- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Buffett Still Believes in Wal-Mart презентация

Содержание

- 1. Why Buffett Still Believes in Wal-Mart

- 2. Wal-Mart treats its shareholders well This is

- 3. Some Might Call Buffett’s Investment Mediocre

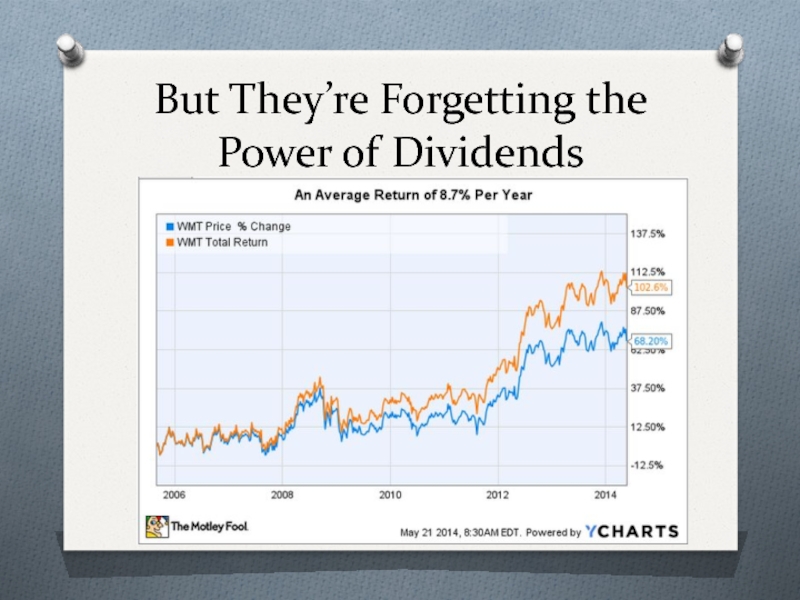

- 4. But They’re Forgetting the Power of Dividends

- 5. Consistent Dividends Back in late 2005,

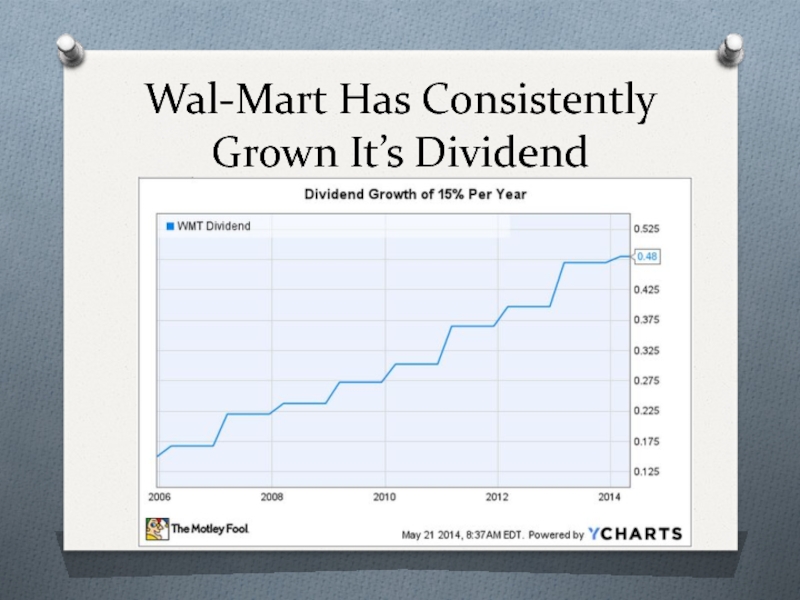

- 6. Wal-Mart Has Consistently Grown It’s Dividend

- 7. The Best Part About the Dividend?

- 8. But That’s Not All… Wal-Mart has

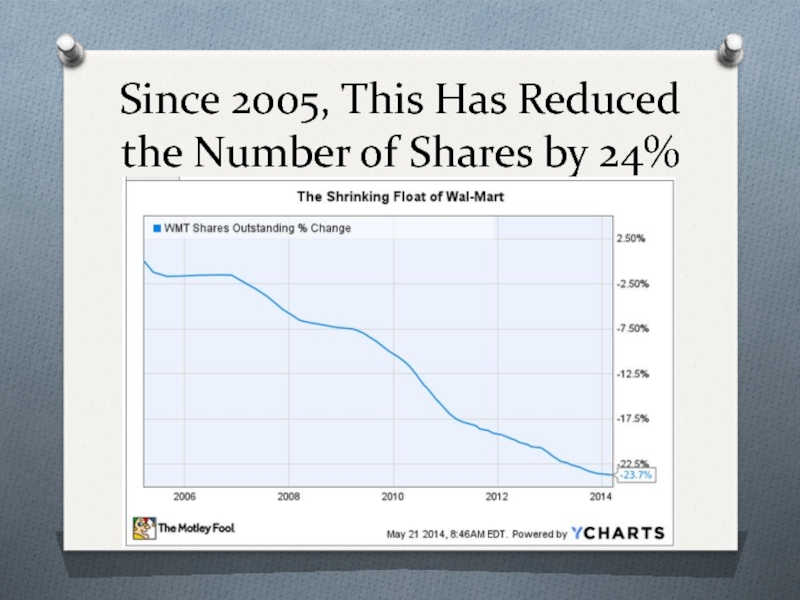

- 9. Since 2005, This Has Reduced the Number of Shares by 24%

- 10. This is a win-win for Buffett The

- 11. For More Dividend Winners… If you’re an

Слайд 2Wal-Mart treats its shareholders well

This is especially true in two key

areas:

Dividends

Share buybacks

Dividends

Share buybacks

Слайд 5Consistent Dividends

Back in late 2005, Wal-Mart paid out $0.60 per

share in dividends.

At the time, that meant Berkshire collected $12 million per year in dividends.

At the time, that meant Berkshire collected $12 million per year in dividends.

Fast forward to today, and Wal-Mart pays out $1.92 in dividends per year.

That means Berkshire will collect $111 million in dividends alone this year from Wal-Mart.

Слайд 7The Best Part About the Dividend?

Over the past 12 months,

Wal-Mart has brought in $12 billion in free cash flow.

At the same time, it has paid out just $6.1 billion in dividends.

That means Wal-Mart is only using about half of its free cash flow to pay its dividend.

Wal-Mart’s payout, therefore, is both sustainable, and has lots of room for growth.

At the same time, it has paid out just $6.1 billion in dividends.

That means Wal-Mart is only using about half of its free cash flow to pay its dividend.

Wal-Mart’s payout, therefore, is both sustainable, and has lots of room for growth.

Слайд 8But That’s Not All…

Wal-Mart has also been using its excess

cash to buy back shares of the company.

This lowers the number of shares outstanding, which gives each shareholder more value.

During 2013 alone, the company bought back 89 million shares, reducing the number of shares outstanding by 3%.

This lowers the number of shares outstanding, which gives each shareholder more value.

During 2013 alone, the company bought back 89 million shares, reducing the number of shares outstanding by 3%.

Слайд 10This is a win-win for Buffett

The investment is relatively safe for

Berkshire Hathaway.

Yet, it has done an excellent job of returning capital to the company.

Since late 2005, Berkshire’s original investment has returned $214 million in dividends, and about $613 million in unrealized stock gains.

Yet, it has done an excellent job of returning capital to the company.

Since late 2005, Berkshire’s original investment has returned $214 million in dividends, and about $613 million in unrealized stock gains.

Слайд 11For More Dividend Winners…

If you’re an income investor looking for some

high-yielders that are off the beaten path, check out the Motley Fool’s special free report:

Top Dividend Stocks for the Next Decade

Top Dividend Stocks for the Next Decade