- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tax Tips презентация

Содержание

- 1. Tax Tips

- 2. Lodging a tax return can seem daunting

- 3. with these top tax tips

- 4. 1. Obtain your refund for tax withheld

- 5. The only way you can get back

- 6. 2. Identify ALL your sources of assessable income!

- 7. This includes any income earned from:

- 8. 3. Consider the special rules for those under 18.

- 9. If you’re under 18 some types of

- 10. “Know yours?” 4. KNOW your deductions! “Yep!”

- 11. Things you can claim You may be

- 12. 5. Claim the RIGHT tax offsets!

- 13. If your study is directly related

- 14. 7. Understand your HELP DEBT

- 15. If you have a HELP Debt… Don’t

- 16. 8. Know if you are a resident for tax purposes

- 17. If you are an overseas student studying

- 18. You should always consult your registered Tax

Слайд 2Lodging a tax return can seem daunting for students. And for

But it doesn’t have to be…

Слайд 3with these

top tax tips

for students

From

CPA Australia

Save yourself

Слайд 5The only way you can get back the income tax that

Tax can be withheld from your pay, and any interest income you earned during this financial year if you have NOT provided your tax file number (TFN).

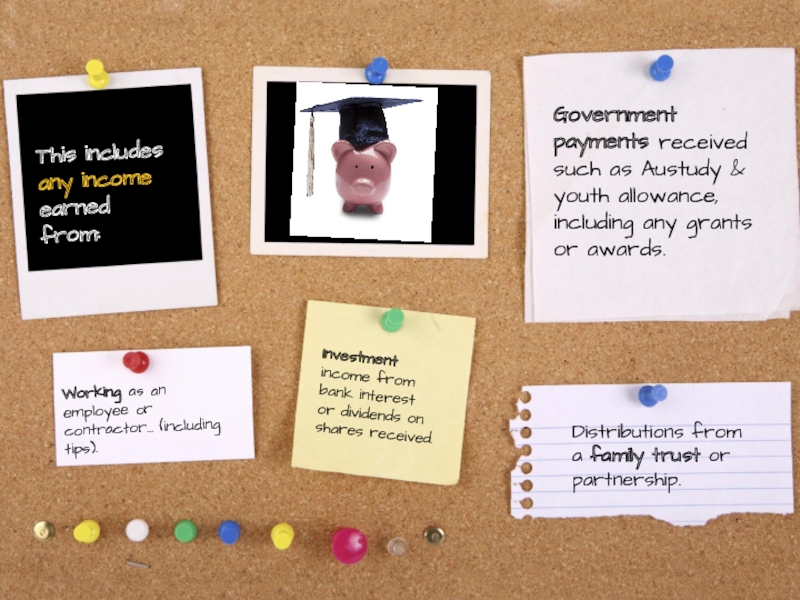

Слайд 7This includes any income earned from:

Working as an employee or

Investment income from bank interest or dividends on shares received.

Distributions from a family trust or partnership.

Government payments received such as Austudy & youth allowance, including any grants or awards.

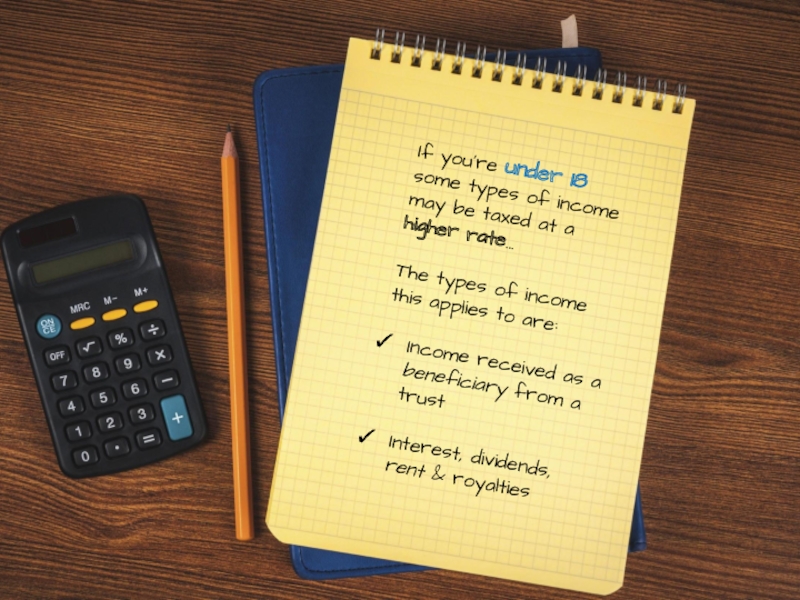

Слайд 9If you’re under 18 some types of income may be taxed

The types of income this applies to are:

Income received as a beneficiary from a trust

Interest, dividends, rent & royalties

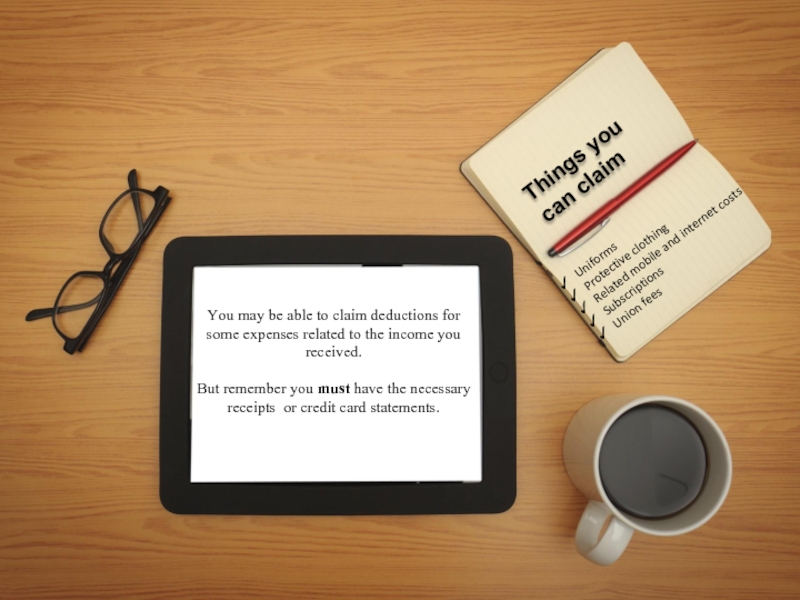

Слайд 11Things you can claim

You may be able to claim deductions for

But remember you must have the necessary receipts or credit card statements.

Uniforms

Protective clothing

Related mobile and internet costs

Subscriptions

Union fees

Слайд 125. Claim the RIGHT tax offsets!

If you receive Austudy, ABSTUDY,

Слайд 13

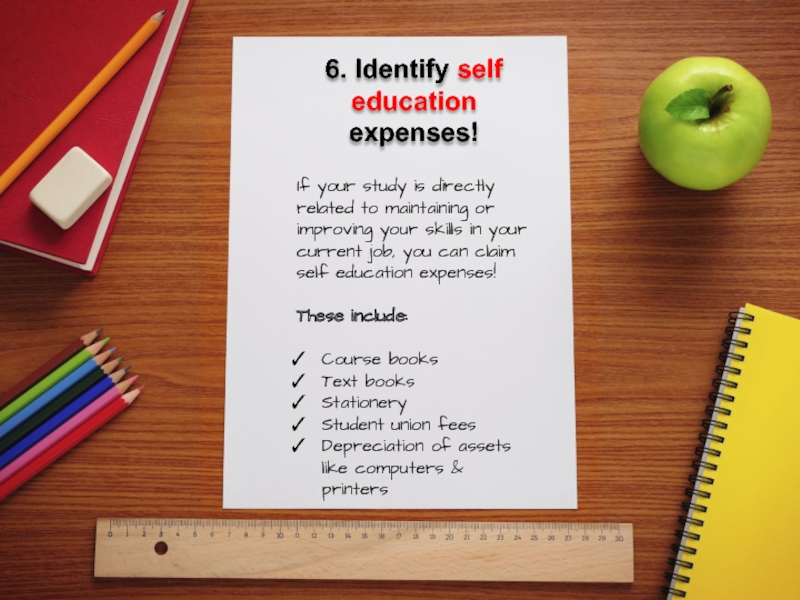

If your study is directly related to maintaining or improving your

These include:

Course books

Text books

Stationery

Student union fees

Depreciation of assets like computers & printers

6. Identify self education expenses!

Слайд 15If you have a HELP Debt… Don’t fret!

Repayments only commence

The specific amount required to be repaid will depend on many factors including your taxable income.

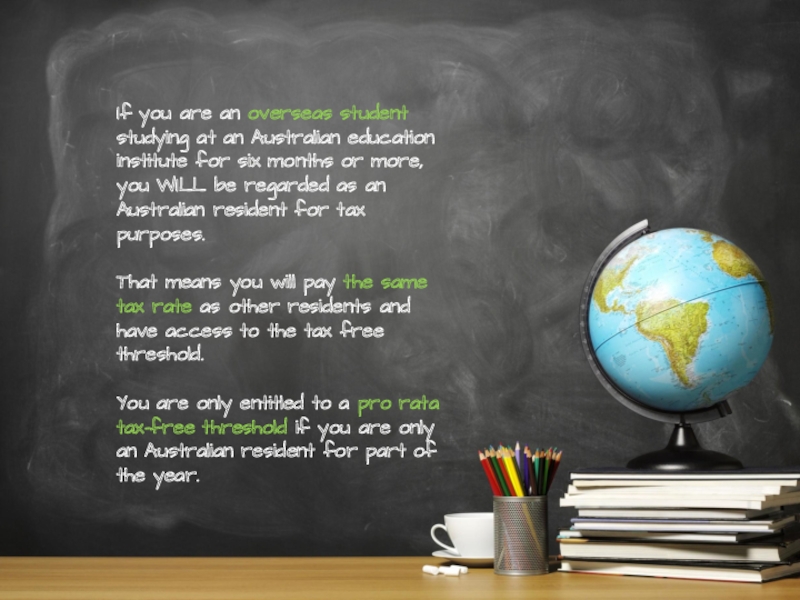

Слайд 17If you are an overseas student studying at an Australian education

That means you will pay the same tax rate as other residents and have access to the tax free threshold.

You are only entitled to a pro rata tax-free threshold if you are only an Australian resident for part of the year.

Слайд 18You should always consult your registered Tax agent.

Happy EOFY from

These tax tips are for students who are Australian residents for tax purposes for the year ending June 30, 2014.