- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

B of A’s Stake in China Construction Bank IN ONE CHART презентация

Содержание

- 1. B of A’s Stake in China Construction Bank IN ONE CHART

- 2. Introduction From 2005 until 2013, Bank

- 3. 2005: B of A buys in

- 4. 2006: Accounting freeze Because Bank of

- 5. 2007: Carrying value increased to $16.4

- 6. 2008: Exercise of option Bank of

- 7. 2009: Sale of initial stake By

- 8. 2010: Fair value accounting for most

- 9. 2011: B of A sells most

- 10. 2012: Fair value accounting for final

- 11. 2013: Sale of last 2 billion

Слайд 2

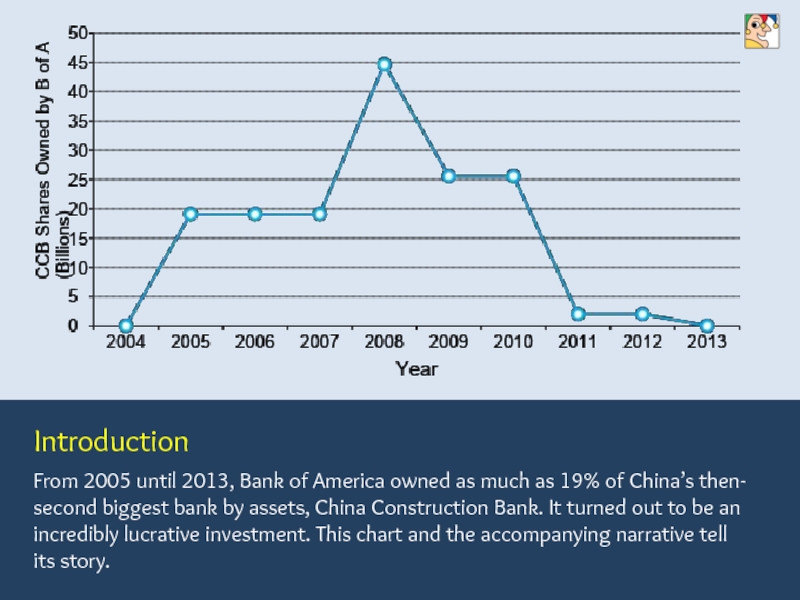

Introduction

From 2005 until 2013, Bank of America owned as much as

19% of China’s then-

second biggest bank by assets, China Construction Bank. It turned out to be an

incredibly lucrative investment. This chart and the accompanying narrative tell

its story.

second biggest bank by assets, China Construction Bank. It turned out to be an

incredibly lucrative investment. This chart and the accompanying narrative tell

its story.

Слайд 3

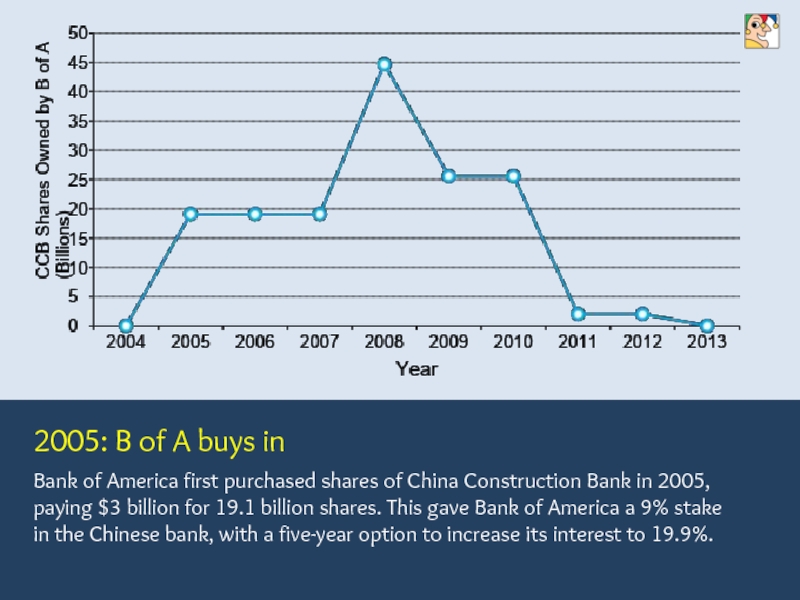

2005: B of A buys in

Bank of America first purchased shares

of China Construction Bank in 2005,

paying $3 billion for 19.1 billion shares. This gave Bank of America a 9% stake

in the Chinese bank, with a five-year option to increase its interest to 19.9%.

paying $3 billion for 19.1 billion shares. This gave Bank of America a 9% stake

in the Chinese bank, with a five-year option to increase its interest to 19.9%.

Слайд 4

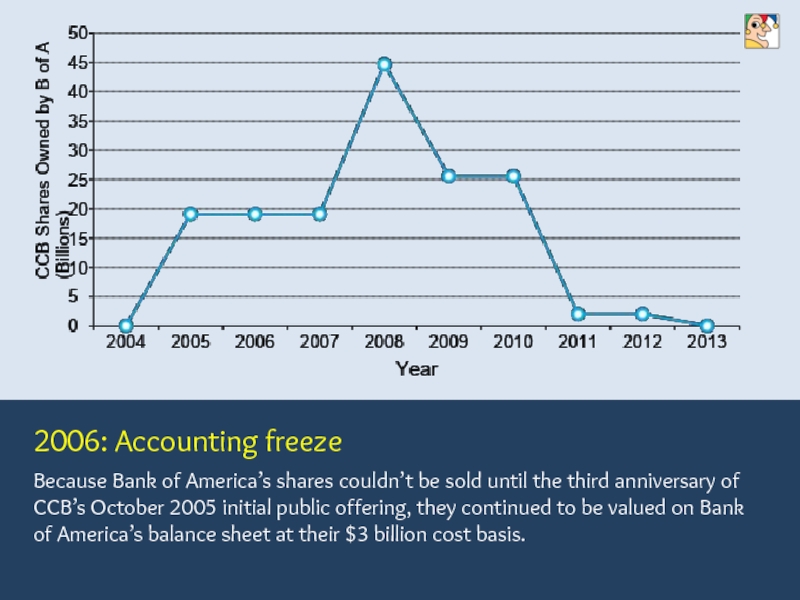

2006: Accounting freeze

Because Bank of America’s shares couldn’t be sold until

the third anniversary of

CCB’s October 2005 initial public offering, they continued to be valued on Bank

of America’s balance sheet at their $3 billion cost basis.

CCB’s October 2005 initial public offering, they continued to be valued on Bank

of America’s balance sheet at their $3 billion cost basis.

Слайд 5

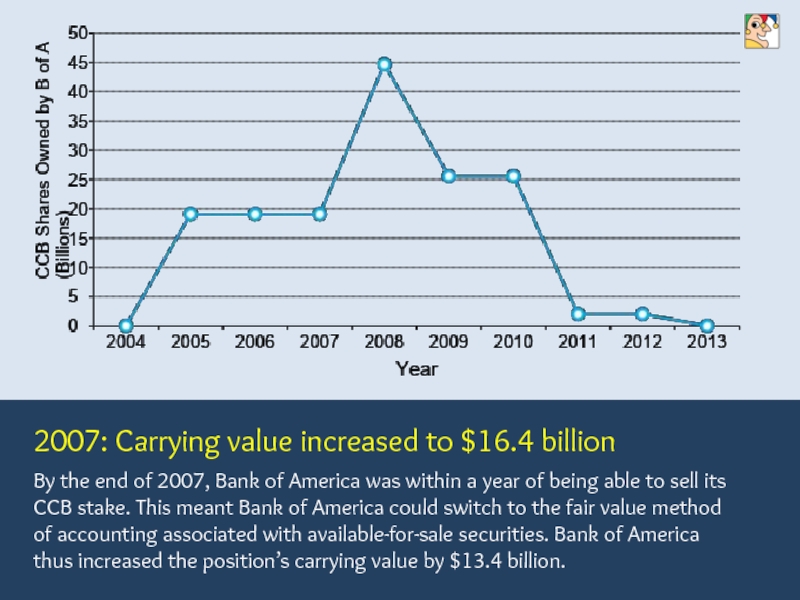

2007: Carrying value increased to $16.4 billion

By the end of 2007,

Bank of America was within a year of being able to sell its

CCB stake. This meant Bank of America could switch to the fair value method

of accounting associated with available-for-sale securities. Bank of America

thus increased the position’s carrying value by $13.4 billion.

CCB stake. This meant Bank of America could switch to the fair value method

of accounting associated with available-for-sale securities. Bank of America

thus increased the position’s carrying value by $13.4 billion.

Слайд 6

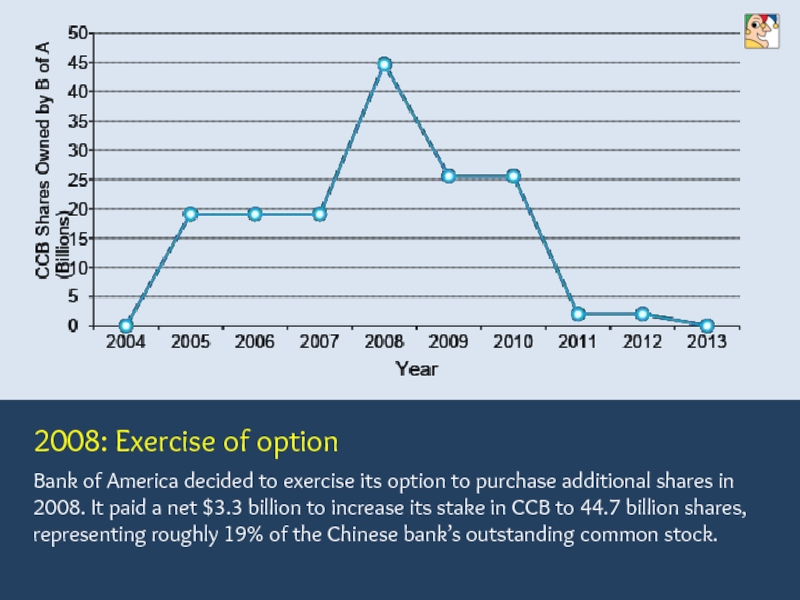

2008: Exercise of option

Bank of America decided to exercise its option

to purchase additional shares in

2008. It paid a net $3.3 billion to increase its stake in CCB to 44.7 billion shares,

representing roughly 19% of the Chinese bank’s outstanding common stock.

2008. It paid a net $3.3 billion to increase its stake in CCB to 44.7 billion shares,

representing roughly 19% of the Chinese bank’s outstanding common stock.

Слайд 7

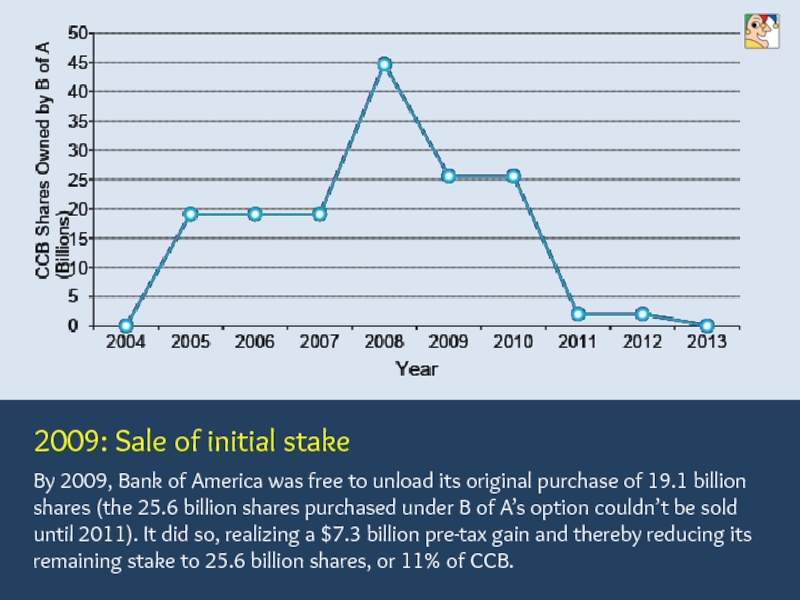

2009: Sale of initial stake

By 2009, Bank of America was free

to unload its original purchase of 19.1 billion

shares (the 25.6 billion shares purchased under B of A’s option couldn’t be sold

until 2011). It did so, realizing a $7.3 billion pre-tax gain and thereby reducing its

remaining stake to 25.6 billion shares, or 11% of CCB.

shares (the 25.6 billion shares purchased under B of A’s option couldn’t be sold

until 2011). It did so, realizing a $7.3 billion pre-tax gain and thereby reducing its

remaining stake to 25.6 billion shares, or 11% of CCB.

Слайд 8

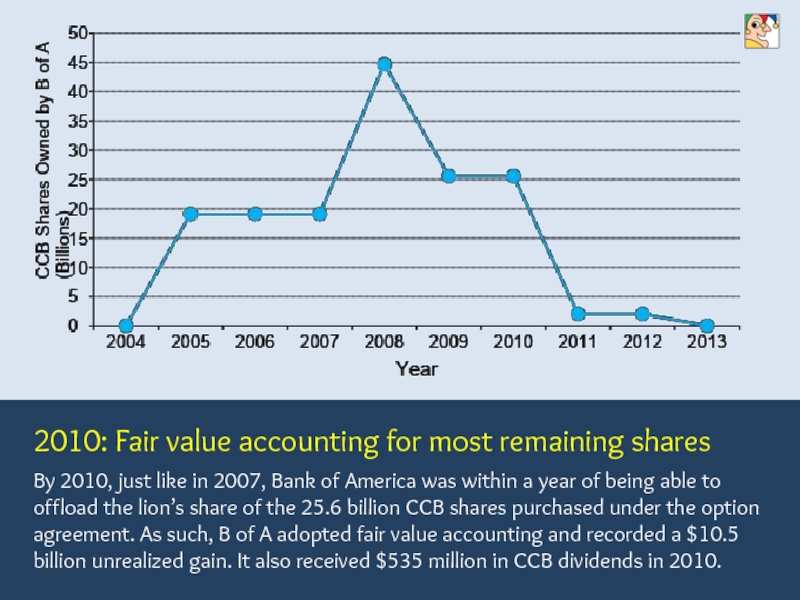

2010: Fair value accounting for most remaining shares

By 2010, just like

in 2007, Bank of America was within a year of being able to

offload the lion’s share of the 25.6 billion CCB shares purchased under the option

agreement. As such, B of A adopted fair value accounting and recorded a $10.5

billion unrealized gain. It also received $535 million in CCB dividends in 2010.

offload the lion’s share of the 25.6 billion CCB shares purchased under the option

agreement. As such, B of A adopted fair value accounting and recorded a $10.5

billion unrealized gain. It also received $535 million in CCB dividends in 2010.

Слайд 9

2011: B of A sells most of remaining stake

Bank of America

was now free to offload all but two billion shares of its CCB

stake -- the latter were still subject to restrictions. It accordingly did so, selling

23.6 billion shares for a pre-tax gain of $6.5 billion. B of A also received $836

million in dividends from CCB in 2011.

stake -- the latter were still subject to restrictions. It accordingly did so, selling

23.6 billion shares for a pre-tax gain of $6.5 billion. B of A also received $836

million in dividends from CCB in 2011.

Слайд 10

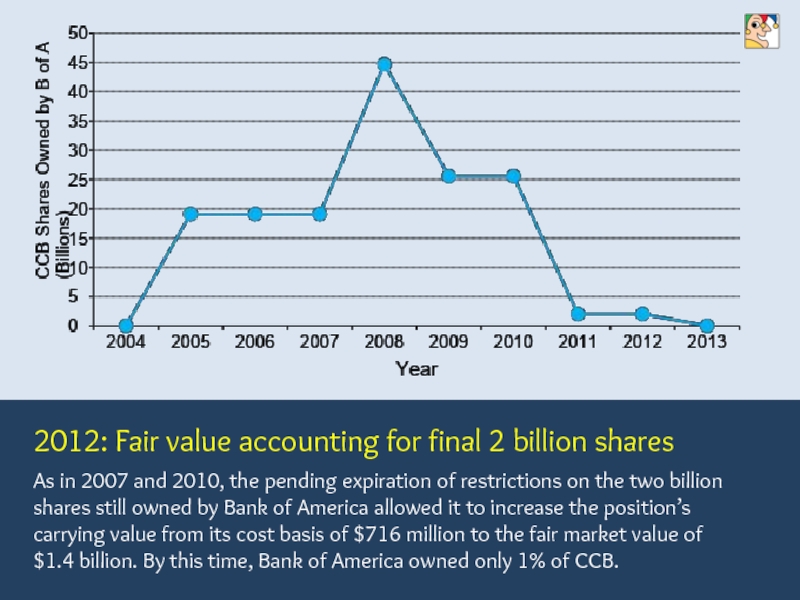

2012: Fair value accounting for final 2 billion shares

As in 2007

and 2010, the pending expiration of restrictions on the two billion

shares still owned by Bank of America allowed it to increase the position’s

carrying value from its cost basis of $716 million to the fair market value of

$1.4 billion. By this time, Bank of America owned only 1% of CCB.

shares still owned by Bank of America allowed it to increase the position’s

carrying value from its cost basis of $716 million to the fair market value of

$1.4 billion. By this time, Bank of America owned only 1% of CCB.

Слайд 11

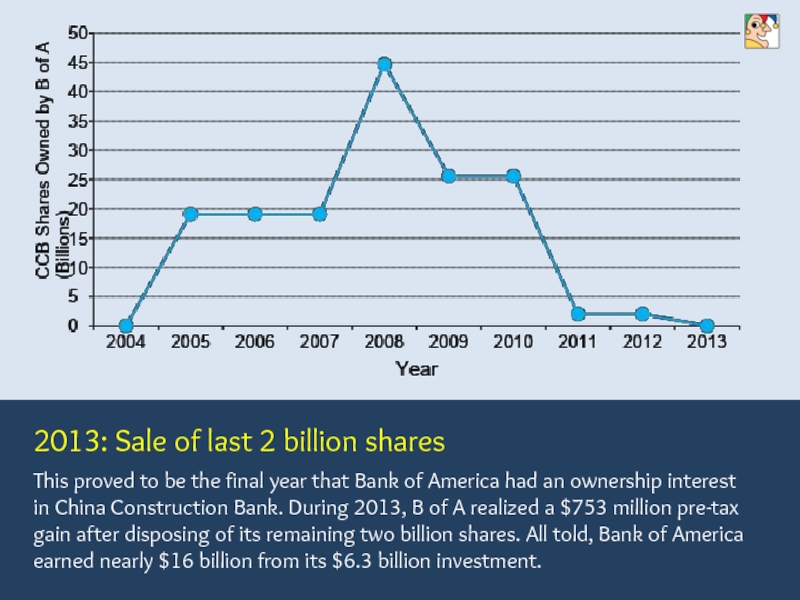

2013: Sale of last 2 billion shares

This proved to be the

final year that Bank of America had an ownership interest

in China Construction Bank. During 2013, B of A realized a $753 million pre-tax

gain after disposing of its remaining two billion shares. All told, Bank of America

earned nearly $16 billion from its $6.3 billion investment.

in China Construction Bank. During 2013, B of A realized a $753 million pre-tax

gain after disposing of its remaining two billion shares. All told, Bank of America

earned nearly $16 billion from its $6.3 billion investment.