- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

1 Dividend You Won’t Regret Buying презентация

Содержание

- 1. 1 Dividend You Won’t Regret Buying

- 2. ConocoPhillips has paid a dividend every single

- 3. Source: ConocoPhillips Not only does ConocoPhillips and

- 4. Just recently ConocoPhillips boosted its payout by

- 5. ConocoPhillips’ dividend history alone suggests that investors

- 6. Reason No. 1: Committed to the Dividend

- 7. Reason No. 1: Committed to the Dividend

- 8. Reason No. 2: Visible Growth ConocoPhillips’ current

- 9. Reason No. 2: Visible Growth As mentioned,

- 10. Reason No. 2: Visible Growth By focusing

- 11. Reason No. 3: Optionality for Future Growth

- 12. Reason No. 3: Optionality for Future Growth

- 13. Reason No. 3: Optionality for Future Growth

- 14. Bottom line is that ConocoPhillips’ dividend is

- 15. Our FREE report on more great dividend stocks like ConocoPhillips.

Слайд 2ConocoPhillips has paid a dividend every single quarter since 2002. That

Before the merger both companies had a long history of paying dividends.

Source: ConocoPhillips

Слайд 3Source: ConocoPhillips

Not only does ConocoPhillips and its predecessor companies have a

Слайд 4Just recently ConocoPhillips boosted its payout by 5.8%. It’s the second

Source: ConocoPhillips

Слайд 5ConocoPhillips’ dividend history alone suggests that investors won’t regret buying its

Source: ConocoPhillips

However, there are three even more compelling reasons why investors won’t regret buying ConocoPhillips.

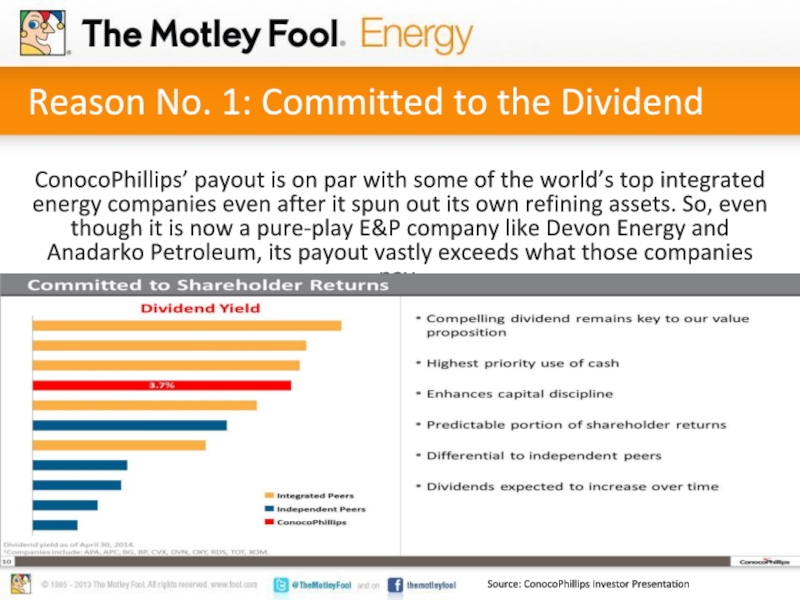

Слайд 6Reason No. 1: Committed to the Dividend

ConocoPhillips’ payout is on par

Source: ConocoPhillips Investor Presentation

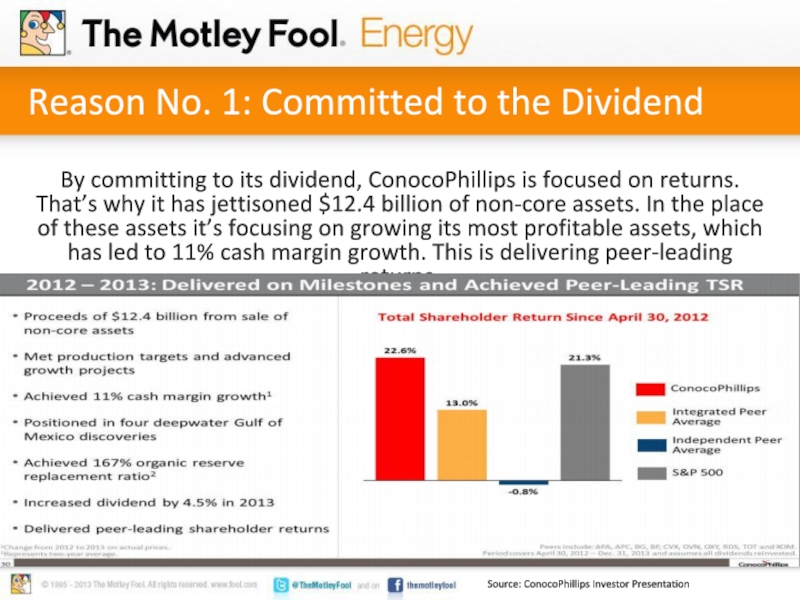

Слайд 7Reason No. 1: Committed to the Dividend

By committing to its dividend,

Source: ConocoPhillips Investor Presentation

Слайд 8Reason No. 2: Visible Growth

ConocoPhillips’ current grow plan calls for production

Devon Energy, for example, plans 10% production growth this year, with higher-margin oil production expected to grow 30%. Meanwhile, it expects to deliver 20% oil production growth next year.

Anadarko Petroleum expects production to grow 5%-7% annually through 2020. However, margin growth isn’t as much of a focus, though the liquids composition of production is expected to go from 44% to 60%+.

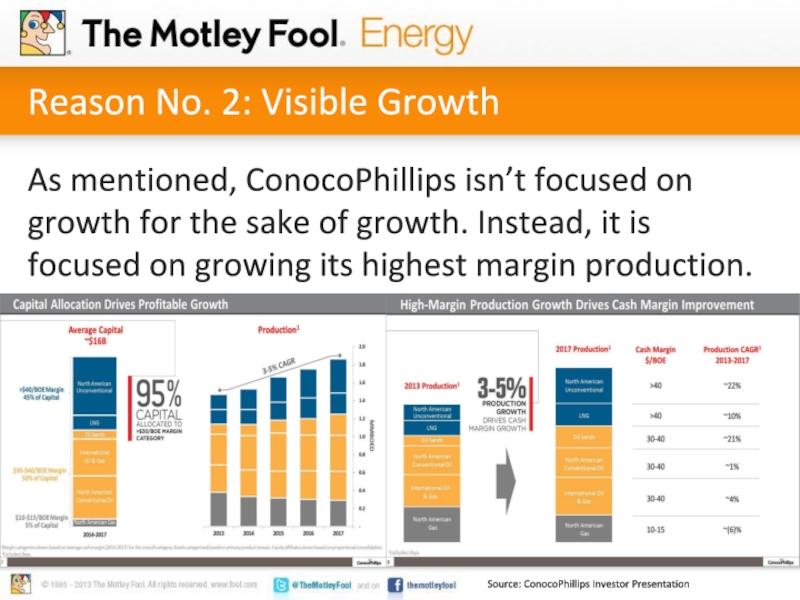

Слайд 9Reason No. 2: Visible Growth

As mentioned, ConocoPhillips isn’t focused on growth

Source: ConocoPhillips Investor Presentation

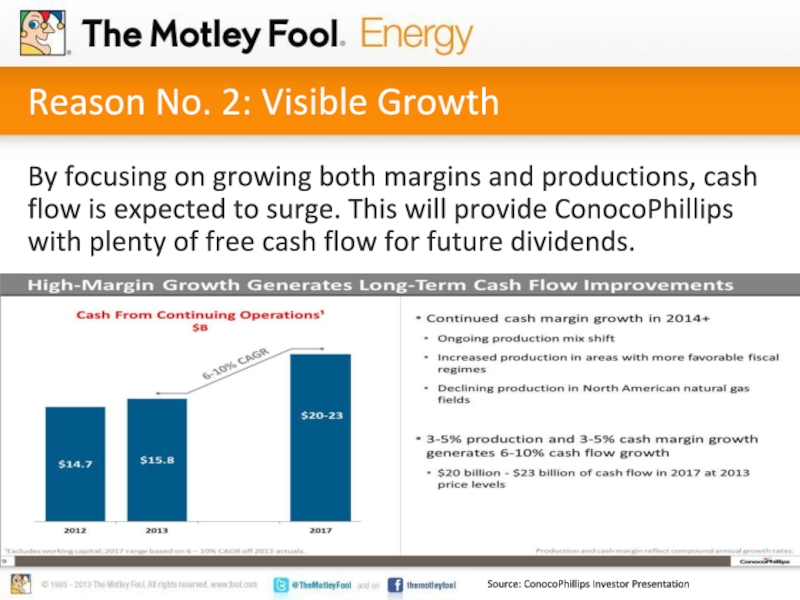

Слайд 10Reason No. 2: Visible Growth

By focusing on growing both margins and

Source: ConocoPhillips Investor Presentation

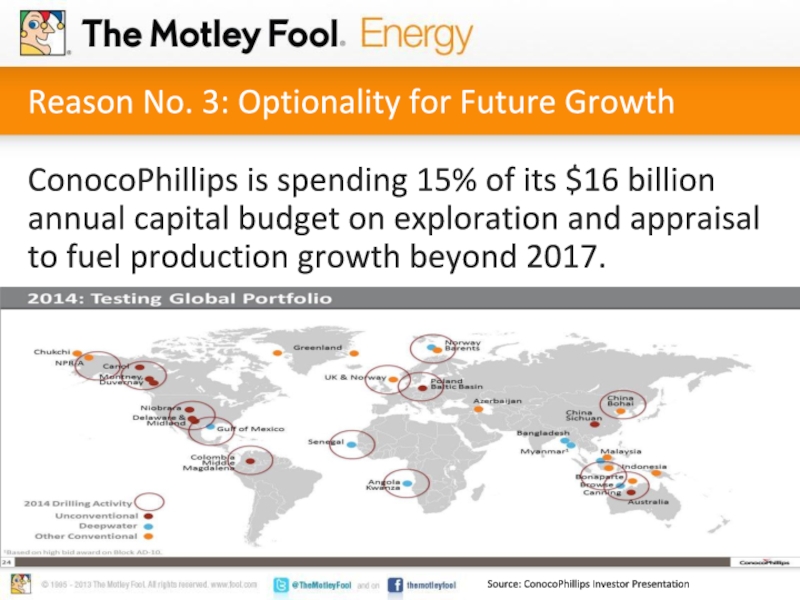

Слайд 11Reason No. 3: Optionality for Future Growth

ConocoPhillips is spending 15% of

Source: ConocoPhillips Investor Presentation

Слайд 12Reason No. 3: Optionality for Future Growth

ConocoPhillips has several compelling future

Four discoveries in the Gulf of Mexico, including the Shenandoah and Coronado finds with Anadarko Petroleum.

Unconventional opportunities in the U.S. (Permian Basin and Niobrara) and Canada (Duvernay and Montney).

Source: ConocoPhillips Investor Presentation

Слайд 13Reason No. 3: Optionality for Future Growth

Deepwater Angola is thought to

Well positioned in LNG with projects in Alaska, Australia and Qatar.

Canadian oil sands position holds upwards of 15 billion barrels of oil equivalent resource potential.

Слайд 14Bottom line is that ConocoPhillips’ dividend is as safe as they

Source: ConocoPhillips

Making it a dividend stock investors won’t regret buying.