- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

An Introduction to Cost Terms and Purposes презентация

Содержание

- 1. An Introduction to Cost Terms and Purposes

- 2. Basic Cost Terminology Cost – sacrificed resource

- 3. Basic Cost Terminology Cost Accumulation – a

- 4. Direct and Indirect Costs Direct Costs –

- 5. Cost Examples Direct Costs Parts Assembly line wages Indirect Costs Electricity Rent Property taxes

- 6. Factors Affecting Direct/Indirect Cost Classification Cost Materiality Availability of Information-gathering Technology Operational Design

- 7. Cost Behavior Variable Costs – changes in

- 8. Cost Behavior, continued Variable costs – are

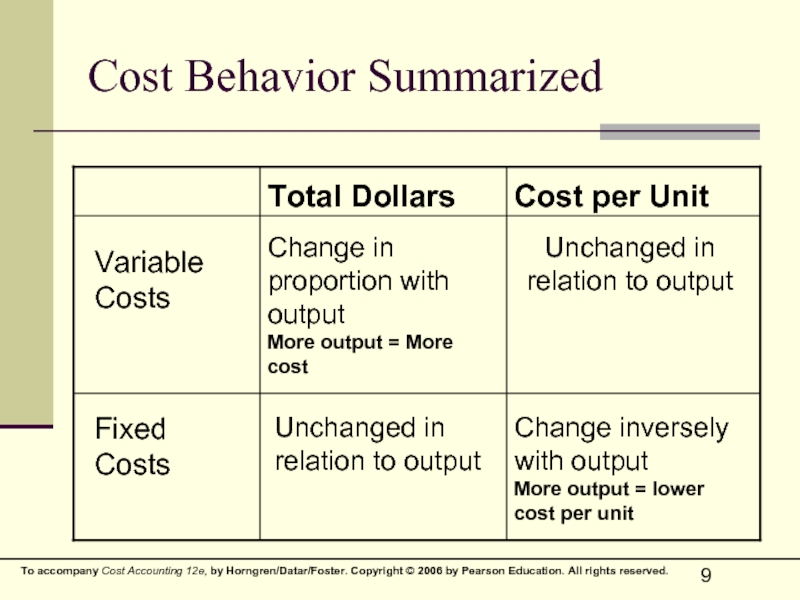

- 9. Cost Behavior Summarized Total Dollars Cost per

- 10. Other Cost Concepts Cost Driver – a

- 11. A Cost Caveat Unit costs should be

- 12. Different Types of Firms Manufacturing-sector companies –

- 13. Types of Inventories Direct Materials – resources

- 14. Types of Product Costs Direct Materials Direct

- 15. Distinctions Between Costs Inventoriable Costs – product

- 16. Cost Flows The Cost of Goods Manufactured

- 17. Cost of Goods Manufactured Calculates the

- 18. Income Statement Figure carries forward from the

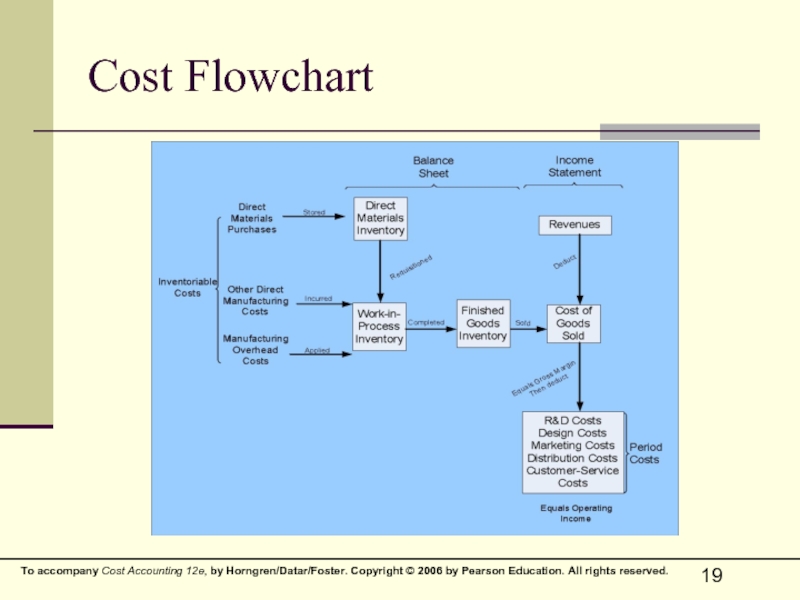

- 19. Cost Flowchart

- 20. Other Cost Considerations Prime cost is a

- 21. Different Definitions of Cost for Different Applications

- 22. Three Common Features of Cost Accounting and

Слайд 2Basic Cost Terminology

Cost – sacrificed resource to achieve a specific objective

Actual

Budgeted Cost – a predicted cost

Cost Object – anything of interest for which a cost is desired

Слайд 3Basic Cost Terminology

Cost Accumulation – a collection of cost data in

Cost Assignment – a general term that includes gathering accumulated costs to a cost object. This includes:

Tracing accumulated costs with a direct relationship to the cost object and

Allocating accumulated costs with an indirect relationship to a cost object

Слайд 4Direct and Indirect Costs

Direct Costs – can be conveniently and economically

Indirect Costs – cannot be conveniently or economically traced (tracked) to a cost object. Instead of being traced, these costs are allocated to a cost object in a rational and systematic manner

Слайд 6Factors Affecting Direct/Indirect Cost Classification

Cost Materiality

Availability of Information-gathering Technology

Operational Design

Слайд 7Cost Behavior

Variable Costs – changes in total in proportion to changes

Fixed Costs – remain unchanged in total regardless of changes in the related level of activity or volume

Costs are fixed or variable only with respect to a specific activity or a given time period

Слайд 8Cost Behavior, continued

Variable costs – are constant on a per-unit basis.

Fixed costs – change inversely with the level of production. As more units are produced, the same fixed cost is spread over more and more units, reducing the cost per unit

Слайд 9Cost Behavior Summarized

Total Dollars

Cost per Unit

Variable

Costs

Change in proportion with output

More

Unchanged in relation to output

Fixed

Costs

Unchanged in relation to output

Change inversely with output

More output = lower cost per unit

Слайд 10Other Cost Concepts

Cost Driver – a variable that causally affects costs

Relevant Range – the band of normal activity level (or volume) in which there is a specific relationship between the level of activity (or volume) and a given cost

For example, fixed costs are fixed only within the relevant range.

Слайд 11A Cost Caveat

Unit costs should be used cautiously. Since unit costs

Слайд 12Different Types of Firms

Manufacturing-sector companies – create and sell their own

Merchandising-sector companies – product resellers

Service-sector companies

Слайд 13Types of Inventories

Direct Materials – resources instock and available for use

Work-in-Process

Finished Goods – products completed and ready for sale

Слайд 14Types of Product Costs

Direct Materials

Direct Labor

Indirect Manufacturing – factory costs that

Слайд 15Distinctions Between Costs

Inventoriable Costs – product manufacturing costs. These costs are

Period Costs – have no future value and are expensed as incurred

Слайд 16Cost Flows

The Cost of Goods Manufactured and the Cost of Goods

Note the importance of inventory accounts in the following accounting reports, and in the cost flow chart

Слайд 17Cost of Goods Manufactured

Calculates the cost of Direct Materials Used

Accumulates the

Adjusts the current period manufacturing costs to account for units actually completed

Слайд 18Income Statement

Figure carries forward from the Schedule of Cost of Goods

Period Costs are expensed as incurred

Слайд 20Other Cost Considerations

Prime cost is a term referring to all direct

Conversion cost is a term referring to direct labor and factory overhead costs, collectively

Overtime labor costs are considered part of overhead

Слайд 21Different Definitions of Cost for Different Applications

Pricing and product-mix decisions –

Contracting with government agencies – very specific definitions of cost for “cost plus profit” contracts

Preparing external-use financial statements – GAAP-driven product costs only

Слайд 22Three Common Features of Cost Accounting and Cost Management

Calculating the cost

Obtaining information for planning and control, and performance evaluation

Analyzing the relevant information for making decisions