This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Chesapeake Energy, Clean Energy Fuels, and Legacy Reserves All Surged This Week презентация

Содержание

- 1. Why Chesapeake Energy, Clean Energy Fuels, and Legacy Reserves All Surged This Week

- 2. Oil prices took investors on a

- 3. What: The stock of natural gas producer

- 4. So What: Key driver: After an abysmal

- 5. Now What: After a myriad of downgrades

- 6. What: Natural gas fuel purveyor Clean Energy

- 7. So What: Key driver: Clean Energy Fuels

- 8. Now What: The company is on pace

- 9. What: The unit price of oil and

- 10. So What: Key driver: Legacy Reserves acquired

- 11. Now What: The acquisition is expected to

- 12. This $19 trillion industry could destroy the

Слайд 2

Oil prices took investors on a wild ride this week. However,

despite enduring the steepest one-day drop in months, three energy stocks actually surged more than double digits this week.

Here’s a look at the news that moved these stocks.

Here’s a look at the news that moved these stocks.

Photo credit: TaxCredits.net

Слайд 3What:

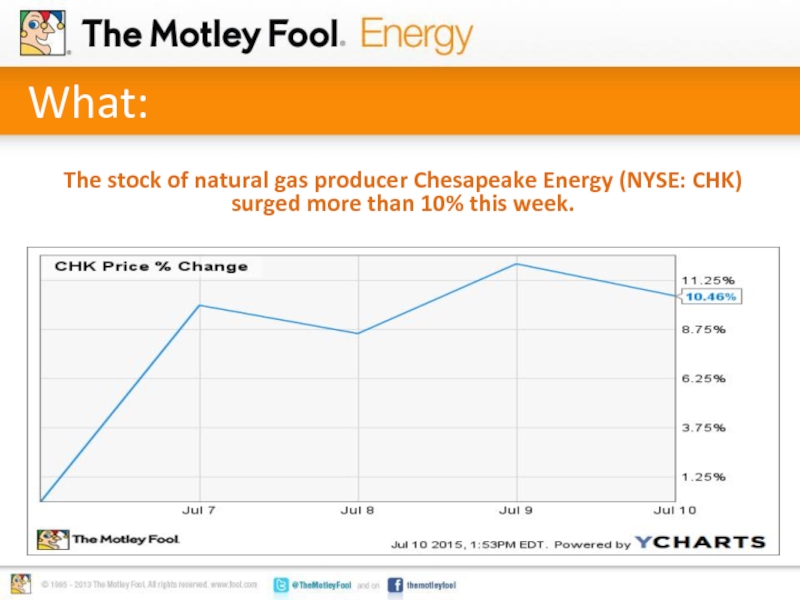

The stock of natural gas producer Chesapeake Energy (NYSE: CHK) surged

more than 10% this week.

Слайд 4So What:

Key driver: After an abysmal first half where Chesapeake Energy

was the worst-performing energy stock in the S&P 500, its stock surged 10% on Tuesday

Tuesday’s surge wasn’t sparked by any news, but more of a relief rally as inventors finally came around to the improving story that analysts from both Wunderlich and Goldman Sachs pointed out the week before

Tuesday’s surge wasn’t sparked by any news, but more of a relief rally as inventors finally came around to the improving story that analysts from both Wunderlich and Goldman Sachs pointed out the week before

Слайд 5Now What:

After a myriad of downgrades during the first half, several

analysts have turned bullish on the company in July

Fueling the bullishness is the recent sale of $840 million in assets in Oklahoma that will simplify its balance sheet

Key takeaway: Analysts and investors finally think that the worst is over at Chesapeake

Fueling the bullishness is the recent sale of $840 million in assets in Oklahoma that will simplify its balance sheet

Key takeaway: Analysts and investors finally think that the worst is over at Chesapeake

Слайд 6What:

Natural gas fuel purveyor Clean Energy Fuels’ (NASDAQ: CLNE) stock jumped

18% this week.

Слайд 7So What:

Key driver: Clean Energy Fuels said it completed 14 new

fuel stations for refuse customers in the first six months of 2015

Twenty-two more stations for refuse customers are expected to be complete by the end of the year

Twenty-two more stations for refuse customers are expected to be complete by the end of the year

Слайд 8Now What:

The company is on pace to build a record 36

stations for refuse customers, which is really driving its business right now

Key takeaway: Signs are emerging that its key refuse refueling business isn’t only growing, but its growth is accelerating

Key takeaway: Signs are emerging that its key refuse refueling business isn’t only growing, but its growth is accelerating

Слайд 9What:

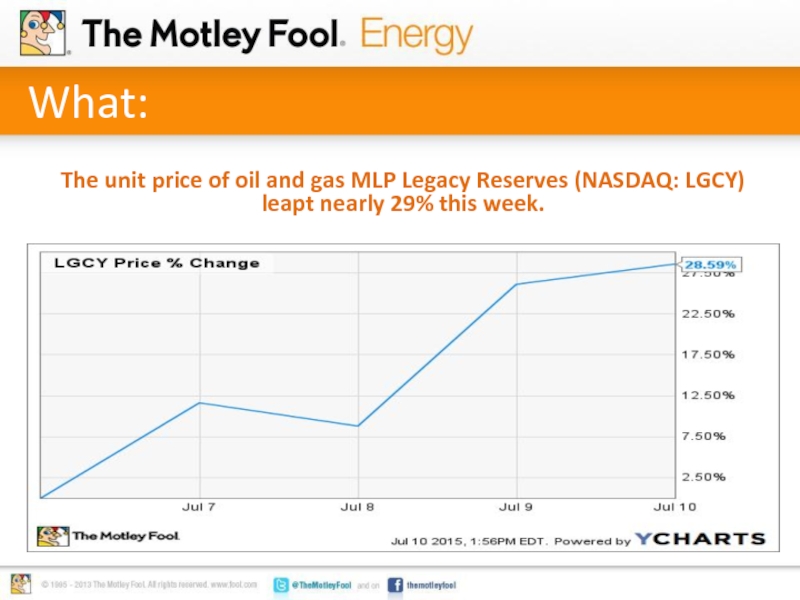

The unit price of oil and gas MLP Legacy Reserves (NASDAQ:

LGCY) leapt nearly 29% this week.

Слайд 10So What:

Key driver: Legacy Reserves acquired $440 million in natural gas

properties and related gathering and processing assets in East Texas

The company also signed an agreement with a private equity company to fund the development of acreage in the Permian Basin

The company also signed an agreement with a private equity company to fund the development of acreage in the Permian Basin

Слайд 11Now What:

The acquisition is expected to be immediately accretive and have

long-term development upside should natural gas prices rise

The funding deal will provide cash to develop its horizontal acreage in the Permian

Key takeaway: With these deals, Legacy boosts its short-term cash flow and its long-term growth outlook

The funding deal will provide cash to develop its horizontal acreage in the Permian

Key takeaway: With these deals, Legacy boosts its short-term cash flow and its long-term growth outlook

Слайд 12This $19 trillion industry could destroy the Internet

One bleeding-edge technology is

about to put the World Wide Web to bed. And if you act right away, it could make you wildly rich. Experts are calling it the single largest business opportunity in the history of capitalism... The Economist is calling it "transformative"... But you'll probably just call it "how I made my millions." Don't be too late to the party -- click below for one stock to own when the Web goes dark.