- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How to Find Your “Retirement Number” презентация

Содержание

- 1. How to Find Your “Retirement Number”

- 2. Step 1: How much did you spend

- 3. Step 2: Subtracting Rent/Mortgage

- 4. Step 2: Subtracting Rent/Mortgage Many people expect

- 5. Step 3: Subtracting Life or Disability Insurance

- 6. Step 3: Subtracting Life or Disability Insurance

- 7. Step 4: Reducing Your Food Budget

- 8. Step 4: Reducing Your Food Budget In

- 9. Step 5: Reducing Your Transportation Budget

- 10. Step 5: Reducing Your Transportation Budget In

- 11. Step 6: Increase Healthcare Spending

- 12. Step 6: Increase Healthcare Spending Here is

- 13. Step 7: Subtract out Social Security Benefits

- 14. Step 7: Subtract out Social Security Benefits

- 15. Step 8: Find Your Retirement Number

- 16. Step 8: Find Your Retirement Number Take

- 17. The Secret Behind the Overlooked $60,000 Social

Слайд 2Step 1: How much did you spend this year?

This might take

You can use tools like mint.com, or personalcapital.com to help.

For the purposes of this article, I’ll use my family’s 2014 total spending as an example: $50,000

Слайд 4Step 2: Subtracting Rent/Mortgage

Many people expect to have their homes paid

If that doesn’t include you, ignore this step.

Otherwise, subtract out the amount you paid in rent/mortgage this year from your overall spending.

In 2014, my family spent $10,200 on this.

We expect to own our home by the time we retire, so we feel comfortable subtracting this.

New spending total: $39,800

Слайд 6Step 3: Subtracting Life or Disability Insurance

The whole idea behind life

If you’re retired, there aren’t any future cash flows to protect.

In some cases, however, it still makes sense to keep some insurance.

In 2014, my family spent $3,240 on whole and term life insurance, as well as disability insurance.

We feel comfortable subtracting this—knowing that we’ll add in costs for long-term care insurance in step #5.

New spending total: $36,560

Слайд 8Step 4: Reducing Your Food Budget

In retirement, you generally spend less

Depending on your age right now, here’s how much the Bureau of Labor Statistics found that food and alcohol budgets shrunk for those 65 and older:

25 to 34 years old: 17%

35 to 44 years old: 34%

45 to 54 years old: 35%

55 to 64 years old: 23%

In 2014, my family spent $5,750 on food and alcohol.

Currently, we are right on the border of 34 to 35-year old family. We go to our local coffee shop often in the winter, to help our one-year-old daughter get out of the house. We feel comfortable reducing this budget by 20%, or $1,150.

New spending total: $35,410.

Слайд 10Step 5: Reducing Your Transportation Budget

In retirement, folks generally drive less

Depending on your age right now, here’s how much the Bureau of Labor Statistics found that transportation budgets shrunk for those 65 and older:

25 to 34 years old: 26%

35 to 44 years old: 36%

45 to 54 years old: 37%

55 to 64 years old: 29%

In 2014, my family spent $7,000 on transportation, with half of it being in the form of airline flights.

Though I’d like to believe we’ll still travel as much, I know that likely won’t be the case. To keep it optimistic, I’ll only reduce costs by 20%—or $1,400—here.

New spending total: $34,010.

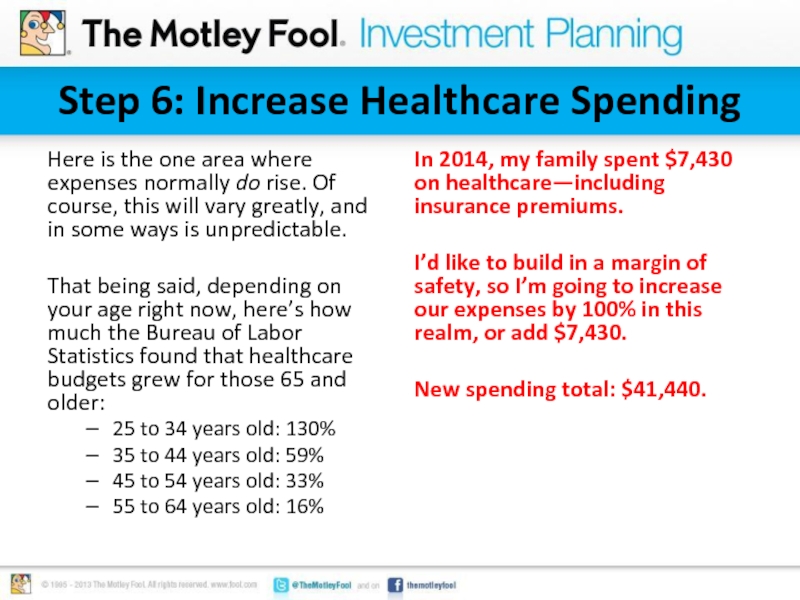

Слайд 12Step 6: Increase Healthcare Spending

Here is the one area where expenses

That being said, depending on your age right now, here’s how much the Bureau of Labor Statistics found that healthcare budgets grew for those 65 and older:

25 to 34 years old: 130%

35 to 44 years old: 59%

45 to 54 years old: 33%

55 to 64 years old: 16%

In 2014, my family spent $7,430 on healthcare—including insurance premiums.

I’d like to build in a margin of safety, so I’m going to increase our expenses by 100% in this realm, or add $7,430.

New spending total: $41,440.

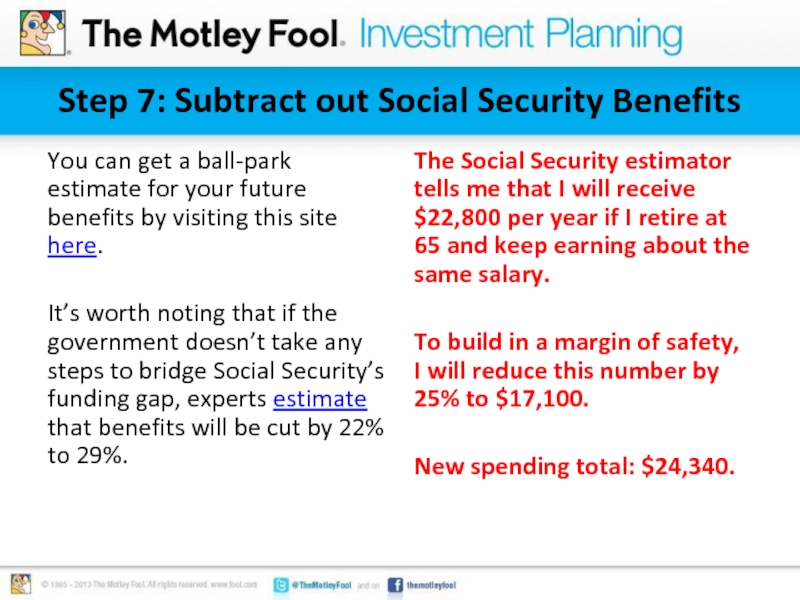

Слайд 14Step 7: Subtract out Social Security Benefits

You can get a ball-park

It’s worth noting that if the government doesn’t take any steps to bridge Social Security’s funding gap, experts estimate that benefits will be cut by 22% to 29%.

The Social Security estimator tells me that I will receive $22,800 per year if I retire at 65 and keep earning about the same salary.

To build in a margin of safety, I will reduce this number by 25% to $17,100.

New spending total: $24,340.

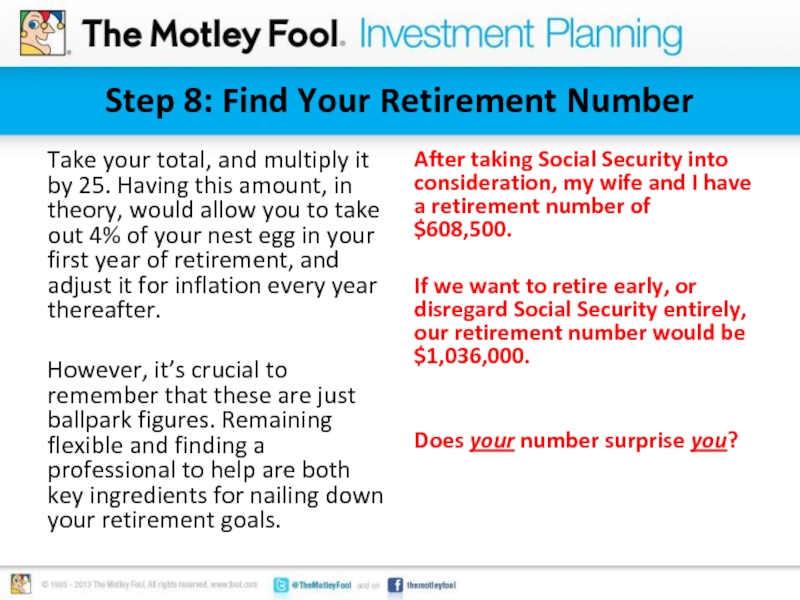

Слайд 16Step 8: Find Your Retirement Number

Take your total, and multiply it

However, it’s crucial to remember that these are just ballpark figures. Remaining flexible and finding a professional to help are both key ingredients for nailing down your retirement goals.

After taking Social Security into consideration, my wife and I have a retirement number of $608,500.

If we want to retire early, or disregard Social Security entirely, our retirement number would be $1,036,000.

Does your number surprise you?