- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Blackhorse Silicon Valley Trip:GGV introduction & State of the VC Market презентация

Содержание

- 1. Blackhorse Silicon Valley Trip:GGV introduction & State of the VC Market

- 2. Table of Contents Table of Contents GGV

- 3. GGV Capital Highlights

- 4. 15 Years of Investing in the US

- 5. Our Proven Sectors Propel Deal Flow and

- 6. Fund V Ecosystems INTERNET OF THINGS COMMERCE

- 7. Deal Profile Cross-border advantage Sector focus Multi-stage

- 8. GGV Capital: Single Partnership Team

- 9. Market Overview

- 10. VC Dollars Growing, but Deal # Holding

- 11. Expansion & Late Stage Rounds Growing in

- 12. M&A Volumes at 2-Year Low After Record

- 13. # of IPOs Similarly at 2-Year Lows

- 14. US IPO Trends

- 15. Median Years to IPO Increasing Over Time…

- 16. …And the Revenue Bar for Going Public

- 17. …But Profitability is Not a Prerequisite…

- 18. 2014’s Top >$1B Tech IPOs Were Enterprise

- 19. 2015’s Tech IPOs Show Early Promise Shopify:

- 20. US M&A Trends

- 21. M&A Deal Value Reached 16-Month High in

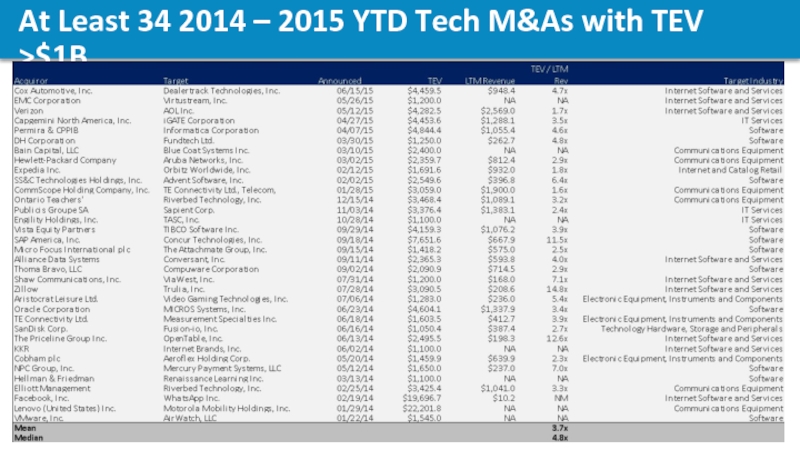

- 22. At Least 34 2014 – 2015 YTD Tech M&As with TEV >$1B

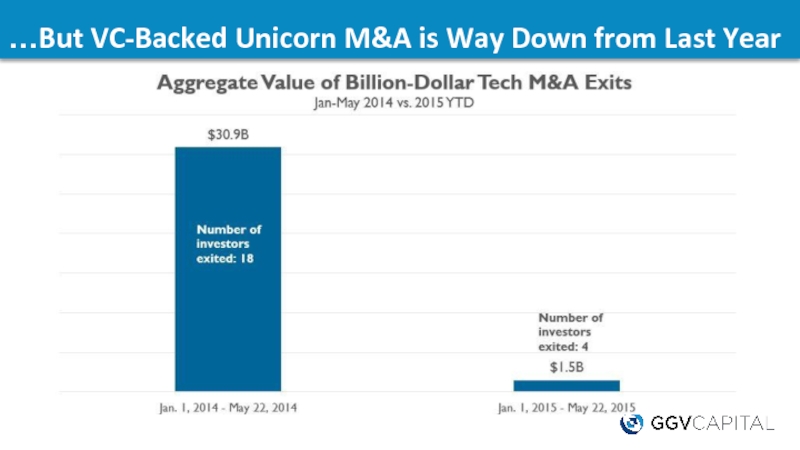

- 23. …But VC-Backed Unicorn M&A is Way Down from Last Year

- 24. US Venture Capital Trends

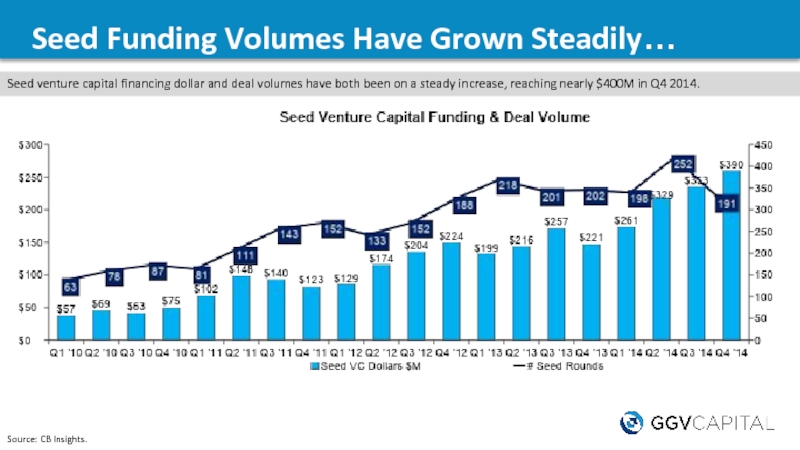

- 25. Seed Funding Volumes Have Grown Steadily… Seed

- 26. …And Seed Deal Sizes are Creeping Upward… Source: CB Insights.

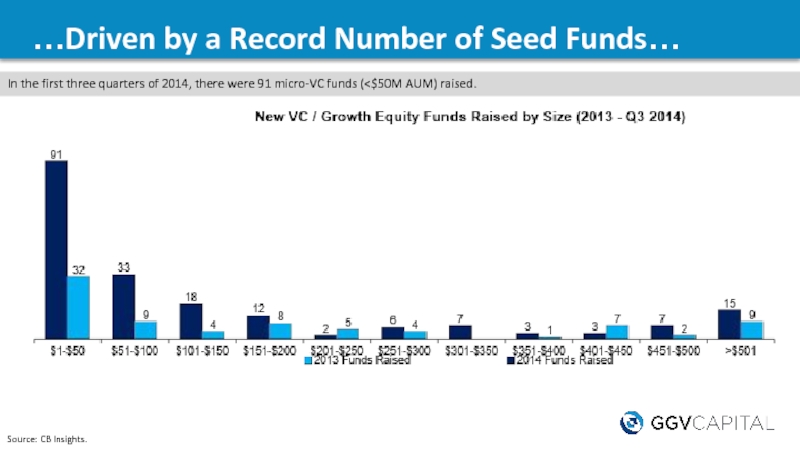

- 27. …Driven by a Record Number of Seed

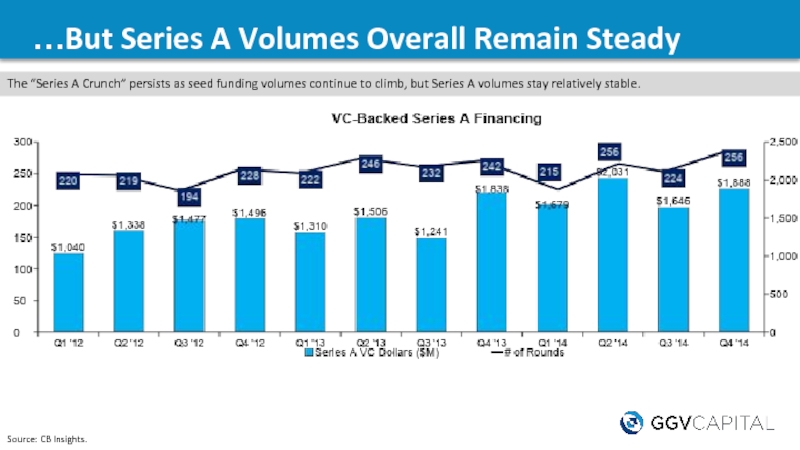

- 28. …But Series A Volumes Overall Remain Steady

- 29. 2014 VC Fundraising Far Exceeded Tech IPO Proceeds Source: CB Insights.

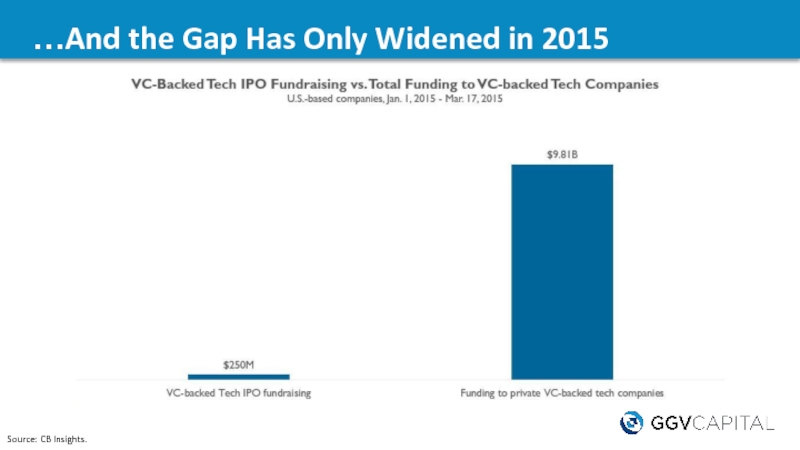

- 30. …And the Gap Has Only Widened in 2015 Source: CB Insights.

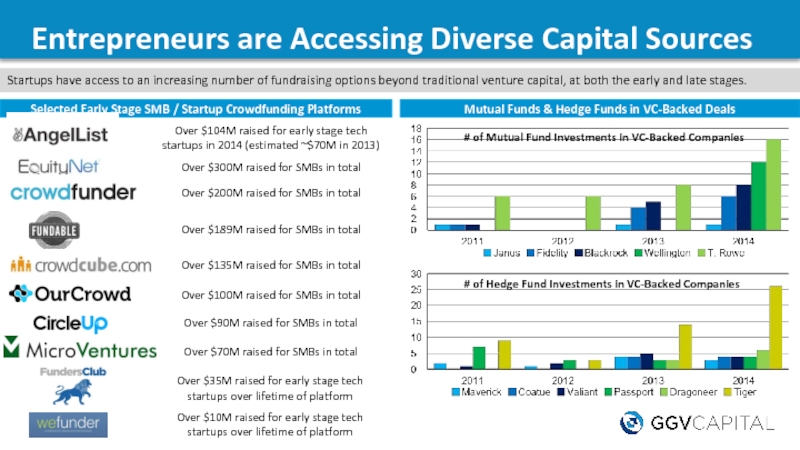

- 31. Entrepreneurs are Accessing Diverse Capital Sources Selected

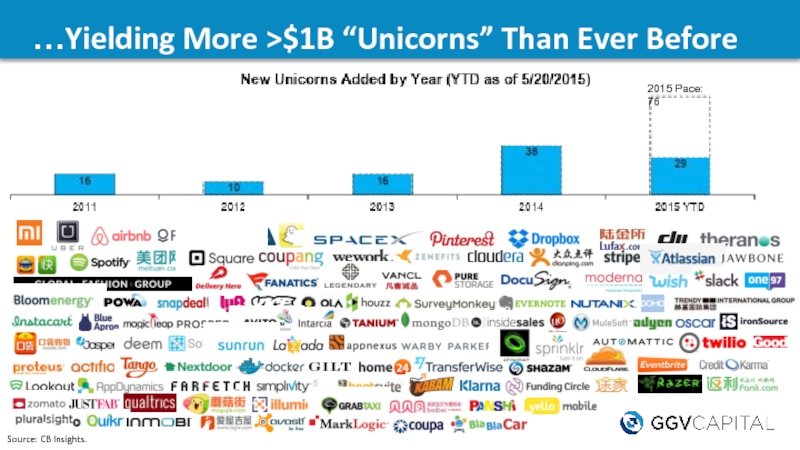

- 32. …Yielding More >$1B “Unicorns” Than Ever Before Source: CB Insights. 2015 Pace: 76

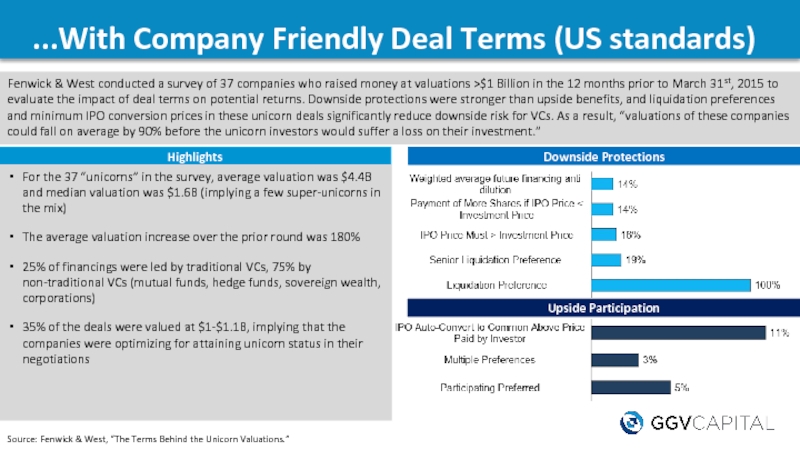

- 33. ...With Company Friendly Deal Terms (US standards)

Слайд 1Blackhorse Silicon Valley Trip:

GGV introduction & State of the VC Market

June

Glenn Solomon

Managing Partner, GGV Capital

Слайд 2Table of Contents

Table of Contents

GGV Capital Highlights

Market Overview

IPO Trends

M&A Trends

US Venture

Слайд 415 Years of Investing in the US & China

Resulting in 18

Resulting in 10 Private $1B+ Outcomes

Resulting in 21 $1B+ Outcomes

Tujia

爱屋吉屋

Слайд 5Our Proven Sectors Propel Deal Flow and Success

E-Commerce

Travel

Internet of Things

Gaming

AAC Technologies

CONFIDENTIAL

Digital

Marketing Youku-Tudou

Pandora

LightChaser

Percolate

SoundCloud

Buddy Media

Cross-Border

Ehang

Zepp

Wish

Quixey

Chukong

OnDemand

Services

Opendoor

51Credit

Xiaozhan

IWJW

Didi Dache

FlightCar

SaaS / Cloud

Zendesk

21Vianet

SuccessFactors

Synack

Kingsoft WPS

Domo

Global Discovery

Prynt

Wigo

CareerDean

Grubmarket

Dianhuabang

Totspot

Слайд 6Fund V Ecosystems

INTERNET OF THINGS

COMMERCE

MOMS/PETS

LIFESTYLE

ACCESSORIES

CLOUD / SAAS

ON DEMAND SERVICES

MOBILE / SOCIAL

Baobao

Exutech

Xiaohongshu

GOODS

EDUCATION

AUTO

HOME

FINANCE

爱屋吉屋

51zhangdan

Слайд 7Deal Profile

Cross-border advantage

Sector focus

Multi-stage investment

Market leader with 10x return profile

Typically lead

Median: $8-10m for 10-20%, double down on winners

Слайд 8GGV Capital: Single Partnership Team

Hany Nada

Jeff Richards

Glenn Solomon

Hans Tung

Jixun Foo

Joined GGV

Prior: DFJ ePlanet, NSTB Singapore, HP

Representative investments: MediaV, Qunar, Youku-Tudou, Meilishuo, Grabtaxi

Founding Partner

Prior: Piper Jaffray

Representative investments: DraftKings, Glu Mobile, Houzz,

Youku-Tudou, Soundcloud

Joined GGV in 2008

Prior: Verisign, Founder of R4, QuantumShift, PWC

Representative investments: Appirio, BlueKai, Buddy Media, HotelTonight, Flipboard

Joined GGV in 2006

Prior: Partech, SPO, Goldman, Sachs & Co.

Representative investments: AlienVault, Nimble Storage, Pandora, Square, Zendesk, SuccessFactors

Joined GGV in 2013

Prior: Qiming, Bessemer, Crimson Asia, HelloAsia, Merrill Lynch

Representative investments: Forgame, Wish, Curse, Xiaomi, Xiaohongxu

Jenny Lee

Joined GGV in 2005

Prior: JAFCO Asia, Morgan Stanley, ST Aerospace

Representative investments:

YY, 21Vianet, Pactera, Chukong, Zepp, Xiaozhan

CONFIDENTIAL

Слайд 10VC Dollars Growing, but Deal # Holding Steady

Source: MoneyTree, PwC and

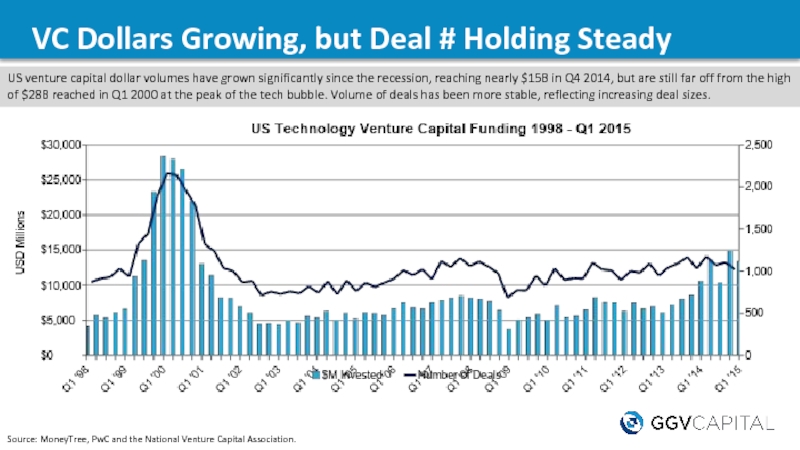

US venture capital dollar volumes have grown significantly since the recession, reaching nearly $15B in Q4 2014, but are still far off from the high of $28B reached in Q1 2000 at the peak of the tech bubble. Volume of deals has been more stable, reflecting increasing deal sizes.

Слайд 11Expansion & Late Stage Rounds Growing in Size

Average deal sizes for

Source: MoneyTree, PwC and the National Venture Capital Association.

Слайд 12M&A Volumes at 2-Year Low After Record Q4 ‘14

Source: NVCA &

The first quarter of 2015 has been slow for venture-backed M&A at $2B in disclosed deal value and 86 total deals, the lowest since Q1 2013.

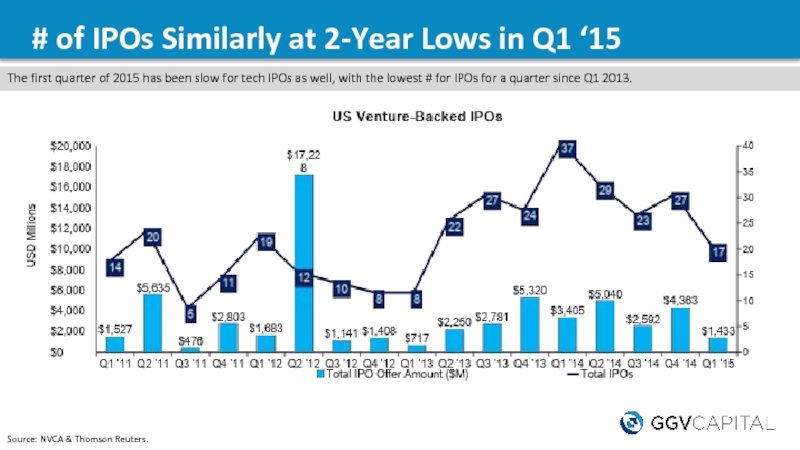

Слайд 13# of IPOs Similarly at 2-Year Lows in Q1 ‘15

The first

Source: NVCA & Thomson Reuters.

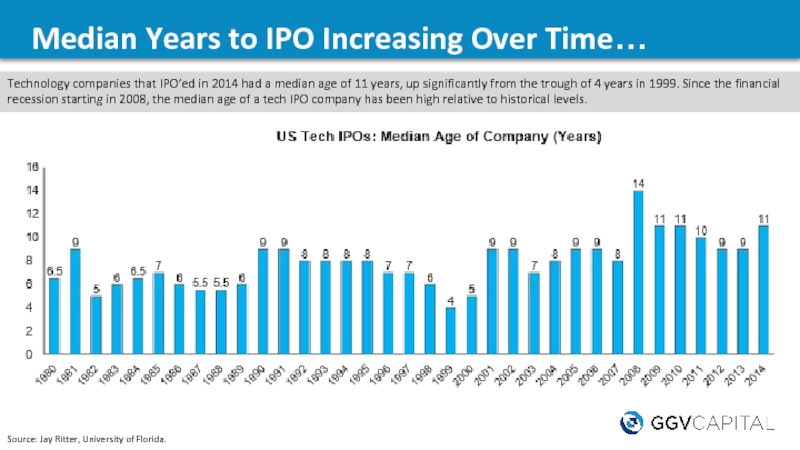

Слайд 15Median Years to IPO Increasing Over Time…

Technology companies that IPO’ed in

Source: Jay Ritter, University of Florida.

Слайд 16…And the Revenue Bar for Going Public is High…

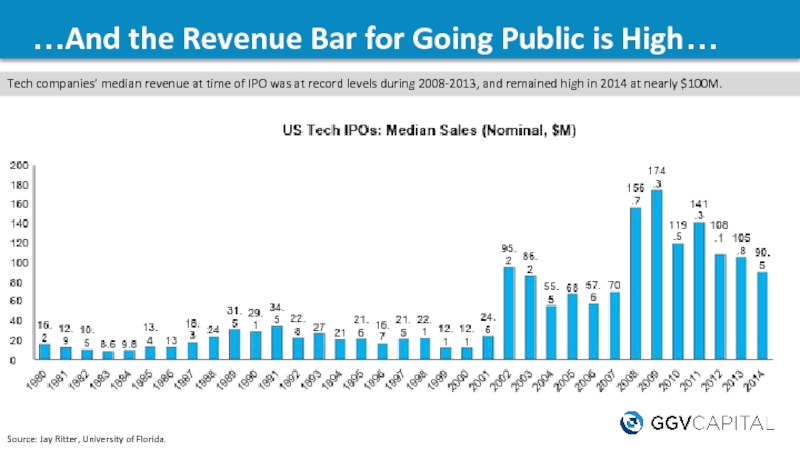

Tech companies’ median

Source: Jay Ritter, University of Florida.

Слайд 17…But Profitability is Not a Prerequisite…

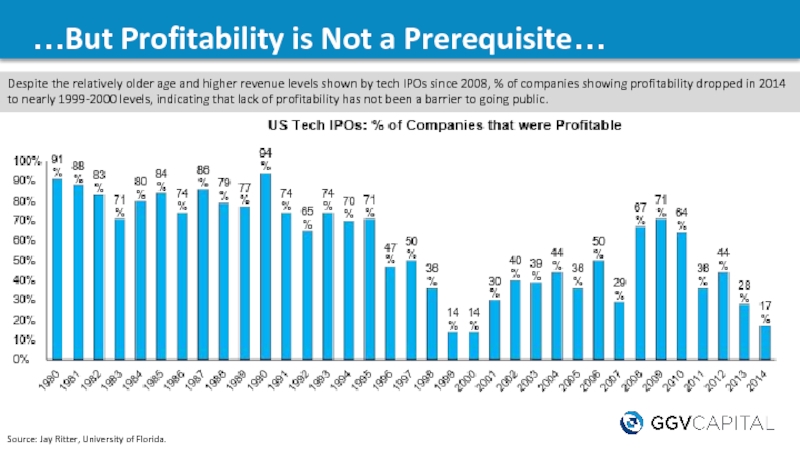

Source: Jay Ritter, University of

Despite the relatively older age and higher revenue levels shown by tech IPOs since 2008, % of companies showing profitability dropped in 2014 to nearly 1999-2000 levels, indicating that lack of profitability has not been a barrier to going public.

Слайд 182014’s Top >$1B Tech IPOs Were Enterprise Companies

Source: Capital IQ. Data

Out of 2014’s >$1B Market Cap, venture-backed tech IPOs, horizontal SaaS (Zendesk, Paylocity) and enterprise infrastructure (New Relic, Hortonworks, Arista Networks) were the best performing categories.

Post-IPO Trading Days

Hortonworks: +64% from Offer

Arista: +91% from Offer

Zendesk: +163% from Offer

New Relic: +54% from Offer

Paylocity: +109% from Offer

Gruhub: +33% from Offer

Wayfair: +32% from Offer

Opower: -39% from Offer

King: -37% from Offer

Coupons.com: -26% from Offer

Lending Club: +2% from Offer

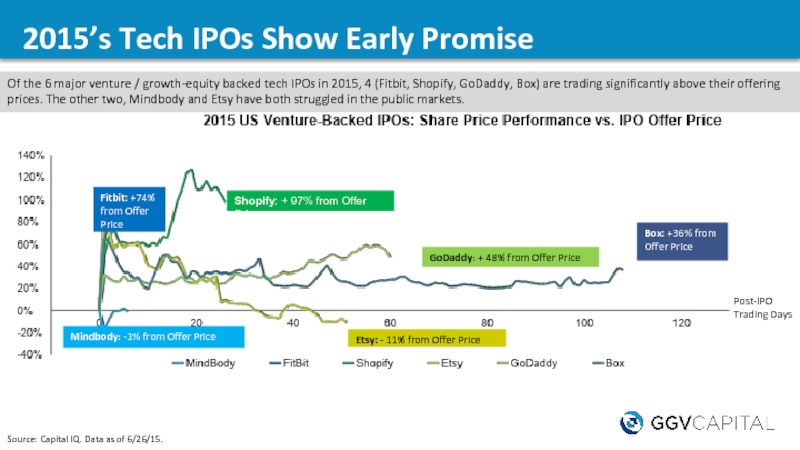

Слайд 192015’s Tech IPOs Show Early Promise

Shopify: + 97% from Offer Price

GoDaddy:

Etsy: - 11% from Offer Price

Box: +36% from Offer Price

Fitbit: +74% from Offer Price

Mindbody: -1% from Offer Price

Source: Capital IQ. Data as of 6/26/15.

Of the 6 major venture / growth-equity backed tech IPOs in 2015, 4 (Fitbit, Shopify, GoDaddy, Box) are trading significantly above their offering prices. The other two, Mindbody and Etsy have both struggled in the public markets.

Post-IPO Trading Days

Слайд 21M&A Deal Value Reached 16-Month High in May ‘15

Source: FactSet.

US M&A

Слайд 25Seed Funding Volumes Have Grown Steadily…

Seed venture capital financing dollar and

Source: CB Insights.

Слайд 27…Driven by a Record Number of Seed Funds…

Source: CB Insights.

In the

Слайд 28…But Series A Volumes Overall Remain Steady

The “Series A Crunch” persists

Source: CB Insights.

Слайд 31Entrepreneurs are Accessing Diverse Capital Sources

Selected Early Stage SMB / Startup

Over $104M raised for early stage tech startups in 2014 (estimated ~$70M in 2013)

Over $300M raised for SMBs in total

Over $200M raised for SMBs in total

Over $189M raised for SMBs in total

Over $135M raised for SMBs in total

Over $100M raised for SMBs in total

Over $90M raised for SMBs in total

Over $70M raised for SMBs in total

Over $35M raised for early stage tech startups over lifetime of platform

Over $10M raised for early stage tech startups over lifetime of platform

Startups have access to an increasing number of fundraising options beyond traditional venture capital, at both the early and late stages.

Mutual Funds & Hedge Funds in VC-Backed Deals

# of Mutual Fund Investments in VC-Backed Companies

# of Hedge Fund Investments in VC-Backed Companies

Слайд 33...With Company Friendly Deal Terms (US standards)

Fenwick & West conducted a

Source: Fenwick & West, “The Terms Behind the Unicorn Valuations.”

Highlights

Downside Protections

For the 37 “unicorns” in the survey, average valuation was $4.4B and median valuation was $1.6B (implying a few super-unicorns in the mix)

The average valuation increase over the prior round was 180%

25% of financings were led by traditional VCs, 75% by non-traditional VCs (mutual funds, hedge funds, sovereign wealth, corporations)

35% of the deals were valued at $1-$1.1B, implying that the companies were optimizing for attaining unicorn status in their negotiations

Upside Participation