- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Foreign exchange market презентация

Содержание

- 1. Foreign exchange market

- 2. Foreign exchange market – the financial market

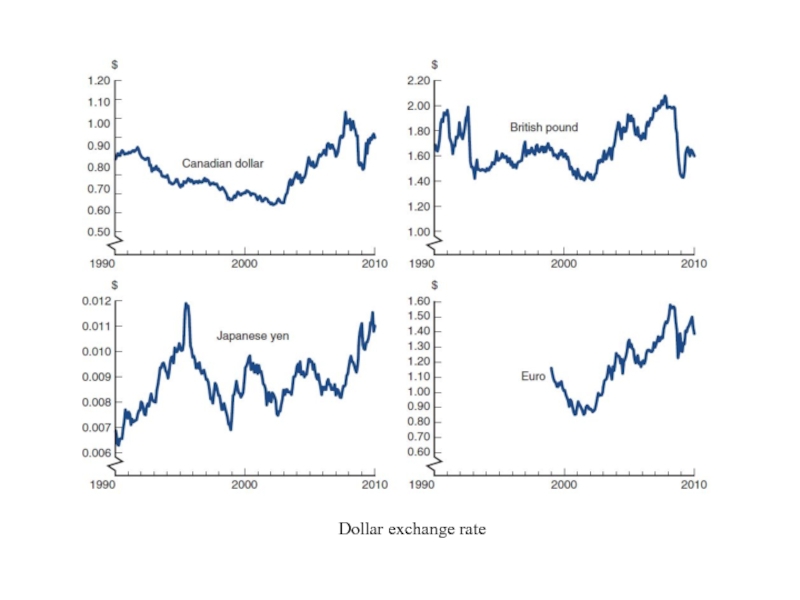

- 3. Dollar exchange rate

- 4. Law of One Price If two countries

- 5. Theory of Purchasing Power Parity The theory

- 6. Factors That Affect Exchange Rates in the

- 7. Equilibrium in the Foreign Exchange Market Equilibrium

- 8. Explaining Changes in Exchange Rates Shifts in

- 9. Factors That Change the Exchange Rate

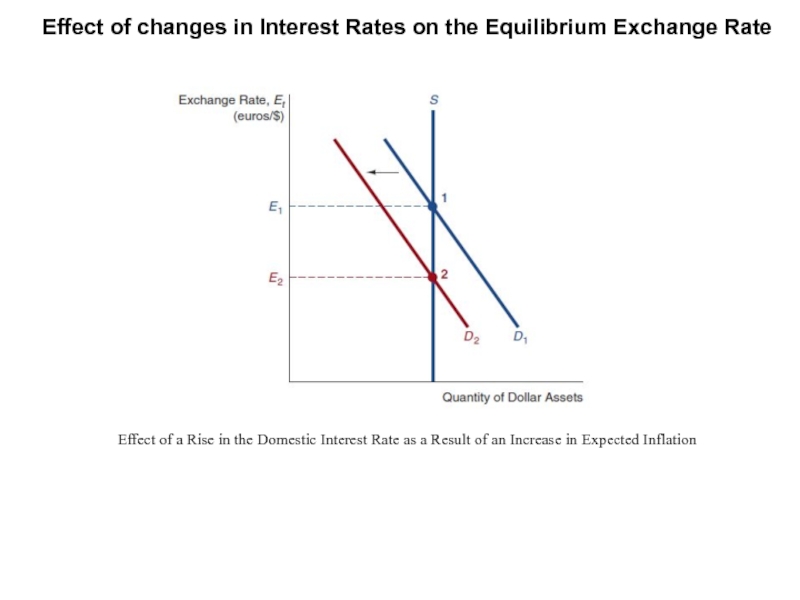

- 10. Effect of changes in Interest Rates on

Слайд 2Foreign exchange market – the financial market where exchange rates are

Exchange rate – the price of one currency in terms of another.

Spot transactions involve the immediate (two-day) exchange of bank deposits.

Forward transactions involve the exchange of bank deposits at some specified future date.

Spot exchange rate is the exchange rate for the spot transaction.

Forward exchange rate is the exchange rate for the forward transaction. When a currency increases in value, it experiences appreciation; when it falls in value and is worth fewer U.S. dollars, it undergoes depreciation.

FX swap – the combination of an offsetting spot transaction and a new forward contract

Basic terms

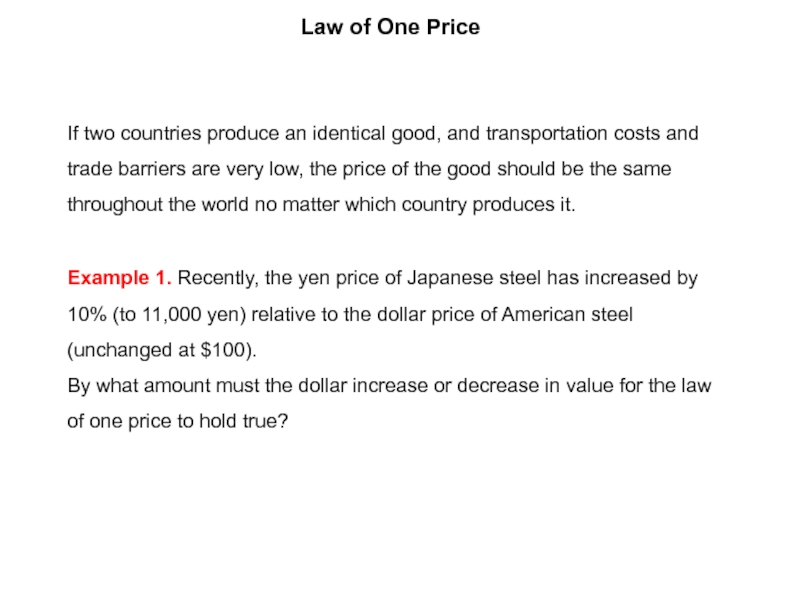

Слайд 4Law of One Price

If two countries produce an identical good, and

Example 1. Recently, the yen price of Japanese steel has increased by 10% (to 11,000 yen) relative to the dollar price of American steel (unchanged at $100).

By what amount must the dollar increase or decrease in value for the law of one price to hold true?

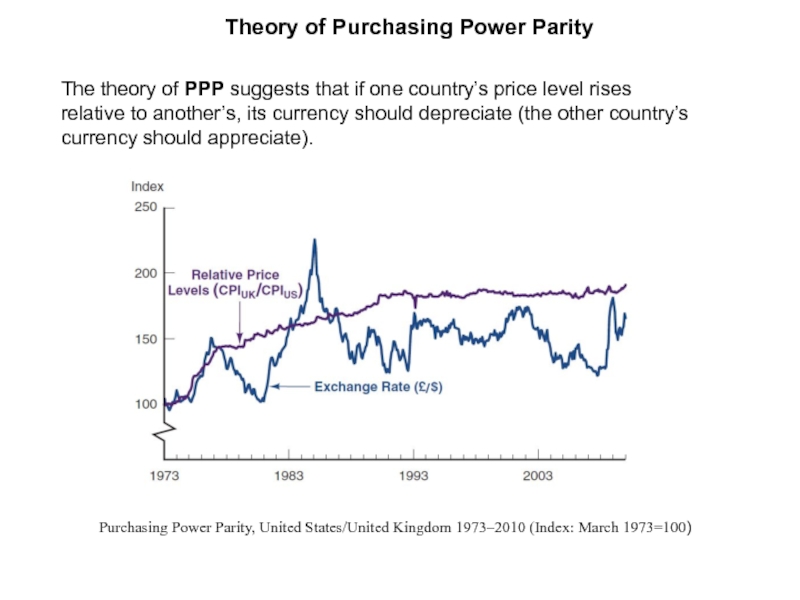

Слайд 5Theory of Purchasing Power Parity

The theory of PPP suggests that if

Purchasing Power Parity, United States/United Kingdom 1973–2010 (Index: March 1973=100)

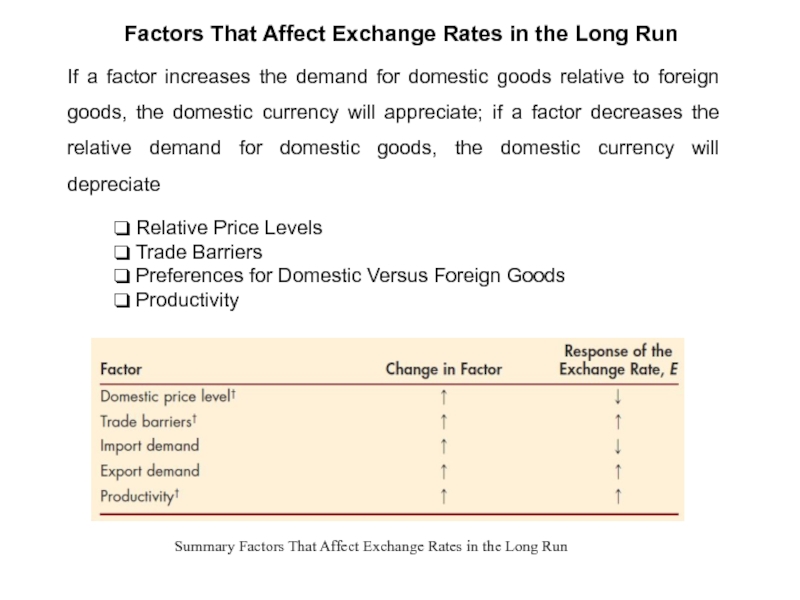

Слайд 6Factors That Affect Exchange Rates in the Long Run

Relative Price

Trade Barriers

Preferences for Domestic Versus Foreign Goods

Productivity

If a factor increases the demand for domestic goods relative to foreign goods, the domestic currency will appreciate; if a factor decreases the relative demand for domestic goods, the domestic currency will depreciate

Summary Factors That Affect Exchange Rates in the Long Run

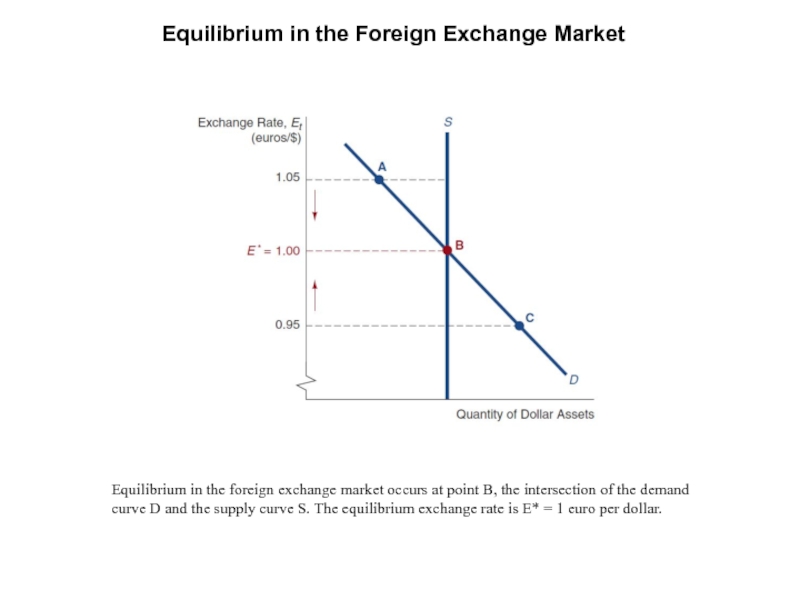

Слайд 7Equilibrium in the Foreign Exchange Market

Equilibrium in the foreign exchange market

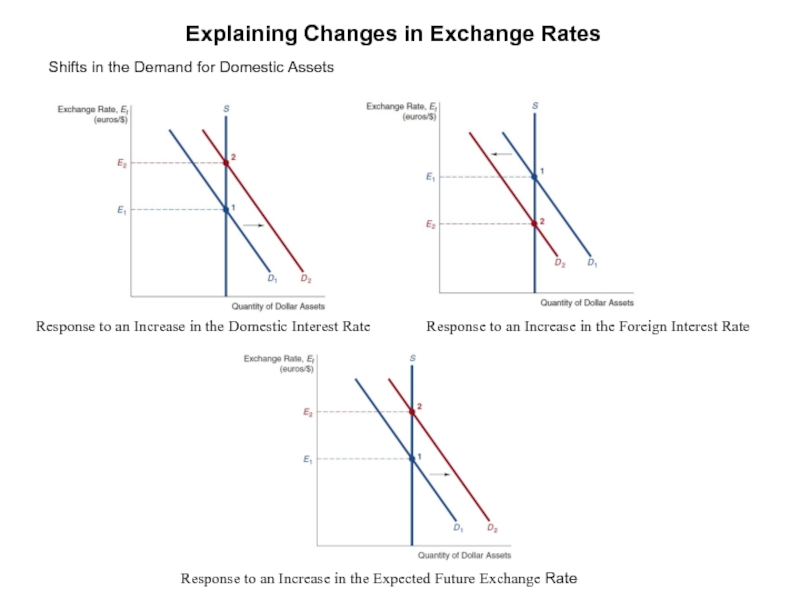

Слайд 8Explaining Changes in Exchange Rates

Shifts in the Demand for Domestic Assets

Response

Response to an Increase in the Foreign Interest Rate

Response to an Increase in the Expected Future Exchange Rate