- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

SaaS Money Metrics: Why VCs Should Focus More on Retention Than GrowthJune 2014 презентация

Содержание

- 1. SaaS Money Metrics: Why VCs Should Focus More on Retention Than GrowthJune 2014

- 2. SaaS Money Metrics About IVP SaaS Market Overview Measuring SaaS Efficiency Retention is King

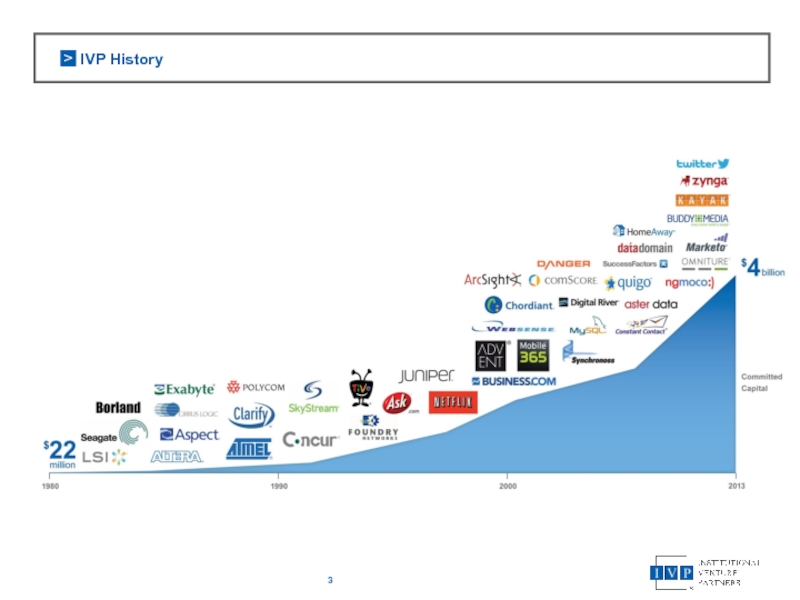

- 3. IVP History

- 4. IVP Summary Current Fund: IVP XIV, a $1

- 5. IVP SaaS Investments

- 6. SaaS Money Metrics About IVP SaaS Market Overview Measuring SaaS Efficiency Retention is King

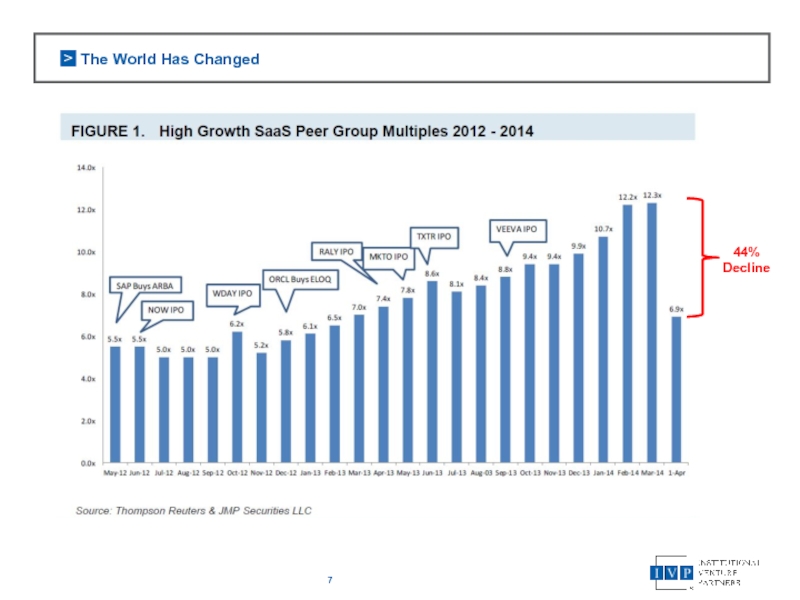

- 7. The World Has Changed 44% Decline

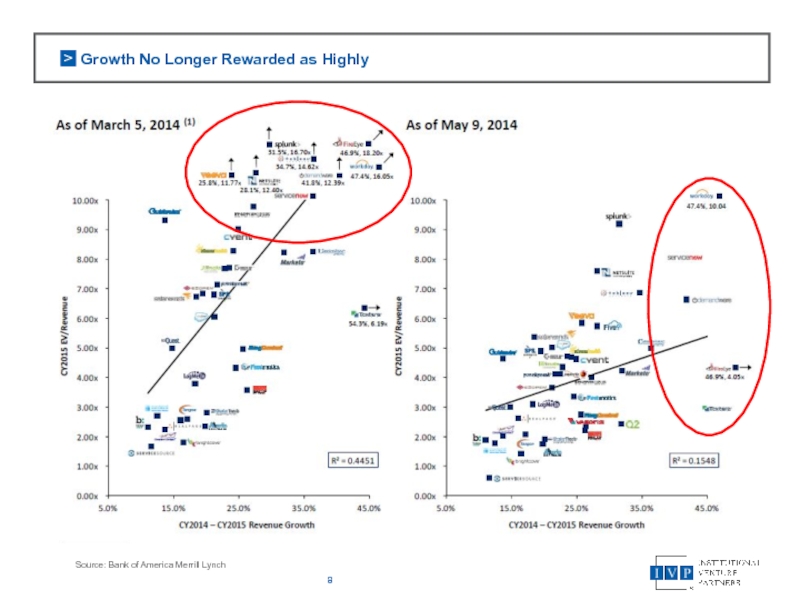

- 8. Growth No Longer Rewarded as Highly Source: Bank of America Merrill Lynch

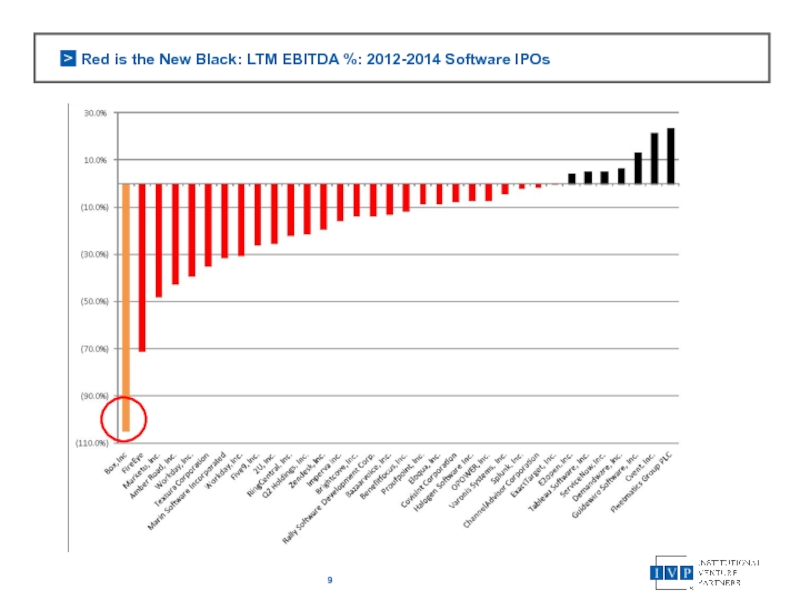

- 9. Red is the New Black: LTM EBITDA %: 2012-2014 Software IPOs

- 10. SaaS Money Metrics About IVP SaaS Market Overview Measuring SaaS Efficiency Retention is King

- 11. ThrustSSC 760 MPH .04 MPG

- 12. Chevy Spark EV 89 MPH 128 MPG

- 13. Two Measures of SaaS Efficiency Magic Number LTV / CAC

- 14. Magic Number Magic Number = (Q1 GP$

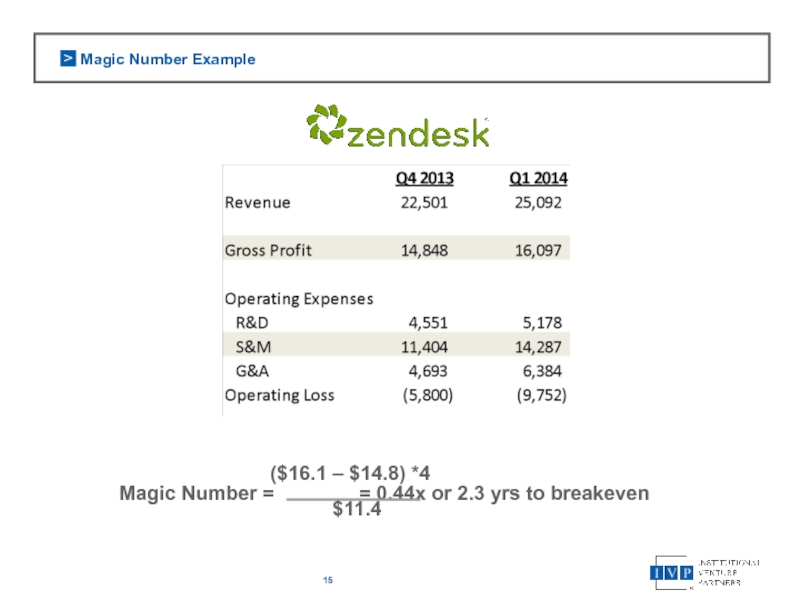

- 15. Magic Number Example Magic Number = = 0.44x

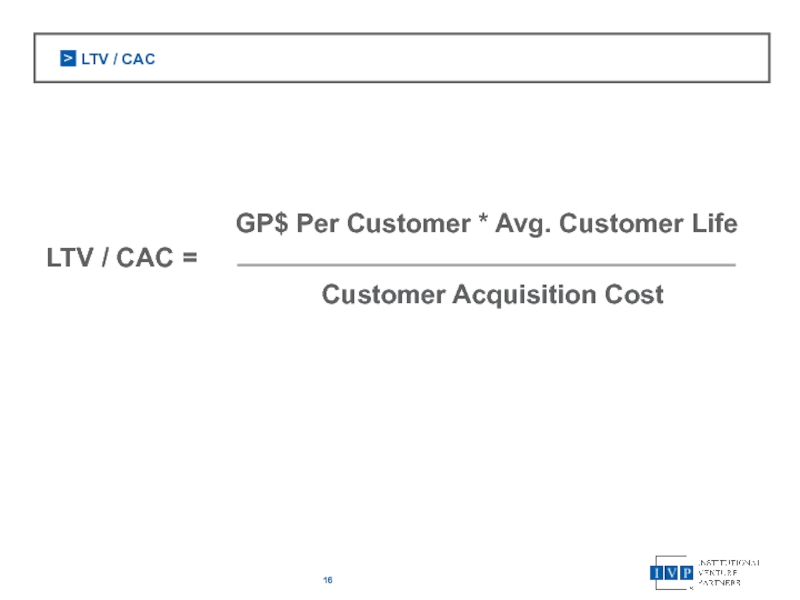

- 16. LTV / CAC LTV / CAC =

- 17. LTV / CAC Example LTV / CAC

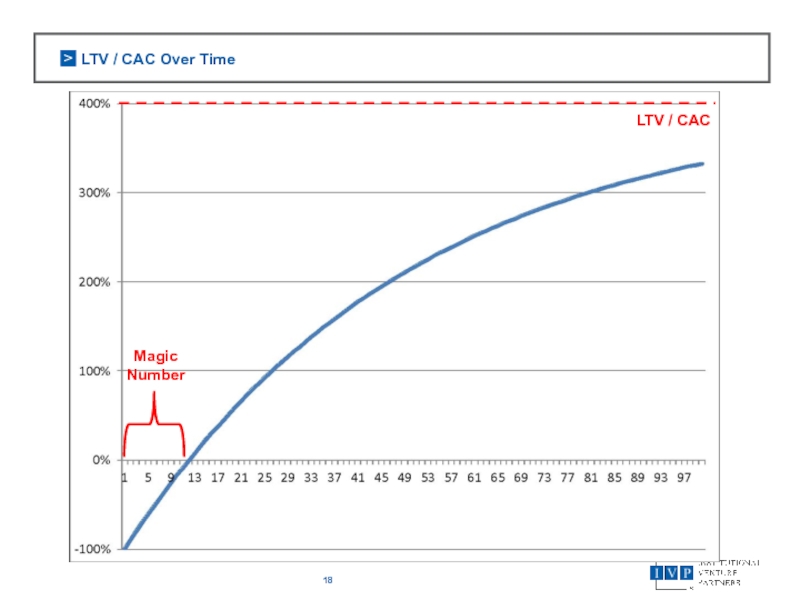

- 18. LTV / CAC Over Time Magic Number LTV / CAC

- 19. SaaS Efficiency Goals Magic Number = Above

- 20. SaaS Money Metrics About IVP SaaS Market Overview Measuring SaaS Efficiency Retention is King

- 21. Retention Trumps Growth Company A $200K New

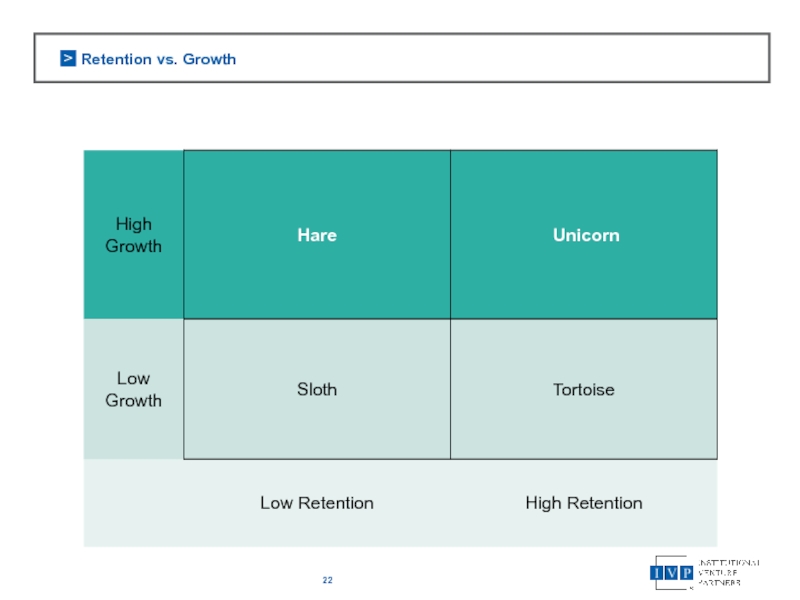

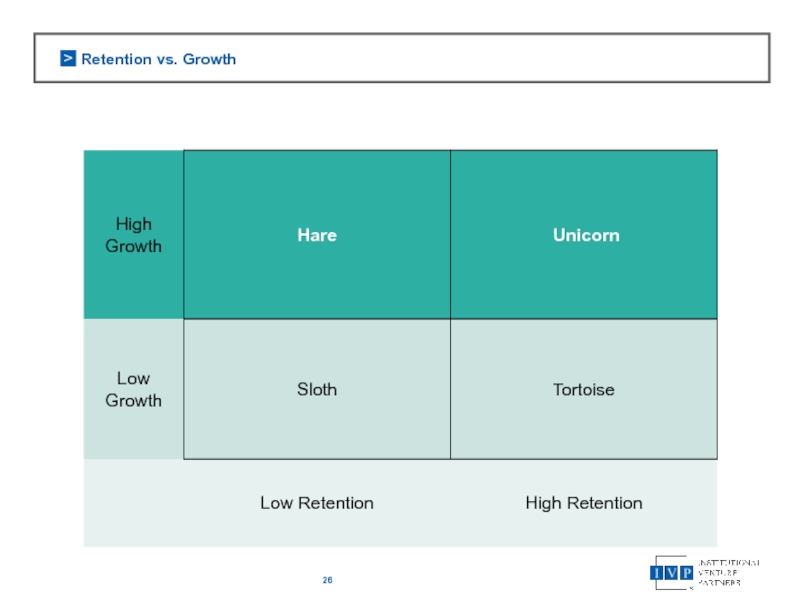

- 22. Retention vs. Growth

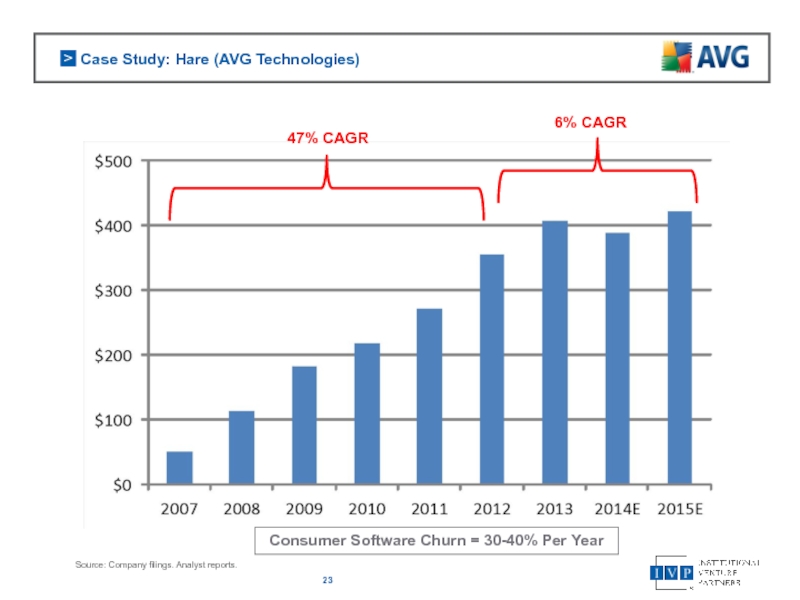

- 23. Case Study: Hare (AVG Technologies) Source: Company

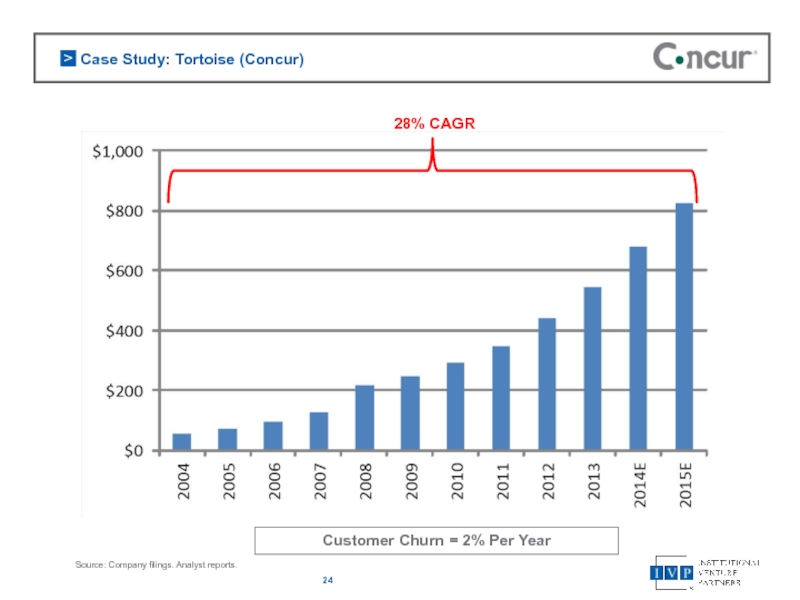

- 24. Case Study: Tortoise (Concur) 28% CAGR

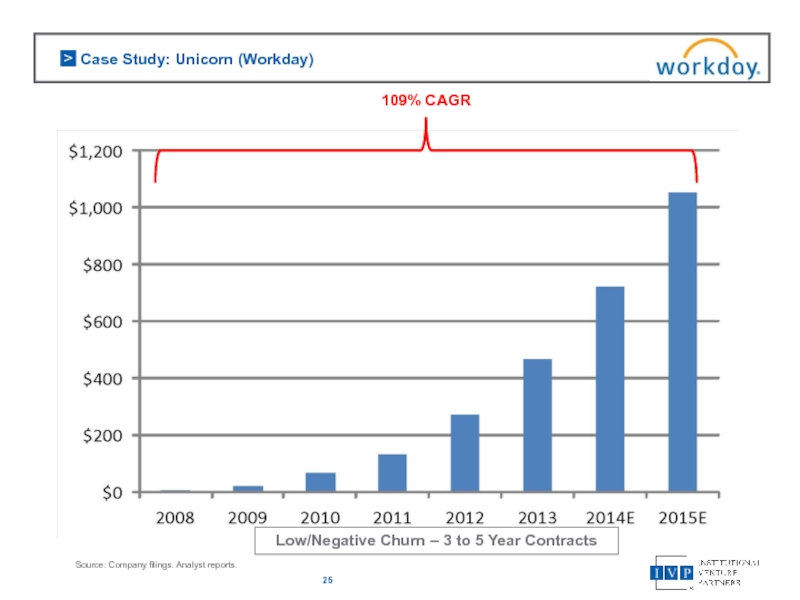

- 25. Case Study: Unicorn (Workday) 109% CAGR

- 26. Retention vs. Growth

- 27. Retention vs. Growth

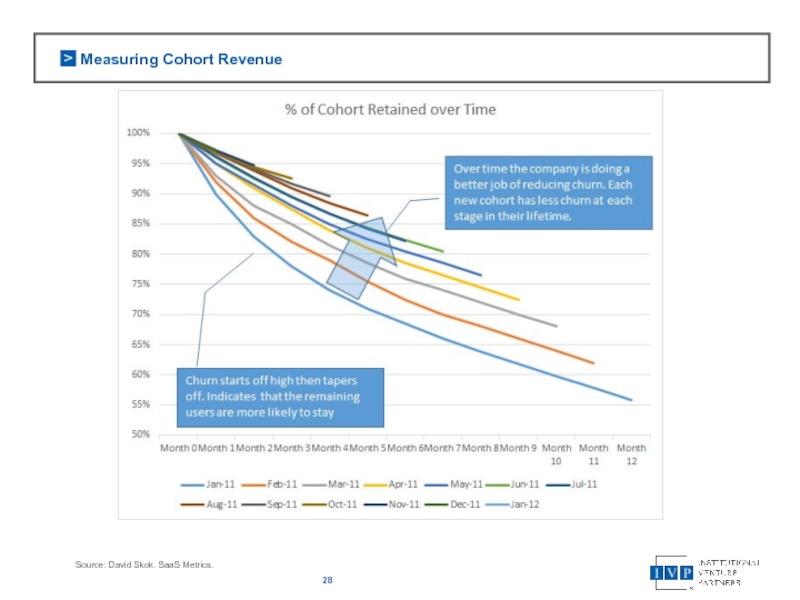

- 28. Measuring Cohort Revenue Source: David Skok. SaaS Metrics.

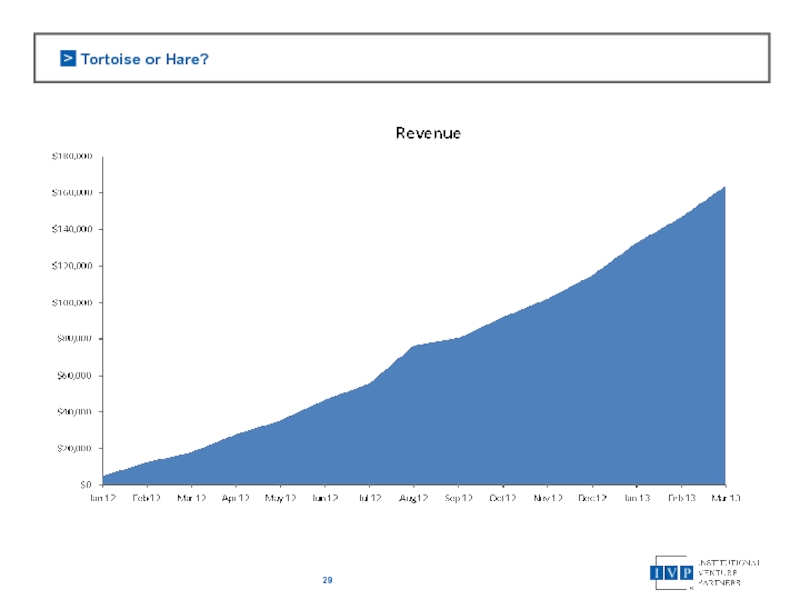

- 29. Tortoise or Hare?

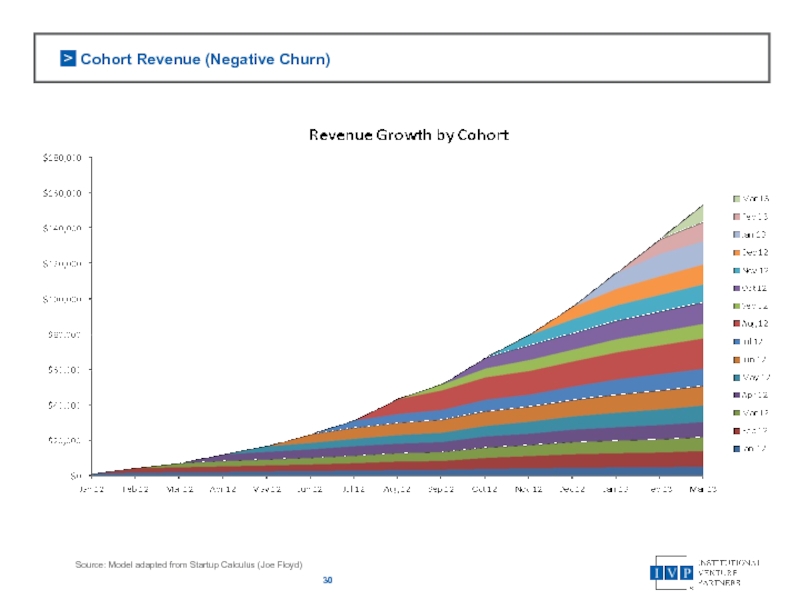

- 30. Cohort Revenue (Negative Churn) Source: Model adapted from Startup Calculus (Joe Floyd)

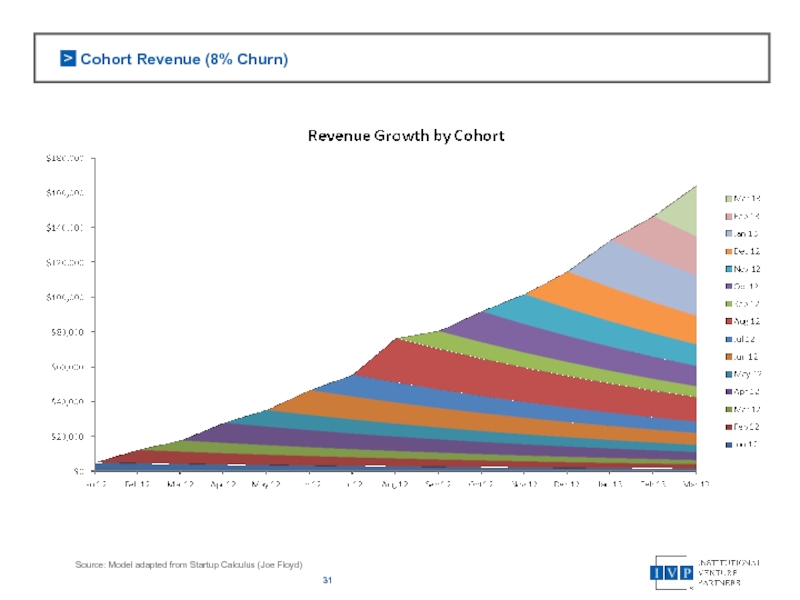

- 31. Source: Model adapted from Startup Calculus (Joe Floyd) Cohort Revenue (8% Churn)

- 32. Questions Jules Maltz General Partner, IVP jmaltz@ivp.com @julesmaltz Thank You!

Слайд 4IVP Summary

Current Fund: IVP XIV, a $1 billion later-stage venture capital fund

Target

Investment Focus: Growth companies, generally with over $10 million in revenue

Geography: Primarily United States

Team: 6 General Partners with over 100 years of combined experience

Portfolio: Over 300 companies, 99 of which have gone public

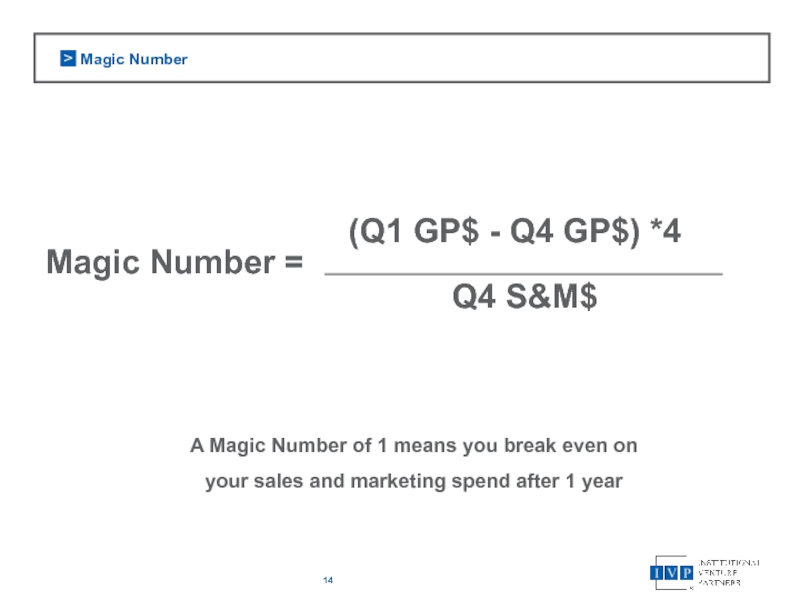

Слайд 14Magic Number

Magic Number =

(Q1 GP$ - Q4 GP$) *4

Q4 S&M$

A Magic

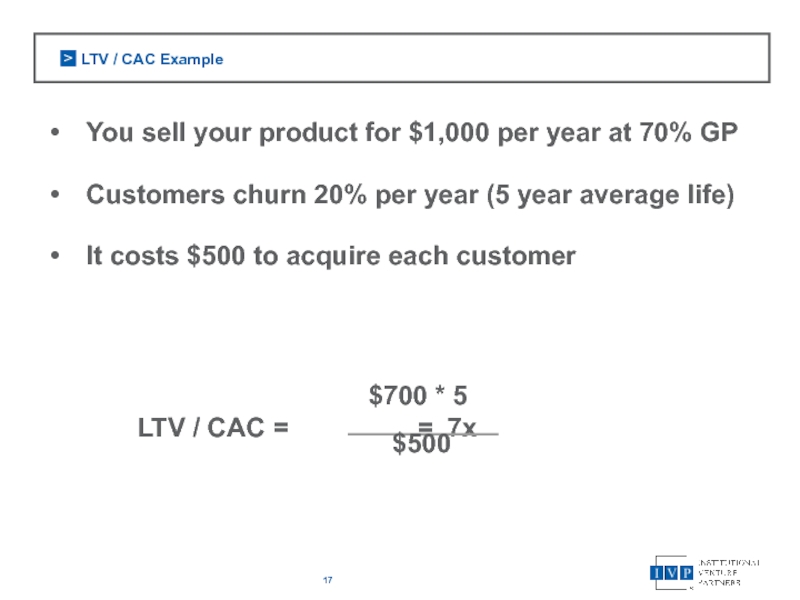

Слайд 17LTV / CAC Example

LTV / CAC = = 7x

$700 * 5

$500

You sell

Customers churn 20% per year (5 year average life)

It costs $500 to acquire each customer

Слайд 21Retention Trumps Growth

Company A

$200K New Revenue Per Month

90% Monthly Retention

3 Years

Company B

$100K New Revenue Per Month

99% Monthly Retention

3 Years Later = $3.1M Run-Rate

Слайд 23Case Study: Hare (AVG Technologies)

Source: Company filings. Analyst reports.

47% CAGR

6%

Consumer Software Churn = 30-40% Per Year

Слайд 24Case Study: Tortoise (Concur)

28% CAGR

Customer Churn = 2% Per Year

Source: Company

Слайд 25Case Study: Unicorn (Workday)

109% CAGR

Low/Negative Churn – 3 to 5 Year

Source: Company filings. Analyst reports.