- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Comparing alternatives презентация

Содержание

- 1. Comparing alternatives

- 2. Comparing Alternatives

- 3. The Objective To learn how to

- 4. Three groups of investment alternatives 1. Mutually

- 5. The fundamental purpose of capital investment is

- 6. Investment alternatives and cost alternatives An Investment

- 7. The study period must be appropriate for

- 8. Case 1: Study period = Useful life

- 9. Equivalent Worth (EW) Methods: PW, AW, FW

- 10. Example: Investment Alternatives Study period = Useful

- 11. Solution PW(12%) = -I + A(P/A,

- 12. Example: Cost Alternatives Study period = Useful

- 13. Solution AW = I(A/P, 12%, 7)

- 14. IRR Method: Why not select the investment

- 15. IRR Method: Another Example Given three MEAs

- 16. Solution steps Step 2: compare DN with

- 17. Solution steps Step 4: compare alternative 2

- 18. Solution steps Step 4: next comparison: alternative

- 19. Case 2: Study period ≠ Useful life

- 20. Study period ≠ Useful life Up until

- 21. Example: 5-24 Cost alternative: Study period>Useful

- 22. Example: 5-24 - Solution Consider the AW

- 23. Example: 5-24 – PW Solution based on

- 24. What if the study period is not

- 25. Study period > Useful life Use the

- 26. Case 2: Study period < useful life

- 27. Example: Cotermination Useful life of A =

- 28. Example: Solution AW(A) (10%) = -50,000(A/P,10, 20)

- 29. Example: Solution Market Value of Boiler B

Слайд 1American University of Armenia

IE 340 – Engineering Economics

Spring Semester, 2016

Ch5- Comparing

Слайд 3The Objective

To learn how to properly apply the profitability measures

The cash-flow analysis methods (previously described) used in this process:

Present Worth ( PW )

Annual Worth ( AW )

Future Worth ( FW )

Internal Rate of Return ( IRR )

External Rate of Return ( ERR )

Слайд 4Three groups of investment alternatives

1. Mutually exclusive

At

Example: suppose you are shopping for a car. You consider several cars, but will only buy one from a mutually exclusive set of choices

2. Independent

The choice of a project is independent of the choice of any other project in the group, so that all or none of the projects may be selected or some number in between

3. Contingent

The choice of the project is conditional on the choice of one or more other projects

Слайд 5The fundamental purpose of capital investment is to obtain at least

Basic Rule:

Spend the least amount of capital possible unless the extra capital can be justified by the extra savings or benefits

In other words, any increment of capital spent (above the minimum) must be able to pay its own way

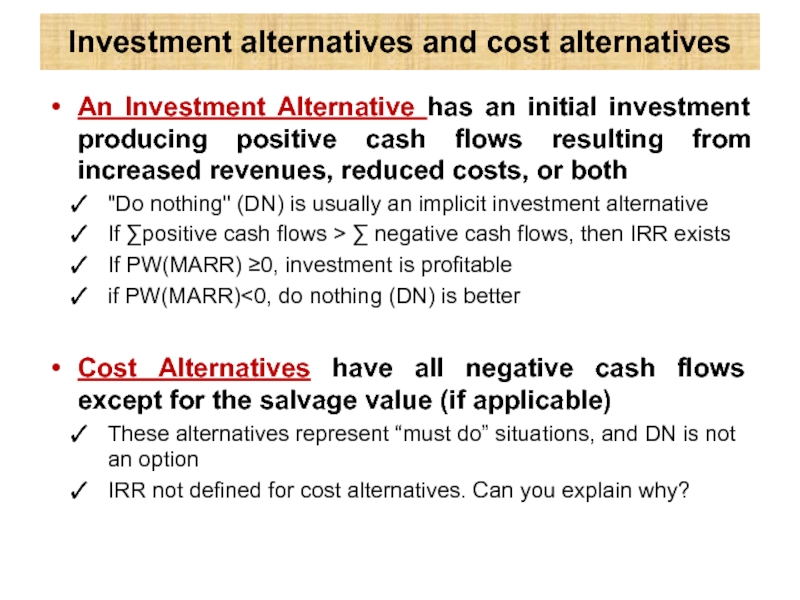

Слайд 6Investment alternatives and cost alternatives

An Investment Alternative has an initial investment

"Do nothing" (DN) is usually an implicit investment alternative

If ∑positive cash flows > ∑ negative cash flows, then IRR exists

If PW(MARR) ≥0, investment is profitable

if PW(MARR)<0, do nothing (DN) is better

Cost Alternatives have all negative cash flows except for the salvage value (if applicable)

These alternatives represent “must do” situations, and DN is not an option

IRR not defined for cost alternatives. Can you explain why?

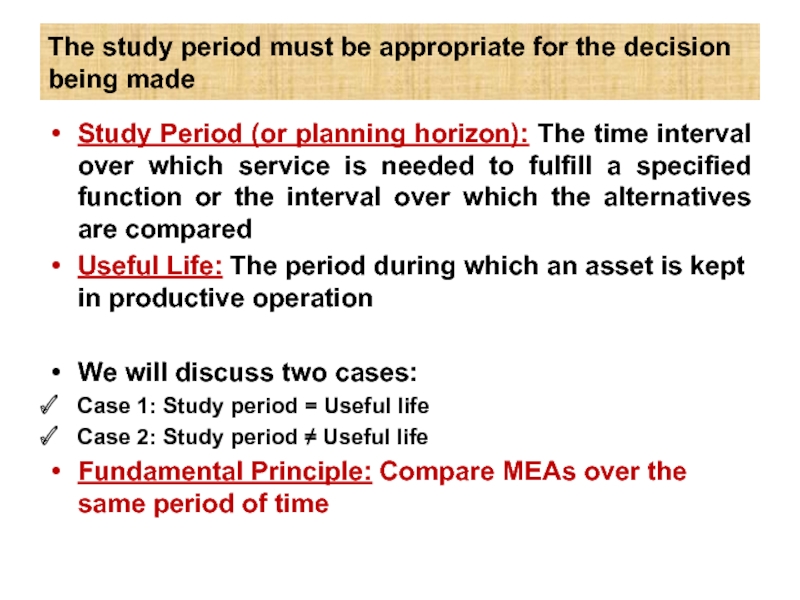

Слайд 7The study period must be appropriate for the decision being made

Study

Useful Life: The period during which an asset is kept in productive operation

We will discuss two cases:

Case 1: Study period = Useful life

Case 2: Study period ≠ Useful life

Fundamental Principle: Compare MEAs over the same period of time

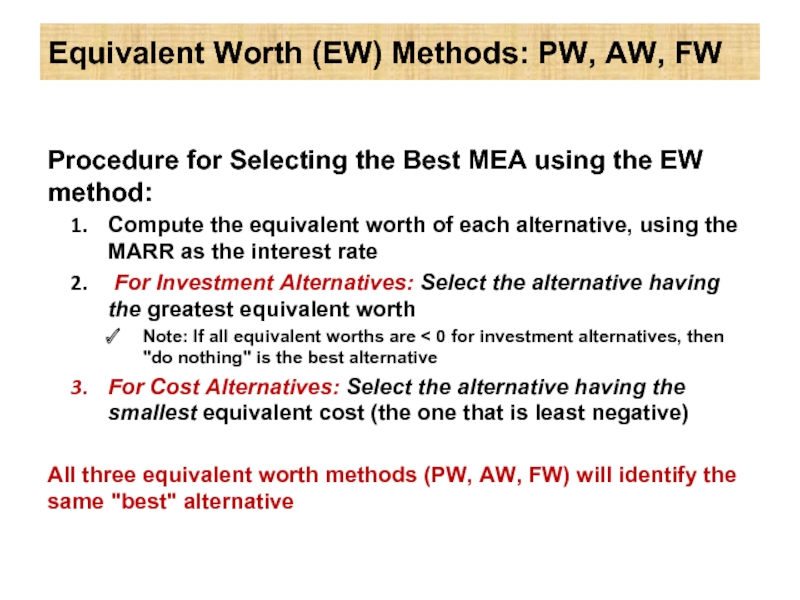

Слайд 9Equivalent Worth (EW) Methods: PW, AW, FW

Procedure for Selecting the Best

Compute the equivalent worth of each alternative, using the MARR as the interest rate

For Investment Alternatives: Select the alternative having the greatest equivalent worth

Note: If all equivalent worths are < 0 for investment alternatives, then "do nothing" is the best alternative

For Cost Alternatives: Select the alternative having the smallest equivalent cost (the one that is least negative)

All three equivalent worth methods (PW, AW, FW) will identify the same "best" alternative

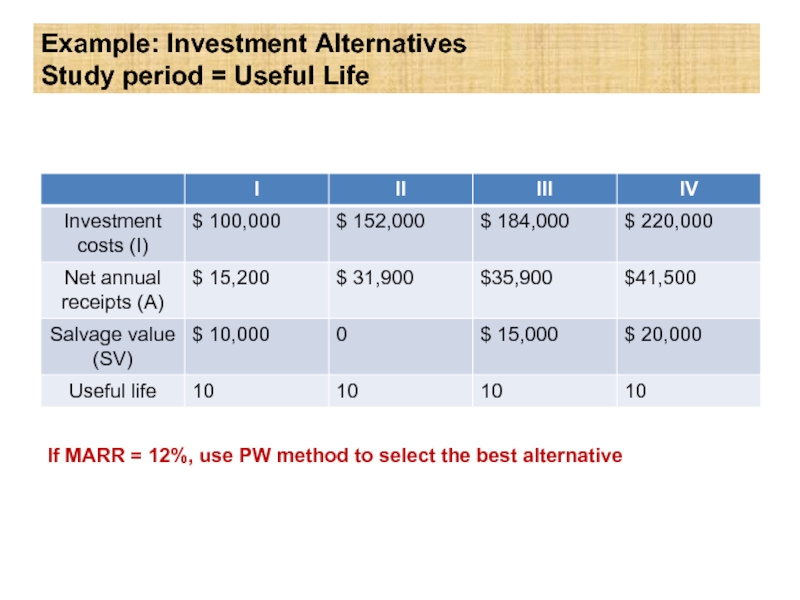

Слайд 10Example: Investment Alternatives

Study period = Useful Life

If MARR = 12%, use

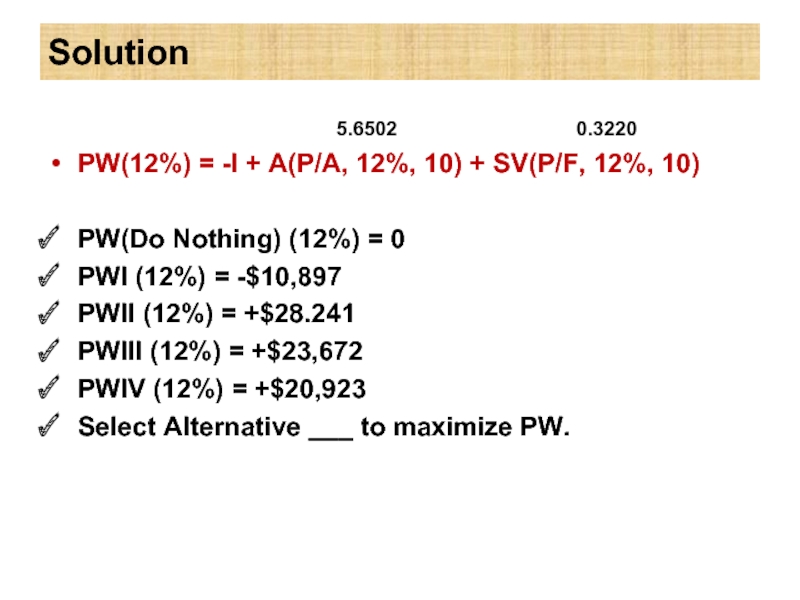

Слайд 11Solution

PW(12%) = -I + A(P/A, 12%, 10) + SV(P/F, 12%, 10)

PW(Do

PWI (12%) = -$10,897

PWII (12%) = +$28.241

PWIII (12%) = +$23,672

PWIV (12%) = +$20,923

Select Alternative ___ to maximize PW.

5.6502

0.3220

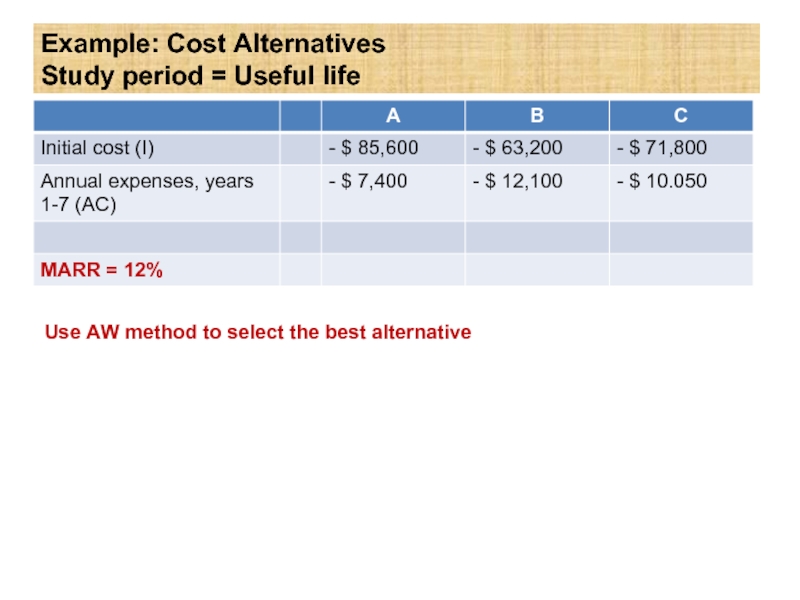

Слайд 12Example: Cost Alternatives

Study period = Useful life

Use AW method to select

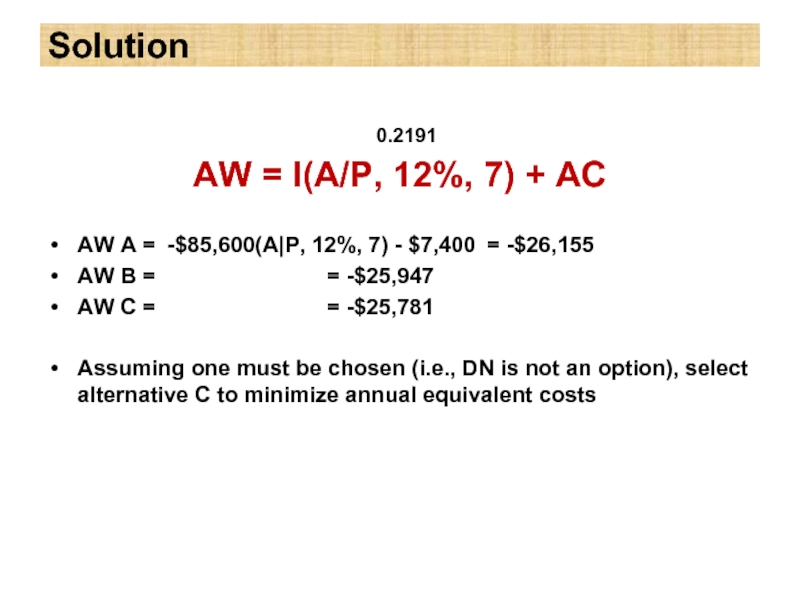

Слайд 13Solution

AW = I(A/P, 12%, 7) + AC

AW A = -$85,600(A|P, 12%,

AW B = = -$25,947

AW C = = -$25,781

Assuming one must be chosen (i.e., DN is not an option), select alternative C to minimize annual equivalent costs

0.2191

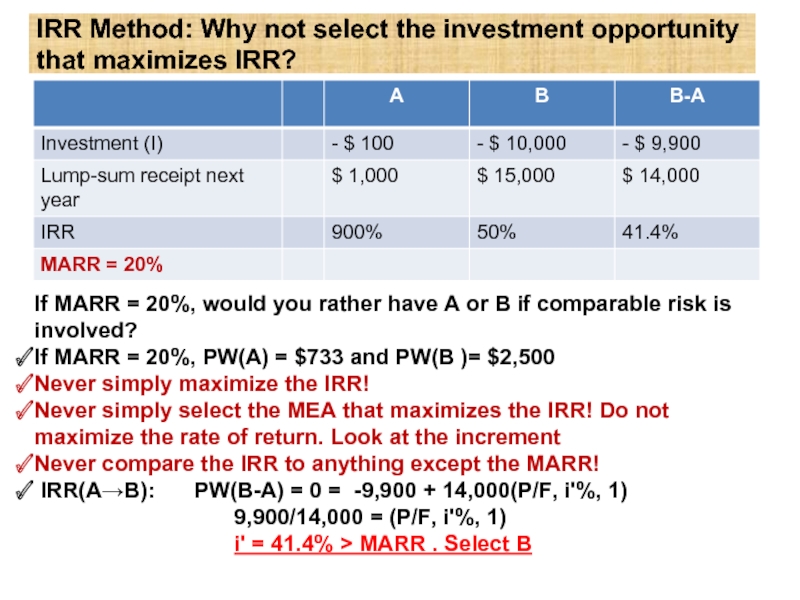

Слайд 14IRR Method: Why not select the investment opportunity that maximizes IRR?

If

If MARR = 20%, PW(A) = $733 and PW(B )= $2,500

Never simply maximize the IRR!

Never simply select the MEA that maximizes the IRR! Do not maximize the rate of return. Look at the increment

Never compare the IRR to anything except the MARR!

IRR(A→B): PW(B-A) = 0 = -9,900 + 14,000(P/F, i'%, 1)

9,900/14,000 = (P/F, i'%, 1)

i' = 41.4% > MARR . Select B

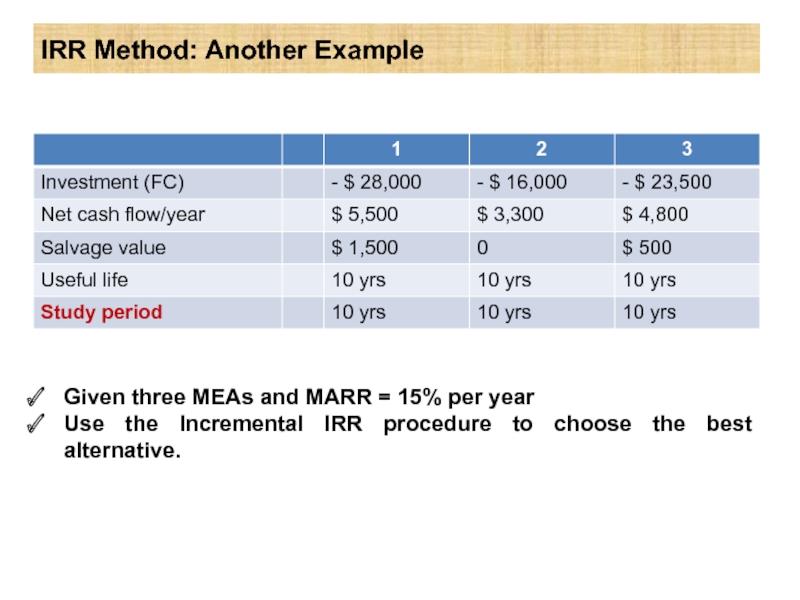

Слайд 15IRR Method: Another Example

Given three MEAs and MARR = 15% per

Use the Incremental IRR procedure to choose the best alternative.

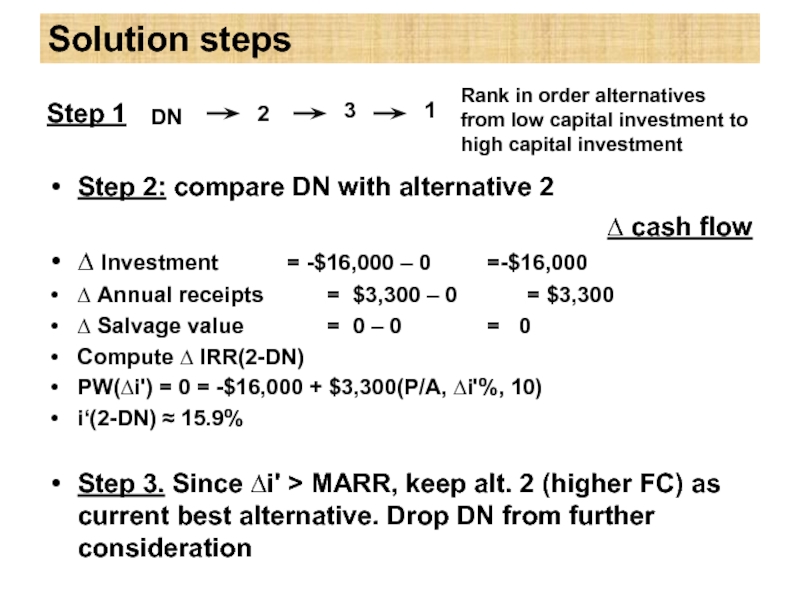

Слайд 16Solution steps

Step 2: compare DN with alternative 2

∆ Investment = -$16,000

∆ Annual receipts = $3,300 – 0 = $3,300

∆ Salvage value = 0 – 0 = 0

Compute ∆ IRR(2-DN)

PW(∆i') = 0 = -$16,000 + $3,300(P/A, ∆i'%, 10)

i‘(2-DN) ≈ 15.9%

Step 3. Since ∆i' > MARR, keep alt. 2 (higher FC) as current best alternative. Drop DN from further consideration

Rank in order alternatives from low capital investment to high capital investment

∆ cash flow

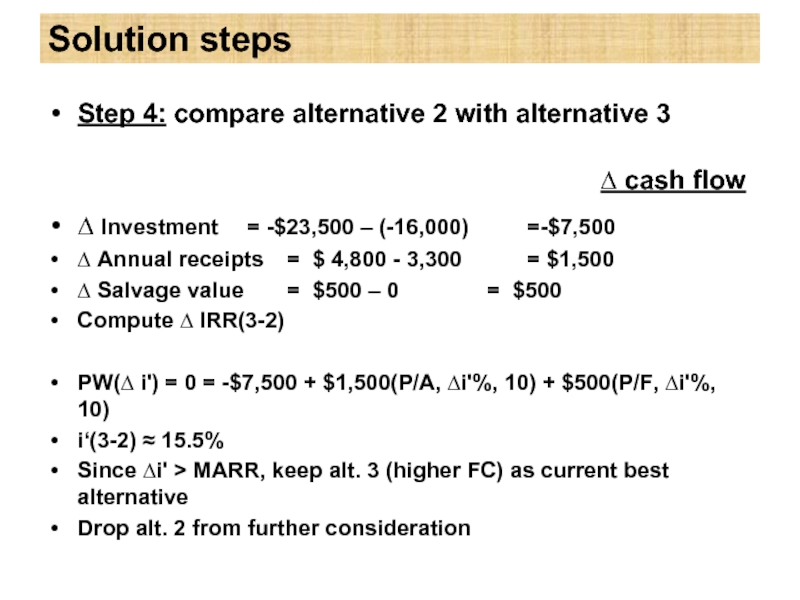

Слайд 17Solution steps

Step 4: compare alternative 2 with alternative 3

∆ Investment =

∆ Annual receipts = $ 4,800 - 3,300 = $1,500

∆ Salvage value = $500 – 0 = $500

Compute ∆ IRR(3-2)

PW(∆ i') = 0 = -$7,500 + $1,500(P/A, ∆i'%, 10) + $500(P/F, ∆i'%, 10)

i‘(3-2) ≈ 15.5%

Since ∆i' > MARR, keep alt. 3 (higher FC) as current best alternative

Drop alt. 2 from further consideration

∆ cash flow

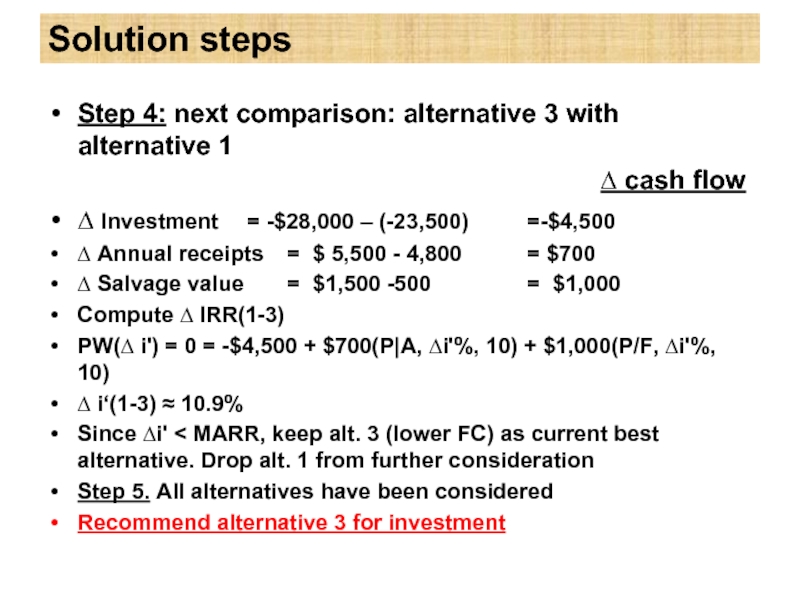

Слайд 18Solution steps

Step 4: next comparison: alternative 3 with alternative 1

∆ Investment

∆ Annual receipts = $ 5,500 - 4,800 = $700

∆ Salvage value = $1,500 -500 = $1,000

Compute ∆ IRR(1-3)

PW(∆ i') = 0 = -$4,500 + $700(P|A, ∆i'%, 10) + $1,000(P/F, ∆i'%, 10)

∆ i‘(1-3) ≈ 10.9%

Since ∆i' < MARR, keep alt. 3 (lower FC) as current best alternative. Drop alt. 1 from further consideration

Step 5. All alternatives have been considered

Recommend alternative 3 for investment

∆ cash flow

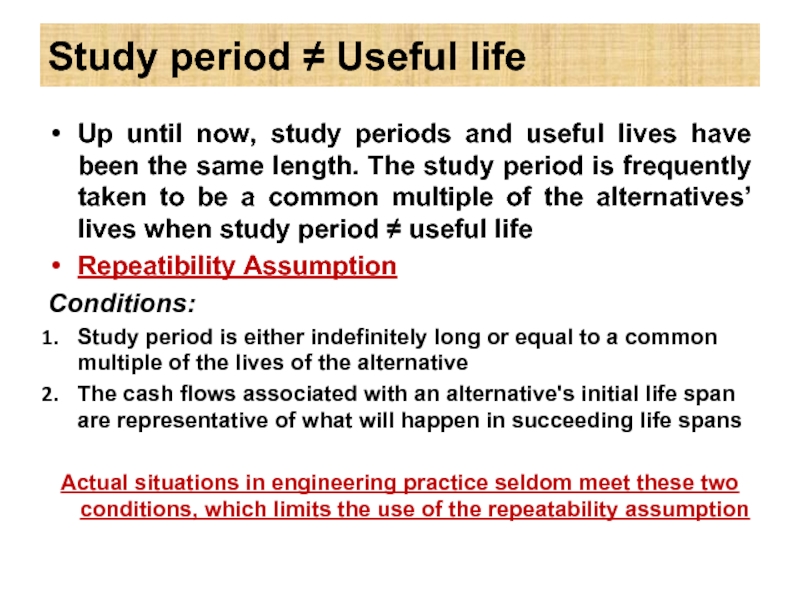

Слайд 20Study period ≠ Useful life

Up until now, study periods and useful

Repeatibility Assumption

Conditions:

Study period is either indefinitely long or equal to a common multiple of the lives of the alternative

The cash flows associated with an alternative's initial life span are representative of what will happen in succeeding life spans

Actual situations in engineering practice seldom meet these two conditions, which limits the use of the repeatability assumption

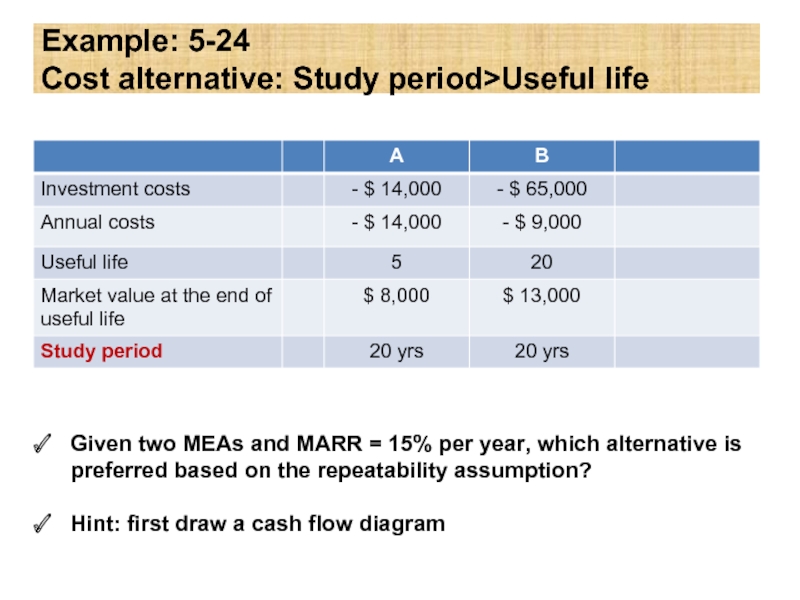

Слайд 21Example: 5-24

Cost alternative: Study period>Useful life

Given two MEAs and MARR

Hint: first draw a cash flow diagram

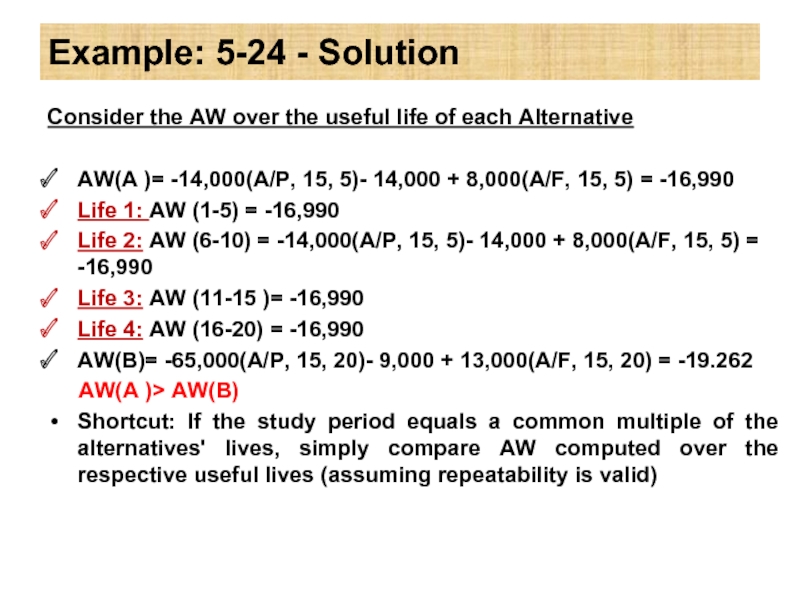

Слайд 22Example: 5-24 - Solution

Consider the AW over the useful life of

AW(A )= -14,000(A/P, 15, 5)- 14,000 + 8,000(A/F, 15, 5) = -16,990

Life 1: AW (1-5) = -16,990

Life 2: AW (6-10) = -14,000(A/P, 15, 5)- 14,000 + 8,000(A/F, 15, 5) = -16,990

Life 3: AW (11-15 )= -16,990

Life 4: AW (16-20) = -16,990

AW(B)= -65,000(A/P, 15, 20)- 9,000 + 13,000(A/F, 15, 20) = -19.262

AW(A )> AW(B)

Shortcut: If the study period equals a common multiple of the alternatives' lives, simply compare AW computed over the respective useful lives (assuming repeatability is valid)

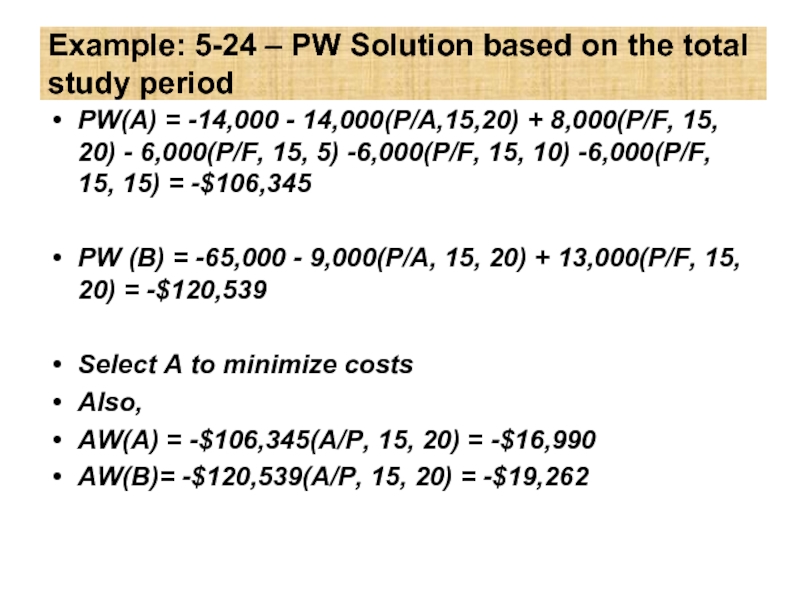

Слайд 23Example: 5-24 – PW Solution based on the total study period

PW(A)

PW (B) = -65,000 - 9,000(P/A, 15, 20) + 13,000(P/F, 15, 20) = -$120,539

Select A to minimize costs

Also,

AW(A) = -$106,345(A/P, 15, 20) = -$16,990

AW(B)= -$120,539(A/P, 15, 20) = -$19,262

Слайд 24What if the study period is not a common multiple of

An appropriate study period need to be selected (coterminated assumption)

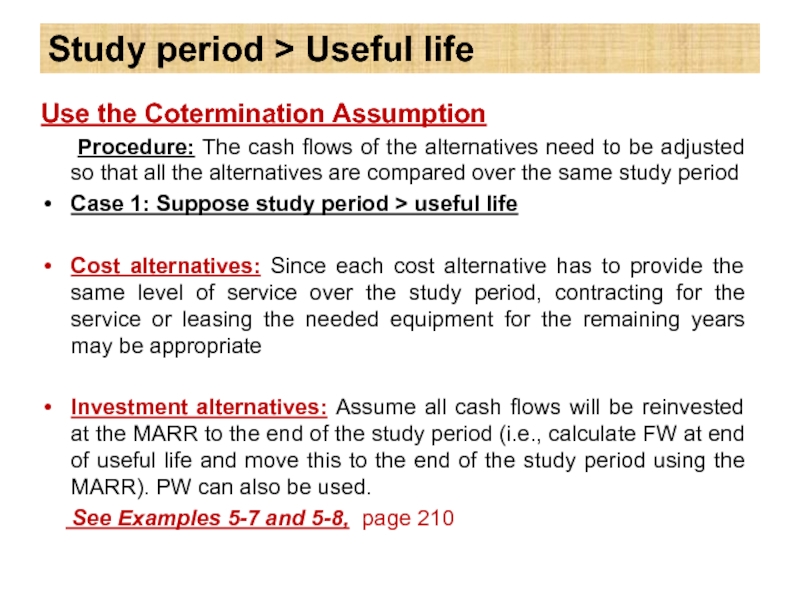

Слайд 25Study period > Useful life

Use the Cotermination Assumption

Procedure:

Case 1: Suppose study period > useful life

Cost alternatives: Since each cost alternative has to provide the same level of service over the study period, contracting for the service or leasing the needed equipment for the remaining years may be appropriate

Investment alternatives: Assume all cash flows will be reinvested at the MARR to the end of the study period (i.e., calculate FW at end of useful life and move this to the end of the study period using the MARR). PW can also be used.

See Examples 5-7 and 5-8, page 210

Слайд 26Case 2: Study period < useful life

When the study period is

Procedure: The cash flows of the alternatives need to be adjusted to terminate at the end of the study period

Truncate the alternative at the end of the study period using an estimated Market Value

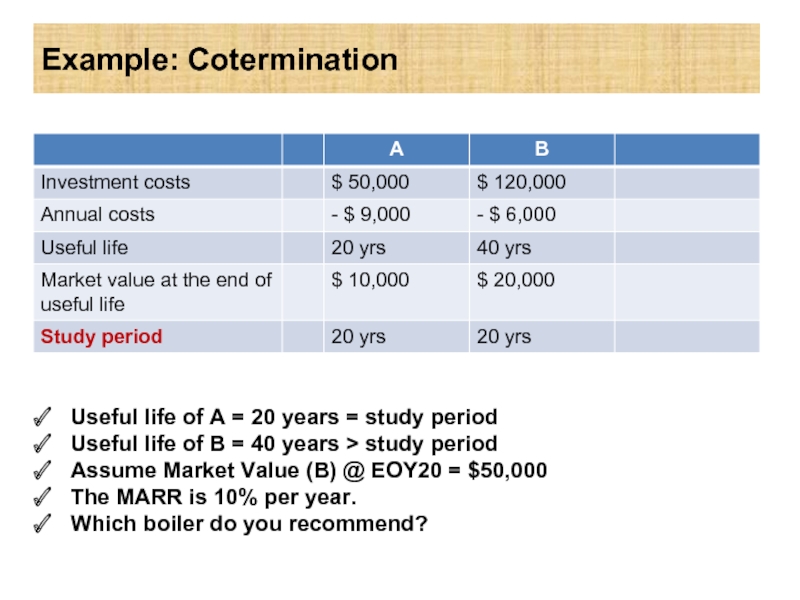

Слайд 27Example: Cotermination

Useful life of A = 20 years = study period

Useful

Assume Market Value (B) @ EOY20 = $50,000

The MARR is 10% per year.

Which boiler do you recommend?

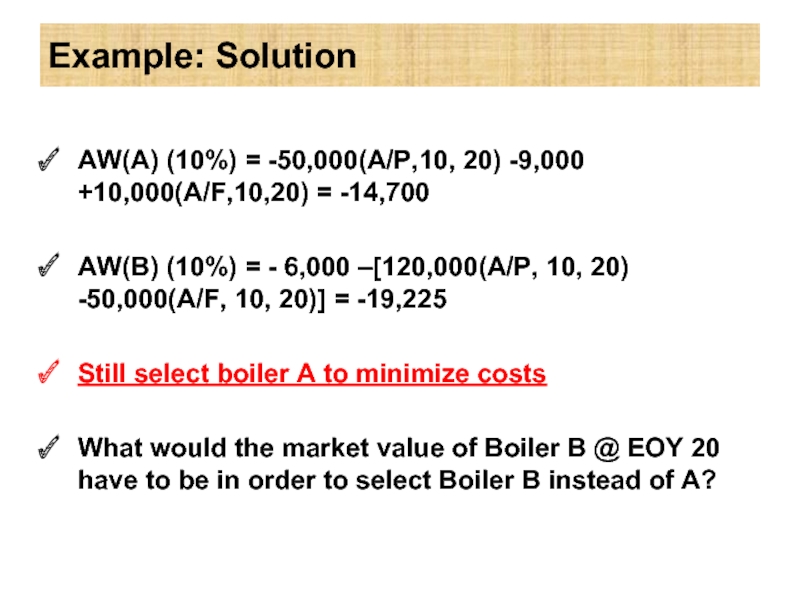

Слайд 28Example: Solution

AW(A) (10%) = -50,000(A/P,10, 20) -9,000 +10,000(A/F,10,20) = -14,700

AW(B) (10%)

Still select boiler A to minimize costs

What would the market value of Boiler B @ EOY 20 have to be in order to select Boiler B instead of A?

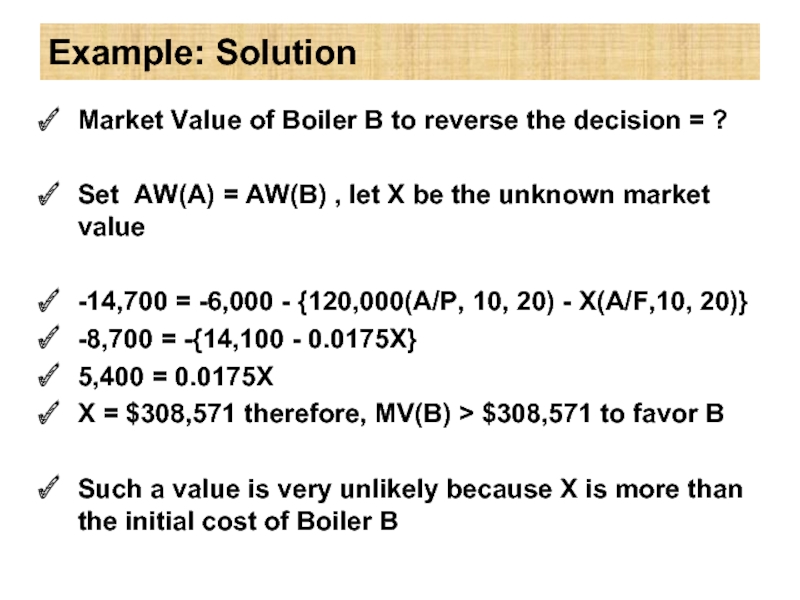

Слайд 29Example: Solution

Market Value of Boiler B to reverse the decision =

Set AW(A) = AW(B) , let X be the unknown market value

-14,700 = -6,000 - {120,000(A/P, 10, 20) - X(A/F,10, 20)}

-8,700 = -{14,100 - 0.0175X}

5,400 = 0.0175X

X = $308,571 therefore, MV(B) > $308,571 to favor B

Such a value is very unlikely because X is more than the initial cost of Boiler B