- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The No. 1 Tip to Accelerate Your Financial Independence Day презентация

Содержание

- 1. The No. 1 Tip to Accelerate Your Financial Independence Day

- 2. What’s that tip? Treat every penny you

- 3. Time is money Think of your spending

- 4. Where do your expenses fit? Every expense

- 5. Getting there faster: Cut the tail

- 6. Fewer buckets: More money for the important

- 7. Financial independence: Easy as A-B-C You reach

- 8. Is that all there is to it?

- 9. The most critical part – controlling your

- 10. Why this matters to you Life is

- 11. How to Get Even More Income During Retirement

Слайд 2What’s that tip?

Treat every penny you earn as if it were

a critical part of your financial plan.

By making everyday financial priority calls with that perspective in mind, you can build a plan that accelerates the arrival of your financial independence day.

By making everyday financial priority calls with that perspective in mind, you can build a plan that accelerates the arrival of your financial independence day.

Слайд 3Time is money

Think of your spending in terms of buckets of

time

Past – Debts on stuff you no longer have or use

Present – Current living expenses

Future – Financial goals

Stuff happens – Emergency and other unexpected spending

Within each time bucket, rank your priorities

Must have – Absolutely critical for sustaining your life

Like to have – Things that make your life worth living

Can live without – Everything else you’re spending money on

Past – Debts on stuff you no longer have or use

Present – Current living expenses

Future – Financial goals

Stuff happens – Emergency and other unexpected spending

Within each time bucket, rank your priorities

Must have – Absolutely critical for sustaining your life

Like to have – Things that make your life worth living

Can live without – Everything else you’re spending money on

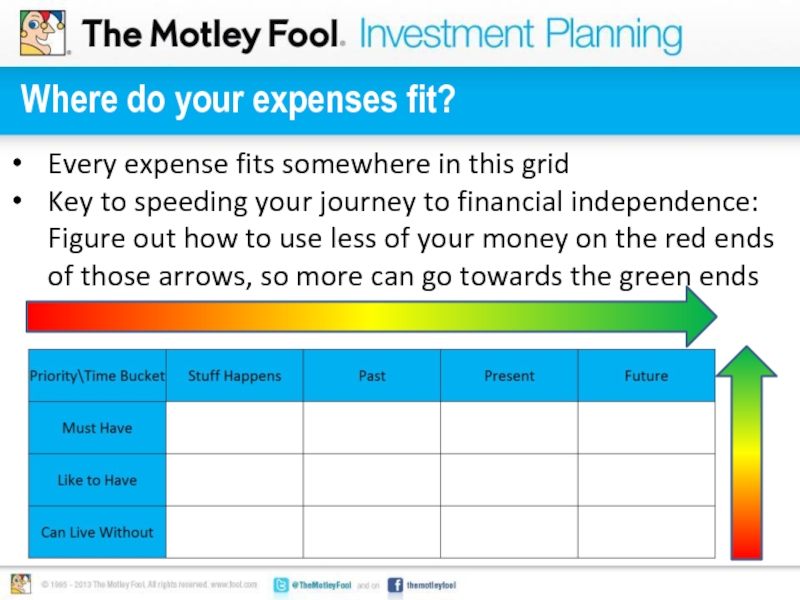

Слайд 4Where do your expenses fit?

Every expense fits somewhere in this grid

Key

to speeding your journey to financial independence: Figure out how to use less of your money on the red ends of those arrows, so more can go towards the green ends

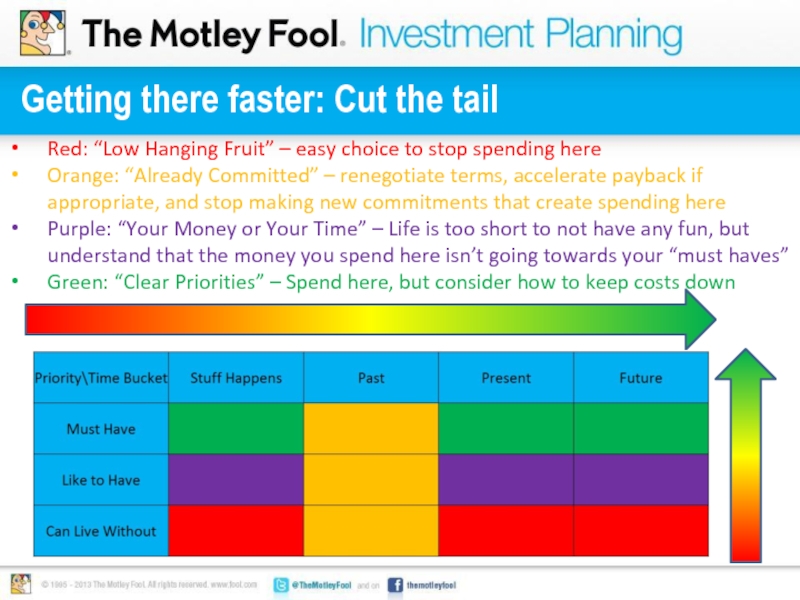

Слайд 5Getting there faster: Cut the tail

Red: “Low Hanging Fruit” – easy

choice to stop spending here

Orange: “Already Committed” – renegotiate terms, accelerate payback if appropriate, and stop making new commitments that create spending here

Purple: “Your Money or Your Time” – Life is too short to not have any fun, but understand that the money you spend here isn’t going towards your “must haves”

Green: “Clear Priorities” – Spend here, but consider how to keep costs down

Orange: “Already Committed” – renegotiate terms, accelerate payback if appropriate, and stop making new commitments that create spending here

Purple: “Your Money or Your Time” – Life is too short to not have any fun, but understand that the money you spend here isn’t going towards your “must haves”

Green: “Clear Priorities” – Spend here, but consider how to keep costs down

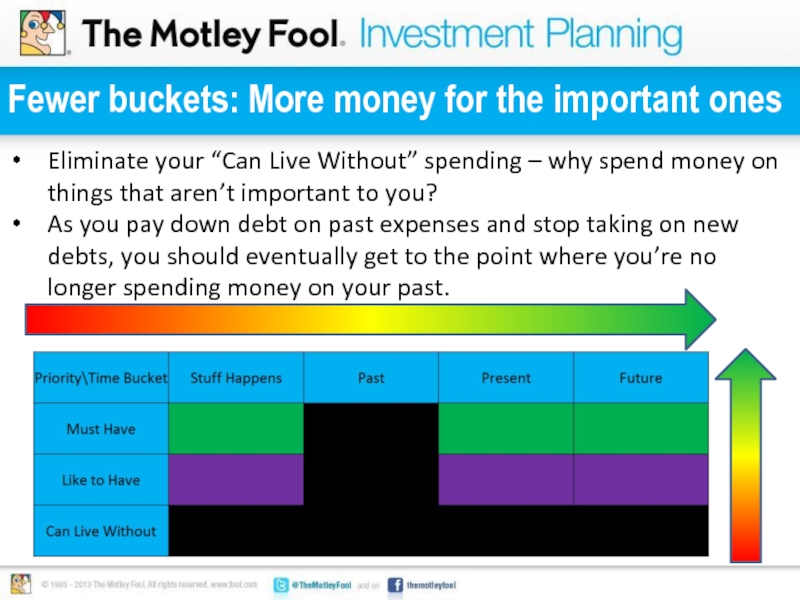

Слайд 6Fewer buckets: More money for the important ones

Eliminate your “Can Live

Without” spending – why spend money on things that aren’t important to you?

As you pay down debt on past expenses and stop taking on new debts, you should eventually get to the point where you’re no longer spending money on your past.

As you pay down debt on past expenses and stop taking on new debts, you should eventually get to the point where you’re no longer spending money on your past.

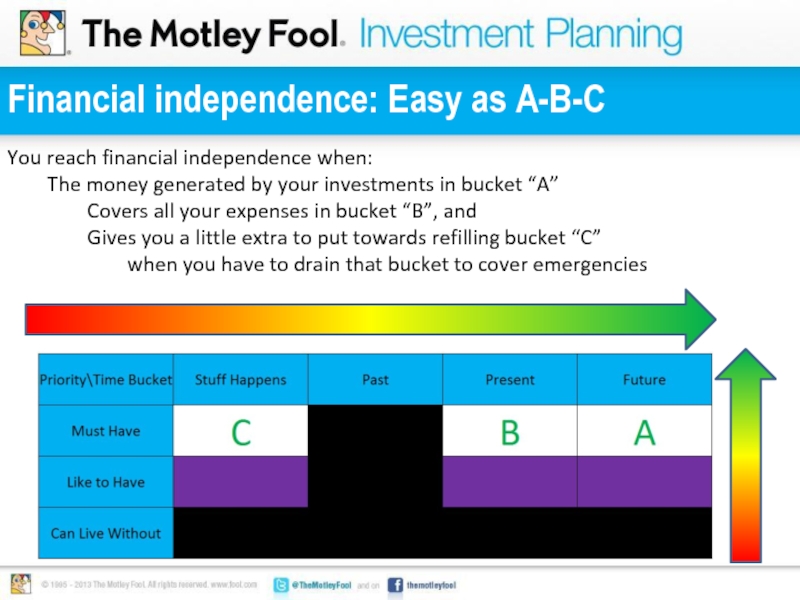

Слайд 7Financial independence: Easy as A-B-C

You reach financial independence when:

The money generated

by your investments in bucket “A”

Covers all your expenses in bucket “B”, and

Gives you a little extra to put towards refilling bucket “C”

when you have to drain that bucket to cover emergencies

Covers all your expenses in bucket “B”, and

Gives you a little extra to put towards refilling bucket “C”

when you have to drain that bucket to cover emergencies

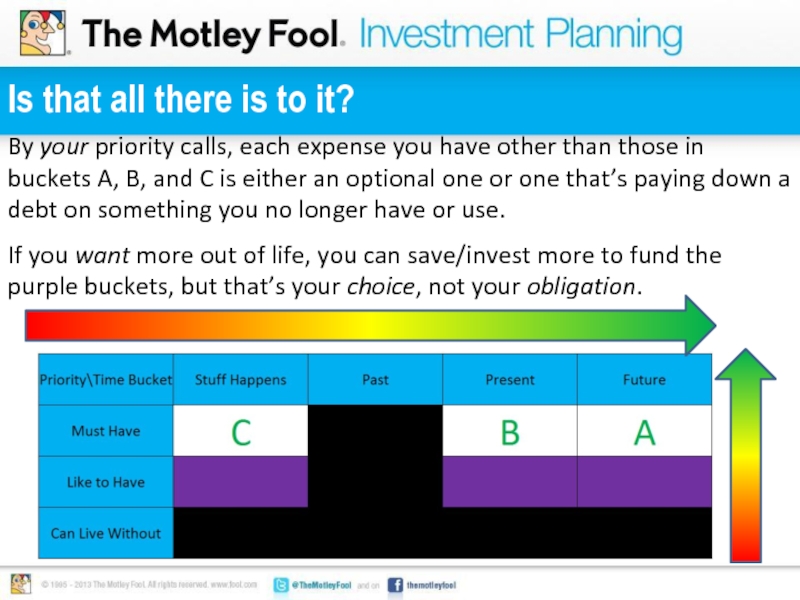

Слайд 8Is that all there is to it?

By your priority calls, each

expense you have other than those in buckets A, B, and C is either an optional one or one that’s paying down a debt on something you no longer have or use.

If you want more out of life, you can save/invest more to fund the purple buckets, but that’s your choice, not your obligation.

If you want more out of life, you can save/invest more to fund the purple buckets, but that’s your choice, not your obligation.

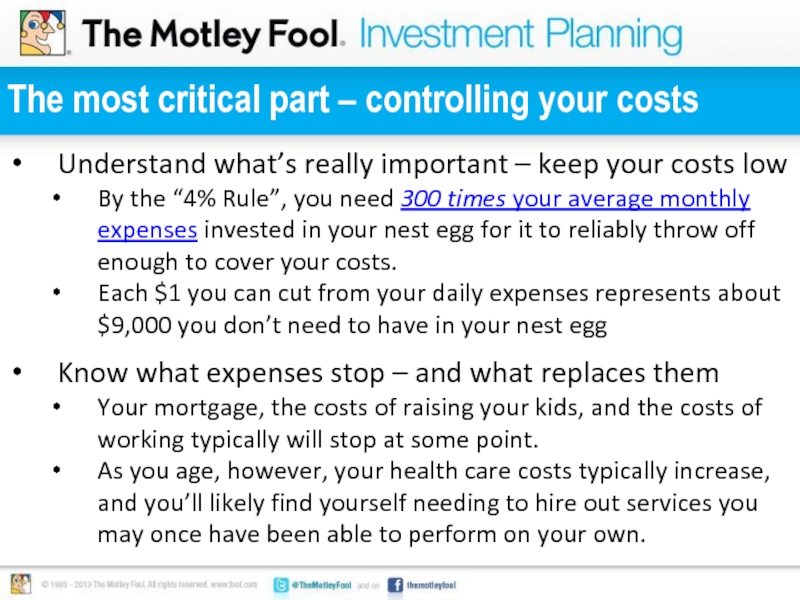

Слайд 9The most critical part – controlling your costs

Understand what’s really important

– keep your costs low

By the “4% Rule”, you need 300 times your average monthly expenses invested in your nest egg for it to reliably throw off enough to cover your costs.

Each $1 you can cut from your daily expenses represents about $9,000 you don’t need to have in your nest egg

Know what expenses stop – and what replaces them

Your mortgage, the costs of raising your kids, and the costs of working typically will stop at some point.

As you age, however, your health care costs typically increase, and you’ll likely find yourself needing to hire out services you may once have been able to perform on your own.

By the “4% Rule”, you need 300 times your average monthly expenses invested in your nest egg for it to reliably throw off enough to cover your costs.

Each $1 you can cut from your daily expenses represents about $9,000 you don’t need to have in your nest egg

Know what expenses stop – and what replaces them

Your mortgage, the costs of raising your kids, and the costs of working typically will stop at some point.

As you age, however, your health care costs typically increase, and you’ll likely find yourself needing to hire out services you may once have been able to perform on your own.

Слайд 10Why this matters to you

Life is too short to spend your

time on things that are not important to you.

The stronger your financial focus on the things that matter to you, the smaller the portion of your time that ultimately gets obligated to cover the expenses of the things that don’t.

The sooner you reach financial independence, the sooner you gain the ability to focus more of your incredibly precious and limited time on the things that really matter to you.

The stronger your financial focus on the things that matter to you, the smaller the portion of your time that ultimately gets obligated to cover the expenses of the things that don’t.

The sooner you reach financial independence, the sooner you gain the ability to focus more of your incredibly precious and limited time on the things that really matter to you.