- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Facebook Stock Jumped 35% презентация

Содержание

- 1. Why Facebook Stock Jumped 35%

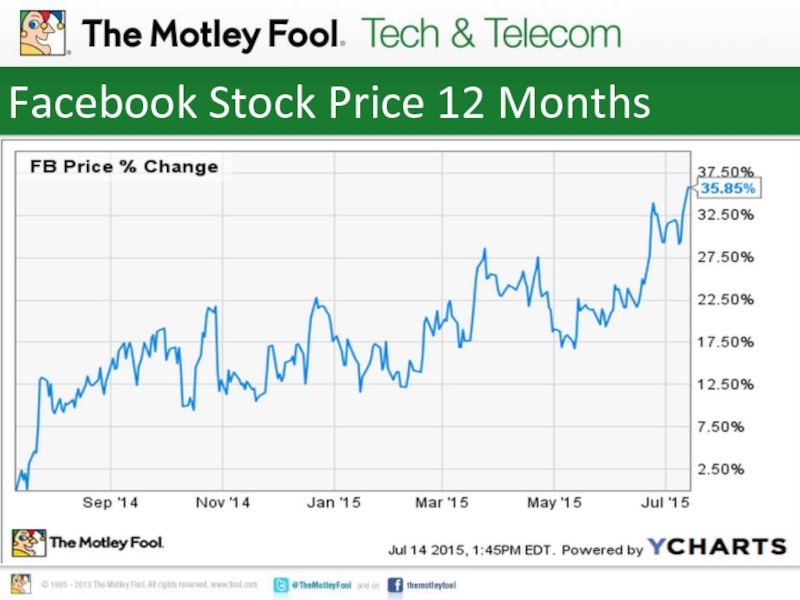

- 2. Facebook Stock Price 12 Months

- 3. 3 Key Growth Drivers Expanding user base

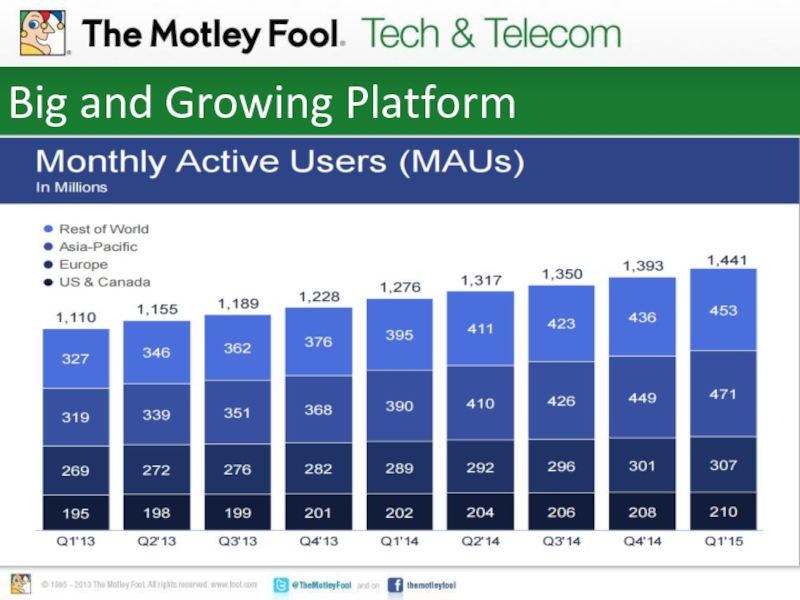

- 4. Big and Growing Platform

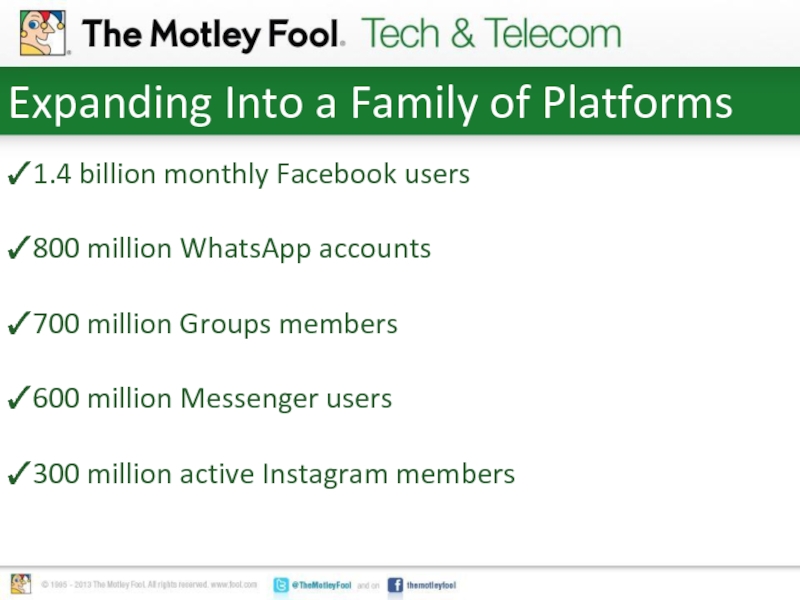

- 5. Expanding Into a Family of Platforms 1.4

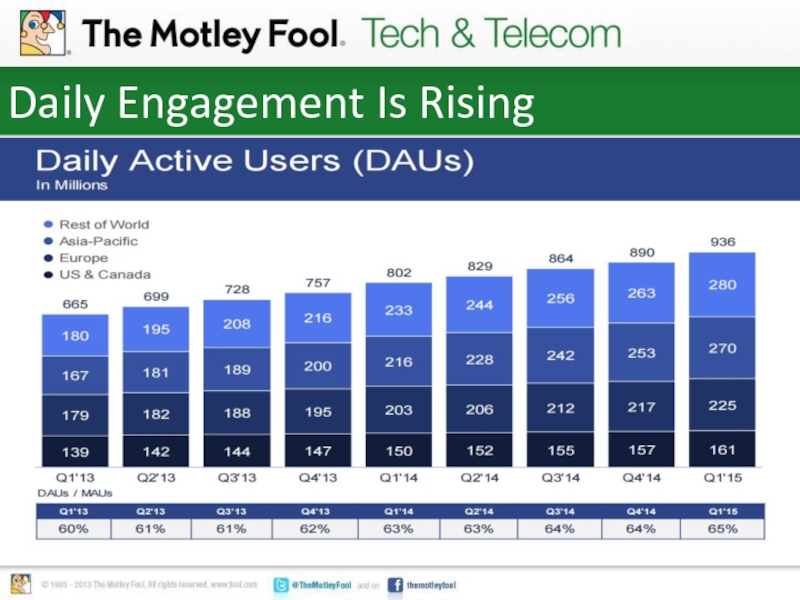

- 6. Daily Engagement Is Rising

- 7. Daily Engagement Is Rising “We continue to

- 8. Healthy Monetization Trends Average revenue per user

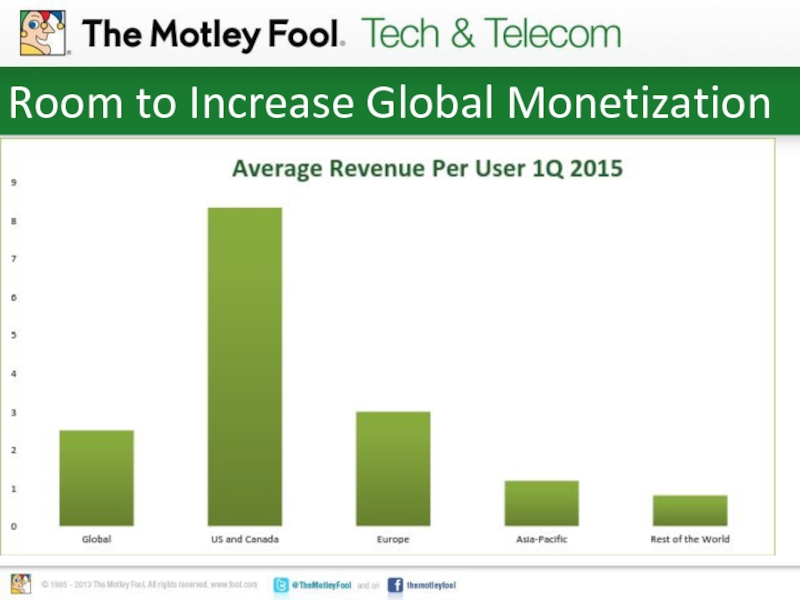

- 9. Room to Increase Global Monetization

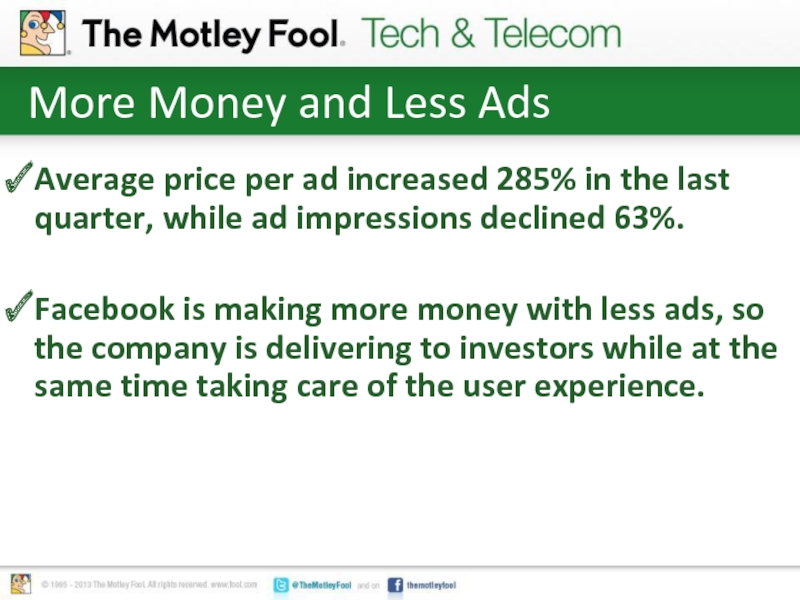

- 10. More Money and Less Ads Average price

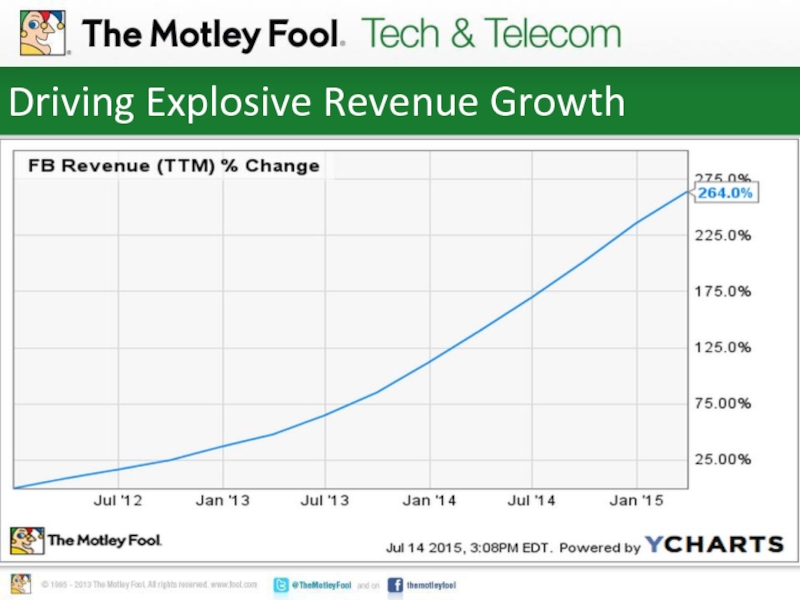

- 11. Driving Explosive Revenue Growth

- 12. 3 Companies Poised to Explode When Cable

Слайд 5Expanding Into a Family of Platforms

1.4 billion monthly Facebook users

800 million

WhatsApp accounts

700 million Groups members

600 million Messenger users

300 million active Instagram members

700 million Groups members

600 million Messenger users

300 million active Instagram members

Слайд 7Daily Engagement Is Rising

“We continue to see strong growth in daily

engagement around the world, including in our most engaged markets.”

Facebook founder and CEO Mark Zuckerberg. Facebook earnings conference call 1Q 2015

Facebook founder and CEO Mark Zuckerberg. Facebook earnings conference call 1Q 2015

Слайд 8Healthy Monetization Trends

Average revenue per user grew 25% to $2.5 on

a global scale during the last quarter.

Monetization levels are much higher in the U.S. and Canada than in other markets. This indicates that Facebook enjoys considerable room to continue increasing monetization in the future.

Monetization levels are much higher in the U.S. and Canada than in other markets. This indicates that Facebook enjoys considerable room to continue increasing monetization in the future.

Слайд 10More Money and Less Ads

Average price per ad increased 285% in

the last quarter, while ad impressions declined 63%.

Facebook is making more money with less ads, so the company is delivering to investors while at the same time taking care of the user experience.

Facebook is making more money with less ads, so the company is delivering to investors while at the same time taking care of the user experience.

Слайд 123 Companies Poised to Explode When Cable Dies Cable is dying. And

there are 3 stocks that are poised to explode when this faltering $2.2 trillion industry finally bites the dust. Just like newspaper publishers, telephone utilities, stockbrokers, record companies, bookstores, travel agencies, and big box retailers did when the Internet swept away their business models. And when cable falters, you don't want to miss out on these 3 companies that are positioned to benefit. Click here for their names. Hint: They're not the ones you'd think!