (NYSE: LMT) popped on powerful earnings (and an acquisition…

and a potential divestiture) Monday, slumped, popped again, slumped again, and ended the week not much higher than where they began.

Слайд 10So What:

Q2 sales grew 3%, to $11.6 billion, beating estimates by

5%

Per-share profits of $2.94 per share likewise beat estimates, growing 6.5% year over year

Cash from operations was up 29%, and even after accelerated capital investment, that left Lockheed Martin with $1.07 billion in free cash flow for the quarter, a 22% year-over-year improvemnet according to data from S&P Capital IQ

Per-share profits of $2.94 per share likewise beat estimates, growing 6.5% year over year

Cash from operations was up 29%, and even after accelerated capital investment, that left Lockheed Martin with $1.07 billion in free cash flow for the quarter, a 22% year-over-year improvemnet according to data from S&P Capital IQ

Text

Слайд 11Now What:

Of course, the big news at Lockheed Martin was the

company’s $9 billion acquisition of United Technologies’ (NYSE: UTX) Sikorsky helicopters business. The deal looks good, thanks to a $1.9 billion tax benefit that drops Lockheed’s effective purchase price to $7.1 billion.

But only time will tell if Lockheed can parlay its profit-making proficiency in fighter jets into a turnaround in profitability at Sikorsky.

But only time will tell if Lockheed can parlay its profit-making proficiency in fighter jets into a turnaround in profitability at Sikorsky.

Text

Слайд 12This $19 trillion industry could destroy the Internet One bleeding-edge technology is

about to put the World Wide Web to bed. And if you act quickly, you could be among the savvy investors who enjoy the profits from this stunning change. Experts are calling it the single largest business opportunity in the history of capitalism... The Economist is calling it "transformative"... But you'll probably just call it "how I made my millions." Don't be too late to the party -- click here for one stock to own when the Web goes dark.