- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How “fit” is your capital allocation strategy? презентация

Содержание

- 1. How “fit” is your capital allocation strategy?

- 2. Today’s speakers Ellen Licking Senior Analyst, Global

- 3. Pricier targets Increased execution risk for

- 4. Activist investors shake up the status quo

- 5. Activists target larger biopharmas over time

- 6. The drivers of biopharma

- 7. 1. Operational performance Vital signs: EY perspectives

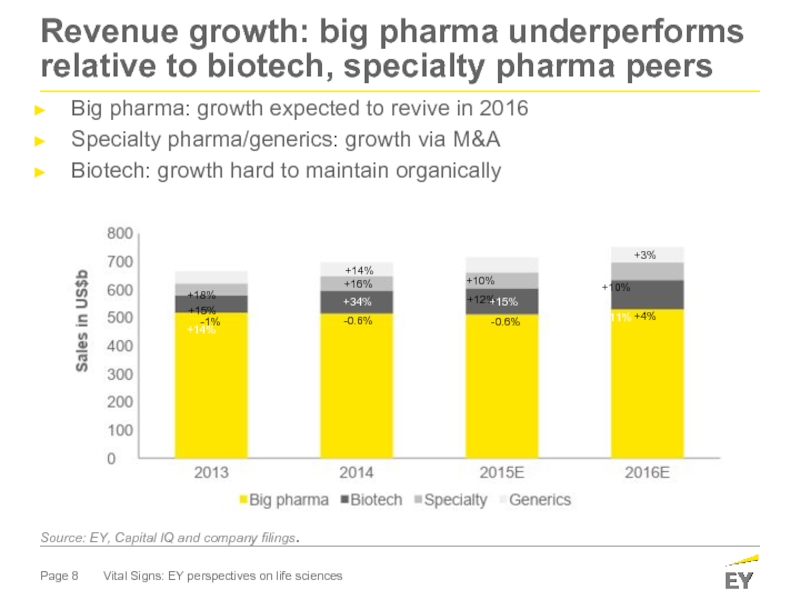

- 8. -1% +18% +15% +14% +14% -0.6% +16%

- 9. Operating margins: big pharma rebounds but still

- 10. Total shareholder return as a performance measure:

- 11. 2. The R&D cycle Key considerations:

- 12. Nearly 200 new drugs are forecasted to

- 13. 3. Capital structure Key considerations:

- 14. Big pharmas return cash to shareholders; biotechs,

- 15. Working capital key to development of more

- 16. 4. Business portfolio and M&A Key considerations:

- 17. Robust M&A market continues in 2015 with

- 18. As companies focus on core priorities, more

- 19. Creating long-term value

- 20. At each stage of the life cycle,

- 21. Value creation comes from

- 22. Summary: Build these 5 steps into strategic

- 23. Additional information ey.com/vitalsigns http://ow.ly/NTufL

- 24. EY | Assurance | Tax | Transactions

Слайд 2Today’s speakers

Ellen Licking

Senior Analyst, Global Life Sciences Sector

Andrew Forman

Global Life Sciences

Andy Lorenzetti

TAS Divestitures and Integration

Principal, Ernst & Young LLP

David Womelsdorf

Global Client Service Partner and

Principal, Ernst & Young LLP

Слайд 3

Pricier targets

Increased execution risk for deals

Repurchase shares or reinvest in the

Slowdown in emerging markets

Pricing pressures

Portfolio optimization

Maintaining revenue growth and operating margins

Unsustainable R&D costs

Integration challenges

Investors are prepared to take a more aggressive stance.

One significant managerial misstep opens the door to activism.

Business pressures increased the importance of getting the capital agenda right

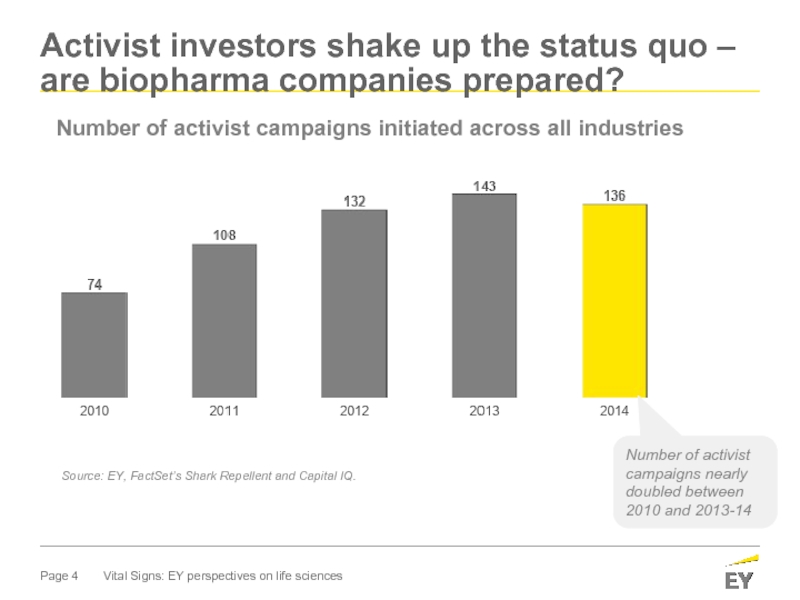

Слайд 4Activist investors shake up the status quo – are biopharma companies

Source: EY, FactSet’s Shark Repellent and Capital IQ.

Number of activist campaigns nearly doubled between 2010 and 2013-14

Number of activist campaigns initiated across all industries

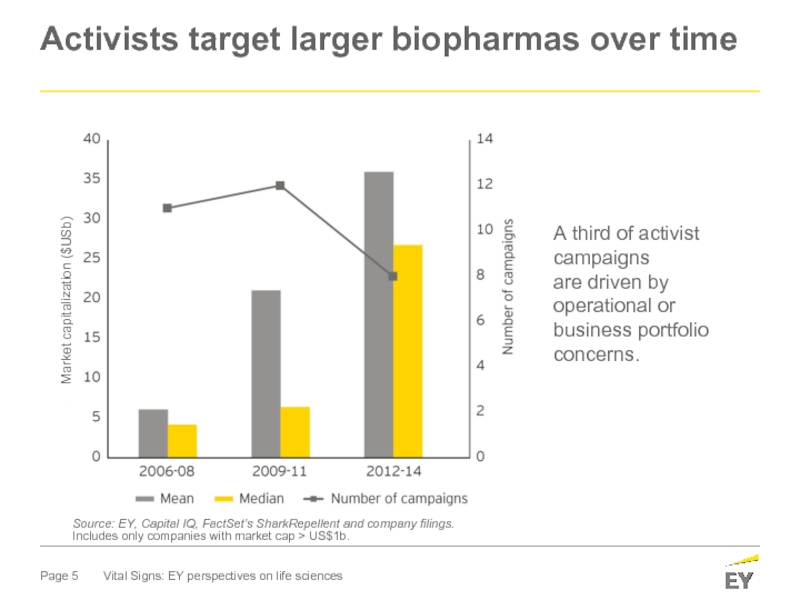

Слайд 5Activists target larger biopharmas over time

Source: EY, Capital IQ, FactSet’s SharkRepellent

A third of activist campaigns

are driven by

operational or

business portfolio concerns.

Market capitalization ($USb)

Слайд 71. Operational performance

Vital signs: EY perspectives on life sciences

Key considerations:

Revenue growth

Operating

Shareholder return

Other: SG&A, effective tax rates

Simply put, “good enough” operational performance is less relevant if shareholders believe more could be done.

Слайд 8-1%

+18%

+15%

+14%

+14%

-0.6%

+16%

+34%

-0.6%

+10%

+12%

+15%

+3%

+10%

+11%

+4%

Revenue growth: big pharma underperforms relative to biotech, specialty pharma peers

Big pharma: growth expected to revive in 2016

Specialty pharma/generics: growth via M&A

Biotech: growth hard to maintain organically

Source: EY, Capital IQ and company filings.

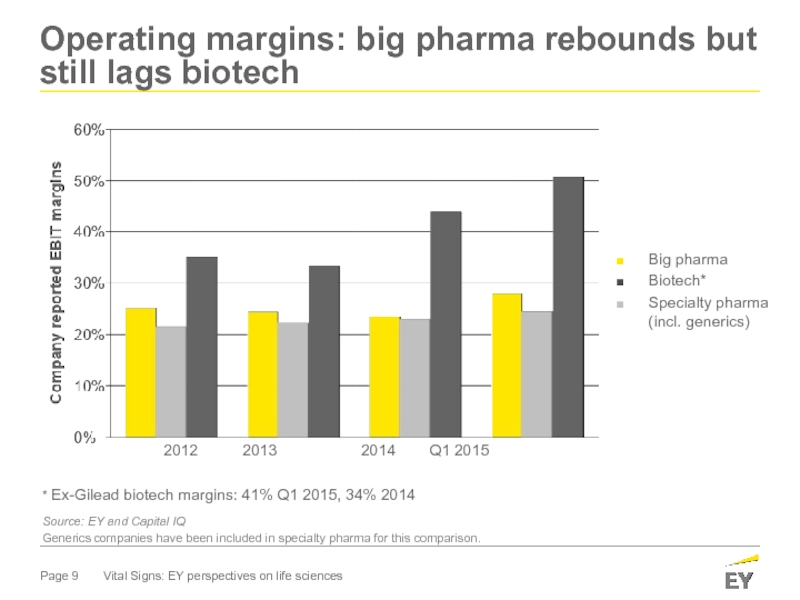

Слайд 9Operating margins: big pharma rebounds but still lags biotech

Generics companies have

Source: EY and Capital IQ

* Ex-Gilead biotech margins: 41% Q1 2015, 34% 2014

Big pharma

Biotech*

Specialty pharma

(incl. generics)

2012 2013 2014 Q1 2015

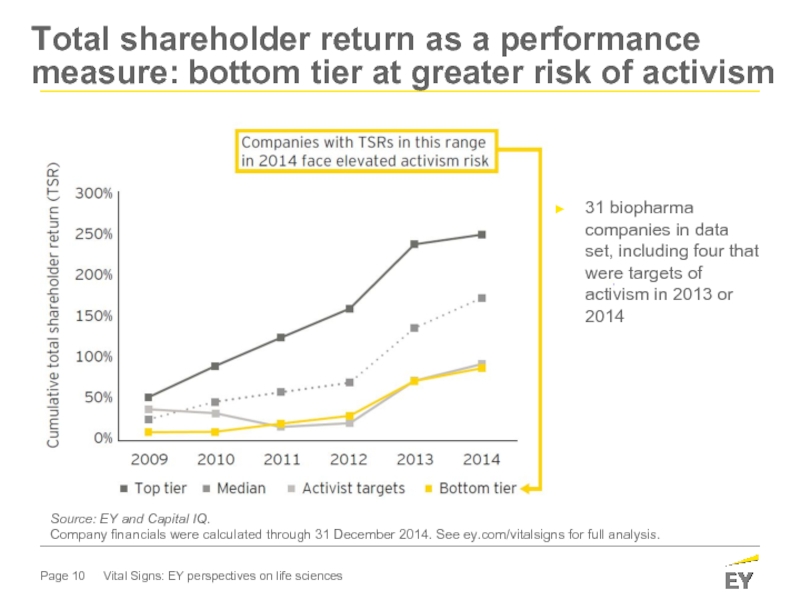

Слайд 10Total shareholder return as a performance measure: bottom tier at greater

Source: EY and Capital IQ.

Company financials were calculated through 31 December 2014. See ey.com/vitalsigns for full analysis.

31 biopharma companies in data set, including four that were targets of activism in 2013 or 2014

Слайд 112. The R&D cycle

Key considerations:

R&D as percentage of sales

Estimated ROIC

Use of milestone or gating mechanisms to improve R&D decisions

The biopharmas that drive the greatest value and productivity from their R&D organizations are the ones that have the most options with respect to capital allocation.

▬ Paul Clancy, CFO, Biogen

Слайд 12Nearly 200 new drugs are forecasted to be launched in the

… continuing a second wave of innovation similar to levels seen in the mid-2000s.

Source: “Global Outlook for Medicines Through 2018,” IMS Health and FDA’s Center for Drug Evaluation and Research.

Number of NME approvals (FDA)

Biopharma pipeline renaissance: analysts project ~ 25% increase in approvals

Слайд 133. Capital structure

Key considerations:

Current available cash balance

Leverage

Excess working capital

Are

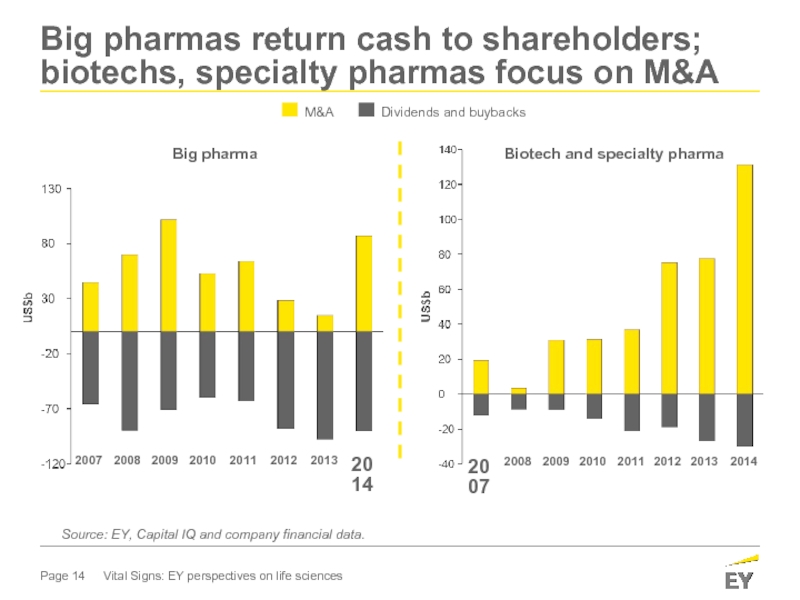

Слайд 14Big pharmas return cash to shareholders; biotechs, specialty pharmas focus on

2014

2013

2012

2011

2010

2009

2008

2007

Source: EY, Capital IQ and company financial data.

Big pharma

Biotech and specialty pharma

Слайд 15Working capital key to development of more cost-effective, less risky business

Big pharma companies have as much as US$50billion in excess working capital (WC)

Big pharma’s 2014 WC performance stronger than in 2007, but …

… WC varies widely overall along the metrics we track (e.g., DSO, DIO, DPO and C2C)

Individual opportunities for improvement, especially by adopting practices of leading WC performers in other industries

Слайд 164. Business portfolio and M&A

Key considerations:

Is there critical mass in a

Perform sum-of-the-parts analyses

Financial data is not generally captured in ways that make it easy to assess the business implications of different kinds of carve-outs.

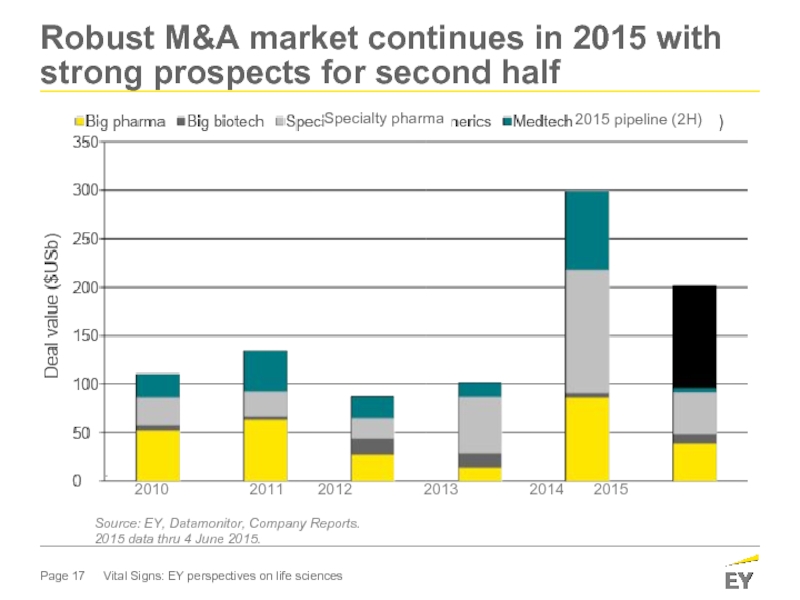

Слайд 17Robust M&A market continues in 2015 with strong prospects for second

Source: EY, Datamonitor, Company Reports.

2015 data thru 4 June 2015.

.

2010 2011 2012 2013 2014 2015

Specialty pharma

2015 pipeline (2H)

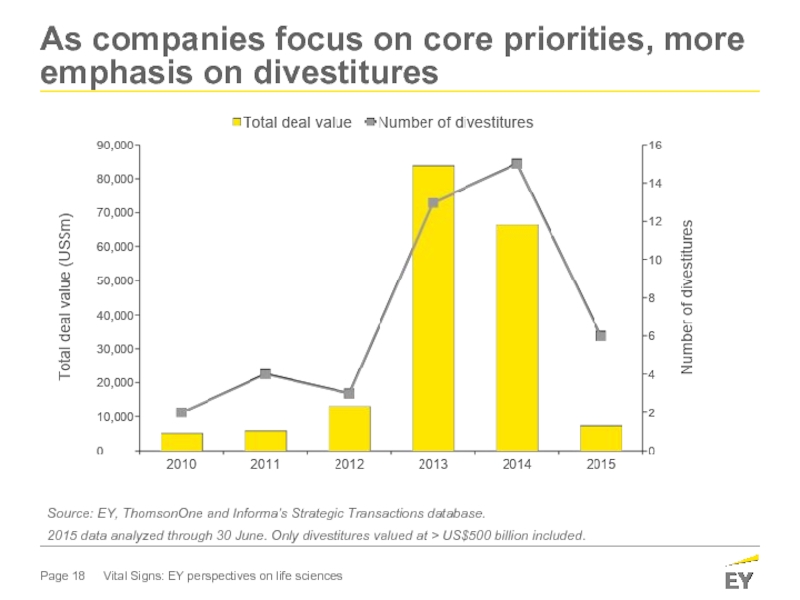

Слайд 18As companies focus on core priorities, more emphasis on divestitures

Source: EY,

2015 data analyzed through 30 June. Only divestitures valued at > US$500 billion included.

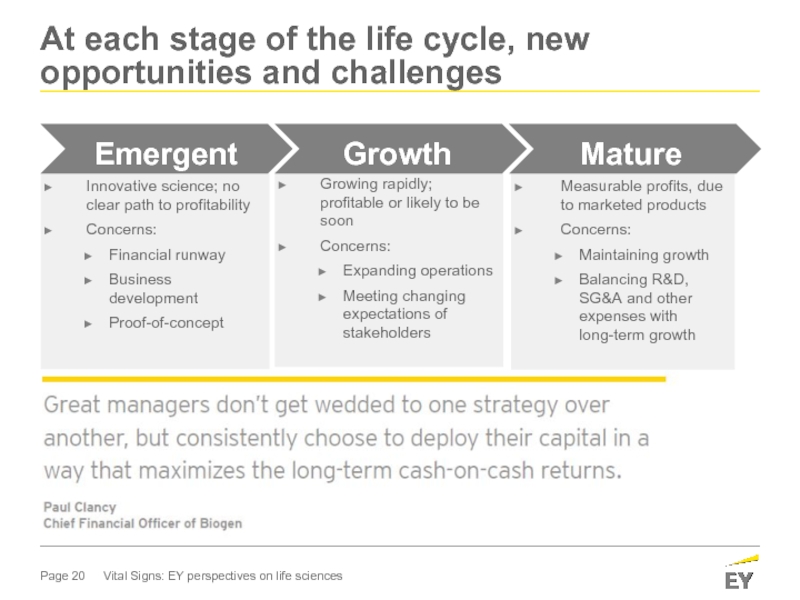

Слайд 20At each stage of the life cycle, new opportunities and challenges

Concerns:

Financial runway

Business development

Proof-of-concept

Emergent

Growing rapidly;

profitable or likely to be

soon

Concerns:

Expanding operations

Meeting changing expectations of stakeholders

Growth

Measurable profits, due

to marketed products

Concerns:

Maintaining growth

Balancing R&D, SG&A and other expenses with long-term growth

Mature

Слайд 21

Value creation comes from holistic deployment of capital agenda

The R&D cycle

Capital

Business portfolio

and M&A

2

3

4

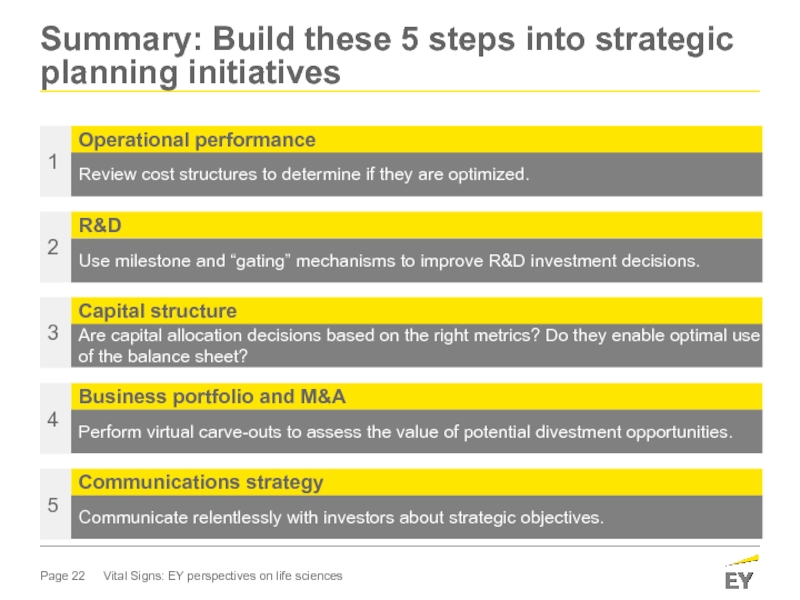

Слайд 22Summary: Build these 5 steps into strategic planning initiatives

Review cost structures

Operational performance

1

Use milestone and “gating” mechanisms to improve R&D investment decisions.

R&D

2

Are capital allocation decisions based on the right metrics? Do they enable optimal use of the balance sheet?

Capital structure

3

Perform virtual carve-outs to assess the value of potential divestment opportunities.

Business portfolio and M&A

4

Communicate relentlessly with investors about strategic objectives.

Communications strategy

5

Слайд 24EY | Assurance | Tax | Transactions | Advisory

About EY

EY is

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

Ernst & Young LLP is a client-serving member firm of Ernst & Young Global Limited operating in the US.

© 2015 Ernst & Young LLP.

All Rights Reserved.

1509-1697453

EYG No. FN0234

ED none

ey.com/vitalsigns

ey.com/lifesciences