- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Things You Can’t Miss in Caterpillar Inc.’s Upcoming Earnings Report презентация

Содержание

- 1. 3 Things You Can’t Miss in Caterpillar Inc.’s Upcoming Earnings Report

- 2. 1 Backlog value: a key indicator of future potential revenue

- 3. Story so far Caterpillar’s backlog is declining

- 4. What you should watch Backlog: I’m

- 5. 2 Signs of stress in the North American construction market

- 6. A bleak picture Data source: Caterpillar retail

- 7. What you should watch While downgrading its

- 8. 3 Restructuring and growth plans

- 9. The big plan In

- 10. What you should watch While Caterpillar

- 11. This Could Be The Next Billion-Dollar iSecret

Слайд 3Story so far

Caterpillar’s backlog is declining rapidly – In Q2, it

fell 10% sequentially and 23% year over year. Half the year-over-year decline was in its construction industries division.

Prices of key commodities like oil, coal, and iron ore have hit multi-year lows in recent months. As a result, companies in these sectors are aggressively cutting down on capital expenditures.

Prices of key commodities like oil, coal, and iron ore have hit multi-year lows in recent months. As a result, companies in these sectors are aggressively cutting down on capital expenditures.

Слайд 4What you should watch

Backlog: I’m expecting another double-digit slump in Q3.

With mining and oil and gas already weak, a big drop in construction backlog will be a double whammy.

Order rates: Backlog could reach dangerously low levels and revenues could dry up if orders for Caterpillar’s equipment don’t pick up soon.

Order rates: Backlog could reach dangerously low levels and revenues could dry up if orders for Caterpillar’s equipment don’t pick up soon.

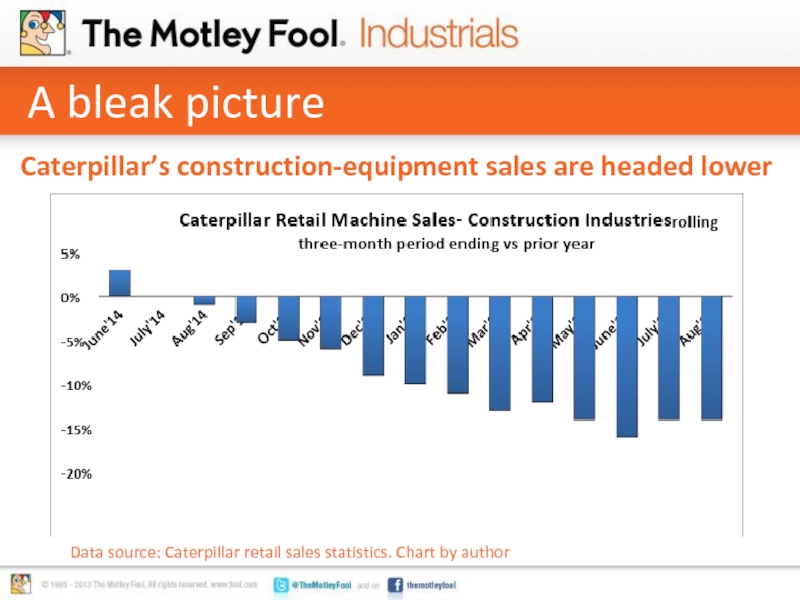

Слайд 6A bleak picture

Data source: Caterpillar retail sales statistics. Chart by author

Caterpillar’s

construction-equipment sales are headed lower

Слайд 7What you should watch

While downgrading its outlook last month, Caterpillar mentioned

that “construction equipment sales are well below prior peaks in North America.”

North America is Caterpillar’s largest market, and also among its strongest. So any sluggishness will bode ill for the company, especially when international markets are already weak.

North America is Caterpillar’s largest market, and also among its strongest. So any sluggishness will bode ill for the company, especially when international markets are already weak.

Слайд 9The big plan

In September, Caterpillar revealed massive restructuring plans

across all business segments that “could impact more than 20 facilities” and 10,000 people around the world.

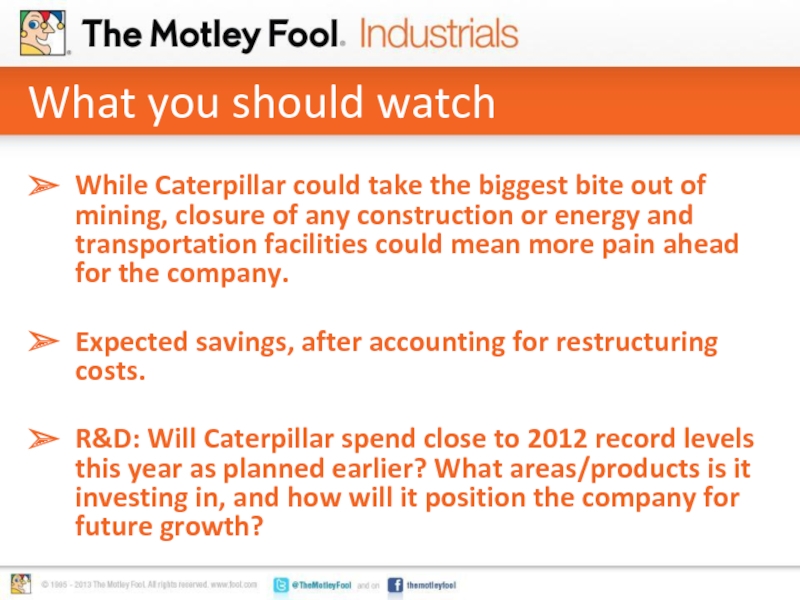

Слайд 10What you should watch

While Caterpillar could take the biggest bite

out of mining, closure of any construction or energy and transportation facilities could mean more pain ahead for the company.

Expected savings, after accounting for restructuring costs.

R&D: Will Caterpillar spend close to 2012 record levels this year as planned earlier? What areas/products is it investing in, and how will it position the company for future growth?

Expected savings, after accounting for restructuring costs.

R&D: Will Caterpillar spend close to 2012 record levels this year as planned earlier? What areas/products is it investing in, and how will it position the company for future growth?