- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

CREDIT SCORE презентация

Содержание

- 1. CREDIT SCORE

- 2. A credit score is a nasty, brutish beast.

- 3. But not only can it be beat…

- 4. You can MAKE IT WORK for you.

- 5. The key is to understand how credit scores are calculated.

- 6. And that’s exactly what I’m about to explain…

- 7. But before doing so, let’s cover a few PRELIMINARY MATTERS

- 8. Your credit score is a number between 300 and 850.

- 9. Its purpose is to gauge

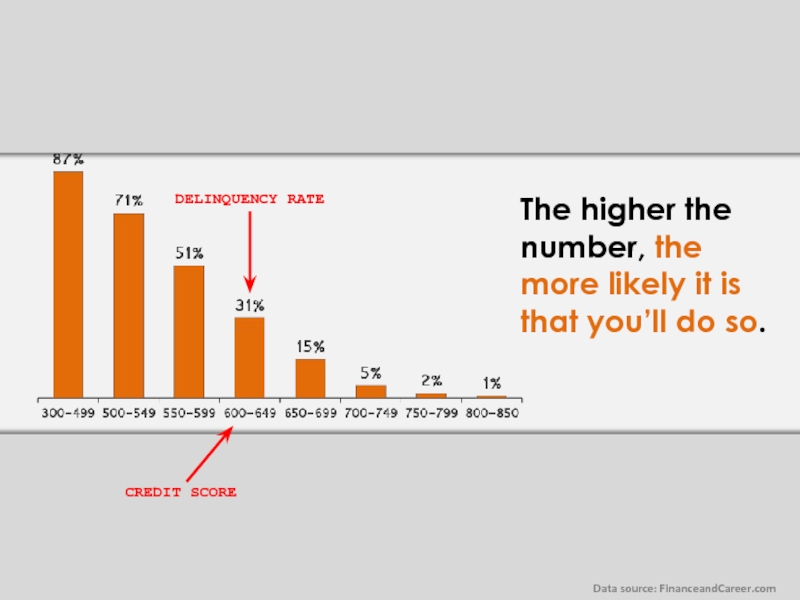

- 10. The higher the number, the

- 11. So, what’s a GOOD SCORE?

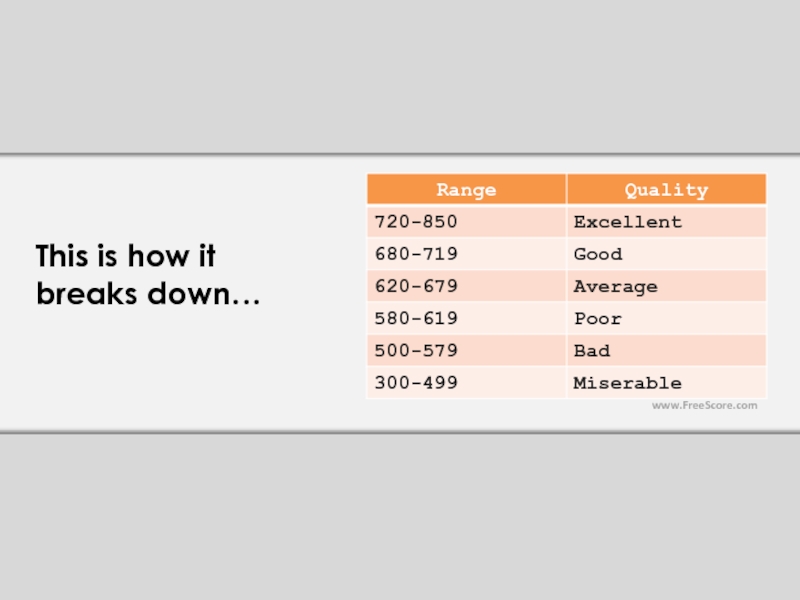

- 12. This is how it breaks down… www.FreeScore.com

- 13. Simple enough, right?

- 14. So here’s the question:

- 15. So here’s the question: What

- 16. And the answer is:

- 17. And the answer is: You have to fight fire with fire.

- 18. You have to understand how

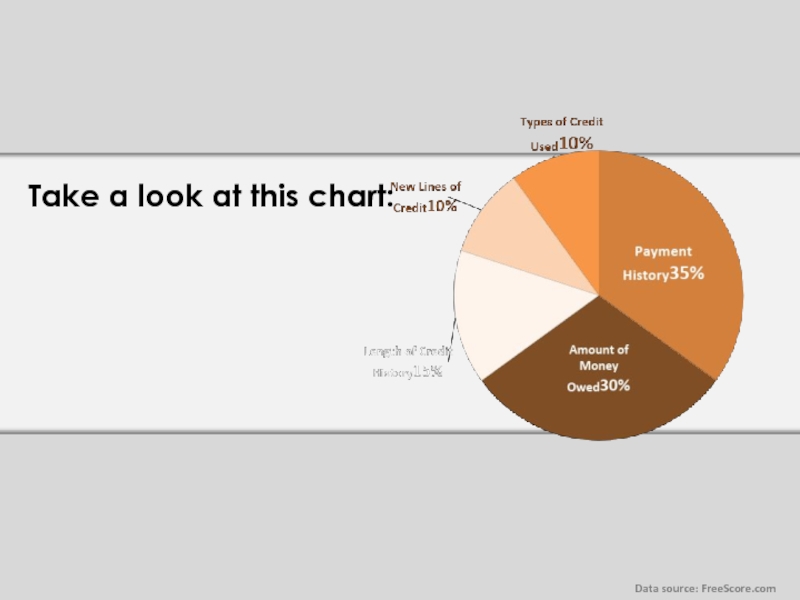

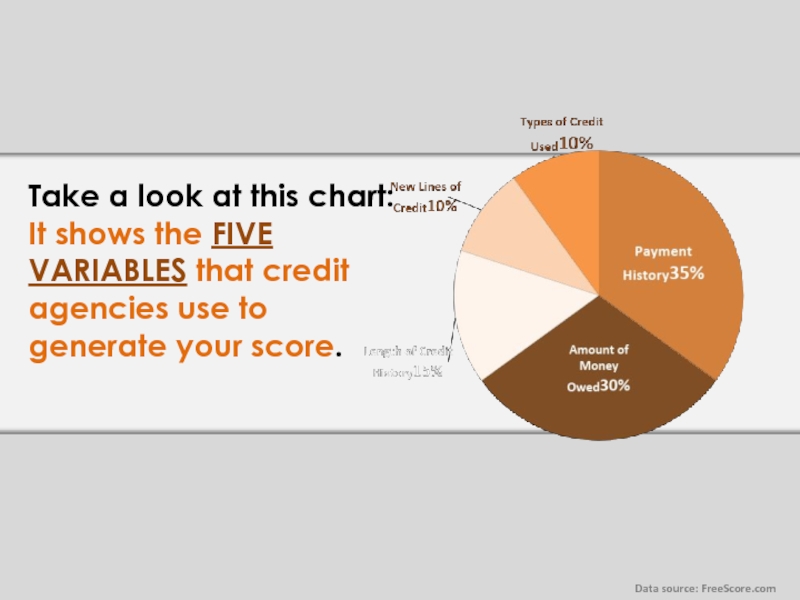

- 19. Take a look at this chart: Data source: FreeScore.com

- 20. Take a look at this

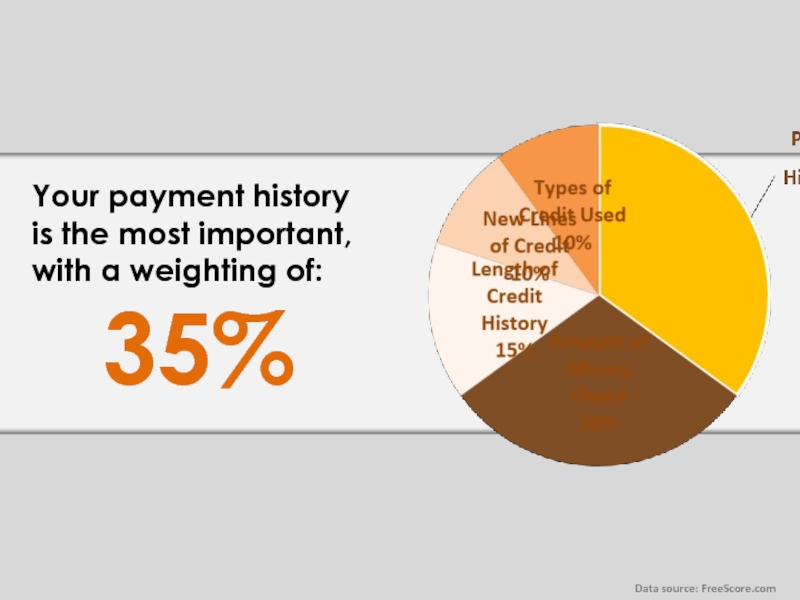

- 21. Your payment history is the

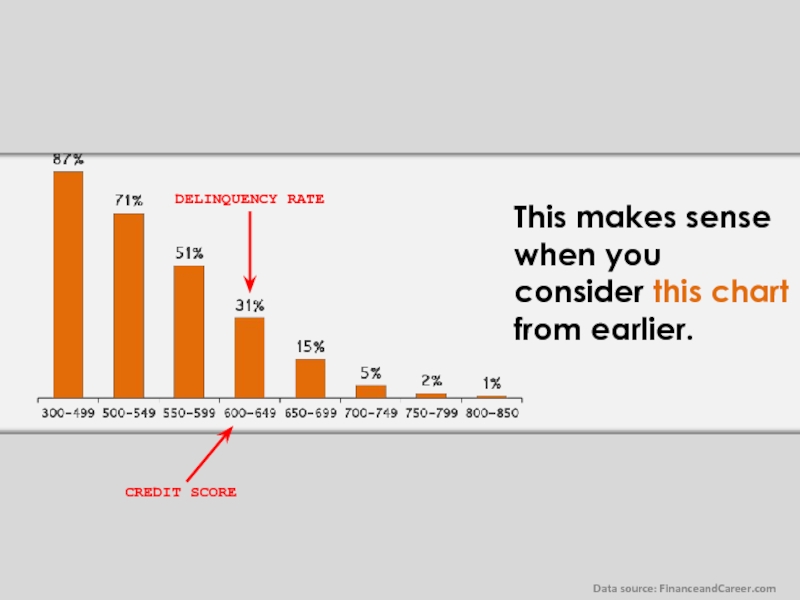

- 22. This makes sense when you

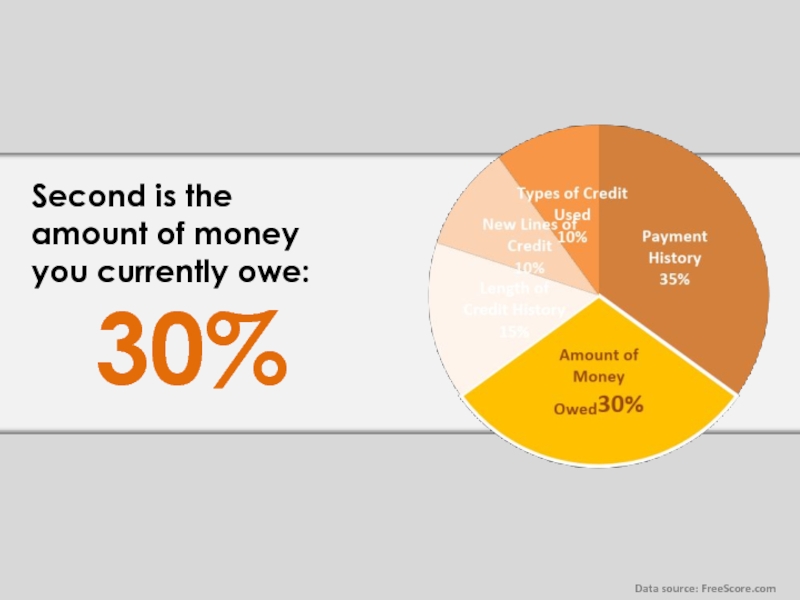

- 23. Second is the amount of money you currently owe: 30% Data source: FreeScore.com

- 24. This is why maxed out credit cards are so bad.

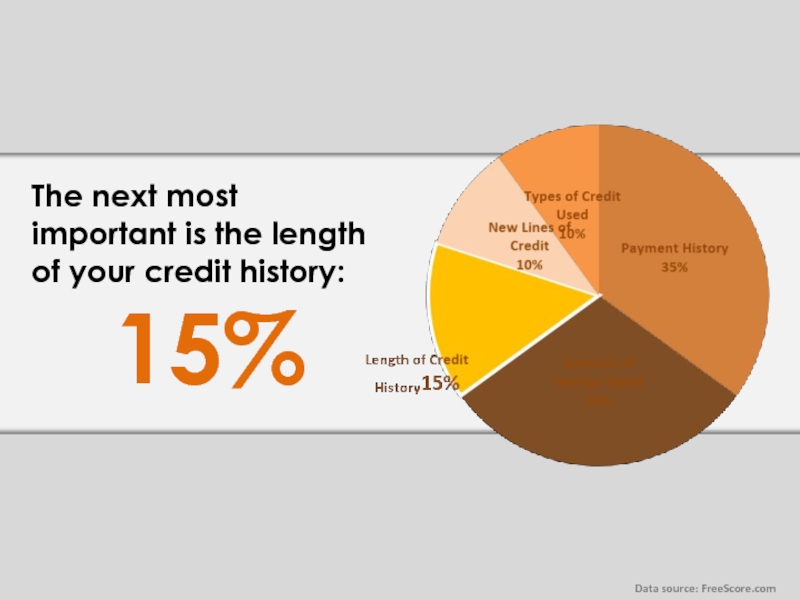

- 25. The next most important is

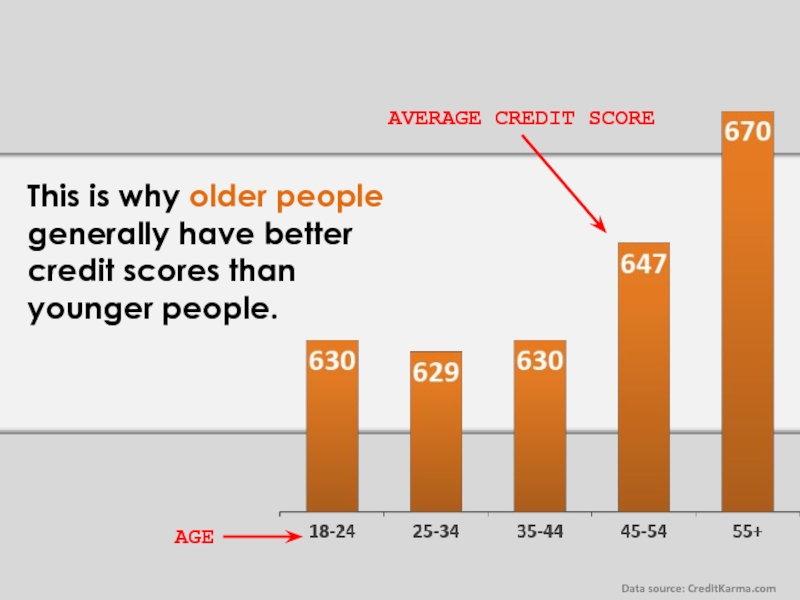

- 26. This is why older people

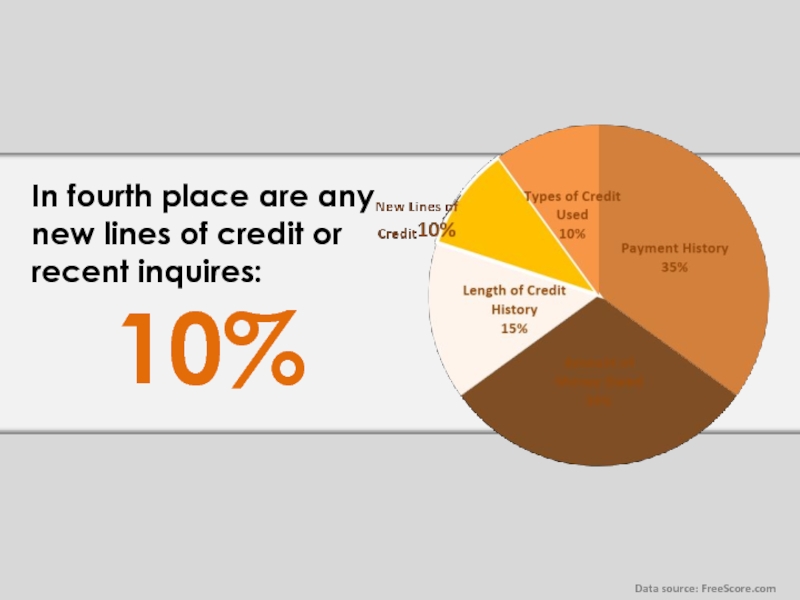

- 27. In fourth place are any

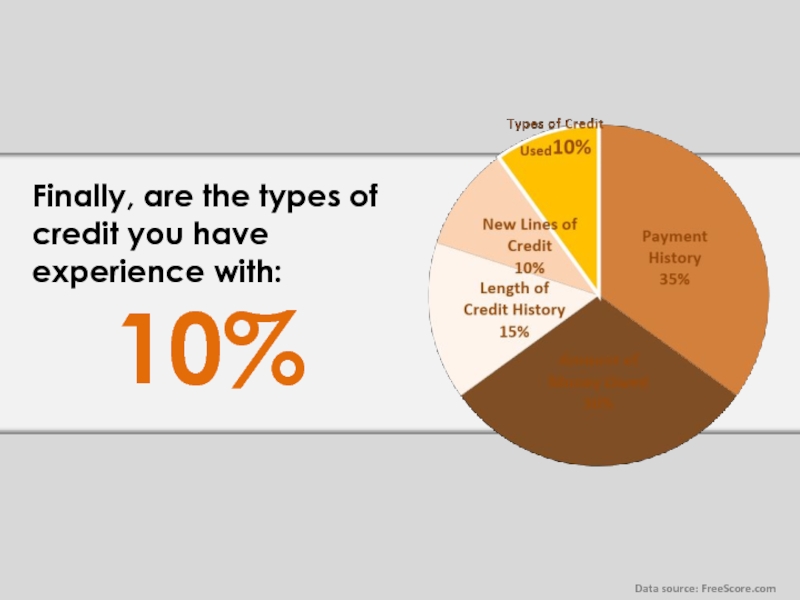

- 28. Finally, are the types of

- 29. The two main types include:

- 30. The two main types include: Revolving accounts Like credit cards…

- 31. The two main types include:

- 32. So, to tie everything back together into a pretty little package…

- 33. If you want to improve your credit score…

- 34. FIRST Identify which of the five variables are wanting in your case.

- 35. SECOND Prioritize their importance based on the weighting.

- 36. THIRD And then attack them one by one.

- 37. While the process takes discipline

- 38. For more valuable advice, click

Слайд 10

The higher the number, the more likely it is that you’ll

DELINQUENCY RATE

CREDIT SCORE

Data source: FinanceandCareer.com

Слайд 18

You have to understand how your score is calculated in order

Слайд 20

Take a look at this chart: It shows the FIVE VARIABLES

Data source: FreeScore.com

Слайд 21

Your payment history is the most important, with a weighting of:

35%

Data

Слайд 22

This makes sense when you consider this chart from earlier.

DELINQUENCY RATE

CREDIT

Data source: FinanceandCareer.com

Слайд 26

This is why older people generally have better credit scores than

AGE

AVERAGE CREDIT SCORE

Data source: CreditKarma.com

Слайд 27

In fourth place are any new lines of credit or recent

10%

Data source: FreeScore.com