- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Rate-lifting in the US. And why it matters for the UK презентация

Содержание

- 1. Rate-lifting in the US. And why it matters for the UK

- 2. Before the FOMC meeting, markets put a

- 3. Some traditional rules of thumb say rates

- 4. Source: Bloomberg There is about a

- 5. Why lower for longer?

- 6. Four things making the Fed think twice

- 7. Source: Macrobond, Bloomberg China is a big

- 8. Source: Financial Stability Board, Macrobond, Bloomberg Quantitative

- 9. Source: Bloomberg, Macrobond Recent history may

- 10. Why is this important for UK interest rates?

- 11. The Fed & The Bank of England

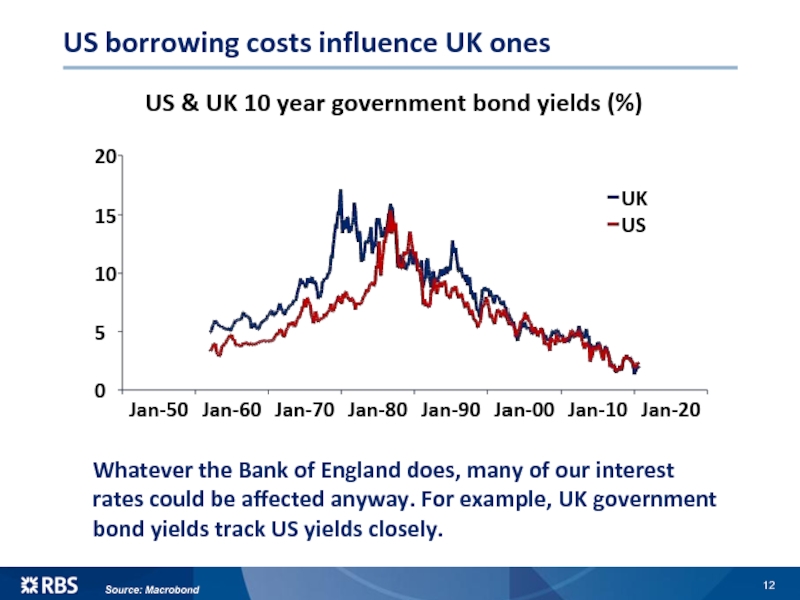

- 12. US borrowing costs influence UK ones Source:

- 13. Follow us on Twitter @RBS_Economics https://twitter.com/rbs_economics Or visit us online

- 14. Disclaimer This material is published by

Слайд 1Rate-lifting in the US. And why it matters for the UK

Rupert

RBS Economics (@RBS_Economics)

September 2015

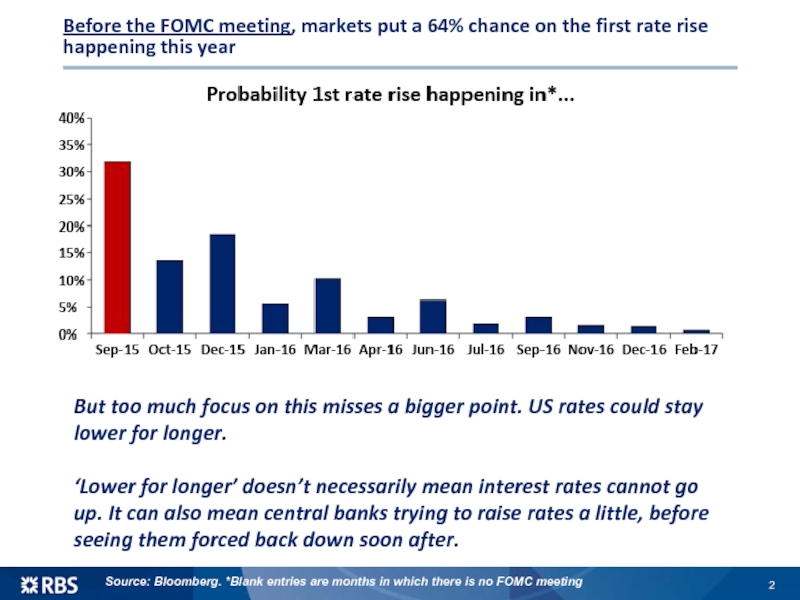

Слайд 2Before the FOMC meeting, markets put a 64% chance on the

But too much focus on this misses a bigger point. US rates could stay lower for longer.

‘Lower for longer’ doesn’t necessarily mean interest rates cannot go up. It can also mean central banks trying to raise rates a little, before seeing them forced back down soon after.

Source: Bloomberg. *Blank entries are months in which there is no FOMC meeting

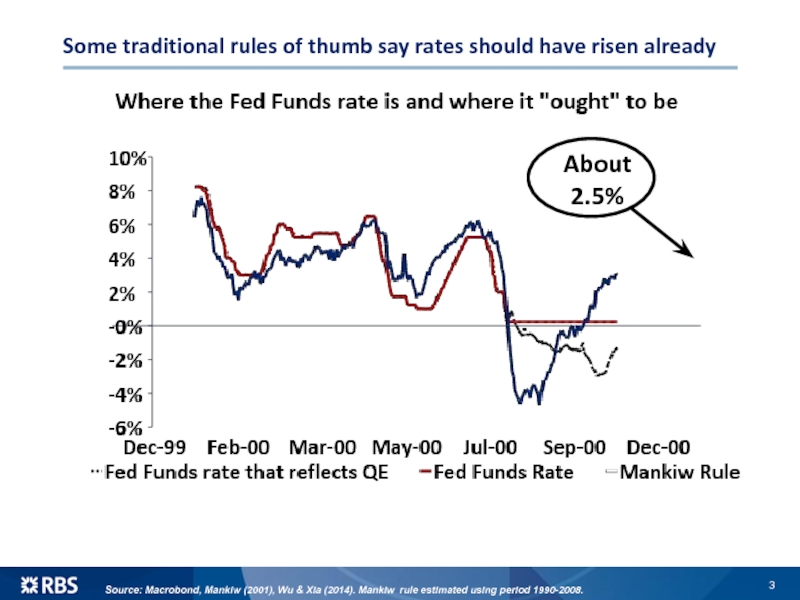

Слайд 3Some traditional rules of thumb say rates should have risen already

Source:

About 2.5%

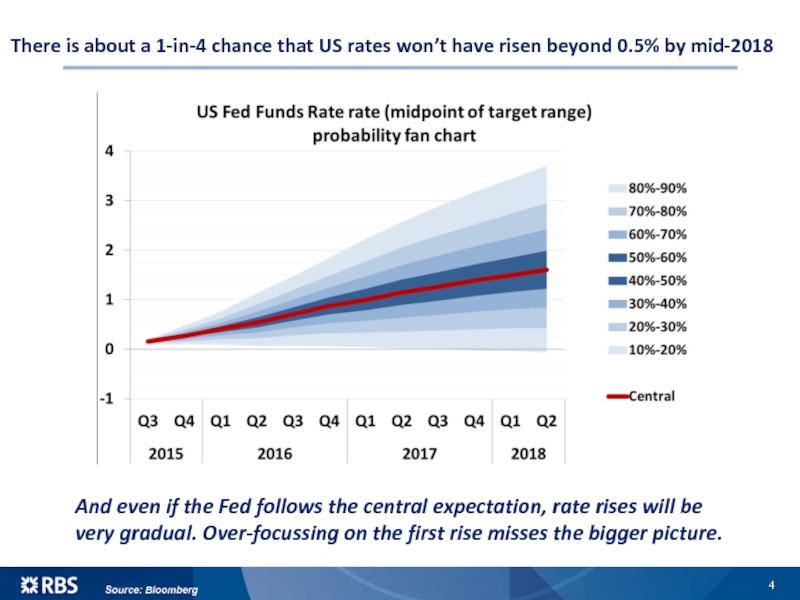

Слайд 4Source: Bloomberg

There is about a 1-in-4 chance that US rates

And even if the Fed follows the central expectation, rate rises will be very gradual. Over-focussing on the first rise misses the bigger picture.

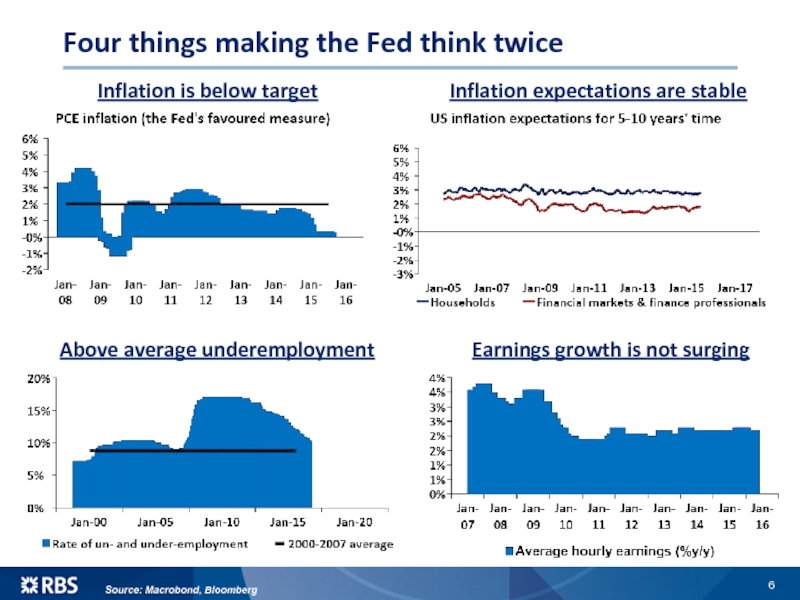

Слайд 6Four things making the Fed think twice

Inflation is below target

Inflation expectations

Above average underemployment

Earnings growth is not surging

Source: Macrobond, Bloomberg

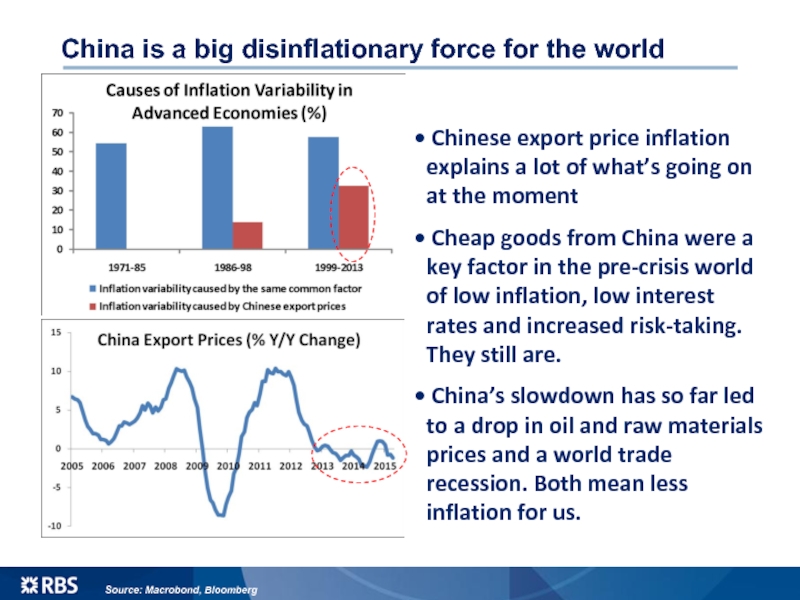

Слайд 7Source: Macrobond, Bloomberg

China is a big disinflationary force for the world

Cheap goods from China were a key factor in the pre-crisis world of low inflation, low interest rates and increased risk-taking. They still are.

China’s slowdown has so far led to a drop in oil and raw materials prices and a world trade recession. Both mean less inflation for us.

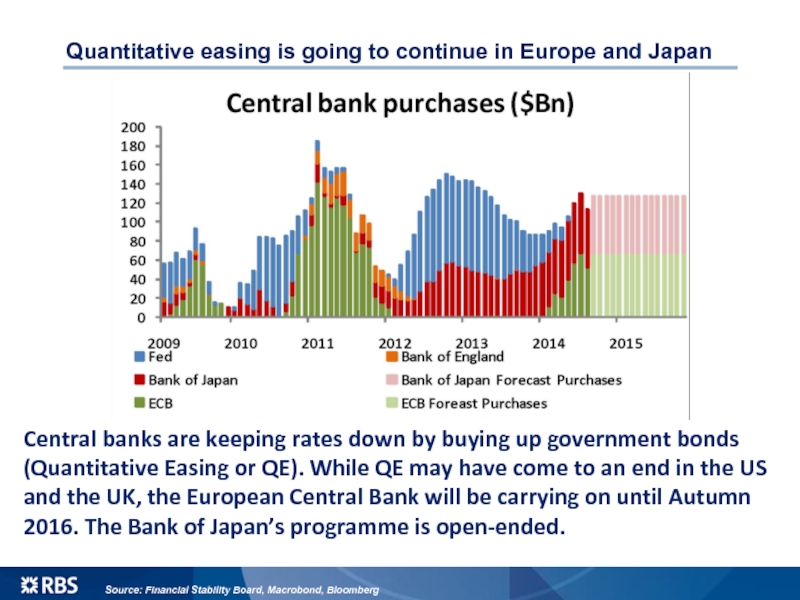

Слайд 8Source: Financial Stability Board, Macrobond, Bloomberg

Quantitative easing is going to continue

Central banks are keeping rates down by buying up government bonds (Quantitative Easing or QE). While QE may have come to an end in the US and the UK, the European Central Bank will be carrying on until Autumn 2016. The Bank of Japan’s programme is open-ended.

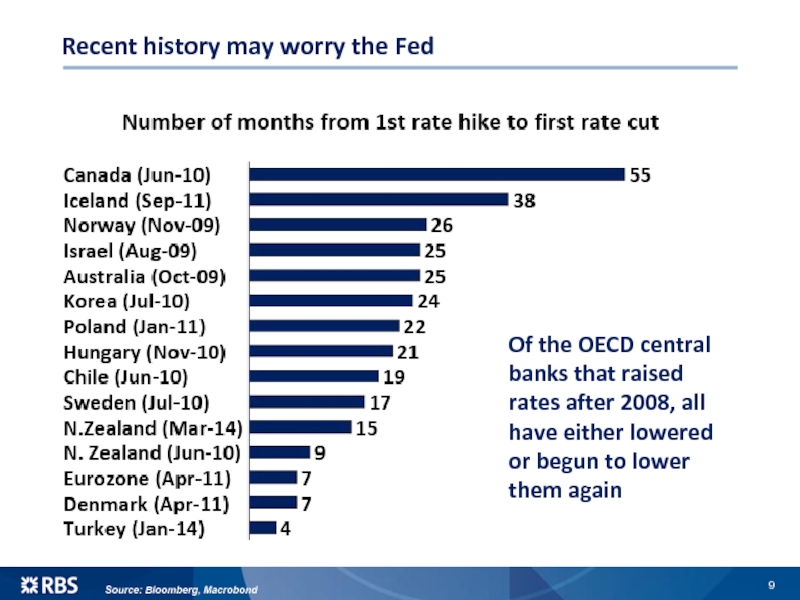

Слайд 9Source: Bloomberg, Macrobond

Recent history may worry the Fed

Of the OECD

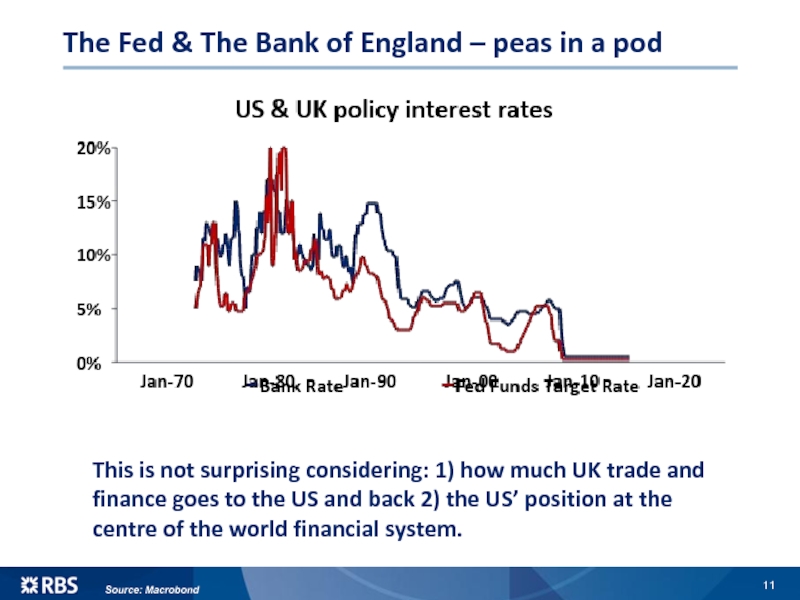

Слайд 11The Fed & The Bank of England – peas in a

Source: Macrobond

This is not surprising considering: 1) how much UK trade and finance goes to the US and back 2) the US’ position at the centre of the world financial system.