- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Retirement Saving & Spending Study презентация

Содержание

- 1. Retirement Saving & Spending Study

- 2. Table of Contents Methodology Workers

- 3. Methodology 3,026 working adults 18+ currently contributing

- 4. WORKERS’ 401(k) ACCOUNTS

- 5. Market Value of 401(k) Plan Retirement

- 6. Base: Millennial workers Market Value of 401(k)

- 7. Personal Deferral Rate Retirement Saving and

- 8. 401(k) Contribution Compared With Past 12 Months

- 9. Recommended Contribution Retirement Saving and Spending Study

- 10. Increasing Your 401(k) Contribution Retirement Saving and

- 11. Reasons for Contributing Below the Maximum Retirement

- 12. Major Reasons for Contributing Below the Maximum

- 13. Influence of Match on Contribution Retirement Saving

- 14. Retirement Expectations Retirement Saving and Spending Study

- 15. Base: Workers Social Security By Worker Generation

- 16. AUTO-FEATURES AND TARGET DATE FUNDS

- 17. True of Target Date Funds Retirement Saving

- 18. True of Target Date Funds (cont.) Retirement

- 19. Market Value and Allocation of Assets Retirement

- 20. Satisfaction with Investments Overall Retirement Saving and

- 21. Automatic Enrollment Summary Retirement Saving and Spending

- 22. Opt Out Rate Retirement Saving and Spending

- 23. Base: Total workers who were enrolled automatically

- 24. Attitudes About Automatic Enrollment Retirement Saving and

- 25. Automatic Escalation Retirement Saving and Spending Study

- 26. SPENDING, SAVING, AND ADVICE

- 27. Dealing With Money Retirement Saving and Spending

- 28. Dealing With Money Retirement Saving and Spending

- 29. Dealing With Money (cont.) Retirement Saving and

- 30. Managing Spending Retirement Saving and Spending Study

- 31. Credit Card Spending Retirement Saving and Spending

- 32. Managing Credit Cards Differently Retirement Saving and

- 33. #1 Funding Financial Priority Retirement Saving and

- 34. #1 Funding Financial Priority (cont.) Retirement Saving

- 35. Sources of Funds for Emergency Retirement Saving

- 36. Advised Retirement Saving and Spending Study RSS2

- 37. On Track to Meet Financial Goals

- 38. Financial Well-Being Compared With Parents Compared

- 39. Perceived Job Security Base: Workers How concerned

- 40. PROFILES OF WORKERS WITH 401(k)S: MILLENNIALS, GEN X, AND BABY BOOMERS

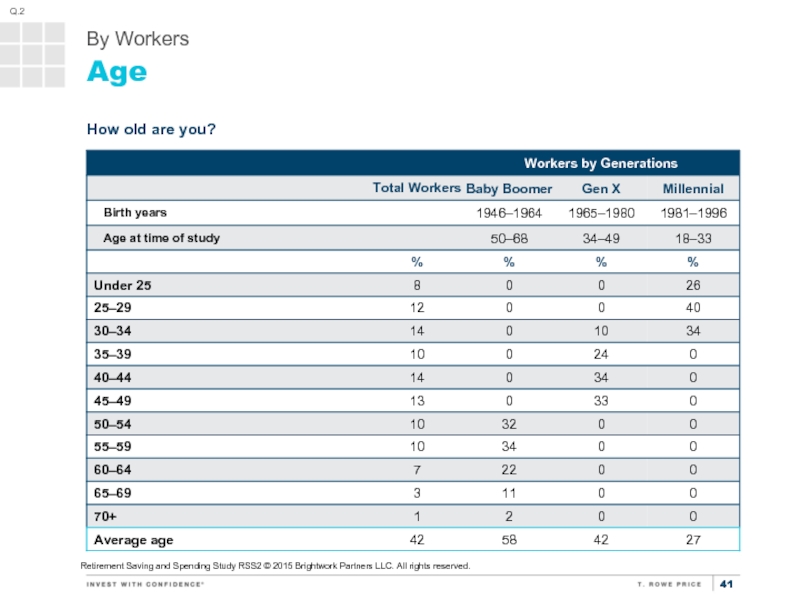

- 41. Age Q. 2 How old are

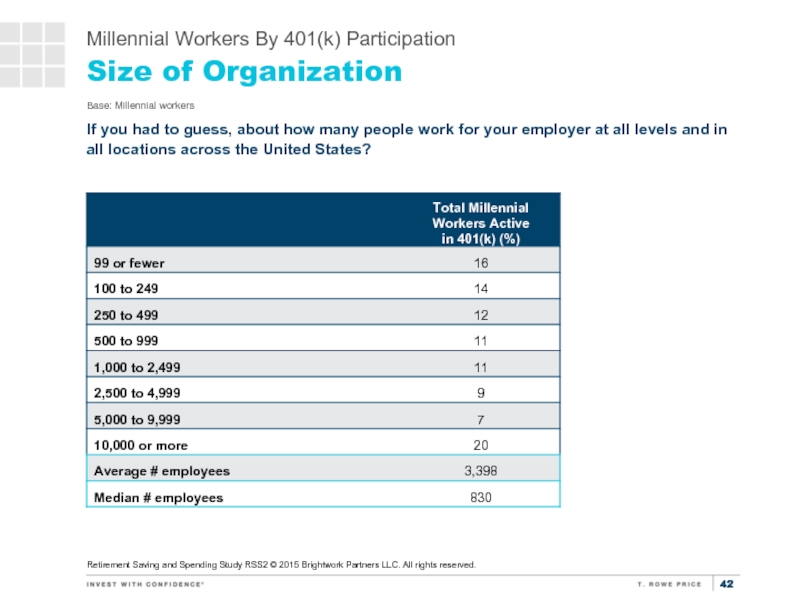

- 42. Size of Organization Retirement Saving and Spending

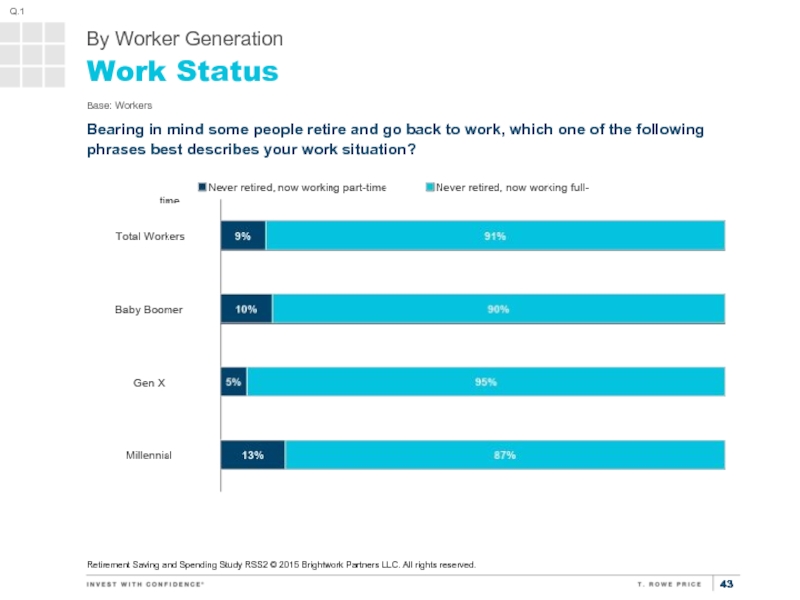

- 43. Work Status Base: Workers Bearing in mind

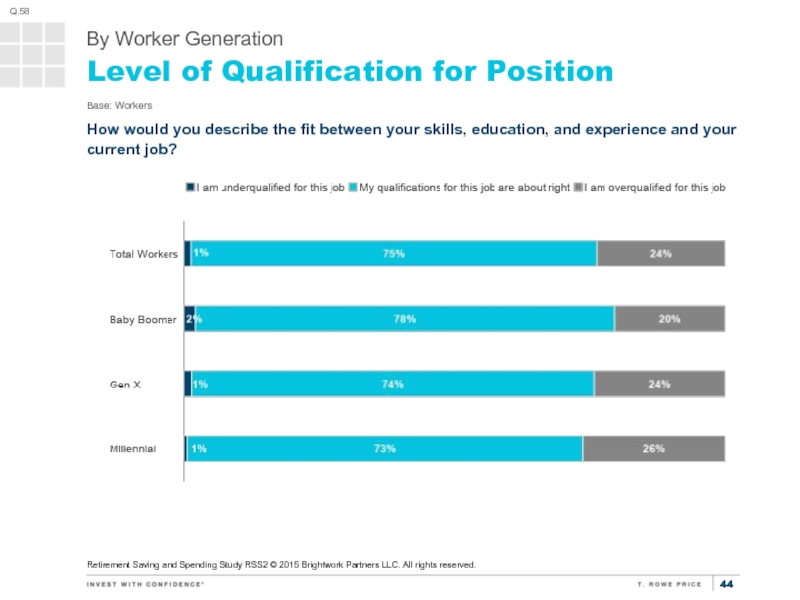

- 44. Level of Qualification for Position Base: Workers

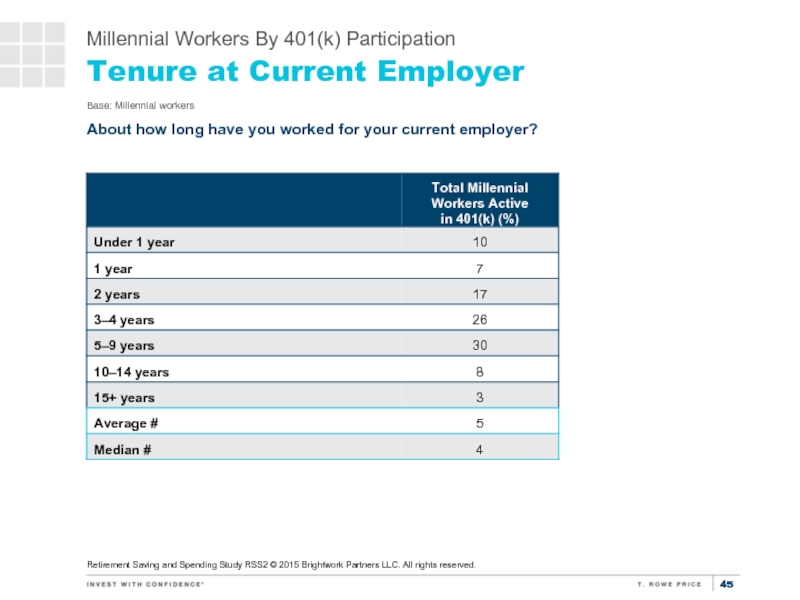

- 45. Tenure at Current Employer Base: Millennial workers

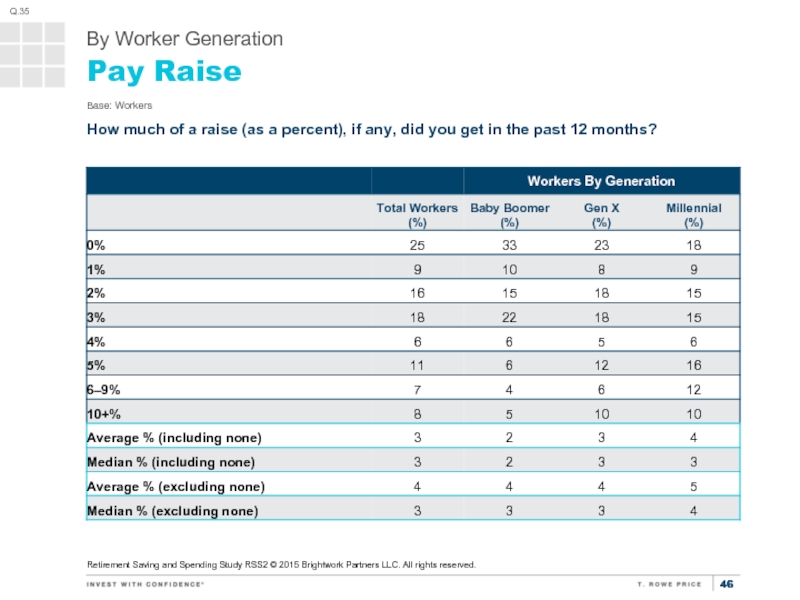

- 46. Pay Raise Base: Workers How much of

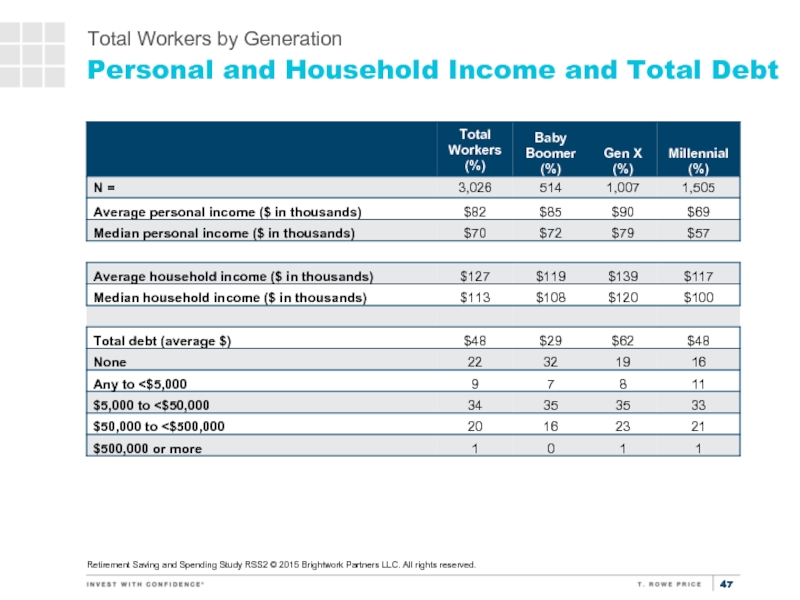

- 47. Personal and Household Income and Total Debt

- 48. MILLENNIALS WHO ARE ELIGIBLE TO PARTICIPATE IN

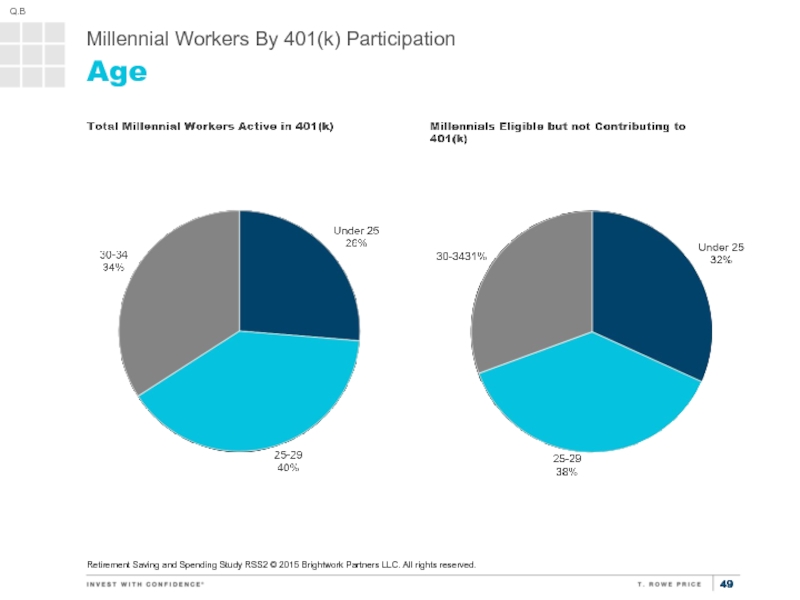

- 49. Age Q.B Retirement Saving and Spending

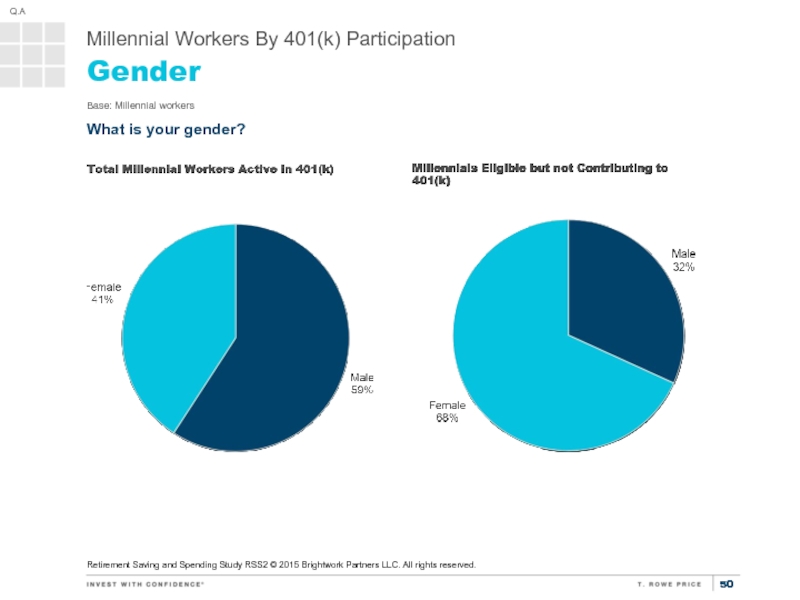

- 50. Gender Base: Millennial workers What is

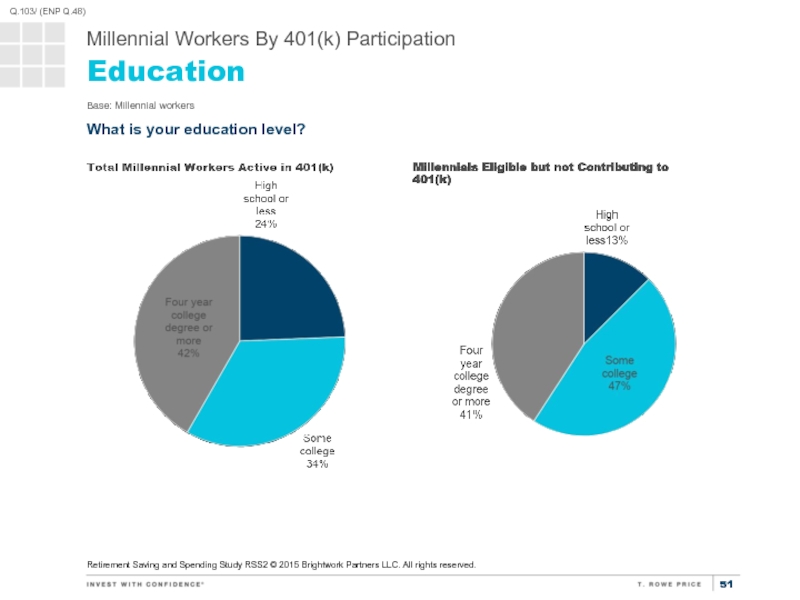

- 51. Education Base: Millennial workers What is your

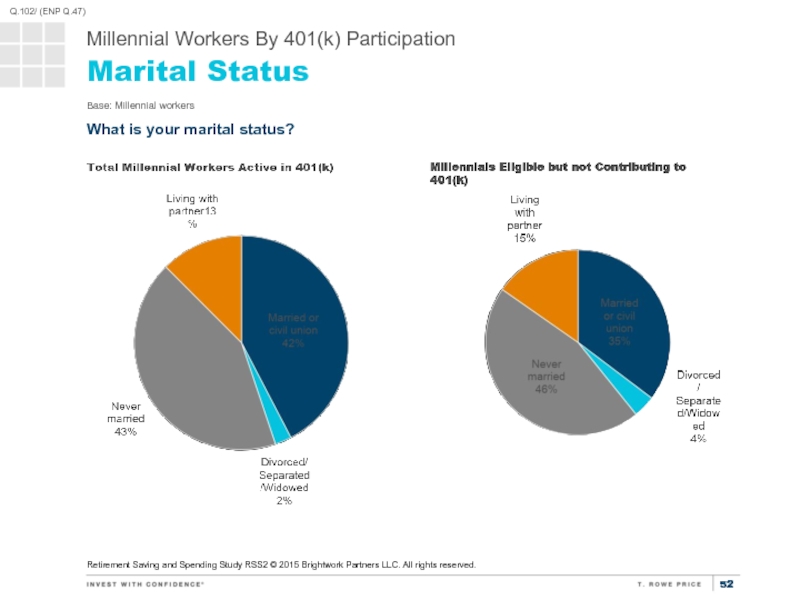

- 52. Marital Status Base: Millennial workers What is

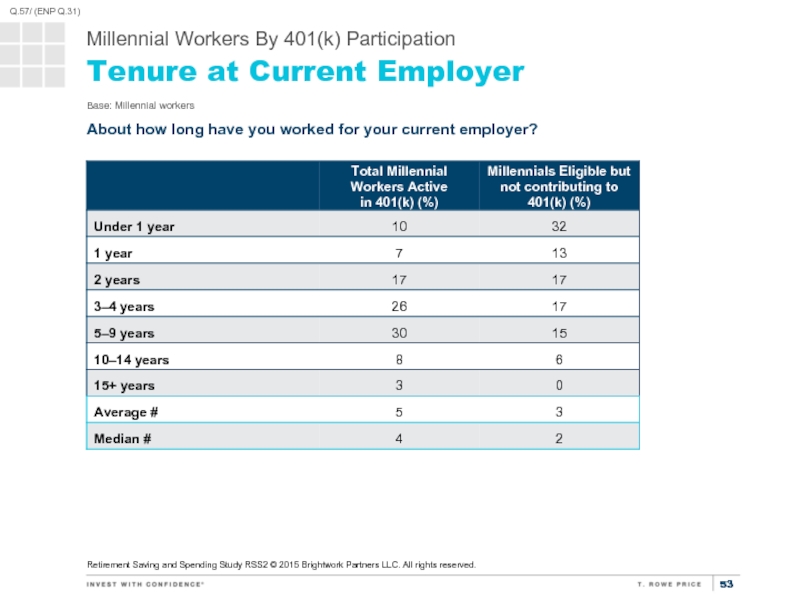

- 53. Tenure at Current Employer Base: Millennial workers

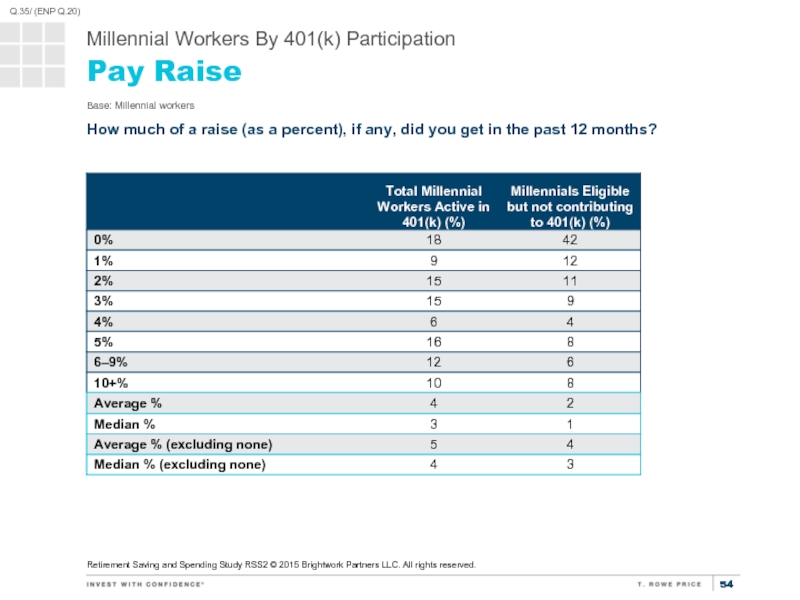

- 54. Pay Raise Base: Millennial workers How much

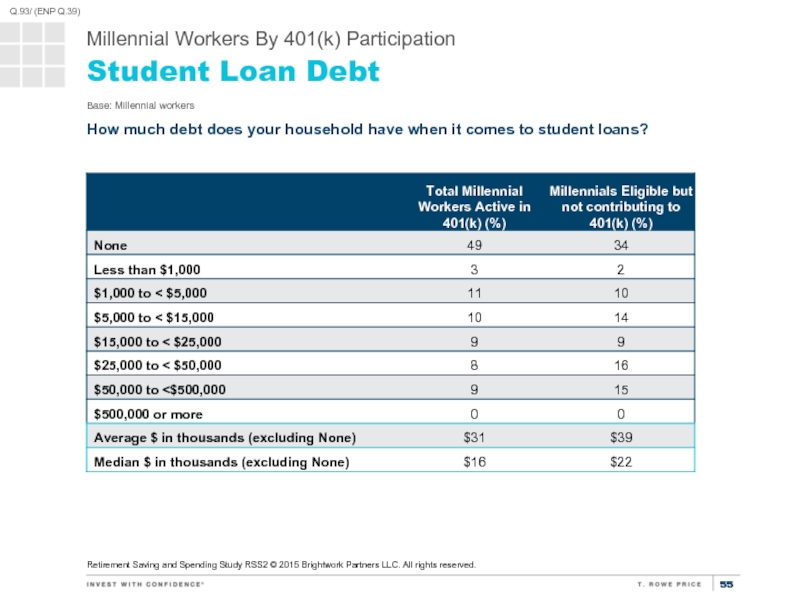

- 55. Student Loan Debt Base: Millennial workers How

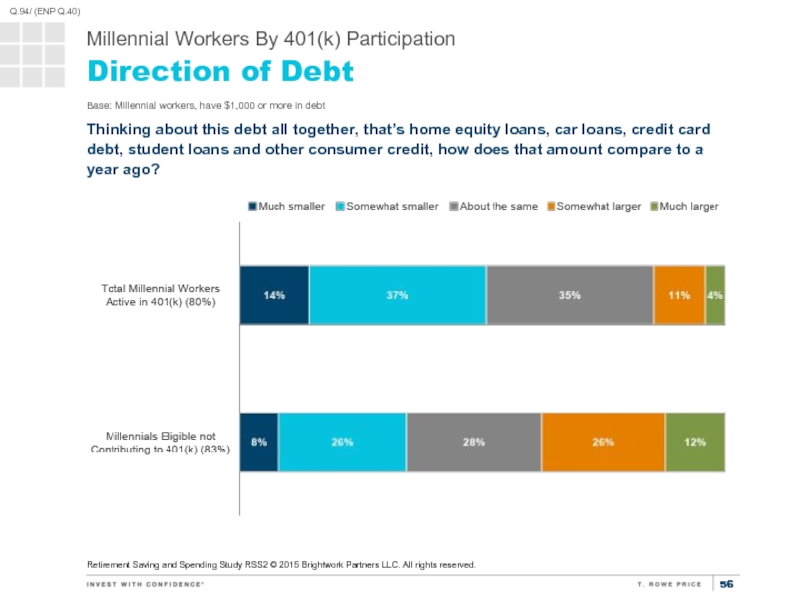

- 56. Direction of Debt Base: Millennial workers, have

- 57. Dealing With Money Base: Millennial workers, describes

- 58. Major Reasons for Contributing Below the Maximum

- 59. Financial Well-Being Compared With Parents Base: Millennial

- 60. RETIREES WHO SAVED IN 401(k)S

- 61. Age Average Age 63 How old are

- 62. How Long Ago Retired Base: Retirees; average:

- 63. Work Status Base: Retirees Bearing in mind

- 64. Relative Earnings Base: Retirees working full or

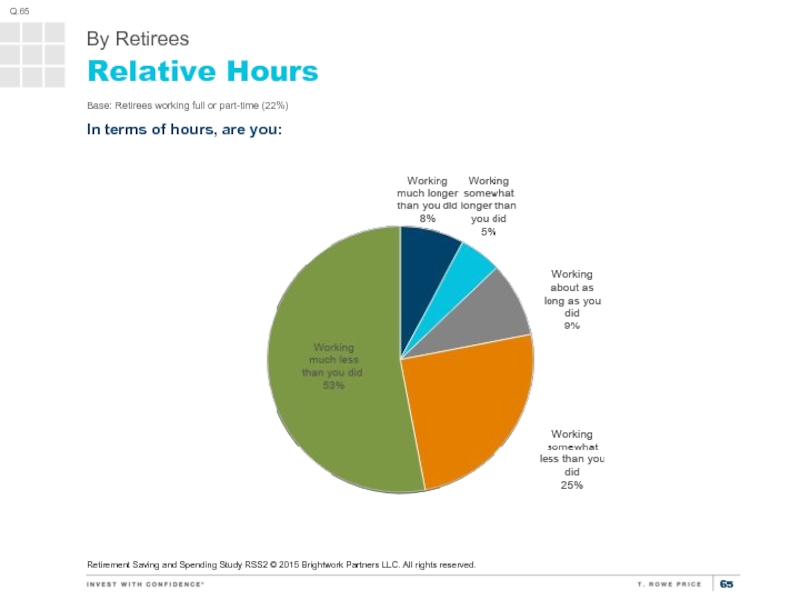

- 65. Relative Hours Base: Retirees working full or

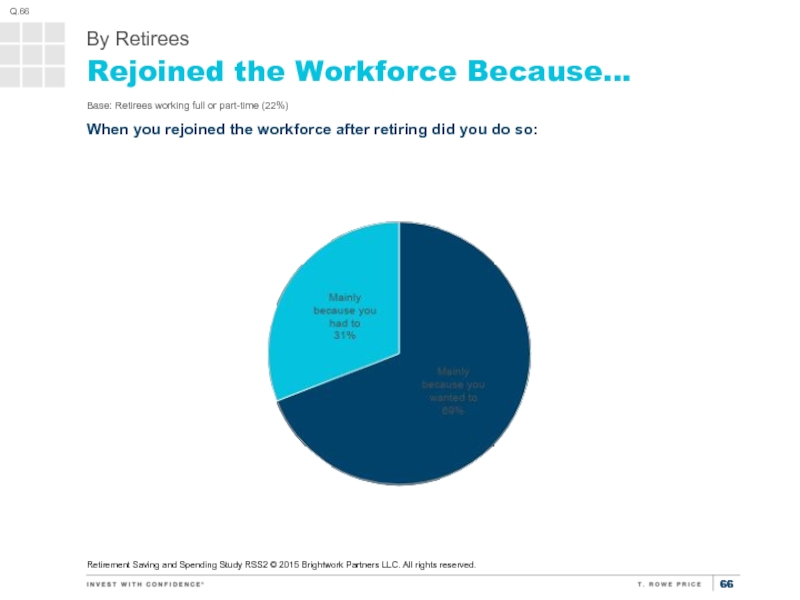

- 66. Rejoined the Workforce Because... Base: Retirees working

- 67. Looking for Work Because... Base: Retirees looking

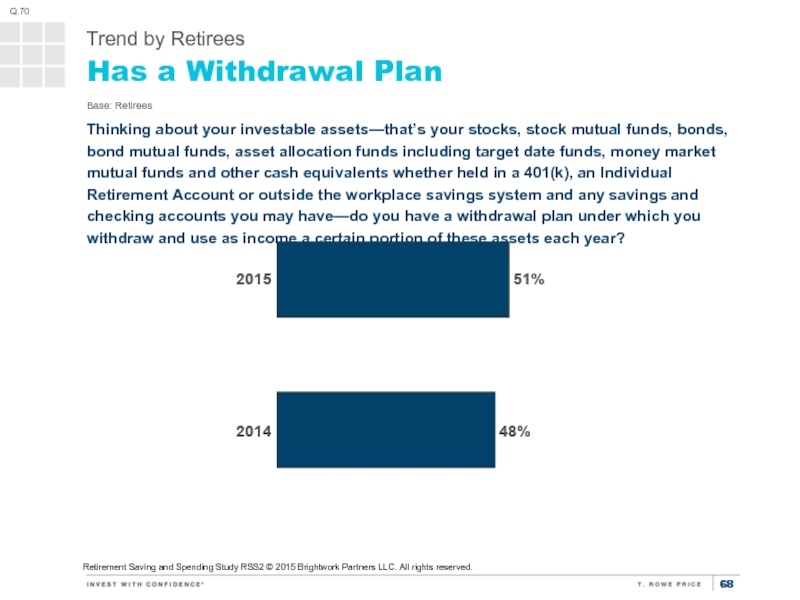

- 68. Has a Withdrawal Plan Base: Retirees Thinking

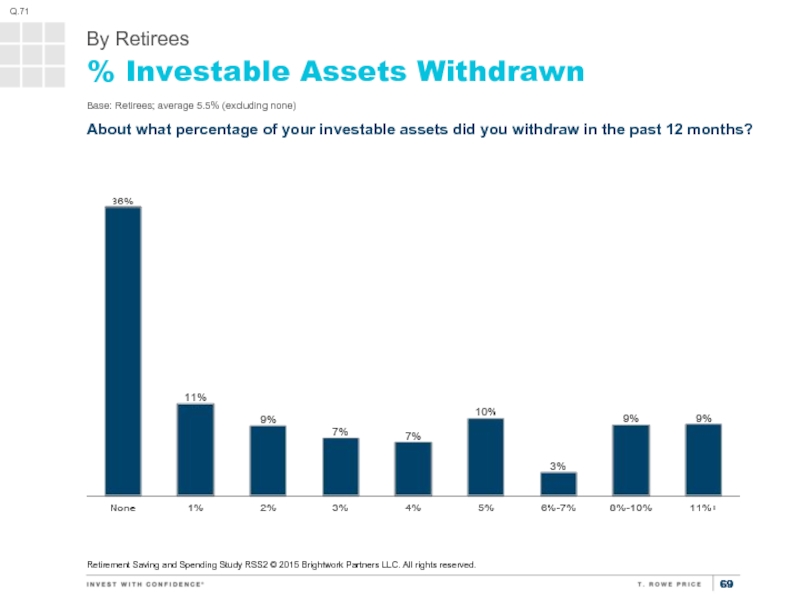

- 69. % Investable Assets Withdrawn Base: Retirees; average

- 70. Organizing Retirement Income "Very or Somewhat closely"

- 71. Sources of Retirement Income (Mean %) Base:

- 72. Compared With When Working Base: Retirees Compared

- 73. Proportion of Annual Income Replaced Base: Retirees;

- 74. True of My Retirement Base: Retirees Given

- 75. Financial Well-Being Compared With Parents Note only

- 76. On Track to Meet Financial Goals

- 77. Satisfaction in Retirement Base: Retirees All things

Слайд 2Table of Contents

Methodology

Workers with 401(k)s: Millennials, Gen X, and

Workers’ 401(k) Accounts

Auto-features and Target Date Funds

Saving, Spending and Advice

Profiles

Millennials who are eligible to participate in their employers’ 401(k) but do not (eligible but not contributing or non-savers)

Retirees who saved in 401(k)s

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved

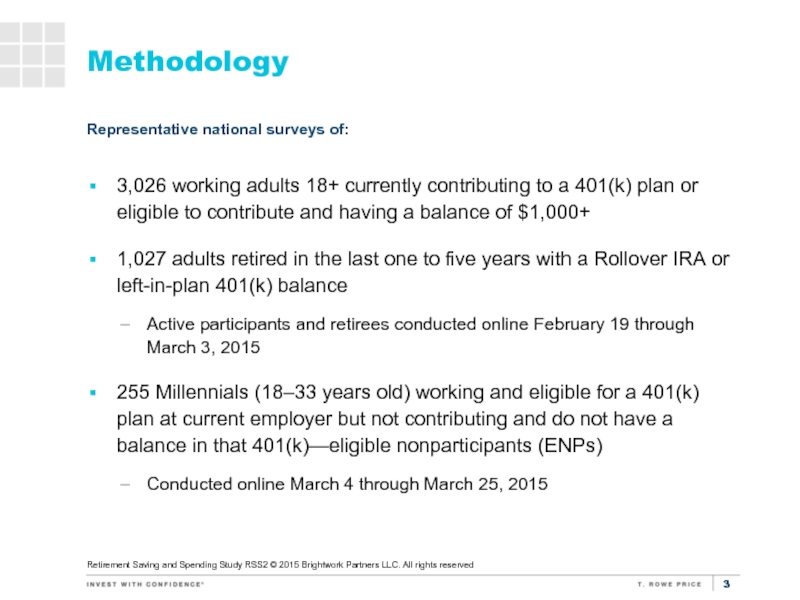

Слайд 3Methodology

3,026 working adults 18+ currently contributing to a 401(k) plan or

1,027 adults retired in the last one to five years with a Rollover IRA or left-in-plan 401(k) balance

Active participants and retirees conducted online February 19 through March 3, 2015

255 Millennials (18–33 years old) working and eligible for a 401(k) plan at current employer but not contributing and do not have a balance in that 401(k)—eligible nonparticipants (ENPs)

Conducted online March 4 through March 25, 2015

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved

Representative national surveys of:

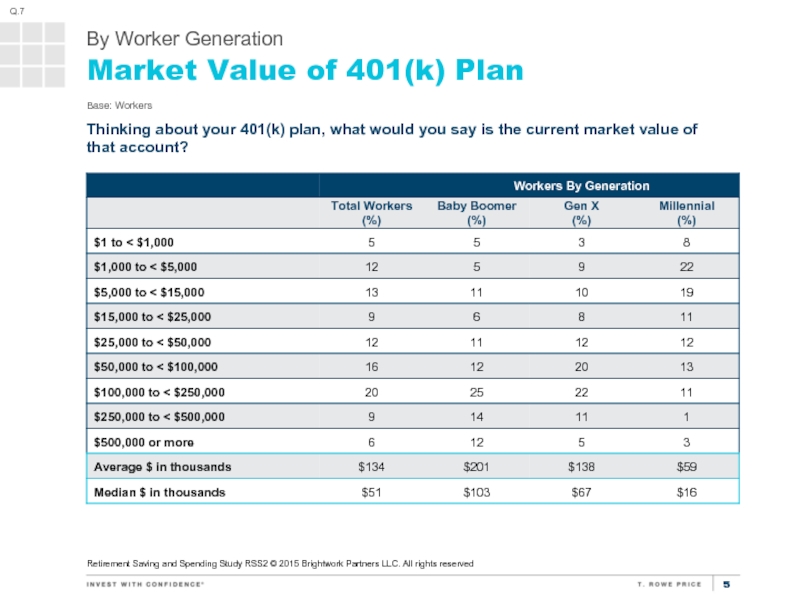

Слайд 5Market Value of 401(k) Plan

Retirement Saving and Spending Study RSS2 ©

Base: Workers

Thinking about your 401(k) plan, what would you say is the current market value of

that account?

By Worker Generation

Q.7

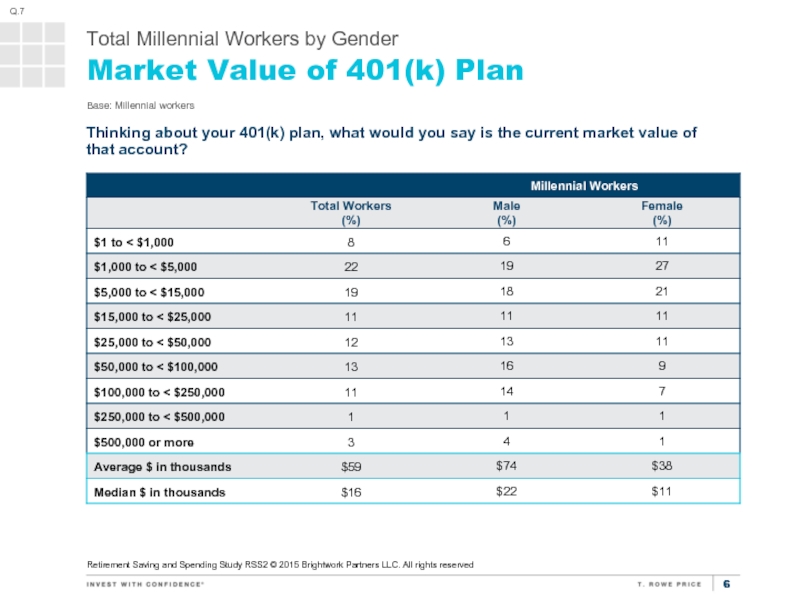

Слайд 6Base: Millennial workers

Market Value of 401(k) Plan

Total Millennial Workers by Gender

Thinking

Q.7

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved

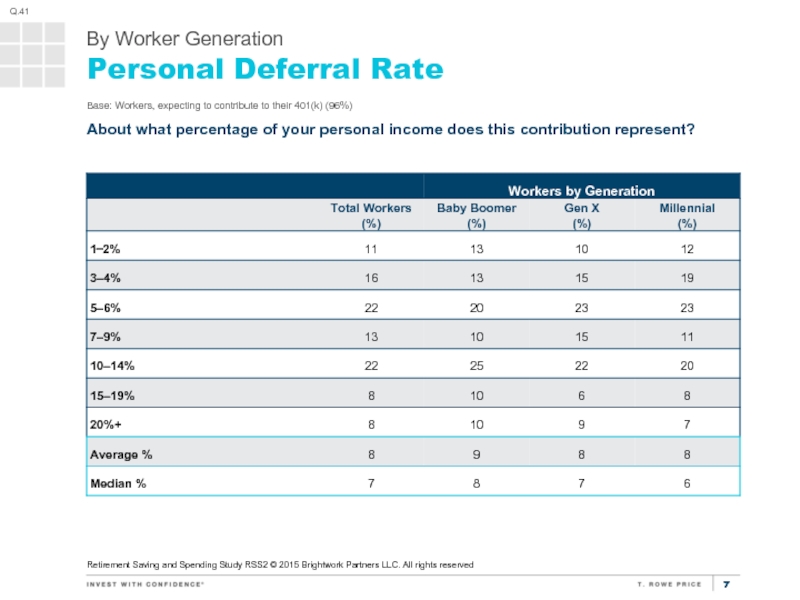

Слайд 7Personal Deferral Rate

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

Base: Workers, expecting to contribute to their 401(k) (96%)

About what percentage of your personal income does this contribution represent?

By Worker Generation

Q.41

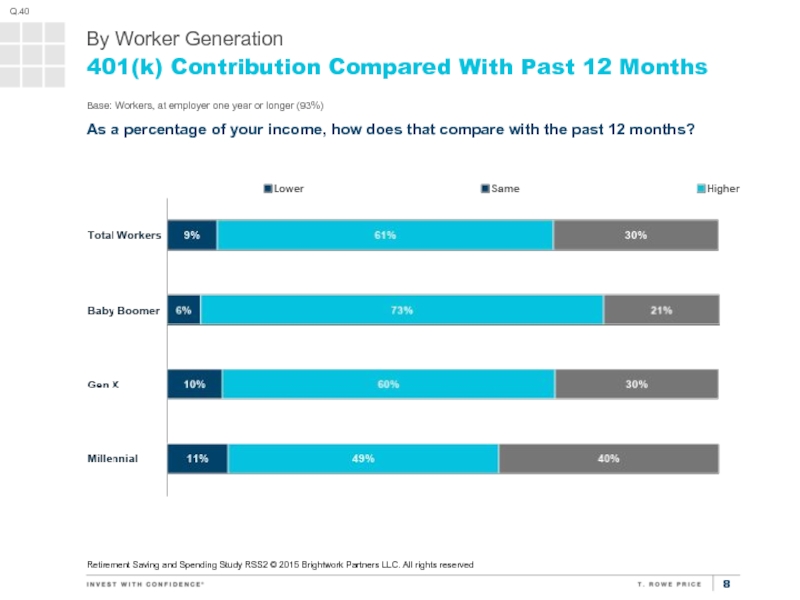

Слайд 8401(k) Contribution Compared With Past 12 Months

Retirement Saving and Spending Study

Base: Workers, at employer one year or longer (93%)

As a percentage of your income, how does that compare with the past 12 months?

By Worker Generation

Q.40

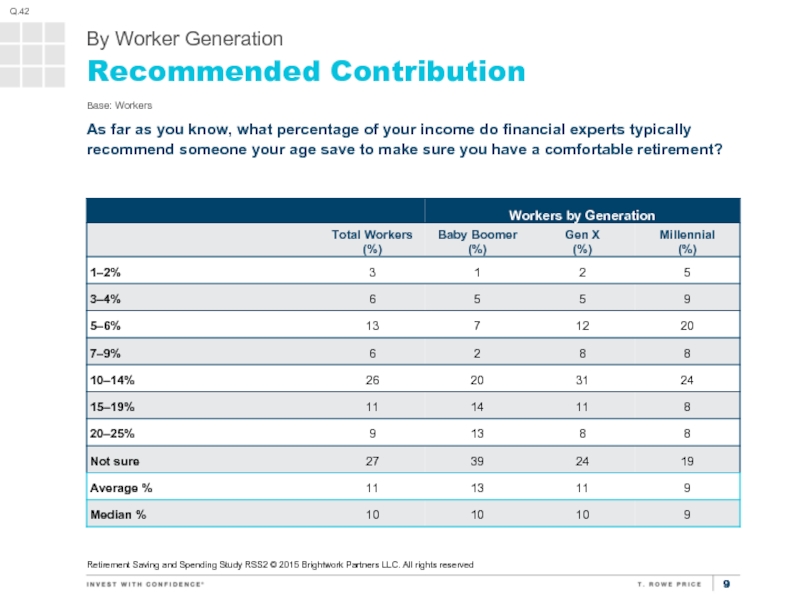

Слайд 9Recommended Contribution

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners

Base: Workers

As far as you know, what percentage of your income do financial experts typically recommend someone your age save to make sure you have a comfortable retirement?

Q.42

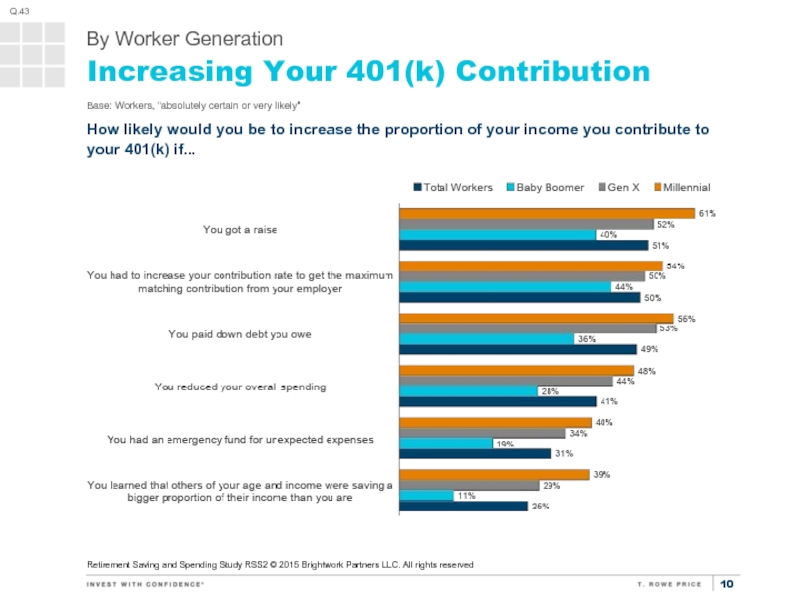

Слайд 10Increasing Your 401(k) Contribution

Retirement Saving and Spending Study RSS2 © 2015

Base: Workers, “absolutely certain or very likely"

How likely would you be to increase the proportion of your income you contribute to your 401(k) if...

Q.43

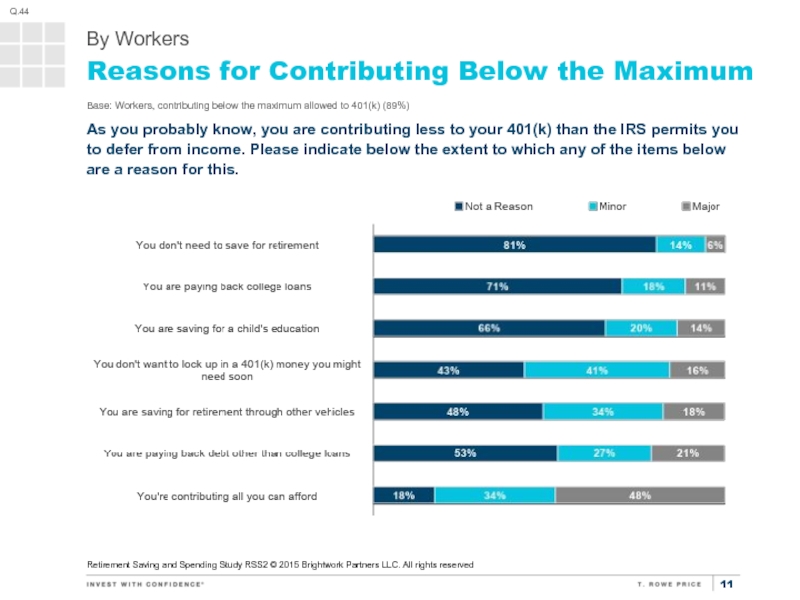

Слайд 11Reasons for Contributing Below the Maximum

Retirement Saving and Spending Study RSS2

Base: Workers, contributing below the maximum allowed to 401(k) (89%)

As you probably know, you are contributing less to your 401(k) than the IRS permits you to defer from income. Please indicate below the extent to which any of the items below are a reason for this.

Q.44

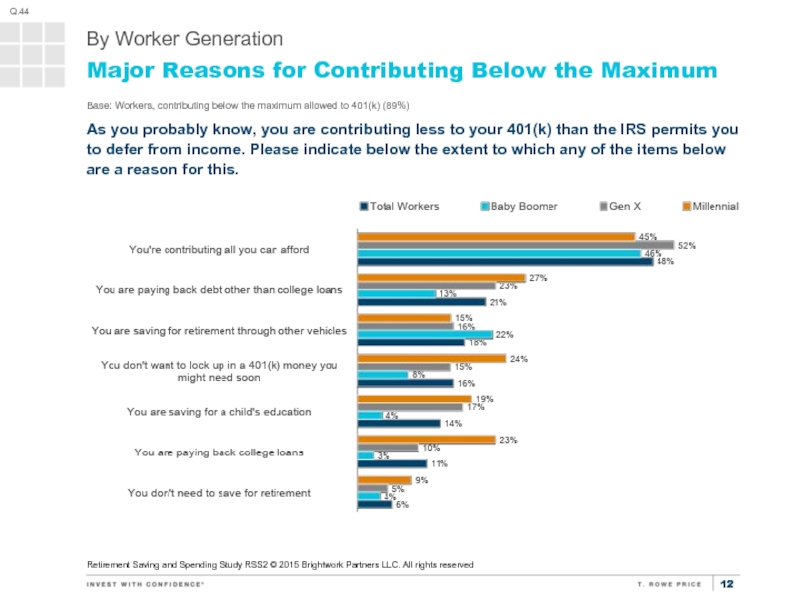

Слайд 12Major Reasons for Contributing Below the Maximum

Retirement Saving and Spending Study

Base: Workers, contributing below the maximum allowed to 401(k) (89%)

As you probably know, you are contributing less to your 401(k) than the IRS permits you to defer from income. Please indicate below the extent to which any of the items below are a reason for this.

Q.44

Слайд 13Influence of Match on Contribution

Retirement Saving and Spending Study RSS2 ©

Base: Workers, expecting an employer match (86%)

To what extent is your contribution rate determined by this match? You set your contribution rate...

Q.46

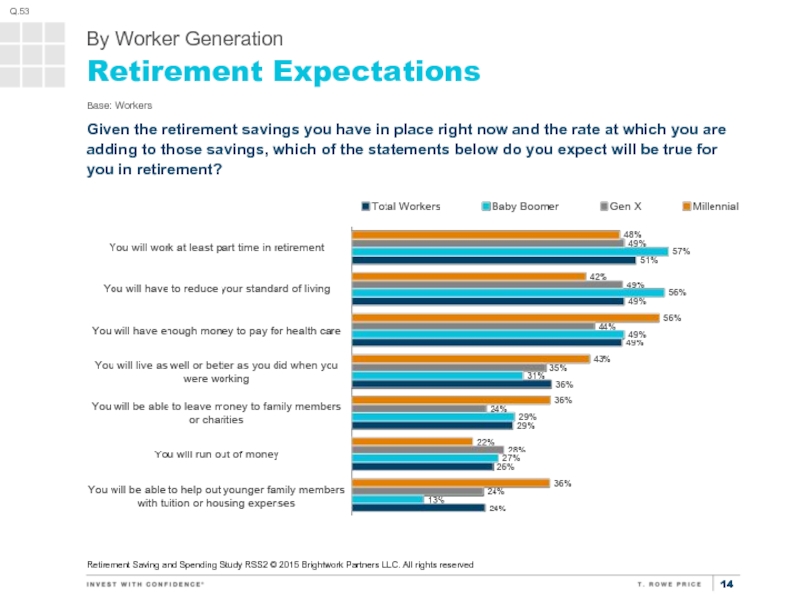

Слайд 14Retirement Expectations

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners

Base: Workers

Given the retirement savings you have in place right now and the rate at which you are adding to those savings, which of the statements below do you expect will be true for you in retirement?

Q.53

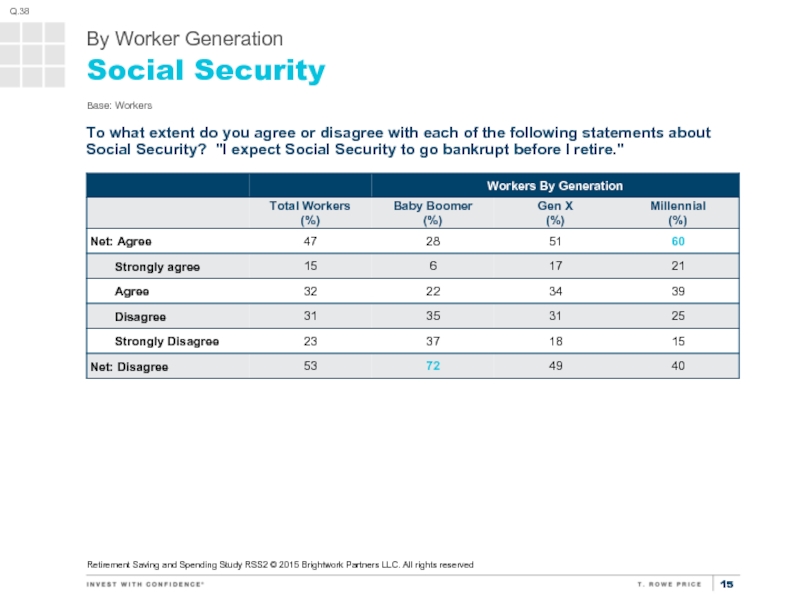

Слайд 15Base: Workers

Social Security

By Worker Generation

To what extent do you agree

Q.38

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved

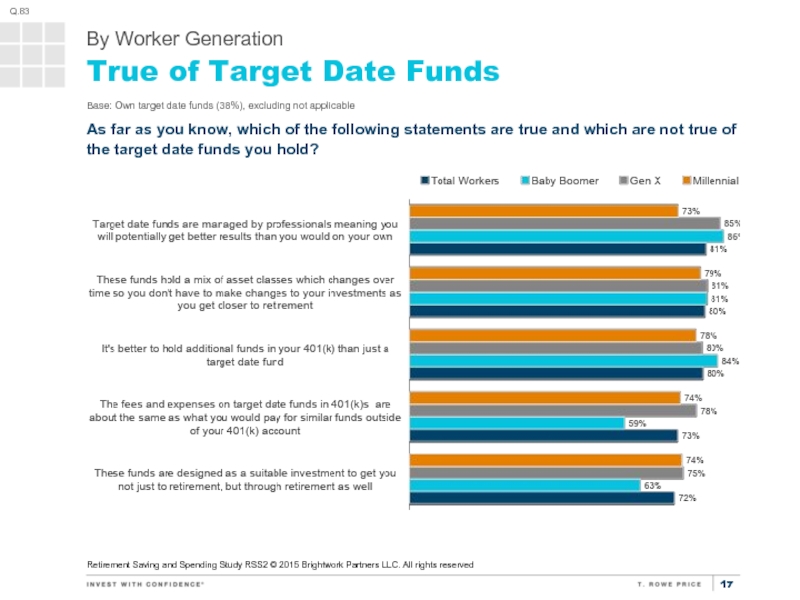

Слайд 17True of Target Date Funds

Retirement Saving and Spending Study RSS2 ©

Base: Own target date funds (38%), excluding not applicable

As far as you know, which of the following statements are true and which are not true of the target date funds you hold?

Q.83

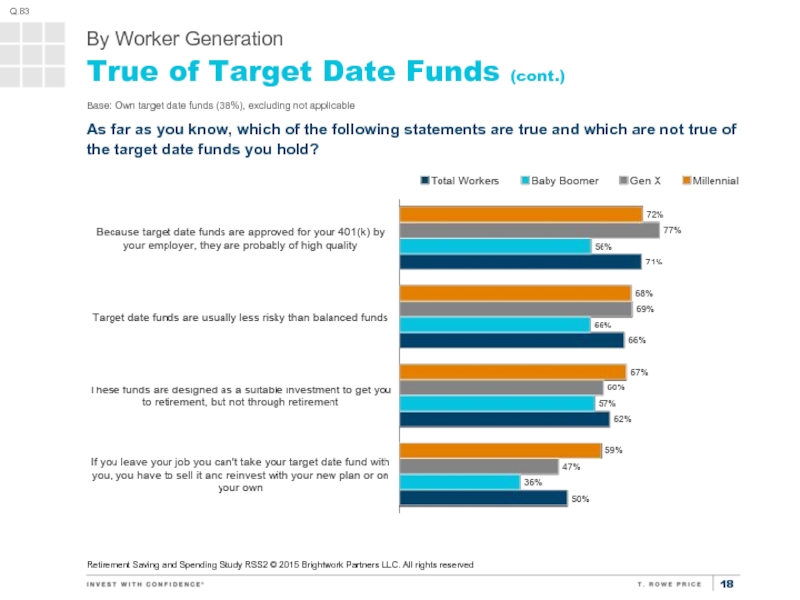

Слайд 18True of Target Date Funds (cont.)

Retirement Saving and Spending Study RSS2

Base: Own target date funds (38%), excluding not applicable

As far as you know, which of the following statements are true and which are not true of the target date funds you hold?

Q.83

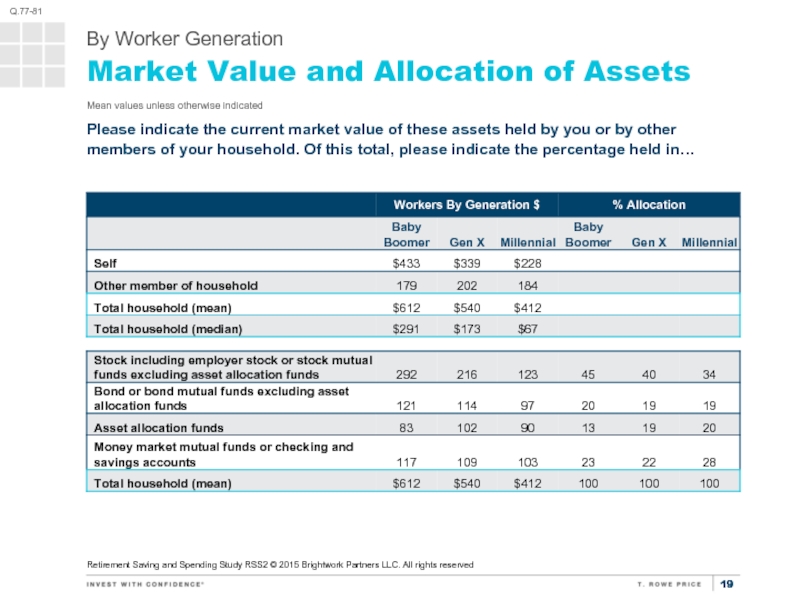

Слайд 19Market Value and Allocation of Assets

Retirement Saving and Spending Study RSS2

Mean values unless otherwise indicated

Please indicate the current market value of these assets held by you or by other members of your household. Of this total, please indicate the percentage held in…

Q.77-81

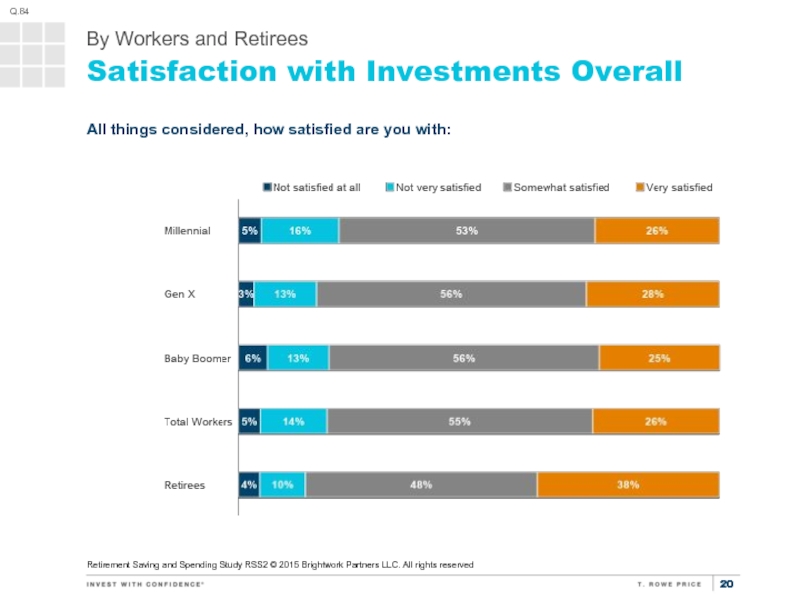

Слайд 20Satisfaction with Investments Overall

Retirement Saving and Spending Study RSS2 © 2015

All things considered, how satisfied are you with:

Q.84

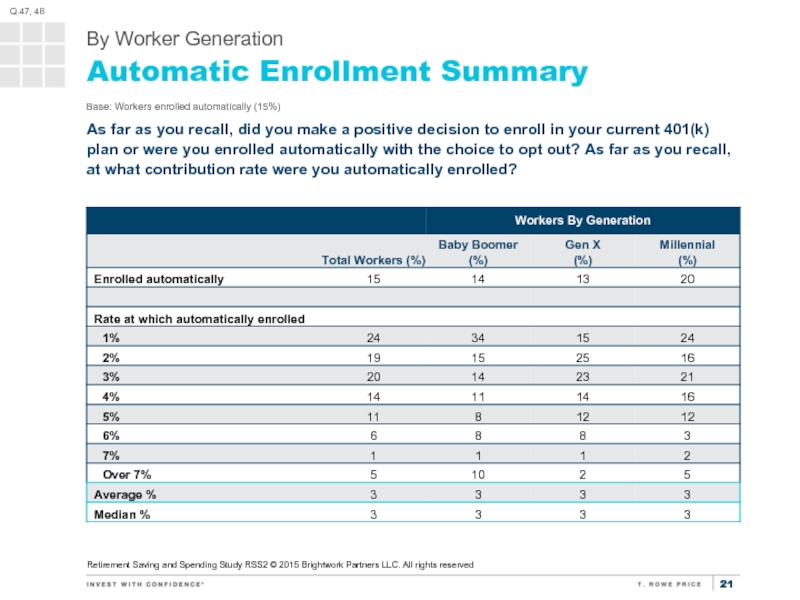

Слайд 21Automatic Enrollment Summary

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

As far as you recall, did you make a positive decision to enroll in your current 401(k) plan or were you enrolled automatically with the choice to opt out? As far as you recall, at what contribution rate were you automatically enrolled?

Q.47, 48

Base: Workers enrolled automatically (15%)

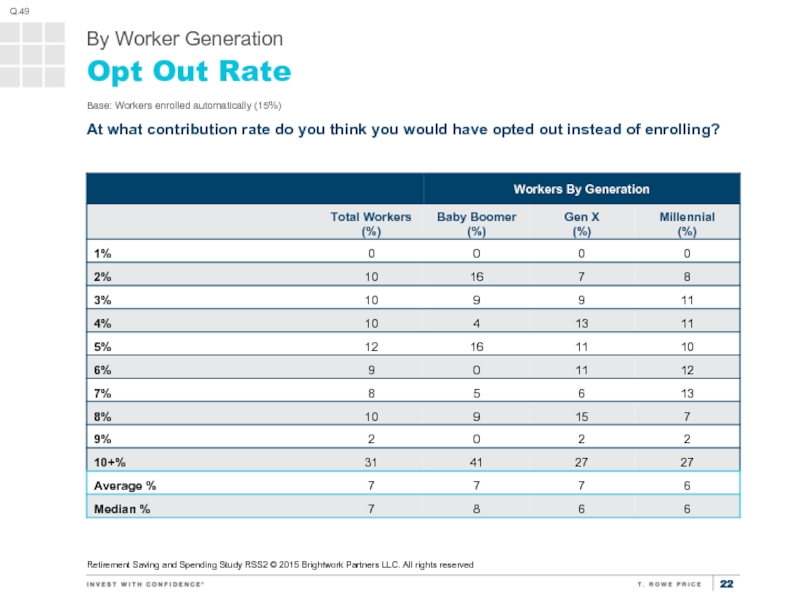

Слайд 22Opt Out Rate

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

Base: Workers enrolled automatically (15%)

At what contribution rate do you think you would have opted out instead of enrolling?

Q.49

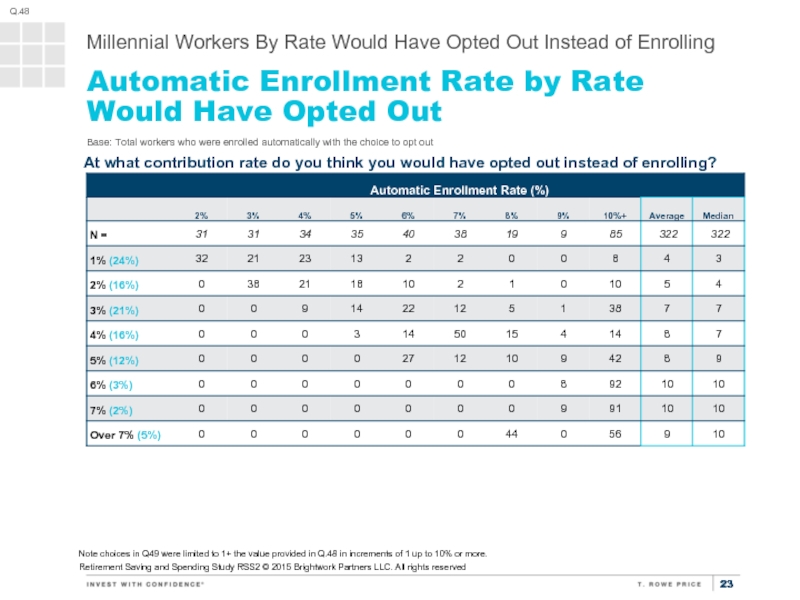

Слайд 23Base: Total workers who were enrolled automatically with the choice to

Note choices in Q49 were limited to 1+ the value provided in Q.48 in increments of 1 up to 10% or more.

Automatic Enrollment Rate by Rate Would Have Opted Out

Millennial Workers By Rate Would Have Opted Out Instead of Enrolling

At what contribution rate do you think you would have opted out instead of enrolling?

Q.48

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved

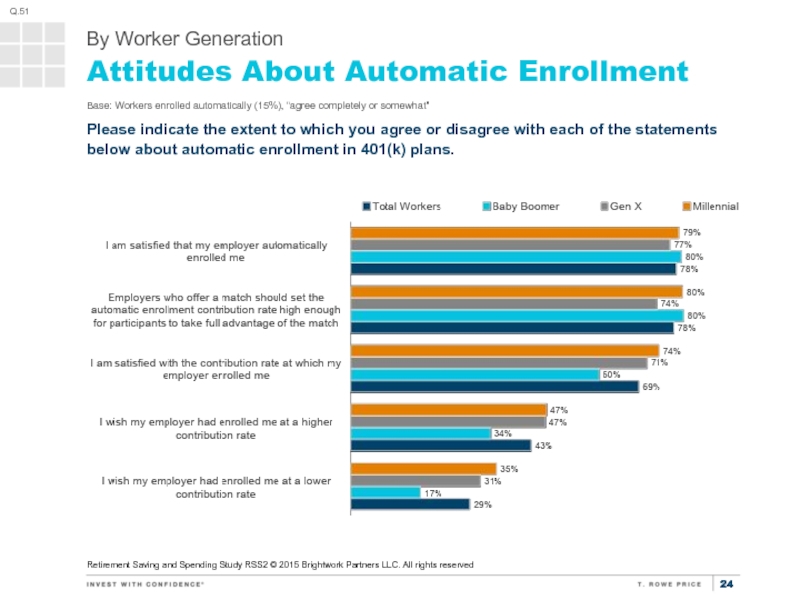

Слайд 24Attitudes About Automatic Enrollment

Retirement Saving and Spending Study RSS2 © 2015

Base: Workers enrolled automatically (15%), “agree completely or somewhat"

Please indicate the extent to which you agree or disagree with each of the statements below about automatic enrollment in 401(k) plans.

Q.51

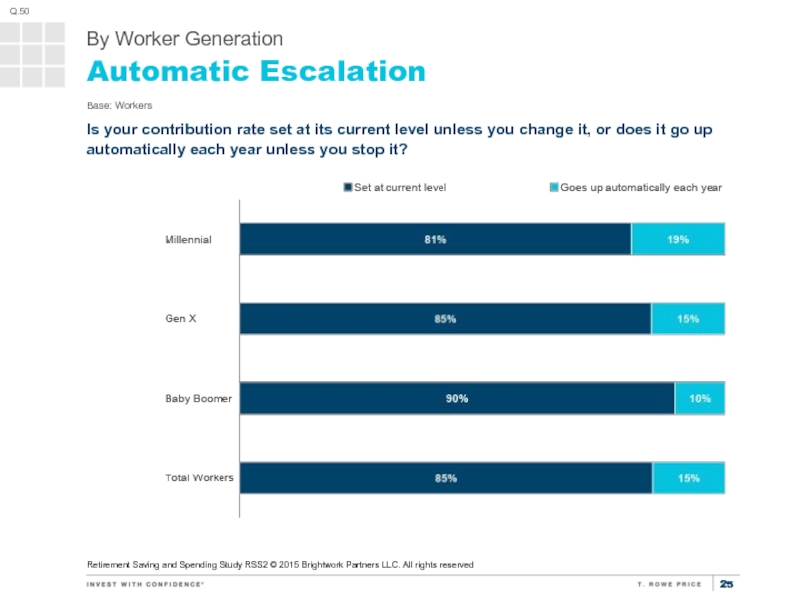

Слайд 25Automatic Escalation

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners

Base: Workers

Is your contribution rate set at its current level unless you change it, or does it go up automatically each year unless you stop it?

Q.50

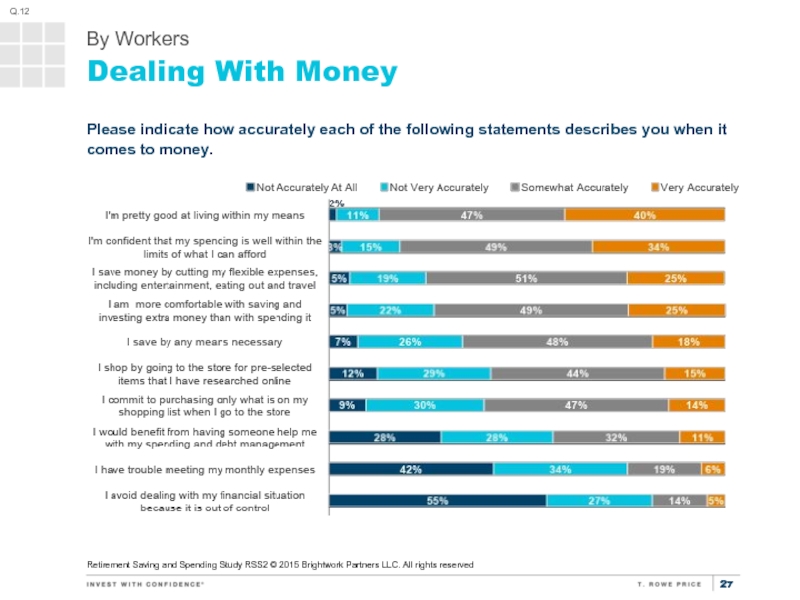

Слайд 27Dealing With Money

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

Please indicate how accurately each of the following statements describes you when it comes to money.

Q.12

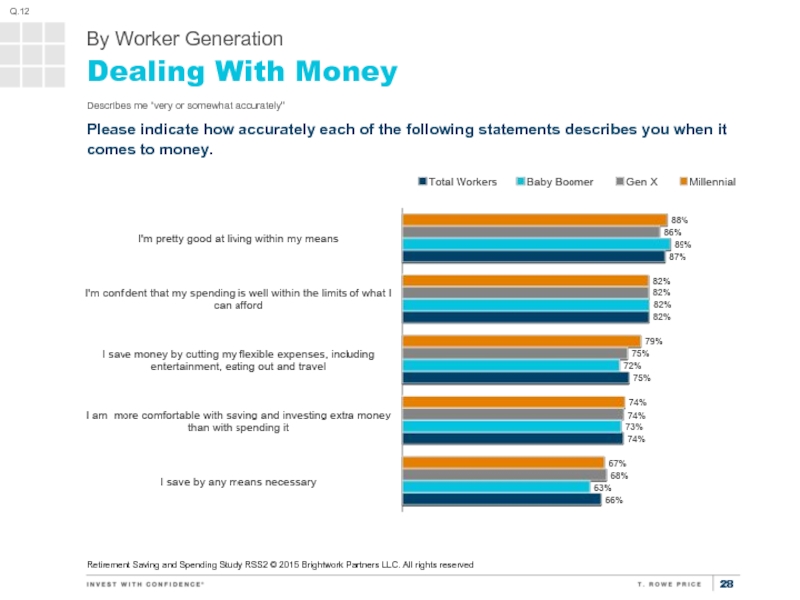

Слайд 28Dealing With Money

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

Describes me “very or somewhat accurately"

Q.12

Please indicate how accurately each of the following statements describes you when it comes to money.

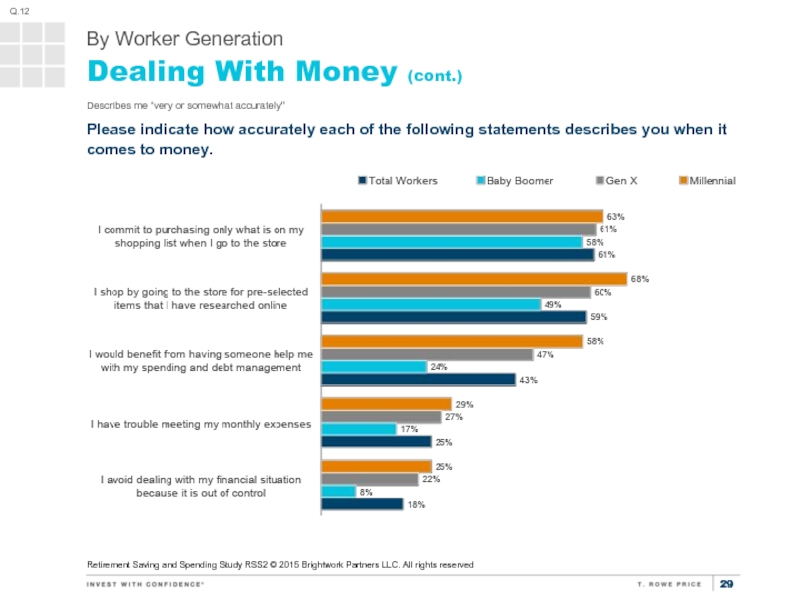

Слайд 29Dealing With Money (cont.)

Retirement Saving and Spending Study RSS2 © 2015

Describes me “very or somewhat accurately"

Please indicate how accurately each of the following statements describes you when it comes to money.

Q.12

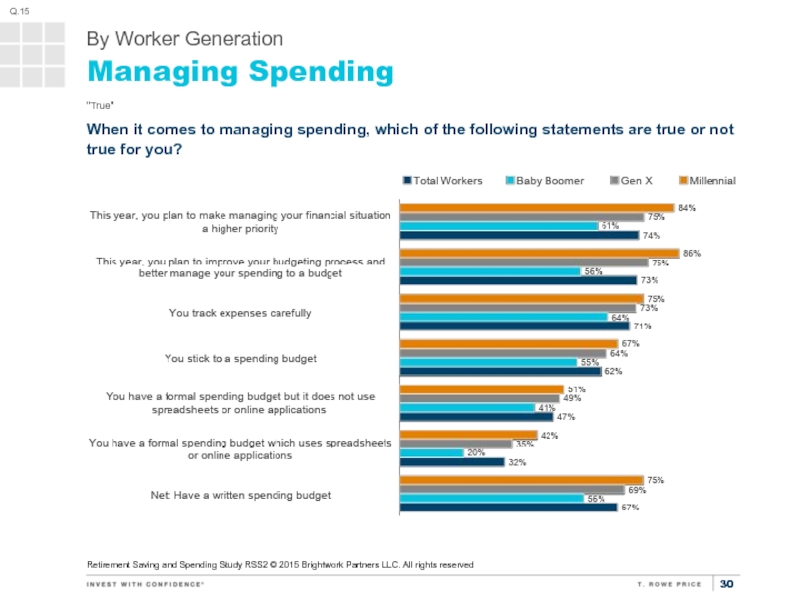

Слайд 30Managing Spending

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners

"True"

When it comes to managing spending, which of the following statements are true or not true for you?

Q.15

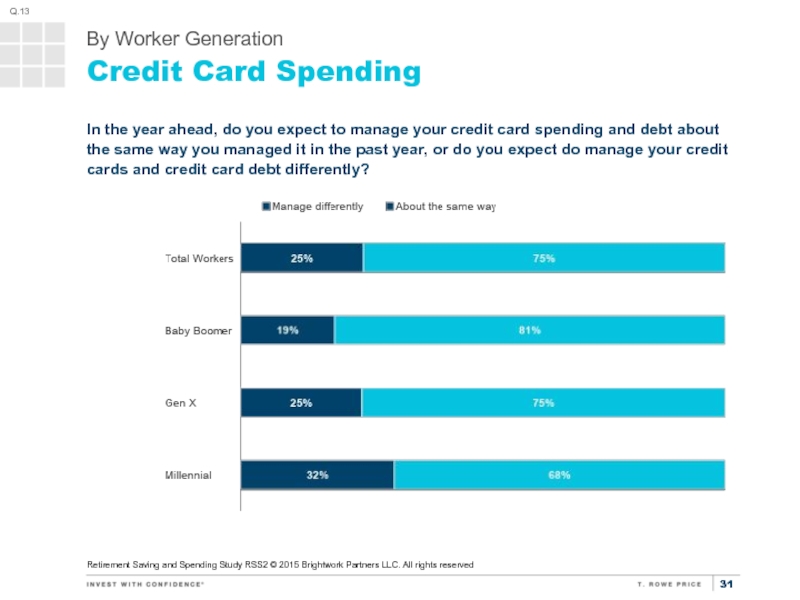

Слайд 31Credit Card Spending

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

In the year ahead, do you expect to manage your credit card spending and debt about the same way you managed it in the past year, or do you expect do manage your credit cards and credit card debt differently?

Q.13

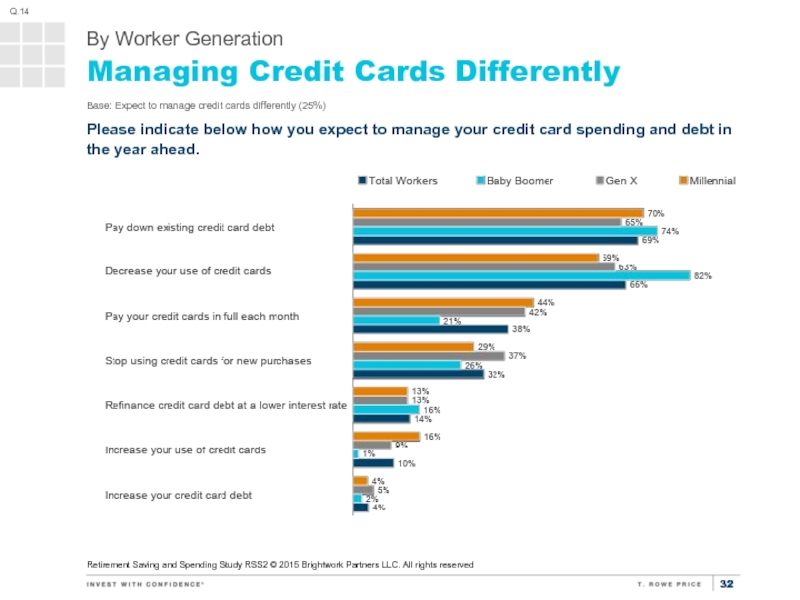

Слайд 32Managing Credit Cards Differently

Retirement Saving and Spending Study RSS2 © 2015

Base: Expect to manage credit cards differently (25%)

Please indicate below how you expect to manage your credit card spending and debt in the year ahead.

Q.14

Слайд 33#1 Funding Financial Priority

Retirement Saving and Spending Study RSS2 © 2015

Base: Workers, ranked at least one item (98%)

In terms of how your household is funding financial priorities this year, please rank which of the items below comes first, which comes second, which third and so on until the end of the list. If an item does not apply to you or isn’t a priority at all, enter a rank of zero..

Q.55

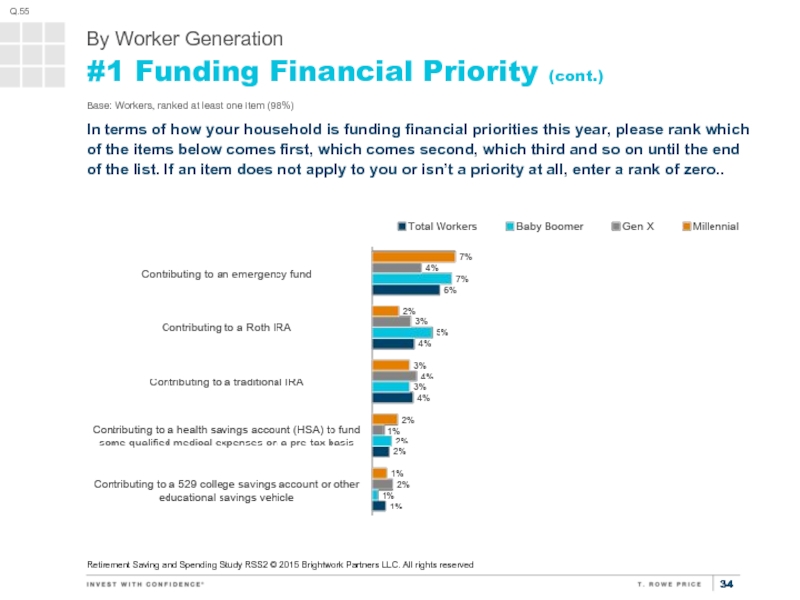

Слайд 34#1 Funding Financial Priority (cont.)

Retirement Saving and Spending Study RSS2 ©

Base: Workers, ranked at least one item (98%)

In terms of how your household is funding financial priorities this year, please rank which of the items below comes first, which comes second, which third and so on until the end of the list. If an item does not apply to you or isn’t a priority at all, enter a rank of zero..

Q.55

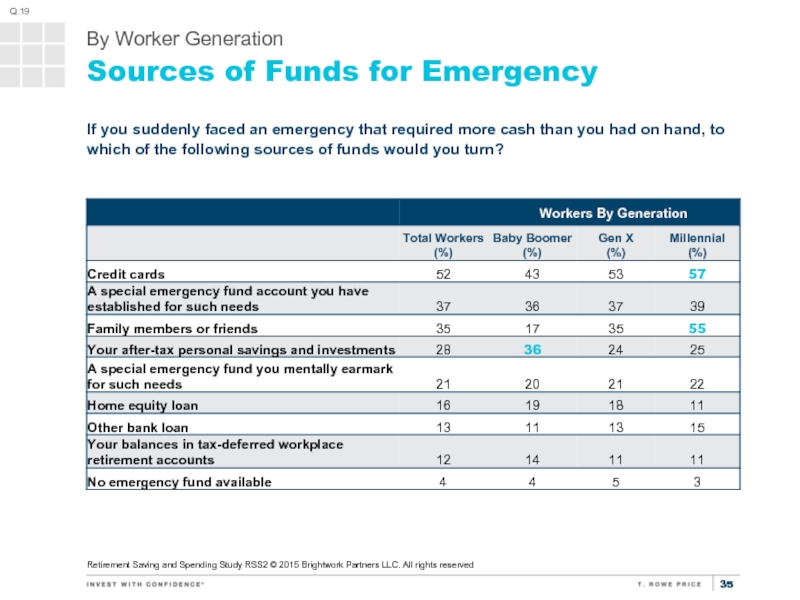

Слайд 35Sources of Funds for Emergency

Retirement Saving and Spending Study RSS2 ©

If you suddenly faced an emergency that required more cash than you had on hand, to which of the following sources of funds would you turn?

Q.19

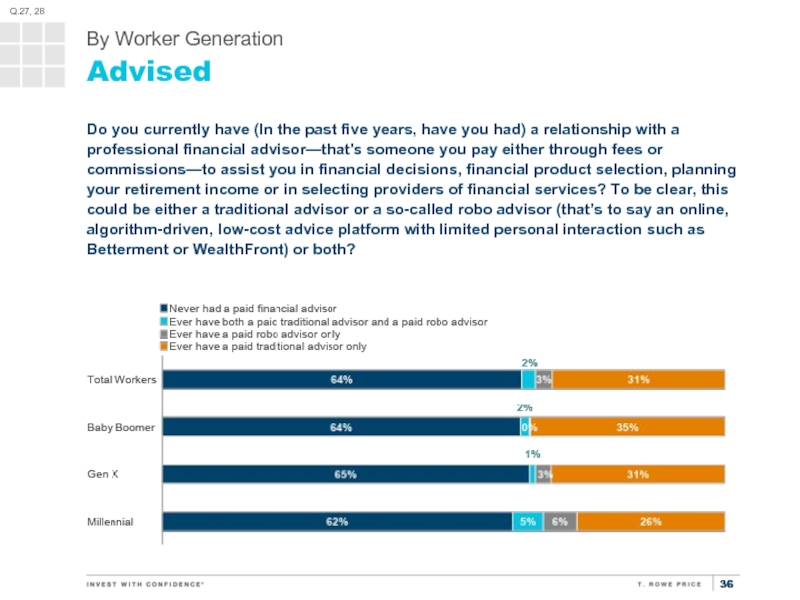

Слайд 36Advised

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC.

Do you currently have (In the past five years, have you had) a relationship with a professional financial advisor—that's someone you pay either through fees or commissions—to assist you in financial decisions, financial product selection, planning your retirement income or in selecting providers of financial services? To be clear, this could be either a traditional advisor or a so-called robo advisor (that’s to say an online, algorithm-driven, low-cost advice platform with limited personal interaction such as Betterment or WealthFront) or both?

Q.27, 28

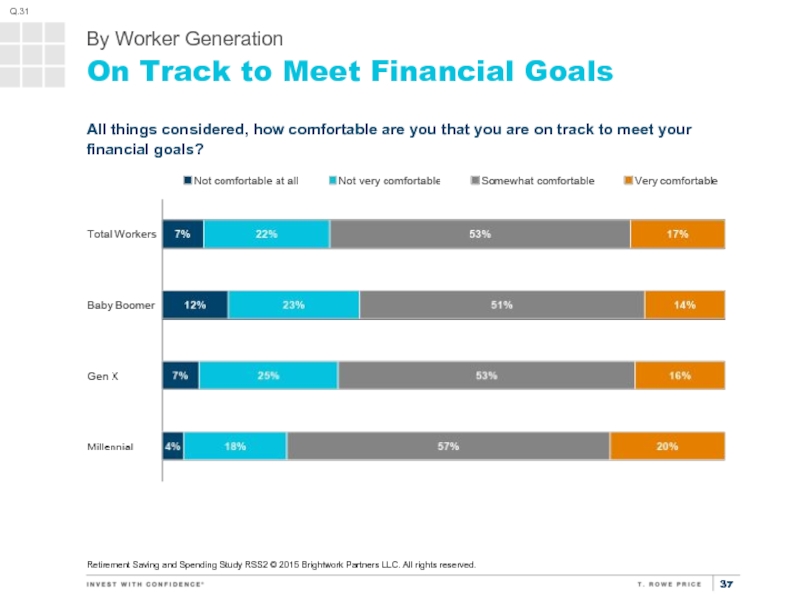

Слайд 37On Track to Meet Financial Goals

All things considered, how comfortable are

Q.31

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

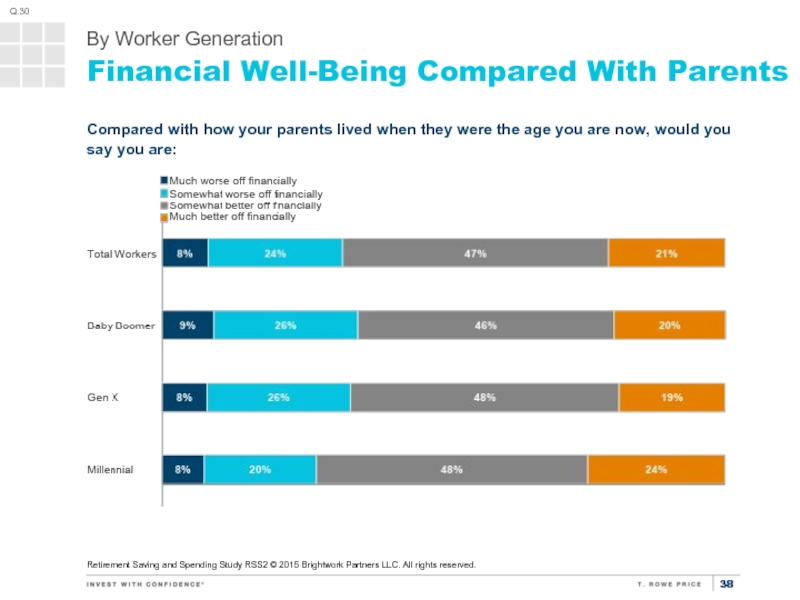

Слайд 38Financial Well-Being Compared With Parents

Compared with how your parents lived when

Q.30

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

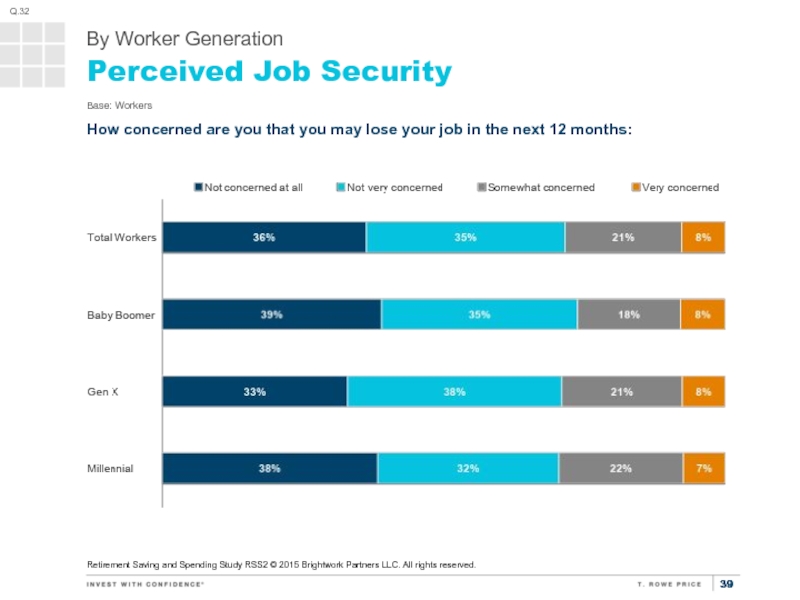

Слайд 39Perceived Job Security

Base: Workers

How concerned are you that you may lose

Q.32

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 41Age

Q. 2

How old are you?

Q.2

Retirement Saving and Spending Study RSS2 ©

Слайд 42Size of Organization

Retirement Saving and Spending Study RSS2 © 2015 Brightwork

Base: Millennial workers

If you had to guess, about how many people work for your employer at all levels and in all locations across the United States?

Слайд 43Work Status

Base: Workers

Bearing in mind some people retire and go back

Q.1

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 44Level of Qualification for Position

Base: Workers

How would you describe the fit

Q.58

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 45Tenure at Current Employer

Base: Millennial workers

About how long have you worked

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 46Pay Raise

Base: Workers

How much of a raise (as a percent), if

Q.35

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 47Personal and Household Income and Total Debt

Total Workers by Generation

Retirement

Слайд 48MILLENNIALS WHO ARE ELIGIBLE TO PARTICIPATE IN THEIR EMPLOYERS’ 401(k) BUT

Слайд 49Age

Q.B

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC.

Слайд 50Gender

Base: Millennial workers

What is your gender?

Q.A

Retirement Saving and Spending Study RSS2

Слайд 51Education

Base: Millennial workers

What is your education level?

Q.103/ (ENP Q.48)

Retirement Saving and

Слайд 52Marital Status

Base: Millennial workers

What is your marital status?

Q.102/ (ENP Q.47)

Retirement Saving

Слайд 53Tenure at Current Employer

Base: Millennial workers

About how long have you worked

Q.57/ (ENP Q.31)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 54Pay Raise

Base: Millennial workers

How much of a raise (as a percent),

Q.35/ (ENP Q.20)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 55Student Loan Debt

Base: Millennial workers

How much debt does your household have

Q.93/ (ENP Q.39)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 56Direction of Debt

Base: Millennial workers, have $1,000 or more in debt

Thinking

Q.94/ (ENP Q.40)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

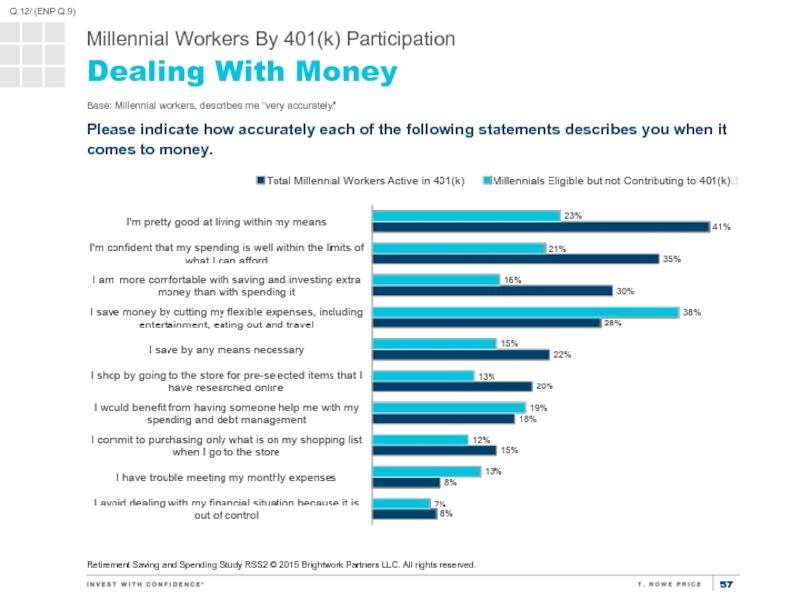

Слайд 57Dealing With Money

Base: Millennial workers, describes me “very accurately"

Please indicate how

Q.12/ (ENP Q.9)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

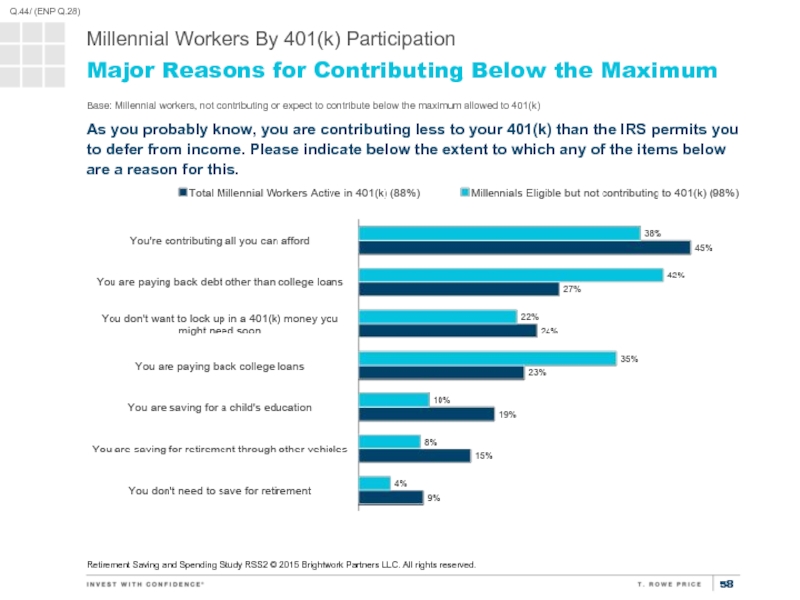

Слайд 58Major Reasons for Contributing Below the Maximum

Base: Millennial workers, not contributing

As you probably know, you are contributing less to your 401(k) than the IRS permits you to defer from income. Please indicate below the extent to which any of the items below are a reason for this.

Q.44/ (ENP Q.28)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

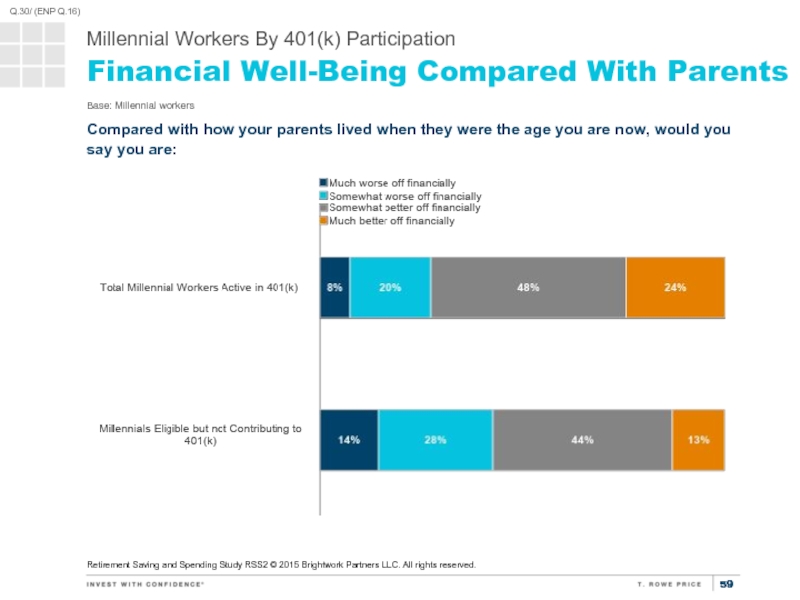

Слайд 59Financial Well-Being Compared With Parents

Base: Millennial workers

Compared with how your parents

Q.30/ (ENP Q.16)

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

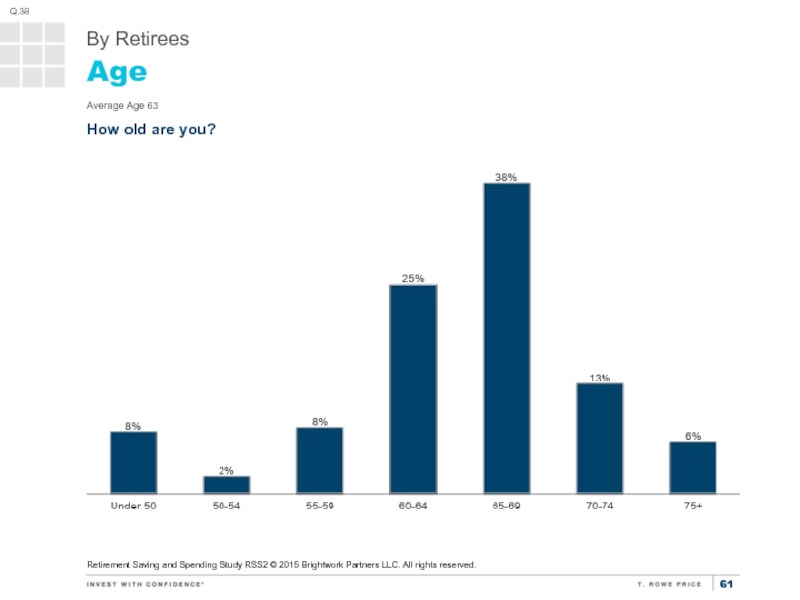

Слайд 61Age

Average Age 63

How old are you?

Q.38

Retirement Saving and Spending Study RSS2

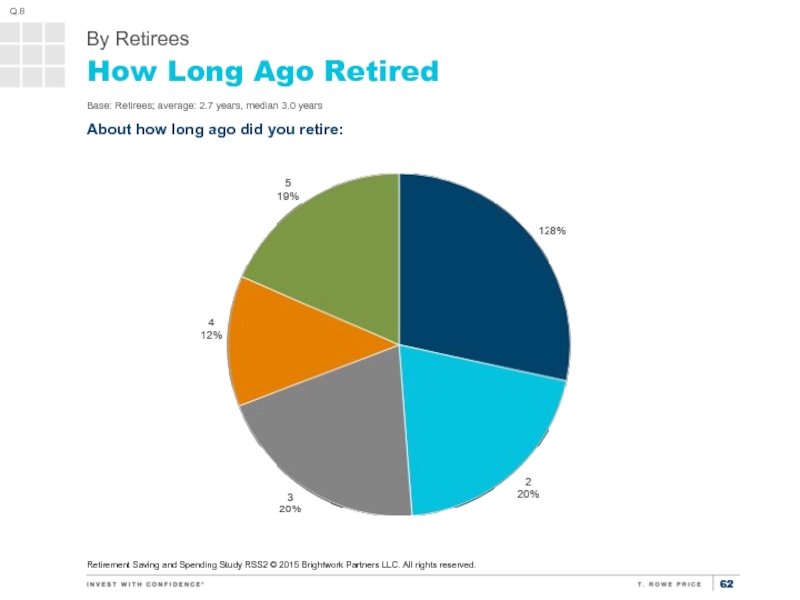

Слайд 62How Long Ago Retired

Base: Retirees; average: 2.7 years, median 3.0 years

About

Q.8

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

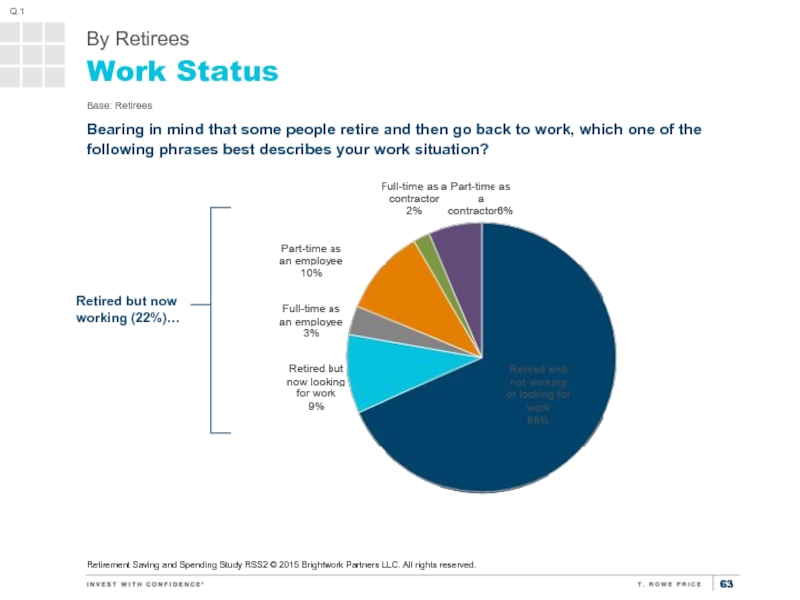

Слайд 63Work Status

Base: Retirees

Bearing in mind that some people retire and then

Retired but now

working (22%)…

Q.1

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

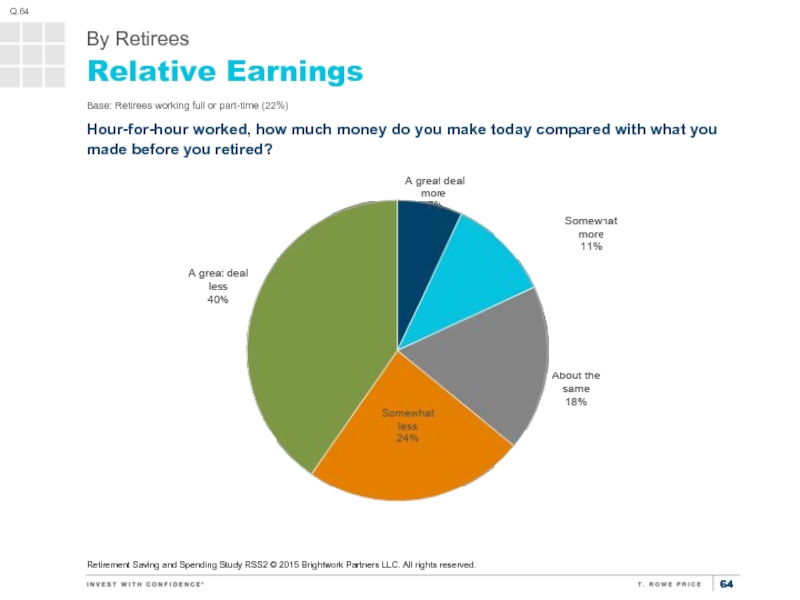

Слайд 64Relative Earnings

Base: Retirees working full or part-time (22%)

Hour-for-hour worked, how much

Q.64

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 65Relative Hours

Base: Retirees working full or part-time (22%)

In terms of hours,

Q.65

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 66Rejoined the Workforce Because...

Base: Retirees working full or part-time (22%)

When you

Q.66

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 67Looking for Work Because...

Base: Retirees looking for work (9%)

Are you looking

Q.67

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 68Has a Withdrawal Plan

Base: Retirees

Thinking about your investable assets—that’s your stocks,

Q.70

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

Слайд 69% Investable Assets Withdrawn

Base: Retirees; average 5.5% (excluding none)

About what percentage

Q.71

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

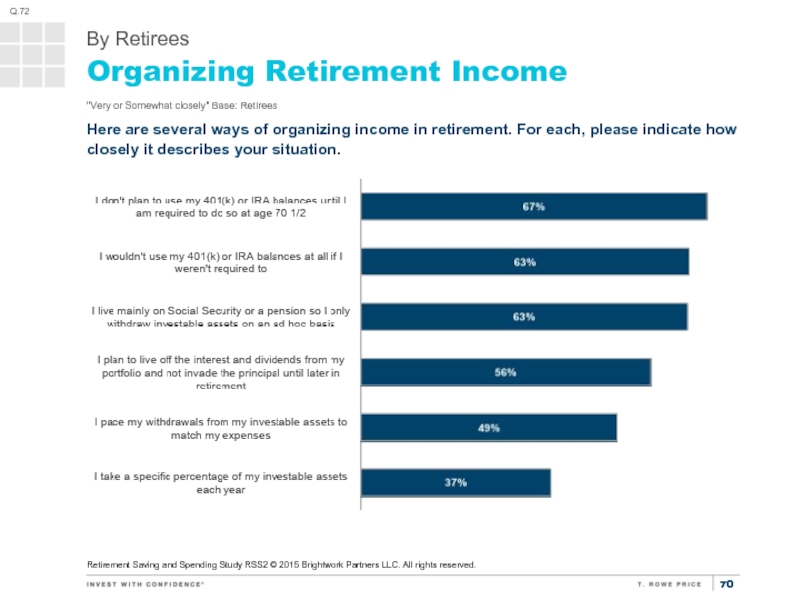

Слайд 70Organizing Retirement Income

"Very or Somewhat closely" Base: Retirees

Here are several ways

Q.72

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

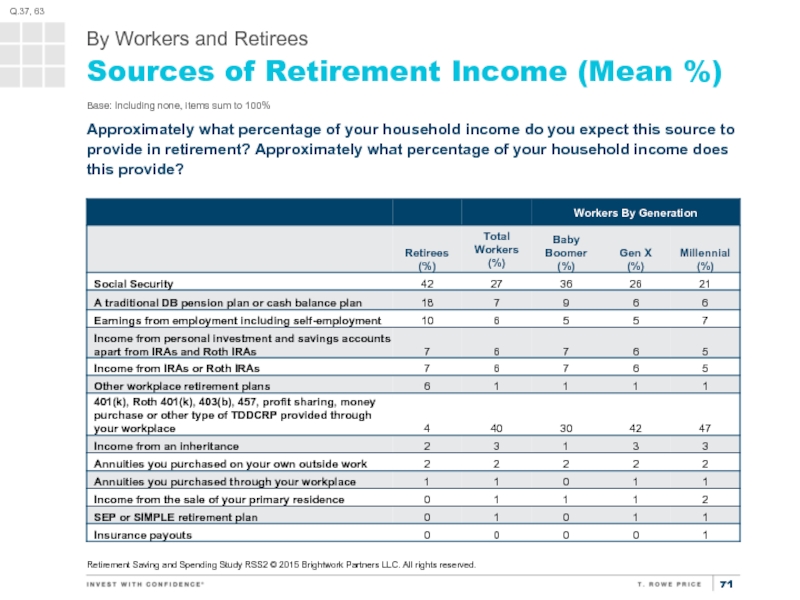

Слайд 71Sources of Retirement Income (Mean %)

Base: Including none, items sum to

Approximately what percentage of your household income do you expect this source to provide in retirement? Approximately what percentage of your household income does this provide?

Q.37, 63

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

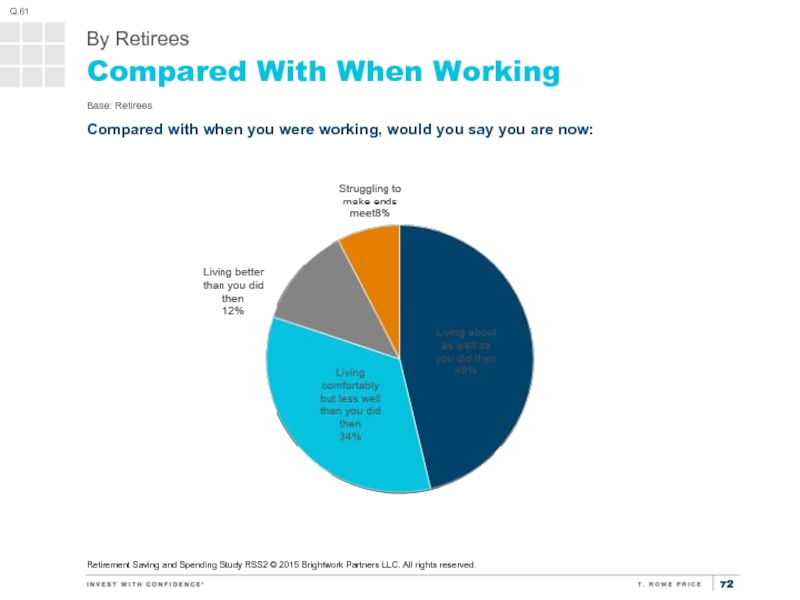

Слайд 72Compared With When Working

Base: Retirees

Compared with when you were working, would

Q.61

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

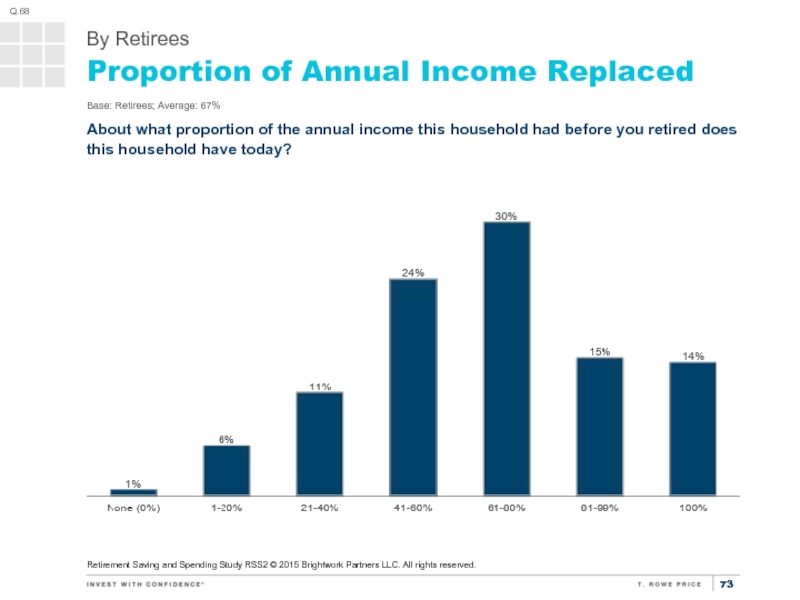

Слайд 73Proportion of Annual Income Replaced

Base: Retirees; Average: 67%

About what proportion of

Q.68

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

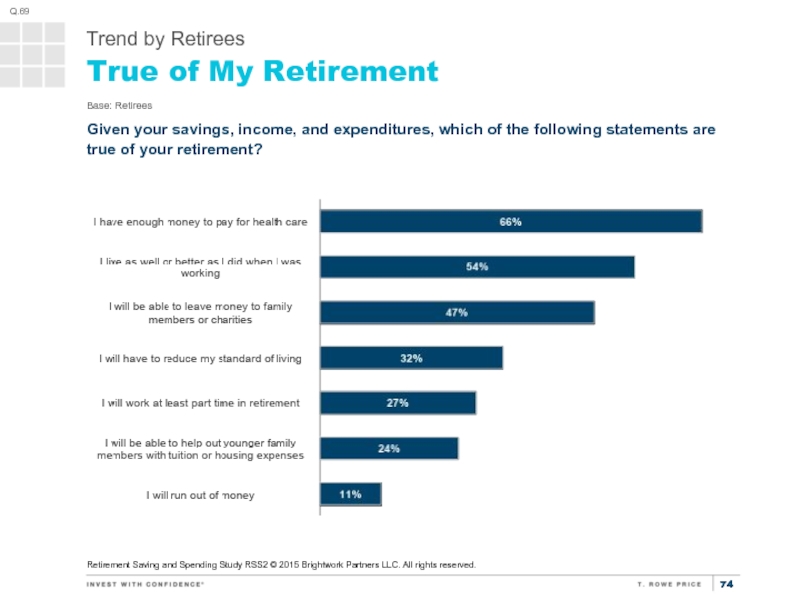

Слайд 74True of My Retirement

Base: Retirees

Given your savings, income, and expenditures, which

Q.69

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

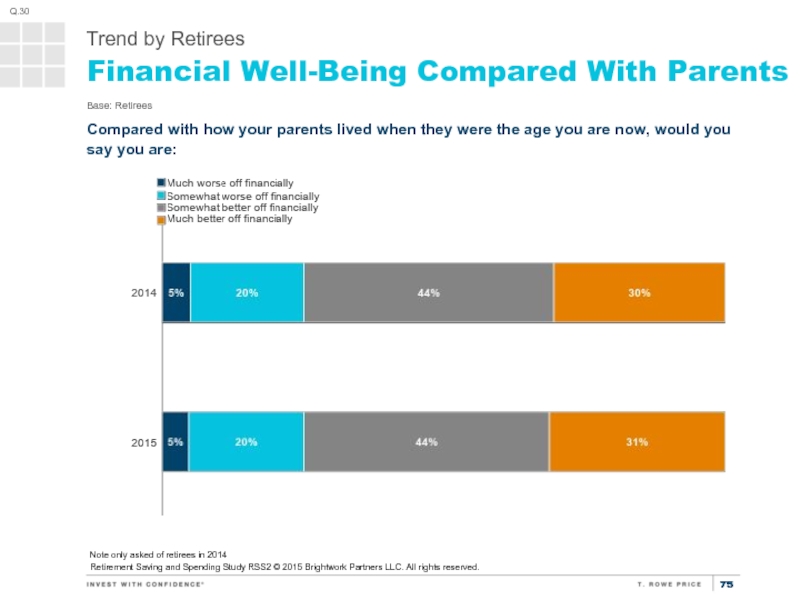

Слайд 75Financial Well-Being Compared With Parents

Note only asked of retirees in 2014

Base:

Compared with how your parents lived when they were the age you are now, would you say you are:

Q.30

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

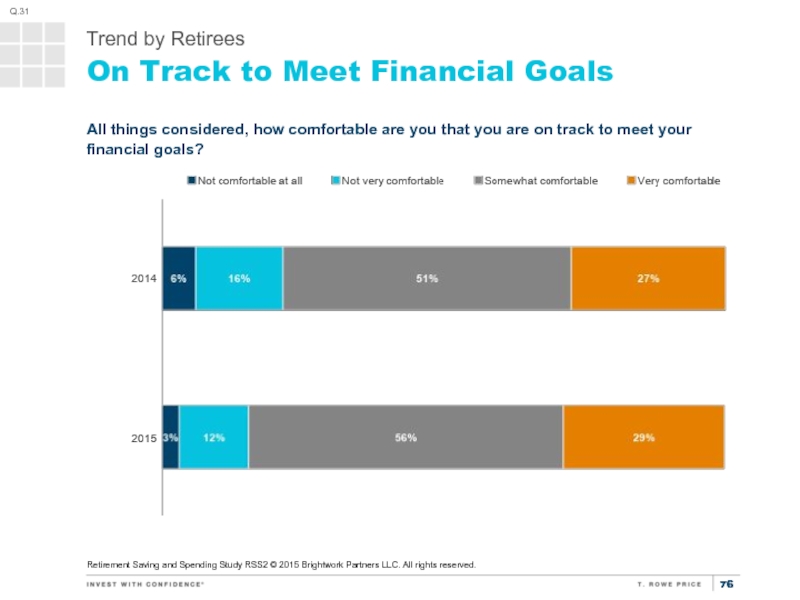

Слайд 76On Track to Meet Financial Goals

All things considered, how comfortable are

Q.31

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.

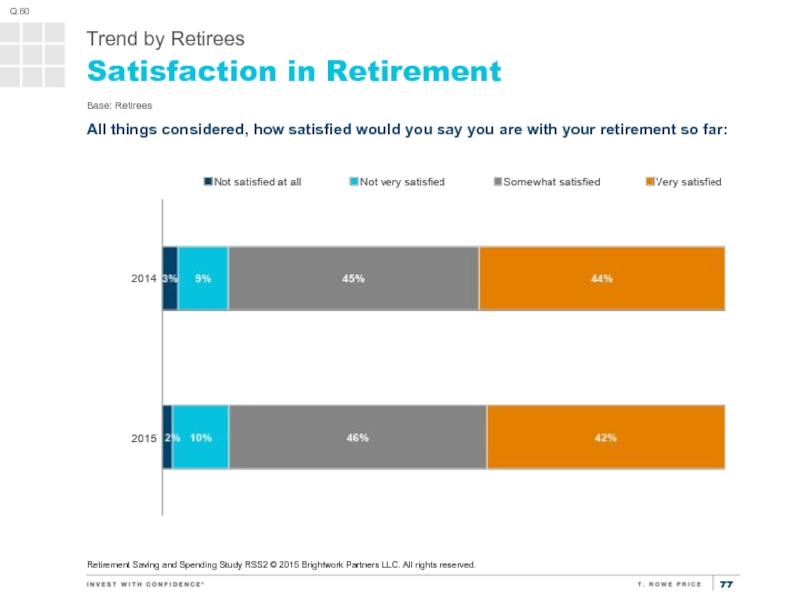

Слайд 77Satisfaction in Retirement

Base: Retirees

All things considered, how satisfied would you say

Q.60

Retirement Saving and Spending Study RSS2 © 2015 Brightwork Partners LLC. All rights reserved.