- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Stocks That Could Make Huge Moves This Week презентация

Содержание

- 1. 3 Stocks That Could Make Huge Moves This Week

- 2. Five Below Five Below is a fast-growing

- 3. Here’s What You Should Watch Over the

- 4. Winnebago Industries Winnebago is a leading provider

- 5. Here’s What You Should Watch Over the

- 6. GameStop GameStop is a leading brick-and-mortar seller

- 7. Here’s What You Should Watch Over the

- 8. One Great Stock for 2015 and Beyond!

Слайд 2Five Below

Five Below is a fast-growing clothing retailer. The company focuses

Currently, 18% of shares are sold short.

Part of this is because the company trades for 41 times earnings, a very heady valuation for a discounted clothing retailer. But some is because the company has already announced disappointing sales for the holiday quarter.

Слайд 3Here’s What You Should Watch

Over the Short-Term

Five Below is expected to

The company expects revenues to clock in at $262 million.

For 2015, expectations are set for $837 million in sales and earnings of $1.09 per share.

Over the Long-Term

This will be new CEO Joel Anderson’s first conference call in his new roll. Listen in to see if he instills the same confidence that founder/former-CEO David Schlessinger.

The company had forecast a growth in comparable store sales of 4%, but after an underwhelming holiday period, it’ll likely come in lower. Pay attention to just how low comps were.

Слайд 4Winnebago Industries

Winnebago is a leading provider of RV and motorhomes in

Currently, 16% of Vera Bradley’s shares are sold short.

Over the past year, the backlog for Winnebago vehicles has fallen sharply, leading many to believe that demand for these high-end motorhomes may be waning.

Слайд 5Here’s What You Should Watch

Over the Short-Term

Winnebago is expected to report

Earnings are expected to come in at $0.38 per share.

For the current fiscal year, expectations are set for $1.01 billion in sales and earnings of $1.68 per share.

Over the Long-Term

The company said it hopes to keep its backlog at a “sustainable” rate of around $200 million. Last quarter, it sat at just under $206 million. See how close the company is to hitting this target.

Average selling prices (ASPs) for Winnebago’s vehicles has fallen recently, which is hurting margins. Pay attention to see if this trend continues.

Слайд 6GameStop

GameStop is a leading brick-and-mortar seller of video games in the

Currently, 44% of shares are sold short.

The biggest concern with GameStop is that video game companies are making a permanent shift to digital, downloadable games. This would mean a distribution network of brick-and-mortar stores like GameStop would become less necessary.

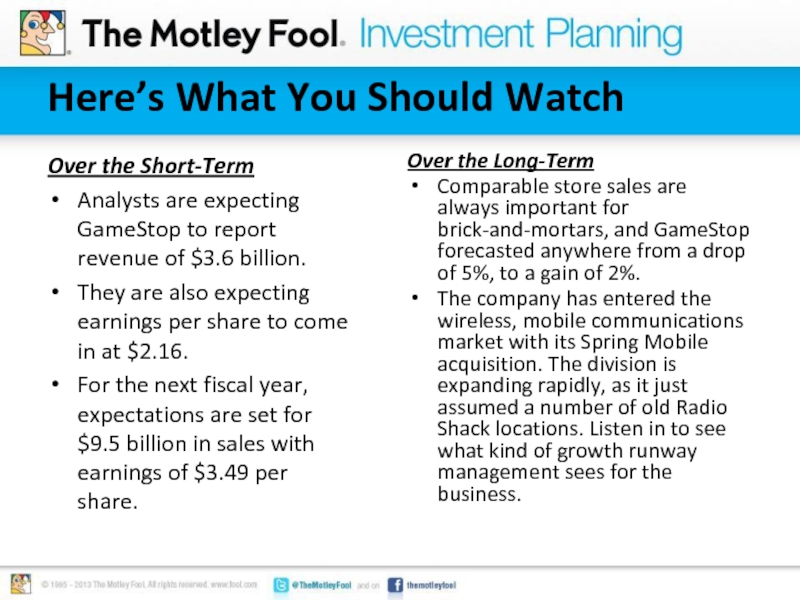

Слайд 7Here’s What You Should Watch

Over the Short-Term

Analysts are expecting GameStop to

They are also expecting earnings per share to come in at $2.16.

For the next fiscal year, expectations are set for $9.5 billion in sales with earnings of $3.49 per share.

Over the Long-Term

Comparable store sales are always important for brick-and-mortars, and GameStop forecasted anywhere from a drop of 5%, to a gain of 2%.

The company has entered the wireless, mobile communications market with its Spring Mobile acquisition. The division is expanding rapidly, as it just assumed a number of old Radio Shack locations. Listen in to see what kind of growth runway management sees for the business.