- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Lululemon NASDAQ: LULU Jason A. Moser презентация

Содержание

- 1. Lululemon NASDAQ: LULU Jason A. Moser

- 2. Retail’s brutal holiday season resulted in weak

- 3. What does Lululemon do? It sells clothes.

- 4. How do they do it? 254 company-owned

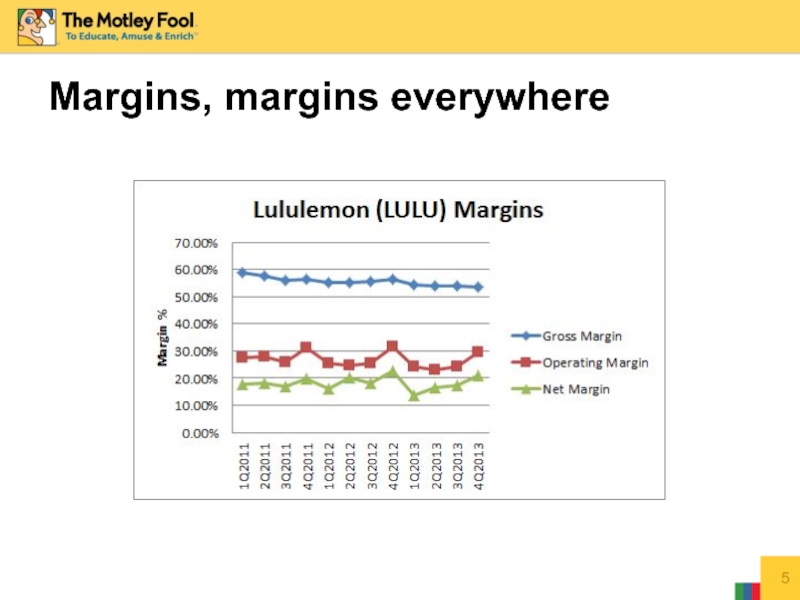

- 5. Margins, margins everywhere

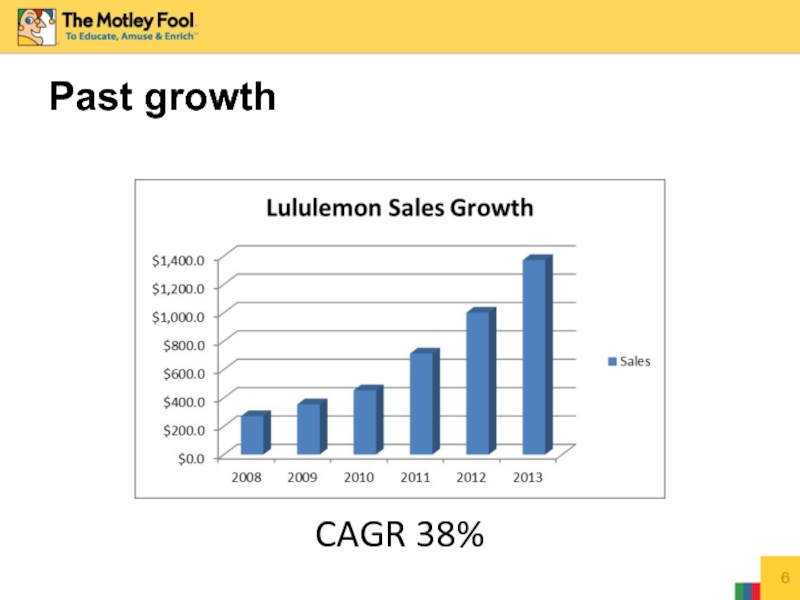

- 6. Past growth CAGR 38%

- 7. What’s the market opportunity? Long-term target 350-375

- 8. Lululemon

- 9. Direct-to-consumer Direct to consumer introduced in 2009.

- 10. Who do they compete with? Anyone

- 11. Management Laurent Potdevin CEO/Director 2/2014 Former Pres.

- 12. Management Tara Poseley CPO 10/2013 Former President

- 13. Understanding future worth It’s worth looking at

- 14. Lululemon is a cash flow rich business

- 15. Understanding future worth Lululemon typically carries one

- 16. What are management’s long-term margin goals? Gross

- 17. Retail is known for its lack of

- 18. Founder Chip Wilson is no stranger to

- 19. Management’s annual cash incentive bonuses are tied

- 20. Lululemon was fast out of the gate

Слайд 2Retail’s brutal holiday season resulted in weak top line growth &

The move to ecommerce continues to quickly shape the changing retail space.

Lululemon isn’t immune, however new leadership, expanded product lines and direct-to-consumer offer a powerful brand on sale today.

The idea

Слайд 3What does Lululemon do?

It sells clothes. Plain and simple.

OK seriously, known

Слайд 4How do they do it?

254 company-owned stores (2/14/2014)

North America, Australia

Wholesale via studios, health centers, etc.

Direct-to-consumer = e-commerce sales

Слайд 7What’s the market opportunity?

Long-term target 350-375 stores in North America;

Next three

Europe and Asia both show evidence of demand which will boost the overall opportunity;

Store count and breakdown today:

Слайд 8

Lululemon also owns 12 ivivva athletica stores which specialize in dance-inspired

What’s ivivva?

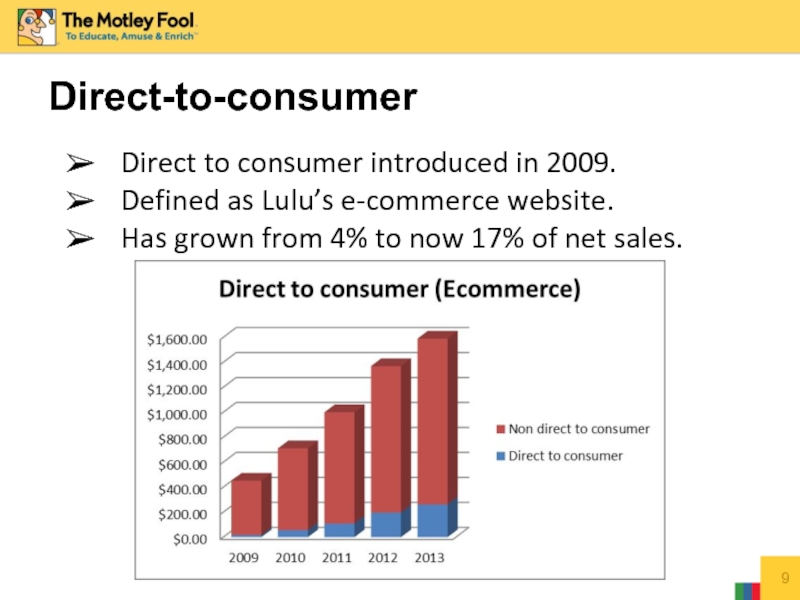

Слайд 9Direct-to-consumer

Direct to consumer introduced in 2009.

Defined as Lulu’s e-commerce website.

Has

Слайд 10Who do they compete with?

Anyone and everyone

in the retail clothing

fashion, sports or otherwise.

Слайд 11Management

Laurent Potdevin

CEO/Director 2/2014

Former Pres. TOMS Shoes

John Currie

CFO since 1/2007

Слайд 12Management

Tara Poseley

CPO 10/2013

Former President Kmart Apparel as well as 15 year

Delaney Schweitzer

EVP Retail Ops NA 3/2010

With Lululemon since 2002

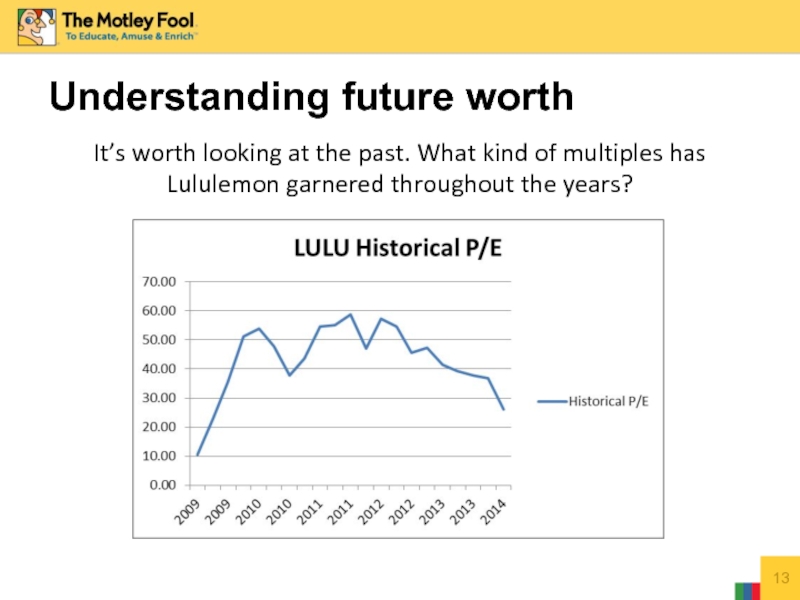

Слайд 13Understanding future worth

It’s worth looking at the past. What kind of

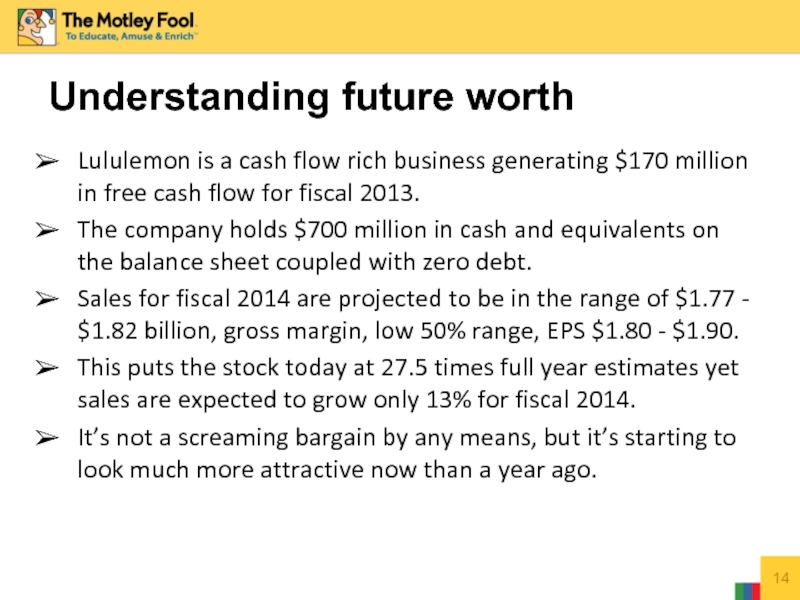

Слайд 14Lululemon is a cash flow rich business generating $170 million in

The company holds $700 million in cash and equivalents on the balance sheet coupled with zero debt.

Sales for fiscal 2014 are projected to be in the range of $1.77 - $1.82 billion, gross margin, low 50% range, EPS $1.80 - $1.90.

This puts the stock today at 27.5 times full year estimates yet sales are expected to grow only 13% for fiscal 2014.

It’s not a screaming bargain by any means, but it’s starting to look much more attractive now than a year ago.

Understanding future worth

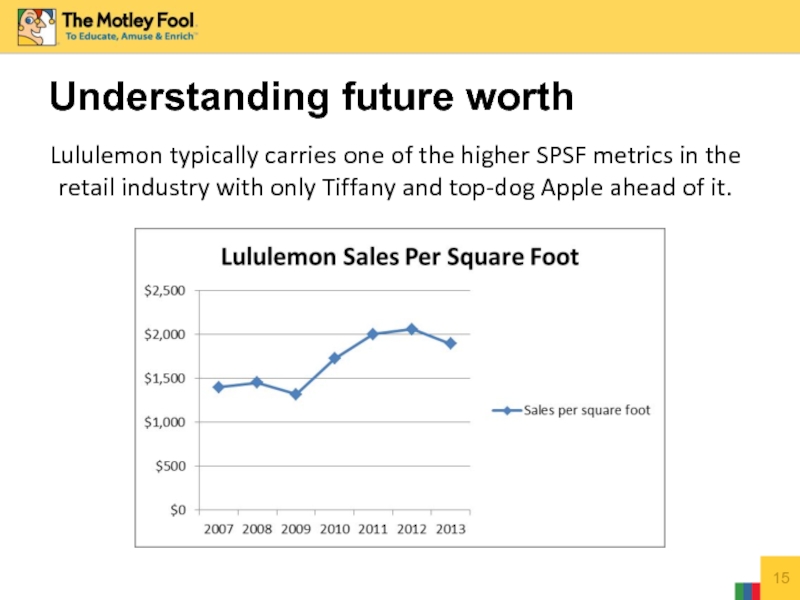

Слайд 15Understanding future worth

Lululemon typically carries one of the higher SPSF metrics

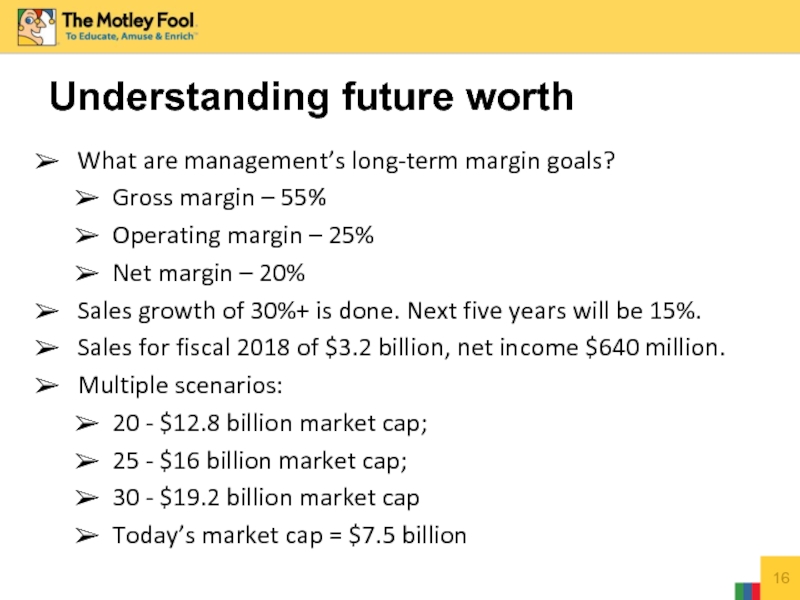

Слайд 16What are management’s long-term margin goals?

Gross margin – 55%

Operating margin –

Net margin – 20%

Sales growth of 30%+ is done. Next five years will be 15%.

Sales for fiscal 2018 of $3.2 billion, net income $640 million.

Multiple scenarios:

20 - $12.8 billion market cap;

25 - $16 billion market cap;

30 - $19.2 billion market cap

Today’s market cap = $7.5 billion

Understanding future worth

Слайд 17Retail is known for its lack of competitive advantages. Depending on

New CEO Potdevin is an unknown, though I’m optimistic.

Sourcing for Luon (30% of total fabric from one supplier);

Founder Chip Wilson holds a bit more than 29% of the company’s outstanding shares.

While growth in direct-to-consumer is a net positive, it does present additional tech and distribution challenges.

ivivva is an additional lever for growth; failure on this front would hurt.

Risks

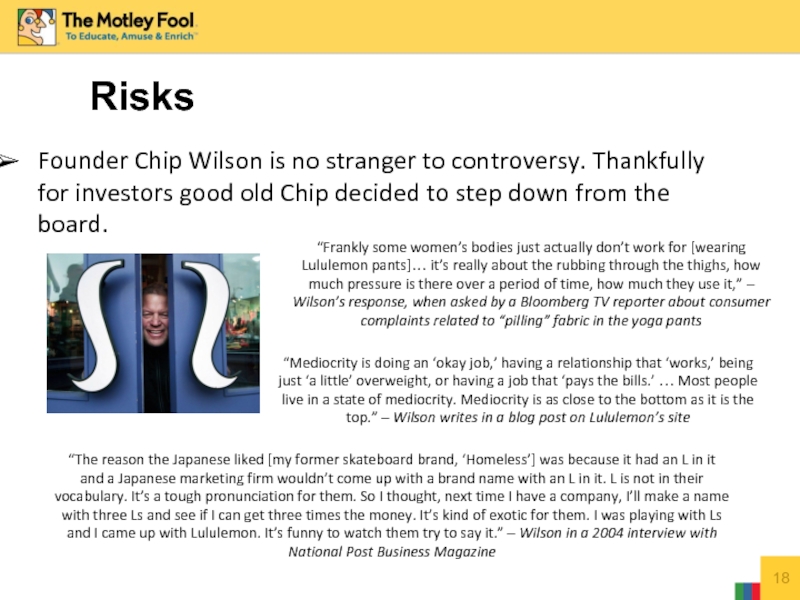

Слайд 18Founder Chip Wilson is no stranger to controversy. Thankfully for investors

Risks

“Frankly some women’s bodies just actually don’t work for [wearing Lululemon pants]… it’s really about the rubbing through the thighs, how much pressure is there over a period of time, how much they use it,” – Wilson’s response, when asked by a Bloomberg TV reporter about consumer complaints related to “pilling” fabric in the yoga pants

“Mediocrity is doing an ‘okay job,’ having a relationship that ‘works,’ being just ‘a little’ overweight, or having a job that ‘pays the bills.’ … Most people live in a state of mediocrity. Mediocrity is as close to the bottom as it is the top.” – Wilson writes in a blog post on Lululemon’s site

“The reason the Japanese liked [my former skateboard brand, ‘Homeless’] was because it had an L in it and a Japanese marketing firm wouldn’t come up with a brand name with an L in it. L is not in their vocabulary. It’s a tough pronunciation for them. So I thought, next time I have a company, I’ll make a name with three Ls and see if I can get three times the money. It’s kind of exotic for them. I was playing with Ls and I came up with Lululemon. It’s funny to watch them try to say it.” – Wilson in a 2004 interview with National Post Business Magazine

Слайд 19Management’s annual cash incentive bonuses are tied to: operating income (50%),

Are the multiple scenarios in “Understanding future worth” reasonable? If the growth is still in fact there then yes. Under Armour ($12.2 billion market cap) still trades for 75 times earnings and Nike ($65 billion market cap) is 25 times earnings. Both have admittedly larger market opportunities.

Very encouraged by the website, focus on free-shipping homes in on exactly what consumers want. More than 13% of all clothing sales now occur online.

Are margin targets reasonable? Yes, particularly if Europe and Asia succeed.

Questions/ideas to ponder

Слайд 20Lululemon was fast out of the gate but the past couple

Leadership changes are not always bad and can sometimes be very good. I am optimistic in this case given the low bar Wilson set and Potdevin’s experience.

Lululemon shares are down over 17% year to date bringing the stock to a more reasonable valuation considering what I see as an overall positive picture over the coming five years.

I’m calling a buy-around of $50 for Lululemon shares today to outperform the S&P 500 over the next 3-5 years.

Bottom line takeaway for investors