- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Stocks That Could Make Huge Moves This Week презентация

Содержание

- 1. 3 Stocks That Could Make Huge Moves This Week

- 2. Greenbrier Companies Greenbrier manufactures rail cars used

- 3. Here’s What You Should Watch Over the

- 4. CalAmp CalAmp manufactures machine-to-machine communication devices—otherwise known

- 5. Here’s What You Should Watch Over the

- 6. McCormick & Company McCormick makes spices

- 7. Here’s What You Should Watch Over the

- 8. The $19 Trillion Industry that Could Destroy

Слайд 2Greenbrier Companies

Greenbrier manufactures rail cars used by railroad companies to move

Currently, 33% of Greenbrier’s shares are sold short.

With energy prices plunging, many investors worry that shale exploration in remote areas will die down, meaning slower demand for Greenbrier’s rail cars.

Photo: Greenbrier Companies

Слайд 3Here’s What You Should Watch

Over the Short Term

Greenbrier is expected to

Analysts expect the company to have collected $741 million in sales.

For the rest of 2015, analysts are expecting the company to bring in $5.92 per share on sales of $2.6 billion.

Over the Long Term

Listen in to the conference call to see if there have been any railcar cancellations from customers.

Pay close attention to the company’s backlog of orders, which stood at 46,000 last quarter.

Слайд 4CalAmp

CalAmp manufactures machine-to-machine communication devices—otherwise known as “The Internet of Things”

Currently, 14% of CalAmp’s shares are sold short.

The company is part of an industry still in its infancy. Competition is heavy and investors have legitimate concerns that CalAmp will emerge a winner without its technology being commoditized.

Source: CalAmp

Слайд 5Here’s What You Should Watch

Over the Short Term

CalAmp is expected to

Earnings are expected to come in at $0.26 per share.

For the rest of the fiscal year (which just started), expectations are set for $283 million in revenue and $1.12 per share in earnings.

Over the Long Term

Usage-Based Insurance (UBI) is a huge potential market for CalAmp. Pay close attention to growth in this segment of the company.

Growth within the construction industry is lumpy, so pay more attention to full-year results and full-year projections for this part of the business.

Слайд 6McCormick & Company

McCormick makes spices and seasonings sold around the

Currently, 7% of McCormick’s shares are sold short.

This actually isn’t a “huge” short percentage. However, investors are likely thinking that a spice company trading for 23 times earnings is a bit pricey.

Photo: McCormick & Company

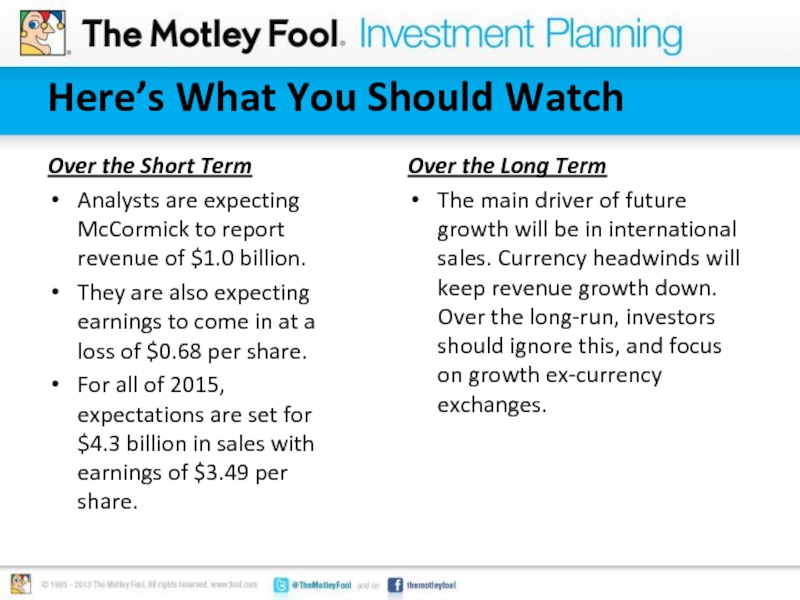

Слайд 7Here’s What You Should Watch

Over the Short Term

Analysts are expecting McCormick

They are also expecting earnings to come in at a loss of $0.68 per share.

For all of 2015, expectations are set for $4.3 billion in sales with earnings of $3.49 per share.

Over the Long Term

The main driver of future growth will be in international sales. Currency headwinds will keep revenue growth down. Over the long-run, investors should ignore this, and focus on growth ex-currency exchanges.