- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Things Everyone Should Know About the Oil Industry презентация

Содержание

- 1. 3 Things Everyone Should Know About the Oil Industry

- 2. Oil’s importance continues to grow The history

- 3. Oil’s importance continues to grow Today, oil

- 4. Because oil is so important to the

- 5. No 1. The Oil Industry is Cyclical

- 6. Boom, bust, recovery…and then repeat. Strong demand

- 7. Boom, bust, recovery…and then repeat. Oil prices

- 8. No 2. The Oil Industry is Capital

- 9. The decline curve and the demand pull

- 10. No 3. Outside Forces Add Volatility Geopolitics,

- 11. Forces beyond the market’s control Case Study:

- 12. Forces beyond the market’s control Case Study:

- 13. Conclusion: Investing in the oil industry isn’t

- 14. This $19 trillion industry could destroy the

Слайд 2Oil’s importance continues to grow

The history of oil dates back more

Mankind continued to find new uses for oil as it was eventually used for heating and lighting.

Photo credit: Flickr user John Nuttall.

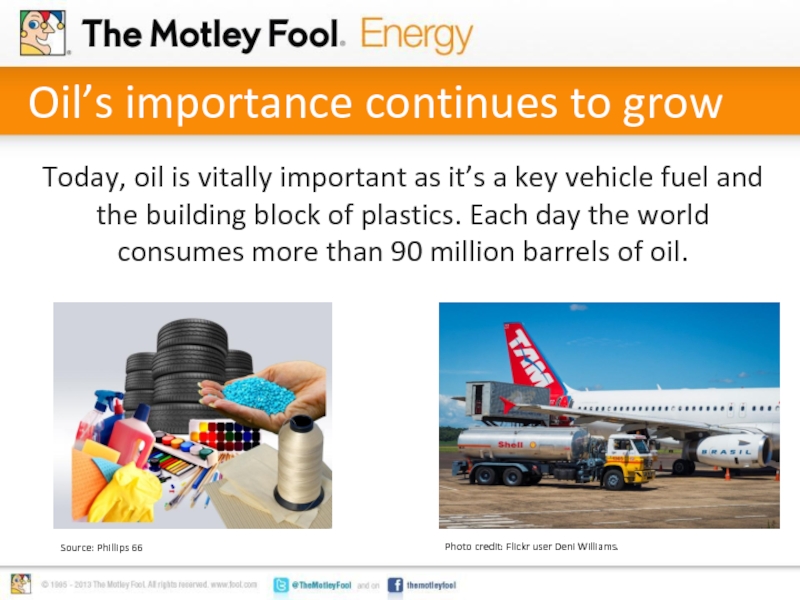

Слайд 3Oil’s importance continues to grow

Today, oil is vitally important as it’s

Photo credit: Flickr user Deni Williams.

Source: Phillips 66

Слайд 4Because oil is so important to the world economy it has

Photo credit: Flickr user Ben Klocek

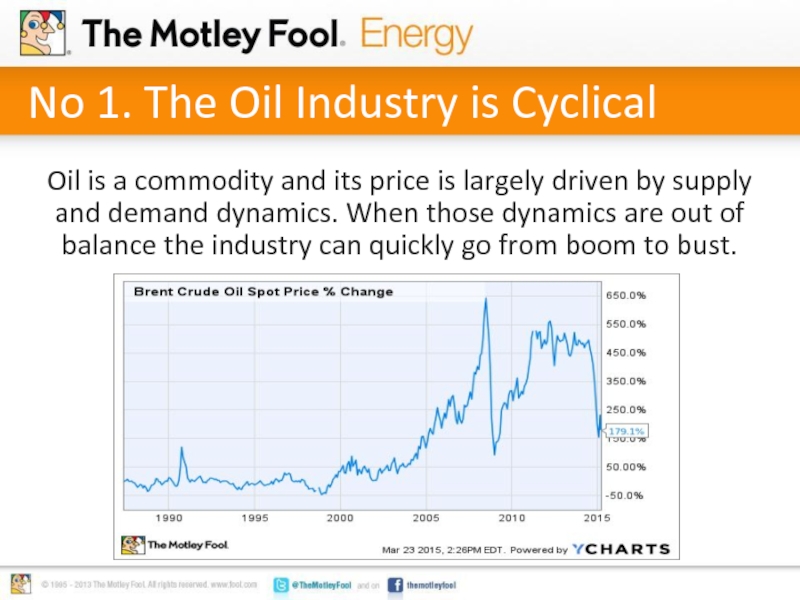

Слайд 5No 1. The Oil Industry is Cyclical

Oil is a commodity and

Слайд 6Boom, bust, recovery…and then repeat.

Strong demand for oil = robust oil

Robust oil prices = lots of cash flowing into oil company’s coffers

Lots of cash = capital to invest in new wells

More wells = more oil supply

Eventually too much oil hits the market and oil prices drop

Low oil prices lead to increase demand for oil starting the cycle all over again

Слайд 7Boom, bust, recovery…and then repeat.

Oil prices have been freaking investors out

88 years with a greater than 10% change, once every year and a half

69 years with a greater than 15% change, or once every 2.25 years

44 years with a greater than 25% change, once every 3.5 years

13 years with a greater than 50% change, once every dozen years or so

Слайд 8No 2. The Oil Industry is Capital Intense

The industry needs to

Source: Chevron Corporation

Слайд 9The decline curve and the demand pull

The worldwide oil production decline

In order to keep production steady oil companies need to invest in new wells to offset decline from legacy wells

Meanwhile, global oil demand increases by about 1%-2% per year

This combination makes the oil industry very capital intense as most oil companies reinvest all of their cash flow and then some into new wells

Слайд 10No 3. Outside Forces Add Volatility

Geopolitics, conflicts and natural disasters can

Iraqi oil fires after the first Gulf War. Photo credit: Flickr user Bryan Dorrough

Photo credit: Flickr user Day Donaldson

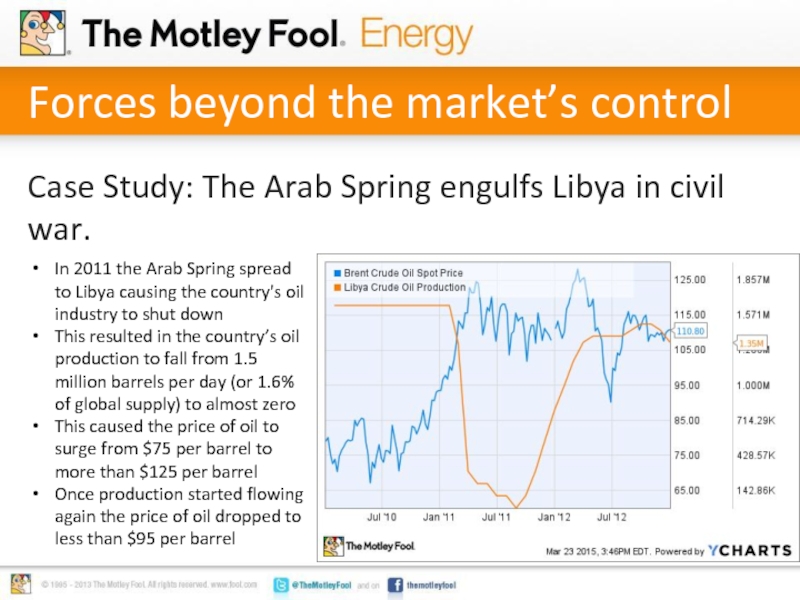

Слайд 11Forces beyond the market’s control

Case Study: The Arab Spring engulfs Libya

In 2011 the Arab Spring spread to Libya causing the country's oil industry to shut down

This resulted in the country’s oil production to fall from 1.5 million barrels per day (or 1.6% of global supply) to almost zero

This caused the price of oil to surge from $75 per barrel to more than $125 per barrel

Once production started flowing again the price of oil dropped to less than $95 per barrel

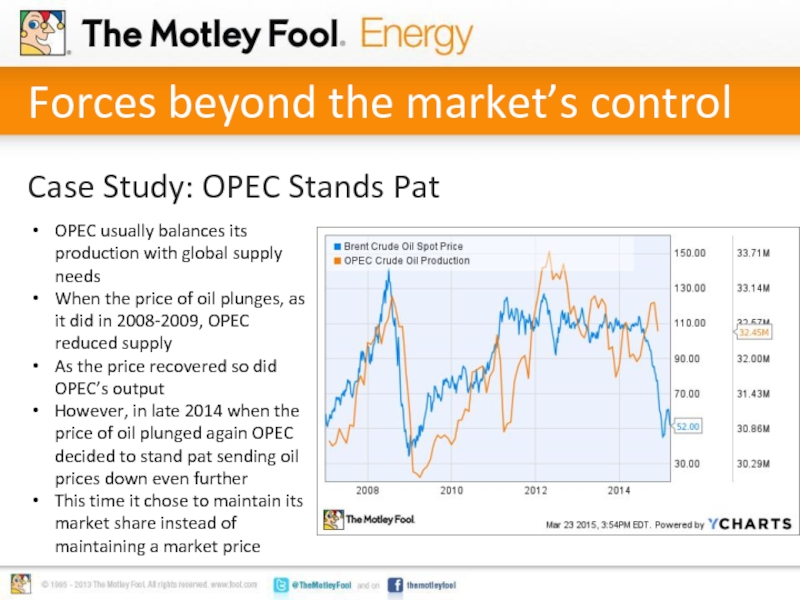

Слайд 12Forces beyond the market’s control

Case Study: OPEC Stands Pat

OPEC usually balances

When the price of oil plunges, as it did in 2008-2009, OPEC reduced supply

As the price recovered so did OPEC’s output

However, in late 2014 when the price of oil plunged again OPEC decided to stand pat sending oil prices down even further

This time it chose to maintain its market share instead of maintaining a market price

Слайд 13Conclusion: Investing in the oil industry isn’t for the faint of

Photo credit: Flickr user DVIDSHUB

The oil industry is critical to modern society. However, investors need to be aware that it’s highly cyclical, capital intense and subject to outside forces. This can cause a lot of unexpected volatility as well as a lot of profit potential.