- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

This course is concerned with making good economic decisions in engineering презентация

Содержание

- 1. This course is concerned with making good economic decisions in engineering

- 2. This course is concerned with making good

- 3. One of the important parts of economic

- 4. Physical output (products) Monetary income (profits) What Do Organizations Produce?

- 5. People’s services (labor) Materials and supplies

- 6. Most operating organizations’ costs can be

- 7. Most common direct costs: material &

- 8. Costs that cannot be traced directly

- 9. Standard Costs Representative costs per unit of

- 10. The costs of doing business (typically not

- 11. The cost or total amount of investment

- 12. Costs that remain constant: Don’t vary with

- 13. Costs that vary with activity level: E.g.,

- 14. This is simply total cost divided by

- 15. This is the cost change for

- 16. Let’s say: Fixed cost is $50, variable

- 17. Marginal cost: It is the correct

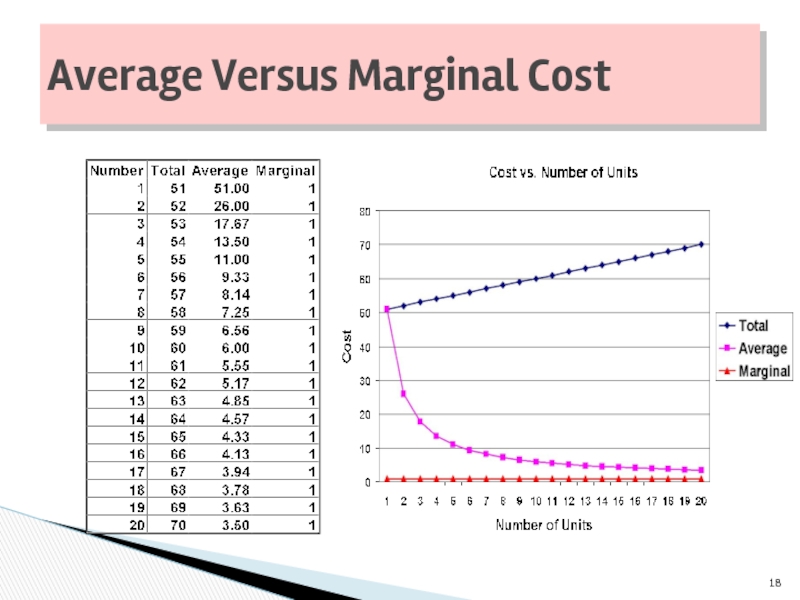

- 18. Average Versus Marginal Cost

- 19. Because is the change

- 20. Recurring are the costs that are

- 21. Opportunity cost is what you have

- 22. Sunk costs are costs that can’t be

- 23. This is the total cost for a

- 24. Accounting Method Engineering Method Statistical Method Cost-Estimating Methods

- 25. Based on historical data Costs are

- 26. Depends upon the knowledge of physical

- 27. Uses statistical tools (from simple graphs

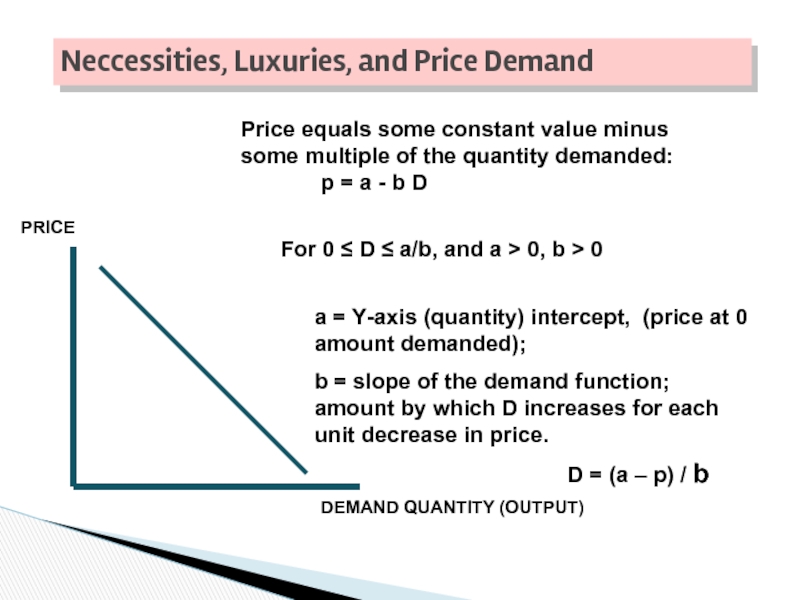

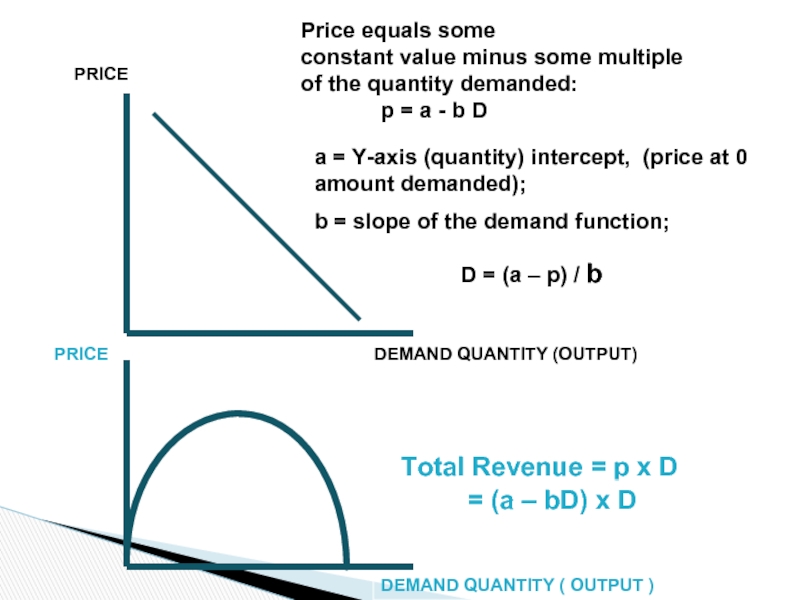

- 28. PRICE DEMAND QUANTITY (OUTPUT) Price equals some

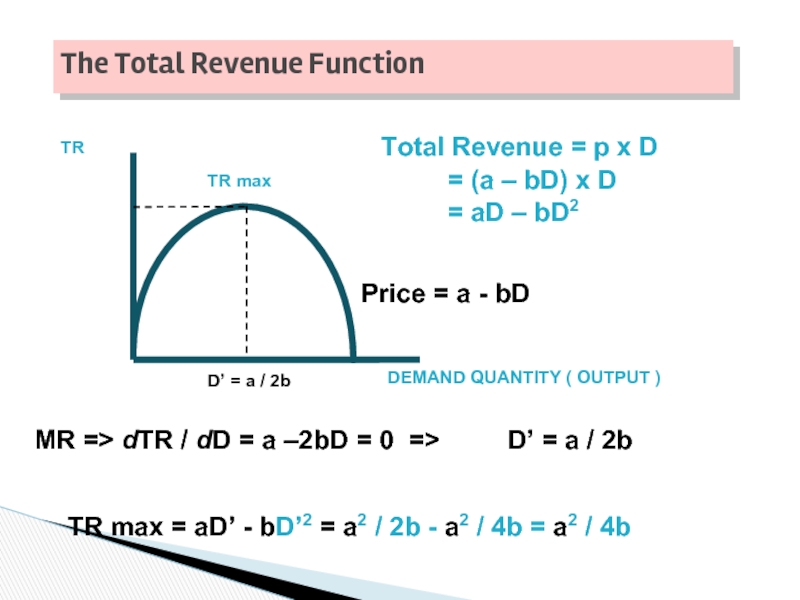

- 29. TR Total Revenue = p

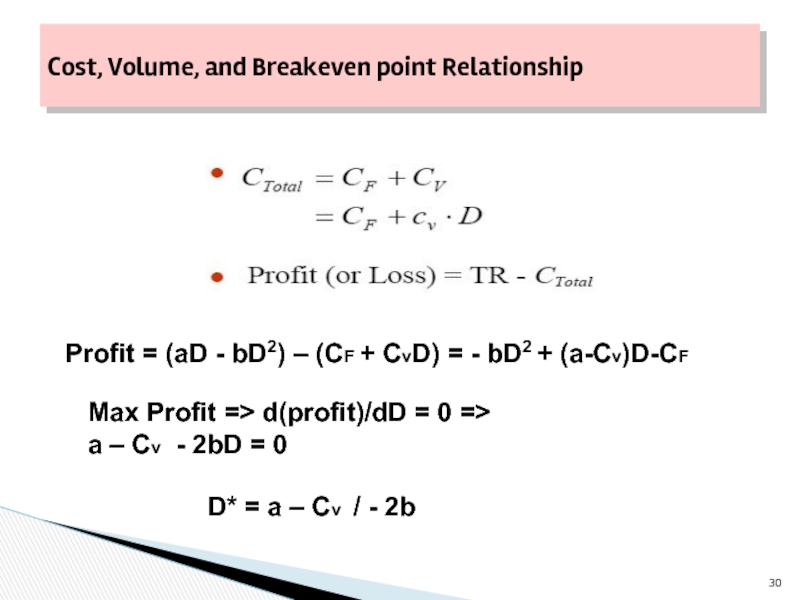

- 30. Cost, Volume, and Breakeven point Relationship Profit

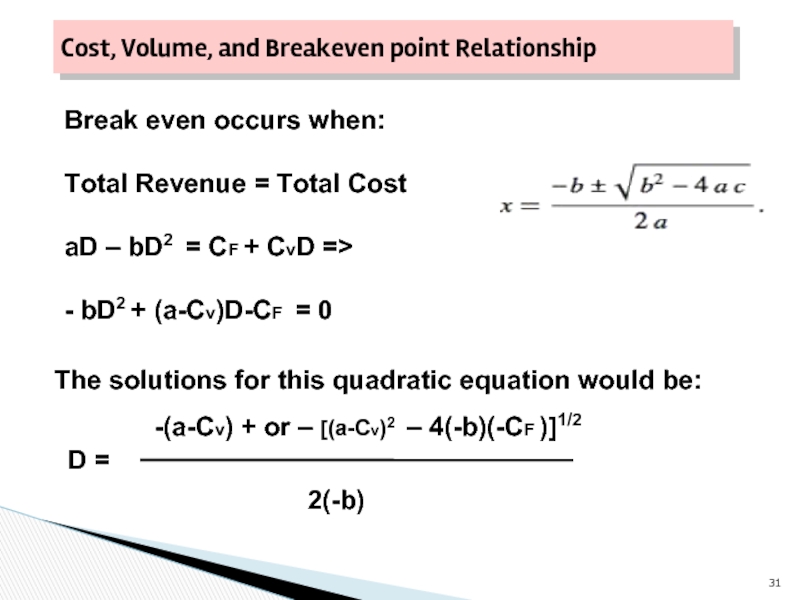

- 31. Cost, Volume, and Breakeven point Relationship Break

- 32. Cost, Volume, and Breakeven point Relationship Scenario 1: demand is a function of price.

- 33. PRICE DEMAND QUANTITY (OUTPUT) Price equals some

- 34. Cost / Revenue Quantity ( Output )

- 35. Example 2.6 A Company produces an electronic

- 36. Solution d(profit) / dD = a

- 37. Cost, Volume, and Breakeven point Relationship Scenario

- 38. Engineers must maintain a life-cycle (“cradle to

- 39. Determine optimal value for a certain alternative’s

- 40. Fixed cost(s) Cost(s) that vary directly with

- 41. Identify primary cost-driving design variable Write

- 42. When alternatives for accomplishing a

- 43. Total Cost in Material Selection In many

- 44. Make Versus Purchase (Outsourcing) Studies A company

- 45. Make Versus Purchase (Outsourcing) Studies Opportunity

- 46. Lumber put through the planer increases in

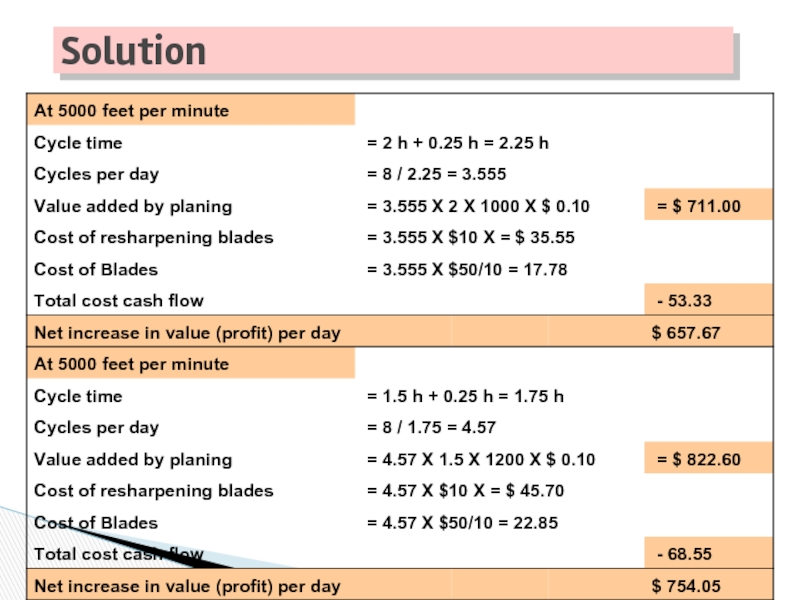

- 47. Solution

Слайд 1Cost Classification and Design Economics

Lecture 2; Chapter 2

AMERICAN UNIVERSITY OF

IE340-ENGINEERING ECONOMICS

SPRING SEMESTER, 2017

Слайд 2This course is concerned with making good economic decisions in engineering

These

Managers

Accountants

Etc.

You need to be able to communicate with these people, so you need a common language

Introduction

Слайд 3One of the important parts of economic decision is identification of

Several cost situations occur frequently

People have developed terms to describe these

You need to know these terms to

Understand what others are saying to you

Be able to persuade others that you know what you’re doing and therefore should be listened to

Introduction (cont.)

Слайд 5

People’s services (labor)

Materials and supplies

Raw materials used to make their final

Indirect materials (lubrication oil, etc.)

Electric power and other energy inputs

Capital (money), which is used to pay for:

Land and buildings

Producer goods (e.g., tools, equipment)

Taxes

What Inputs Do They Use?

Слайд 6

Most operating organizations’ costs can be summarized under two headings

Direct costs

Overhead

Of these, overhead costs are often the most complicated and troublesome

Cost classification (direct and overhead)

Слайд 7

Most common direct costs: material & labor

These are costs that:

Can be

Can be conveniently allocated to a particular category (e.g. a product or service)

Examples:

Cost of steel used for making bolts

Salary of a nurse on cardiac surgery ward

Direct costs

Слайд 8

Costs that cannot be traced directly to a particular product/service, because

Examples:

Depreciation, taxes, insurance, maintenance; electricity; general repairs; common tools

Supervisors, engineers, and other administrative/clerical personnel

Can also include materials and labor for inspection, testing, etc.

Overhead (indirect) costs

Слайд 9Standard Costs

Representative costs per unit of output established before the good

They are developed from anticipated direct labor hours, materials, and overhead categories

Play an important role in cost control and other management functions

Comparing the actual cost with the standard cost

Estimating future manufacturing costs

Preparing bids on products or services requested by customers

Слайд 10The costs of doing business (typically not including depreciation)

Includes both

Examples

Materials and supplies,

wages and salaries,

fuel, water, electric power,

taxes, insurance

Operating expenses

Слайд 11The cost or total amount of investment required for getting an

Occurs only once for any given activity

Typically assumed to be paid in year 0

Typically used for capital (land, buildings, tools, equipment), not operating expenses

First Cost

Слайд 12Costs that remain constant:

Don’t vary with level of production

Examples:

Depreciation, maintenance, taxes,

Fixed costs are only relatively fixed, they may change when:

Large changes in usage of resources occur

When plant expansion or shutdown is involved

Fixed Costs

Слайд 13Costs that vary with activity level:

E.g., with number of units produced

Typically

May (or may not) remain constant per unit of product

Examples:

Materials costs, direct labor, direct electric power

Variable Costs

Слайд 14This is simply total cost divided by volume

Often called “unit cost”

Example

Here cost is purely variable (no fixed cost)

Average cost is (250 N)/N = $250

Example 2: cost is $6000 + $100 N

Average cost is $100 + 6000/N (decreases with larger N; economy of scale)

Average cost

Слайд 15

This is the cost change for making one more or one

For Example 2 (cost = $6000 + 100 N):

N = 100: cost is $16,000

N = 101: cost is $16,100

Here marginal cost is $100, but average cost (at N = 100) is $160

So average and marginal cost may differ!

Marginal (Incremental) cost

Слайд 16Let’s say:

Fixed cost is $50, variable cost is $1 per unit

(Cost equation = $50 + $1 N)

If we make 10 units:

Total cost is $60

Average cost is total cost/number of units:

$60/10=$6 per unit

Marginal cost is the extra cost (additional cost) if we increase our production by 1 unit: $1 per unit

Marginal (incremental cost):

an example

Слайд 17Marginal cost:

It is the correct value to look at in

We need to compare marginal costs to marginal benefits

In our example, marginal cost<

Marginal cost can also be > average cost

Marginal (incremental cost)

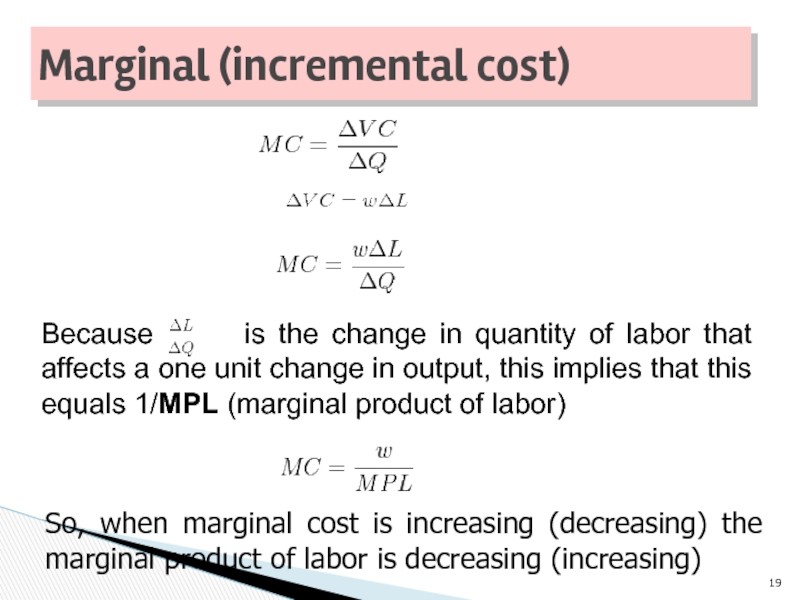

Слайд 19Because is the change in quantity of labor

So, when marginal cost is increasing (decreasing) the marginal product of labor is decreasing (increasing)

Marginal (incremental cost)

Слайд 20

Recurring are the costs that are repetitive

All variable costs are recurring,

A fixed cost can be recurring cost, e.g. Office space rental for architectural and engineering service

An example of a nonrecurring cost can be the cost of constructing a plant or purchasing a piece of land

Recurring and Nonrecurring Costs

Слайд 21

Opportunity cost is what you have to give up to get

Often expressed in dollar terms; but not always:

Opportunity cost of this lecture is 1 hour’s sleep, or more

Opportunity cost

Слайд 22Sunk costs are costs that can’t be recovered

Not the same as

Sunk costs are generally irrelevant to decision

Example:

If a firm sinks $1 million on an enterprise software installation, that cost is "sunk" because it was a one-time thing and cannot be recovered once expended.

Room painting

Sunk Costs

Слайд 23This is the total cost for a system, machine, project, etc.

Major subdivisions:

Acquisition cost

Operation cost

Maintenance cost

Life-cycle cost

Слайд 25

Based on historical data

Costs are classified into fixed, variable and semivariable

simplicity

low cost

Disadvantages:

future might not be like the past

Accounting Method

Слайд 26

Depends upon the knowledge of physical relationships (labor-hours, kw of energy,

Conjecture about the future is made on the basis of the knowledge on the capacity of equipment, capabilities of people…

Useful when historical data is unavailable

Engineering Method

Слайд 27

Uses statistical tools (from simple graphs to complex regressions)

Objective is to

The most reliable method when data is available

Statistical Method

Слайд 28PRICE

DEMAND QUANTITY (OUTPUT)

Price equals some constant value minus some multiple of

p = a - b D

a = Y-axis (quantity) intercept, (price at 0 amount demanded);

b = slope of the demand function; amount by which D increases for each unit decrease in price.

D = (a – p) / b

Neccessities, Luxuries, and Price Demand

For 0 ≤ D ≤ a/b, and a > 0, b > 0

Слайд 29

TR

Total Revenue = p x D

DEMAND QUANTITY ( OUTPUT )

The Total

= (a – bD) x D

= aD – bD2

MR => dTR / dD = a –2bD = 0 =>

D’ = a / 2b

D’ = a / 2b

TR max

TR max = aD’ - bD’2 = a2 / 2b - a2 / 4b = a2 / 4b

Price = a - bD

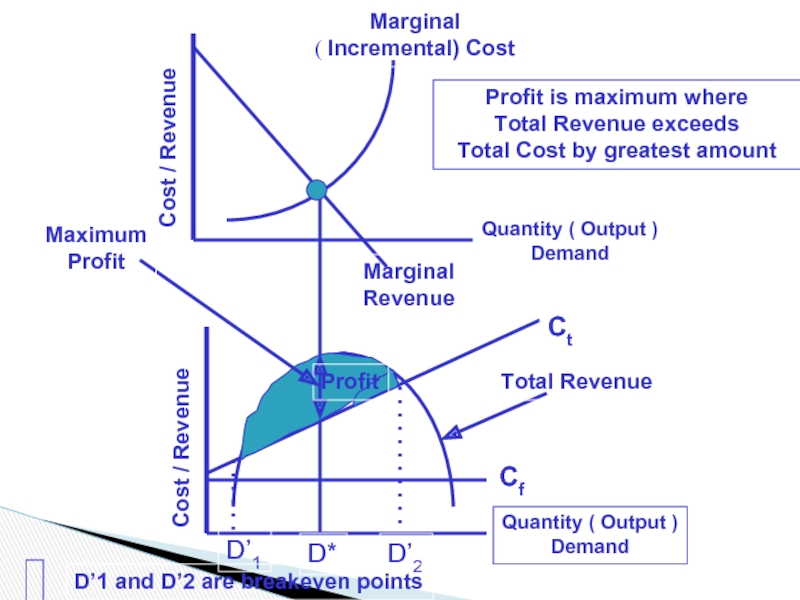

Слайд 30Cost, Volume, and Breakeven point Relationship

Profit = (aD - bD2) –

Max Profit => d(profit)/dD = 0 =>

a – Cv - 2bD = 0

D* = a – Cv / - 2b

Слайд 31Cost, Volume, and Breakeven point Relationship

Break even occurs when:

Total Revenue =

aD – bD2 = CF + CvD =>

- bD2 + (a-Cv)D-CF = 0

The solutions for this quadratic equation would be:

-(a-Cv) + or – [(a-Cv)2 – 4(-b)(-CF )]1/2

D =

2(-b)

Слайд 33PRICE

DEMAND QUANTITY (OUTPUT)

Price equals some

constant value minus some multiple

of

p = a - b D

a = Y-axis (quantity) intercept, (price at 0 amount demanded);

b = slope of the demand function;

D = (a – p) / b

PRICE

Total Revenue = p x D

= (a – bD) x D

DEMAND QUANTITY ( OUTPUT )

Слайд 34Cost / Revenue

Quantity ( Output )

Demand

Marginal

( Incremental) Cost

Cost / Revenue

Quantity

Demand

Cf

Ct

D’1

D’2

D*

Profit

Total Revenue

Maximum

Profit

Profit is maximum where

Total Revenue exceeds

Total Cost by greatest amount

D’1 and D’2 are breakeven points

Marginal

Revenue

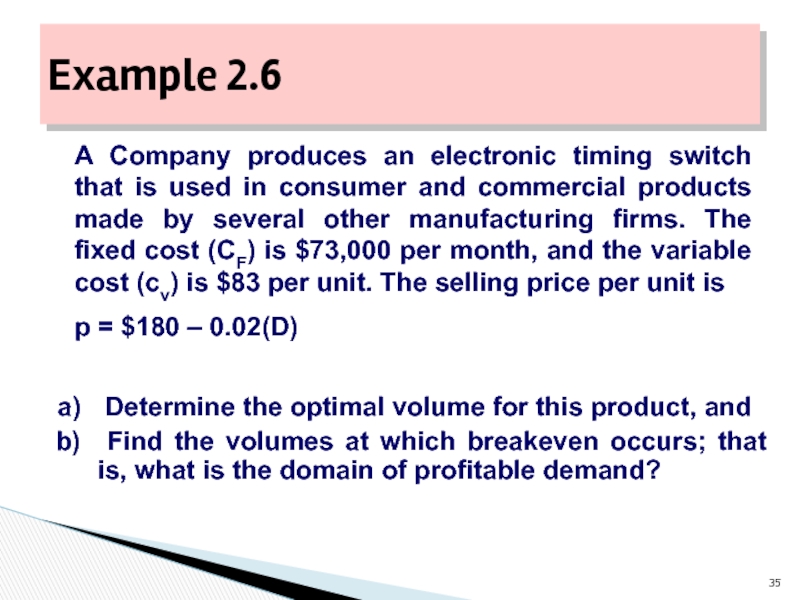

Слайд 35Example 2.6

A Company produces an electronic timing switch that is used

p = $180 – 0.02(D)

Determine the optimal volume for this product, and

Find the volumes at which breakeven occurs; that is, what is the domain of profitable demand?

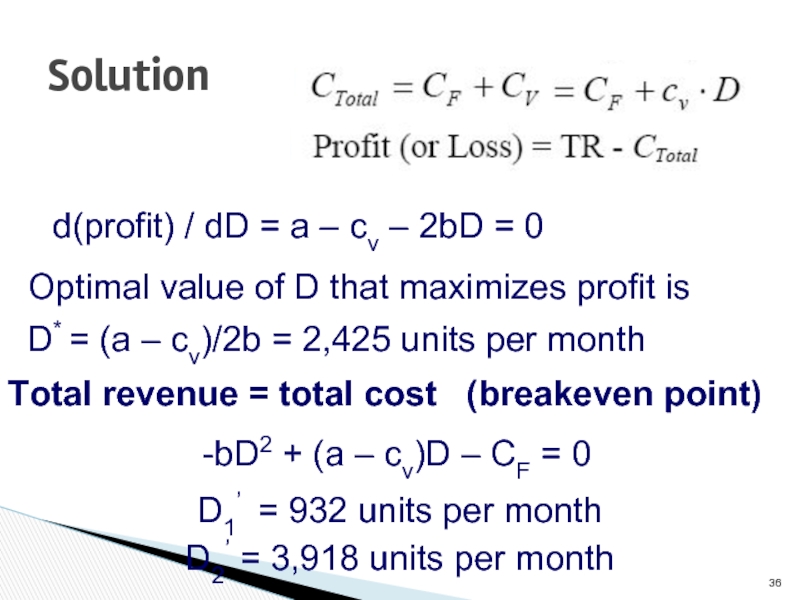

Слайд 36Solution

d(profit) / dD = a – cv – 2bD =

Optimal value of D that maximizes profit is

D* = (a – cv)/2b = 2,425 units per month

Total revenue = total cost (breakeven point)

-bD2 + (a – cv)D – CF = 0

D1’ = 932 units per month

D2’ = 3,918 units per month

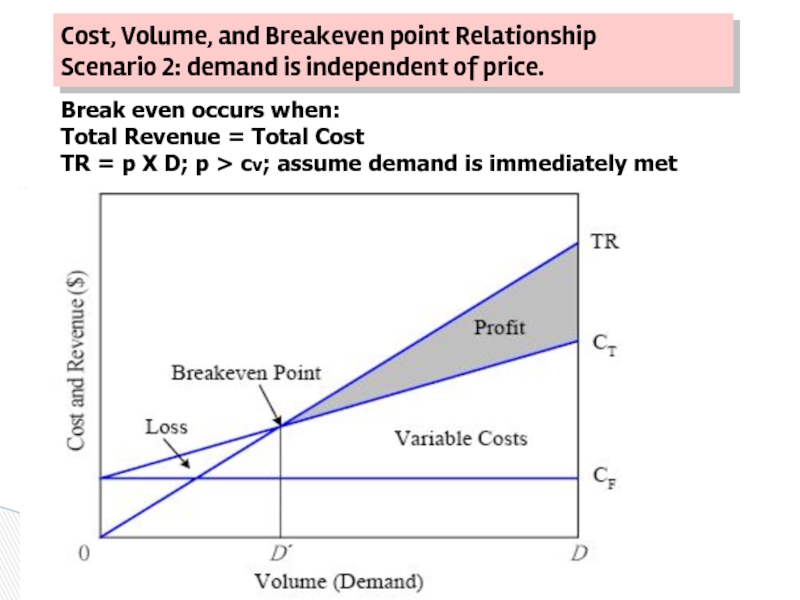

Слайд 37Cost, Volume, and Breakeven point Relationship Scenario 2: demand is independent of

Break even occurs when:

Total Revenue = Total Cost

TR = p X D; p > cv; assume demand is immediately met

Слайд 38Engineers must maintain a life-cycle (“cradle to

grave”) design perspective as they

Ensures engineers consider:

Initial investment costs

Operation and maintenance expenses

Other annual expenses in later years

Environmental and social consequences over design life

Cost driven design optimization

Design for the environment movement

This green-engineering approach has the following goals:

Prevention of waste

Improved materials selection

Reuse and recycling of resources

Слайд 39Determine optimal value for a certain alternative’s design variable

Example: what velocity

Select the best alternative, each with its own unique value for the design variable

Example: what insulation thickness is best for a home in Gyumri

Cost-driven Design Optimization Problem Tasks

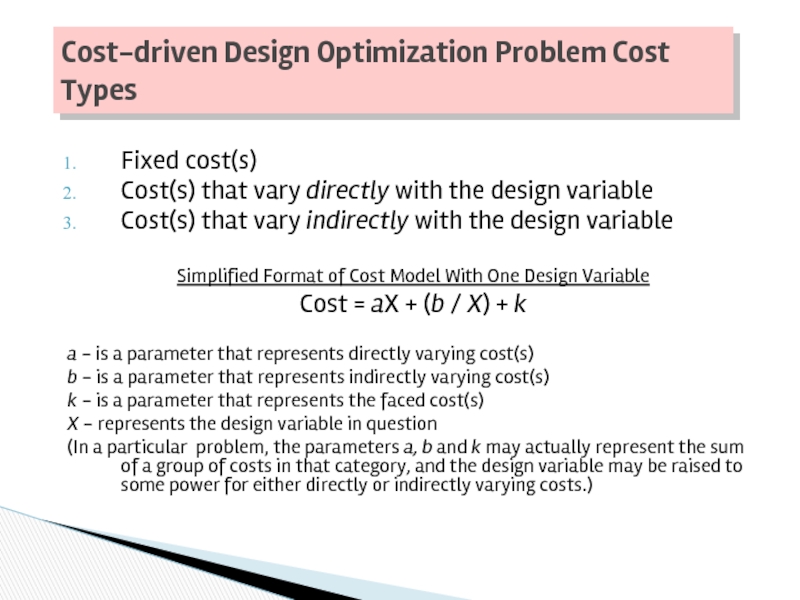

Слайд 40Fixed cost(s)

Cost(s) that vary directly with the design variable

Cost(s) that vary

Simplified Format of Cost Model With One Design Variable

Cost = aX + (b / X) + k

a - is a parameter that represents directly varying cost(s)

b - is a parameter that represents indirectly varying cost(s)

k - is a parameter that represents the faced cost(s)

X - represents the design variable in question

(In a particular problem, the parameters a, b and k may actually represent the sum of a group of costs in that category, and the design variable may be raised to some power for either directly or indirectly varying costs.)

Cost-driven Design Optimization Problem Cost Types

Слайд 41Identify primary cost-driving design variable

Write an expression for the cost model

Set first derivative of cost model with respect to continuous design variable equal to 0. (For discrete design variables, compute cost model for each discrete value over selected range).

Solve equation in step 3 for optimum value of continuous design variables

For continuous design variables, use the second derivative of the cost model with respect to the design variable to determine whether optimum corresponds to global maximum or minimum.

General Approach for Optimizing a Design With Respect to Cost

Слайд 42 When alternatives for accomplishing a task are compared for

Rules for Selecting Preferred Alternative

Rule 1 – When revenues and other economic benefits are present and vary among alternatives, choose alternative that maximizes overall profitability based on the number of defect-free units of output

Rule 2 – When revenues and economic benefits are not present or are constant among alternatives, consider only costs and select alternative that minimizes total cost per defect-free output

Present Economy Studies

Слайд 43Total Cost in Material Selection

In many cases, selection of among materials

Alternative Machine Speeds

Machines can frequently be operated at different speeds, resulting in different rates of product output. However, this usually results in different frequencies of machine downtime. Such situations lead to present economy studies to determine preferred operating speed.

Present Economy Studies

Слайд 44Make Versus Purchase (Outsourcing) Studies

A company may choose to produce an

direct, indirect or overhead costs are incurred regardless of whether the item is purchased from an outside supplier, and

The incremental cost of producing the item in the short run is less than the supplier’s price.

The relevant short-run costs of the make versus purchase decisions are the incremental costs incurred and the opportunity costs of resources

Present Economy Studies

Слайд 45Make Versus Purchase (Outsourcing) Studies

Opportunity costs may become significant when in-house

In the long run, capital investments in additional manufacturing plant and capacity are often feasible alternatives to outsourcing.

Present Economy Studies

Слайд 46Lumber put through the planer increases in value by $0.10 per

At what speed should the planer be operated?

At what speed should it be operated when only one job requiring 6,000 board-feet of planing is considered.

Example 2.13 – Best Operating Speed