Image source: Dow Chemical

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Stocks to Buy: 5 Reasons Value Investors Should Consider Dow Chemical Today презентация

Содержание

- 1. Stocks to Buy: 5 Reasons Value Investors Should Consider Dow Chemical Today

- 2. Diversity: Helps reduce earnings volatility 1

- 3. Diverse businesses Performance plastics

- 4. Diverse end markets Dow’s

- 5. Innovative leadership: A compelling competitive advantage 2

- 6. Full steam ahead Dow demonstrated its innovative

- 7. Solid foundation for the future

- 8. Strong operational performance and financials 3

- 9. Growing profits Dow’s net profit has more

- 10. Rapidly rising EBITDA* *EBITDA = Earnings before

- 11. How is Dow pulling it off? Through

- 12. Strong financials Key stats as of June

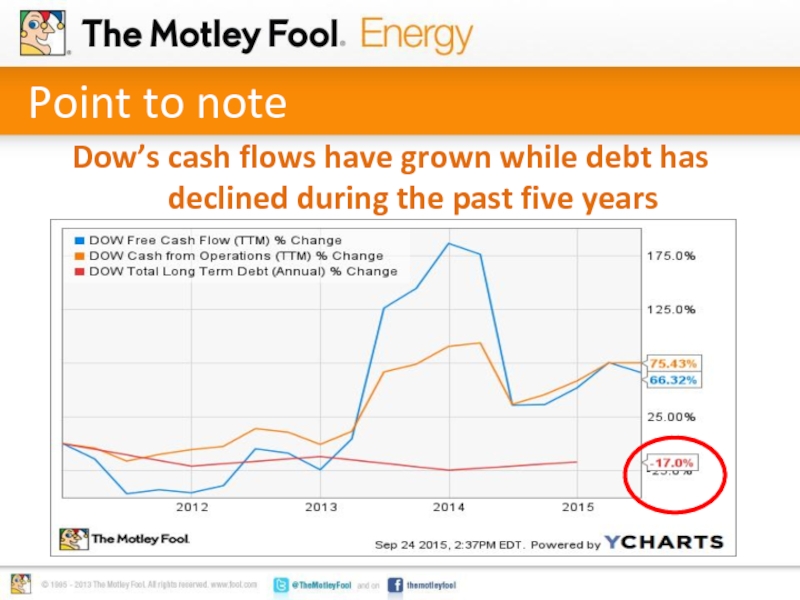

- 13. Point to note Dow’s cash flows have

- 14. Big-ticket growth plans = solid foundation for the future 4

- 15. Investing for growth Major

- 16. Investing for growth Key projects include

- 17. Impressive shareholder returns 5

- 18. Value for shareholders Dow demonstrated its commitment

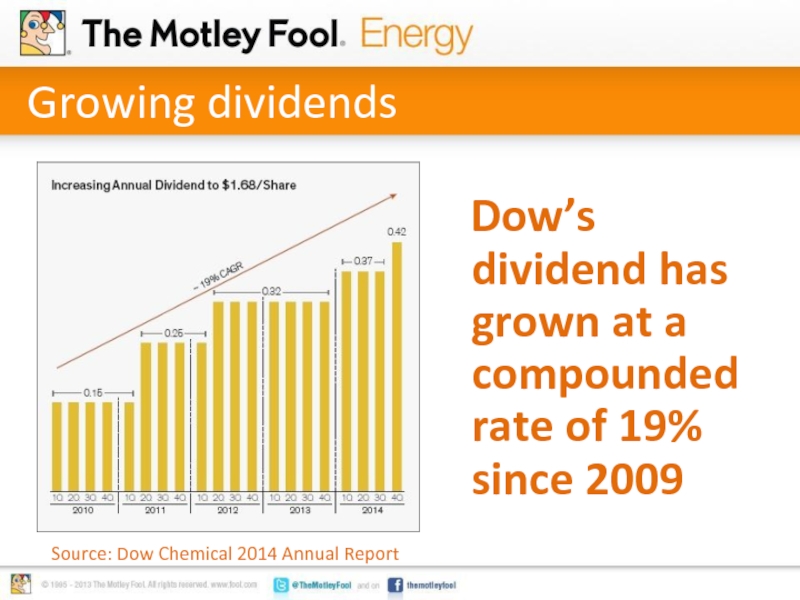

- 19. Growing dividends Dow’s dividend has

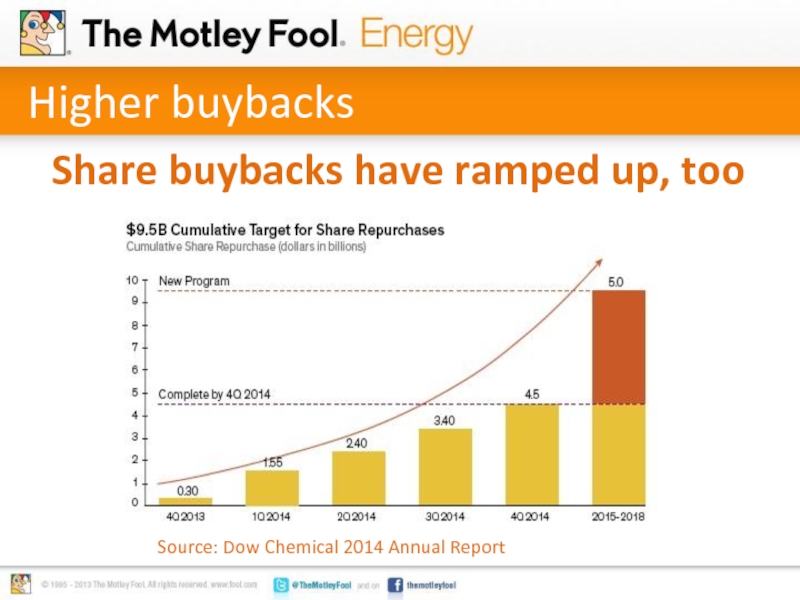

- 20. Higher buybacks Share buybacks have ramped up, too Source: Dow Chemical 2014 Annual Report

- 21. To sum up Dow Chemical measures up

- 22. This Could Be The Next Billion-Dollar iSecret

Слайд 1Stocks to Buy: 5 Reasons Value Investors Should Consider Dow Chemical

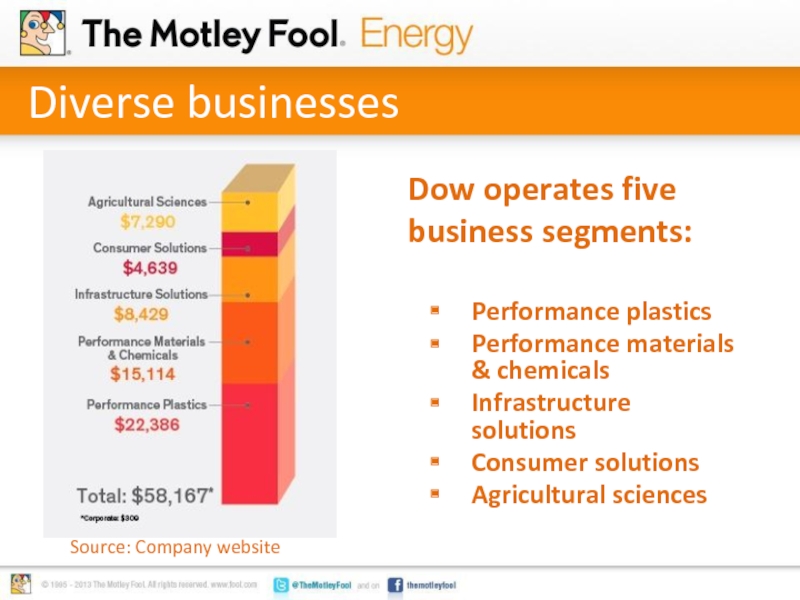

Слайд 3Diverse businesses

Performance plastics

Performance materials & chemicals

Infrastructure solutions

Consumer solutions

Agricultural sciences

Dow operates five business segments:

Source: Company website

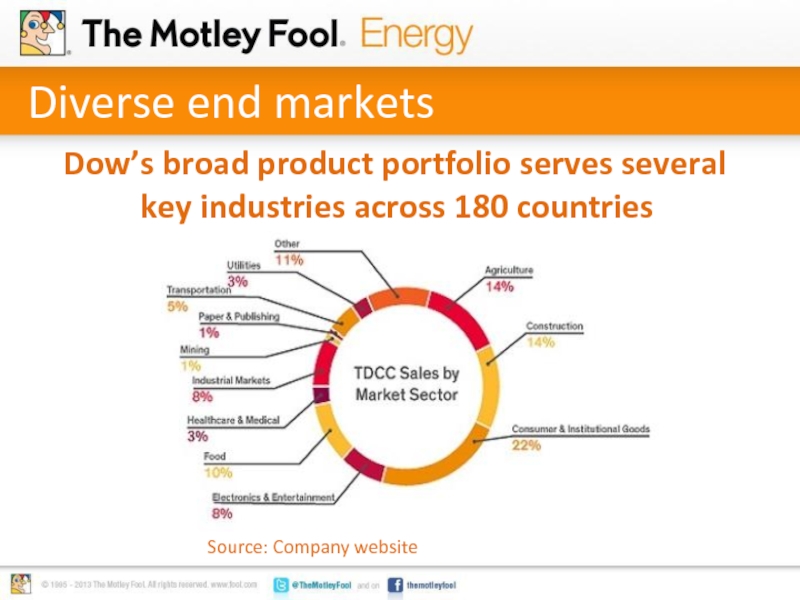

Слайд 4Diverse end markets

Dow’s broad product portfolio serves several

Source: Company website

Слайд 6Full steam ahead

Dow demonstrated its innovative leadership last year, with

More than

635 new U.S. patents – a record for the company

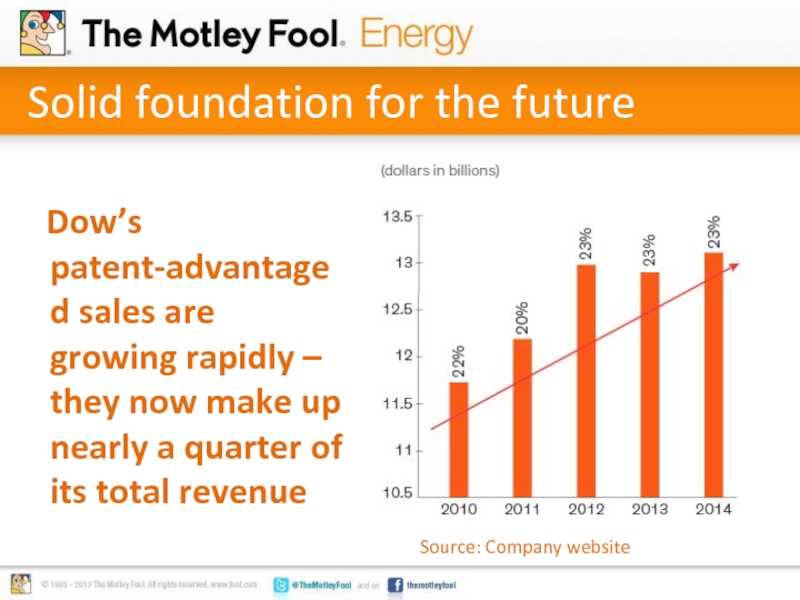

Слайд 7Solid foundation for the future

Dow’s patent-advantaged sales are growing

Source: Company website

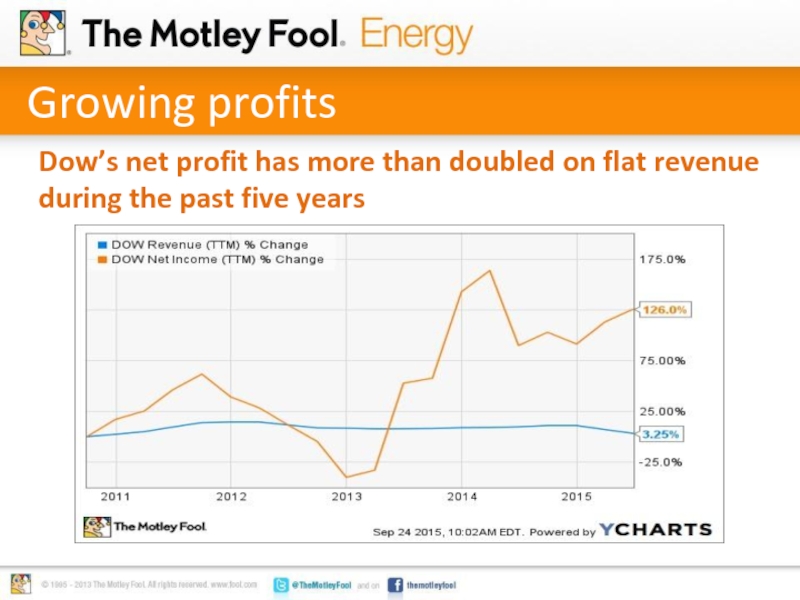

Слайд 9Growing profits

Dow’s net profit has more than doubled on flat revenue

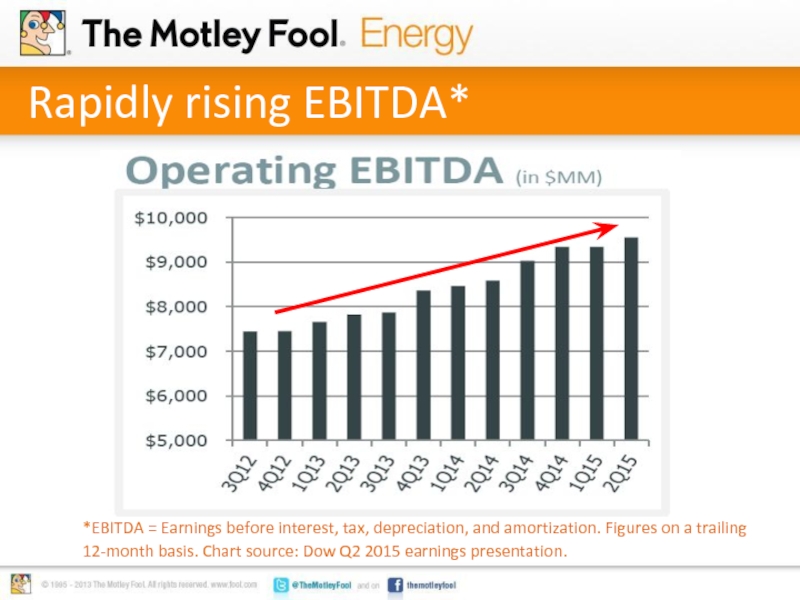

Слайд 10Rapidly rising EBITDA*

*EBITDA = Earnings before interest, tax, depreciation, and amortization.

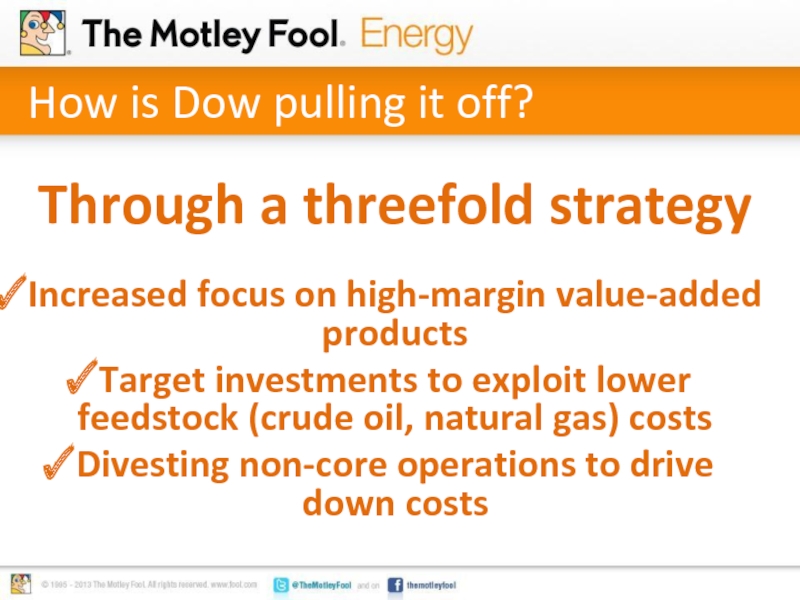

Слайд 11How is Dow pulling it off?

Through a threefold strategy

Increased focus on

Target investments to exploit lower feedstock (crude oil, natural gas) costs

Divesting non-core operations to drive down costs

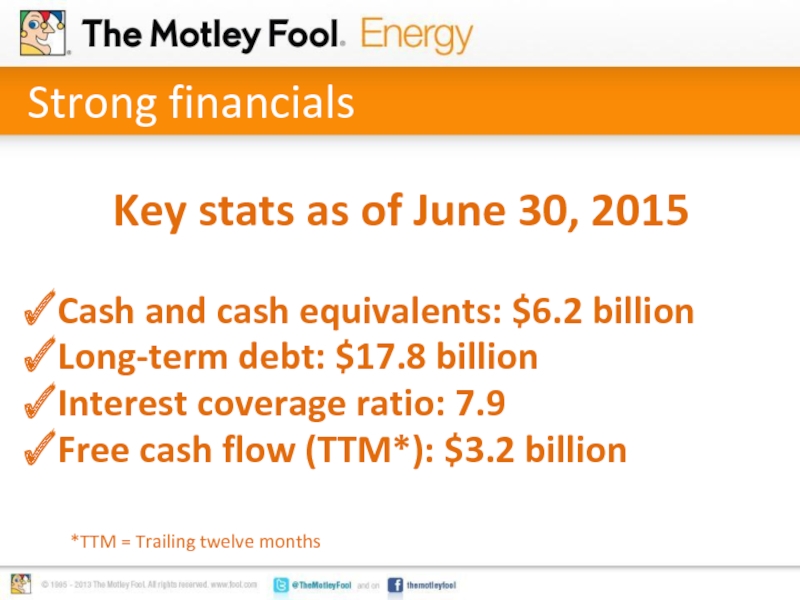

Слайд 12Strong financials

Key stats as of June 30, 2015

Cash and cash equivalents:

Long-term debt: $17.8 billion

Interest coverage ratio: 7.9

Free cash flow (TTM*): $3.2 billion

*TTM = Trailing twelve months

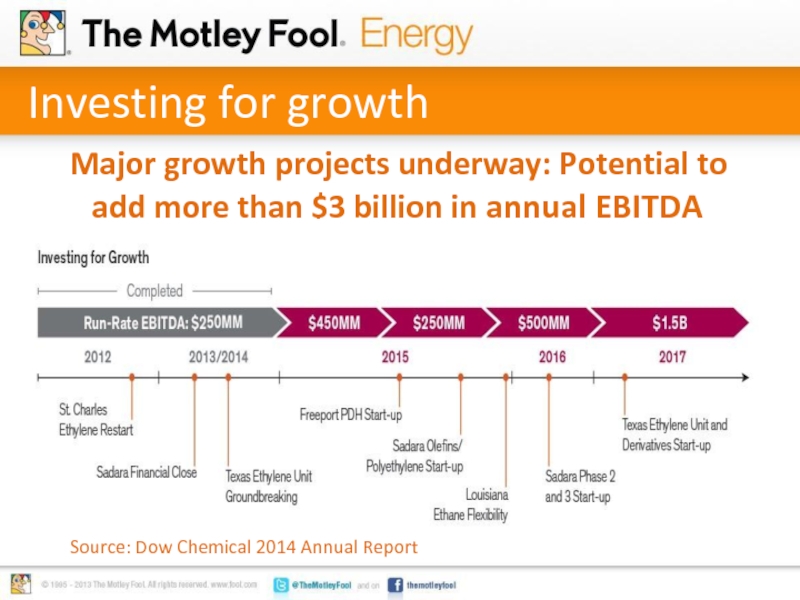

Слайд 15Investing for growth

Major growth projects underway: Potential to

Source: Dow Chemical 2014 Annual Report

Слайд 16Investing for growth

Key projects include

Sadara: Dow-Saudi Aramco joint venture to build

New ethylene, propylene production plants in Texas

Слайд 18Value for shareholders

Dow demonstrated its commitment to shareholders in 2014, when

Increased its dividend twice

Expanded its share repurchase program to $9.5 billion from $4.5 billion

Слайд 19Growing dividends

Dow’s dividend has grown at a compounded rate

Source: Dow Chemical 2014 Annual Report