- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

LOW OIL PRICES and THE NEW CLIMATE ECONOMYOpportunity or constraint? презентация

Содержание

- 1. LOW OIL PRICES and THE NEW CLIMATE ECONOMYOpportunity or constraint?

- 2. Context: Our energy system is built on

- 3. Firstly cheaper oil helps the global economy

- 4. Volatility hurts the economy 1 Increase decision

- 5. We should not bank on low oil

- 6. We should not deny fossil fuel subsidies

- 7. Recognise that renewable costs are decreasing fast

- 8. Co-benefits have high value and are not

- 9. We should reflect on signals from long-term

- 10. So are low oil prices an opportunity

- 11. Take advantage of low price to reform

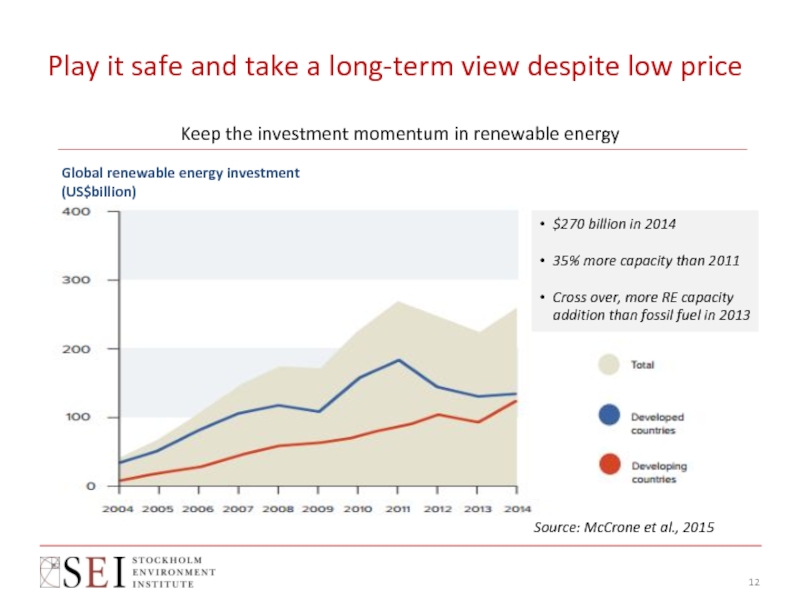

- 12. Play it safe and take a long-term view despite low price

- 13. Realize that a low carbon transition can

- 14. Concluding remarks Oil (and fossil fuels) still

- 15. Thoughts?

Слайд 1

LOW OIL PRICES and THE NEW CLIMATE ECONOMY

Opportunity or constraint?

Luca De

Stockholm Environment Institute

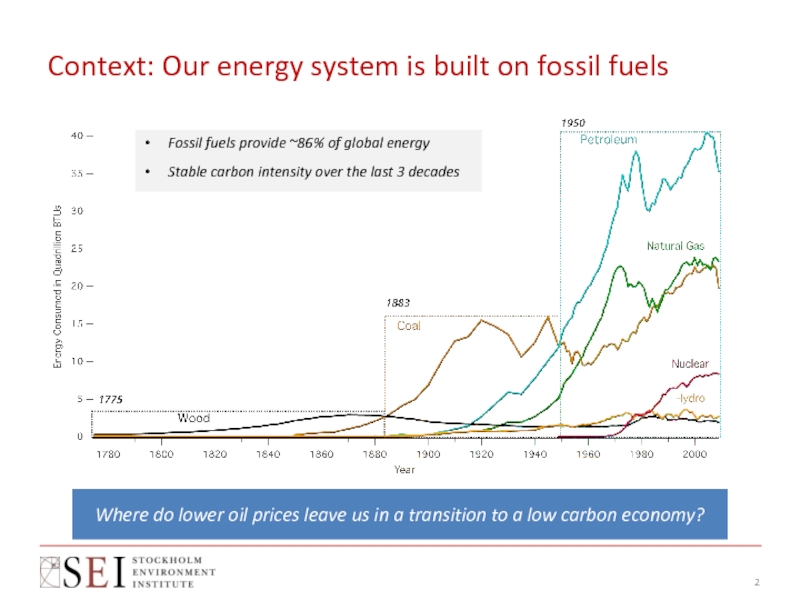

Слайд 2Context: Our energy system is built on fossil fuels

Where do lower

Fossil fuels provide ~86% of global energy

Stable carbon intensity over the last 3 decades

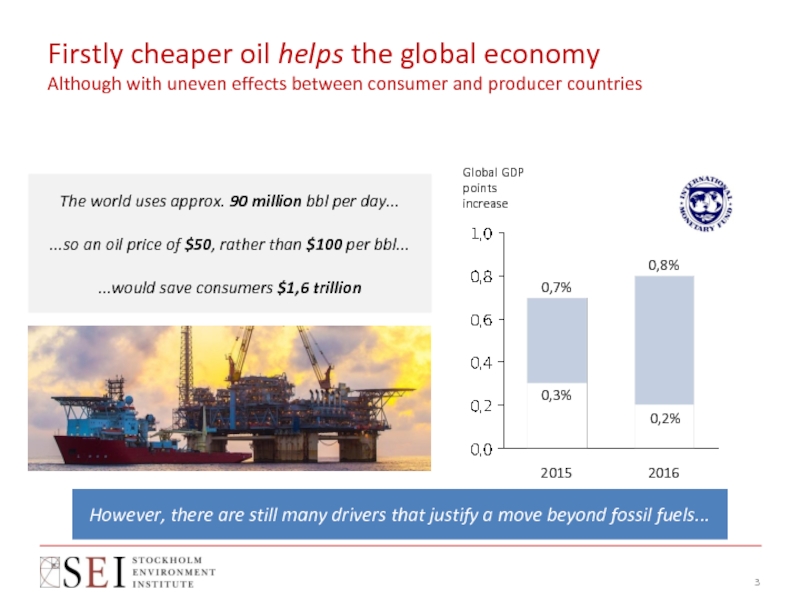

Слайд 3Firstly cheaper oil helps the global economy Although with uneven effects between

2016

0,8%

2015

0,7%

Global GDP

points increase

The world uses approx. 90 million bbl per day...

...so an oil price of $50, rather than $100 per bbl...

...would save consumers $1,6 trillion

0,3%

0,2%

However, there are still many drivers that justify a move beyond fossil fuels...

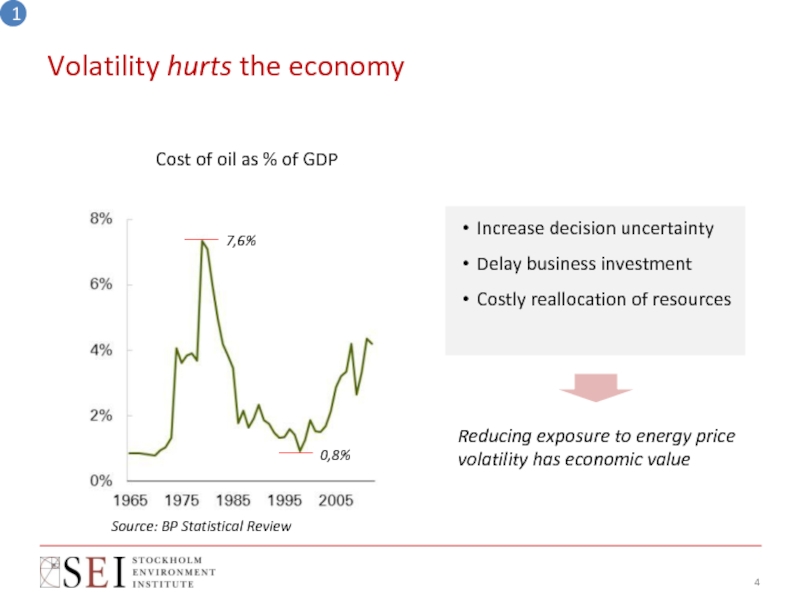

Слайд 4Volatility hurts the economy

1

Increase decision uncertainty

Delay business investment

Costly reallocation of resources

Cost

Reducing exposure to energy price volatility has economic value

7,6%

0,8%

Source: BP Statistical Review

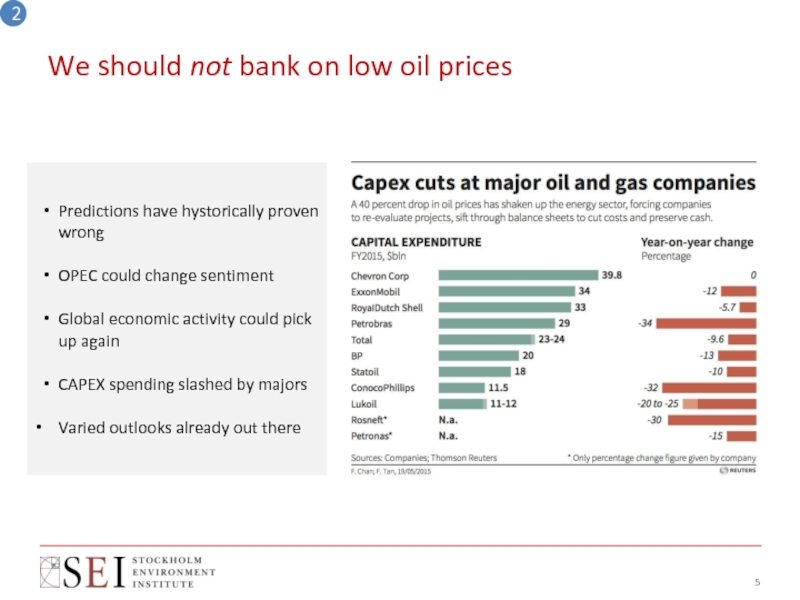

Слайд 5We should not bank on low oil prices

2

Predictions have hystorically

OPEC could change sentiment

Global economic activity could pick up again

CAPEX spending slashed by majors

Varied outlooks already out there

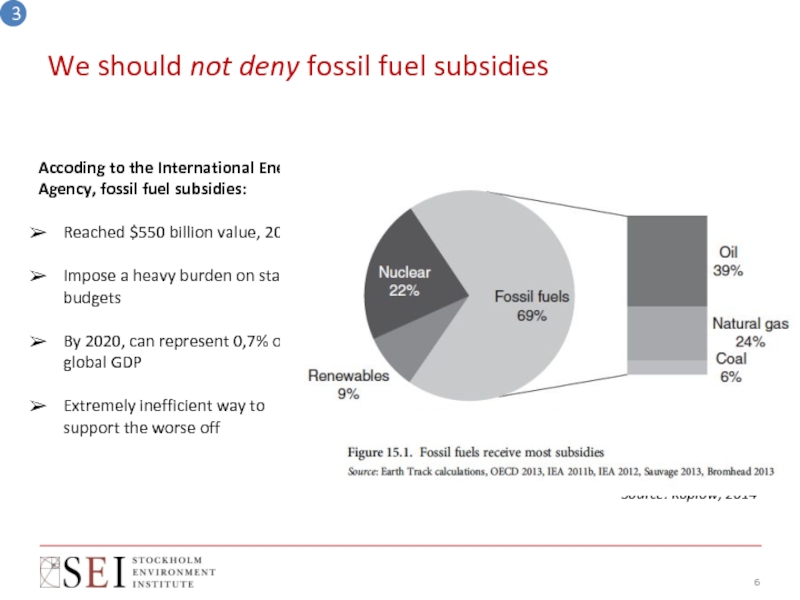

Слайд 6We should not deny fossil fuel subsidies

3

Source: Koplow, 2014

Accoding to the

Reached $550 billion value, 2013

Impose a heavy burden on state budgets

By 2020, can represent 0,7% of global GDP

Extremely inefficient way to support the worse off

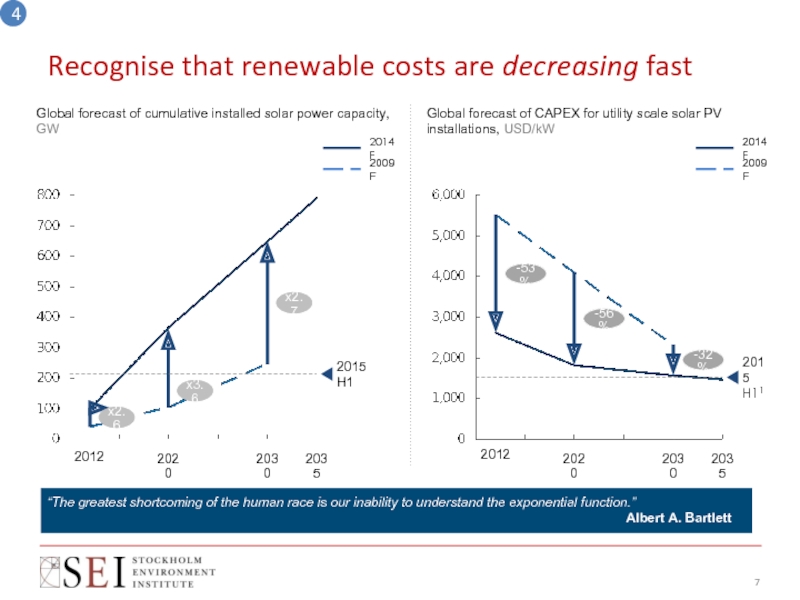

Слайд 7Recognise that renewable costs are decreasing fast

4

2020

2035

2030

2015

H1

x2.7

x3.6

x2.6

2012

2035

2030

2020

-32%

-53%

2015

H11

-56%

2012

2009F

2014F

2014F

2009F

“The greatest shortcoming

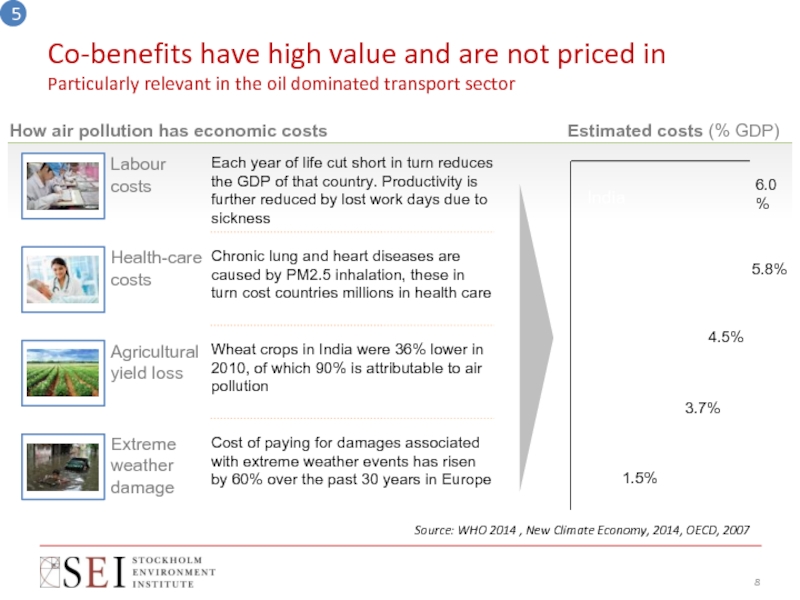

Слайд 8Co-benefits have high value and are not priced in Particularly relevant in

5

How air pollution has economic costs

Each year of life cut short in turn reduces the GDP of that country. Productivity is further reduced by lost work days due to sickness

Chronic lung and heart diseases are caused by PM2.5 inhalation, these in turn cost countries millions in health care

Wheat crops in India were 36% lower in 2010, of which 90% is attributable to air pollution

Cost of paying for damages associated with extreme weather events has risen by 60% over the past 30 years in Europe

Extreme weather damage

Agricultural yield loss

Health-care costs

Labour costs

3.7%

UK

Germany

USA

4.5%

India

6.0%

1.5%

5.8%

China

Estimated costs (% GDP)

Source: WHO 2014 , New Climate Economy, 2014, OECD, 2007

Слайд 9We should reflect on signals from long-term investors

6

Reallocation of capital, both

Potential for fossil fuel assets to become ”stranded”

Institutional investors becoming more active shareholders

Long term players (pension funds, insurances, central banks) increasingly considering climate risks

“The exposure of UK investors, including insurance companies, to climate shifts is potentially huge”

Mark Carney, Governor Bank of England

In order to fulfil long-term liabilities, insurers like Allianz need stable investments and long-term yields – and this is exactly what wind and solar farms have to offer”

David Jones, Head of Renewables at Allianz

Слайд 10So are low oil prices an opportunity to correct course?

Fuel price

Renewables getting cheaper

Fossil fuel subsidies

Investors concerns

Co-benefits drivers

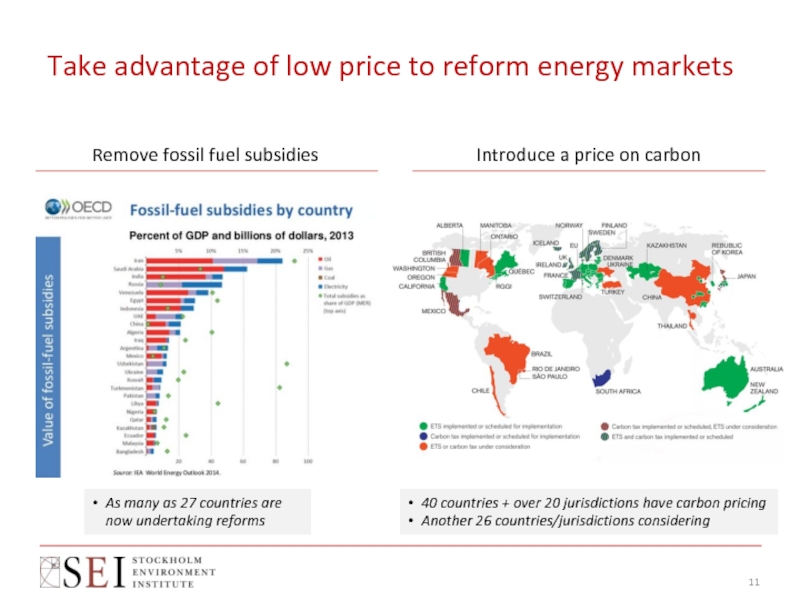

Слайд 11Take advantage of low price to reform energy markets

Remove fossil fuel

Introduce a price on carbon

As many as 27 countries are now undertaking reforms

40 countries + over 20 jurisdictions have carbon pricing

Another 26 countries/jurisdictions considering

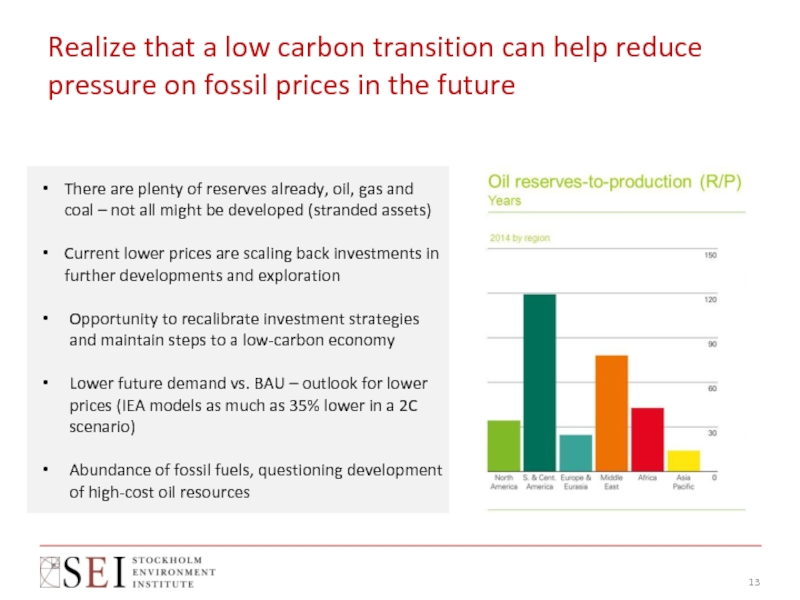

Слайд 13Realize that a low carbon transition can help reduce pressure on

There are plenty of reserves already, oil, gas and coal – not all might be developed (stranded assets)

Current lower prices are scaling back investments in further developments and exploration

Opportunity to recalibrate investment strategies and maintain steps to a low-carbon economy

Lower future demand vs. BAU – outlook for lower prices (IEA models as much as 35% lower in a 2C scenario)

Abundance of fossil fuels, questioning development of high-cost oil resources

Слайд 14Concluding remarks

Oil (and fossil fuels) still dominate the energy mix and

However, we should not allow this to derail our transition towards a better, more sustainable energy system as the long term economic benefits of structural changes to economies and energy systems remain valid

In fact we should see this as an opportunity to reform our energy markets

True costs of fossil fuels and reduce their subsidies

Introduce a price for carbon

Target some of the long lasting co-benefits