- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Banking Sector – UCO Bank презентация

Содержание

- 1. Banking Sector – UCO Bank

- 2. Banking Industry

- 3. Functions of Bank Accepting deposits from Public

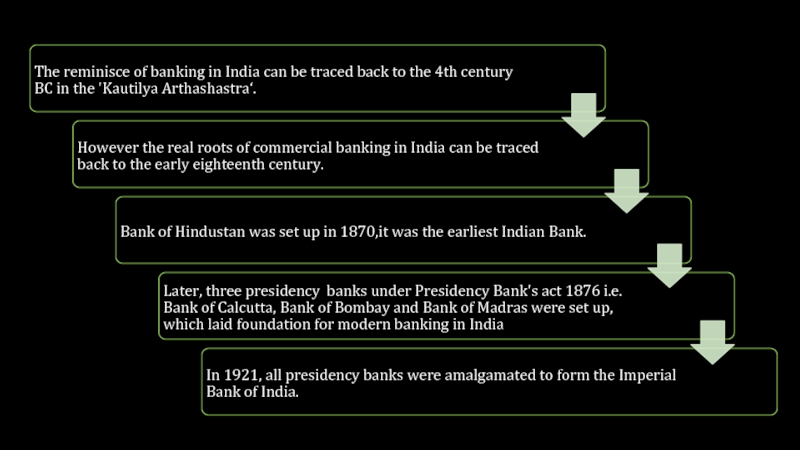

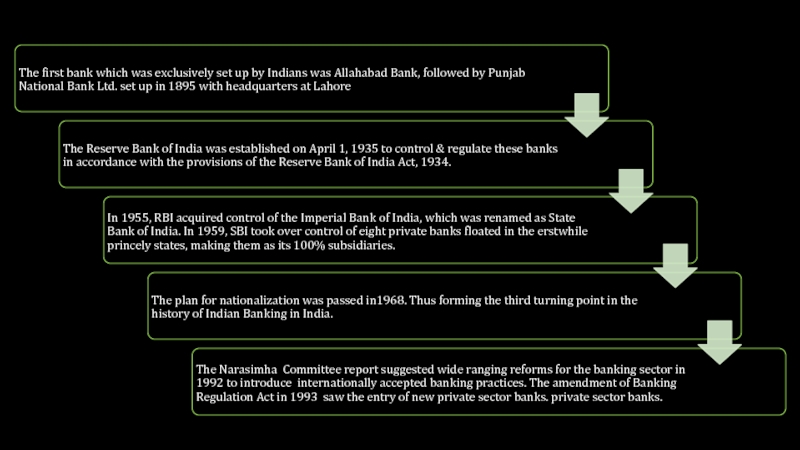

- 4. History of Banking in India

- 7. Who Regulates the Financial Sector in India?

- 8. Banking Structure in India

- 9. Indian Financial System –Share by Asset Size

- 10. Share in the Banking Space Public sector

- 11. Types of Banks Central Bank (RBI) Non

- 12. Business Division

- 13. Loan Products • Auto Loan • Gold

- 14. Growth Drivers of the Banking Industry

- 15. Opportunities in the Banking Sector Mortgage to

- 16. UCO bank

- 17. Profile of UCO bank Established by G.D.

- 18. Size of UCO bank The bank has

- 19. Various scheme offered by UCO bank UCO

- 20. CSR of UCO bank The Bank believes

- 21. Career opportunity in UCO bank

- 22. Skills & competencies Key Management Skills required

- 23. SWOT analysis of UCO bank

- 24. Thank You Prepared by:- Sajal Mondal

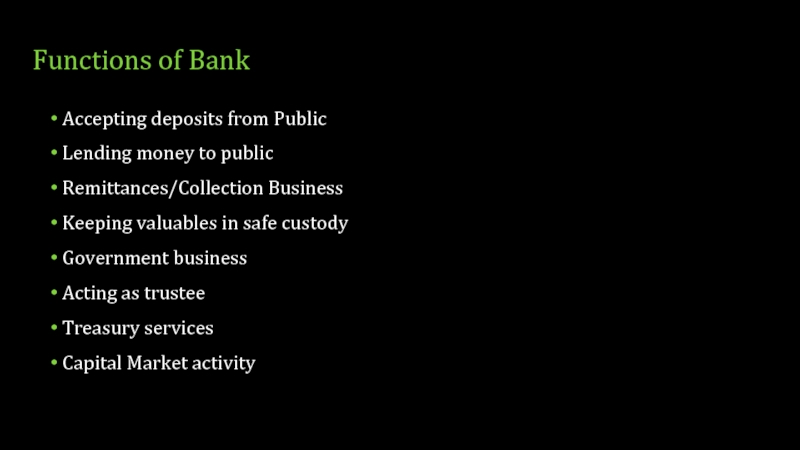

Слайд 3Functions of Bank

Accepting deposits from Public

Lending money to public

Remittances/Collection Business

Keeping valuables

Government business

Acting as trustee

Treasury services

Capital Market activity

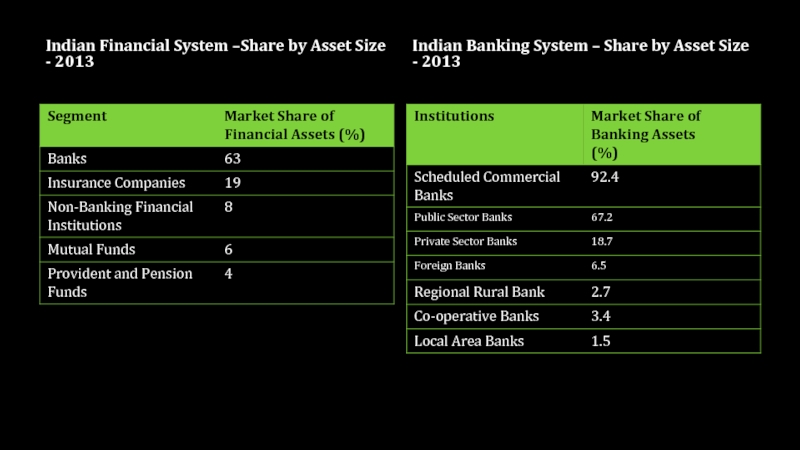

Слайд 9Indian Financial System –Share by Asset Size - 2013

Indian Banking System

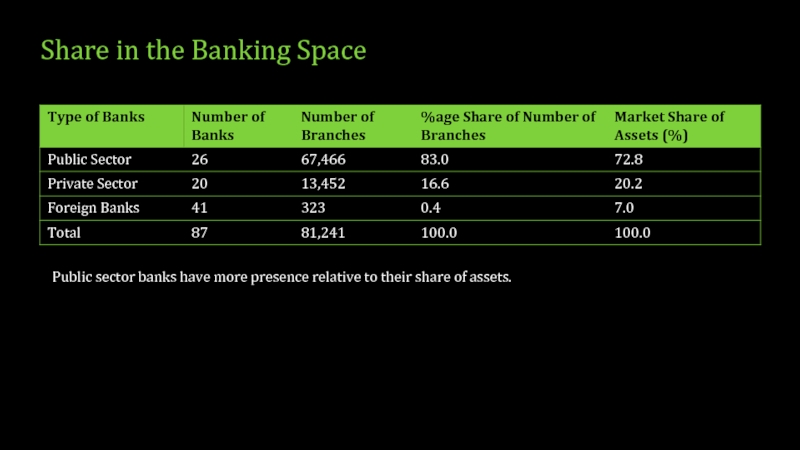

Слайд 10Share in the Banking Space

Public sector banks have more presence relative

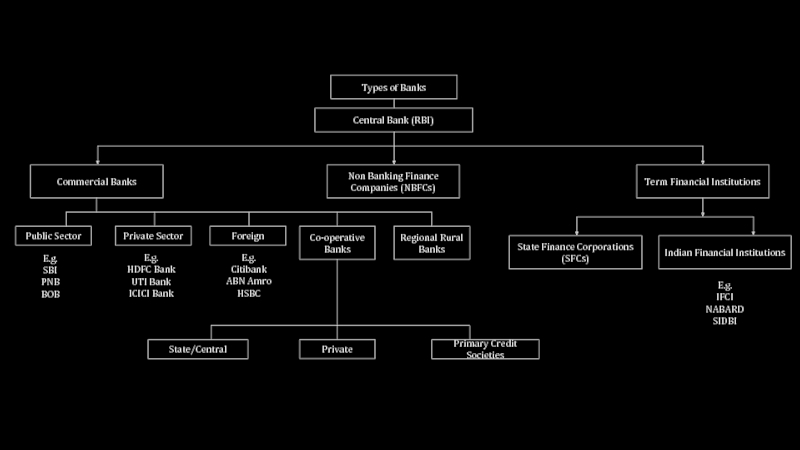

Слайд 11Types of Banks

Central Bank (RBI)

Non Banking Finance Companies (NBFCs)

Commercial Banks

Term Financial

State Finance Corporations (SFCs)

Indian Financial Institutions

E.g.

IFCI

NABARD

SIDBI

Public Sector

Private Sector

Foreign

Co-operative Banks

Regional Rural Banks

E.g.

SBI

PNB

BOB

E.g.

HDFC Bank

UTI Bank

ICICI Bank

E.g.

Citibank

ABN Amro

HSBC

State/Central

Private

Primary Credit Societies

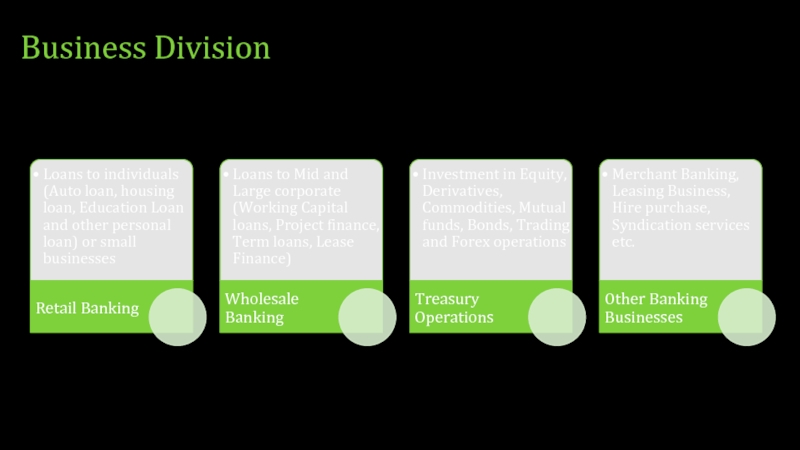

Слайд 13Loan Products

• Auto Loan

• Gold Loan

• House Loan

• Credit cards

• Education

• Loan against Securities

• Retail Banking Business

Deposit Products

• Deposits

• Saving Accounts

• Current Accounts

• Fixed / Recurring

• Corporate Salary A/C

Other Products/Services

• NRI services

• POS Terminals

• Private Banking

• Demat Services

• Mutual Fund Sales

• Foreign Exchange Services

Commercial Banking

• Term Loan

• Guarantees

• Bill Collection

• Letter of Credit

• Working Capital

• Forex & Derivatives

• Wholesale Deposits

Transaction Banking

• Cash Management

• Custodian Services

• Clearing Bank Services

• Tax Collections

• Banker to Public Issues

Commodities(Inc Hedging)

Key Segment

• Large Corporate

• Emerging Corporate

• Financial Institutions

• Government/PSUs

• Agriculture Commodities

Product Segment

• Equities

• Derivatives

• Capital Market

• Debt Securities

• Foreign Exchange

Other Financing

• Cash Management

• Statutory Reserve

• Financial Decisions

• Asset Liability Management

1

Retail Banking

2

Wholesale Banking

Слайд 15Opportunities in the Banking Sector

Mortgage to cross Rs 40 lakh crores

Wealth Management to be a big business

Rapid growth of branches & ATMs

Mobile banking to see huge growth

Infrastructure financing to reach over Rs 20 trillion on commercial banks book by 2020

New Models to serve the small & Medium Enterprises (SME)

Слайд 17Profile of UCO bank

Established by G.D. Birla on 6th January 1943

The bank was nationalized on 19th July 1969

Headquarter in Kolkata

As of September 2013 Mr. Arun Kaul is the chair man & Managing director of UCO bank

Слайд 18Size of UCO bank

The bank has some 45 regional offices and

Market capitalization of UCO bank is Rs 5,046 Cr

CAGR of UCO bank 16.15%

No. Of employee is 24,201

Honours Your Trust s the tag line and Commitment to Customers is the USP.

Major competitors of UCO bank are . Indian bank, Union Bank of India, Dena bank, Indian Over seas bank

Слайд 19Various scheme offered by UCO bank

UCO KISAN BHOOMI VRIDHI Scheme

UCO KISAN

UCO ESTATE PURCHASE LOAN Scheme

Scheme for Solar Irrigation Pump set

Слайд 20CSR of UCO bank

The Bank believes that carrying out Corporate Social

- An amount of Rs. 4.90 lakh to Shivaji University, Kolhapur, Maharashtra under environment protection category for installation ofSolar Plant Device.

- Rs. 2 lakh to Ramakrishna Math, Nattarampalli, Vellore, Tamilnadufor construction of building for an orphanage

- Rs. 10 lakh to Mahaveer Viklang Sahayata Samity, Jaipur for helping the physically challenged.

Слайд 21Career opportunity in UCO bank

Finance professional is key

Business Development Manager in Financial Services

Branch Manager in Retail Banking

Business Development Manager in Corporate Sales

Business Development Manager Broking

Portfolio Manager

Banking Business Analyst

Banking Customer Service Manager

Bank Loan Manager

Assistant Bank Mana

Слайд 22Skills & competencies

Key Management Skills required in Banking Industry are -

Communication

Analytical Skills

Decision making skill

Teamwork Sills

IT skills

They help Bank Manager to have a cordial atmosphere in Bank so that customer is satisfied with services and financial product information provided by Bank

Recruitment criteria for UCO bank

As UCO bank is public undertaking bank it`s all recruitments are done through IBPS exam. The candidate should qualify the mentioned exam for get chance in UCO bank. For the MBA graduates bank has some own quota, but candidate should go through the exam. Some time the bank hires MBA graduate from the college campus.