- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How to Buy Disney Stock for Cheap презентация

Содержание

- 1. How to Buy Disney Stock for Cheap

- 2. Looking to buy Disney stock for cheap?

- 3. Main questions for investors What is

- 4. Main questions for investors Example Put

- 5. Main questions for investors How put

- 6. Going back to the example If Disney

- 7. When to sell puts When you like

- 8. Disney is a great candidate for put

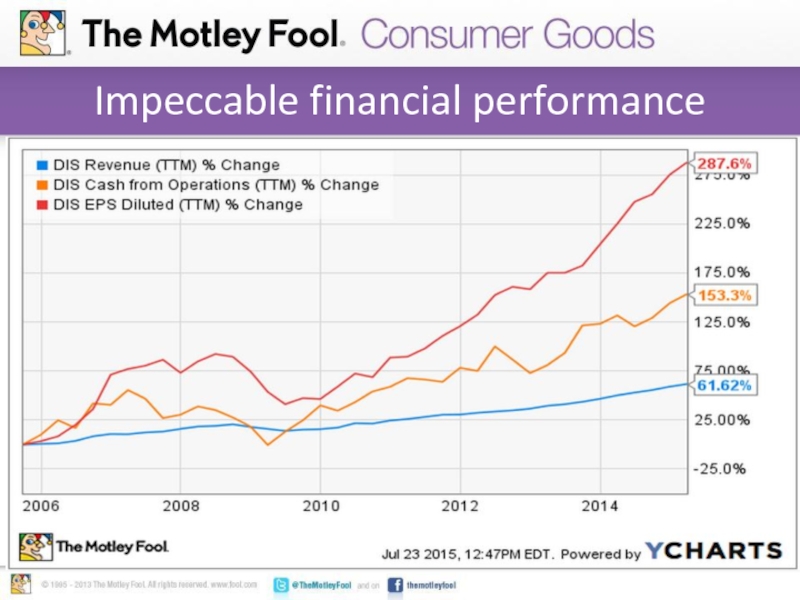

- 9. Impeccable financial performance

- 10. 3 Companies Poised to Explode When Cable

Слайд 2Looking to buy Disney stock for cheap?

Waiting for a pullback can

be a problem if the stock never comes down to your intended purchase price.

With put selling you make a profit even if the stock never falls to that price level.

Income from put selling reduces your effective entry price.

You are making a commitment to buy the stock in the future, so you need to be able to trust the company.

With put selling you make a profit even if the stock never falls to that price level.

Income from put selling reduces your effective entry price.

You are making a commitment to buy the stock in the future, so you need to be able to trust the company.

Слайд 3Main questions for investors

What is a put option?

A put option is

a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time.

Слайд 4Main questions for investors

Example

Put options on Disney stock with expiration date

January 15, 2016 and a strike price of $110 allow the buyer of the contract to sell 100 shares of Disney for $110 each until January 15, 2016.

This contract is currently selling for approximately $290.

This contract is currently selling for approximately $290.

Слайд 5Main questions for investors

How put selling works

If the stock is above

the strike price at expiration, the puts will not be executed, so the seller keeps the put price as pure profit and has no further obligations.

If the stock price is below the strike price, the puts will be executed. The put seller will need to buy the stock at the strike price.

Income from the put sell reduces the effective purchase price.

If the stock price is below the strike price, the puts will be executed. The put seller will need to buy the stock at the strike price.

Income from the put sell reduces the effective purchase price.

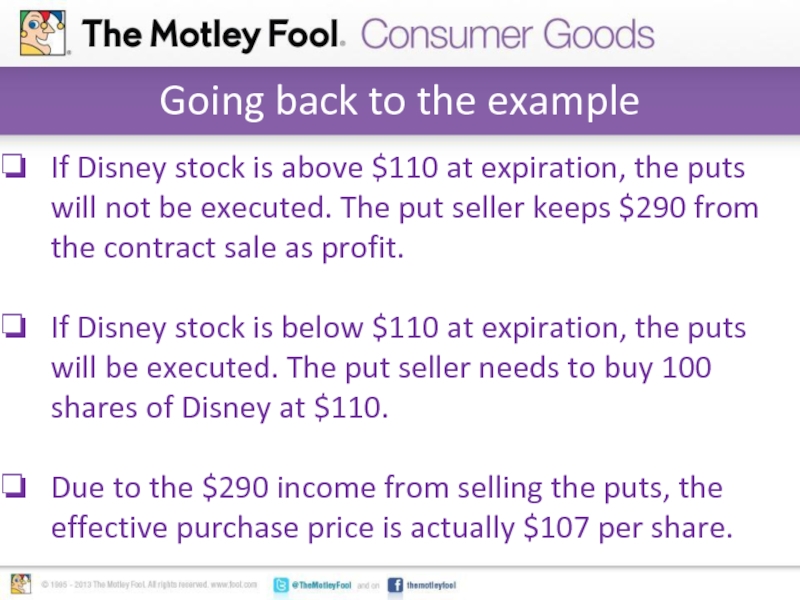

Слайд 6Going back to the example

If Disney stock is above $110 at

expiration, the puts will not be executed. The put seller keeps $290 from the contract sale as profit.

If Disney stock is below $110 at expiration, the puts will be executed. The put seller needs to buy 100 shares of Disney at $110.

Due to the $290 income from selling the puts, the effective purchase price is actually $107 per share.

If Disney stock is below $110 at expiration, the puts will be executed. The put seller needs to buy 100 shares of Disney at $110.

Due to the $290 income from selling the puts, the effective purchase price is actually $107 per share.

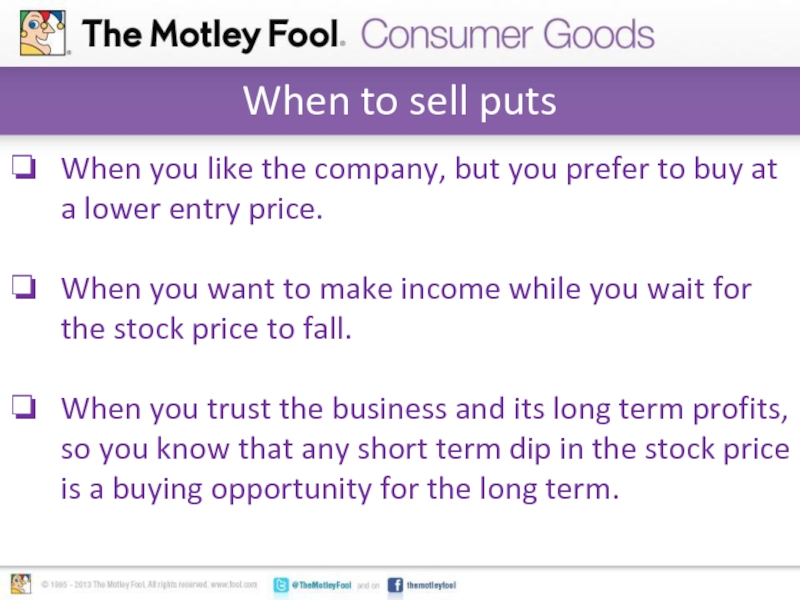

Слайд 7When to sell puts

When you like the company, but you prefer

to buy at a lower entry price.

When you want to make income while you wait for the stock price to fall.

When you trust the business and its long term profits, so you know that any short term dip in the stock price is a buying opportunity for the long term.

When you want to make income while you wait for the stock price to fall.

When you trust the business and its long term profits, so you know that any short term dip in the stock price is a buying opportunity for the long term.

Слайд 8Disney is a great candidate for put selling

Disney is a world-class

player in the entertainment industry. The company has enormous brand power and it owns many of the most valuable intellectual properties in the business.

A proven management team with a rock-solid trajectory at the company.

Plenty of promising growth venues, including the new Star Wars movie scheduled for release in December.

A proven management team with a rock-solid trajectory at the company.

Plenty of promising growth venues, including the new Star Wars movie scheduled for release in December.

Слайд 103 Companies Poised to Explode When Cable Dies Cable is dying. And

there are 3 stocks that are poised to explode when this faltering $2.2 trillion industry finally bites the dust. Just like newspaper publishers, telephone utilities, stockbrokers, record companies, bookstores, travel agencies, and big box retailers did when the Internet swept away their business models. And when cable falters, you don't want to miss out on these 3 companies that are positioned to benefit. Click here for their names. Hint: They're not the ones you'd think!