- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How The 2016 Presidential Election Could Affect Your Taxes презентация

Содержание

- 1. How The 2016 Presidential Election Could Affect Your Taxes

- 2. The Democrats and Republicans have very different

- 3. November 5, 2015 The Republican Candidates

- 4. Donald Trump 4 tax brackets instead of

- 5. Dr. Ben Carson Carson is yet to

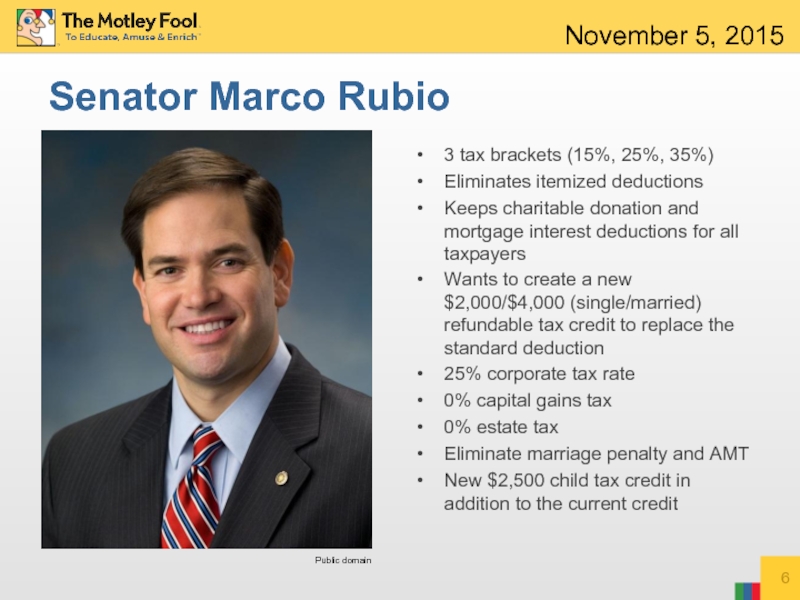

- 6. Senator Marco Rubio 3 tax brackets (15%,

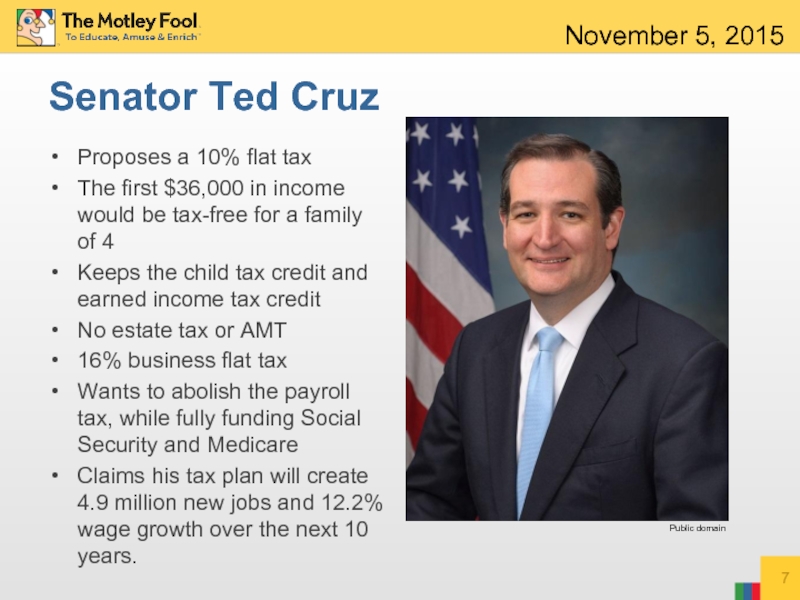

- 7. Senator Ted Cruz Proposes a 10% flat

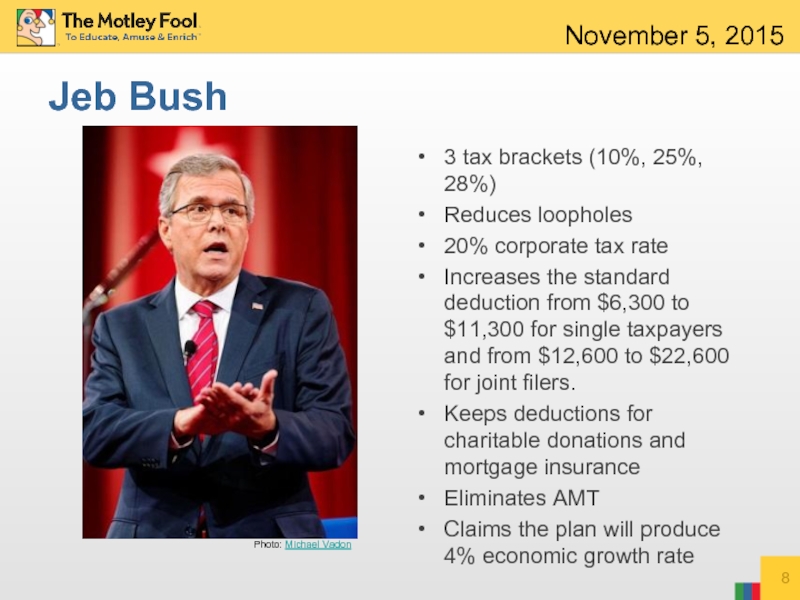

- 8. Jeb Bush 3 tax brackets (10%, 25%,

- 9. Carly Fiorina Has not released a detailed

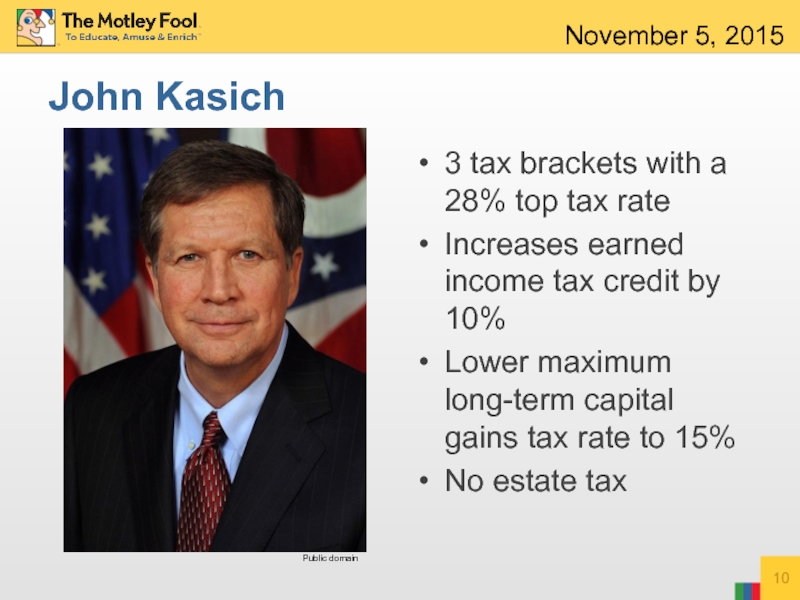

- 10. John Kasich 3 tax brackets with a

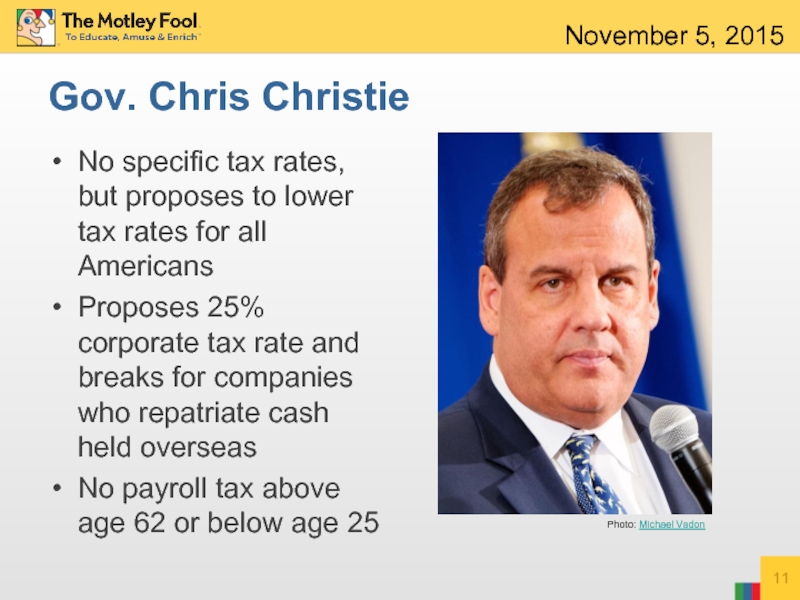

- 11. Gov. Chris Christie No specific tax rates,

- 12. November 5, 2015 The Democratic Candidates

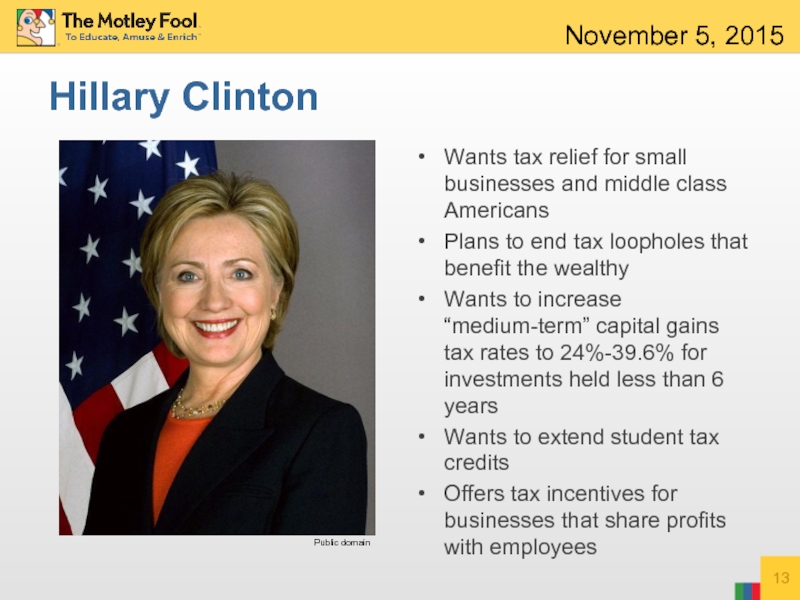

- 13. Hillary Clinton Wants tax relief for small

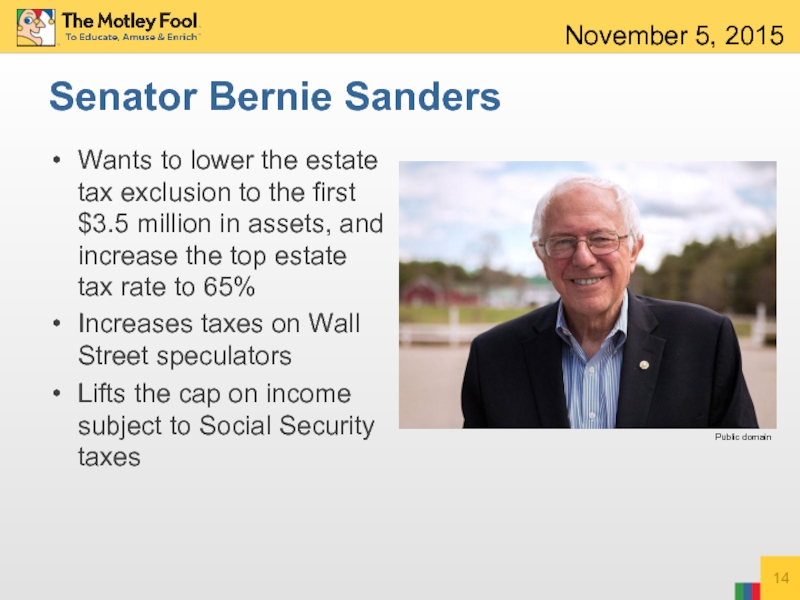

- 14. Senator Bernie Sanders Wants to lower the

- 15. You also may be interested in…

Слайд 2The Democrats and Republicans have very different ideas on taxes.

In general,

Democrats feel the wealthy should pay a higher share.

Here are the details each candidate has released about their tax plans so far.

Note: This slideshow includes candidates polling nationally at 3% support or higher as of 11/4/2015

Overview

Слайд 4Donald Trump

4 tax brackets instead of 7

Top tax rate of 25%

No

Eliminate the marriage penalty and Alternative Minimum Tax (AMT)

Maximum corporate tax rate of 15%

No death/estate tax

November 5, 2015

Photo: Gage Skidmore

Слайд 5Dr. Ben Carson

Carson is yet to release a detailed tax plan,

Wants to eliminate the estate tax

Has said that a tax return should be completed in 15 minutes or less

November 5, 2015

Photo: Gage Skidmore

Слайд 6Senator Marco Rubio

3 tax brackets (15%, 25%, 35%)

Eliminates itemized deductions

Keeps charitable

Wants to create a new $2,000/$4,000 (single/married) refundable tax credit to replace the standard deduction

25% corporate tax rate

0% capital gains tax

0% estate tax

Eliminate marriage penalty and AMT

New $2,500 child tax credit in addition to the current credit

November 5, 2015

Public domain

Слайд 7Senator Ted Cruz

Proposes a 10% flat tax

The first $36,000 in income

Keeps the child tax credit and earned income tax credit

No estate tax or AMT

16% business flat tax

Wants to abolish the payroll tax, while fully funding Social Security and Medicare

Claims his tax plan will create 4.9 million new jobs and 12.2% wage growth over the next 10 years.

November 5, 2015

Public domain

Слайд 8Jeb Bush

3 tax brackets (10%, 25%, 28%)

Reduces loopholes

20% corporate tax rate

Increases

Keeps deductions for charitable donations and mortgage insurance

Eliminates AMT

Claims the plan will produce 4% economic growth rate

November 5, 2015

Photo: Michael Vadon

Слайд 9Carly Fiorina

Has not released a detailed tax plan, but wants to

Says the entire tax code should be able to fit on 3 pages (more than 70,000 currently)

November 5, 2015

Photo: Gage Skidmore

Слайд 10John Kasich

3 tax brackets with a 28% top tax rate

Increases earned

Lower maximum long-term capital gains tax rate to 15%

No estate tax

November 5, 2015

Public domain

Слайд 11Gov. Chris Christie

No specific tax rates, but proposes to lower tax

Proposes 25% corporate tax rate and breaks for companies who repatriate cash held overseas

No payroll tax above age 62 or below age 25

November 5, 2015

Photo: Michael Vadon

Слайд 13Hillary Clinton

Wants tax relief for small businesses and middle class Americans

Plans

Wants to increase “medium-term” capital gains tax rates to 24%-39.6% for investments held less than 6 years

Wants to extend student tax credits

Offers tax incentives for businesses that share profits with employees

November 5, 2015

Public domain

Слайд 14Senator Bernie Sanders

Wants to lower the estate tax exclusion to the

Increases taxes on Wall Street speculators

Lifts the cap on income subject to Social Security taxes

November 5, 2015

Public domain