- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Banking Industry OverviewSectors, trends, and disruptionsAugust 2015 презентация

Содержание

- 1. Banking Industry OverviewSectors, trends, and disruptionsAugust 2015

- 2. Banking Overview

- 3. S&P 500 Breakdown 19.4 T 7.3 T

- 4. Role of Banks Banks serve an

- 5. Categories of Banks Full-Service Banks Community Banks

- 6. Banking Landscape – Banks by Size Assets

- 7. JP Morgan Chase

- 8. Bank of America

- 9. Citigroup 1997

- 10. Wells Fargo

- 11. Financial Stability Oversight Council (FSCOC) Federal Reserve

- 12. Major Banking Legislation Dodd-Frank Wall

- 13. Drivers of Change in the Banking Industry

- 14. SMB Credit Education Finance Banking Landscape –

- 15. Banking Landscape – Industry Sector Magnitude by

- 16. Banking Landscape – Industry Sector Magnitude by

- 17. Lending Real Estate – Residential Mortgages

- 18. Residential Mortgages Overview Annual Loan Volume Outstanding

- 19. Residential Mortgages – Trends in the Industry

- 20. Lending Education Finance

- 21. Education Financing Overview 83% Outstanding Debt is

- 22. Private Education Financing – Trends in the

- 23. Lending Purchase Finance – Auto Lending

- 24. Auto Loan Overview Industry Size Customer Base

- 25. Auto Loans – Trends in the Industry

- 26. Lending Consumer Credit

- 27. Consumer Credit Overview Industry Size Credit

- 28. Consumer Credit – Trends in the Industry

- 29. Lending SMB Lending

- 30. Small Business Lending Overview Industry Size Customer

- 31. SMB Lending – Trends in the Industry

- 32. Lending Payday

- 33. Industry Size Customer Base The average payday

- 34. Trends Payday Loans – Trends in the

- 35. Venture Financing

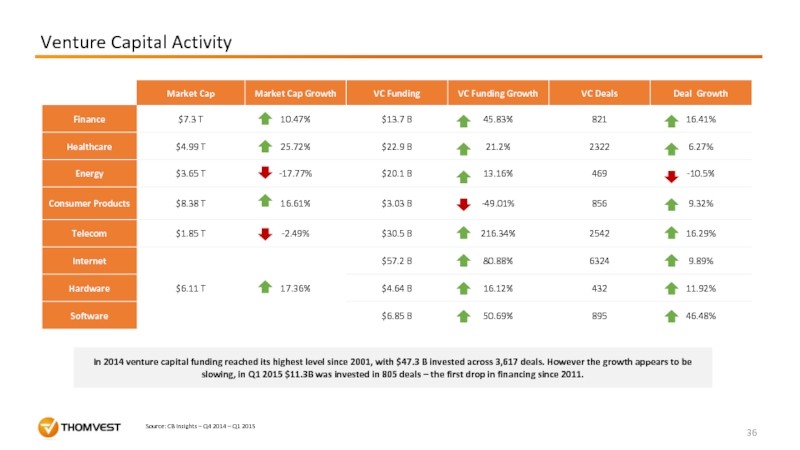

- 36. Venture Capital Activity In 2014

- 37. What Sectors are Hot? Source: CB Insights

- 38. FinTech Investing has Increased Source: CB Insights

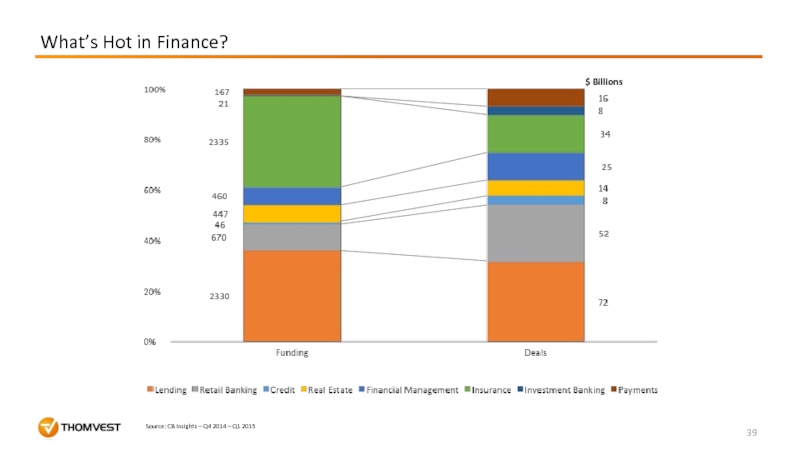

- 39. What’s Hot in Finance? Source: CB Insights – Q4 2014 – Q1 2015 $ Billions

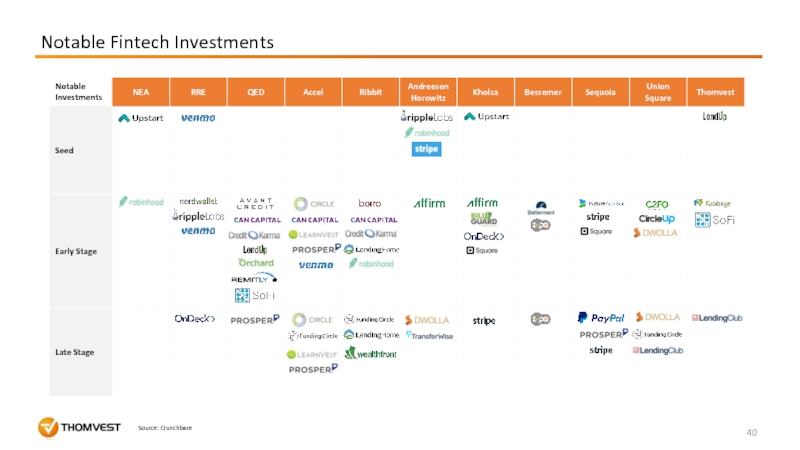

- 40. Notable Fintech Investments Source: Crunchbase

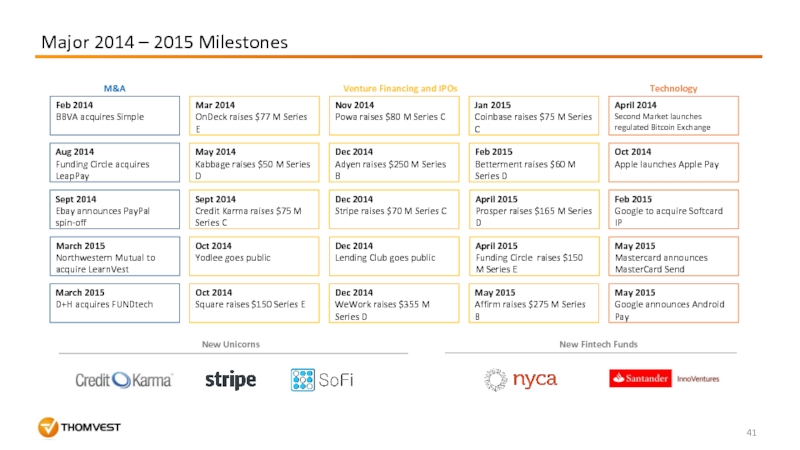

- 41. Major 2014 – 2015 Milestones New Unicorns New Fintech Funds

- 42. Fintech Sentiment 70% think that in

- 43. Sources (1/3) "The Top 50 U.S. Banks

- 44. Sources (2/3) “Overview of Recent Developments in

- 45. Sources (3/3) “Trends in Student Aid 2014.”

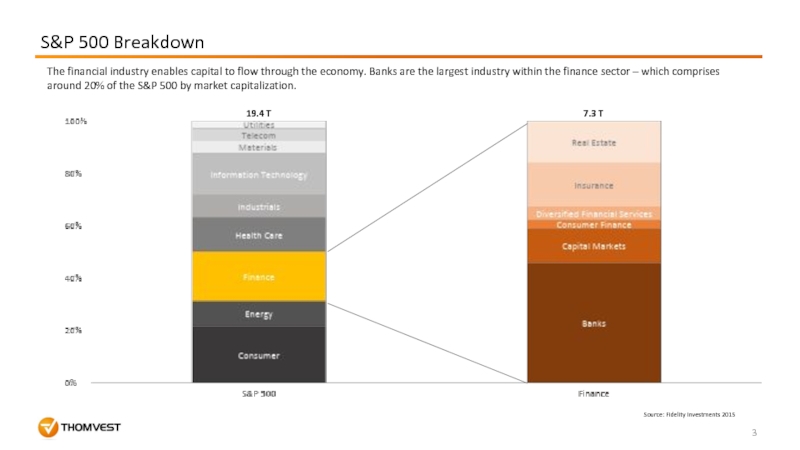

Слайд 3S&P 500 Breakdown

19.4 T

7.3 T

Source: Fidelity Investments 2015

The financial industry enables

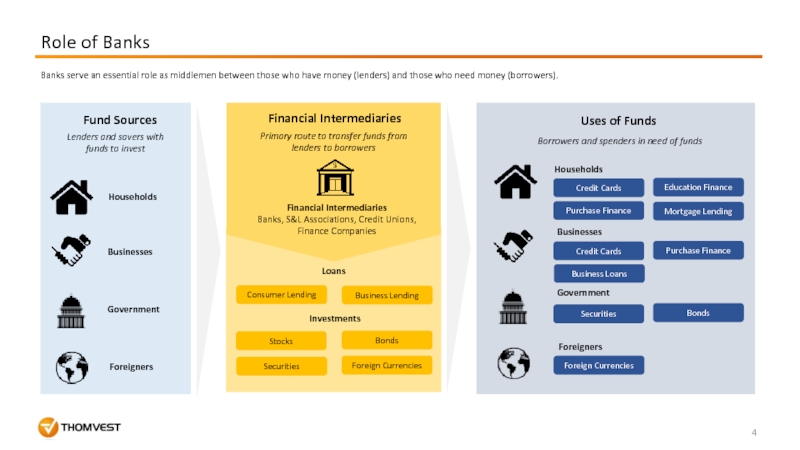

Слайд 4

Role of Banks

Banks serve an essential role as middlemen between those

Fund Sources

Lenders and savers with funds to invest

Businesses

Households

Government

Foreigners

Uses of Funds

Businesses

Households

Government

Foreigners

Borrowers and spenders in need of funds

Primary route to transfer funds from lenders to borrowers

Financial Intermediaries

Financial Intermediaries

Banks, S&L Associations, Credit Unions, Finance Companies

Loans

Investments

Consumer Lending

Business Lending

Stocks

Bonds

Securities

Foreign Currencies

Credit Cards

Education Finance

Mortgage Lending

Purchase Finance

Foreign Currencies

Bonds

Securities

Credit Cards

Purchase Finance

Business Loans

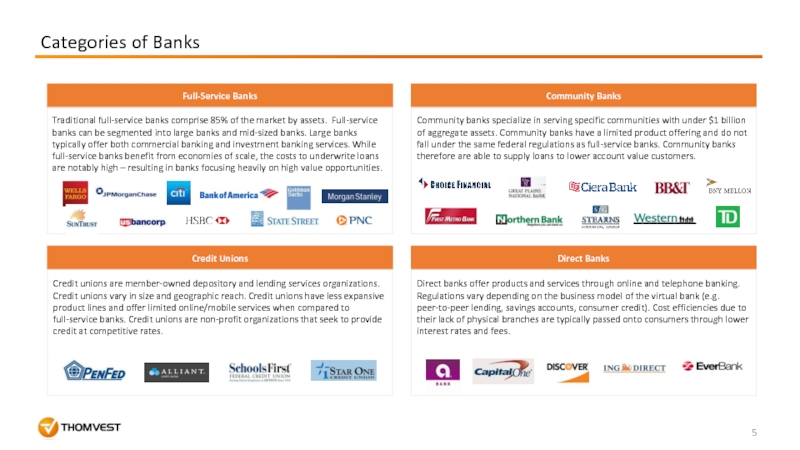

Слайд 5Categories of Banks

Full-Service Banks

Community Banks

Direct Banks

Community banks specialize in serving specific

Direct banks offer products and services through online and telephone banking. Regulations vary depending on the business model of the virtual bank (e.g. peer-to-peer lending, savings accounts, consumer credit). Cost efficiencies due to their lack of physical branches are typically passed onto consumers through lower interest rates and fees.

Credit Unions

Traditional full-service banks comprise 85% of the market by assets. Full-service banks can be segmented into large banks and mid-sized banks. Large banks typically offer both commercial banking and investment banking services. While full-service banks benefit from economies of scale, the costs to underwrite loans are notably high – resulting in banks focusing heavily on high value opportunities.

Credit unions are member-owned depository and lending services organizations. Credit unions vary in size and geographic reach. Credit unions have less expansive product lines and offer limited online/mobile services when compared to full-service banks. Credit unions are non-profit organizations that seek to provide credit at competitive rates.

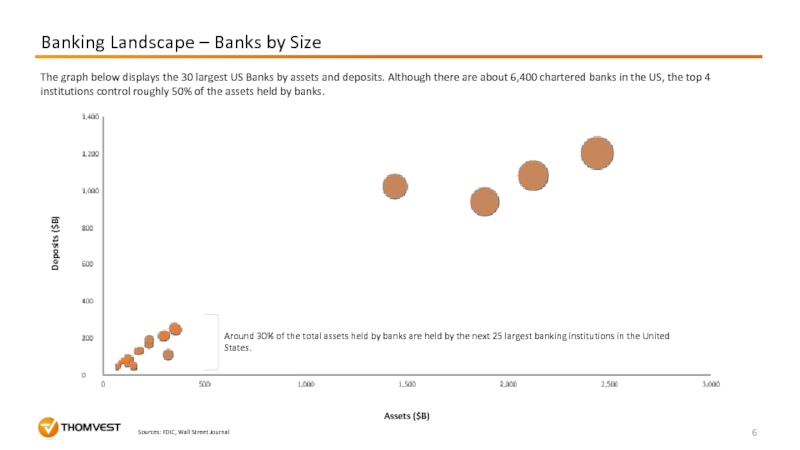

Слайд 6Banking Landscape – Banks by Size

Assets ($B)

Deposits ($B)

The graph below displays

Around 30% of the total assets held by banks are held by the next 25 largest banking institutions in the United States.

Sources: FDIC, Wall Street Journal

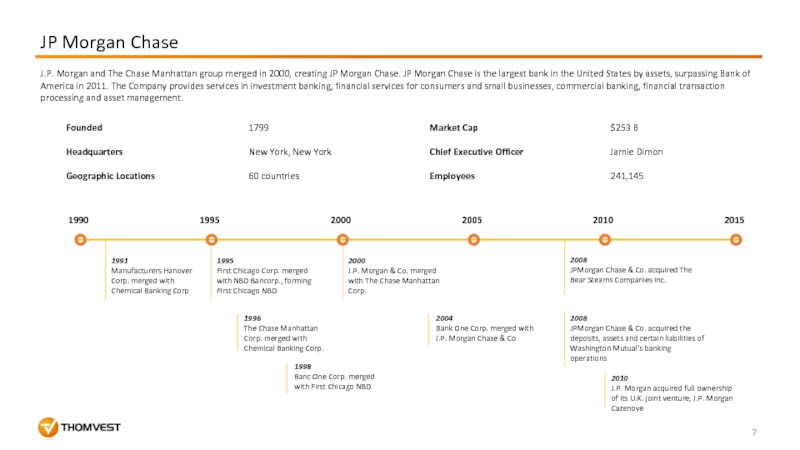

Слайд 7JP Morgan Chase

1991

Manufacturers Hanover Corp. merged with Chemical Banking Corp

1995

First

1996

The Chase Manhattan Corp. merged with Chemical Banking Corp.

1998

Banc One Corp. merged with First Chicago NBD

2000

J.P. Morgan & Co. merged with The Chase Manhattan Corp.

2004

Bank One Corp. merged with J.P. Morgan Chase & Co

2008

JPMorgan Chase & Co. acquired The Bear Stearns Companies Inc.

2008

JPMorgan Chase & Co. acquired the deposits, assets and certain liabilities of Washington Mutual's banking operations

2010

J.P. Morgan acquired full ownership of its U.K. joint venture, J.P. Morgan Cazenove

J.P. Morgan and The Chase Manhattan group merged in 2000, creating JP Morgan Chase. JP Morgan Chase is the largest bank in the United States by assets, surpassing Bank of America in 2011. The Company provides services in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management.

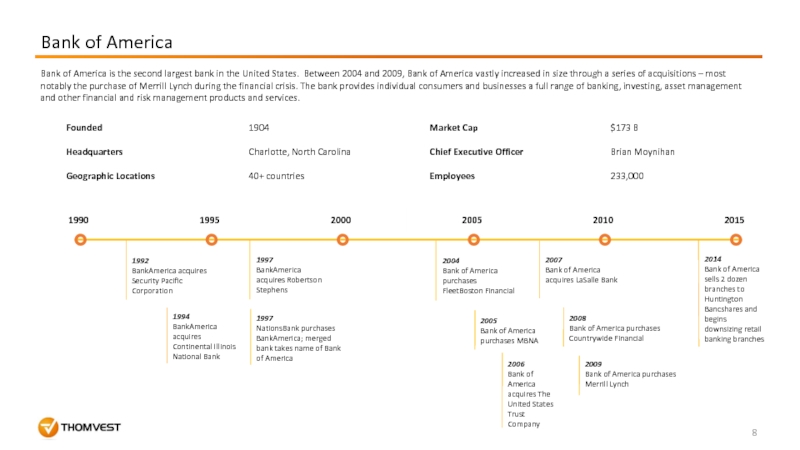

Слайд 8Bank of America

1992

BankAmerica acquires Security Pacific Corporation

1994

BankAmerica acquires Continental Illinois

1997

BankAmerica acquires Robertson Stephens

1997

NationsBank purchases BankAmerica; merged bank takes name of Bank of America

2004

Bank of America purchases FleetBoston Financial

2005

Bank of America purchases MBNA

2006

Bank of America acquires The United States Trust Company

2007

Bank of America acquires LaSalle Bank

2008

Bank of America purchases Countrywide Financial

2009

Bank of America purchases Merrill Lynch

2014

Bank of America sells 2 dozen branches to Huntington Bancshares and begins downsizing retail banking branches

Bank of America is the second largest bank in the United States. Between 2004 and 2009, Bank of America vastly increased in size through a series of acquisitions – most notably the purchase of Merrill Lynch during the financial crisis. The bank provides individual consumers and businesses a full range of banking, investing, asset management and other financial and risk management products and services.

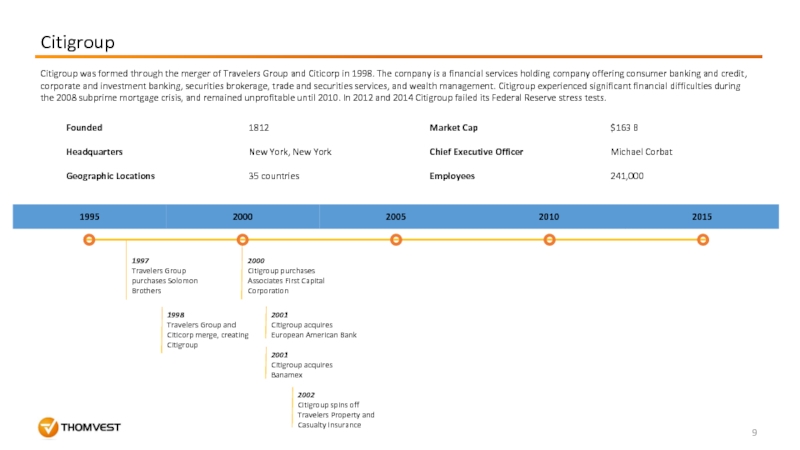

Слайд 9Citigroup

1997

Travelers Group purchases Solomon Brothers

1998

Travelers Group and Citicorp merge, creating

2000

Citigroup purchases Associates First Capital Corporation

2001

Citigroup acquires European American Bank

2001

Citigroup acquires Banamex

2002

Citigroup spins off Travelers Property and Casualty Insurance

Citigroup was formed through the merger of Travelers Group and Citicorp in 1998. The company is a financial services holding company offering consumer banking and credit, corporate and investment banking, securities brokerage, trade and securities services, and wealth management. Citigroup experienced significant financial difficulties during the 2008 subprime mortgage crisis, and remained unprofitable until 2010. In 2012 and 2014 Citigroup failed its Federal Reserve stress tests.

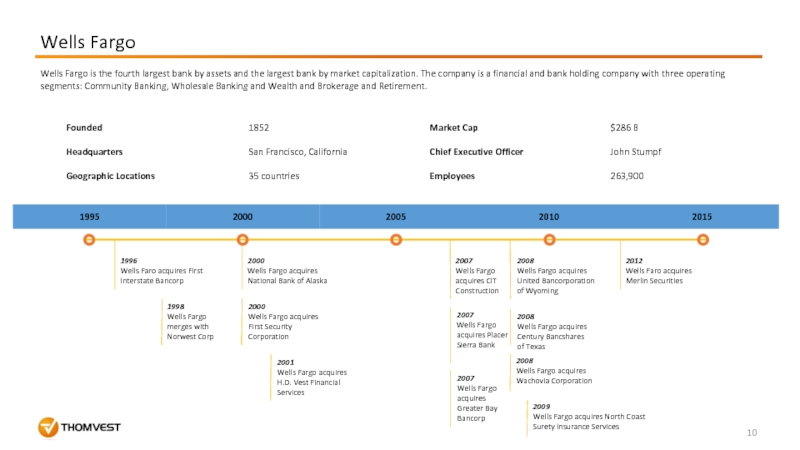

Слайд 10Wells Fargo

1996

Wells Faro acquires First Interstate Bancorp

1998

Wells Fargo merges with

2000

Wells Fargo acquires National Bank of Alaska

2000

Wells Fargo acquires First Security Corporation

2001

Wells Fargo acquires H.D. Vest Financial Services

2007

Wells Fargo acquires CIT Construction

2007

Wells Fargo acquires Placer Sierra Bank

2007

Wells Fargo acquires Greater Bay Bancorp

2008

Wells Fargo acquires United Bancorporation of Wyoming

2008

Wells Fargo acquires Century Bancshares of Texas

2008

Wells Fargo acquires Wachovia Corporation

2009

Wells Fargo acquires North Coast Surety Insurance Services

2012

Wells Faro acquires Merlin Securities

Wells Fargo is the fourth largest bank by assets and the largest bank by market capitalization. The company is a financial and bank holding company with three operating segments: Community Banking, Wholesale Banking and Wealth and Brokerage and Retirement.

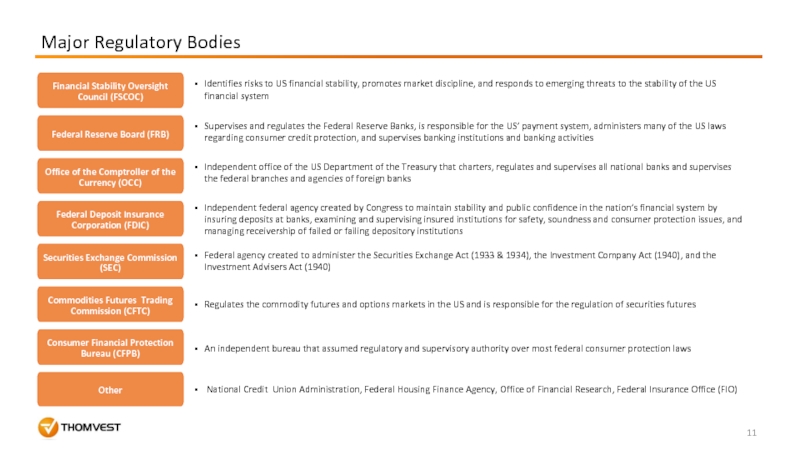

Слайд 11Financial Stability Oversight Council (FSCOC)

Federal Reserve Board (FRB)

Office of the Comptroller

Federal Deposit Insurance Corporation (FDIC)

Securities Exchange Commission (SEC)

Commodities Futures Trading Commission (CFTC)

Consumer Financial Protection Bureau (CFPB)

Other

Supervises and regulates the Federal Reserve Banks, is responsible for the US’ payment system, administers many of the US laws regarding consumer credit protection, and supervises banking institutions and banking activities

Major Regulatory Bodies

Identifies risks to US financial stability, promotes market discipline, and responds to emerging threats to the stability of the US financial system

Independent office of the US Department of the Treasury that charters, regulates and supervises all national banks and supervises the federal branches and agencies of foreign banks

Independent federal agency created by Congress to maintain stability and public confidence in the nation’s financial system by insuring deposits at banks, examining and supervising insured institutions for safety, soundness and consumer protection issues, and managing receivership of failed or failing depository institutions

Federal agency created to administer the Securities Exchange Act (1933 & 1934), the Investment Company Act (1940), and the Investment Advisers Act (1940)

Regulates the commodity futures and options markets in the US and is responsible for the regulation of securities futures

An independent bureau that assumed regulatory and supervisory authority over most federal consumer protection laws

National Credit Union Administration, Federal Housing Finance Agency, Office of Financial Research, Federal Insurance Office (FIO)

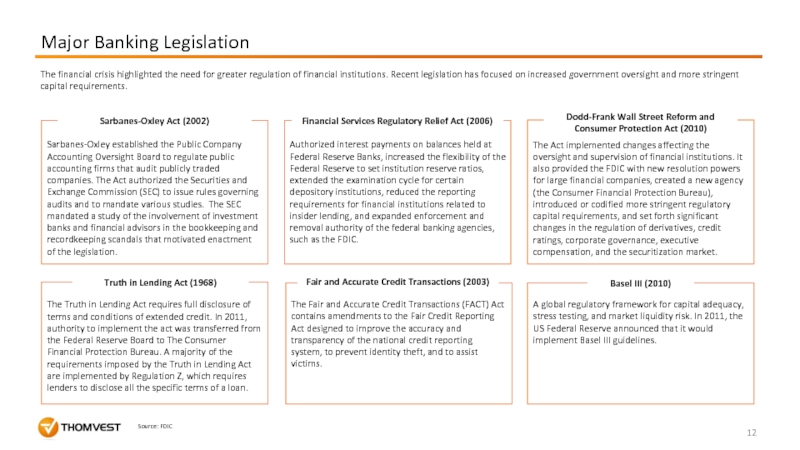

Слайд 12

Major Banking Legislation

Dodd-Frank Wall Street Reform and Consumer Protection Act (2010)

The

Sarbanes-Oxley Act (2002)

Sarbanes-Oxley established the Public Company Accounting Oversight Board to regulate public accounting firms that audit publicly traded companies. The Act authorized the Securities and Exchange Commission (SEC) to issue rules governing audits and to mandate various studies. The SEC mandated a study of the involvement of investment banks and financial advisors in the bookkeeping and recordkeeping scandals that motivated enactment of the legislation.

Financial Services Regulatory Relief Act (2006)

Authorized interest payments on balances held at Federal Reserve Banks, increased the flexibility of the Federal Reserve to set institution reserve ratios, extended the examination cycle for certain depository institutions, reduced the reporting requirements for financial institutions related to insider lending, and expanded enforcement and removal authority of the federal banking agencies, such as the FDIC.

Fair and Accurate Credit Transactions (2003)

The Fair and Accurate Credit Transactions (FACT) Act contains amendments to the Fair Credit Reporting Act designed to improve the accuracy and transparency of the national credit reporting system, to prevent identity theft, and to assist victims.

Truth in Lending Act (1968)

The Truth in Lending Act requires full disclosure of terms and conditions of extended credit. In 2011, authority to implement the act was transferred from the Federal Reserve Board to The Consumer Financial Protection Bureau. A majority of the requirements imposed by the Truth in Lending Act are implemented by Regulation Z, which requires lenders to disclose all the specific terms of a loan.

Basel III (2010)

A global regulatory framework for capital adequacy, stress testing, and market liquidity risk. In 2011, the US Federal Reserve announced that it would implement Basel III guidelines.

The financial crisis highlighted the need for greater regulation of financial institutions. Recent legislation has focused on increased government oversight and more stringent capital requirements.

Source: FDIC

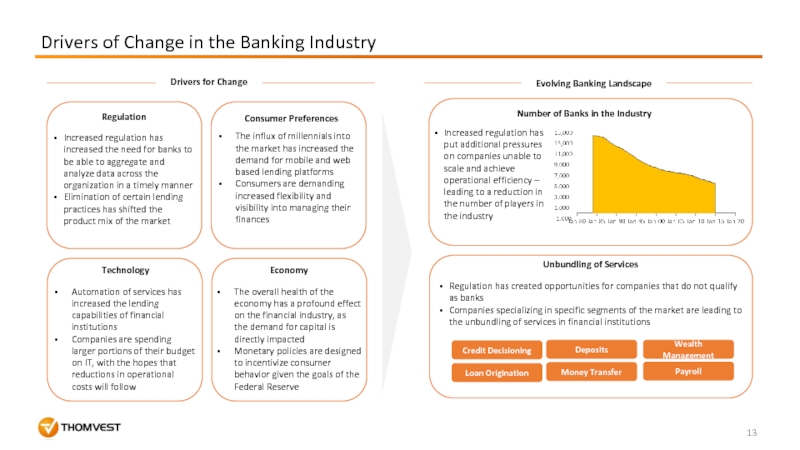

Слайд 13Drivers of Change in the Banking Industry

Regulation

Consumer Preferences

Technology

Economy

Automation of services has

Companies are spending larger portions of their budget on IT, with the hopes that reductions in operational costs will follow

The overall health of the economy has a profound effect on the financial industry, as the demand for capital is directly impacted

Monetary policies are designed to incentivize consumer behavior given the goals of the Federal Reserve

Increased regulation has increased the need for banks to be able to aggregate and analyze data across the organization in a timely manner

Elimination of certain lending practices has shifted the product mix of the market

The influx of millennials into the market has increased the demand for mobile and web based lending platforms

Consumers are demanding increased flexibility and visibility into managing their finances

Drivers for Change

Evolving Banking Landscape

Number of Banks in the Industry

Unbundling of Services

Increased regulation has put additional pressures on companies unable to scale and achieve operational efficiency – leading to a reduction in the number of players in the industry

Regulation has created opportunities for companies that do not qualify as banks

Companies specializing in specific segments of the market are leading to the unbundling of services in financial institutions

Deposits

Money Transfer

Wealth Management

Payroll

Credit Decisioning

Loan Origination

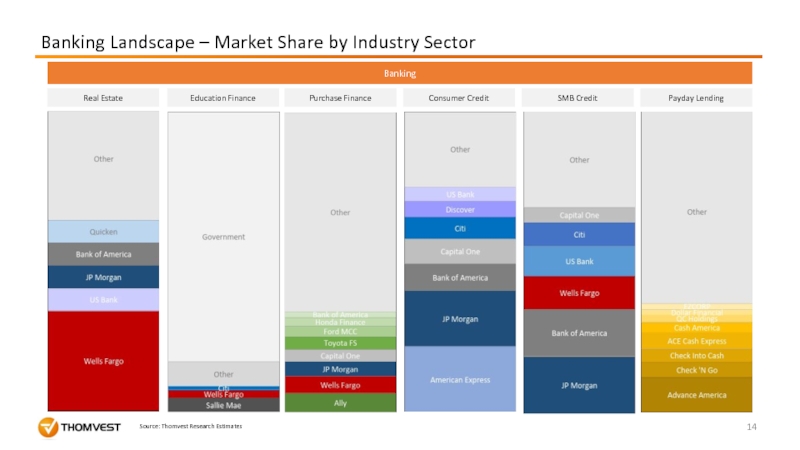

Слайд 14SMB Credit

Education Finance

Banking Landscape – Market Share by Industry Sector

Consumer Credit

Real

Purchase Finance

Payday Lending

Banking

Source: Thomvest Research Estimates

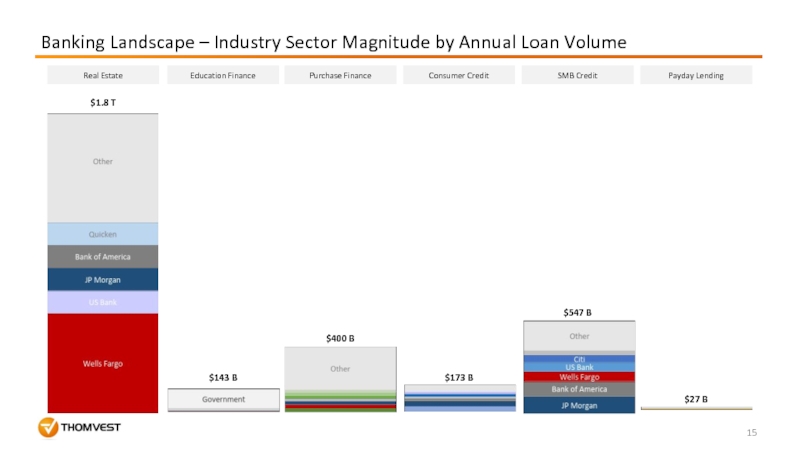

Слайд 15Banking Landscape – Industry Sector Magnitude by Annual Loan Volume

SMB Credit

Education

Consumer Credit

Real Estate

Purchase Finance

Payday Lending

$1.8 T

$143 B

$400 B

$173 B

$547 B

$27 B

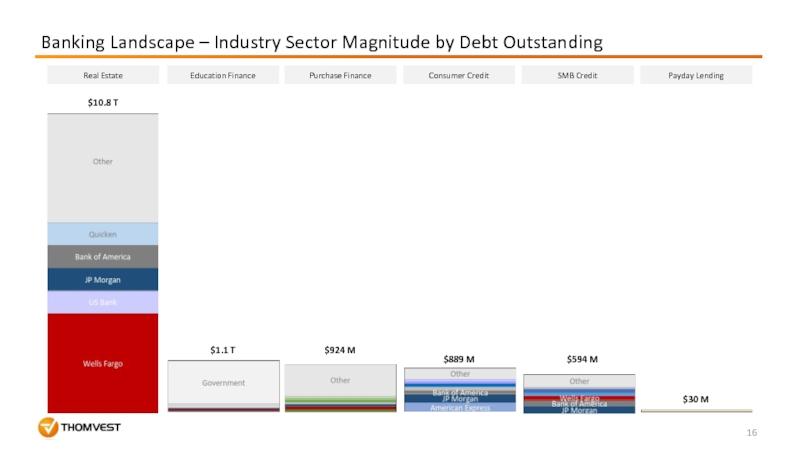

Слайд 16Banking Landscape – Industry Sector Magnitude by Debt Outstanding

SMB Credit

Education Finance

Consumer

Real Estate

Purchase Finance

Payday Lending

$10.8 T

$1.1 T

$924 M

$889 M

$594 M

$30 M

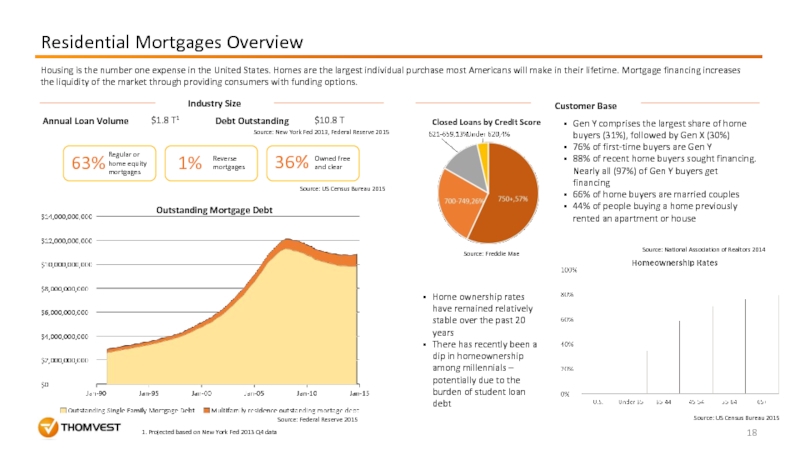

Слайд 18Residential Mortgages Overview

Annual Loan Volume

Outstanding Mortgage Debt

Debt Outstanding

$10.8 T

63%

Regular or home

Reverse mortgages

1%

36%

Owned free and clear

Customer Base

Closed Loans by Credit Score

Home ownership rates have remained relatively stable over the past 20 years

There has recently been a dip in homeownership among millennials – potentially due to the burden of student loan debt

Gen Y comprises the largest share of home buyers (31%), followed by Gen X (30%)

76% of first-time buyers are Gen Y

88% of recent home buyers sought financing. Nearly all (97%) of Gen Y buyers get financing

66% of home buyers are married couples

44% of people buying a home previously rented an apartment or house

Source: US Census Bureau 2015

Source: Freddie Mae

Source: National Association of Realtors 2014

Source: US Census Bureau 2015

Source: Federal Reserve 2015

$1.8 T1

1. Projected based on New York Fed 2013 Q4 data

Source: New York Fed 2013, Federal Reserve 2015

Industry Size

Housing is the number one expense in the United States. Homes are the largest individual purchase most Americans will make in their lifetime. Mortgage financing increases the liquidity of the market through providing consumers with funding options.

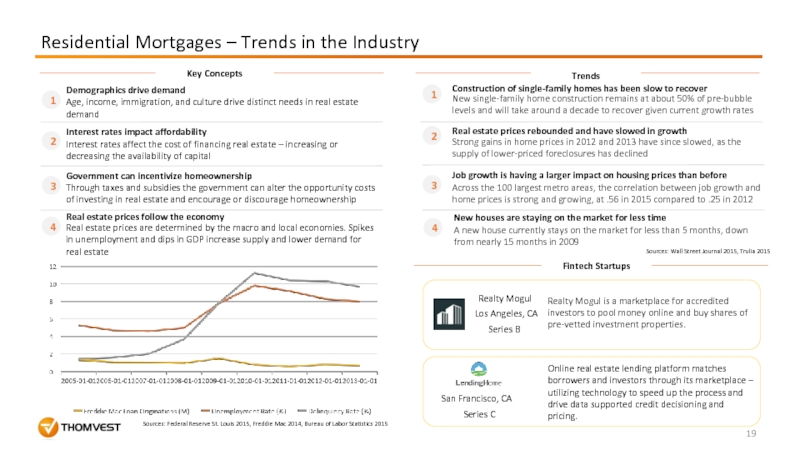

Слайд 19Residential Mortgages – Trends in the Industry

1

2

3

4

Fintech Startups

1

2

3

4

Demographics drive demand

Interest rates

Government can incentivize homeownership

Real estate prices follow the economy

Age, income, immigration, and culture drive distinct needs in real estate demand

Interest rates affect the cost of financing real estate – increasing or decreasing the availability of capital

Through taxes and subsidies the government can alter the opportunity costs of investing in real estate and encourage or discourage homeownership

Real estate prices are determined by the macro and local economies. Spikes in unemployment and dips in GDP increase supply and lower demand for real estate

Job growth is having a larger impact on housing prices than before

Real estate prices rebounded and have slowed in growth

Construction of single-family homes has been slow to recover

New houses are staying on the market for less time

Across the 100 largest metro areas, the correlation between job growth and home prices is strong and growing, at .56 in 2015 compared to .25 in 2012

New single-family home construction remains at about 50% of pre-bubble levels and will take around a decade to recover given current growth rates

Strong gains in home prices in 2012 and 2013 have since slowed, as the supply of lower-priced foreclosures has declined

A new house currently stays on the market for less than 5 months, down from nearly 15 months in 2009

San Francisco, CA

Series C

Online real estate lending platform matches borrowers and investors through its marketplace – utilizing technology to speed up the process and drive data supported credit decisioning and pricing.

Sources: Federal Reserve St. Louis 2015, Freddie Mac 2014, Bureau of Labor Statistics 2015

Sources: Wall Street Journal 2015, Trulia 2015

Trends

Key Concepts

Realty Mogul is a marketplace for accredited investors to pool money online and buy shares of pre-vetted investment properties.

Los Angeles, CA

Series B

Realty Mogul

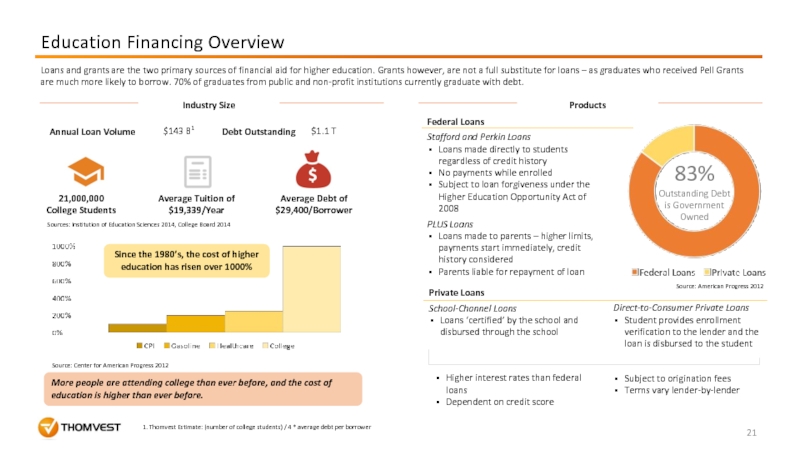

Слайд 21Education Financing Overview

83%

Outstanding Debt is Government Owned

More people are attending college

21,000,000

College Students

Average Tuition of $19,339/Year

Average Debt of $29,400/Borrower

Federal Loans

Stafford and Perkin Loans

Loans made directly to students regardless of credit history

No payments while enrolled

Subject to loan forgiveness under the Higher Education Opportunity Act of 2008

PLUS Loans

Loans made to parents – higher limits, payments start immediately, credit history considered

Parents liable for repayment of loan

Private Loans

School-Channel Loans

Loans ‘certified’ by the school and disbursed through the school

Direct-to-Consumer Private Loans

Student provides enrollment verification to the lender and the loan is disbursed to the student

Higher interest rates than federal loans

Dependent on credit score

Subject to origination fees

Terms vary lender-by-lender

Loans and grants are the two primary sources of financial aid for higher education. Grants however, are not a full substitute for loans – as graduates who received Pell Grants are much more likely to borrow. 70% of graduates from public and non-profit institutions currently graduate with debt.

Industry Size

Annual Loan Volume

Debt Outstanding

Sources: Institution of Education Sciences 2014, College Board 2014

Source: Center for American Progress 2012

Source: American Progress 2012

$1.1 T

$143 B1

1. Thomvest Estimate: (number of college students) / 4 * average debt per borrower

Industry Size

Products

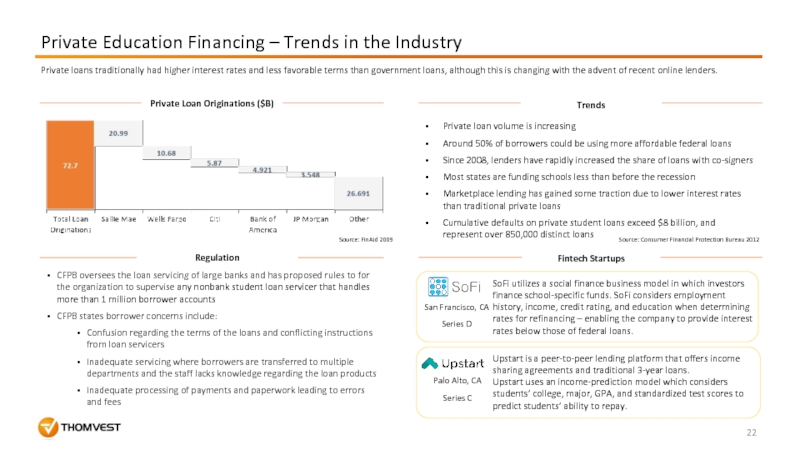

Слайд 22Private Education Financing – Trends in the Industry

Private Loan Originations ($B)

Trends

Fintech

Private loan volume is increasing

Around 50% of borrowers could be using more affordable federal loans

Since 2008, lenders have rapidly increased the share of loans with co-signers

Most states are funding schools less than before the recession

Marketplace lending has gained some traction due to lower interest rates than traditional private loans

Cumulative defaults on private student loans exceed $8 billion, and represent over 850,000 distinct loans

SoFi utilizes a social finance business model in which investors finance school-specific funds. SoFi considers employment history, income, credit rating, and education when determining rates for refinancing – enabling the company to provide interest rates below those of federal loans.

Upstart is a peer-to-peer lending platform that offers income sharing agreements and traditional 3-year loans.

Upstart uses an income-prediction model which considers students’ college, major, GPA, and standardized test scores to predict students’ ability to repay.

Regulation

CFPB oversees the loan servicing of large banks and has proposed rules to for the organization to supervise any nonbank student loan servicer that handles more than 1 million borrower accounts

CFPB states borrower concerns include:

Confusion regarding the terms of the loans and conflicting instructions from loan servicers

Inadequate servicing where borrowers are transferred to multiple departments and the staff lacks knowledge regarding the loan products

Inadequate processing of payments and paperwork leading to errors and fees

San Francisco, CA

Series D

Palo Alto, CA

Series C

Private loans traditionally had higher interest rates and less favorable terms than government loans, although this is changing with the advent of recent online lenders.

Source: Consumer Financial Protection Bureau 2012

Source: FinAid 2009

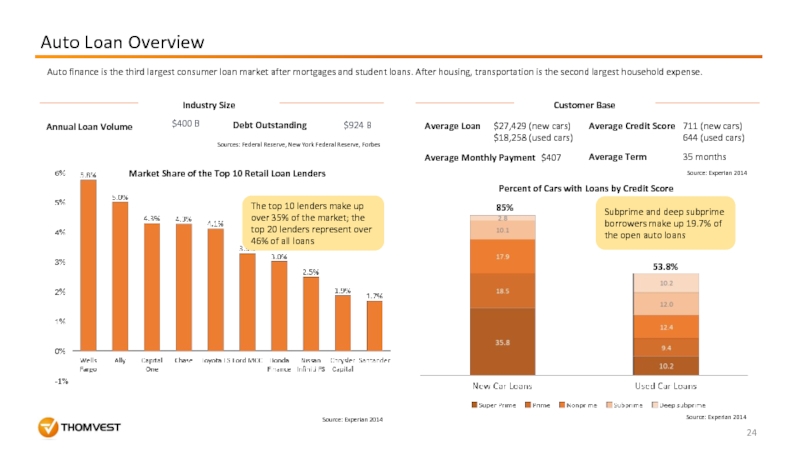

Слайд 24Auto Loan Overview

Industry Size

Customer Base

$924 B

The top 10 lenders make up

Market Share of the Top 10 Retail Loan Lenders

$400 B

Source: Experian 2014

Sources: Federal Reserve, New York Federal Reserve, Forbes

Annual Loan Volume

Debt Outstanding

Average Monthly Payment

85%

53.8%

Percent of Cars with Loans by Credit Score

Subprime and deep subprime borrowers make up 19.7% of the open auto loans

Average Credit Score

711 (new cars)

644 (used cars)

$407

Average Loan

$27,429 (new cars)

$18,258 (used cars)

Average Term

35 months

Source: Experian 2014

Source: Experian 2014

Auto finance is the third largest consumer loan market after mortgages and student loans. After housing, transportation is the second largest household expense.

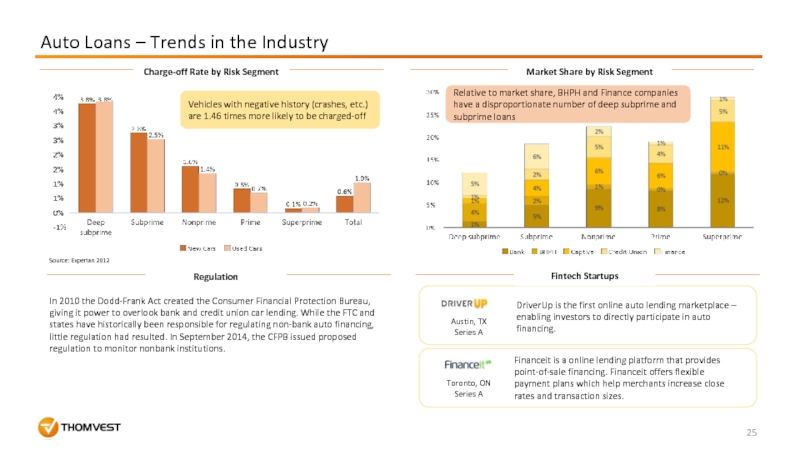

Слайд 25Auto Loans – Trends in the Industry

Charge-off Rate by Risk Segment

Vehicles

Source: Experian 2012

Relative to market share, BHPH and Finance companies have a disproportionate number of deep subprime and subprime loans

Market Share by Risk Segment

Regulation

Toronto, ON

Series A

Austin, TX

Series A

DriverUp is the first online auto lending marketplace – enabling investors to directly participate in auto financing.

Financeit is a online lending platform that provides point-of-sale financing. Financeit offers flexible payment plans which help merchants increase close rates and transaction sizes.

Fintech Startups

In 2010 the Dodd-Frank Act created the Consumer Financial Protection Bureau, giving it power to overlook bank and credit union car lending. While the FTC and states have historically been responsible for regulating non-bank auto financing, little regulation had resulted. In September 2014, the CFPB issued proposed regulation to monitor nonbank institutions.

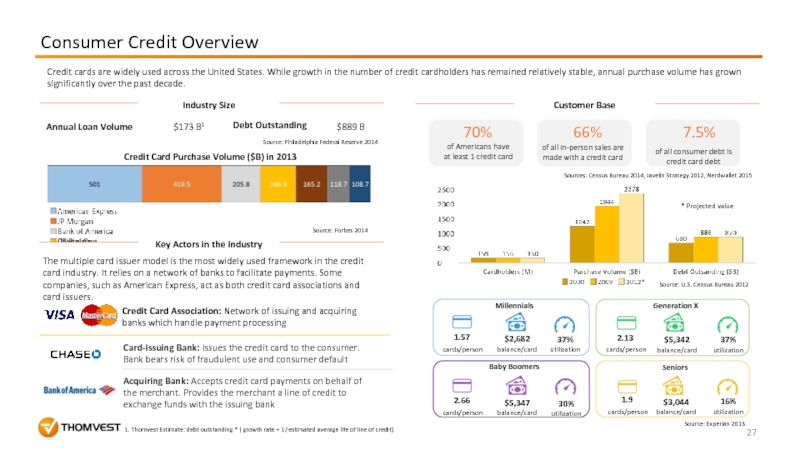

Слайд 27

Consumer Credit Overview

Industry Size

Credit cards are widely used across the United

Card-Issuing Bank: Issues the credit card to the consumer. Bank bears risk of fraudulent use and consumer default

Acquiring Bank: Accepts credit card payments on behalf of the merchant. Provides the merchant a line of credit to exchange funds with the issuing bank

Credit Card Association: Network of issuing and acquiring banks which handle payment processing

Credit Card Purchase Volume ($B) in 2013

$889 B

of Americans have at least 1 credit card

70%

Millennials

Generation X

Baby Boomers

Seniors

1.57

cards/person

$2,682 balance/card

37%

utilization

66%

of all in-person sales are made with a credit card

7.5%

of all consumer debt is credit card debt

2.66

cards/person

$5,347 balance/card

30%

utilization

1.9

cards/person

$3,044 balance/card

16%

utilization

2.13

cards/person

$5,342

balance/card

37%

utilization

Source: Experian 2013

Source: Forbes 2014

Source: U.S. Census Bureau 2012

Sources: Census Bureau 2014, Javelin Strategy 2012, Nerdwallet 2015

1. Thomvest Estimate: debt outstanding * ( growth rate + 1/ estimated average life of line of credit)

$173 B1

* Projected value

Annual Loan Volume

Debt Outstanding

Source: Philadelphia Federal Reserve 2014

Key Actors in the Industry

The multiple card issuer model is the most widely used framework in the credit card industry. It relies on a network of banks to facilitate payments. Some companies, such as American Express, act as both credit card associations and card issuers.

Customer Base

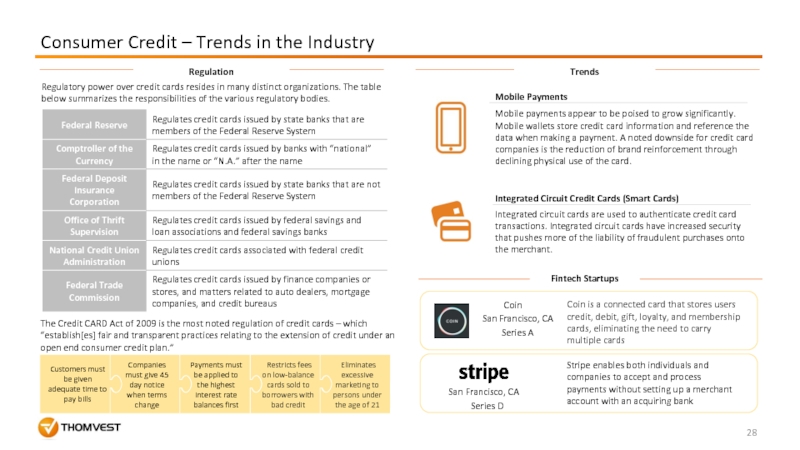

Слайд 28Consumer Credit – Trends in the Industry

Regulatory power over credit cards

The Credit CARD Act of 2009 is the most noted regulation of credit cards – which “establish[es] fair and transparent practices relating to the extension of credit under an open end consumer credit plan.”

Customers must be given adequate time to pay bills

Companies must give 45 day notice when terms change

Payments must be applied to the highest interest rate balances first

Restricts fees on low-balance cards sold to borrowers with bad credit

Eliminates excessive marketing to persons under the age of 21

Mobile Payments

Integrated Circuit Credit Cards (Smart Cards)

Mobile payments appear to be poised to grow significantly. Mobile wallets store credit card information and reference the data when making a payment. A noted downside for credit card companies is the reduction of brand reinforcement through declining physical use of the card.

Integrated circuit cards are used to authenticate credit card transactions. Integrated circuit cards have increased security that pushes more of the liability of fraudulent purchases onto the merchant.

Fintech Startups

Coin

San Francisco, CA

Series A

Coin is a connected card that stores users credit, debit, gift, loyalty, and membership cards, eliminating the need to carry multiple cards

San Francisco, CA

Series D

Stripe enables both individuals and companies to accept and process payments without setting up a merchant account with an acquiring bank

Regulation

Trends

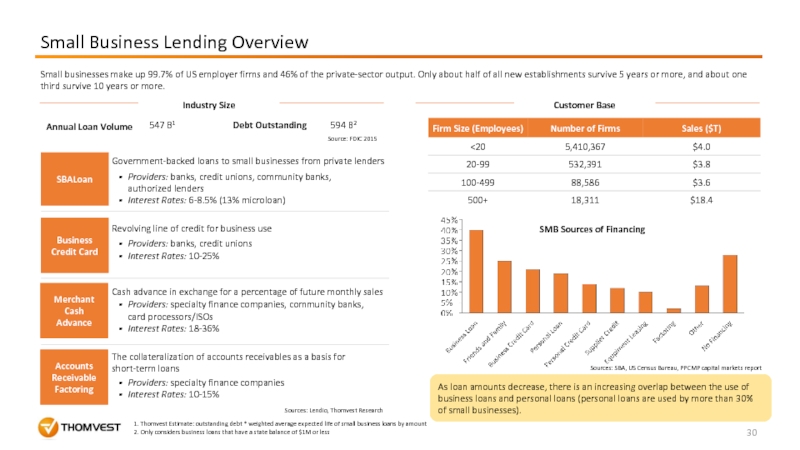

Слайд 30Small Business Lending Overview

Industry Size

Customer Base

Annual Loan Volume

Debt Outstanding

SBALoan

Business Credit Card

Merchant

Government-backed loans to small businesses from private lenders

Revolving line of credit for business use

Cash advance in exchange for a percentage of future monthly sales

Providers: banks, credit unions, community banks, authorized lenders

Interest Rates: 6-8.5% (13% microloan)

Providers: banks, credit unions

Interest Rates: 10-25%

Providers: specialty finance companies, community banks, card processors/ISOs

Interest Rates: 18-36%

Sources: Lendio, Thomvest Research

Accounts Receivable Factoring

The collateralization of accounts receivables as a basis for short-term loans

Providers: specialty finance companies

Interest Rates: 10-15%

1. Thomvest Estimate: outstanding debt * weighted average expected life of small business loans by amount

2. Only considers business loans that have a state balance of $1M or less

594 B2

Source: FDIC 2015

547 B1

As loan amounts decrease, there is an increasing overlap between the use of business loans and personal loans (personal loans are used by more than 30% of small businesses).

SMB Sources of Financing

Sources: SBA, US Census Bureau, PPCMP capital markets report

Small businesses make up 99.7% of US employer firms and 46% of the private-sector output. Only about half of all new establishments survive 5 years or more, and about one third survive 10 years or more.

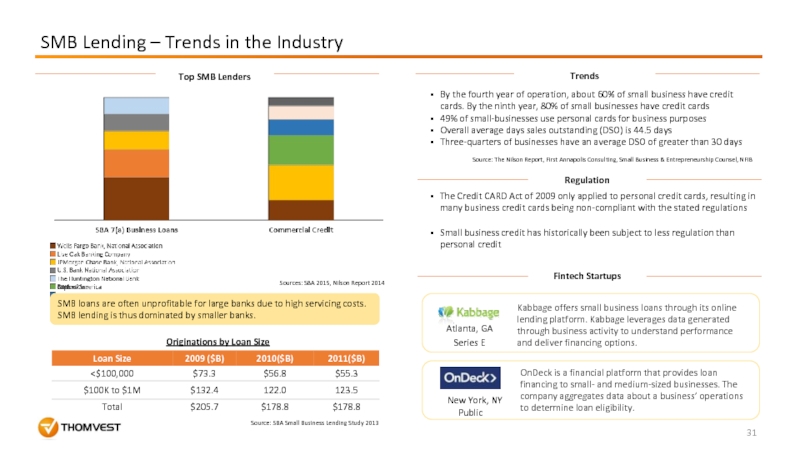

Слайд 31SMB Lending – Trends in the Industry

Regulation

SMB loans are often unprofitable

Originations by Loan Size

Fintech Startups

The Credit CARD Act of 2009 only applied to personal credit cards, resulting in many business credit cards being non-compliant with the stated regulations

Small business credit has historically been subject to less regulation than personal credit

Atlanta, GA

Series E

Kabbage offers small business loans through its online lending platform. Kabbage leverages data generated through business activity to understand performance and deliver financing options.

OnDeck is a financial platform that provides loan financing to small- and medium-sized businesses. The company aggregates data about a business’ operations to determine loan eligibility.

New York, NY

Public

Source: SBA Small Business Lending Study 2013

Sources: SBA 2015, Nilson Report 2014

By the fourth year of operation, about 60% of small business have credit cards. By the ninth year, 80% of small businesses have credit cards

49% of small-businesses use personal cards for business purposes

Overall average days sales outstanding (DSO) is 44.5 days

Three-quarters of businesses have an average DSO of greater than 30 days

Source: The Nilson Report, First Annapolis Consulting, Small Business & Entrepreneurship Counsel, NFIB

Top SMB Lenders

Trends

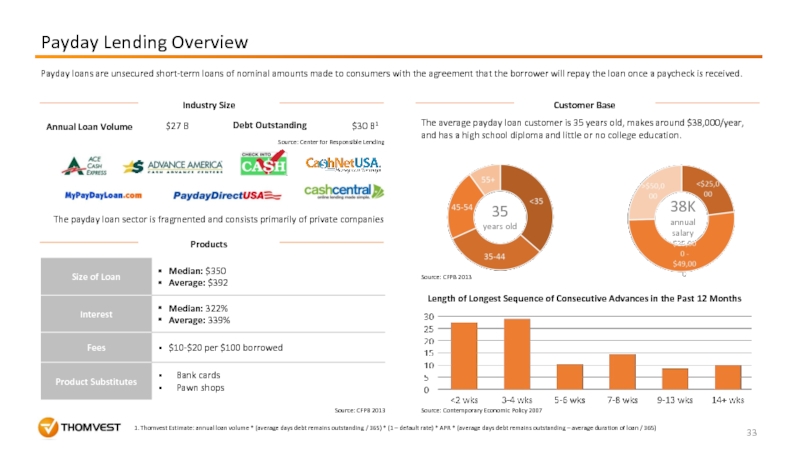

Слайд 33Industry Size

Customer Base

The average payday loan customer is 35 years old,

38K

annual salary

35 years old

Length of Longest Sequence of Consecutive Advances in the Past 12 Months

Source: CFPB 2013

Source: Contemporary Economic Policy 2007

Payday Lending Overview

1. Thomvest Estimate: annual loan volume * (average days debt remains outstanding / 365) * (1 – default rate) * APR * (average days debt remains outstanding – average duration of loan / 365)

Annual Loan Volume

$27 B

The payday loan sector is fragmented and consists primarily of private companies

Debt Outstanding

Source: CFPB 2013

$30 B1

Source: Center for Responsible Lending

Products

Payday loans are unsecured short-term loans of nominal amounts made to consumers with the agreement that the borrower will repay the loan once a paycheck is received.

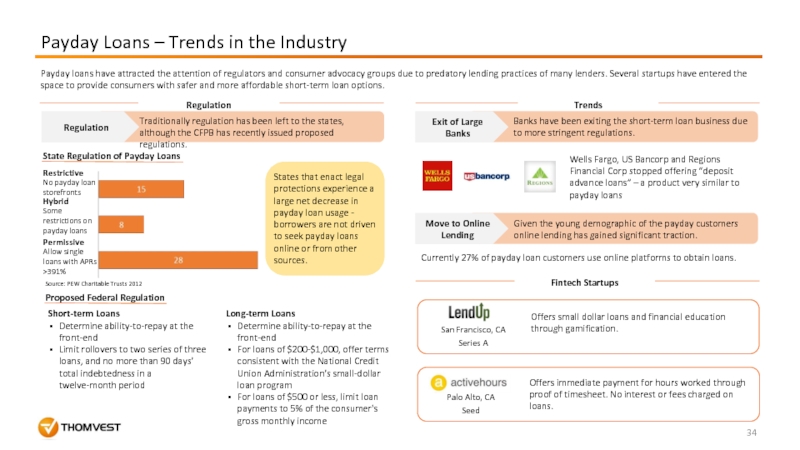

Слайд 34Trends

Payday Loans – Trends in the Industry

Payday loans have attracted the

Regulation

Regulation

Traditionally regulation has been left to the states, although the CFPB has recently issued proposed regulations.

No payday loan storefronts

Restrictive

Hybrid

Some restrictions on payday loans

Permissive

Allow single loans with APRs >391%

State Regulation of Payday Loans

States that enact legal protections experience a large net decrease in payday loan usage - borrowers are not driven to seek payday loans online or from other sources.

Proposed Federal Regulation

Exit of Large Banks

Short-term Loans

Determine ability-to-repay at the front-end

Limit rollovers to two series of three loans, and no more than 90 days' total indebtedness in a twelve-month period

Long-term Loans

Determine ability-to-repay at the front-end

For loans of $200-$1,000, offer terms consistent with the National Credit Union Administration's small-dollar loan program

For loans of $500 or less, limit loan payments to 5% of the consumer's gross monthly income

Banks have been exiting the short-term loan business due to more stringent regulations.

Wells Fargo, US Bancorp and Regions Financial Corp stopped offering “deposit advance loans” – a product very similar to payday loans

Source: PEW Charitable Trusts 2012

Offers immediate payment for hours worked through proof of timesheet. No interest or fees charged on loans.

Palo Alto, CA

Seed

Move to Online Lending

Given the young demographic of the payday customers online lending has gained significant traction.

Fintech Startups

San Francisco, CA

Series A

Offers small dollar loans and financial education through gamification.

Currently 27% of payday loan customers use online platforms to obtain loans.

Слайд 36Venture Capital Activity

In 2014 venture capital funding reached its highest level

Source: CB Insights – Q4 2014 – Q1 2015

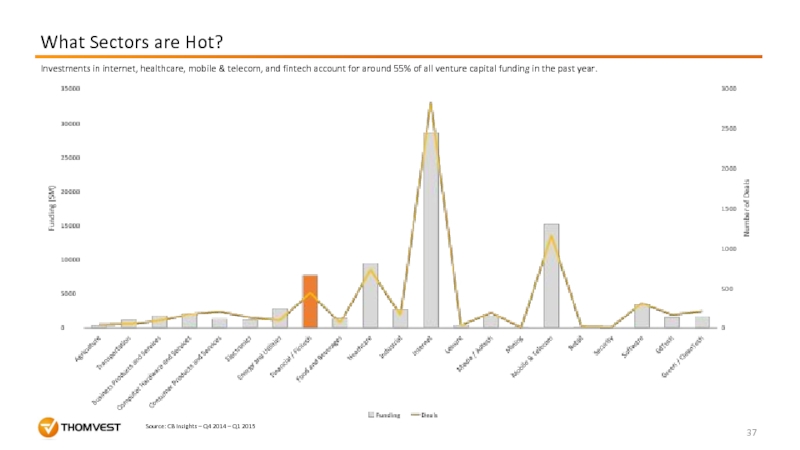

Слайд 37What Sectors are Hot?

Source: CB Insights – Q4 2014 – Q1

Investments in internet, healthcare, mobile & telecom, and fintech account for around 55% of all venture capital funding in the past year.

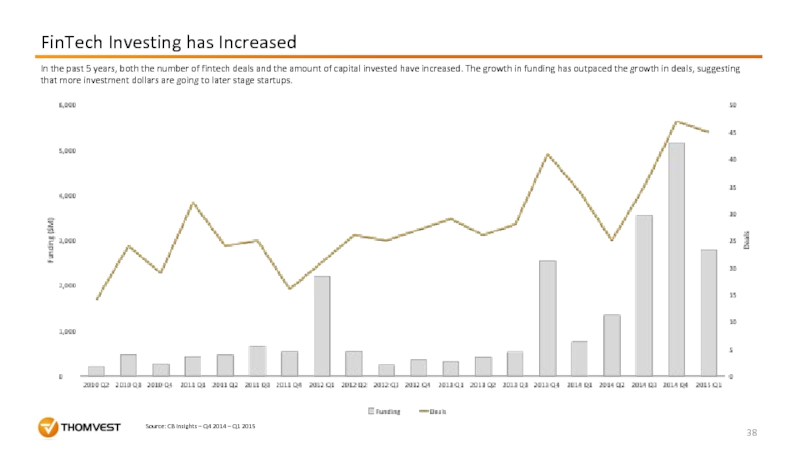

Слайд 38FinTech Investing has Increased

Source: CB Insights – Q4 2014 – Q1

In the past 5 years, both the number of fintech deals and the amount of capital invested have increased. The growth in funding has outpaced the growth in deals, suggesting that more investment dollars are going to later stage startups.

Слайд 42

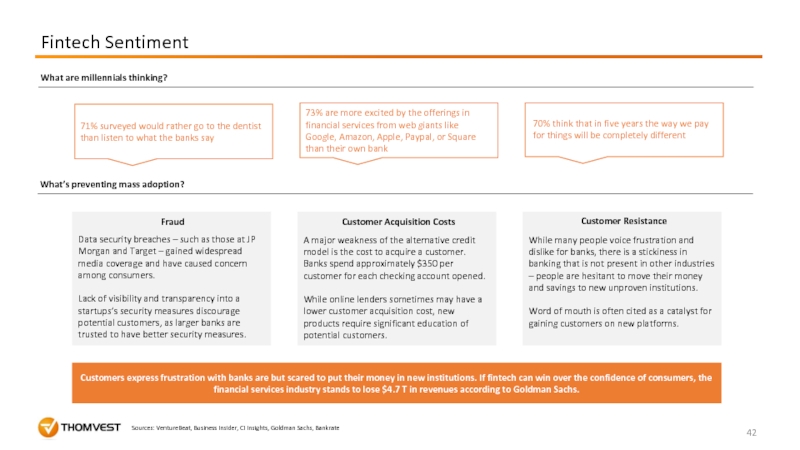

Fintech Sentiment

70% think that in five years the way we pay

71% surveyed would rather go to the dentist than listen to what the banks say

73% are more excited by the offerings in financial services from web giants like Google, Amazon, Apple, Paypal, or Square than their own bank

What are millennials thinking?

What’s preventing mass adoption?

Customers express frustration with banks are but scared to put their money in new institutions. If fintech can win over the confidence of consumers, the financial services industry stands to lose $4.7 T in revenues according to Goldman Sachs.

Sources: VentureBeat, Business Insider, CI Insights, Goldman Sachs, Bankrate

Fraud

Customer Acquisition Costs

Customer Resistance

Data security breaches – such as those at JP Morgan and Target – gained widespread media coverage and have caused concern among consumers.

Lack of visibility and transparency into a startups’s security measures discourage potential customers, as larger banks are trusted to have better security measures.

A major weakness of the alternative credit model is the cost to acquire a customer. Banks spend approximately $350 per customer for each checking account opened.

While online lenders sometimes may have a lower customer acquisition cost, new products require significant education of potential customers.

While many people voice frustration and dislike for banks, there is a stickiness in banking that is not present in other industries – people are hesitant to move their money and savings to new unproven institutions.

Word of mouth is often cited as a catalyst for gaining customers on new platforms.

Слайд 43Sources (1/3)

"The Top 50 U.S. Banks by Assets." The Wall Street

"Statistics at a Glance." Education at a Glance Education at a Glance 2014 (2014): 545-56. FDIC, 31 Mar. 2015.

“Payday Lending Regulation.” Federal Reserve Board. 15 Aug 2013.

“CFPB’s Preliminary Proposal to Address Payday and Similar Debt-Trap Loans.” Center for Responsible Lending. 30 Mar 2015.

“Payday Lending in America: Who Borrows, Where They Borrow, and Why.” PEW Chartable Trusts. Jul 2012.

“The Average Payday Loan Borrower Spends More than Half the Year in Debt to the Lender.” Consumerist. 26 Apr 2013.

“A Comparative Analysis of Payday Loan Customers.” Contemporary Economic Policy. Vol 26, No. 2. Apr 2008.

“Small Business Lending in the United States 2013.” Office of Advocacy – US Small Business Administration. Dec 2014.

“Fast Facts – Payday Loans.” Center for Responsible Lending. 2014.

“CFPB Sets Sights on Payday Loans.” The Wall Street Journal. 4 Jan 2014.

“The Predators’ Creditors: How the Biggest Banks are Bankrolling the Payday Loan Industry.” National People’s Action. 2011.

"Installment Loans." Comptroller of the Currency Administrator of National Banks. 2011.

"Too Risky? Feds Press Banks for More Auto Loan Data." CNBC. 13 Oct. 2014.

"Subprime Trouble? Car Buyers Struggle with Loans." CNBC. 20 Aug. 2014.

“State of the Automotive Finance Market Second Quarter 2014.” Experian. 4 Sept 2014.

“Understanding automotive loan charge-off patterns can help mitigate lender risk.” Experian. 2012.

“Expanding Consumer Protection in Auto Finance.” Center for American Progress. 12 Jan 2015.

“U.S. Agency Says It Will Regulate Nonbank Car-Loan Providers.” The Wall Street Journal. 17 Sept 2015.

“Ally Financial Beats Wells Fargo, Originates the Most Retail Auto Loans in Q3.” Forbes. 09 Dec 2014.

Слайд 44Sources (2/3)

“Overview of Recent Developments in the Credit Card Industry.” FDIC

What is your state of credit? Experian. 2013.

American Household Credit Card Debt Statistics: 2015. Nerdwallet. Jun 2015.

Credit Card debt statistics. Nasdaq. 23 Sept 2014.

“Global Payments at a Glance.” McKinsey & Co. Sept 2014.

“Secret History of the Credit Card.” Frontline. Nov 2014.

“Directory of US Merchant Acquirers.” The Strawhecker Group. 2012.

“A Look at the Country’s Largest Card Lenders: Credit Card Payment Volumes.” Forbes. Nov 2014.

“Cash Dying As Credit Card Payments Predicted to Grow in Volume: Report.” The Huffington Post: Money. Jun 2012.

“Who Regulates Your Wallet?” WalletBlog. Oct 2009.

100 Most Active SBA 7(a) Lenders. US Small Business Administration. 2015.

“Small Business Lending in the United States 2013.” Office of Advocacy: US Small Business Administration. Dec 2014.

The State of US Small Business. Business Insider. Sept 2013.

“Statistics of US Businesses Employment and Payroll Summary: 2012.” US Census. Feb 2015.

“Top 10 Big Banks Lending to Small Business.” Forbes. 2015.

“Top Issuers of Commercial Card in the US.” Nilson Report. 2014.

“State of Small Business Lending: Credit Access During the Recover and How Technology May Change the Game.” Harvard Business School. Jul 2014.

Fast Facts: Back to school statistics. National Center for Education Statistics. 2015.

“The Student Debt Crisis.” Center for American Progress. 25 Oct 2012.

Слайд 45Sources (3/3)

“Trends in Student Aid 2014.” College Board. 2014

“Quick Facts about

“Private Student Loan Report 2013.” MeasureOne. 19 Dec 2013.

“Largest Education Lenders.” FinAid. 2015.

“Most States Funding Schools Less Than Before the Recession.” Center on Budget and Policy Priorities. 20 May 2014.

“Higher Education: State Funding Trends and Policies on Affordability.” United States Government Accountability Office. Dec 2014.

“Private Student Loans.” Consumer Financial Protection Bureau. 29 Aug 2012.

“How Interest Rates Affect Property Values.” Investopedia.

US Housing Market Tracker. Wall Street Journal. 16 Jun 2014.

Annual Rent Prices Vs. Average Home Prices (USA). Areavibes.

“Home Buyer and Seller Generational Trends.” National Association of Realtors. Mar 2014.

“Student Loans and Homeownership Trends.” Board of Governors of the Federal Reserve System. 15 Oct 2014.

“Emerging Trends in Real Estate 2014.” PwC and Urban Land Institute. 2014

30-Year Fixed-Rate Mortgages Since 1971. Freddie Mac. 2015.

Housing Vacancies and Homeownership: Historical Tables. United States Census Bureau.