- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Things to Watch When Alcoa Releases Earnings презентация

Содержание

- 1. 3 Things to Watch When Alcoa Releases Earnings

- 2. Alcoa (NYSE: AA) Alcoa is expected

- 3. So far, Alcoa is off to a

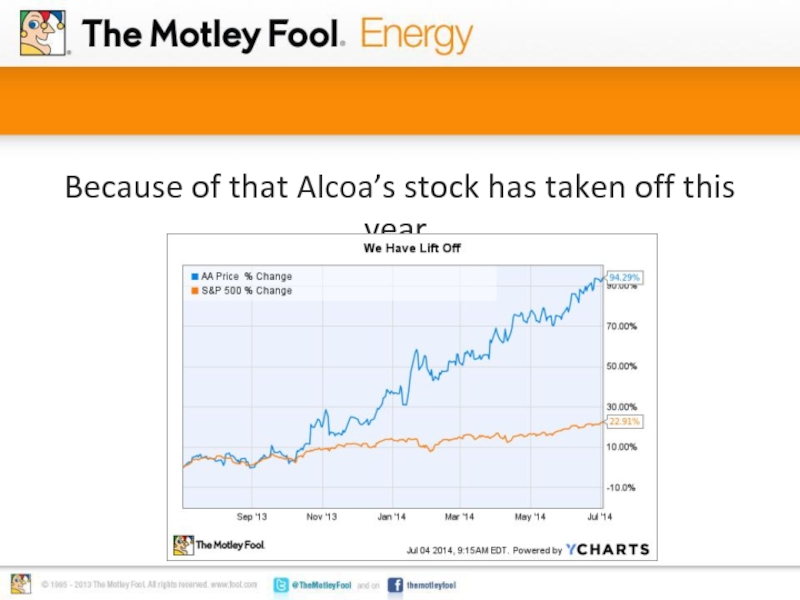

- 4. Because of that Alcoa’s stock has taken off this year.

- 5. That positive momentum can be continued if the company succeeds in the following three areas…

- 6. 1. Look to see if Alcoa can

- 7. 2. Keep an eye to ensure that

- 8. 2. Keep an eye to ensure that

- 9. 3. Watch for any other big changes

- 10. Alcoa’s transition from a commodity focused company

- 11. Our FREE report on top dividend stocks.

Слайд 2Alcoa (NYSE: AA)

Alcoa is expected to report earnings of $0.12

Revenue, however, is expected to drop 3.3% year-over-year to $5.66 billion.

Scheduled to report first quarter results July 8th after markets close.

Photo credit: Alcoa

Слайд 3So far, Alcoa is off to a great start in 2014.

Photo credit: Alcoa

Слайд 5That positive momentum can be continued if the company succeeds in

Слайд 61. Look to see if Alcoa can at least meets earnings

Last quarter Alcoa earned $0.09 per share, which was 80% higher than analysts were expecting.

This quarter analysts expect the company to earn about $0.12 per share, though the range is anywhere from $0.09 per share to $0.16 per share.

In order to maintain its positive momentum the company needs to at least meet the average consensus estimate.

Слайд 72. Keep an eye to ensure that Alcoa can deliver

Recently announced the acquisition of Firth Rixson to strengthen its aerospace offering.

Alcoa has announced a number of investments in value-add businesses like automotive, packaging and aerospace, while reducing its lower margin smelting capacity.

Look for additional announcements as Alcoa’s portfolio transformation continues.

Слайд 82. Keep an eye to ensure that Alcoa can deliver

Recently announced the acquisition of Firth Rixson to strengthen its aerospace offering.

Alcoa has announced a number of investments in value-add businesses like automotive, packaging and aerospace, while reducing its lower margin smelting capacity.

Look for additional announcements as Alcoa’s portfolio transformation continues.

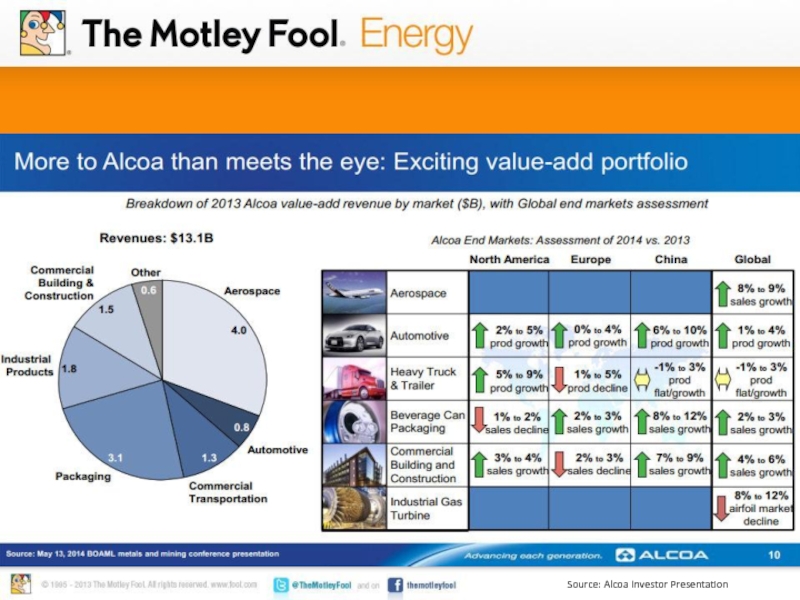

Source: Alcoa Investor Presentation

Слайд 93. Watch for any other big changes on the balance sheet:

As

However, the acquisition of Firth Rixson includes $2.35 million in cash, which is being funded by added debt.

Company remains committed to an investment grade credit rating.

Any weakness in its value-add segment could have an impact on its credit metrics.

Слайд 10Alcoa’s transition from a commodity focused company to one profiting from

Photo credit: Alcoa