- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Toward a Regional Action Agenda презентация

Содержание

- 1. Toward a Regional Action Agenda

- 2. Toward a Regional Action Agenda 1. Exploring

- 3. Threat Assessment: Climate Change hits Asia Pacific

- 4. The Financing Cycle of Climate

- 5. Bonds markets underdeveloped in low income countries

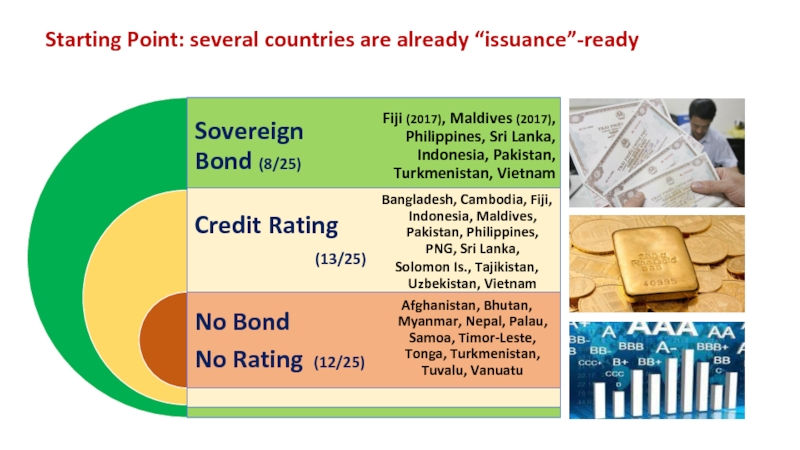

- 6. Starting Point: several countries are already “issuance”-ready

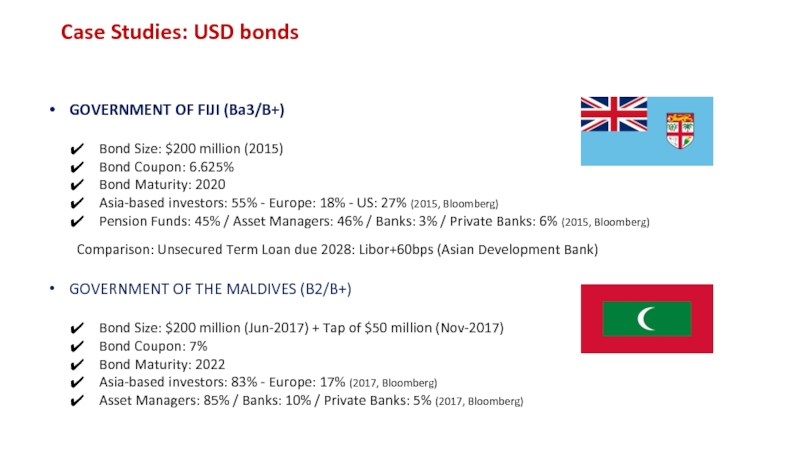

- 7. Case Studies: USD bonds GOVERNMENT OF FIJI

- 8. Toward a Regional Action Agenda 2. Green Bonds Asia Climate Week

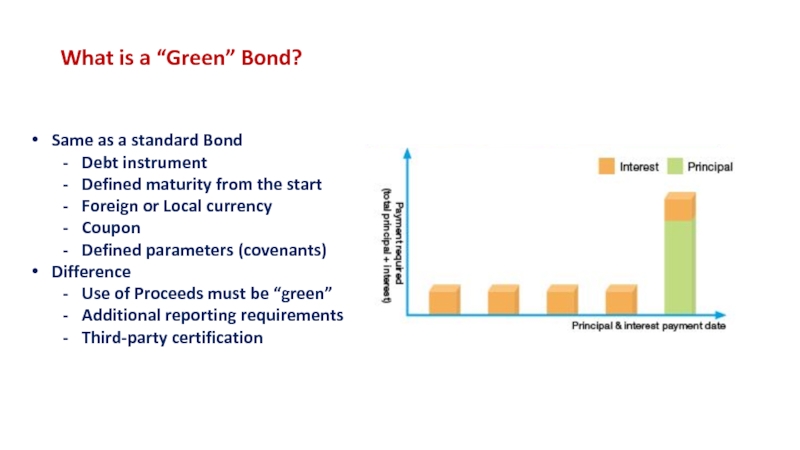

- 9. What is a “Green” Bond? Same as

- 10. Why do they matter? Rising interest from

- 11. What do they finance? GREEN BOND

- 12. Are they cheaper/more expensive? No real evidence

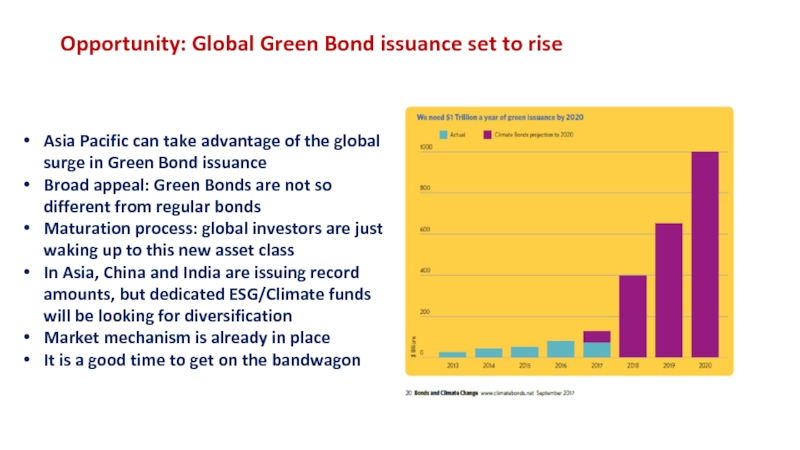

- 13. Opportunity: Global Green Bond issuance set to

- 14. Case Studies: Green bonds in Asia Pacific

- 15. Toward a Regional Action Agenda 3. Road to Market Asia Climate Week

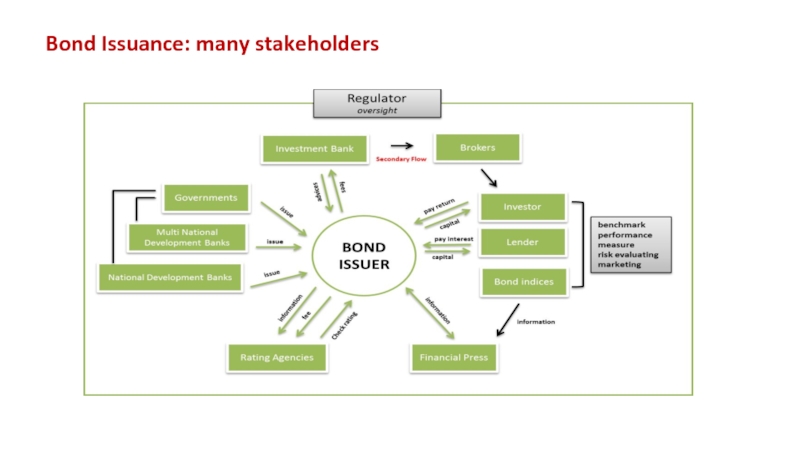

- 16. Bond Issuance: many stakeholders

- 17. Green Bond Principles: why do they matter?

- 18. Green Bond Principles: Regional / Local Under-developed

- 19. Green Bonds: how to build a pipeline

- 20. Adopt Green Bond Principles at

- 21. Grant Facility for Green Bonds Credit Rating

- 22. Concluding Remarks Opportunity to develop capital markets

Слайд 2Toward a Regional Action Agenda

1. Exploring new funding opportunities

Asia Pacific Climate

Слайд 3Threat Assessment: Climate Change hits Asia Pacific countries hard

Low income countries

Floods

Droughts

Rising sea levels

Deforestation

Extreme temperatures

Resources are scarce in these countries

Investment opportunities exist

Public funds alone are not sufficient

Global capital is abundant

Need to urgently find solutions to bring

global capital to the investment

opportunities

Слайд 4

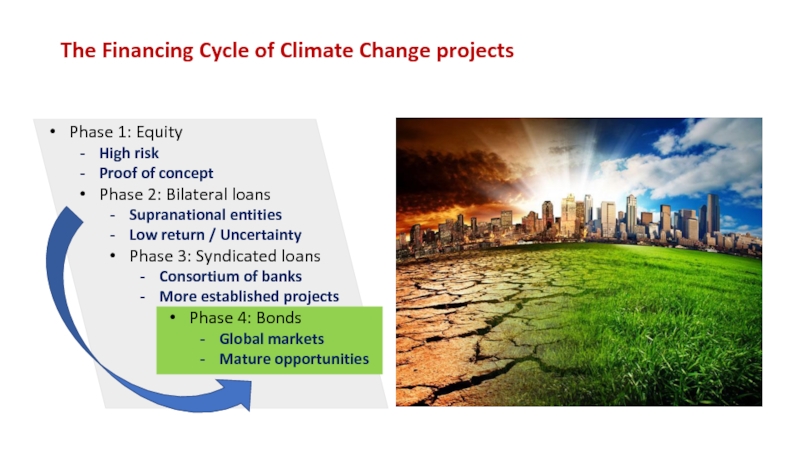

The Financing Cycle of Climate Change projects

Phase 1: Equity

High risk

Proof of

Phase 2: Bilateral loans

Supranational entities

Low return / Uncertainty

Phase 3: Syndicated loans

Consortium of banks

More established projects

Phase 4: Bonds

Global markets

Mature opportunities

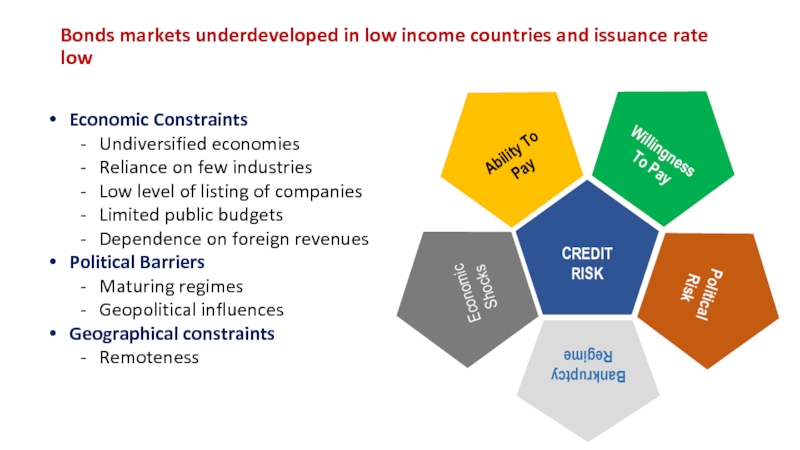

Слайд 5Bonds markets underdeveloped in low income countries and issuance rate low

Economic

Undiversified economies

Reliance on few industries

Low level of listing of companies

Limited public budgets

Dependence on foreign revenues

Political Barriers

Maturing regimes

Geopolitical influences

Geographical constraints

Remoteness

Слайд 7Case Studies: USD bonds

GOVERNMENT OF FIJI (Ba3/B+)

Bond Size: $200 million (2015)

Bond

Bond Maturity: 2020

Asia-based investors: 55% - Europe: 18% - US: 27% (2015, Bloomberg)

Pension Funds: 45% / Asset Managers: 46% / Banks: 3% / Private Banks: 6% (2015, Bloomberg)

Comparison: Unsecured Term Loan due 2028: Libor+60bps (Asian Development Bank)

GOVERNMENT OF THE MALDIVES (B2/B+)

Bond Size: $200 million (Jun-2017) + Tap of $50 million (Nov-2017)

Bond Coupon: 7%

Bond Maturity: 2022

Asia-based investors: 83% - Europe: 17% (2017, Bloomberg)

Asset Managers: 85% / Banks: 10% / Private Banks: 5% (2017, Bloomberg)

Слайд 9What is a “Green” Bond?

Same as a standard Bond

Debt instrument

Defined maturity

Foreign or Local currency

Coupon

Defined parameters (covenants)

Difference

Use of Proceeds must be “green”

Additional reporting requirements

Third-party certification

Слайд 10Why do they matter?

Rising interest from investors:

Fiduciary duties of managers

ESG mandates

Ethical

Private Investors

Sovereign Wealth Funds

High Net Worth Individuals

Lack of diversification opportunities for global fixed income investors

Слайд 12Are they cheaper/more expensive?

No real evidence of a pricing difference

Over-subscription at

Pricing in line

Buy and Hold investors

New market segment

Brown bonds will trade at a discount over time, as seen as more “risky”

Volumes expected to grow strongly in the years to come

Слайд 13Opportunity: Global Green Bond issuance set to rise

Asia Pacific can take

Broad appeal: Green Bonds are not so different from regular bonds

Maturation process: global investors are just waking up to this new asset class

In Asia, China and India are issuing record amounts, but dedicated ESG/Climate funds will be looking for diversification

Market mechanism is already in place

It is a good time to get on the bandwagon

Слайд 14Case Studies: Green bonds in Asia Pacific

GOVERNMENT OF FIJI

Bond Size: FJD

Bond Coupon: 4% (5 year) and 6.3% (13 year)

Bond Maturity: 2022 and 2030

Technical assistance from the World Bank and IFC

Third Party certification

AP Renewables

Bond Size: PHP 10.7 billion = USD 225 million (2016)

Bond Coupon: 7% - Bond Maturity: 2026

Tiwi-MakBan geothermal project

75% guarantee from the Asian Development Bank

Private placement to BPI (sale to insurance companies)

Third Party certification

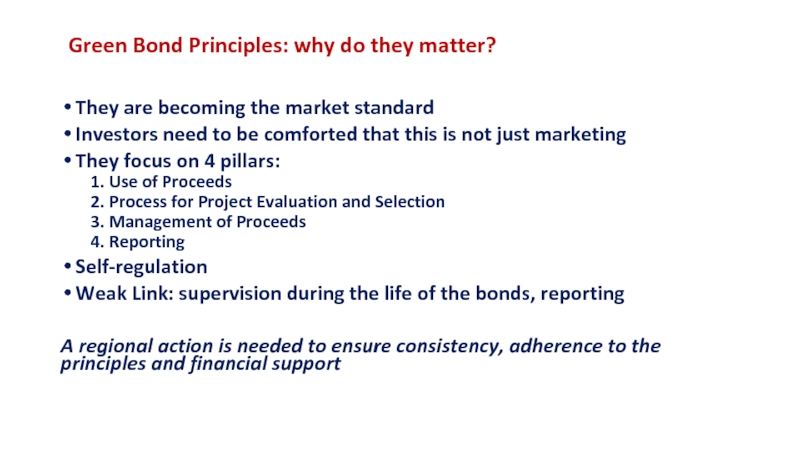

Слайд 17Green Bond Principles: why do they matter?

They are becoming the market

Investors need to be comforted that this is not just marketing

They focus on 4 pillars:

1. Use of Proceeds

2. Process for Project Evaluation and Selection

3. Management of Proceeds

4. Reporting

Self-regulation

Weak Link: supervision during the life of the bonds, reporting

A regional action is needed to ensure consistency, adherence to the principles and financial support

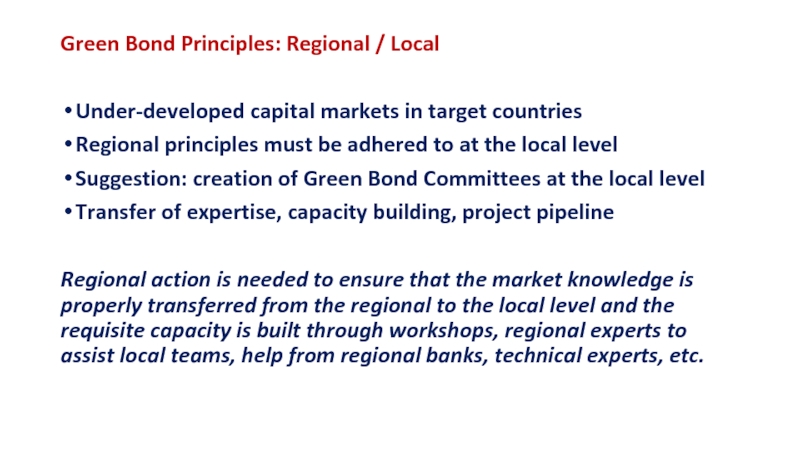

Слайд 18Green Bond Principles: Regional / Local

Under-developed capital markets in target countries

Regional

Suggestion: creation of Green Bond Committees at the local level

Transfer of expertise, capacity building, project pipeline

Regional action is needed to ensure that the market knowledge is properly transferred from the regional to the local level and the requisite capacity is built through workshops, regional experts to assist local teams, help from regional banks, technical experts, etc.

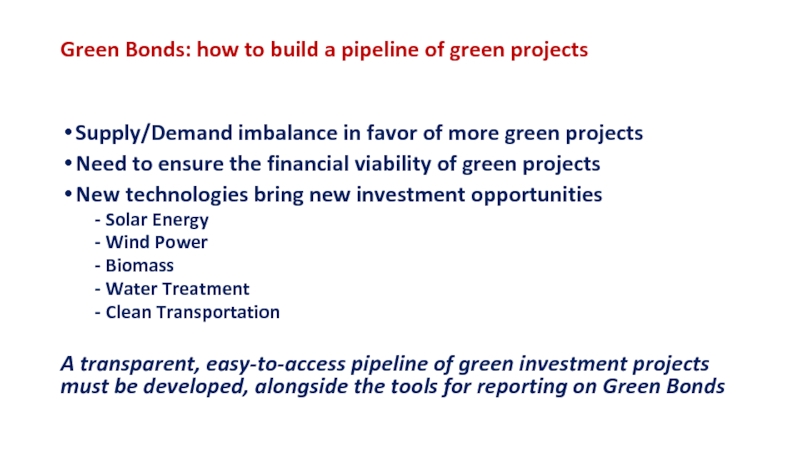

Слайд 19Green Bonds: how to build a pipeline of green projects

Supply/Demand imbalance

Need to ensure the financial viability of green projects

New technologies bring new investment opportunities

Solar Energy

Wind Power

Biomass

Water Treatment

Clean Transportation

A transparent, easy-to-access pipeline of green investment projects must be developed, alongside the tools for reporting on Green Bonds

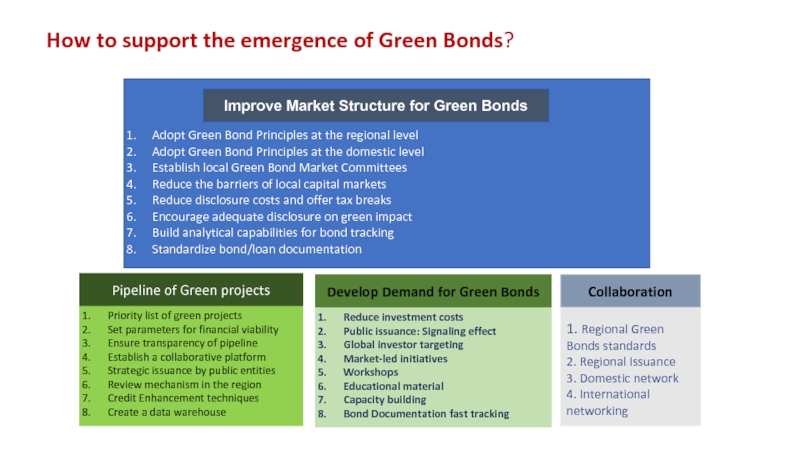

Слайд 20

Adopt Green Bond Principles at the regional level

Adopt Green Bond Principles

Establish local Green Bond Market Committees

Reduce the barriers of local capital markets

Reduce disclosure costs and offer tax breaks

Encourage adequate disclosure on green impact

Build analytical capabilities for bond tracking

Standardize bond/loan documentation

Priority list of green projects

Set parameters for financial viability

Ensure transparency of pipeline

Establish a collaborative platform

Strategic issuance by public entities

Review mechanism in the region

Credit Enhancement techniques

Create a data warehouse

Reduce investment costs

Public issuance: Signaling effect

Global investor targeting

Market-led initiatives

Workshops

Educational material

Capacity building

Bond Documentation fast tracking

1. Regional Green Bonds standards

2. Regional Issuance

3. Domestic network

4. International networking

Improve Market Structure for Green Bonds

Pipeline of Green projects

Develop Demand for Green Bonds

Collaboration

How to support the emergence of Green Bonds?

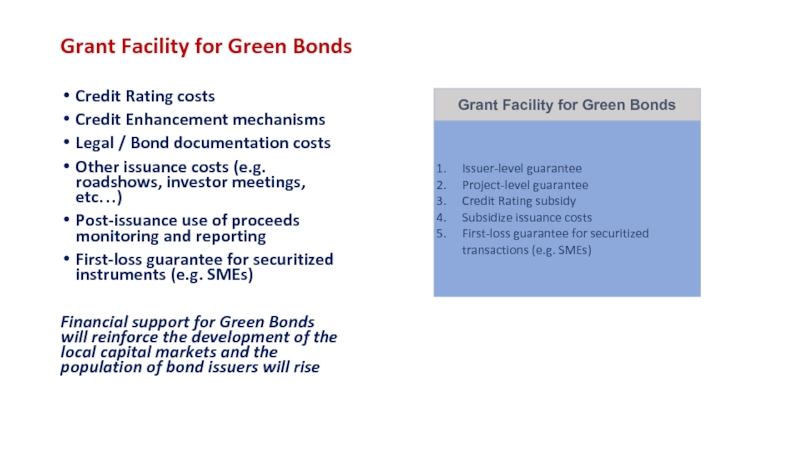

Слайд 21Grant Facility for Green Bonds

Credit Rating costs

Credit Enhancement mechanisms

Legal / Bond

Other issuance costs (e.g. roadshows, investor meetings, etc…)

Post-issuance use of proceeds monitoring and reporting

First-loss guarantee for securitized instruments (e.g. SMEs)

Financial support for Green Bonds will reinforce the development of the local capital markets and the population of bond issuers will rise

Issuer-level guarantee

Project-level guarantee

Credit Rating subsidy

Subsidize issuance costs

First-loss guarantee for securitized transactions (e.g. SMEs)

Grant Facility for Green Bonds

Слайд 22Concluding Remarks

Opportunity to develop capital markets in Asia Pacific

Attract Private Capital

Develop “green” investments in all countries

Respond to market inefficiencies through a targeted programme

Impact/Cost Ratio is highly favourable

Build on the successes of the large countries

Regional cooperation will bring benefits to all stakeholders