- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Double-Entry System презентация

Содержание

- 1. The Double-Entry System

- 2. 2– Measurement Issues Objective 1 Explain, in

- 3. 2– Measuring Business Transactions Once accountants have

- 4. 2– Measurement Issues Recognition issue Valuation issue

- 5. 2– The Recognition Issue Recognition means the

- 6. 2– Point of Recognition for Sales and

- 7. 2– Business Event versus Business Transaction Business

- 8. 2– Business Events That …

- 9. 2– The Valuation Issue Focuses on assigning

- 10. 2– Cost Principle The principle that a

- 12. 2– Analyzing Information Recall - the cost

- 13. 2– The Classification Issue Classification is the

- 14. 2– Discussion What three issues underlie most

- 15. 2– Accounts and the Chart of Accounts

- 16. 2– Accounts Used to record transaction data

- 17. 2– General Ledger Group of company accounts

- 18. 2– Chart of Accounts List of account

- 19. Example of Account Numbering 1000 - 1999:

- 20. 2– Owner's Equity Accounts Revenue and expense

- 21. 2– Account Titles Should describe what is

- 22. 2– Discussion What is an account? Account

- 23. 2– The Double-Entry System: The Basic Method

- 24. 2– Example:

- 25. 2– Principle of Duality Each transaction recorded

- 26. 2–

- 27. 2–

- 29. 2–

- 30. 2– Footings and the Account Balance Footings

- 31. 2– Footings and the Account Balance (cont’d)

- 32. 2– Analyzing and Processing Transactions Rules of

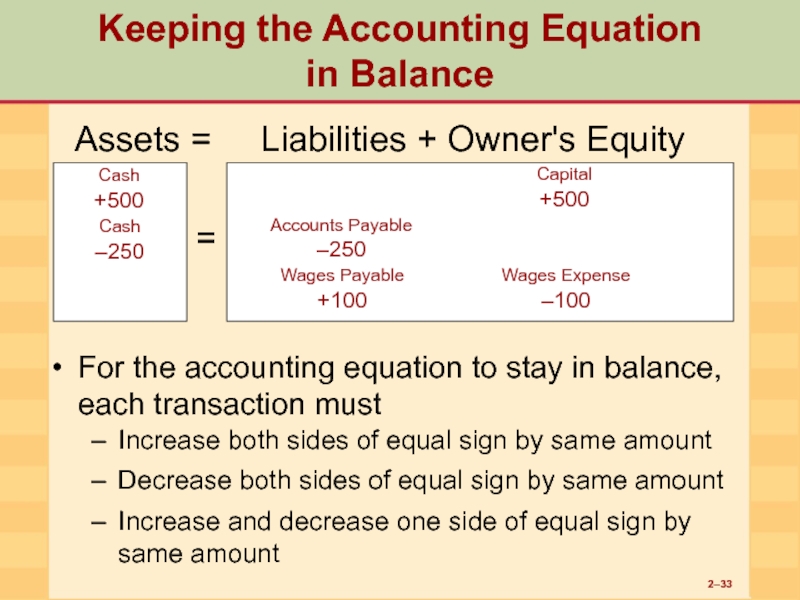

- 33. 2– Keeping the Accounting Equation in

- 34. 2– Accounts and the Accounting Equation

- 35. 2– Accounts and the Accounting Equation

- 36. 2–

- 37. 2– Components of Owner's Equity Capital Withdrawals Revenues Expenses

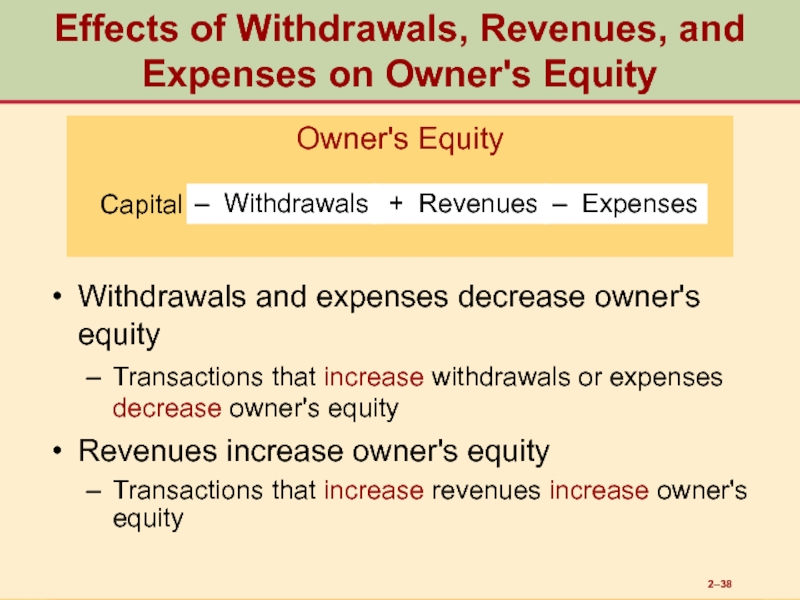

- 38. 2– Owner's Equity Capital – Withdrawals

- 39. 2– Capital Withdrawals Revenues

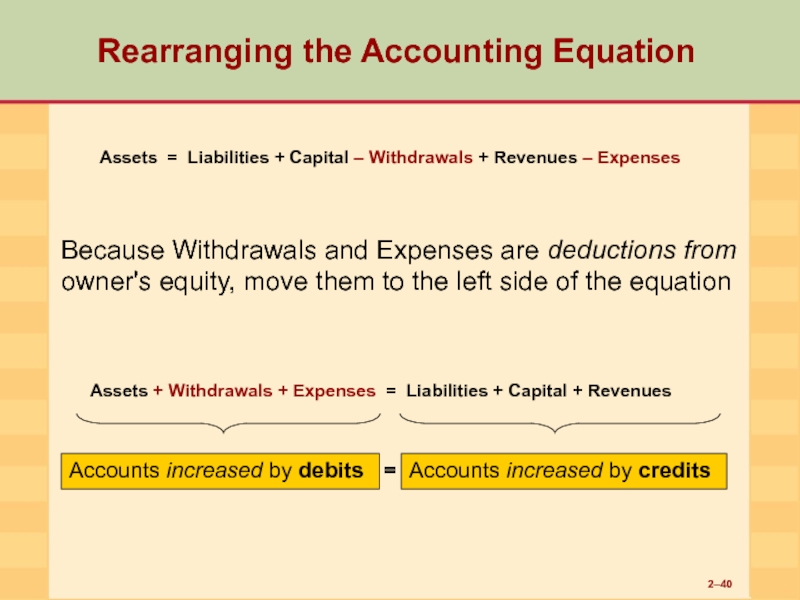

- 40. 2– Rearranging the Accounting Equation Assets =

- 41. 2– Analyzing and Processing Transactions Analyze the

- 42. 2– Analyzing and Processing Transactions (cont’d) Record

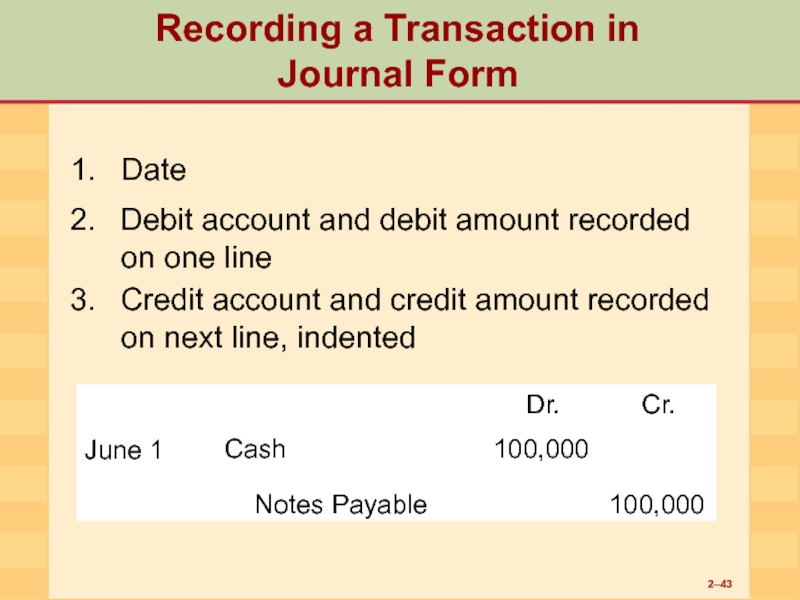

- 43. 2– Recording a Transaction in Journal Form

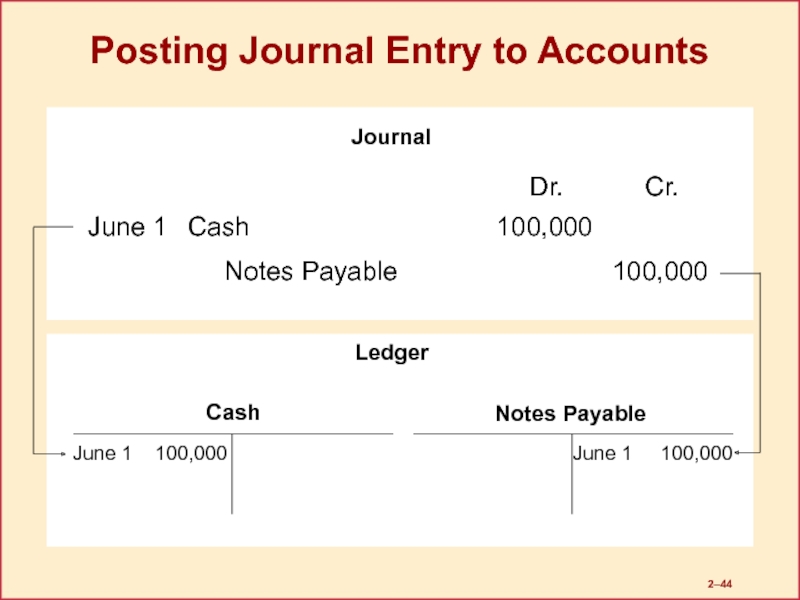

- 44. 2– Posting Journal Entry to Accounts

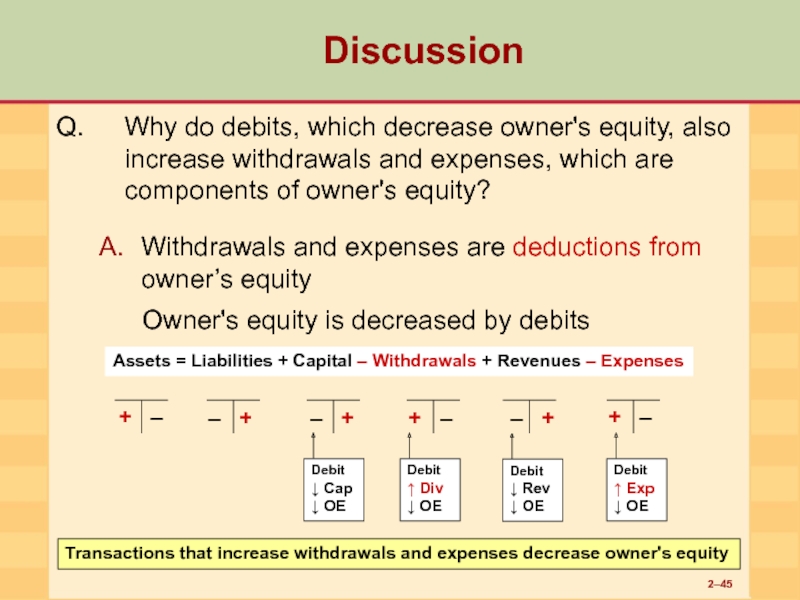

- 45. 2– Discussion Why do debits, which decrease

- 46. 2– Transaction Analysis Illustrated Objective 4 Apply

- 47. 2– Investment in Company Business Transaction

- 48. 2–

- 49. 2– Purchase Assets Business Transaction Step

- 50. 2–

- 51. 2– Purchases Business Transaction Step 1

- 52. 2–

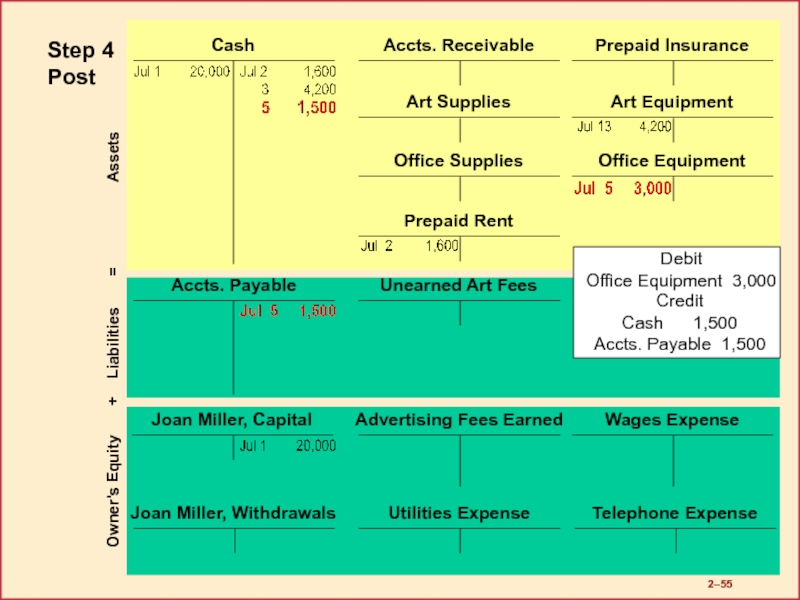

- 53. 2– Purchases Business Transaction Step 1

- 54. 2– Purchases Business Transaction Step 1

- 55. 2–

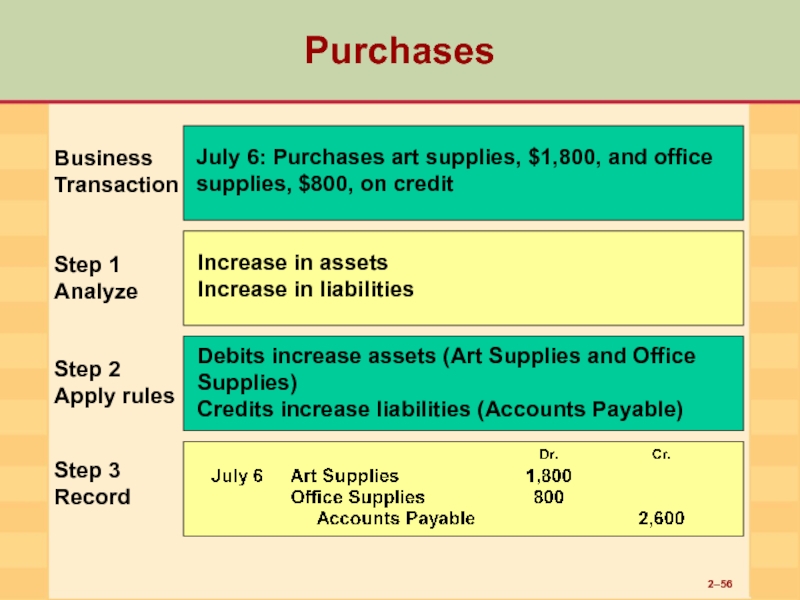

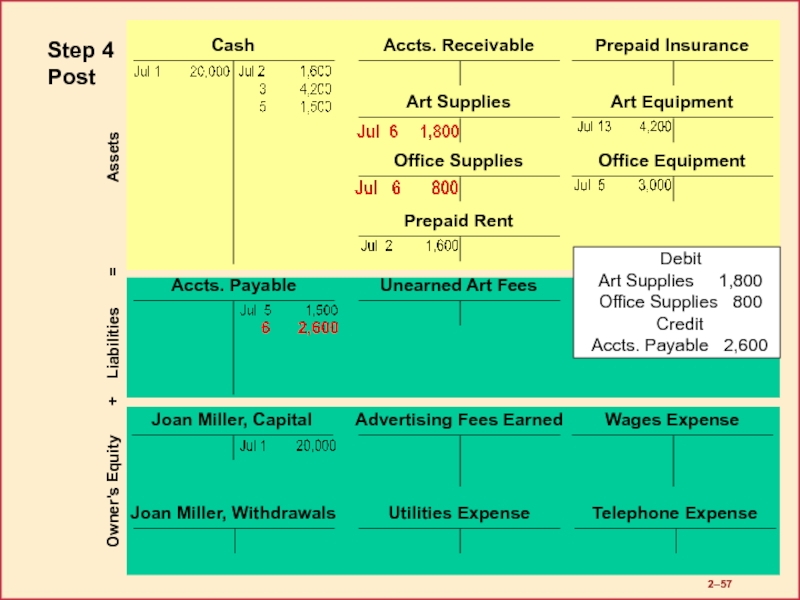

- 56. 2– Purchases Business Transaction Step 1

- 57. 2–

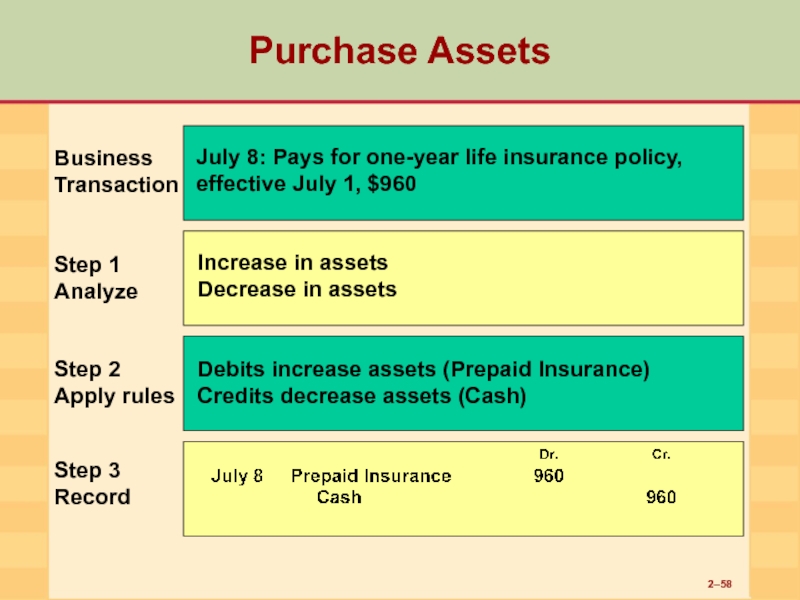

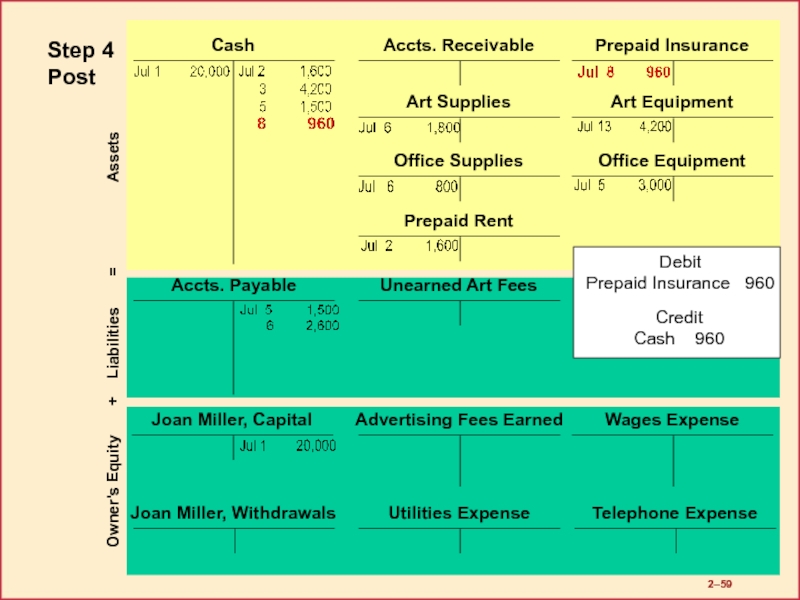

- 58. 2– Purchase Assets Business Transaction Step

- 59. 2–

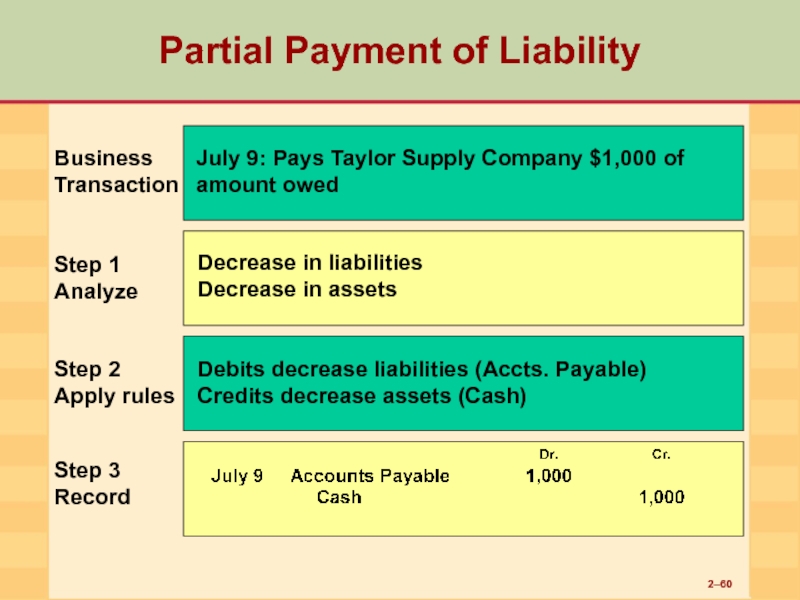

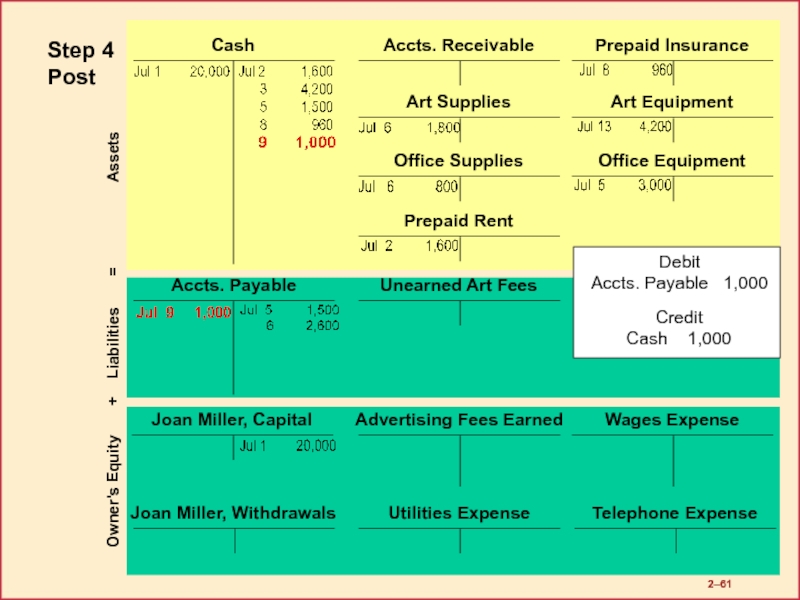

- 60. 2– Partial Payment of Liability Business

- 61. 2–

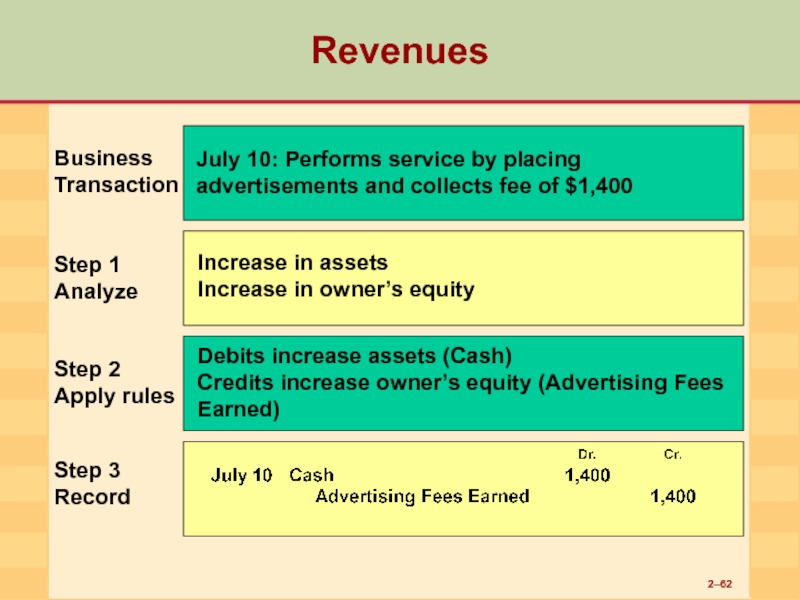

- 62. 2– Revenues Business Transaction Step 1

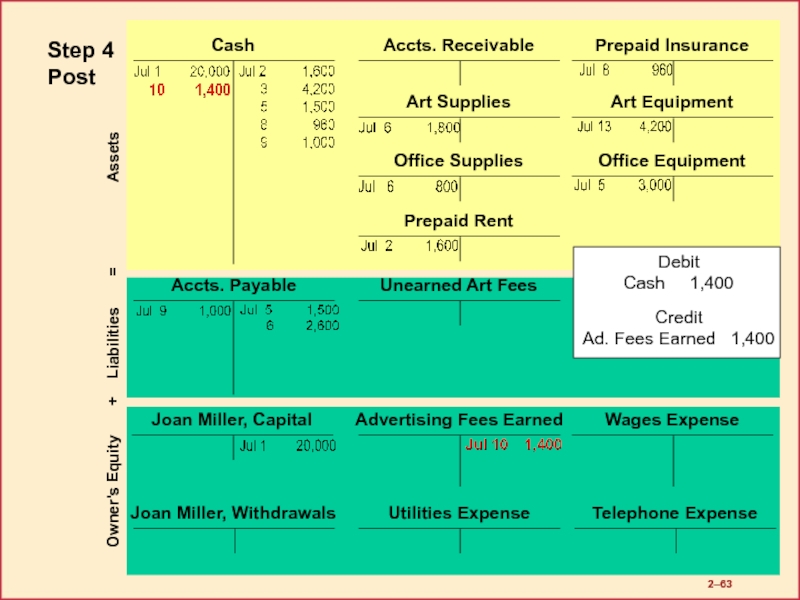

- 63. 2–

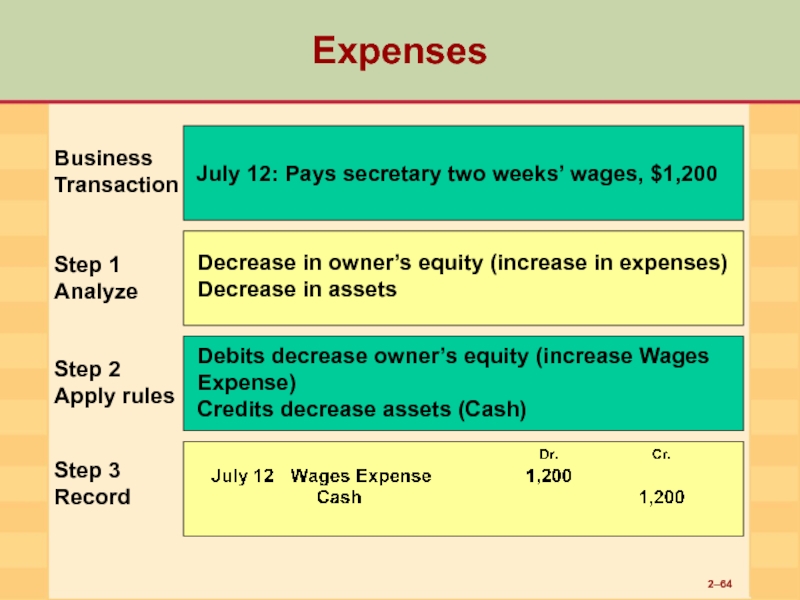

- 64. 2– Expenses Business Transaction Step 1

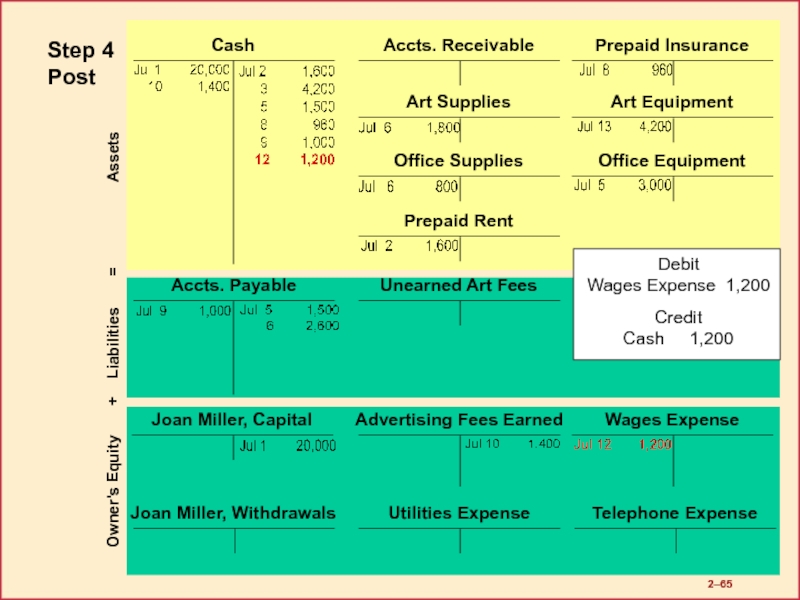

- 65. 2–

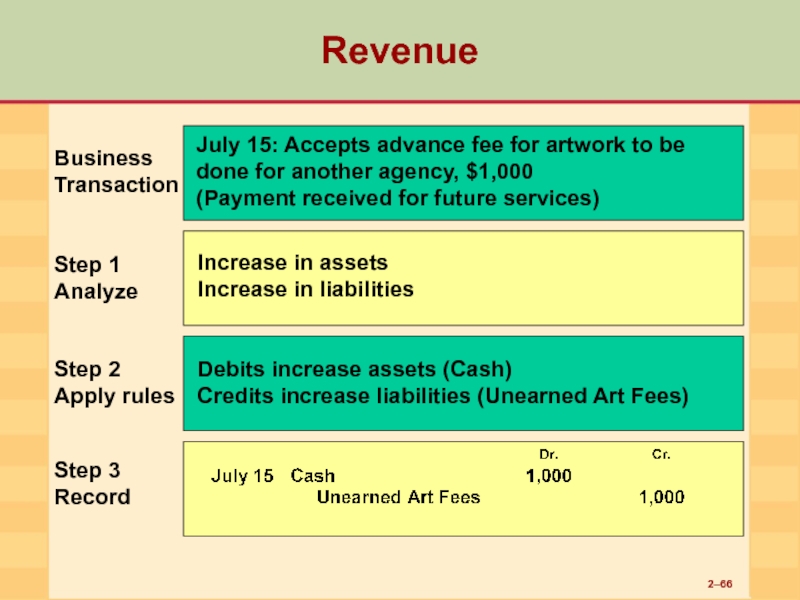

- 66. 2– Revenue Business Transaction Step 1

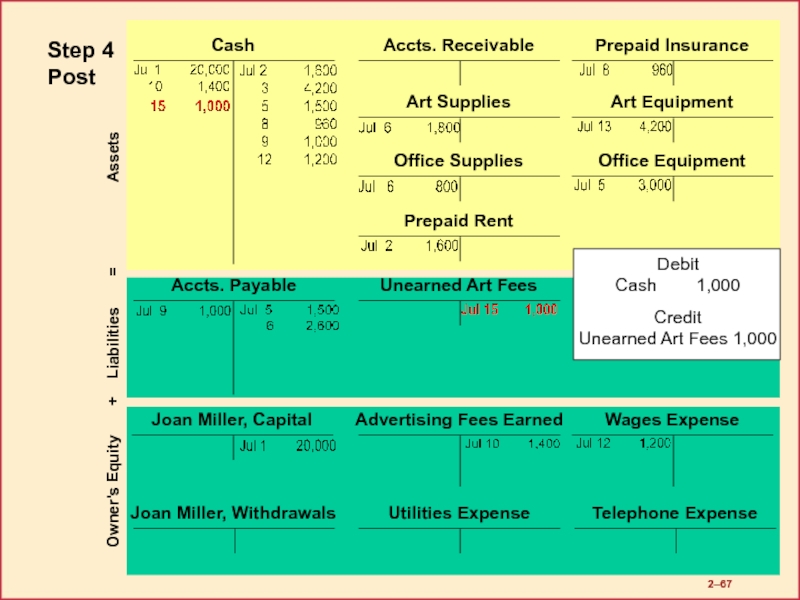

- 67. 2–

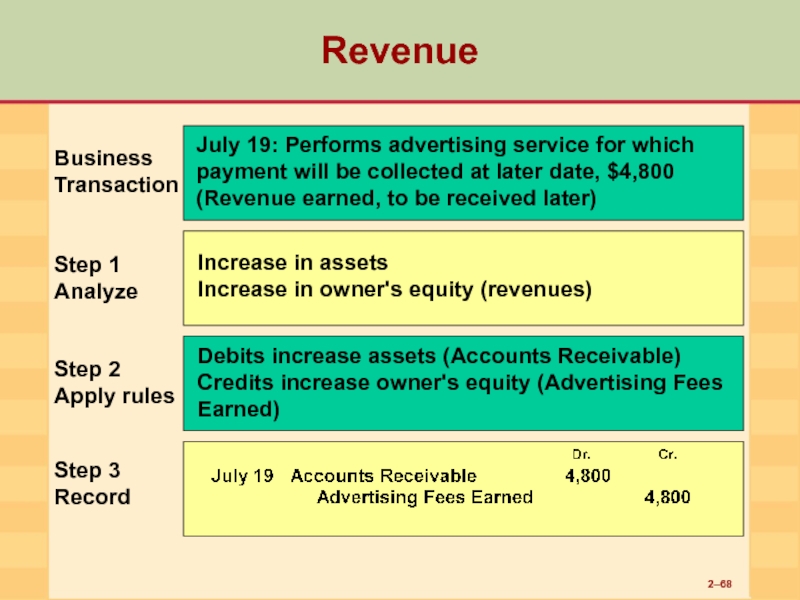

- 68. 2– Revenue Business Transaction Step 1

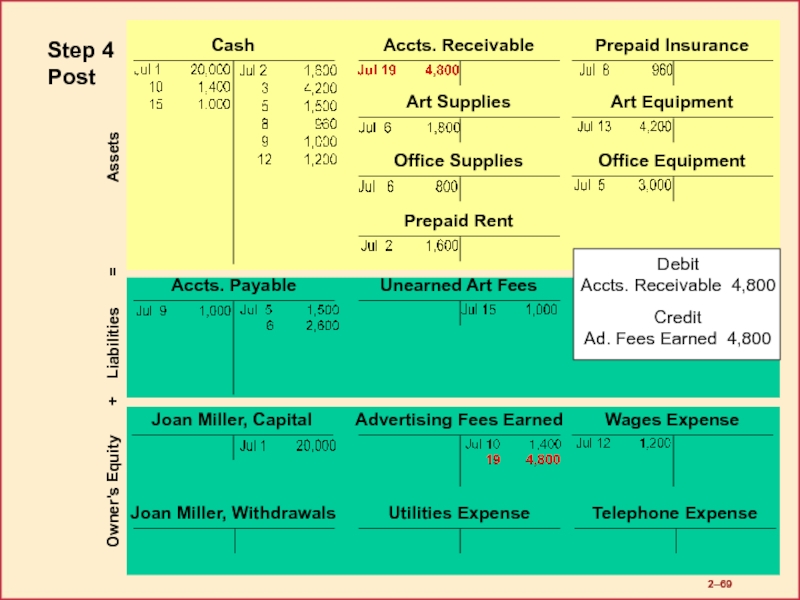

- 69. 2–

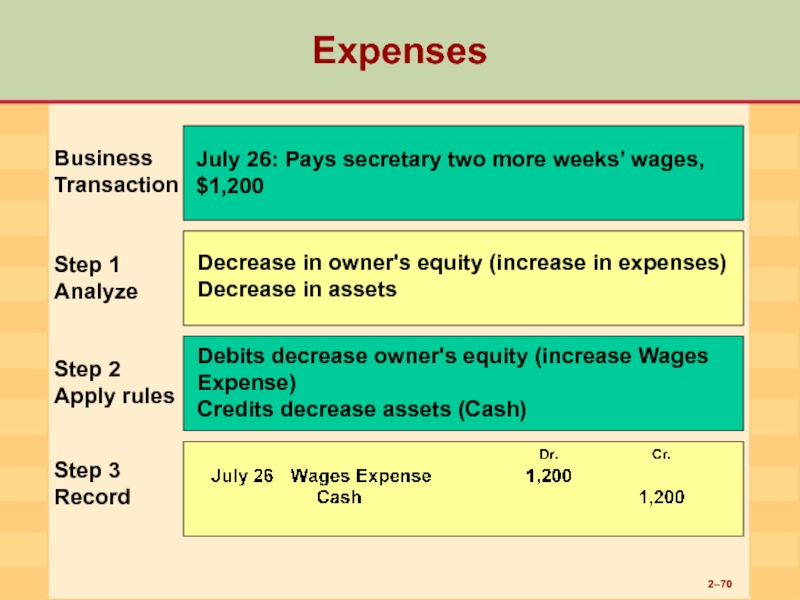

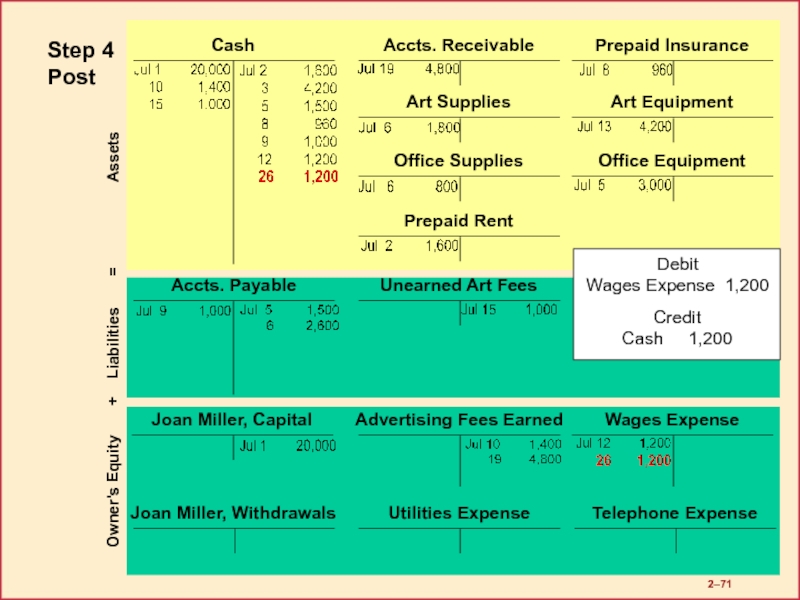

- 70. 2– Expenses Business Transaction Step 1

- 71. 2–

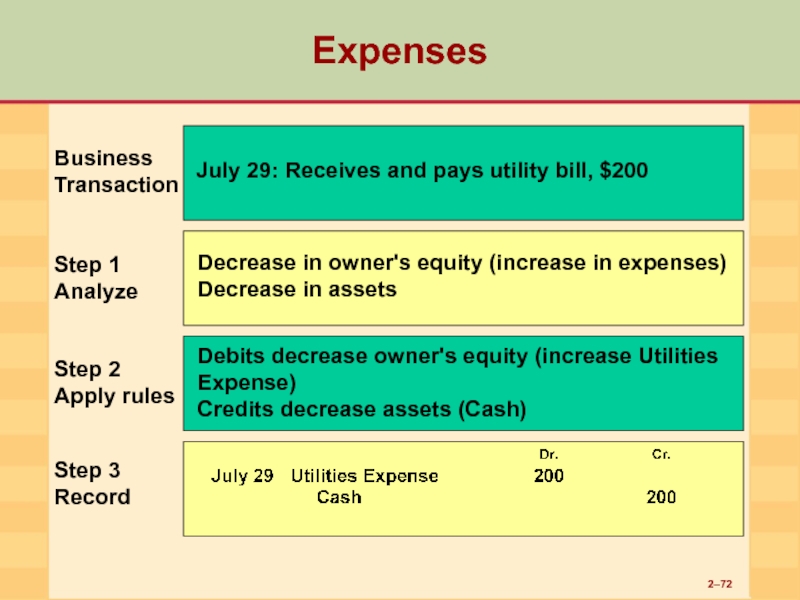

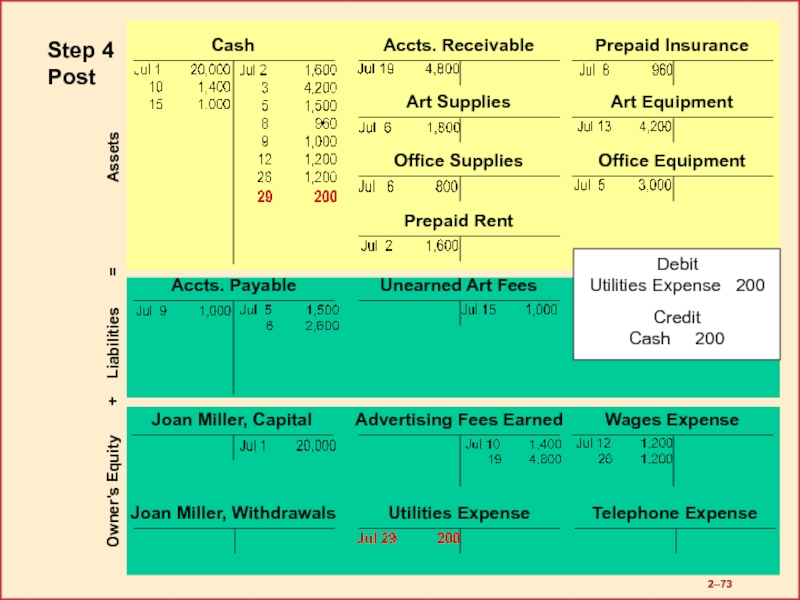

- 72. 2– Expenses Business Transaction Step 1

- 73. 2–

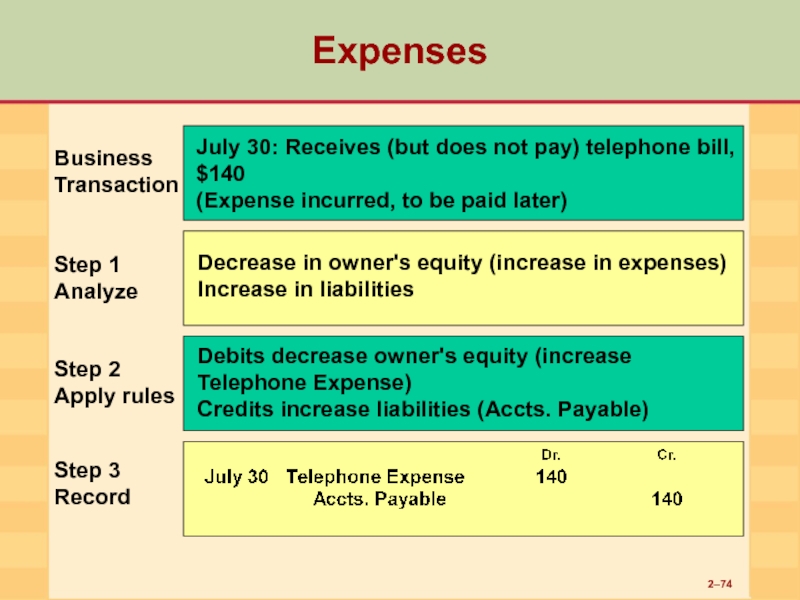

- 74. 2– Expenses Business Transaction Step 1

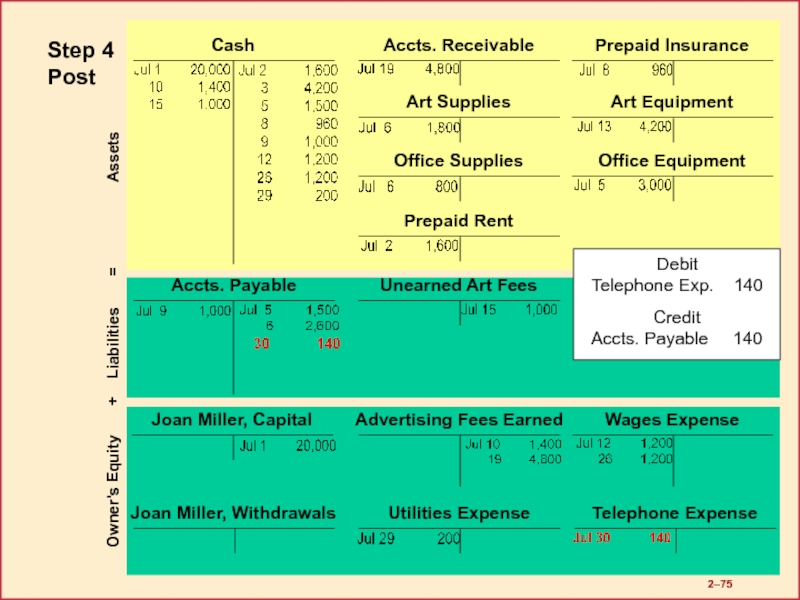

- 75. 2–

- 76. 2– Withdrawals Business Transaction Step 1

- 77. 2–

- 78. 2– Discussion Why does Joan Miller record

- 79. 2– The Trial Balance Objective 5 Prepare

- 80. 2– The Trial Balance For every amount

- 81. 2– Normal Account Balances Normal balance means

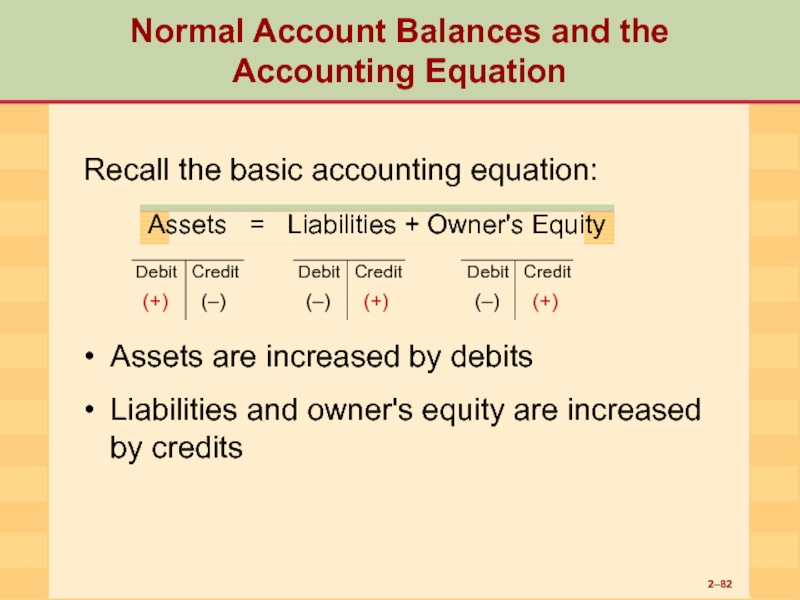

- 82. 2– Debit Credit (–)

- 83. 2– Normal Account Balances and the Accounting

- 84. 2–

- 85. 2– Steps in Preparing a Trial Balance

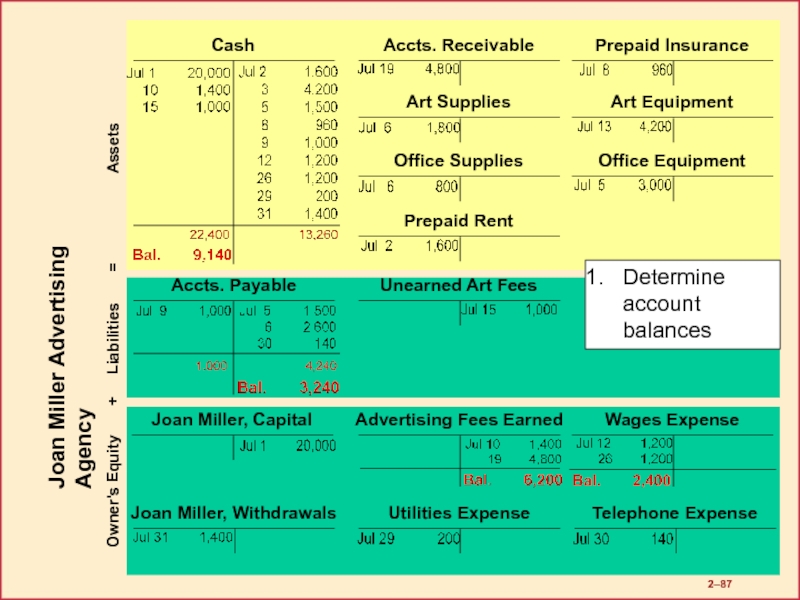

- 86. 2– Joan Miller Advertising Agency Determine the

- 87. 2–

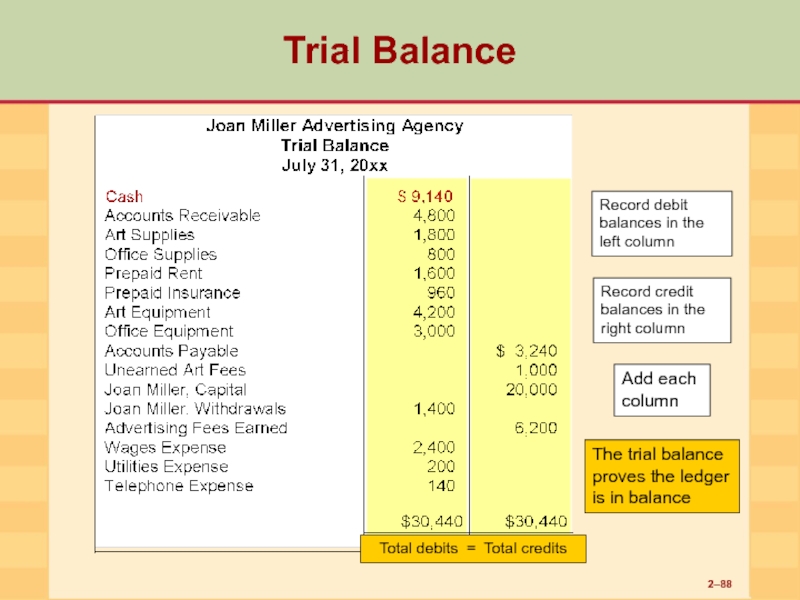

- 88. 2–

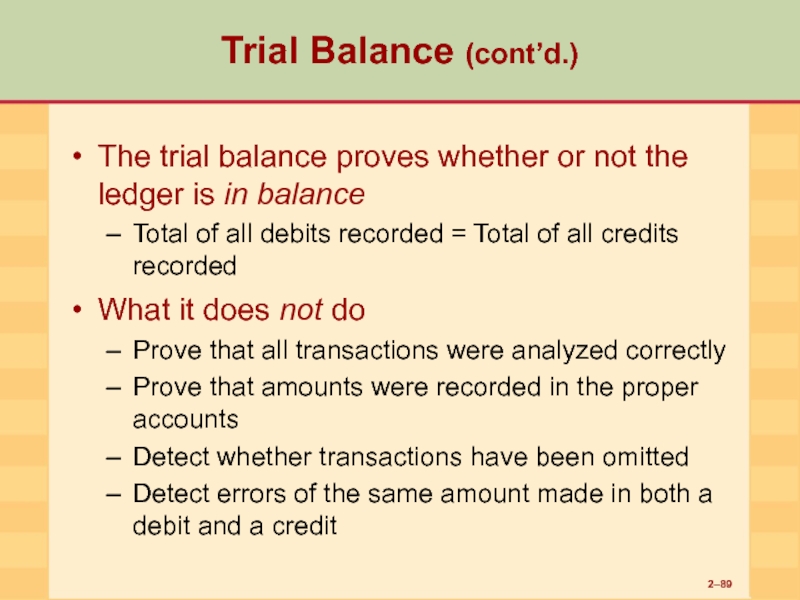

- 89. 2– Trial Balance (cont’d.) The trial balance

- 90. 2– Detecting Errors in the Trial Balance

- 91. 2– Detecting Errors in the Trial Balance

- 92. 2– Does the trial balance detect whether

- 93. 2– Recording and Posting Transactions Objective 6

- 94. 2– The General Journal Why aren’t transactions

- 95. 2– Journalizing … is the process of

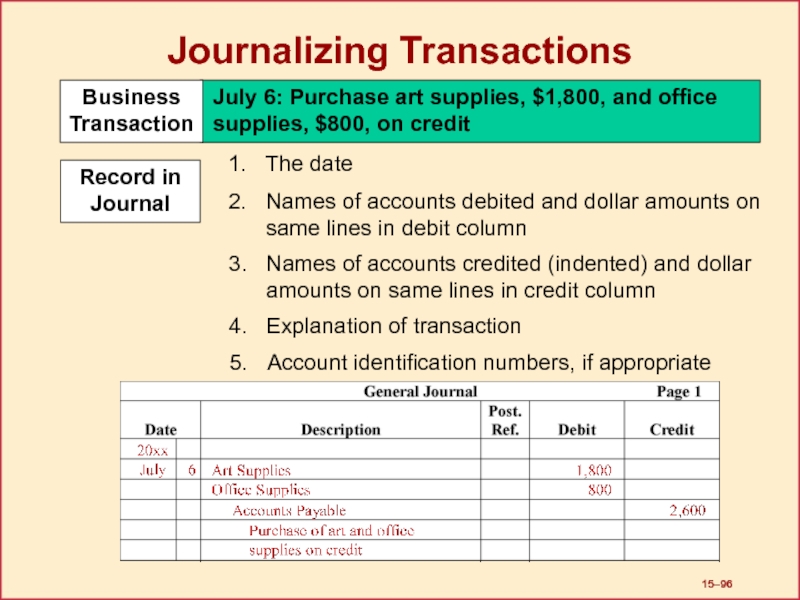

- 96. 15– Journalizing Transactions The date Names of

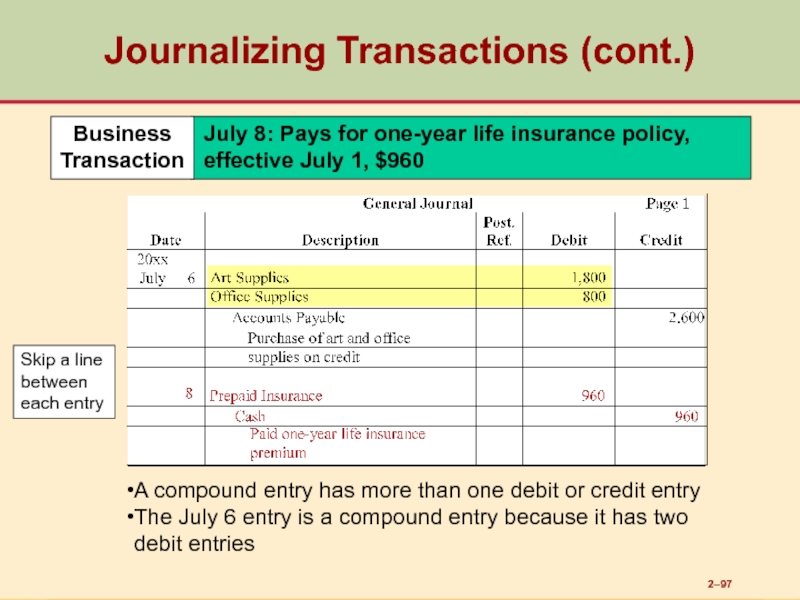

- 97. 2– Journalizing Transactions (cont.) A

- 98. 2– General Ledger Used to record the

- 99. 2–

- 100. 2– Posting to the Ledger

- 101. 2– Posting to the Ledger (cont.)

- 102. 2– Some Notes on Presentation A ruled

Слайд 22–

Measurement Issues

Objective 1

Explain, in simple terms, the generally accepted ways of

Слайд 32–

Measuring Business Transactions

Once accountants have determined a

transaction has occurred, they

When the transaction occurred

The recognition issue

What value to place on the transaction

The valuation issue

How to categorize the components of the transaction

The classification issue

Слайд 42–

Measurement Issues

Recognition issue

Valuation issue

Classification issue

These issues underlie almost every major decision

Controversies exist; solutions are not cut and dried

Слайд 52–

The Recognition Issue

Recognition means the recording of a transaction

Refers to

Point of recognition is important because it affects the financial statements

Слайд 62–

Point of Recognition for Sales and Purchases

Sales and purchases of products

Usually

Or, may set up a recognition point

Predetermined time at which a transaction should be recorded

Sales and purchases of services

Usually recognized when services have been performed

If services are performed over a long period of time, may set up billing at specific points of time

Transaction recorded at each billing

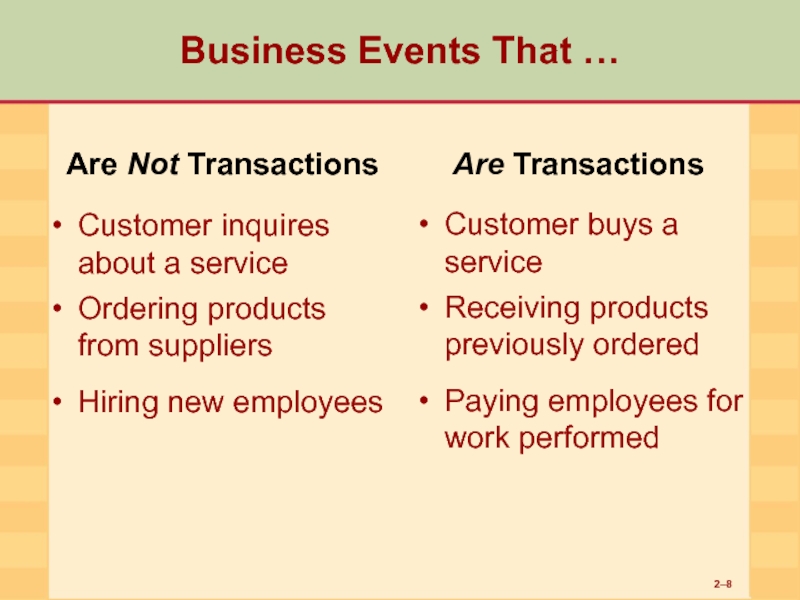

Слайд 72–

Business Event versus Business Transaction

Business Event

Any occurrence related to the course

Business Transaction

Economic event that affects the financial position of a business entity

Слайд 92–

The Valuation Issue

Focuses on assigning a monetary value to a transaction

Most

According to GAAP, use original cost

Also called historical cost

Practice of recording transactions at cost follows the cost principle

Слайд 102–

Cost Principle

The principle that a purchased asset should be recorded at

Cost

Exchange price associated with a business transaction at the point of recognition

Exchange price

Amount a buyer is willing to pay and a seller is willing to receive

Is objective (not influenced by emotion or personal feelings)

Cost principle is used because cost is verifiable

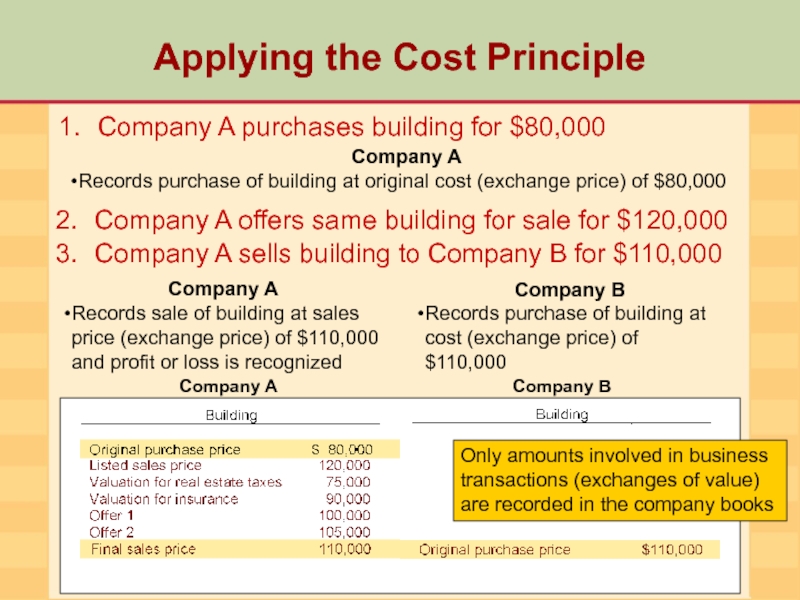

Слайд 11

Applying the Cost Principle

Company B

Company A

Company A purchases building for $80,000

Company

Company A

Records sale of building at sales price (exchange price) of $110,000 and profit or loss is recognized

Company B

Records purchase of building at cost (exchange price) of $110,000

Company A

Records purchase of building at original cost (exchange price) of $80,000

Company A sells building to Company B for $110,000

Only amounts involved in business transactions (exchanges of value) are recorded in the company books

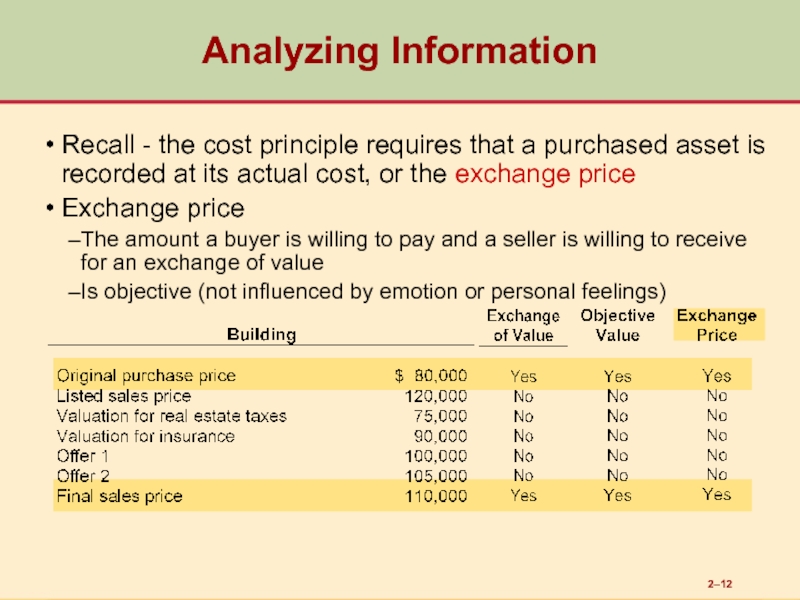

Слайд 122–

Analyzing Information

Recall - the cost principle requires that a purchased asset

Exchange price

The amount a buyer is willing to pay and a seller is willing to receive for an exchange of value

Is objective (not influenced by emotion or personal feelings)

Слайд 132–

The Classification Issue

Classification is the process of assigning transactions to the

Proper classification depends on

Correctly analyzing the effect of each transaction on the business

Maintaining a system of accounts that reflects that effect

The classification issue refers to the uncertainties associated with assigning transactions to the appropriate accounts

Слайд 142–

Discussion

What three issues underlie most accounting decisions?

The recognition issue

When a transaction

The valuation issue

What value should be placed on the transaction

The classification issue

How the components should be categorized

Слайд 152–

Accounts and the Chart of Accounts

Objective 2

Describe the chart of accounts

Слайд 162–

Accounts

Used to record transaction data

Record data in a usable form

Data can

Separate account used for each

Asset

Liability

Component of owner’s equity (includes revenues and expenses)

Слайд 172–

General Ledger

Group of company accounts

Sometimes simply referred to as the ledger

Two

Manual system

Each account on separate page or card

Pages or cards placed together in book or file

Computerized system

Accounts maintained on magnetic tapes or disks

Слайд 182–

Chart of Accounts

List of account numbers with corresponding account names

Helps identify

First digit in account number refers to major financial statement classification

Assets

Liabilities

Owner's equity

Revenues

Expenses

Слайд 19Example of Account Numbering

1000 - 1999: asset accounts

2000 - 2999: liability

3000 - 3999: equity accounts

4000 - 4999: revenue accounts

5000 - 5999: cost of goods sold

6000 - 6999: expense accounts

7000 - 7999: other revenue (for example, interest income)

8000 - 8999: other expense (for example, income taxes)

2–

Слайд 202–

Owner's Equity Accounts

Revenue and expense accounts separated from other owner's equity

Important for legal and financial reporting purposes

Owner's equity accounts represent how much interest in the assets of a company the owner has

Law requires that Capital and Withdrawal accounts be separate from revenues and expenses for tax and financial reporting

Management needs a detailed breakdown of revenues and expenses for budgeting and operating purposes

Слайд 212–

Account Titles

Should describe what is recorded in the account

An account

Identify account’s classification as asset, liability, owner's equity, revenue, or expense

Identify the type of transaction that gave rise to the account

Different companies may use different account names for the same account

Слайд 222–

Discussion

What is an account?

Account

Means by which management accumulates the effects of

Basic storage unit for accounting data

Q. How is an account related to the ledger?

The ledger is a file or book in which the company’s accounts are kept

Слайд 232–

The Double-Entry System:

The Basic Method of Accounting

Objective 3

Define double-entry system and

Слайд 242–

Example:

Pay cash to purchase supplies

Cash paid = effort, sacrifice, source

Supplies received

Double-Entry System

Based on principle of duality

Every economic event has two aspects that balance, or offset, each other

The two aspects represent

Effort and reward

Sacrifice and benefit

Source and use

Слайд 252–

Principle of Duality

Each transaction recorded with at least one debit and

Total amount of debits = total amount of credits

Whole system always in balance

All accounting systems based on principle of duality

Слайд 262–

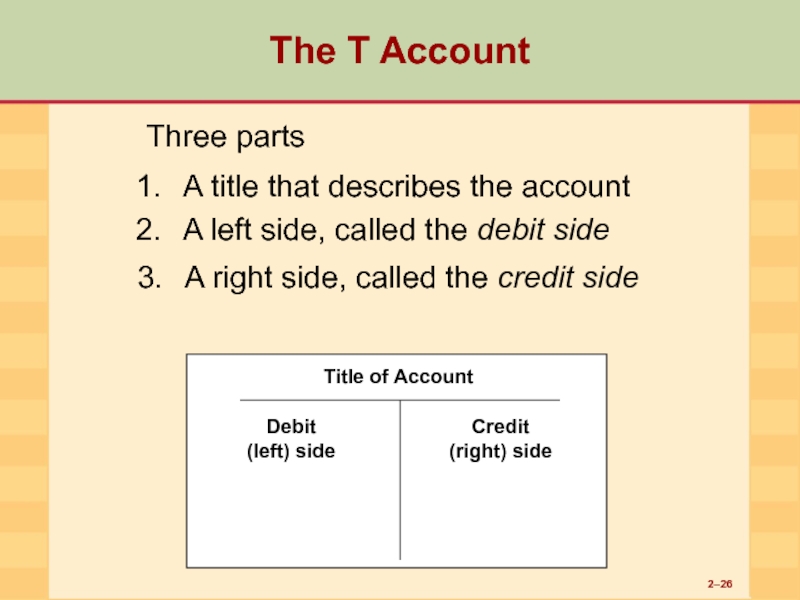

The T Account

Three parts

Title of Account

A left side, called the

Debit

(left) side

A right side, called the credit side

Credit

(right) side

A title that describes the account

Слайд 272–

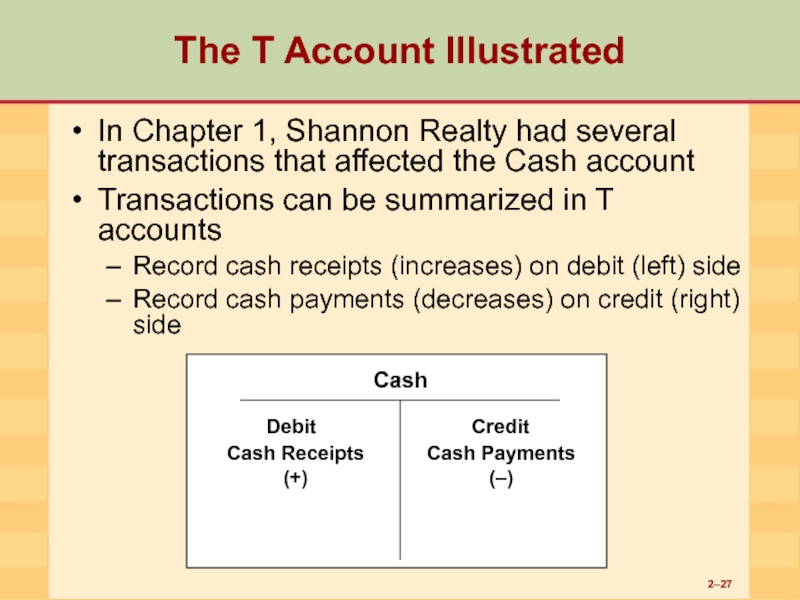

The T Account Illustrated

Title of Account

Debit

(left) side

Credit

(right) side

In Chapter 1, Shannon

Transactions can be summarized in T accounts

Record cash receipts (increases) on debit (left) side

Record cash payments (decreases) on credit (right) side

Cash

Cash Receipts

(+)

Cash Payments

(–)

Слайд 28

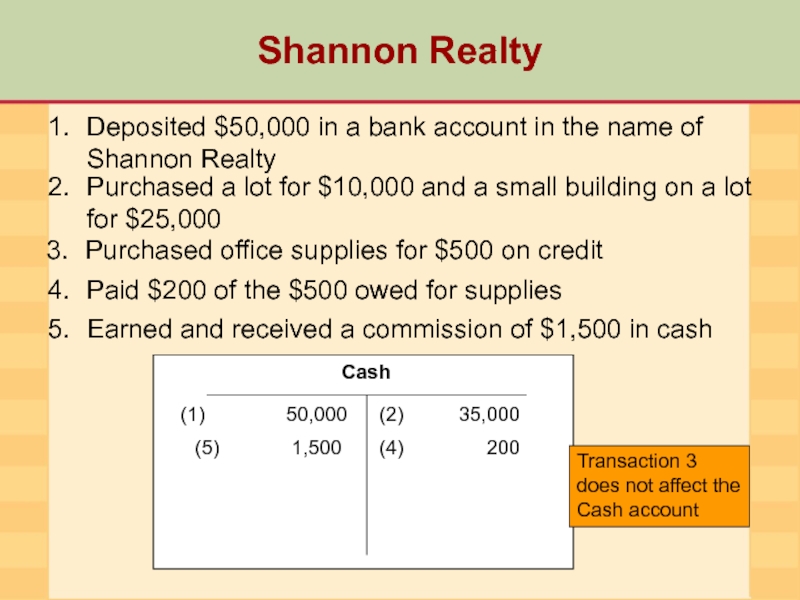

Shannon Realty

Deposited $50,000 in a bank account in the name of

Purchased a lot for $10,000 and a small building on a lot for $25,000

Paid $200 of the $500 owed for supplies

Earned and received a commission of $1,500 in cash

50,000

(2) 35,000

(5) 1,500

Transaction 3 does not affect the Cash account

Purchased office supplies for $500 on credit

(4) 200

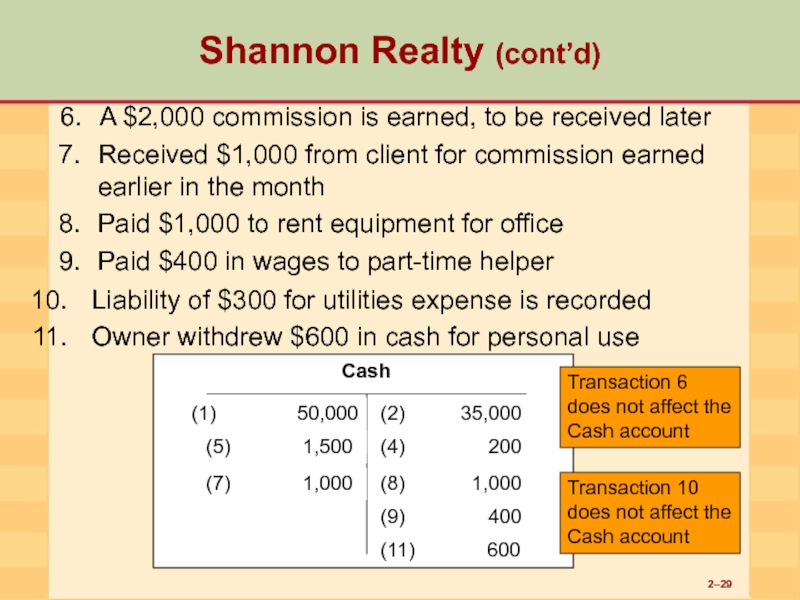

Слайд 292–

50,000

(2)

(5) 1,500

(4) 200

Shannon Realty (cont’d)

Received $1,000 from client for commission earned earlier in the month

Paid $1,000 to rent equipment for office

Paid $400 in wages to part-time helper

Owner withdrew $600 in cash for personal use

(7) 1,000

Transaction 6 does not affect the Cash account

A $2,000 commission is earned, to be received later

Transaction 10 does not affect the Cash account

Liability of $300 for utilities expense is recorded

(8) 1,000

(9) 400

(11) 600

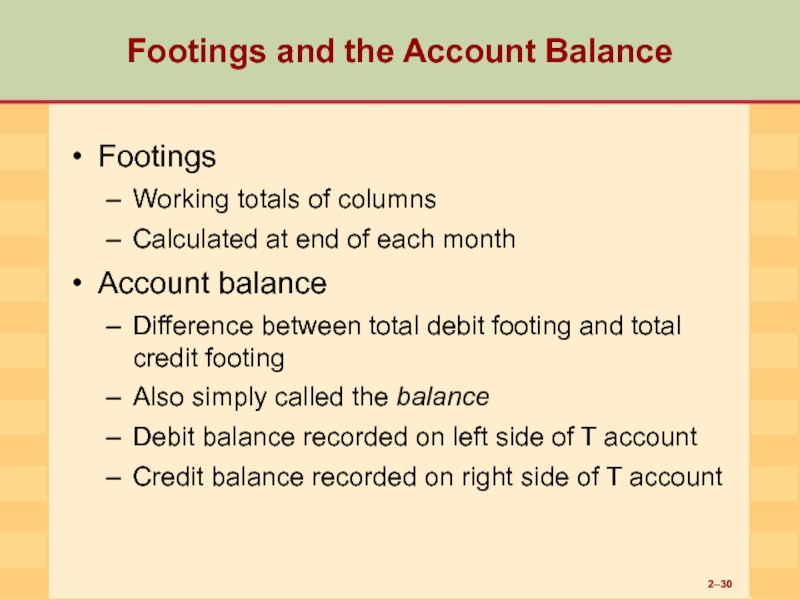

Слайд 302–

Footings and the Account Balance

Footings

Working totals of columns

Calculated at end

Account balance

Difference between total debit footing and total credit footing

Also simply called the balance

Debit balance recorded on left side of T account

Credit balance recorded on right side of T account

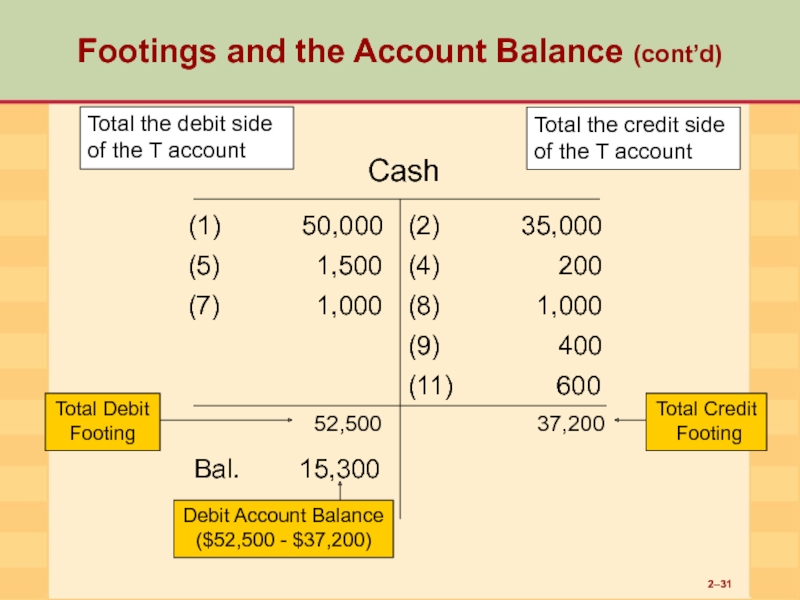

Слайд 312–

Footings and the Account Balance (cont’d)

Cash

(1)

(5) 1,500

(7) 1,000

(2) 35,000

(4) 200

(8) 1,000

(9) 400

(11) 600

52,500

37,200

Bal. 15,300

Total the debit side of the T account

Total the credit side of the T account

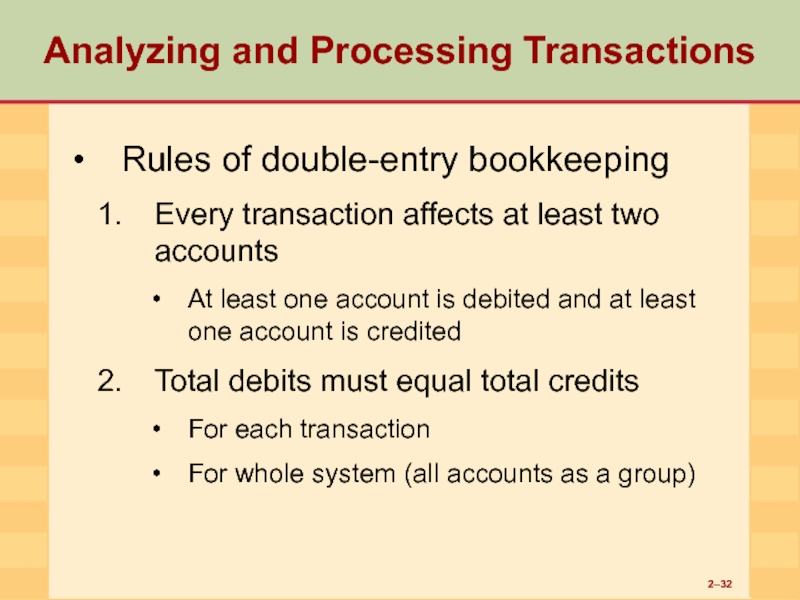

Слайд 322–

Analyzing and Processing Transactions

Rules of double-entry bookkeeping

Every transaction affects at

At least one account is debited and at least one account is credited

Total debits must equal total credits

For each transaction

For whole system (all accounts as a group)

Слайд 332–

Keeping the Accounting Equation

in Balance

For the accounting equation to stay

Assets = Liabilities + Owner's Equity

Increase both sides of equal sign by same amount

Decrease both sides of equal sign by same amount

Increase and decrease one side of equal sign by same amount

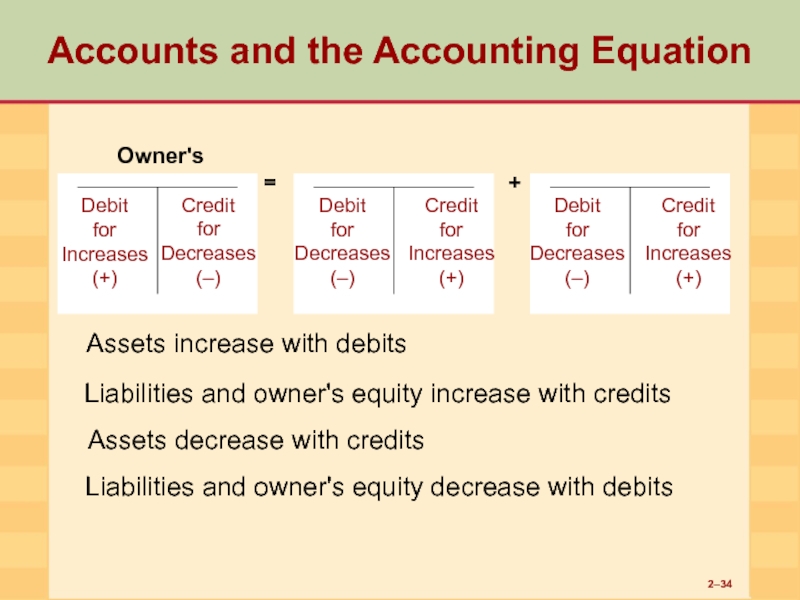

Слайд 342–

Accounts and the Accounting Equation

Assets = Liabilities + Equity

Debit

for

Increases

(+)

Assets increase with debits

Liabilities and owner's equity increase with credits

Assets decrease with credits

Credit

for

Decreases

(–)

Liabilities and owner's equity decrease with debits

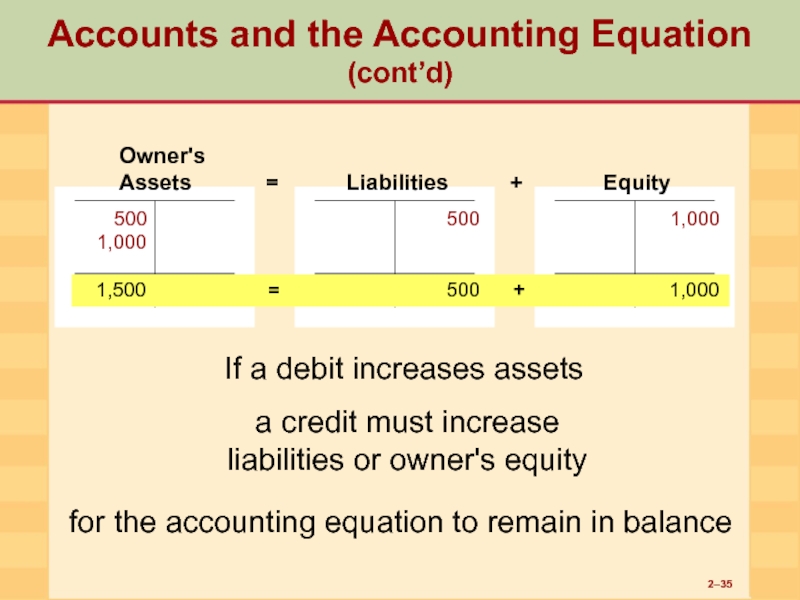

Слайд 352–

Accounts and the Accounting Equation (cont’d)

500

500

1,000

If a debit increases

a credit must increase

liabilities or owner's equity

for the accounting equation to remain in balance

1,000

1,500 = 500 + 1,000

Owner's

Assets = Liabilities + Equity

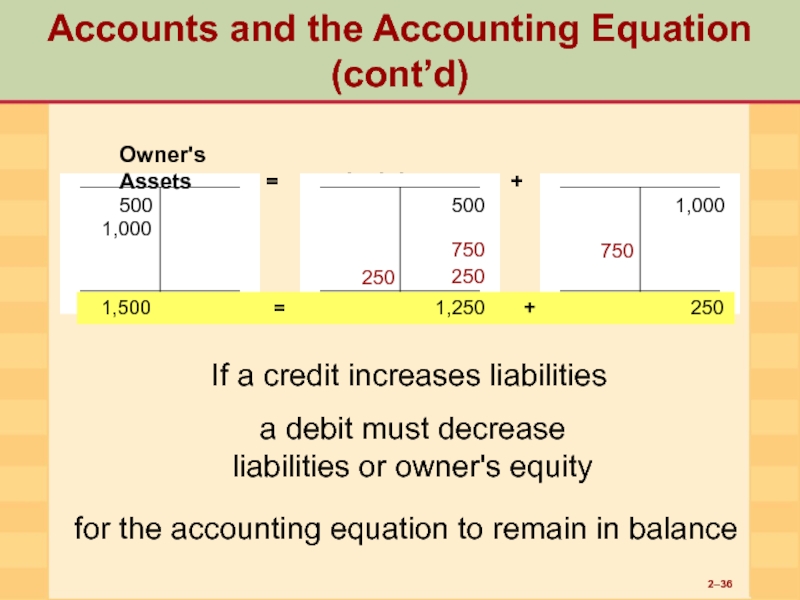

Слайд 362–

Assets = Liabilities + Equity

500

500

1,000

1,000

Accounts and the Accounting Equation (cont’d)

If a credit increases liabilities

a debit must decrease

liabilities or owner's equity

for the accounting equation to remain in balance

750

750

250

250

1,500 = 1,250 + 250

Слайд 382–

Owner's Equity

Capital – Withdrawals + Revenues – Expenses

Effects of Withdrawals, Revenues,

Withdrawals and expenses decrease owner's equity

Transactions that increase withdrawals or expenses decrease owner's equity

+ Revenues

Revenues increase owner's equity

Transactions that increase revenues increase owner's equity

Слайд 392–

Capital Withdrawals Revenues Expenses

Assets = Liabilities + Owner's Equity

Now that the components of owner's equity have been identified

The accounting equation can be expanded to include these components

And their effects on owner's equity are understood

Expanding the Accounting Equation

Capital – Withdrawals + Revenues – Expenses

Слайд 402–

Rearranging the Accounting Equation

Assets = Liabilities + Capital – Withdrawals +

Because Withdrawals and Expenses are deductions from owner's equity, move them to the left side of the equation

Assets + Withdrawals + Expenses = Liabilities + Capital + Revenues

Accounts increased by debits

Accounts increased by credits

=

Слайд 412–

Analyzing and Processing Transactions

Analyze the transaction

Transactions are supported by source documents

Determine

Apply the rules of double entry

Debits increase assets and decrease liabilities and owner's equity

Credits decrease assets and increase liabilities and owner's equity

Слайд 422–

Analyzing and Processing Transactions (cont’d)

Record the entry

Record in chronological order in

Post the entry

Transfer dates and amounts from journal to proper accounts in ledger

Prepare the trial balance

Confirms that accounts are still in balance

Слайд 432–

Recording a Transaction in

Journal Form

Date

Debit account and debit amount recorded on

Credit account and credit amount recorded on next line, indented

Слайд 452–

Discussion

Why do debits, which decrease owner's equity, also increase withdrawals and

Assets = Liabilities + Capital – Withdrawals + Revenues – Expenses

Withdrawals and expenses are deductions from owner’s equity

Transactions that increase withdrawals and expenses decrease owner's equity

Owner's equity is decreased by debits

Слайд 462–

Transaction Analysis Illustrated

Objective 4

Apply the steps for transaction analysis and processing

Слайд 472–

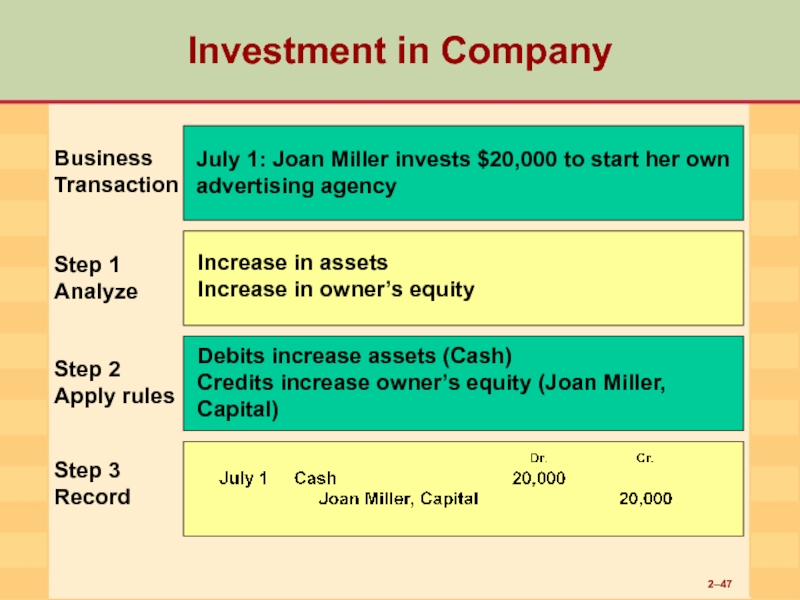

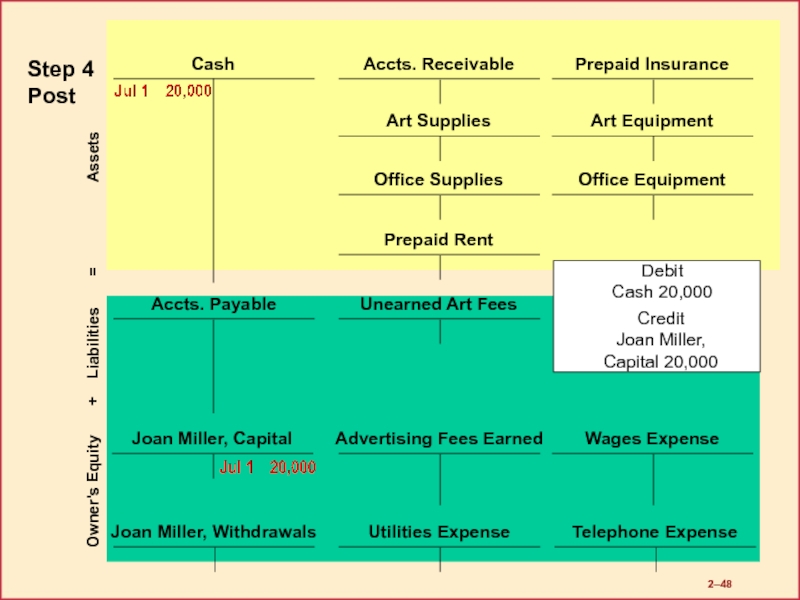

Investment in Company

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 1: Joan Miller

Increase in assets

Increase in owner’s equity

Debits increase assets (Cash)

Credits increase owner’s equity (Joan Miller, Capital)

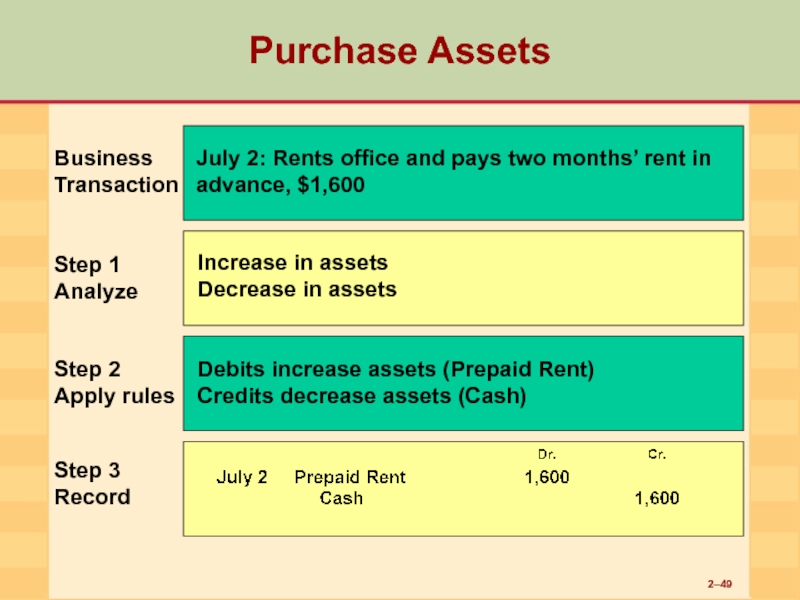

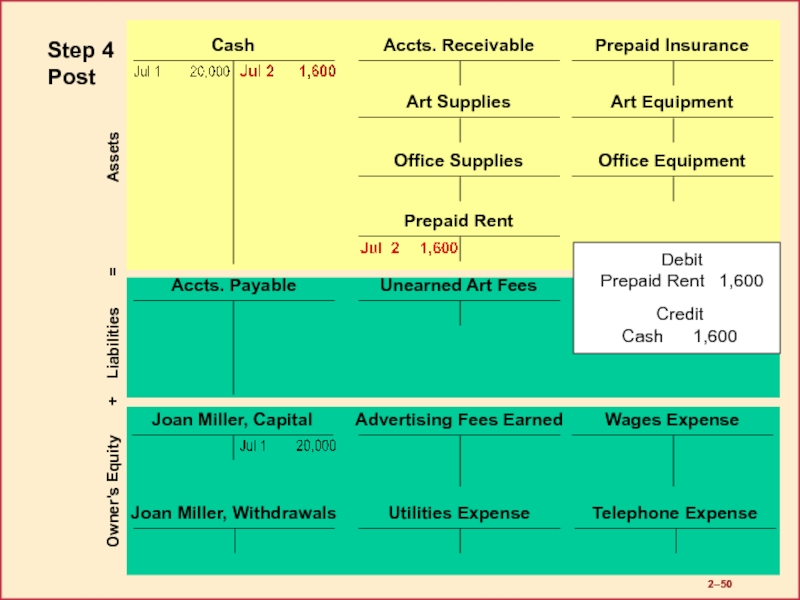

Слайд 492–

Purchase Assets

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 2: Rents office and

Increase in assets

Decrease in assets

Debits increase assets (Prepaid Rent)

Credits decrease assets (Cash)

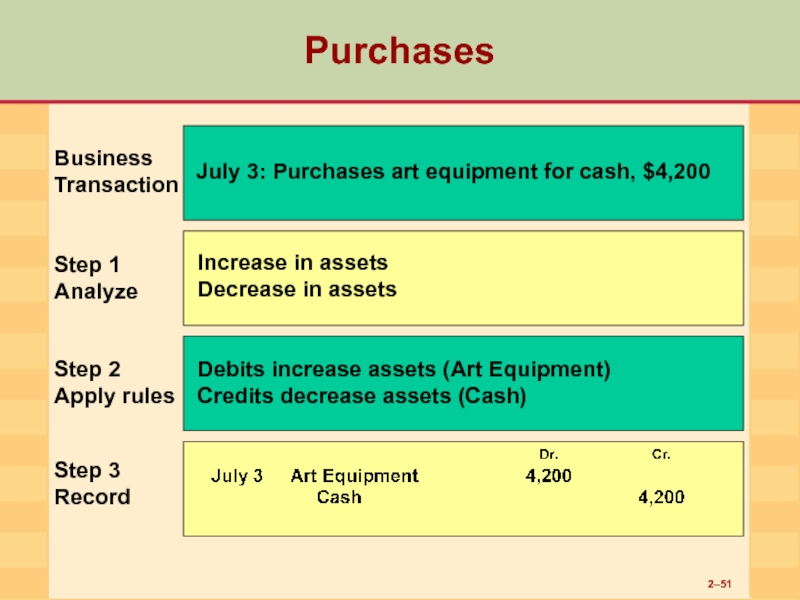

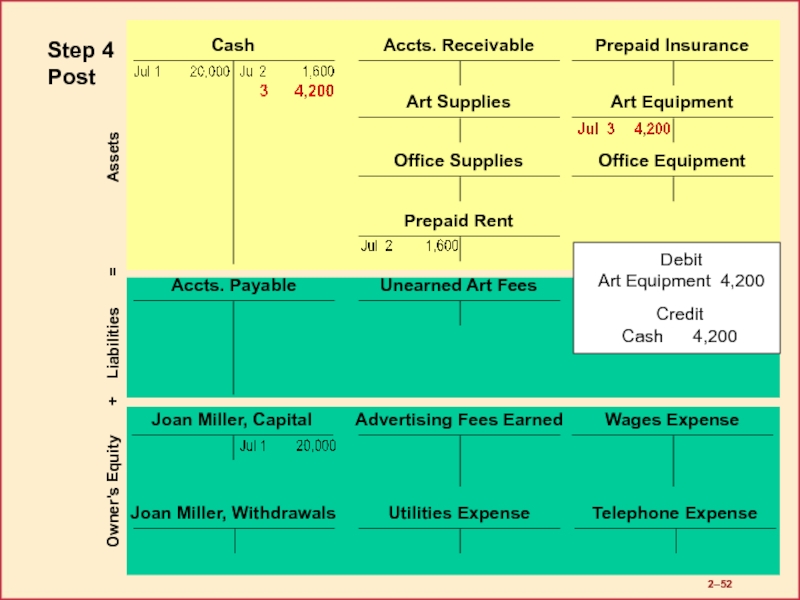

Слайд 512–

Purchases

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 3: Purchases art equipment for

Increase in assets

Decrease in assets

Debits increase assets (Art Equipment)

Credits decrease assets (Cash)

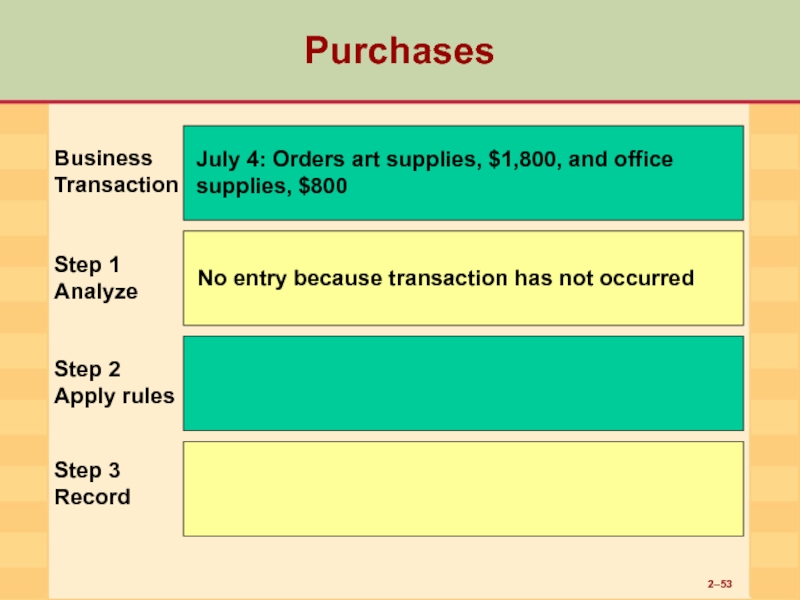

Слайд 532–

Purchases

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 4: Orders art supplies, $1,800,

No entry because transaction has not occurred

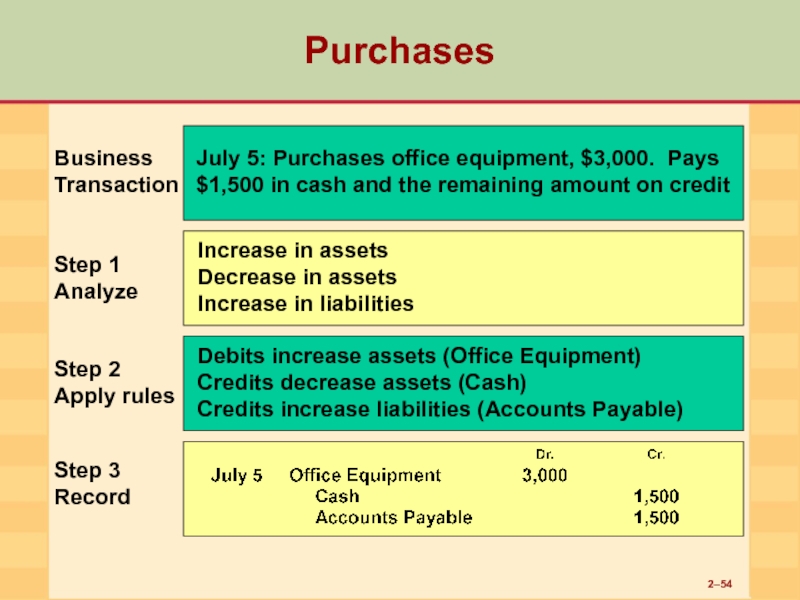

Слайд 542–

Purchases

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 5: Purchases office equipment, $3,000.

Increase in assets

Decrease in assets

Increase in liabilities

Debits increase assets (Office Equipment)

Credits decrease assets (Cash)

Credits increase liabilities (Accounts Payable)

Слайд 562–

Purchases

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 6: Purchases art supplies, $1,800,

Increase in assets

Increase in liabilities

Debits increase assets (Art Supplies and Office Supplies)

Credits increase liabilities (Accounts Payable)

Слайд 582–

Purchase Assets

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 8: Pays for one-year

Increase in assets

Decrease in assets

Debits increase assets (Prepaid Insurance)

Credits decrease assets (Cash)

Слайд 602–

Partial Payment of Liability

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 9: Pays

Decrease in liabilities

Decrease in assets

Debits decrease liabilities (Accts. Payable)

Credits decrease assets (Cash)

Слайд 622–

Revenues

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 10: Performs service by placing

Increase in assets

Increase in owner’s equity

Debits increase assets (Cash)

Credits increase owner’s equity (Advertising Fees Earned)

Слайд 642–

Expenses

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 12: Pays secretary two weeks’

Decrease in owner’s equity (increase in expenses)

Decrease in assets

Debits decrease owner’s equity (increase Wages Expense)

Credits decrease assets (Cash)

Слайд 662–

Revenue

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 15: Accepts advance fee for

(Payment received for future services)

Increase in assets

Increase in liabilities

Debits increase assets (Cash)

Credits increase liabilities (Unearned Art Fees)

Слайд 682–

Revenue

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 19: Performs advertising service for

(Revenue earned, to be received later)

Increase in assets

Increase in owner's equity (revenues)

Debits increase assets (Accounts Receivable)

Credits increase owner's equity (Advertising Fees Earned)

Слайд 692–

Step 4

Post

Debit

Accts. Receivable 4,800

Credit

Ad. Fees Earned 4,800

Owner's Equity

Слайд 702–

Expenses

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 26: Pays secretary two more

Decrease in owner's equity (increase in expenses)

Decrease in assets

Debits decrease owner's equity (increase Wages Expense)

Credits decrease assets (Cash)

Слайд 722–

Expenses

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 29: Receives and pays utility

Decrease in owner's equity (increase in expenses)

Decrease in assets

Debits decrease owner's equity (increase Utilities Expense)

Credits decrease assets (Cash)

Слайд 742–

Expenses

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 30: Receives (but does not

(Expense incurred, to be paid later)

Decrease in owner's equity (increase in expenses)

Increase in liabilities

Debits decrease owner's equity (increase Telephone Expense)

Credits increase liabilities (Accts. Payable)

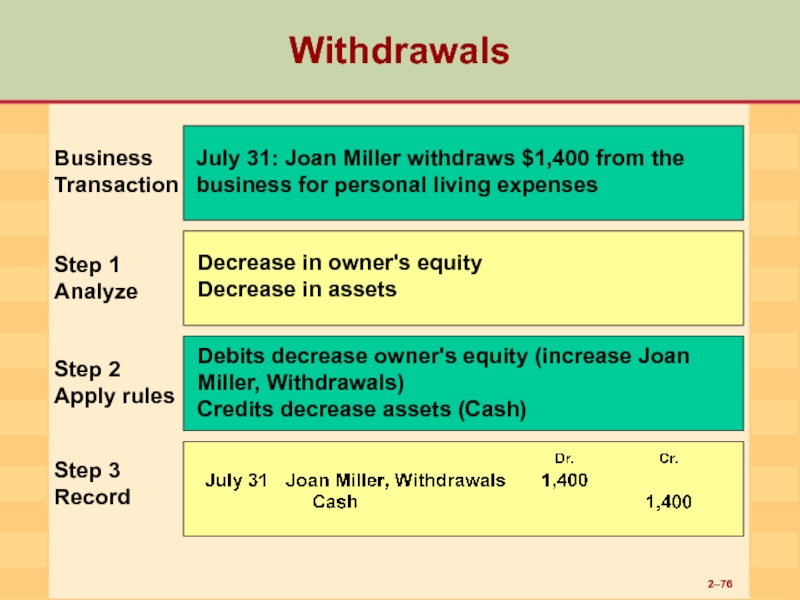

Слайд 762–

Withdrawals

Business

Transaction

Step 1

Analyze

Step 2

Apply rules

Step 3

Record

July 31: Joan Miller withdraws $1,400

Decrease in owner's equity

Decrease in assets

Debits decrease owner's equity (increase Joan Miller, Withdrawals)

Credits decrease assets (Cash)

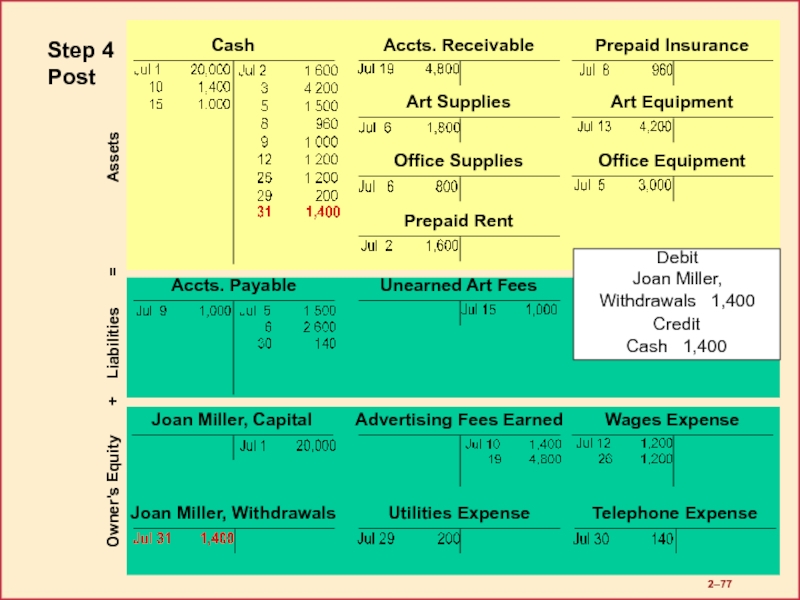

Слайд 772–

Step 4

Post

Owner's Equity + Liabilities

Debit

Joan Miller,

Withdrawals 1,400

Credit

Cash 1,400

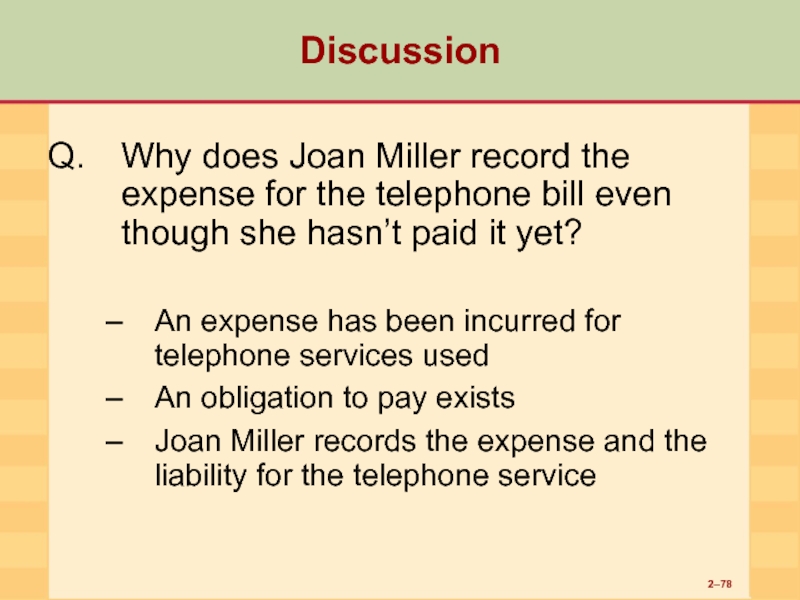

Слайд 782–

Discussion

Why does Joan Miller record the expense for the telephone bill

An expense has been incurred for telephone services used

An obligation to pay exists

Joan Miller records the expense and the liability for the telephone service

Слайд 792–

The Trial Balance

Objective 5

Prepare a trial balance and describe its value

Слайд 802–

The Trial Balance

For every amount debited, an equal amount must be

Result: The total of debits and credits for all the T accounts must be equal

Trial balance is prepared to test this

Usually prepared at the end of a month or an accounting period

Can be prepared anytime

Слайд 812–

Normal Account Balances

Normal balance means usual balance

Refers to whether increases in

Accounts that are increased with debits have a normal debit balance

Accounts that are increased with credits have a normal credit balance

An account may have an “abnormal” balance

Copy into the trial balance as it stands

Слайд 822–

Debit Credit

(–) (+)

Debit Credit

(–)

Debit Credit

(+) (–)

Assets = Liabilities + Owner's Equity

Recall the basic accounting equation:

Assets are increased by debits

Liabilities and owner's equity are increased by credits

Normal Account Balances and the Accounting Equation

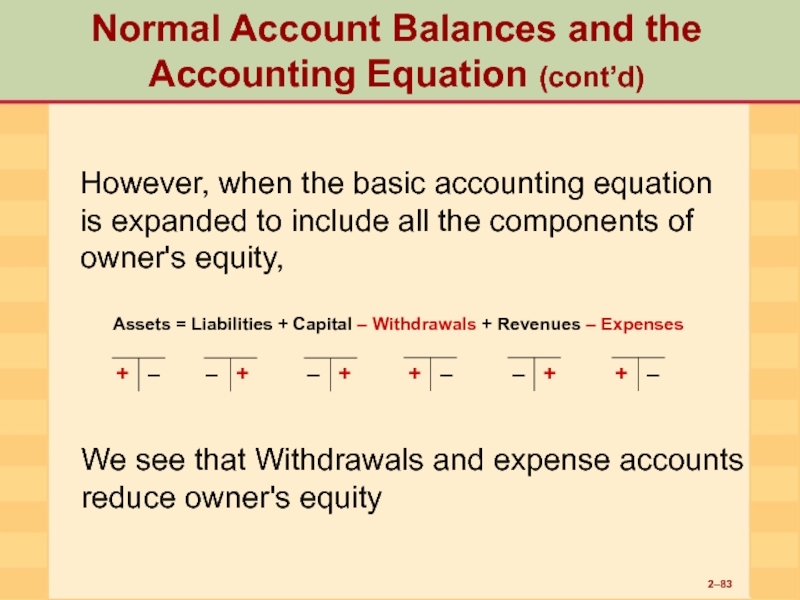

Слайд 832–

Normal Account Balances and the Accounting Equation (cont’d)

Assets = Liabilities +

However, when the basic accounting equation is expanded to include all the components of owner's equity,

We see that Withdrawals and expense accounts reduce owner's equity

Слайд 842–

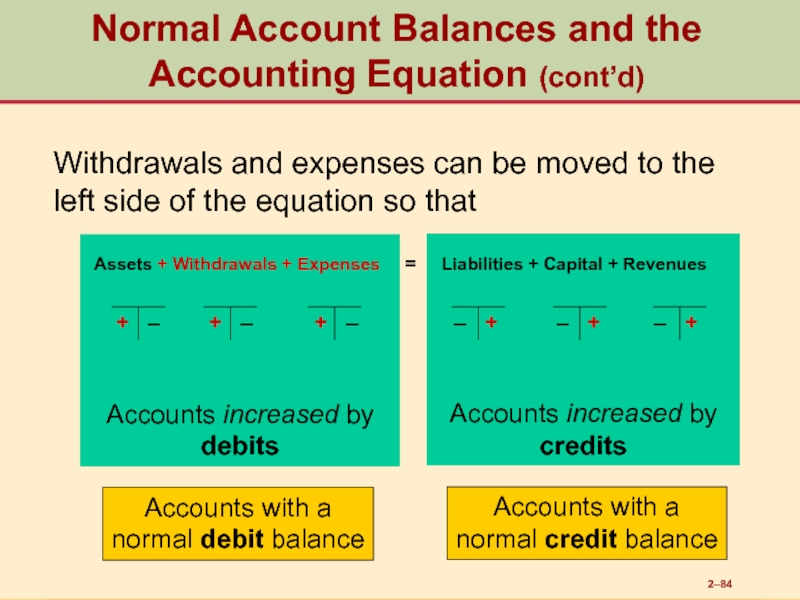

Normal Account Balances and the Accounting Equation (cont’d)

Accounts increased by

credits

Accounts

Assets + Withdrawals + Expenses = Liabilities + Capital + Revenues

Withdrawals and expenses can be moved to the left side of the equation so that

Accounts with a

normal debit balance

Accounts with a

normal credit balance

Слайд 852–

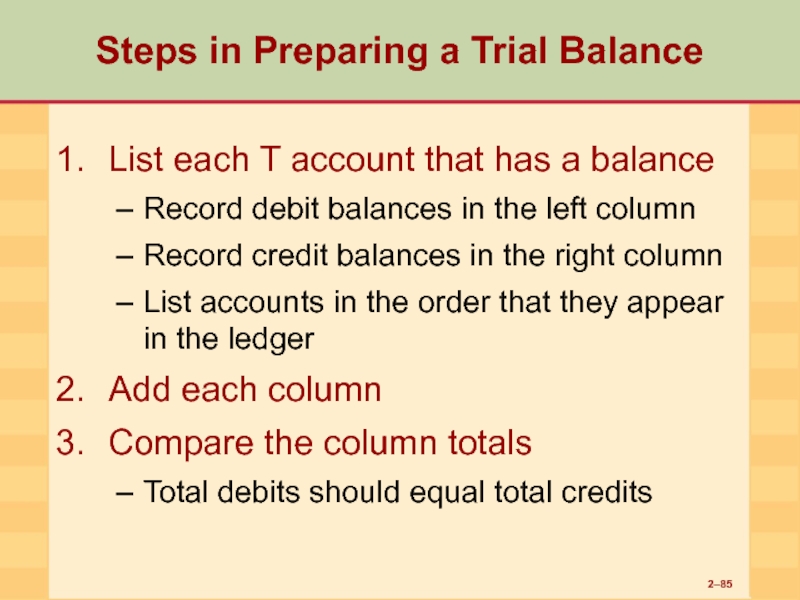

Steps in Preparing a Trial Balance

List each T account that has

Record debit balances in the left column

Record credit balances in the right column

List accounts in the order that they appear in the ledger

Add each column

Compare the column totals

Total debits should equal total credits

Слайд 862–

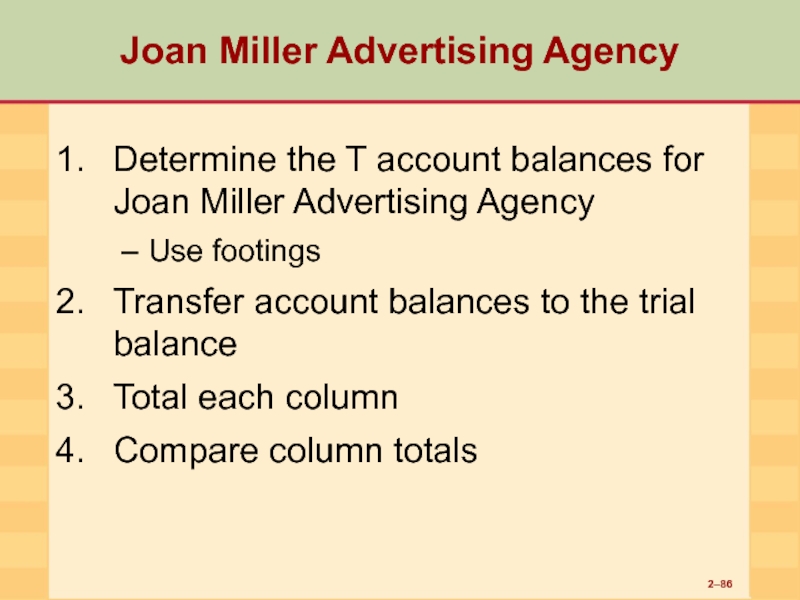

Joan Miller Advertising Agency

Determine the T account balances for Joan Miller

Use footings

Transfer account balances to the trial balance

Total each column

Compare column totals

Слайд 872–

Owner's Equity + Liabilities

Determine account balances

Joan Miller Advertising Agency

Слайд 882–

Trial Balance

Record debit balances in the left column

Record credit balances in

The trial balance proves the ledger is in balance

Total debits = Total credits

Add each column

Слайд 892–

Trial Balance (cont’d.)

The trial balance proves whether or not the ledger

Total of all debits recorded = Total of all credits recorded

What it does not do

Prove that all transactions were analyzed correctly

Prove that amounts were recorded in the proper accounts

Detect whether transactions have been omitted

Detect errors of the same amount made in both a debit and a credit

Слайд 902–

Detecting Errors in the Trial Balance

If the debit and credit columns

A debit entered as a credit, or visa versa

An incorrectly computed account balance

Error in carrying the account balance to the trial balance

Trial balance summed incorrectly

Слайд 912–

Detecting Errors in the Trial Balance (cont’d)

If trial balance is out

Caused by recording an account with a debit balance as a credit, or visa versa

If trial balance is out of balance by an amount divisible by 9

Caused by transposing two numbers when transferring an amount to the trial balance

Слайд 922–

Does the trial balance detect whether transactions have been omitted?

No. The

Prove that all transactions were analyzed correctly

Prove that amounts were recorded in the proper accounts

Detect whether transactions have been omitted

Detect errors of the same amount made in both a debit and a credit

Discussion

Слайд 932–

Recording and Posting Transactions

Objective 6

Record transactions in the general journal and

Слайд 942–

The General Journal

Why aren’t transactions entered directly into the accounts?

Since the

Identify individual transactions

Find errors

Solution

Record all transactions chronologically in a journal

Слайд 952–

Journalizing

… is the process of recording transactions

General journal is the simplest

Also called book of original entry

Separate journal entry records each transaction

Слайд 9615–

Journalizing Transactions

The date

Names of accounts debited and dollar amounts on same

Names of accounts credited (indented) and dollar amounts on same lines in credit column

Explanation of transaction

Account identification numbers, if appropriate

Record in

Journal

Слайд 972–

Journalizing Transactions (cont.)

A compound entry has more than one debit or

The July 6 entry is a compound entry because it has two debit entries

Skip a line between each entry

Слайд 982–

General Ledger

Used to record the details of each transaction

Used to update

T account is a simple, direct form

In practice, the ledger account form is used

Advantage of ledger account form over T account is that current balance of account is always available

Слайд 992–

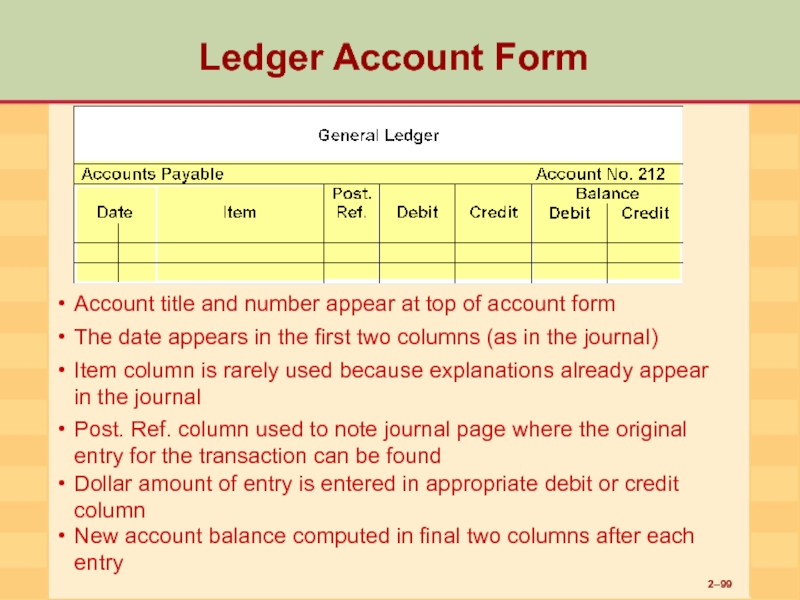

Ledger Account Form

Account title and number appear at top of account form

The date appears in the first two columns (as in the journal)

Item column is rarely used because explanations already appear in the journal

Post. Ref. column used to note journal page where the original entry for the transaction can be found

Dollar amount of entry is entered in appropriate debit or credit column

New account balance computed in final two columns after each entry

Слайд 1002–

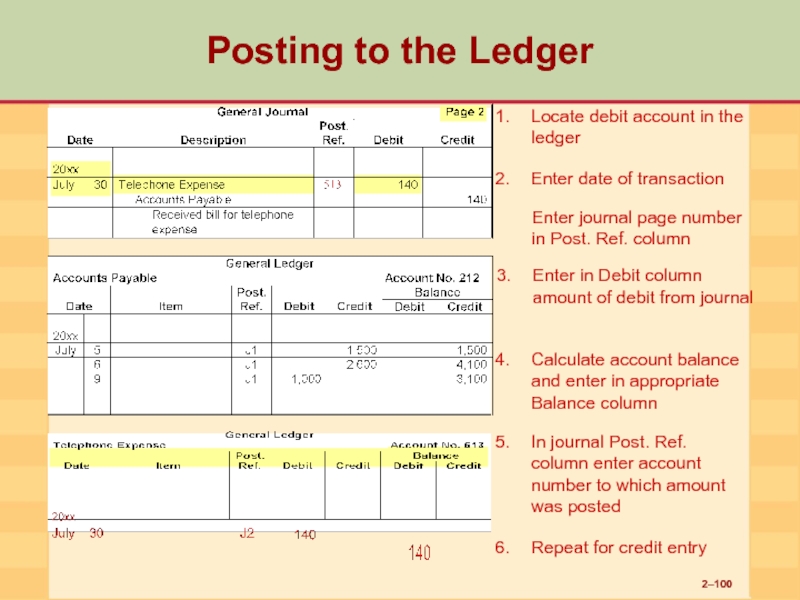

Posting to the Ledger

Locate debit account in the ledger

Enter date of transaction

Enter journal page number in Post. Ref. column

Enter in Debit column amount of debit from journal

Calculate account balance and enter in appropriate Balance column

In journal Post. Ref. column enter account number to which amount was posted

Repeat for credit entry

Слайд 1012–

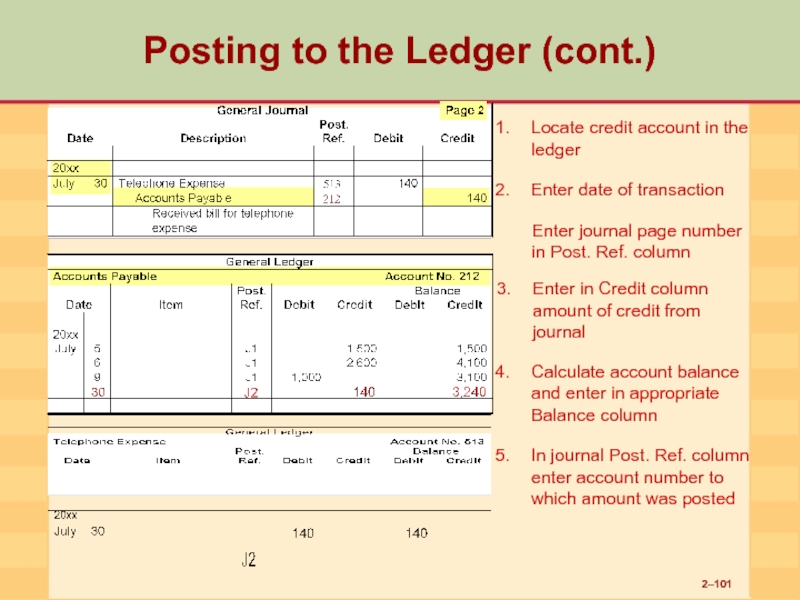

Posting to the Ledger (cont.)

In journal Post. Ref. column enter account number to which amount was posted

Enter in Credit column amount of credit from journal

Enter journal page number in Post. Ref. column

Locate credit account in the ledger

Enter date of transaction

Calculate account balance and enter in appropriate Balance column

Слайд 1022–

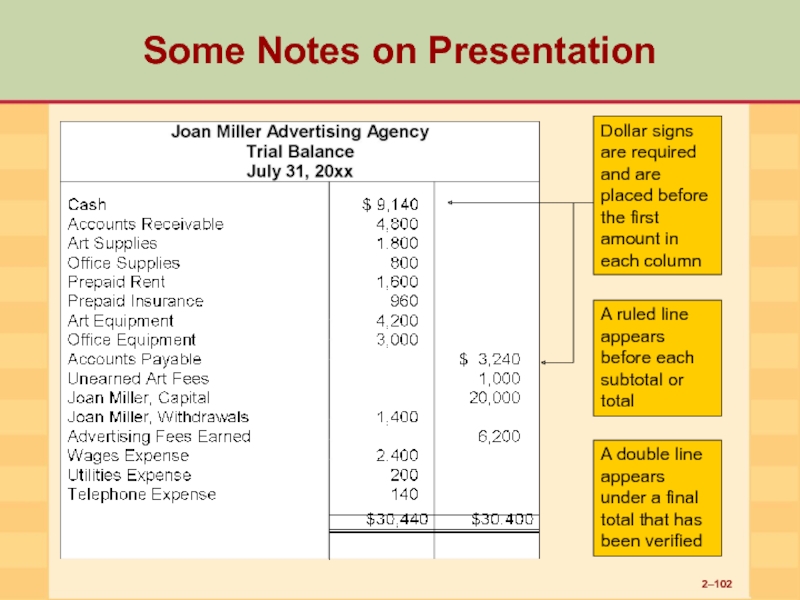

Some Notes on Presentation

A ruled line appears before each subtotal or

A double line appears under a final total that has been verified