By Sean O’Reilly

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Is Baidu’s $1 Billion Share Buyback Program a Good Deal for Shareholders? презентация

Содержание

- 1. Is Baidu’s $1 Billion Share Buyback Program a Good Deal for Shareholders?

- 2. Buffett on Buybacks “There is only one

- 3. A Rough Quarter and a Billion Dollar

- 4. A Rough Quarter and a Billion Dollar

- 5. What goes up must come down…

- 6. What Would Warren Do? Is

- 7. Best Use of Shareholders’ Capital? There are

- 8. Best Use of Shareholders’ Capital? Companies repurchasing

- 9. The “Google” of China China’s Internet market

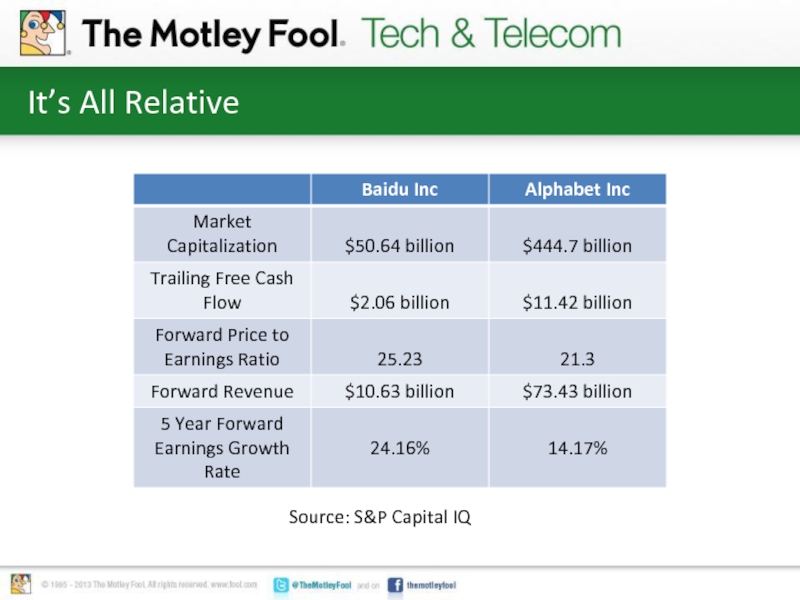

- 10. It’s All Relative Source: S&P Capital IQ

- 11. Foolish Takeaway Baidu trades for just 25

Слайд 2Buffett on Buybacks

“There is only one combination of facts that makes

it advisable for a company to repurchase its shares: First, the company has available funds -- cash plus sensible borrowing capacity -- beyond the near-term needs of the business and, second, finds its stock selling in the market below its intrinsic value, conservatively calculated.”

-- Warren Buffett, 1999 Berkshire Hathaway Chairman’s Letter to Shareholders

-- Warren Buffett, 1999 Berkshire Hathaway Chairman’s Letter to Shareholders

Слайд 3A Rough Quarter and a Billion Dollar Buyback

For the quarter ended

June 30, 2015:

Total revenues up 38.3% year over year to $2.67 billion

Operating profit fell 2.5% to $559.6 million

Net income slid slightly to $590.6 million

Mobile search monthly active users increased 24% year over year to 629 million

Traffic acquisition costs as a percentage of revenues dropped from 13.5% of revenues to 12.7%

Total revenues up 38.3% year over year to $2.67 billion

Operating profit fell 2.5% to $559.6 million

Net income slid slightly to $590.6 million

Mobile search monthly active users increased 24% year over year to 629 million

Traffic acquisition costs as a percentage of revenues dropped from 13.5% of revenues to 12.7%

Слайд 4A Rough Quarter and a Billion Dollar Buyback

The main drag on

profitability was investments in the company’s “O2O” initiative

O2O stands for “online to offline”, which basically means helping mobile internet users buy goods at physical stores

Baidu aims to be a leader in this burgeoning industry despite fierce competition

O2O & Other division reduced operating margins by 25.3%

Following the release, Baidu announced a $1 billion share repurchase program

O2O stands for “online to offline”, which basically means helping mobile internet users buy goods at physical stores

Baidu aims to be a leader in this burgeoning industry despite fierce competition

O2O & Other division reduced operating margins by 25.3%

Following the release, Baidu announced a $1 billion share repurchase program

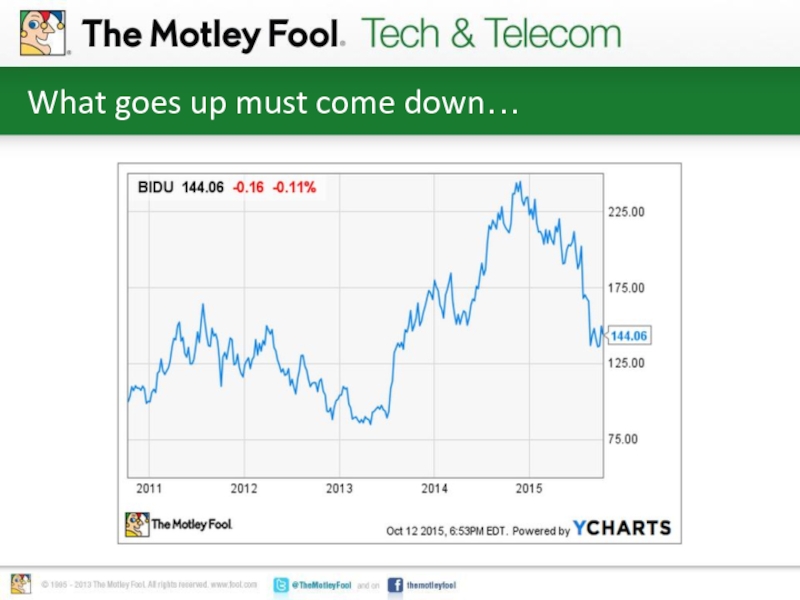

Слайд 6What Would Warren Do?

Is Baidu’s share repurchase program a prime example

of intelligent capital allocation, or a ploy to placate shareholders after a terrible quarter?

Слайд 7Best Use of Shareholders’ Capital?

There are four possible uses for shareholders’

capital:

Capital investments

Dividends

Share repurchases

Acquisitions

Does the $1 billion share repurchase make economic sense?

Capital investments

Dividends

Share repurchases

Acquisitions

Does the $1 billion share repurchase make economic sense?

Слайд 8Best Use of Shareholders’ Capital?

Companies repurchasing shares need to be able

to prove that it is the best use of capital – instead of paying a dividend or expanding

This is tricky because we are on the outside looking in on Baidu’s operations

Comparing Baidu’s valuation to other leading internet search giants is instructive

This is tricky because we are on the outside looking in on Baidu’s operations

Comparing Baidu’s valuation to other leading internet search giants is instructive

Слайд 9The “Google” of China

China’s Internet market is notoriously restrictive and Baidu’s

leading position there is secure for this reason

China’s middle class and Internet use will only grow from here

Growth initiatives like “online to offline” investments offer growth potential in addition to this

China’s middle class and Internet use will only grow from here

Growth initiatives like “online to offline” investments offer growth potential in addition to this

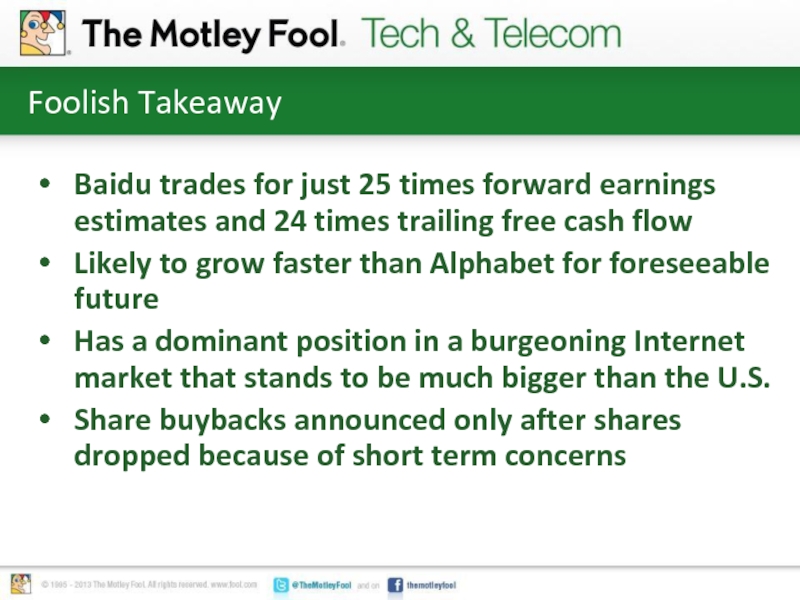

Слайд 11Foolish Takeaway

Baidu trades for just 25 times forward earnings estimates and

24 times trailing free cash flow

Likely to grow faster than Alphabet for foreseeable future

Has a dominant position in a burgeoning Internet market that stands to be much bigger than the U.S.

Share buybacks announced only after shares dropped because of short term concerns

Likely to grow faster than Alphabet for foreseeable future

Has a dominant position in a burgeoning Internet market that stands to be much bigger than the U.S.

Share buybacks announced only after shares dropped because of short term concerns