- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Managing financial resources презентация

Содержание

- 1. Managing financial resources

- 2. Managing Financial Resources Chapter 13 © 2015 Flat World Knowledge

- 3. Chapter Objectives Identify the functions of money

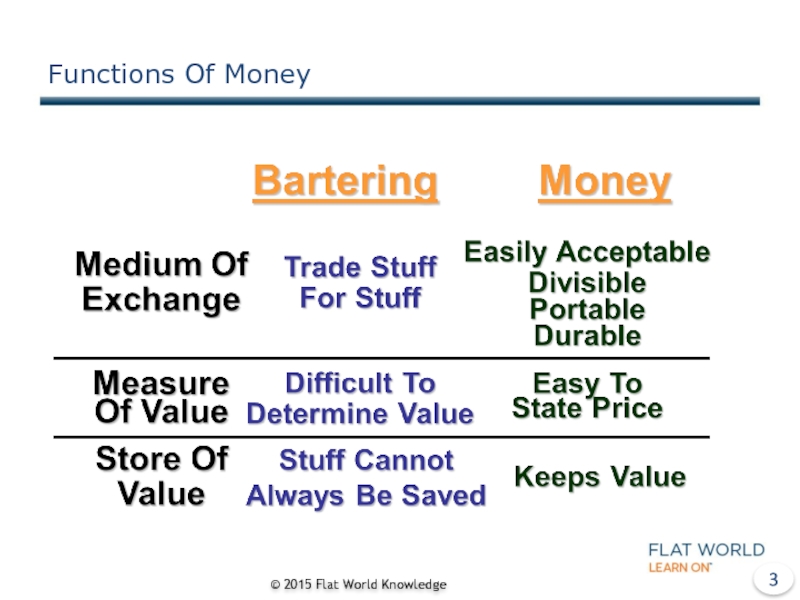

- 4. Functions Of Money © 2015 Flat World Knowledge

- 5. Money Supply © 2015 Flat World Knowledge

- 6. Depository Institutions Commercial Banks Savings Banks Credit Unions © 2015 Flat World Knowledge

- 7. Nondepository Institutions Finance Companies Insurance Companies Brokerage Firms © 2015 Flat World Knowledge

- 8. Financial Services Checking/Savings Accounts ATMs Credit/Debit Cards

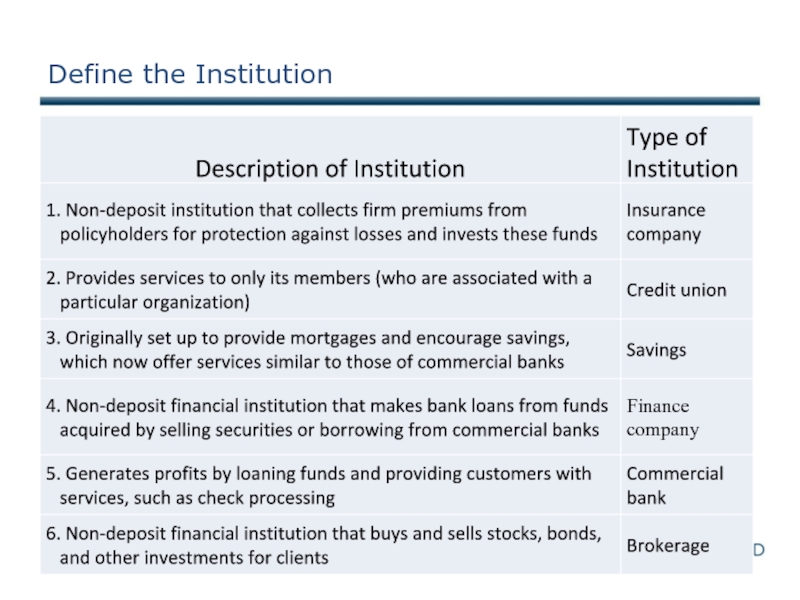

- 9. Define the Institution

- 10. Bank Regulation Federal Depository Insurance Corporation 1933

- 11. Crisis in the Financial Industry Risky

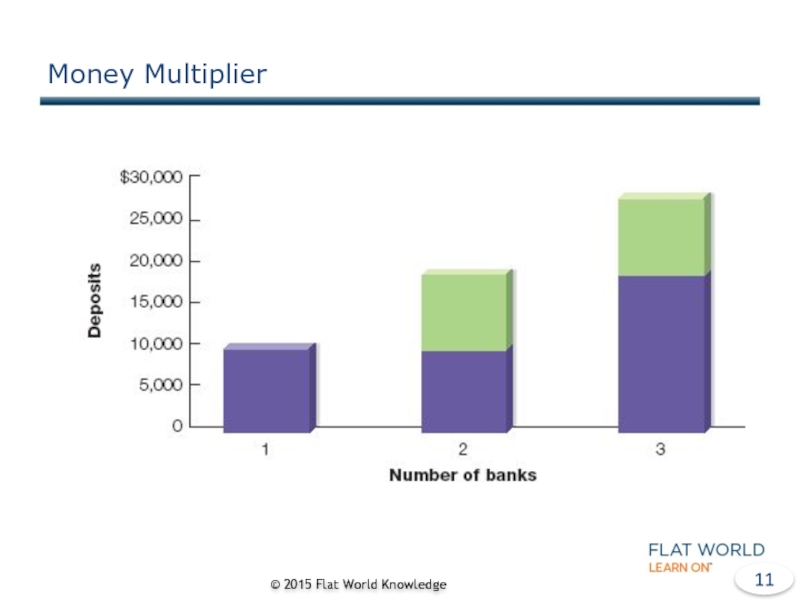

- 12. Money Multiplier © 2015 Flat World Knowledge

- 13. Fluctuating Reserve Rates You just won $10

- 14. Federal Reserve System Central Banking (1913) 12

- 15. Tools Of The Fed Goals Price Stability

- 16. Open Market Operations https://www.stlouisfed.org/in-plain-english/a-closer-look-at-open-market-operations

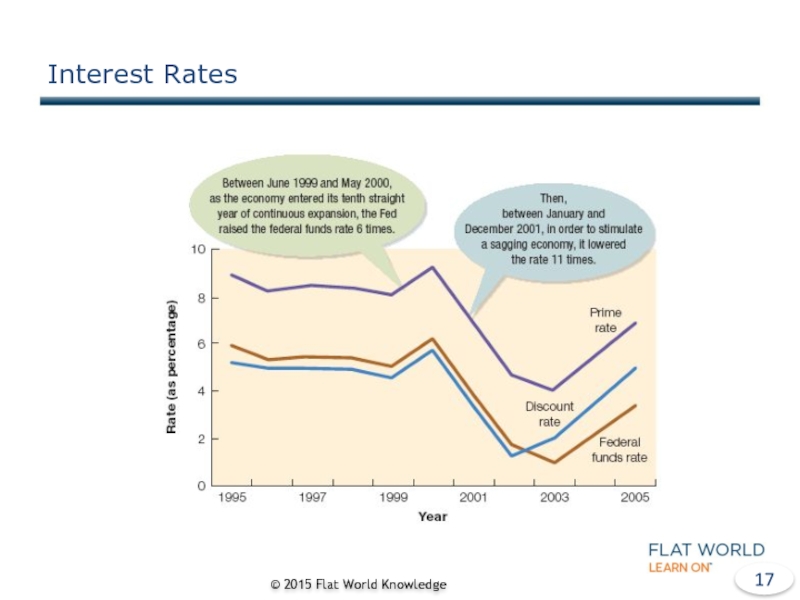

- 17. Federal Funds Rate Federal Funds

- 18. Interest Rates © 2015 Flat World Knowledge

- 19. Banker’s Bank & Government’s Banker Check Clearing

- 20. Financial Manager “…finance is all of the

- 21. Developing A Financial Plan Estimating Sales Getting

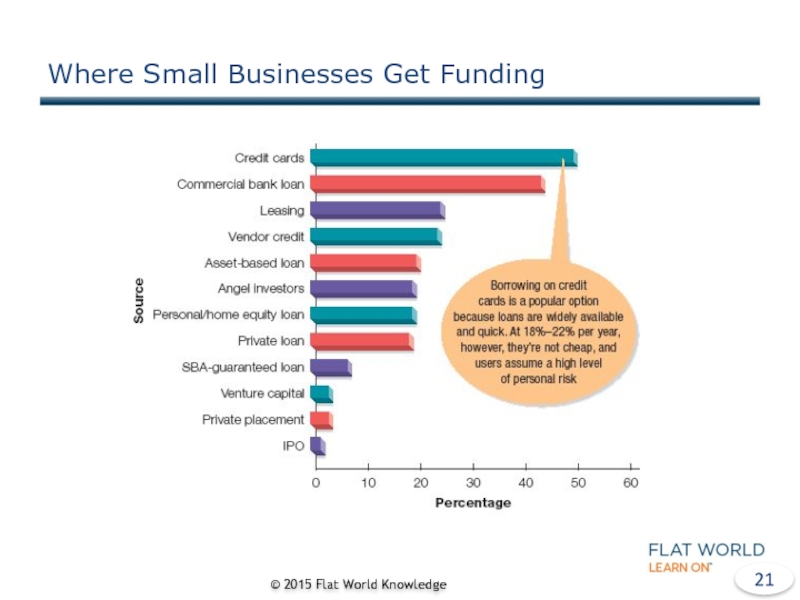

- 22. Where Small Businesses Get Funding © 2015 Flat World Knowledge

- 23. Loan Characteristics Maturity Short-Term Intermediate Long-Term Line

- 24. Growth Stage Financing Managing Cash Accounts

- 25. Sources Of Financing During Growth Stage Bank

- 26. Investors Angels Venture Capitalists Going Public Initial

- 27. Markets And Exchanges Markets Primary Secondary Organized

- 28. Regulating Securities Markets Securities and Exchange

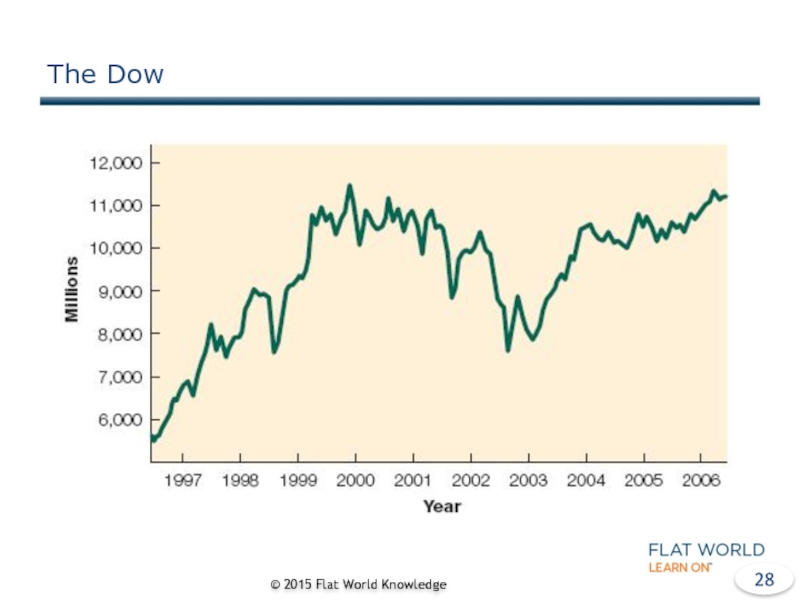

- 29. The Dow © 2015 Flat World Knowledge

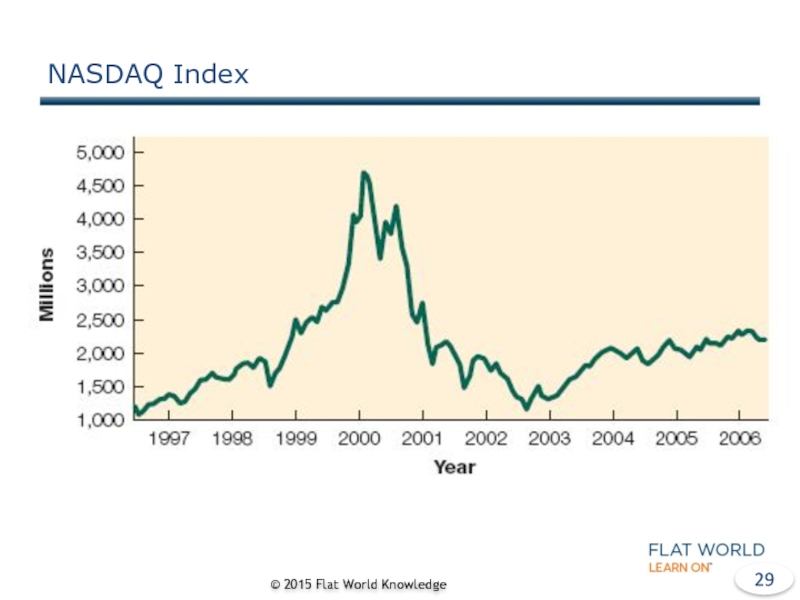

- 30. NASDAQ Index © 2015 Flat World Knowledge

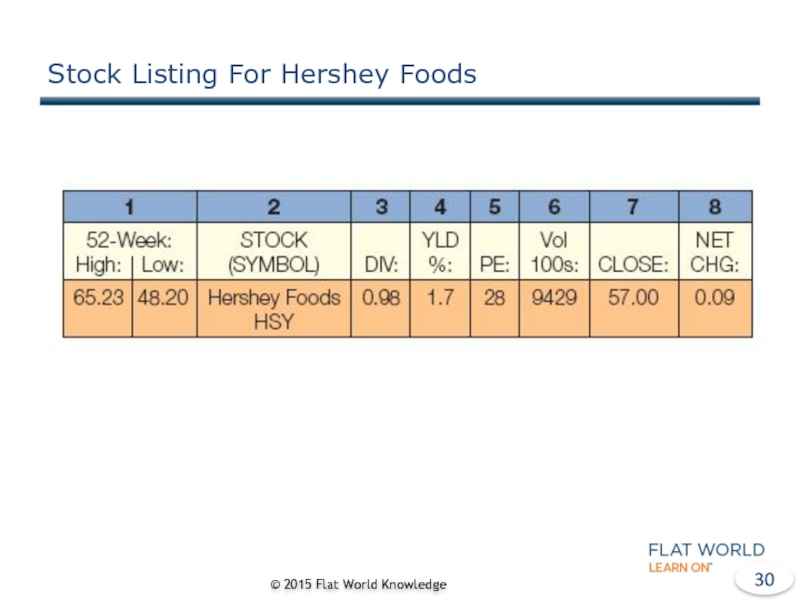

- 31. Stock Listing For Hershey Foods © 2015 Flat World Knowledge

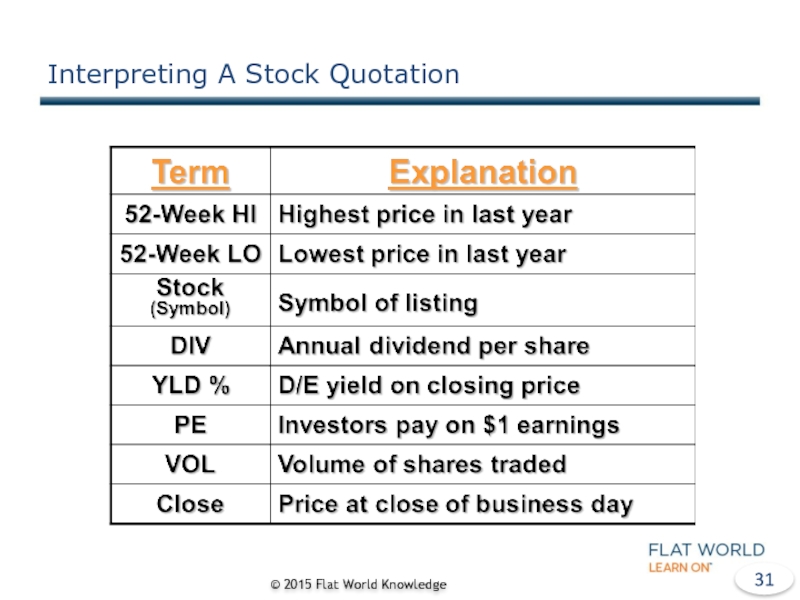

- 32. Interpreting A Stock Quotation © 2015 Flat World Knowledge

- 33. Learning to Quote Quotations Explain each item in the stock listing for Proctor & Gamble.

- 34. Financing The Going Concern © 2015 Flat World Knowledge Equity Financing Debt Financing

- 35. Stockholders’ Equity Risk/Reward Tradeoff Dividends Types of

- 36. Bonds “…debt securities that obligate the issuer

- 37. Financing a Multimillion Dollar Plant Expansion You’re

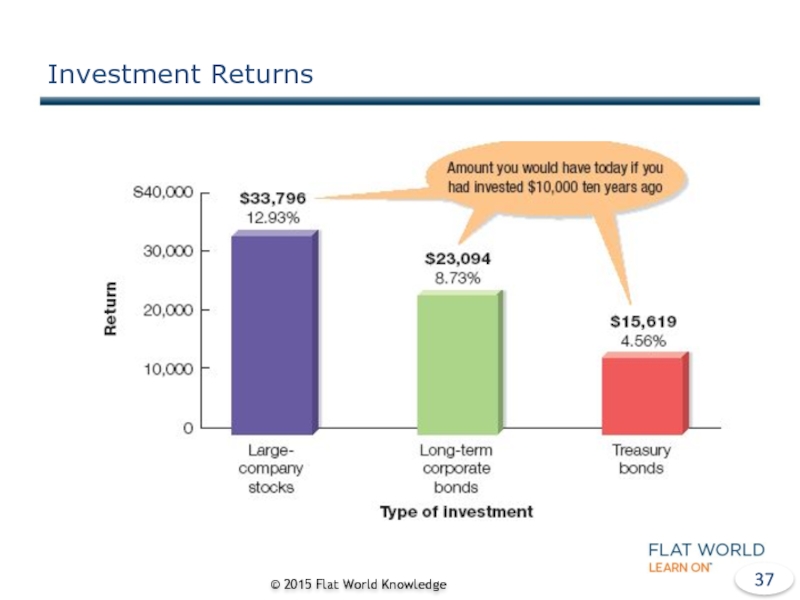

- 38. Investment Returns © 2015 Flat World Knowledge

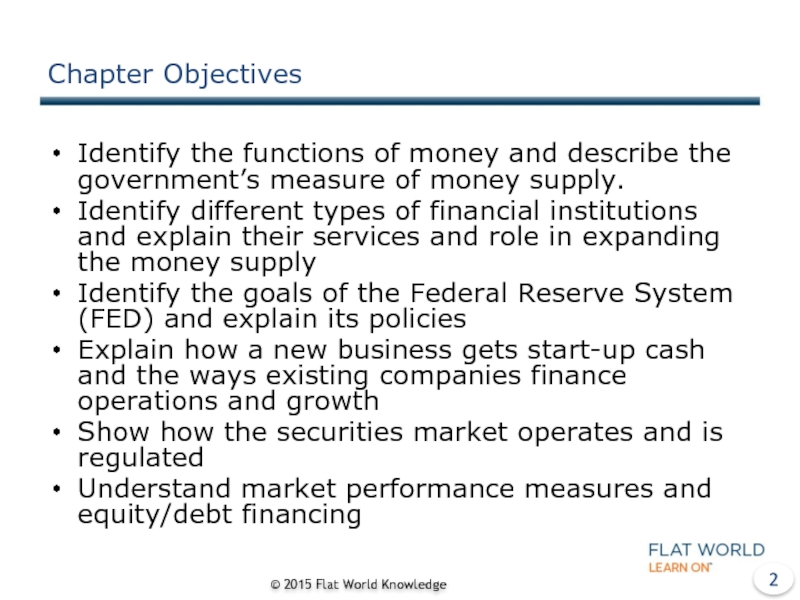

Слайд 3Chapter Objectives

Identify the functions of money and describe the government’s measure

Identify different types of financial institutions and explain their services and role in expanding the money supply

Identify the goals of the Federal Reserve System (FED) and explain its policies

Explain how a new business gets start-up cash and the ways existing companies finance operations and growth

Show how the securities market operates and is regulated

Understand market performance measures and equity/debt financing

© 2015 Flat World Knowledge

Слайд 7Nondepository Institutions

Finance Companies

Insurance Companies

Brokerage Firms

© 2015 Flat World Knowledge

Слайд 8Financial Services

Checking/Savings Accounts

ATMs

Credit/Debit Cards

Loans

Financial Advice

Sells Financial Products

Insurance

Electronic Banking

© 2015 Flat World

Слайд 10Bank Regulation

Federal Depository Insurance Corporation

1933

Insures Deposits

Periodic Examinations

Office of Thrift Supervision

National Credit

© 2015 Flat World Knowledge

Слайд 11Crisis in the Financial Industry

Risky (sub-prime) loans made for homes

Easy credit drove home prices up

Housing bubble burst: prices dropped and foreclosures rose

Bank profits plummeted

Stock prices fell, people stopped spending, country went into a recession

Congress passed Dodd-Frank bill to reduce likelihood of this happening again

© 2015 Flat World Knowledge

Слайд 13Fluctuating Reserve Rates

You just won $10 million in the lottery and

Слайд 14Federal Reserve System

Central Banking (1913)

12 Districts/Banks

Board of Governors

https://www.stlouisfed.org/in-plain-english/history-and-purpose-of-the-fed

© 2015 Flat World

Слайд 15Tools Of The Fed

Goals

Price Stability

Sustainable Economic

Full Employment

Tools

Reserve Requirements

Discount Rate

Open Market Operations

https://www.stlouisfed.org/in-plain-english/how-monetary-policy-works

© 2015 Flat World Knowledge

Слайд 16Open Market Operations

https://www.stlouisfed.org/in-plain-english/a-closer-look-at-open-market-operations

Слайд 19Banker’s Bank & Government’s Banker

Check Clearing

U.S. Treasury’s

Paperwork in Government Securities

Collect Federal Tax Payments

Lender to Government

© 2015 Flat World Knowledge

Слайд 20Financial Manager

“…finance is all of the activities involved in planning for,

“…financial manager determines how much money the company needs, how and where it will get the necessary funds, and how and when it will repay the money…”

© 2015 Flat World Knowledge

Слайд 21Developing A Financial Plan

Estimating Sales

Getting The Money

Personal Assets

Loans—Family/Friends

Bank Loans

Making The Financing

© 2015 Flat World Knowledge

Слайд 23Loan Characteristics

Maturity

Short-Term

Intermediate

Long-Term

Line of Credit

Amortization

Security

Collateral

Unsecured

Interest

© 2015 Flat World Knowledge

Слайд 24Growth Stage Financing

Managing

Cash

Accounts Receivable

Accounts Payable—

Budgeting

© 2015 Flat World Knowledge

Слайд 25Sources Of Financing During Growth Stage

Bank

Additional Owners

Private Investors

© 2015 Flat World

Слайд 26Investors

Angels

Venture Capitalists

Going Public

Initial Public Offering

Investment Banking Firm

© 2015 Flat World Knowledge

Слайд 27Markets And Exchanges

Markets

Primary

Secondary

Organized Exchanges

New York Stock Exchange

American Stock Exchange

Over-The-Counter (OTC)

© 2015

Слайд 28Regulating Securities Markets

Securities and Exchange

Commission (1934)

Prospectus

Insider Trading

Market Indexes

Dow Jones

NASDAQ Composite

S & P 500

Reading a Stock Listing

Bull vs. Bear Market

© 2015 Flat World Knowledge

Слайд 35Stockholders’ Equity

Risk/Reward Tradeoff

Dividends

Types of Stock

Common

Preferred

Cumulative

Convertible

© 2015 Flat World Knowledge

Слайд 36Bonds

“…debt securities that obligate the issuer to make interest payments to

Treasury Bills/Bonds

Municipals (munis)

© 2015 Flat World Knowledge