- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Structuring. Transaction Framework презентация

Содержание

- 1. Structuring. Transaction Framework

- 2. Agenda Overview Perspective Creating

- 3. Overview Amsterdam Institute of Finance May, 2008

- 4. Transaction Framework Strategic Issues Do I

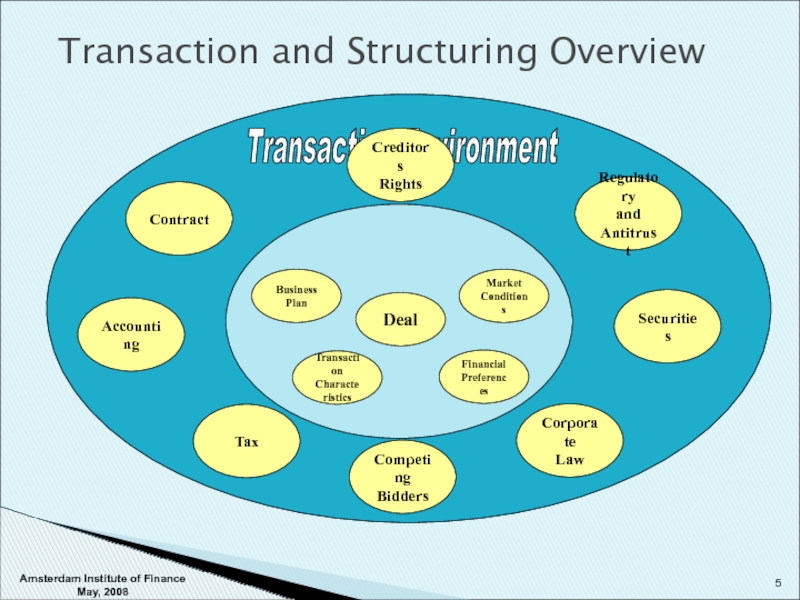

- 5. Transaction and Structuring Overview Accounting Tax

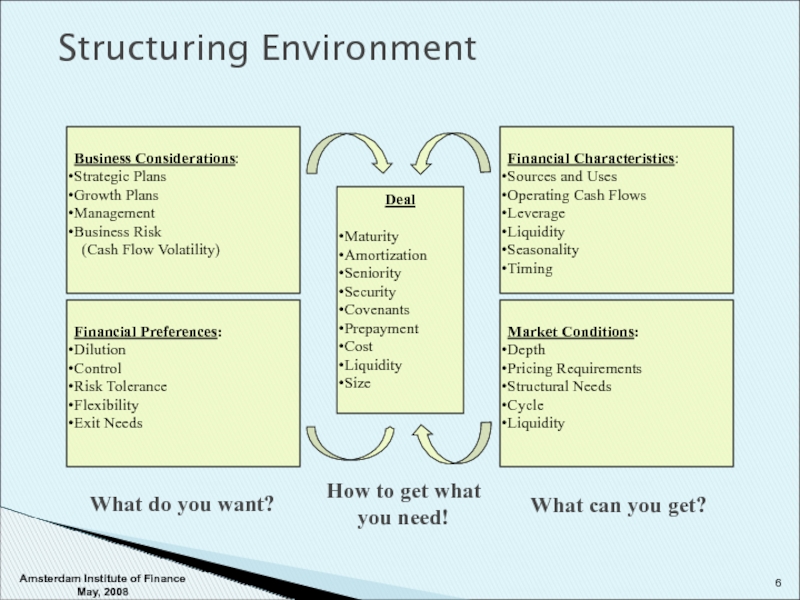

- 6. Structuring Environment Financial Preferences: Dilution Control

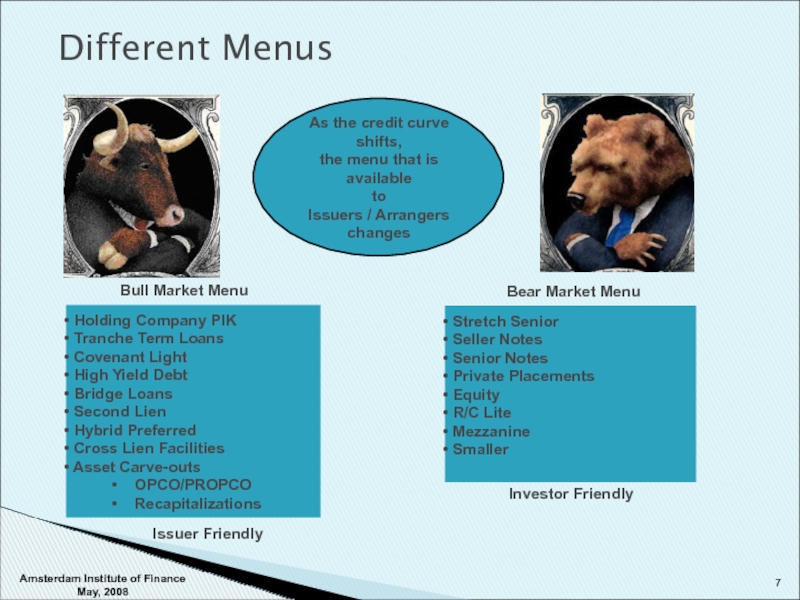

- 7. Different Menus Bull Market Menu Bear

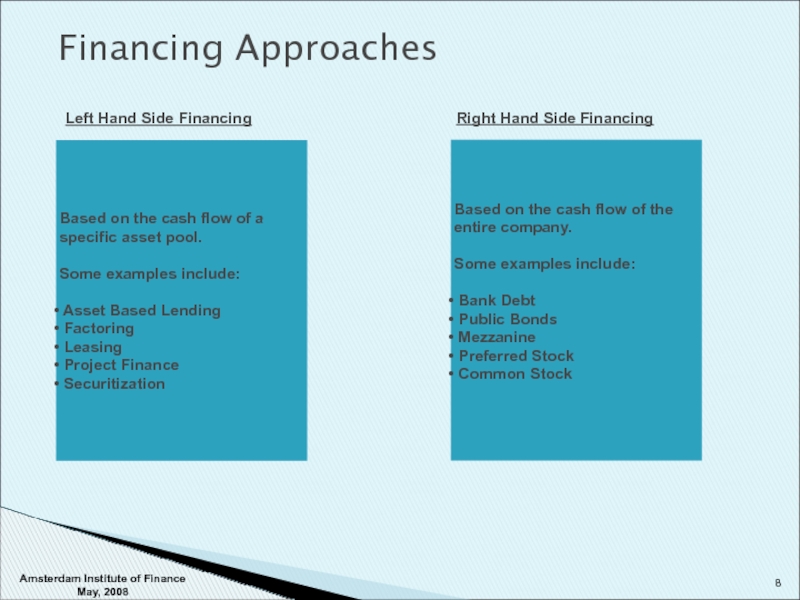

- 8. Financing Approaches Left Hand Side Financing

- 9. Perspective Amsterdam Institute of Finance May, 2008

- 10. Capital Market Specific Factors Credit Specific

- 11. Acceptable leverage levels Interest Rate Amortization

- 12. Public Debt vs. Private Debt Relative Value

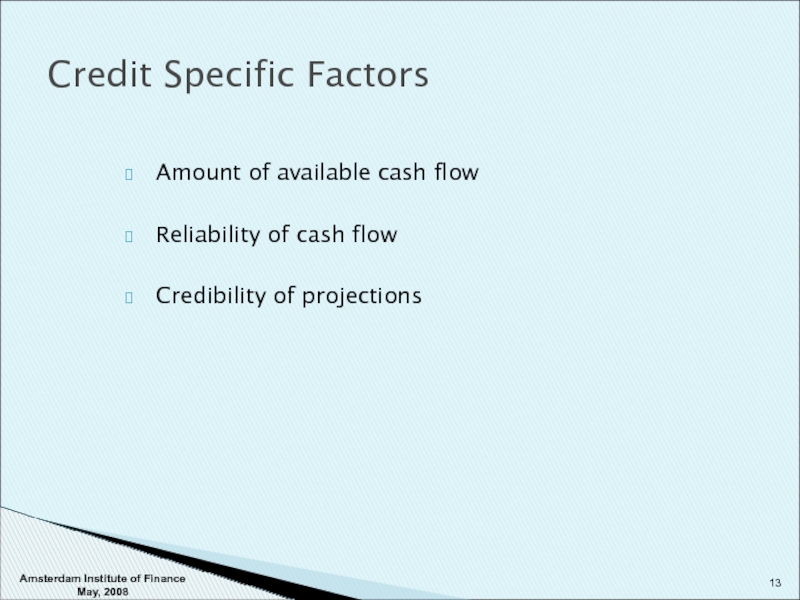

- 13. Amount of available cash flow Reliability

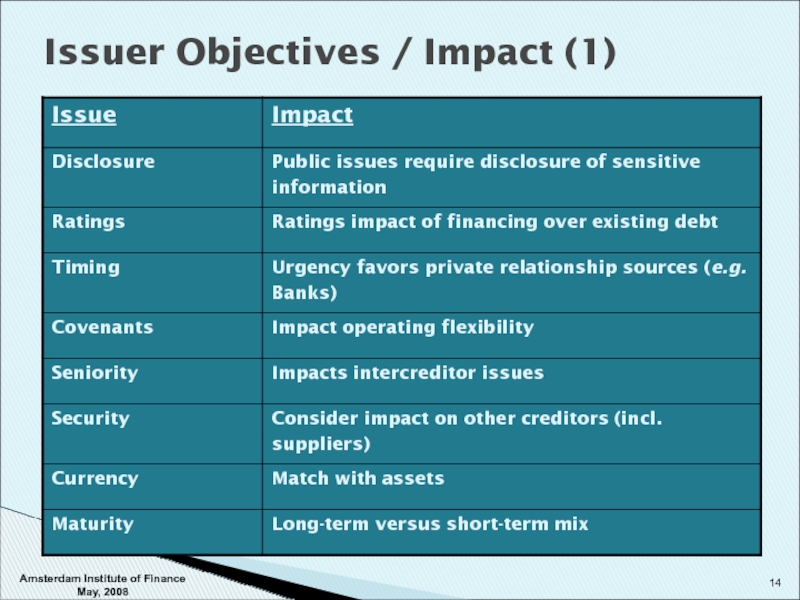

- 14. Issuer Objectives / Impact (1) Amsterdam Institute of Finance May, 2008

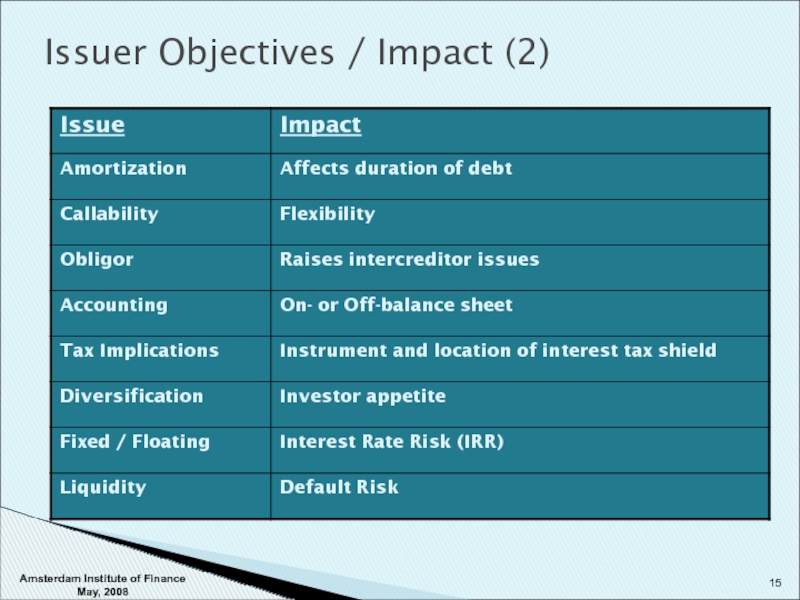

- 15. Issuer Objectives / Impact (2) Amsterdam Institute of Finance May, 2008

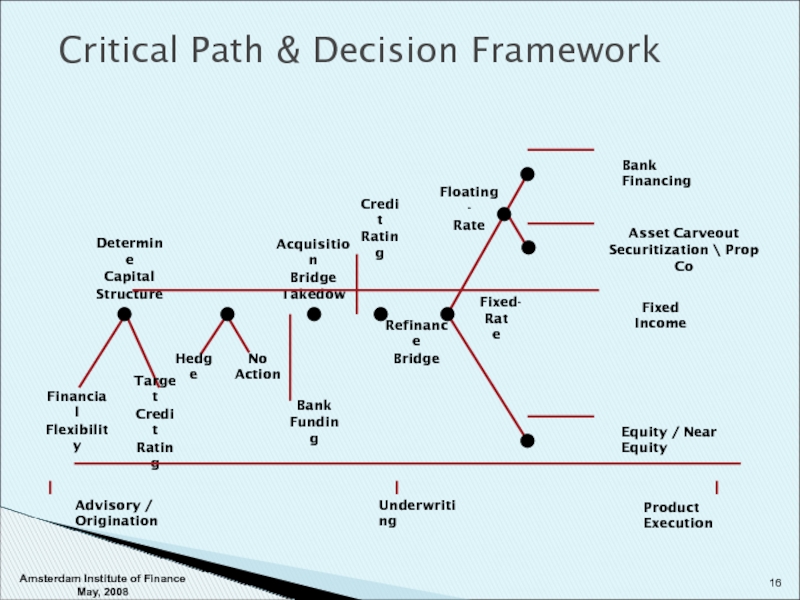

- 16. Critical Path & Decision Framework Financial Flexibility

- 17. Creating the Structure Amsterdam Institute of Finance May, 2008

- 18. Rule of Thumb Measures Balance Sheet Model

- 19. Deal Financial Arithmetic Amsterdam Institute of Finance May, 2008

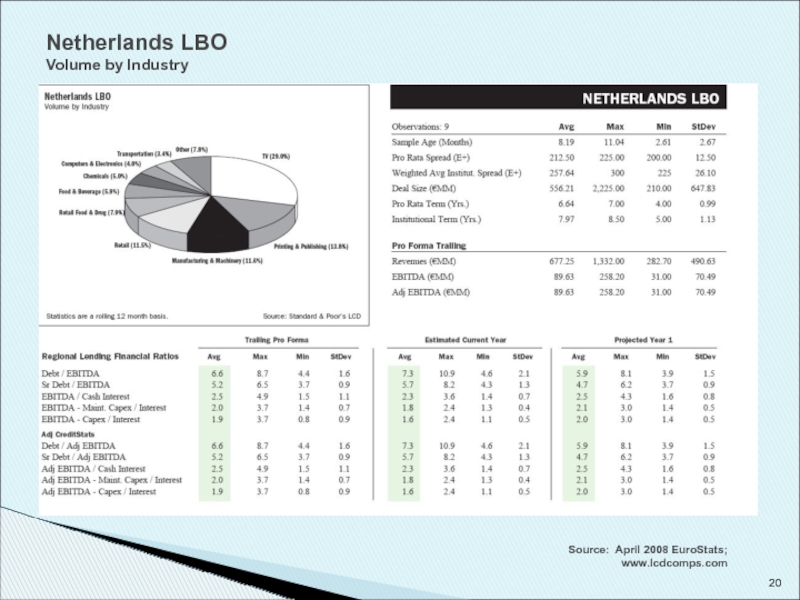

- 20. Netherlands LBO Volume by Industry Source: April 2008 EuroStats; www.lcdcomps.com

- 21. Purchase Price Minimum/Maximum Recapitalization Dividend Debt Refinancing

- 22. Revolver Tied to advance against current assets

- 23. Current Asset approach Use standard

- 24. Term Loans = Maximum Senior Debt -

- 25. Typical bank financings as structured as follows:

- 26. Long Term Debt = Max Total Debt

- 27. Subordination Senior lenders are concerned with

- 28. Contractual Subordination Holding Company Intermediate

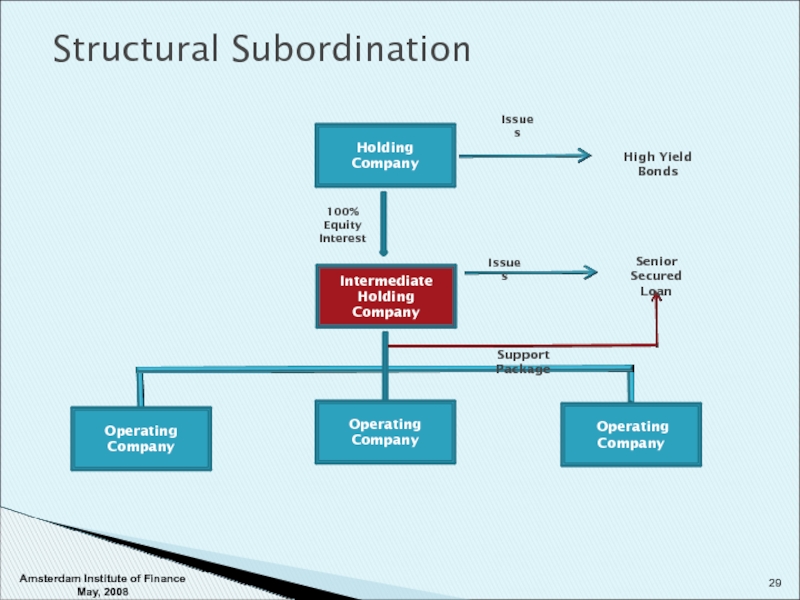

- 29. Structural Subordination Holding Company Intermediate

- 30. Retranche Increase Pricing Lower Leverage Lower Purchase

- 31. Covenants Amsterdam Institute of Finance May, 2008

- 32. PURPOSE: maintain the original deal WHY

- 33. Categories Affirmative The maintenance, preservation and insurance

- 34. There are no standard covenants. They

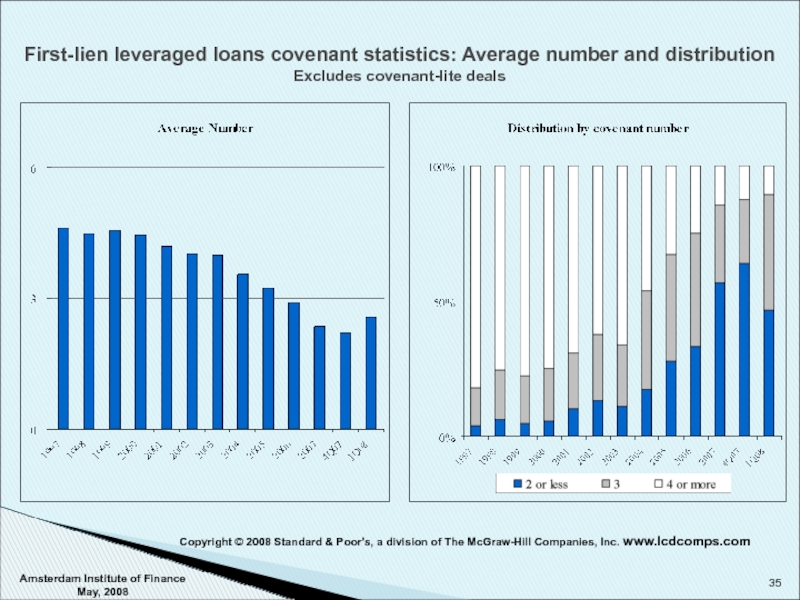

- 35. First-lien leveraged loans covenant statistics: Average number

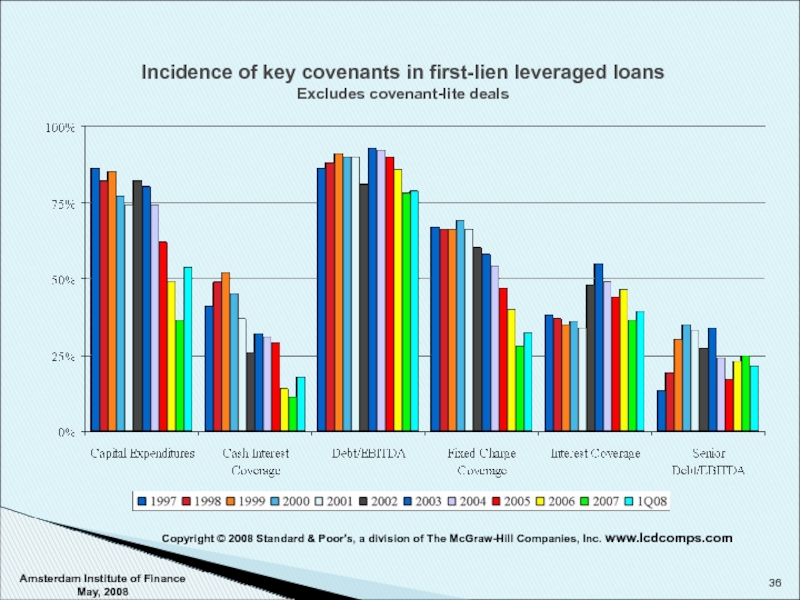

- 36. Amsterdam Institute of Finance May, 2008 Incidence

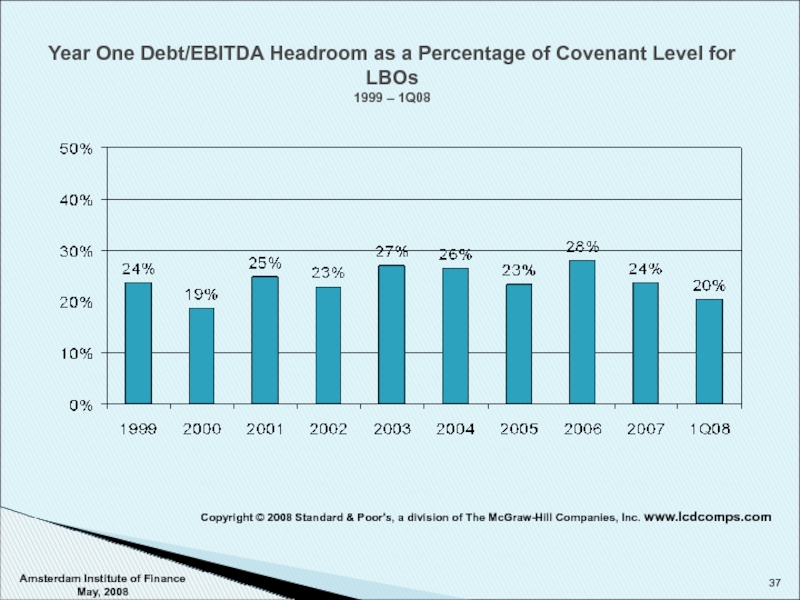

- 37. Amsterdam Institute of Finance May, 2008 Year

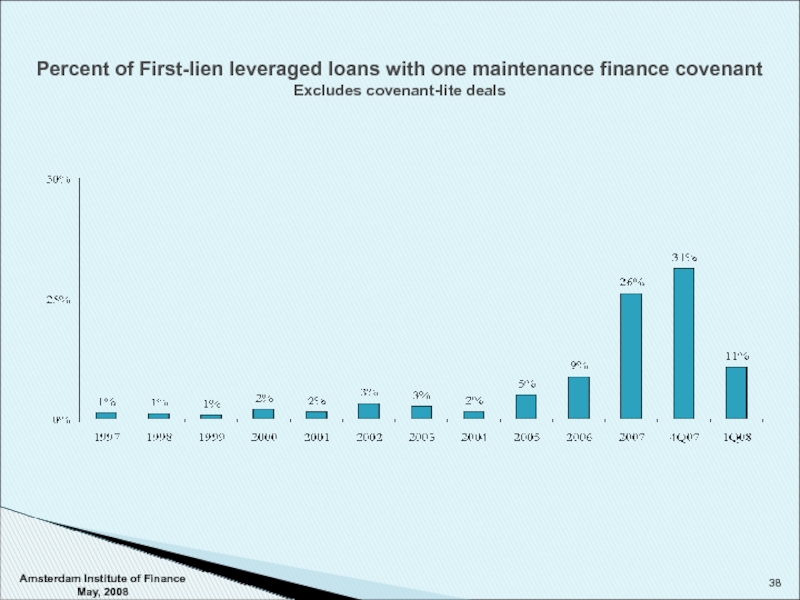

- 38. Amsterdam Institute of Finance May, 2008 Percent

- 39. Average Debt/EBITDA Covenant Level and Projected Ratio

- 40. Covenant Levels and Issues Covenants are negotiated

- 41. Translating Capital Structure and Debt Capacity into

- 42. Project Gear Amsterdam Institute of Finance May, 2008

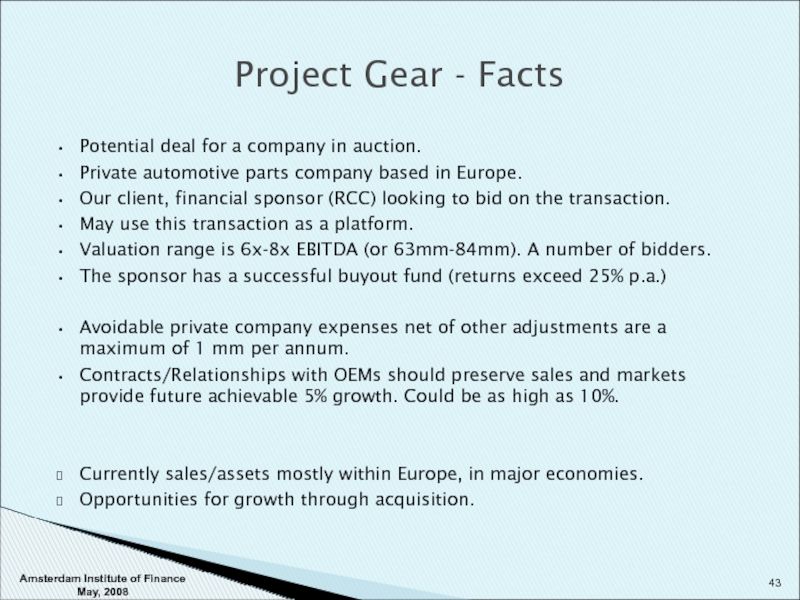

- 43. Project Gear - Facts Potential deal

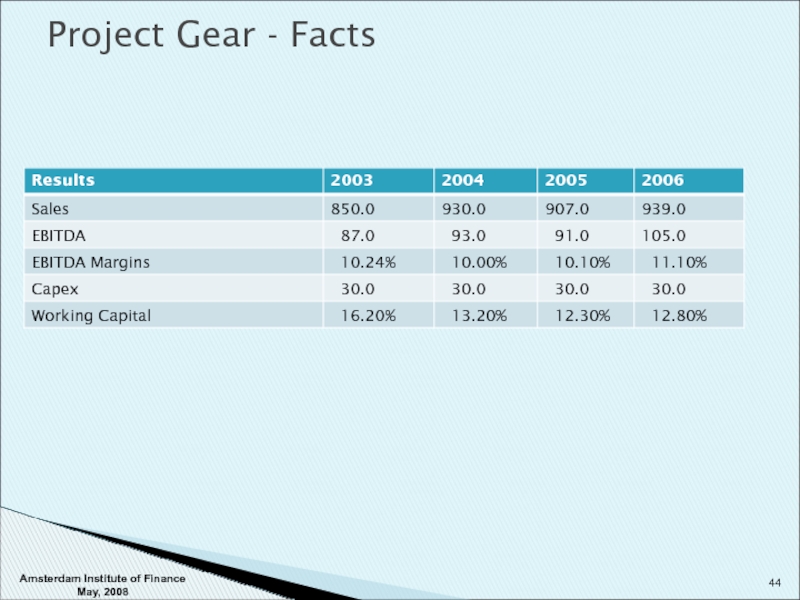

- 44. Project Gear - Facts Amsterdam Institute of Finance May, 2008

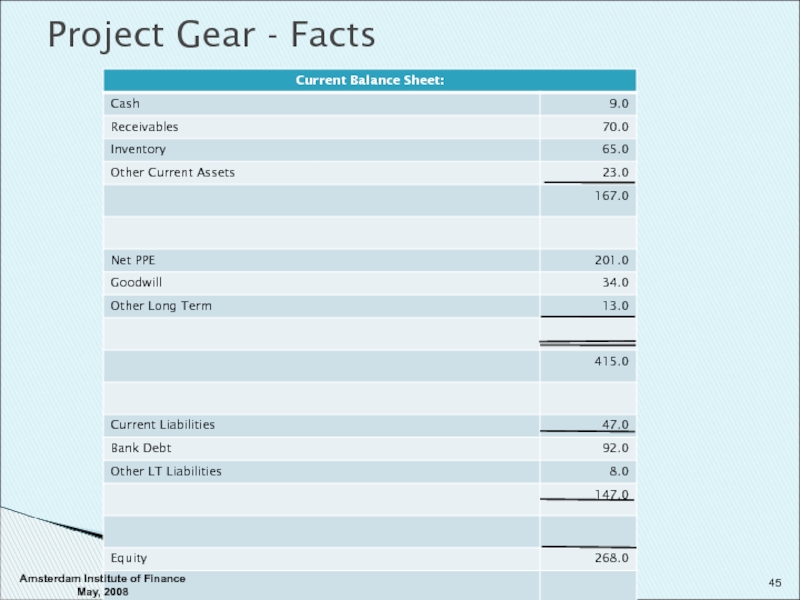

- 45. Project Gear - Facts Amsterdam Institute of Finance May, 2008

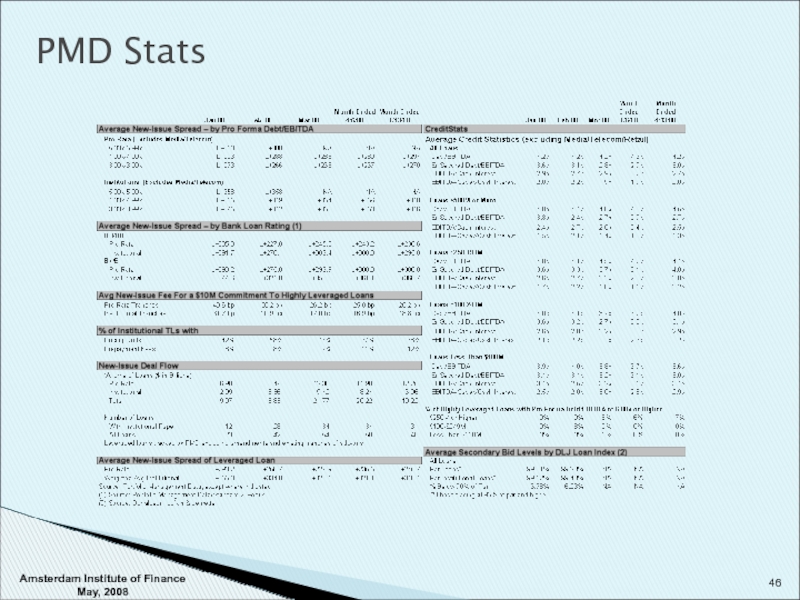

- 46. PMD Stats Amsterdam Institute of Finance May, 2008

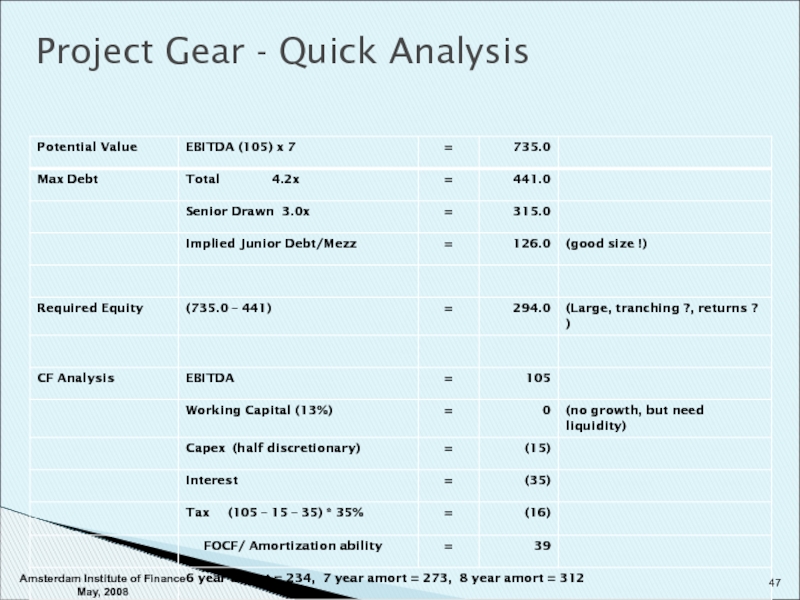

- 47. Project Gear - Quick Analysis Amsterdam Institute of Finance May, 2008

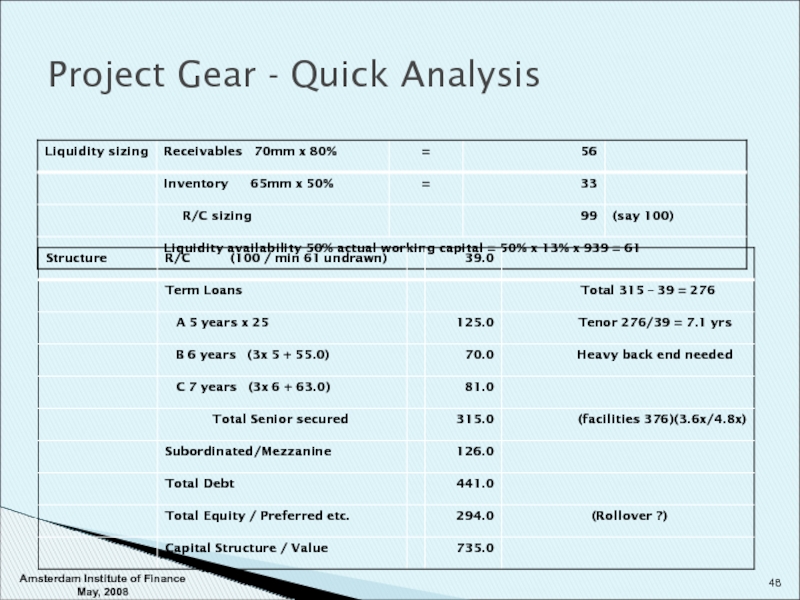

- 48. Project Gear - Quick Analysis Amsterdam Institute of Finance May, 2008

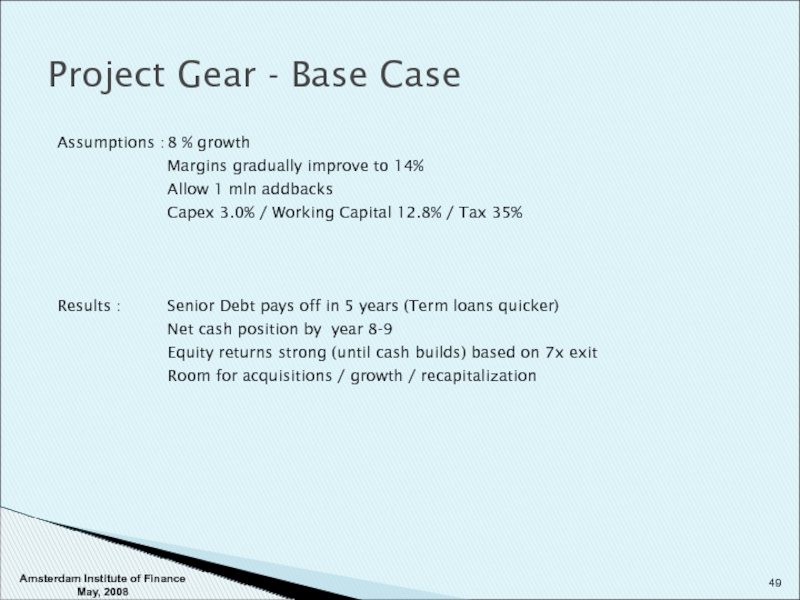

- 49. Project Gear - Base Case Assumptions : 8

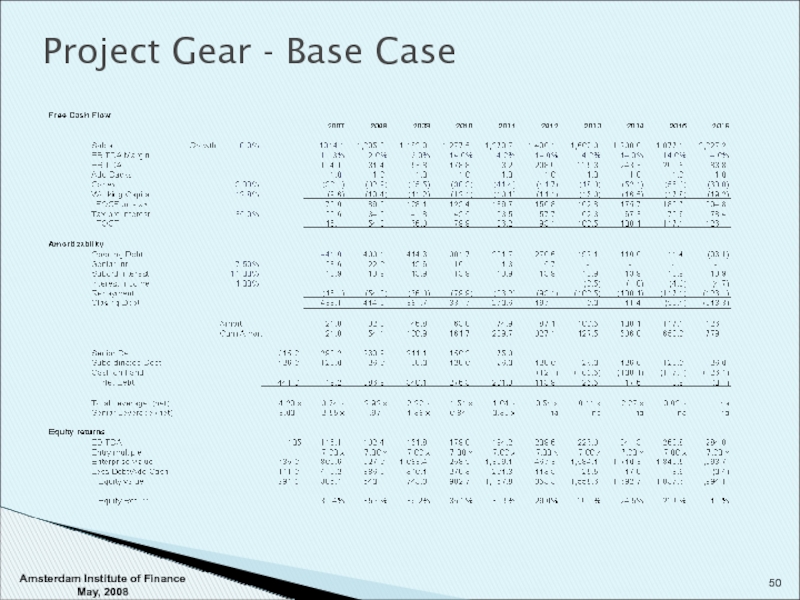

- 50. Project Gear - Base Case Amsterdam Institute of Finance May, 2008

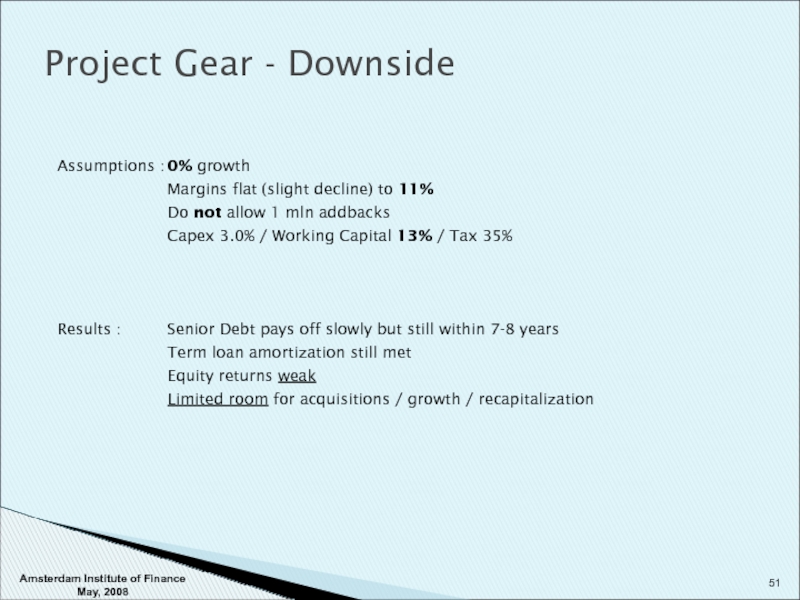

- 51. Project Gear - Downside Assumptions : 0%

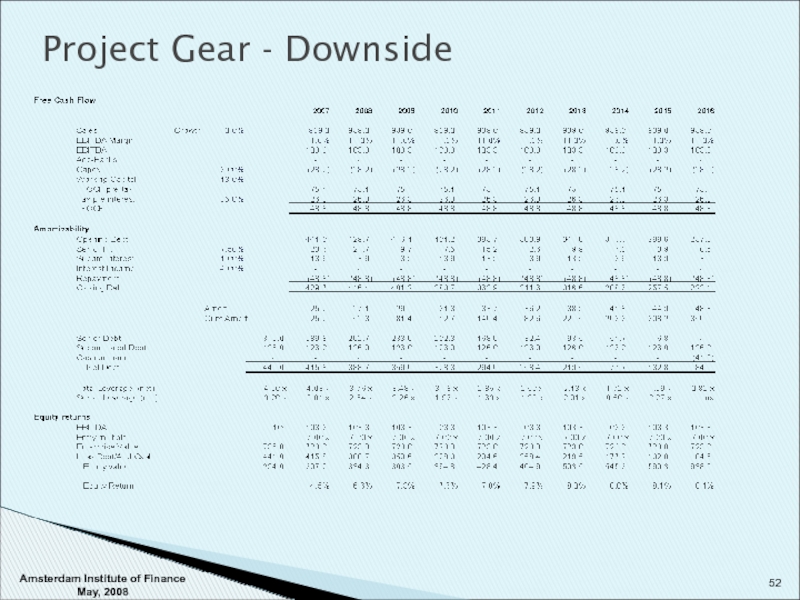

- 52. Project Gear - Downside Amsterdam Institute of Finance May, 2008

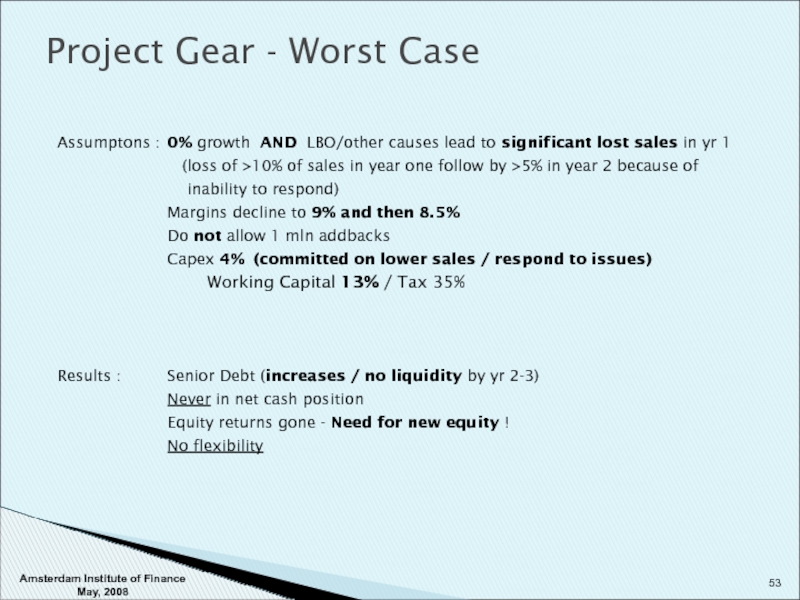

- 53. Project Gear - Worst Case Assumptons : 0%

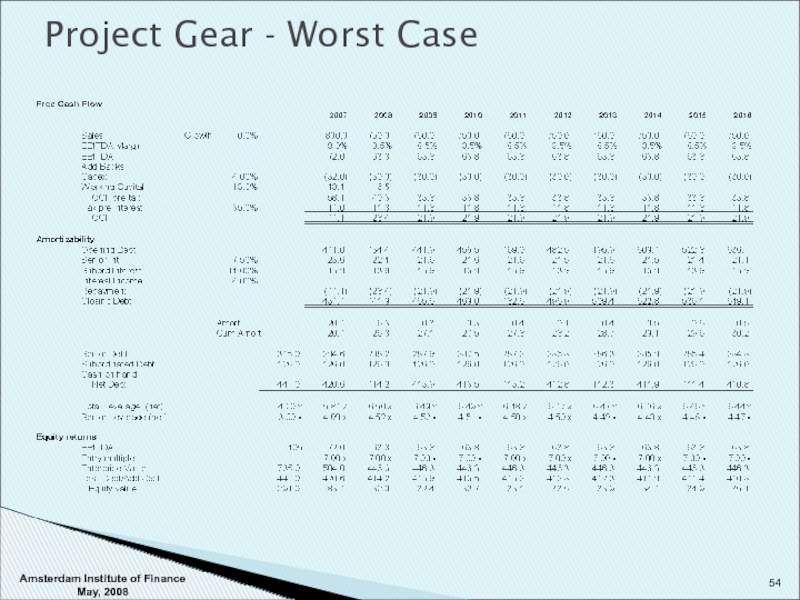

- 54. Project Gear - Worst Case Amsterdam Institute of Finance May, 2008

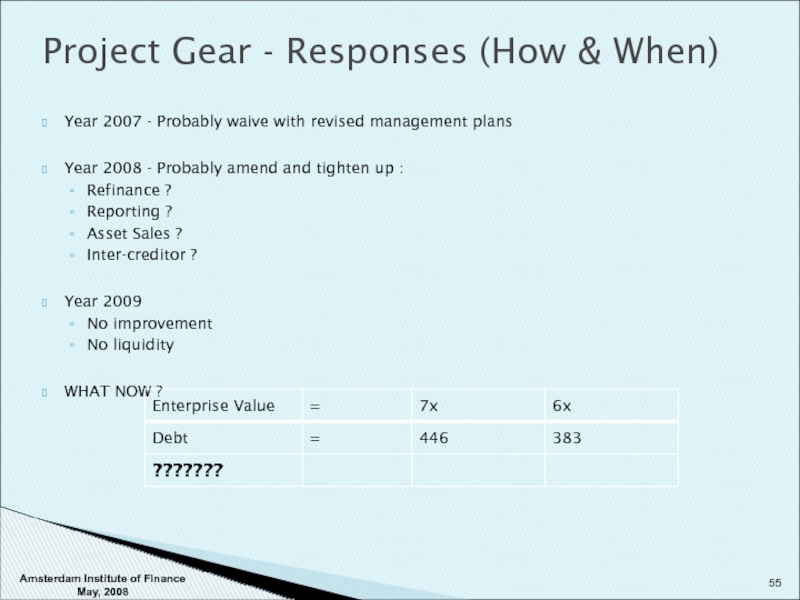

- 55. Project Gear - Responses (How & When)

- 56. Disclosure This information has been prepared solely

Слайд 1Structuring

Joseph V. Rizzi

Amsterdam Institute of Finance

May, 2008

Copyright © Joe Rizzi, 2008

Слайд 2

Agenda

Overview

Perspective

Creating the structure

Covenants

Amsterdam Institute of Finance May, 2008

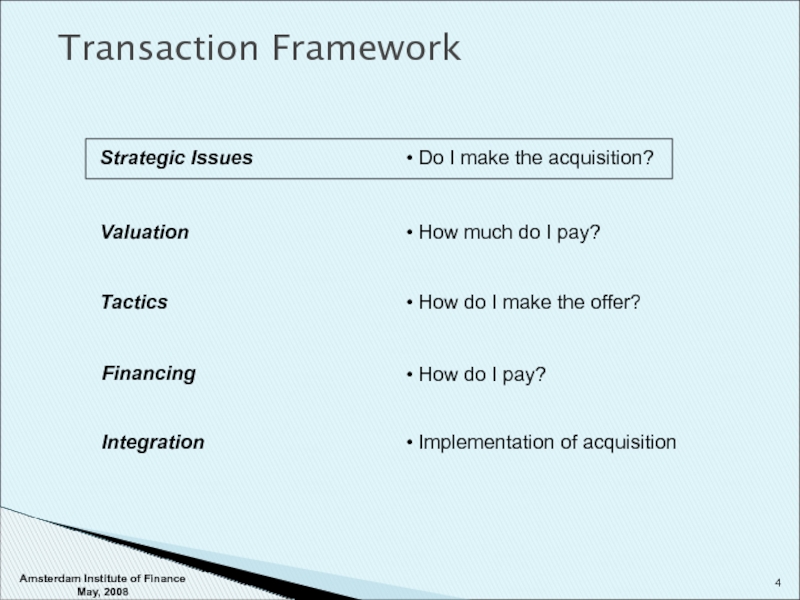

Слайд 4Transaction Framework

Strategic Issues

Do I make the acquisition?

Valuation

How much do

Financing

How do I pay?

Integration

Implementation of acquisition

Tactics

How do I make the offer?

Amsterdam Institute of Finance May, 2008

Слайд 5

Transaction and Structuring Overview

Accounting

Tax

Corporate

Law

Securities

Regulatory

and Antitrust

Transaction Environment

Contract

Structuring Environment

Business

Plan

Transaction

Characteristics

Financial

Preferences

Market

Conditions

Deal

Competing

Bidders

Creditors

Rights

Amsterdam Institute

Слайд 6Structuring Environment

Financial Preferences:

Dilution

Control

Risk Tolerance

Flexibility

Exit Needs

Market Conditions:

Depth

Pricing Requirements

Structural Needs

Cycle

Liquidity

Business Considerations:

Strategic Plans

Growth Plans

Management

Business

(Cash Flow Volatility)

Financial Characteristics:

Sources and Uses

Operating Cash Flows

Leverage

Liquidity

Seasonality

Timing

Deal

Maturity

Amortization

Seniority

Security

Covenants

Prepayment

Cost

Liquidity

Size

What do you want?

How to get what

you need!

What can you get?

Amsterdam Institute of Finance May, 2008

Слайд 7Different Menus

Bull Market Menu

Bear Market Menu

As the credit curve shifts,

the

to

Issuers / Arrangers

changes

Holding Company PIK

Tranche Term Loans

Covenant Light

High Yield Debt

Bridge Loans

Second Lien

Hybrid Preferred

Cross Lien Facilities

Asset Carve-outs

OPCO/PROPCO

Recapitalizations

Stretch Senior

Seller Notes

Senior Notes

Private Placements

Equity

R/C Lite

Mezzanine

Smaller

Issuer Friendly

Investor Friendly

Amsterdam Institute of Finance May, 2008

Слайд 8Financing Approaches

Left Hand Side Financing

Right Hand Side Financing

Based on the cash

Some examples include:

Asset Based Lending

Factoring

Leasing

Project Finance

Securitization

Based on the cash flow of the entire company.

Some examples include:

Bank Debt

Public Bonds

Mezzanine

Preferred Stock

Common Stock

Amsterdam Institute of Finance May, 2008

Слайд 10Capital Market Specific Factors

Credit Specific Factors

Customer Objectives

Valuation

Structuring Perspective

Amsterdam Institute of Finance

Слайд 11Acceptable leverage levels

Interest Rate

Amortization

Acceptable tenor of senior debt

Asset coverage

Size of issue

Market

Amsterdam Institute of Finance May, 2008

Слайд 12Public Debt vs. Private Debt

Relative Value Analysis

Domestic vs. International Issuance

Fixed vs.

Long vs. Short Term

Loans vs. Bonds

Structuring Issues

Amsterdam Institute of Finance May, 2008

Слайд 13Amount of available cash flow

Reliability of cash flow

Credibility of projections

Credit Specific

Amsterdam Institute of Finance May, 2008

Слайд 16Critical Path & Decision Framework

Financial

Flexibility

Target

Credit

Rating

Determine

Capital

Structure

Hedge

No Action

Bank

Funding

Acquisition

Bridge

Takedown

Credit

Rating

Fixed Income

Asset Carveout

Securitization \

Bank Financing

Equity / Near Equity

Refinance

Bridge

Fixed-

Rate

Floating-

Rate

Advisory / Origination

Underwriting

Product Execution

Amsterdam Institute of Finance May, 2008

Слайд 18Rule of Thumb Measures

Balance Sheet Model

Cash Flow Model

Detailed Model

Matching markets to

Reverse inquiry

Projections (amortization capability)

Creating the Capital Structure

Amsterdam Institute of Finance May, 2008

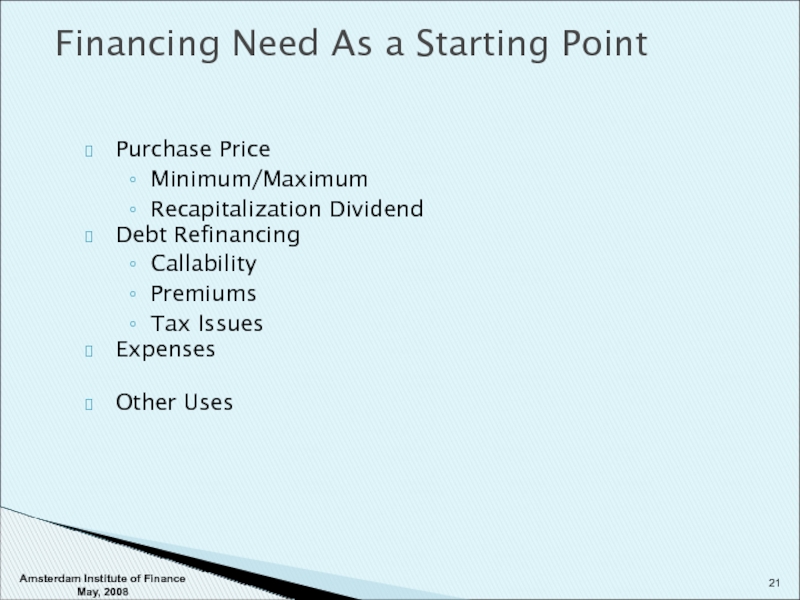

Слайд 21Purchase Price

Minimum/Maximum

Recapitalization Dividend

Debt Refinancing

Callability

Premiums

Tax Issues

Expenses

Other Uses

Financing Need As a Starting Point

Amsterdam

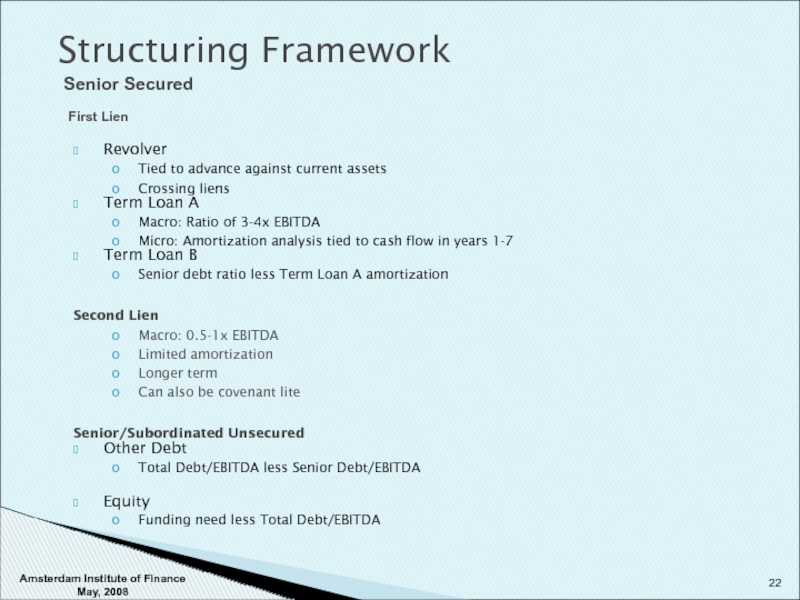

Слайд 22Revolver

Tied to advance against current assets

Crossing liens

Term Loan A

Macro: Ratio of

Micro: Amortization analysis tied to cash flow in years 1-7

Term Loan B

Senior debt ratio less Term Loan A amortization

Second Lien

Macro: 0.5-1x EBITDA

Limited amortization

Longer term

Can also be covenant lite

Senior/Subordinated Unsecured

Other Debt

Total Debt/EBITDA less Senior Debt/EBITDA

Equity

Funding need less Total Debt/EBITDA

Structuring Framework

Senior Secured

First Lien

Amsterdam Institute of Finance May, 2008

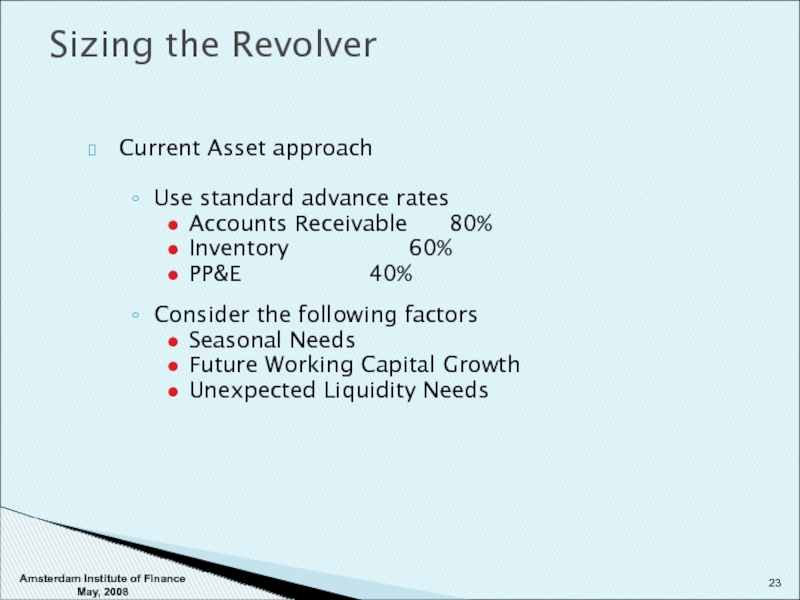

Слайд 23

Current Asset approach

Use standard advance rates

Accounts Receivable 80%

Inventory 60%

PP&E 40%

Consider

Seasonal Needs

Future Working Capital Growth

Unexpected Liquidity Needs

Sizing the Revolver

Amsterdam Institute of Finance May, 2008

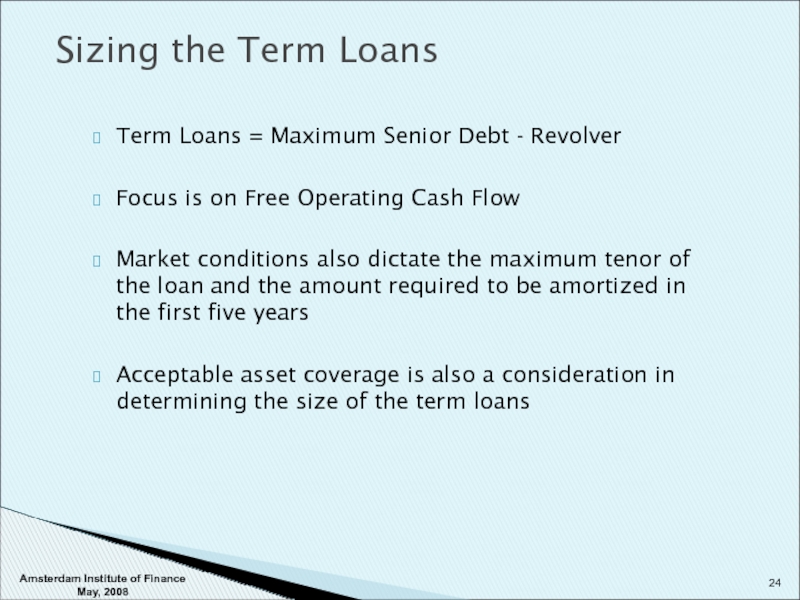

Слайд 24Term Loans = Maximum Senior Debt - Revolver

Focus is on Free

Market conditions also dictate the maximum tenor of the loan and the amount required to be amortized in the first five years

Acceptable asset coverage is also a consideration in determining the size of the term loans

Sizing the Term Loans

Amsterdam Institute of Finance May, 2008

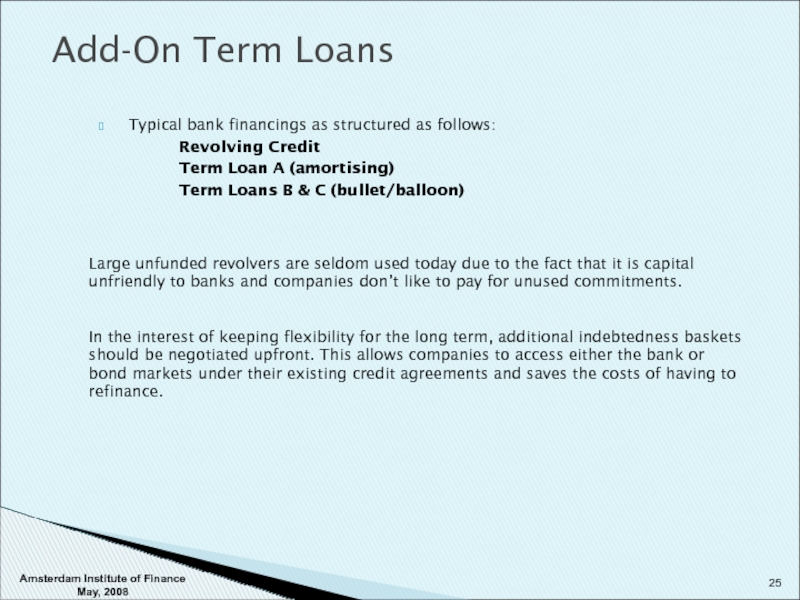

Слайд 25Typical bank financings as structured as follows:

Revolving Credit

Term Loan A (amortising)

Term

Add-On Term Loans

Large unfunded revolvers are seldom used today due to the fact that it is capital unfriendly to banks and companies don’t like to pay for unused commitments.

In the interest of keeping flexibility for the long term, additional indebtedness baskets should be negotiated upfront. This allows companies to access either the bank or bond markets under their existing credit agreements and saves the costs of having to refinance.

Amsterdam Institute of Finance May, 2008

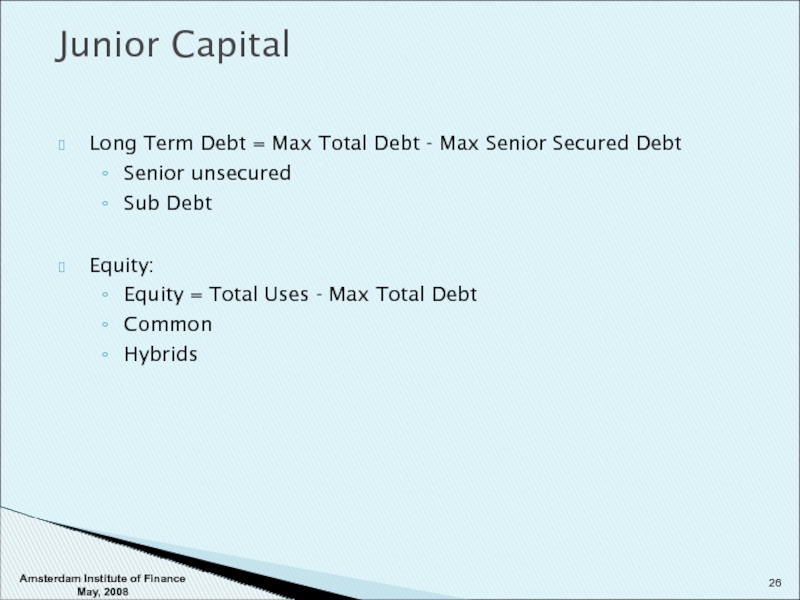

Слайд 26Long Term Debt = Max Total Debt - Max Senior Secured

Senior unsecured

Sub Debt

Equity:

Equity = Total Uses - Max Total Debt

Common

Hybrids

Junior Capital

Amsterdam Institute of Finance May, 2008

Слайд 27Subordination

Senior lenders are concerned with the implications of having high

EURO High Yield investors to date have not been as vocal as senior bank lenders, viewing the issue as one of pricing rather than principle.

All other things being equal, sophisticated investors will probably price structural subordination at 60-120 bps.

Amsterdam Institute of Finance May, 2008

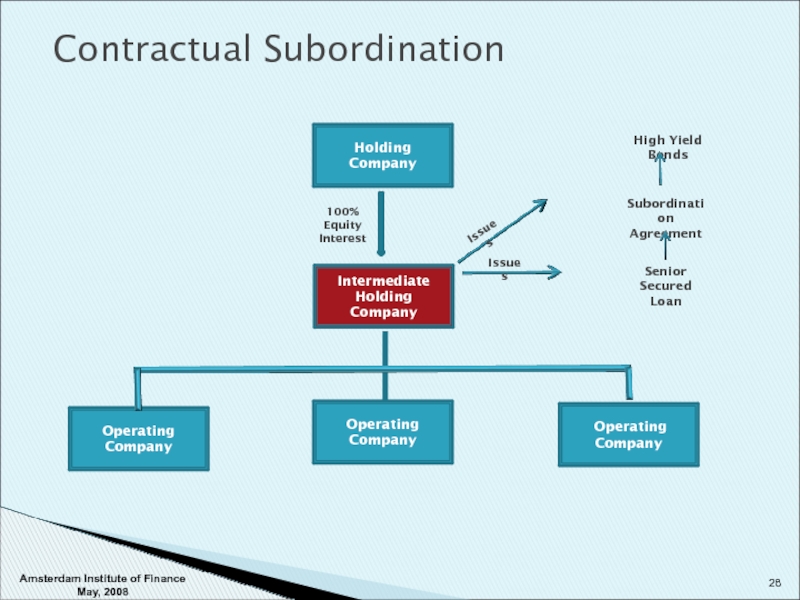

Слайд 28

Contractual Subordination

Holding Company

Intermediate Holding Company

Operating Company

Operating Company

Operating

Company

100% Equity

Interest

Issues

Issues

High Yield Bonds

Subordination

Agreement

Senior

Loan

Amsterdam Institute of Finance May, 2008

Слайд 29

Structural Subordination

Holding Company

Intermediate Holding Company

Operating Company

Operating Company

Operating

Company

100% Equity

Interest

Issues

Issues

High Yield Bonds

Support

Senior Secured

Loan

Amsterdam Institute of Finance May, 2008

Слайд 30Retranche

Increase Pricing

Lower Leverage

Lower Purchase Price

Seller Paper

Increase Equity

Senior Notes to cover Amortizing

Term Loan Carve-Out

Asset Sales

Second Lien

Debt covenants

Fixing Broken Deal

Amsterdam Institute of Finance May, 2008

Слайд 32PURPOSE: maintain the original deal

WHY

Agency problem due to asymmetric information

Adverse Selection

Moral

FOCUS

Asset Substitution

Cash Control

Payment and asset priority

Covenants - Fundamentals

Amsterdam Institute of Finance May, 2008

Слайд 33Categories

Affirmative

The maintenance, preservation and insurance of corporate assets and the compliance

Negative

Limit or prohibit the company from undertaking certain actions which would lower the overall credit quality or damage a potential secondary repayment source

Financial

Provide an early warning for deteriorating operating performance

Approach

Maintenance (Preserving the credit)

Incurrence (Maintaining relative priority of claim)

Covenants – Categories and Approach

Amsterdam Institute of Finance May, 2008

Слайд 34There are no standard covenants.

They must be tailor fit for

The steps in structuring the covenants are:

Identify the risks (Business, Financial & Structural)

Select Covenants to monitor the risks

- Need to prioritize the risks to monitor because it will be impossible to monitor every risk

- The time and costs to monitor the covenants must be considered (i.e. sometimes one covenant can cover multiple risks)

Set Appropriate Levels

- Want the covenants to trigger a warning before any principal or interest payments become delinquent. Need to factor in any seasonal needs to the covenant levels.

Structuring Covenants

Amsterdam Institute of Finance May, 2008

Слайд 35First-lien leveraged loans covenant statistics: Average number and distribution Excludes covenant-lite

Amsterdam Institute of Finance May, 2008

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

Слайд 36Amsterdam Institute of Finance May, 2008

Incidence of key covenants in first-lien

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

Слайд 37Amsterdam Institute of Finance May, 2008

Year One Debt/EBITDA Headroom as a

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

Слайд 38Amsterdam Institute of Finance May, 2008

Percent of First-lien leveraged loans with

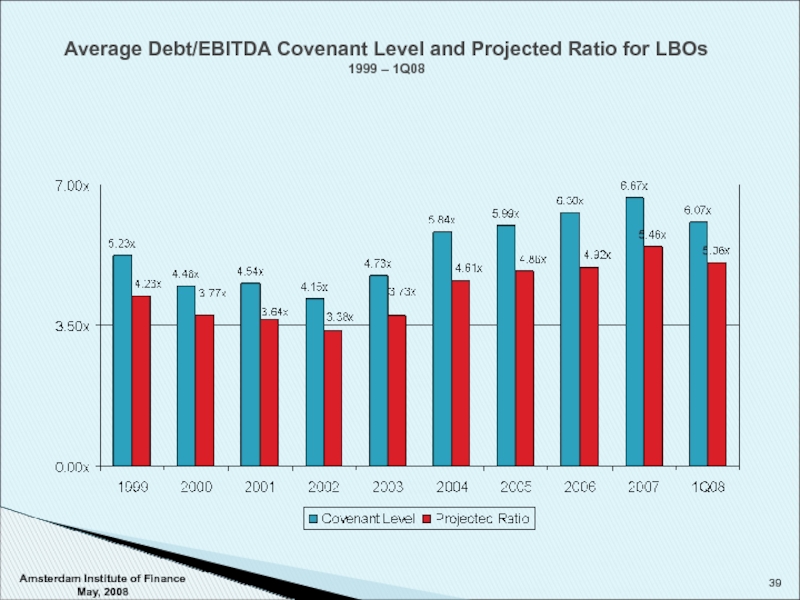

Слайд 39Average Debt/EBITDA Covenant Level and Projected Ratio for LBOs

1999 – 1Q08

Amsterdam

Слайд 40Covenant Levels and Issues

Covenants are negotiated between the lender and borrower.

Covenant

Other covenant issues include releases, voting rights and baskets.

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

Amsterdam Institute of Finance May, 2008

Слайд 41Translating Capital Structure and Debt Capacity into a Detailed Financing Structure.

Conclusion

Amsterdam

Слайд 43Project Gear - Facts

Potential deal for a company in auction.

Private automotive

Our client, financial sponsor (RCC) looking to bid on the transaction.

May use this transaction as a platform.

Valuation range is 6x-8x EBITDA (or 63mm-84mm). A number of bidders.

The sponsor has a successful buyout fund (returns exceed 25% p.a.)

Avoidable private company expenses net of other adjustments are a maximum of 1 mm per annum.

Contracts/Relationships with OEMs should preserve sales and markets provide future achievable 5% growth. Could be as high as 10%.

Currently sales/assets mostly within Europe, in major economies.

Opportunities for growth through acquisition.

Amsterdam Institute of Finance May, 2008

Слайд 49Project Gear - Base Case

Assumptions : 8 % growth

Margins gradually improve to

Allow 1 mln addbacks

Capex 3.0% / Working Capital 12.8% / Tax 35%

Results : Senior Debt pays off in 5 years (Term loans quicker)

Net cash position by year 8-9

Equity returns strong (until cash builds) based on 7x exit

Room for acquisitions / growth / recapitalization

Amsterdam Institute of Finance May, 2008

Слайд 51Project Gear - Downside

Assumptions : 0% growth

Margins flat (slight decline) to 11%

Do

Capex 3.0% / Working Capital 13% / Tax 35%

Results : Senior Debt pays off slowly but still within 7-8 years

Term loan amortization still met

Equity returns weak

Limited room for acquisitions / growth / recapitalization

Amsterdam Institute of Finance May, 2008

Слайд 53Project Gear - Worst Case

Assumptons : 0% growth AND LBO/other causes lead

(loss of >10% of sales in year one follow by >5% in year 2 because of

inability to respond)

Margins decline to 9% and then 8.5%

Do not allow 1 mln addbacks

Capex 4% (committed on lower sales / respond to issues)

Working Capital 13% / Tax 35%

Results : Senior Debt (increases / no liquidity by yr 2-3)

Never in net cash position

Equity returns gone - Need for new equity !

No flexibility

Amsterdam Institute of Finance May, 2008

Слайд 55Project Gear - Responses (How & When)

Year 2007 - Probably waive

Year 2008 - Probably amend and tighten up :

Refinance ?

Reporting ?

Asset Sales ?

Inter-creditor ?

Year 2009

No improvement

No liquidity

WHAT NOW ?

Amsterdam Institute of Finance May, 2008