- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

SCP case study: The American agriculture industry презентация

Содержание

- 1. SCP case study: The American agriculture industry

- 2. SCP case study: The American agriculture industry

- 3. Introduction High correlation between the fraction of

- 4. Structure – Supply and demand Farmers must

- 5. Structure – Supply and demand Demand for

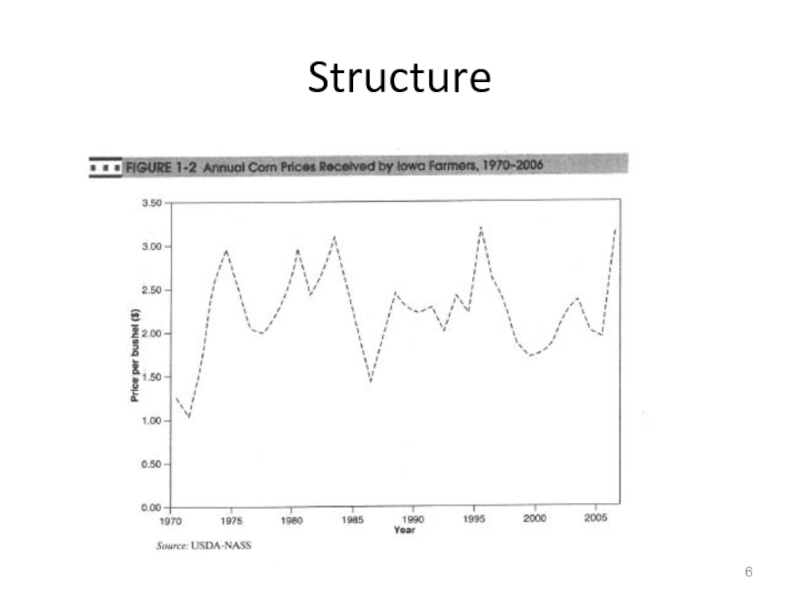

- 6. Structure

- 7. Structure Short-run supply is inelastic, but easy

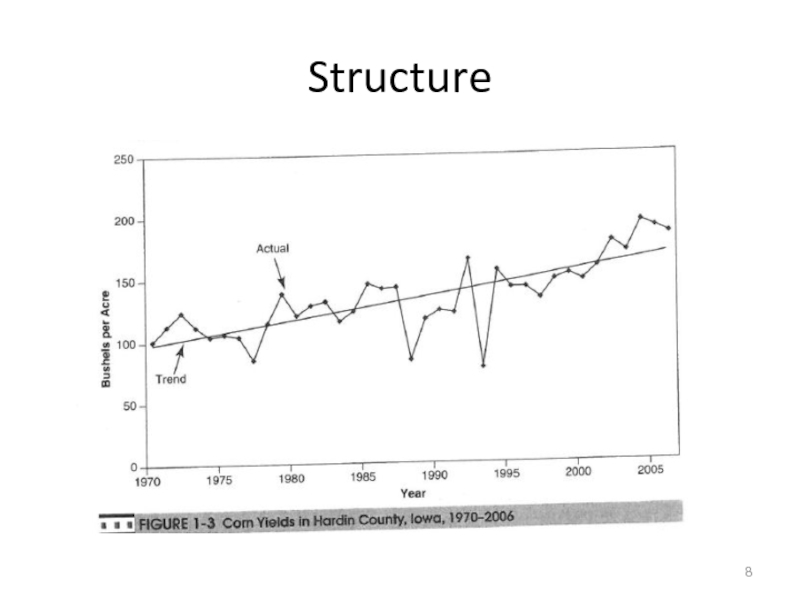

- 8. Structure

- 9. Trends in US farm structure The number

- 10. Trends in US farm structure Sharp restructuring

- 11. Family farms, profits and household income, 2003

- 12. Variation in profitability Considerable variation in profitability,

- 13. Structure: commodity markets Farmers are price takers

- 14. Vertical linkages A large share of farmers

- 15. Conduct: Farmer cooperatives Farmers are price

- 16. Conduct: Farmer cooperatives Farmers seek pricing

- 17. Performance High rates of agricultural productivity growth

- 18. Performance Total factor productivity accounts for the

- 19. Sources of technological change/innovations in agriculture Equipment:

- 20. Sources of technological change/innovations in agriculture Farmers

- 21. Overall performance over time More efficient production

- 22. Revision

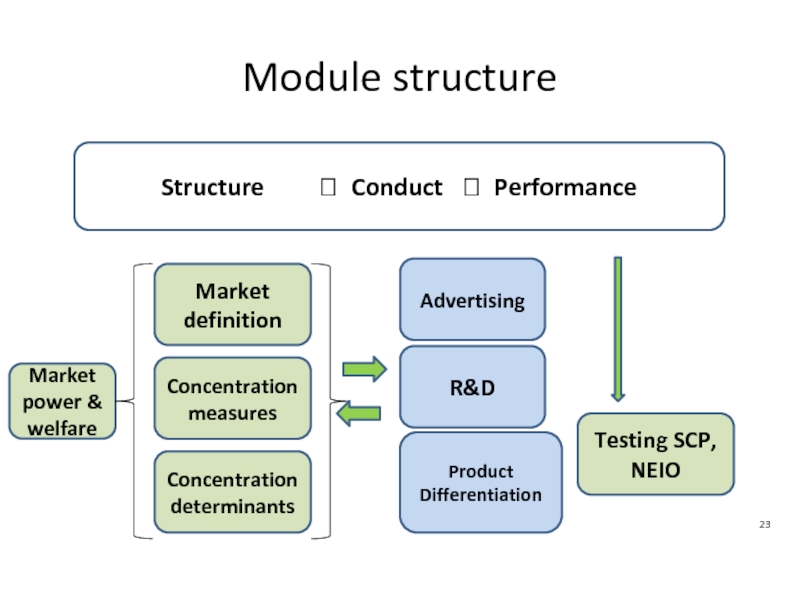

- 23. Module structure Structure

- 24. Structure ? Conduct

- 25. Structure ? Conduct

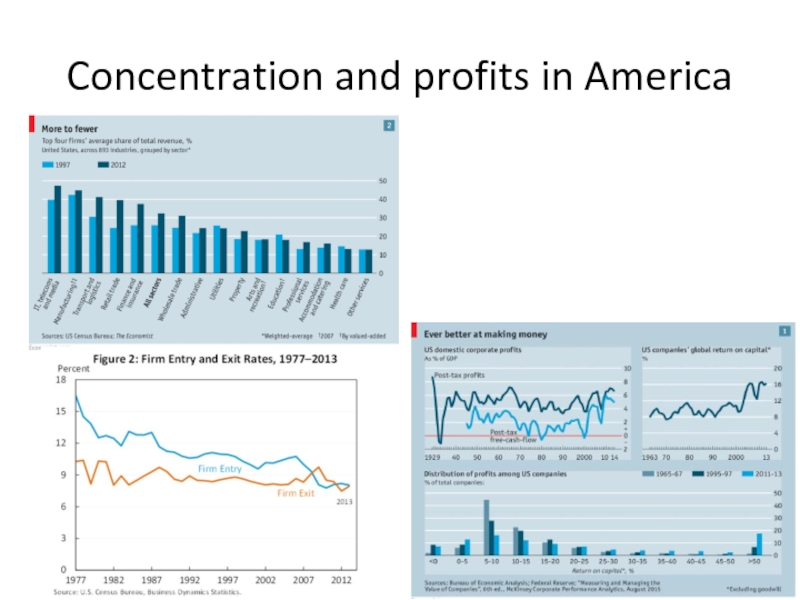

- 26. Concentration and profits in America

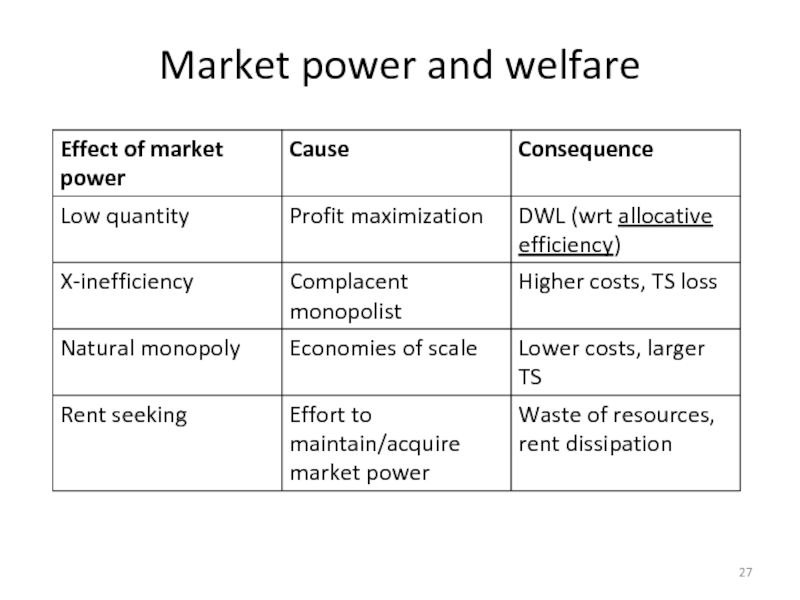

- 27. Market power and welfare

- 28. Market power and welfare Application to internet

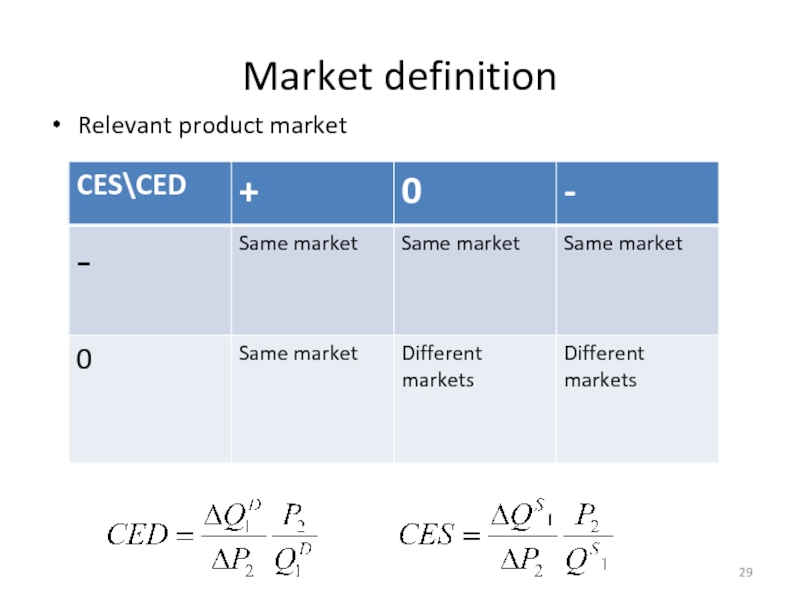

- 29. Market definition Relevant product market

- 30. Market definition Relevant geographic market CED and

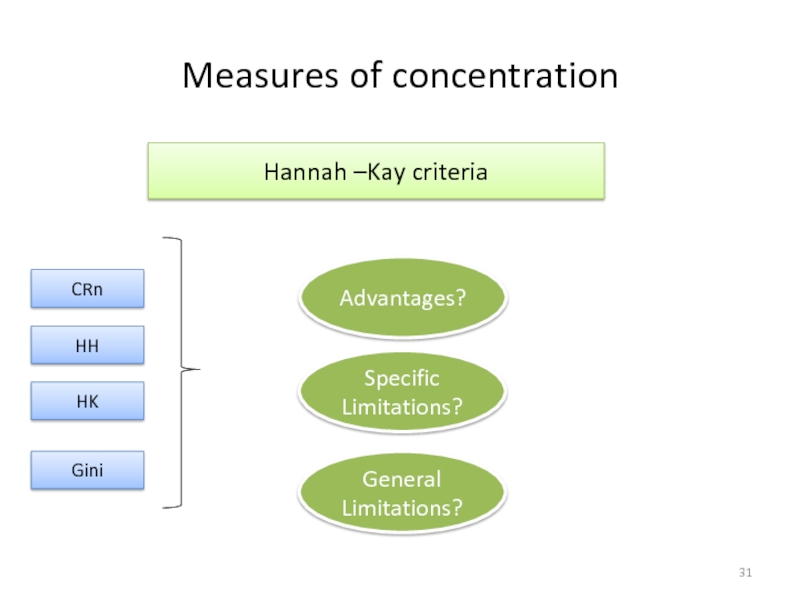

- 31. Measures of concentration Hannah –Kay criteria CRn

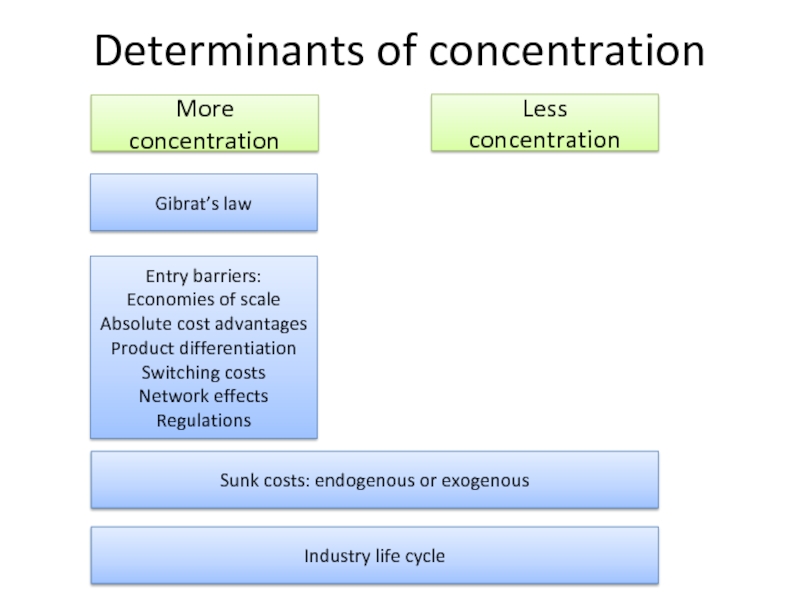

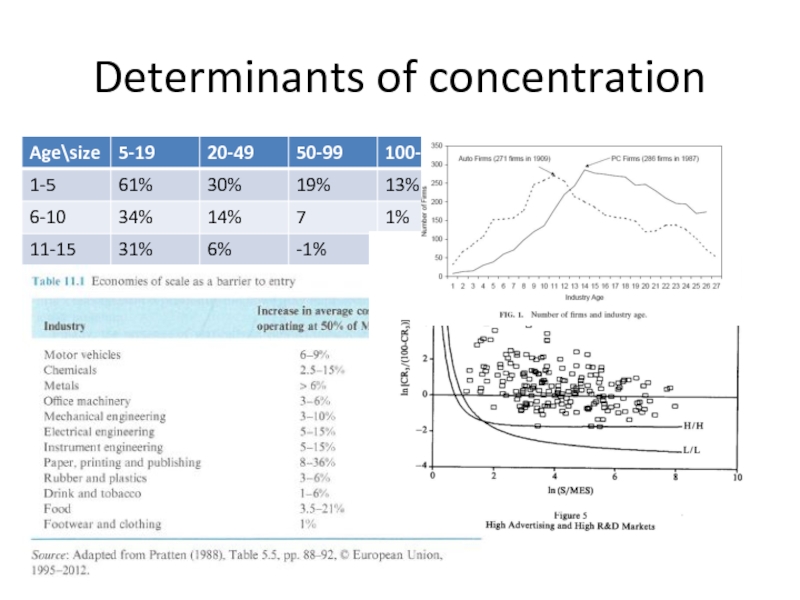

- 32. Determinants of concentration More concentration Less

- 33. Determinants of concentration

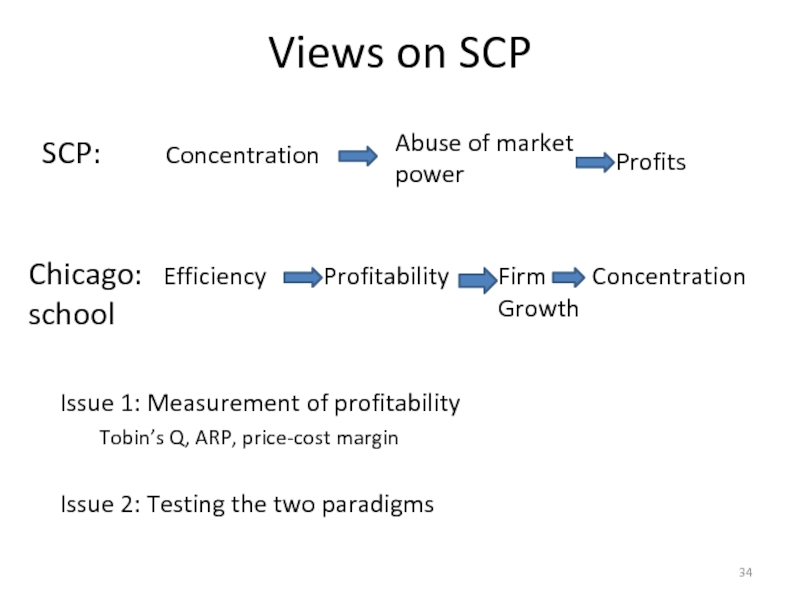

- 34. Views on SCP Abuse of market

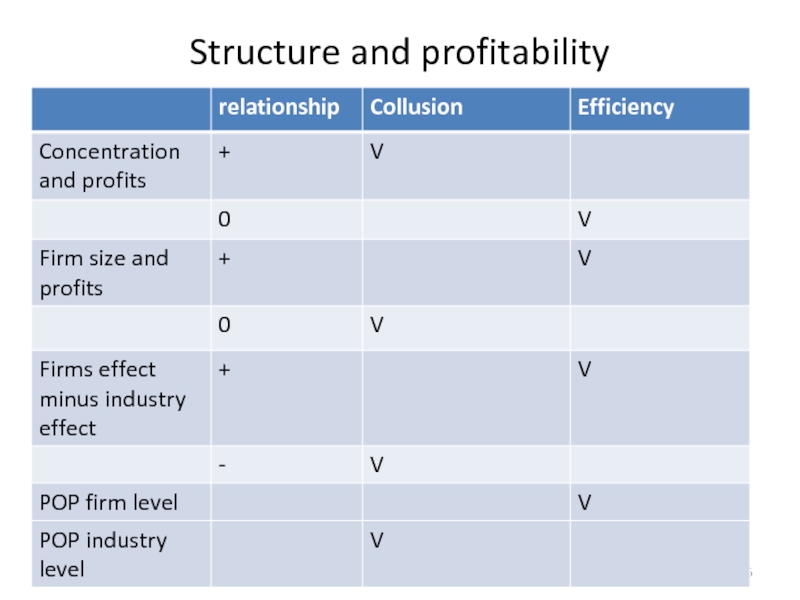

- 35. Structure and profitability

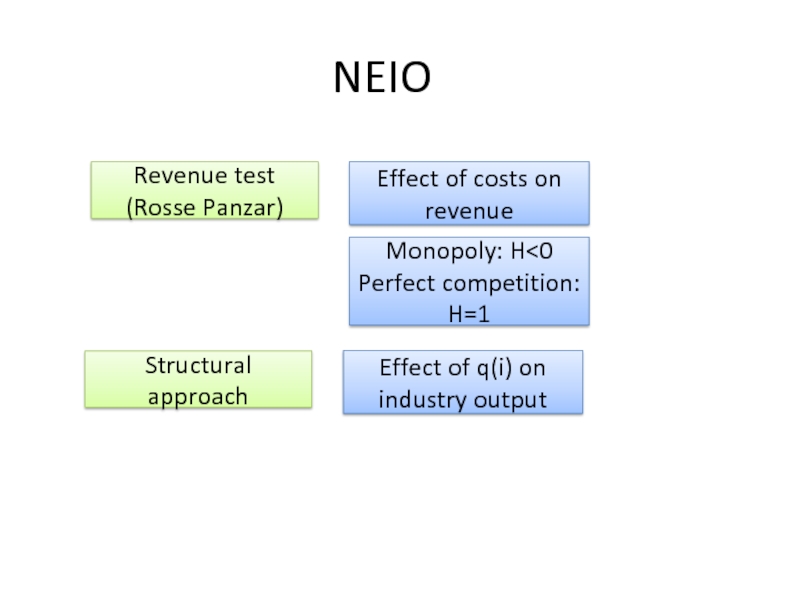

- 36. NEIO Revenue test (Rosse Panzar) Monopoly: H

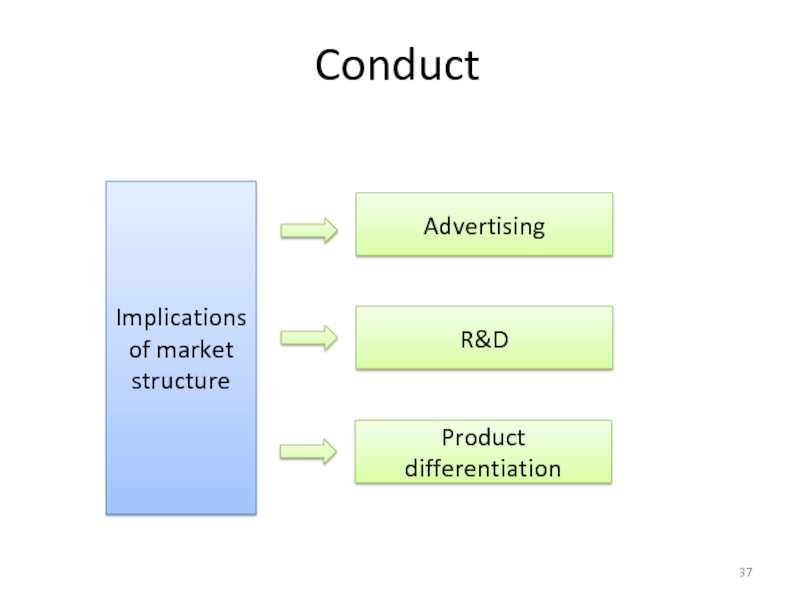

- 37. Conduct Implications of market structure Advertising R&D Product differentiation

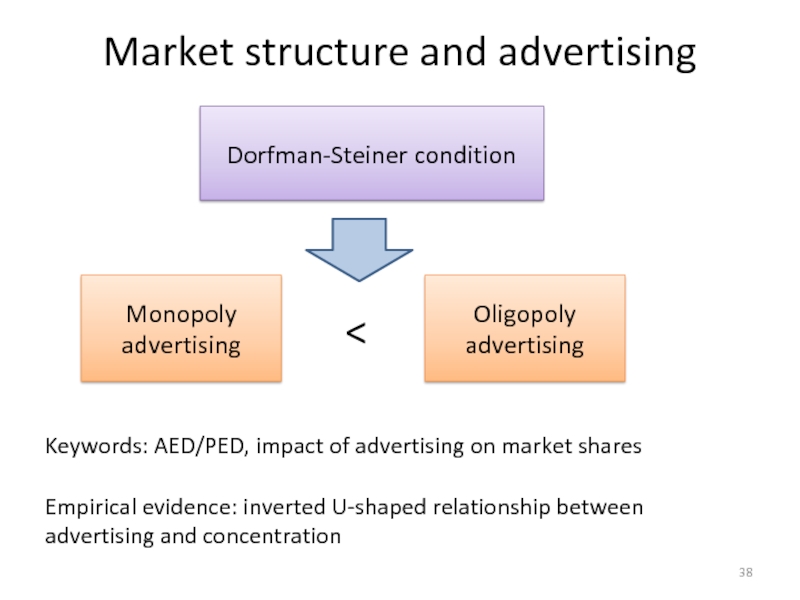

- 38. Market structure and advertising Dorfman-Steiner condition Monopoly advertising

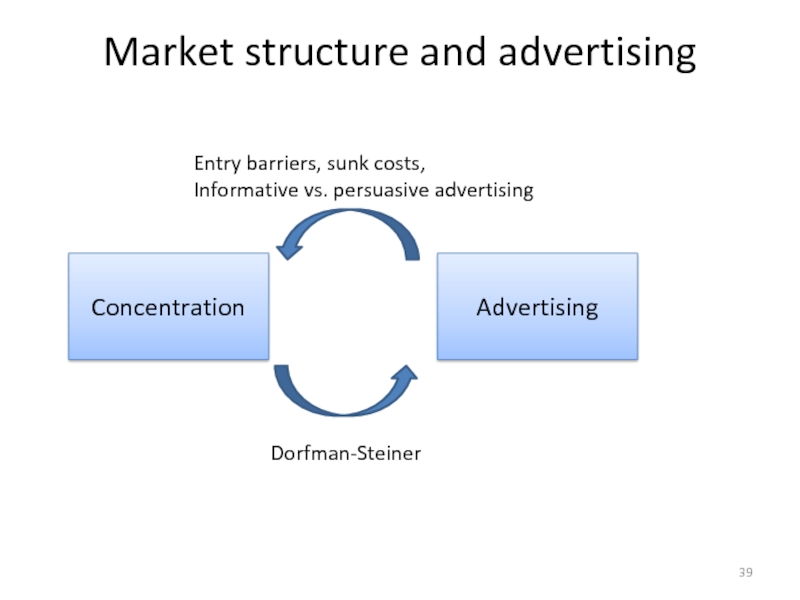

- 39. Market structure and advertising Concentration Advertising Dorfman-Steiner

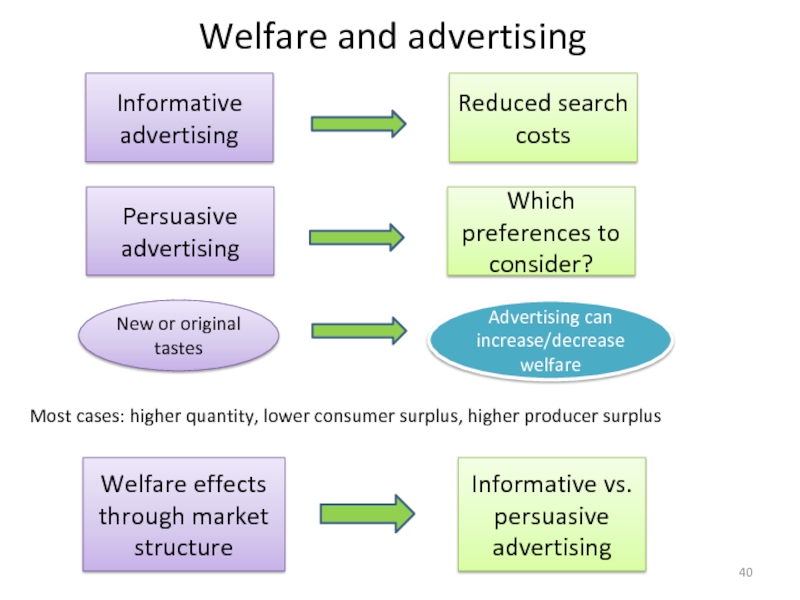

- 40. Welfare and advertising Persuasive advertising Which

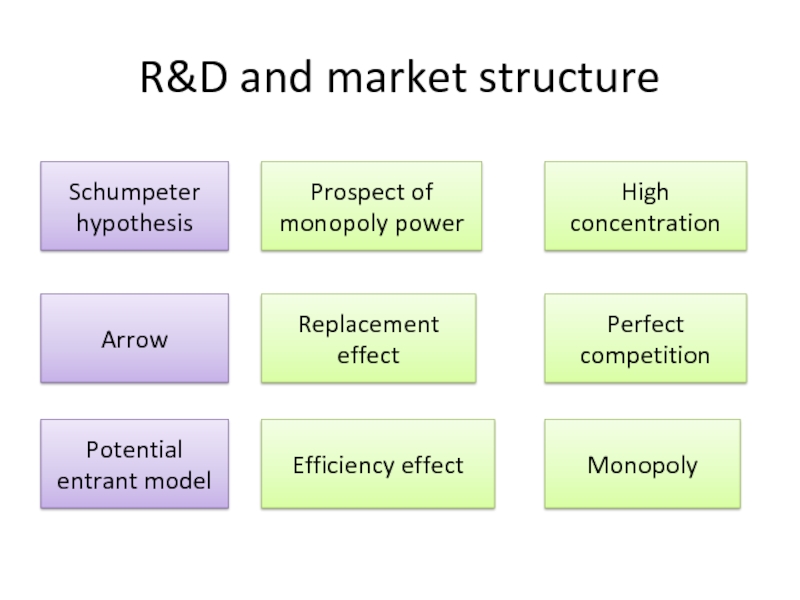

- 41. R&D and market structure Schumpeter hypothesis Prospect

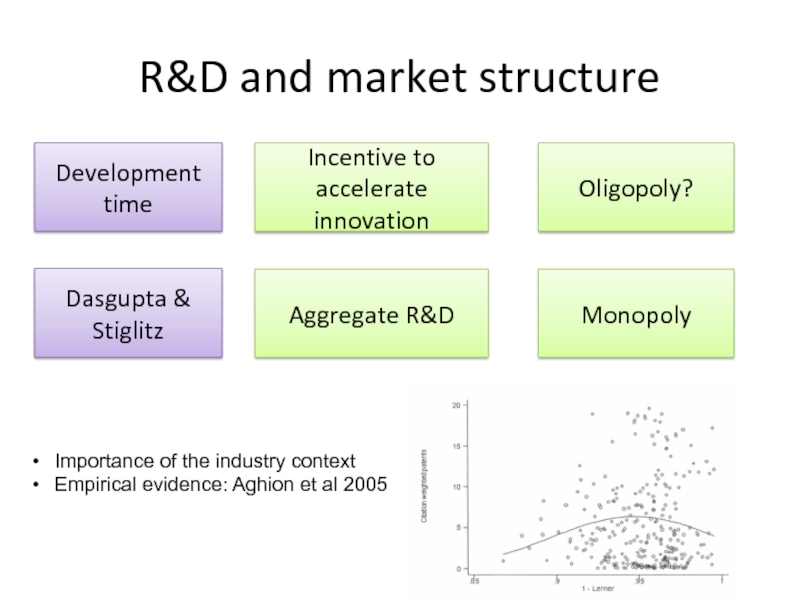

- 42. R&D and market structure Development time Incentive

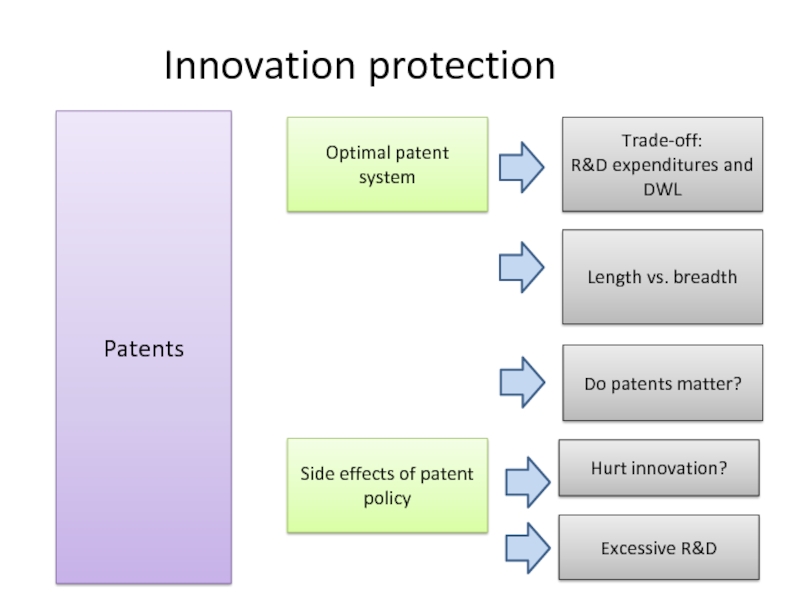

- 43. Innovation protection Patents Optimal patent system

- 44. Product differentiation Sources of differentiation Geography Technology

- 45. Exam structure 1.5 hour Secton A: Answer

- 46. Do not reproduce prepared essays without regard

- 47. Good Practice Use examples whenever possible to

- 48. More Good Practice Label graph axes etc.

- 49. Bullet Points Answers? Reproducing bullet points does

- 50. Final Considerations Where contradictory arguments exist, it

Слайд 3Introduction

High correlation between the fraction of labor force engaged in agriculture

In poor nations, 50-80% work in agriculture

In rich countries, 2-4% work in agriculture

Unique organization: Farms are mostly family-owned, rather than publicly listed firms.

Farms typically operate as price takers.

Productivity growth in US agriculture has exceeded that in the rest of the economy

Слайд 4Structure – Supply and demand

Farmers must make substantial investments before production

Investments cannot be adjusted in the short run → inelastic short-run supply

Supply can shift unexpectedly due to weather and disease conditions

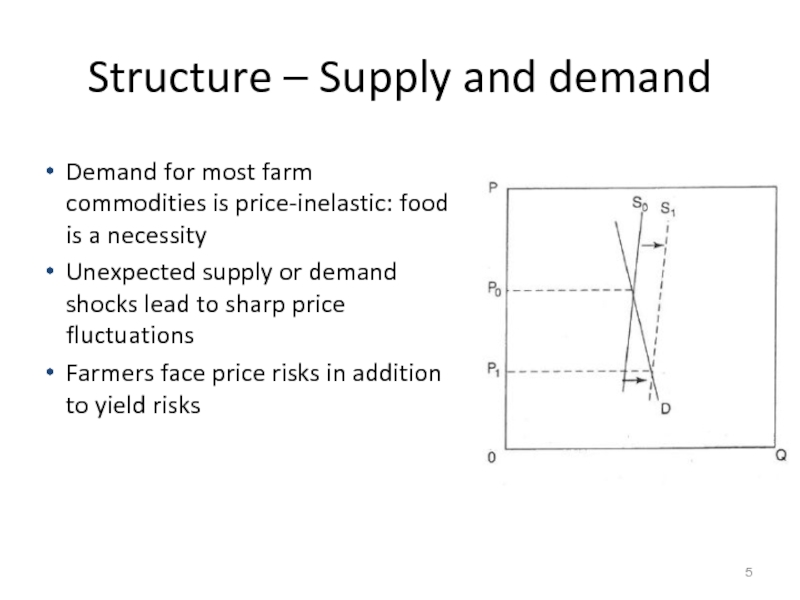

Слайд 5Structure – Supply and demand

Demand for most farm commodities is price-inelastic:

Unexpected supply or demand shocks lead to sharp price fluctuations

Farmers face price risks in addition to yield risks

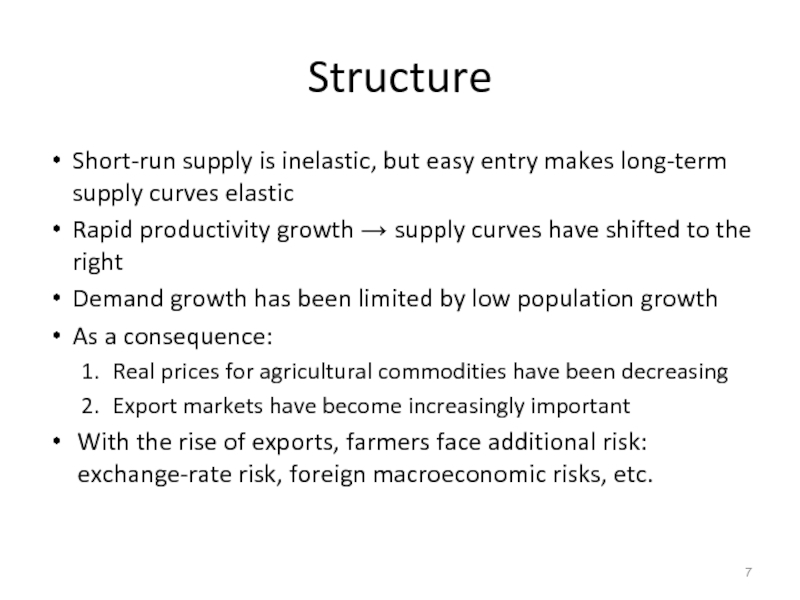

Слайд 7Structure

Short-run supply is inelastic, but easy entry makes long-term supply curves

Rapid productivity growth → supply curves have shifted to the right

Demand growth has been limited by low population growth

As a consequence:

Real prices for agricultural commodities have been decreasing

Export markets have become increasingly important

With the rise of exports, farmers face additional risk: exchange-rate risk, foreign macroeconomic risks, etc.

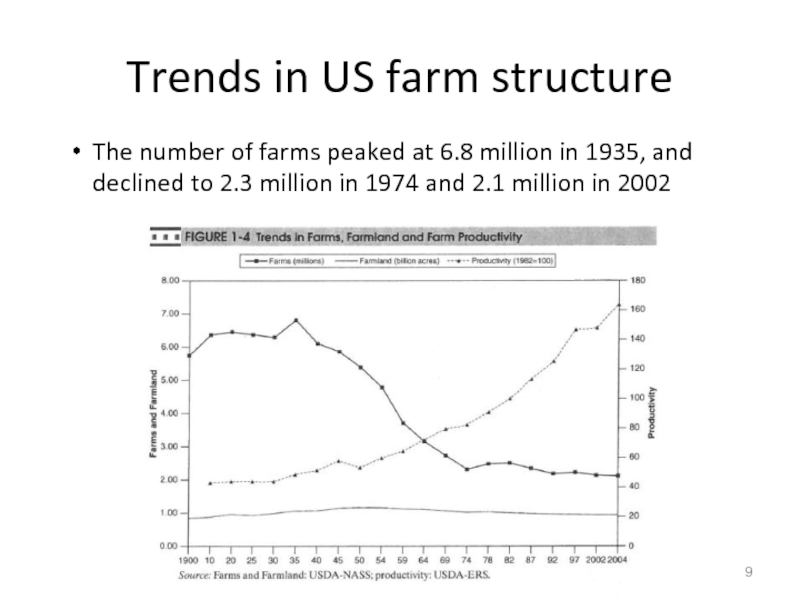

Слайд 9Trends in US farm structure

The number of farms peaked at 6.8

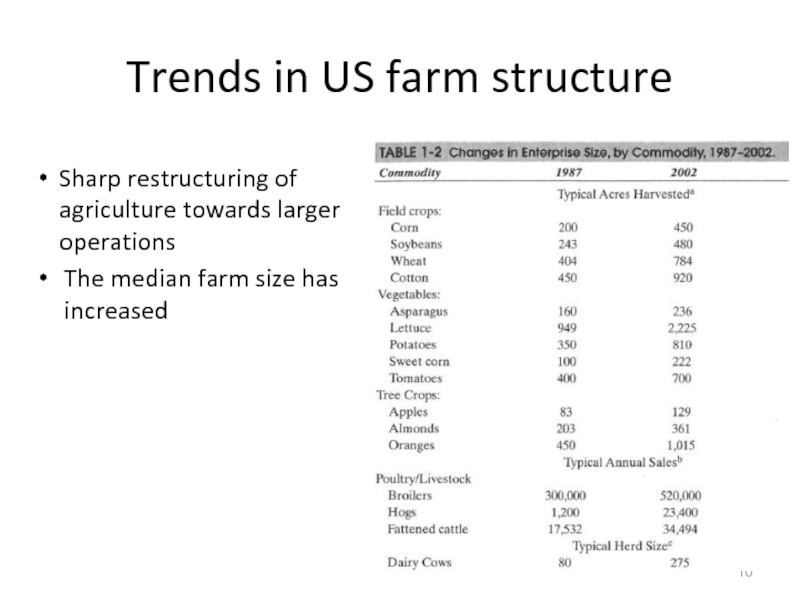

Слайд 10Trends in US farm structure

Sharp restructuring of agriculture towards larger operations

The

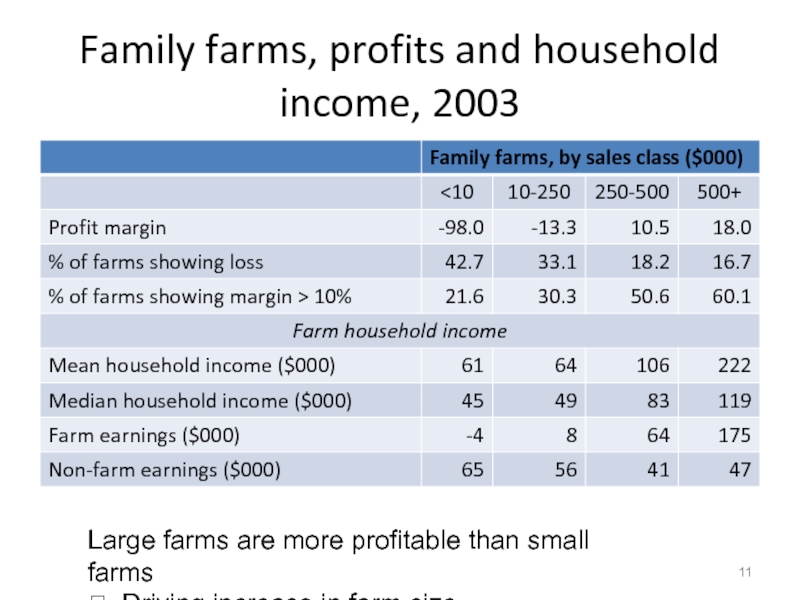

Слайд 11Family farms, profits and household income, 2003

Large farms are more profitable

? Driving increase in farm size

Слайд 12Variation in profitability

Considerable variation in profitability, many small farms remain profitable:

Risk

Skill disparities

Product innovation by small farms → niche markets through marketing, special products (kiwi fruit, tofu-variety soybeans etc.) and/or special product attributes (free-range chicken, organic vegetables etc.)

Слайд 13Structure: commodity markets

Farmers are price takers in almost all commodity markets

The

Sources of monopsony power:

High nationwide concentration (e.g. packers of fed cattle CR4 = 80%)

High transport costs (e.g. fed cattle are shipped less than 160 km → regional monopsony even if there are several national buyers)

Perishability (e.g. livestock lose value when they are stored beyond their optimal weight → time-constrained search for better deals)

Specialization (e.g. a buyer’s demand causes a farm to plant a highly specific variety tailored to the buyer’s request → asset specificity)

Asymmetric information (buyers make hundreds of deals per day; sellers make a few deals per year)

Слайд 14Vertical linkages

A large share of farmers rely on long-term contracts with

Long-term contracts are more common when farmers face perishability and transport cost problems (→ fewer potential buyers)

Prices may be set by the contract, and shift the risk price fluctuations

Слайд 15Conduct: Farmer cooperatives

Farmers are price takers, but they buy from

Inputs: machinery, seed, petroleum, pesticide…

Industries processing farm commodities are increasingly concentrated.

Слайд 16Conduct: Farmer cooperatives

Farmers seek pricing power by organizing cooperatives →

Cooperatives have little market power over consumers, but are sometimes effective in countering the monopoly power suppliers and the monopsony of buyers.

Because farmers are price takers, they are allowed to sell through cooperatives, violating the Sherman Act.

Most cooperatives do not differentiate their products.

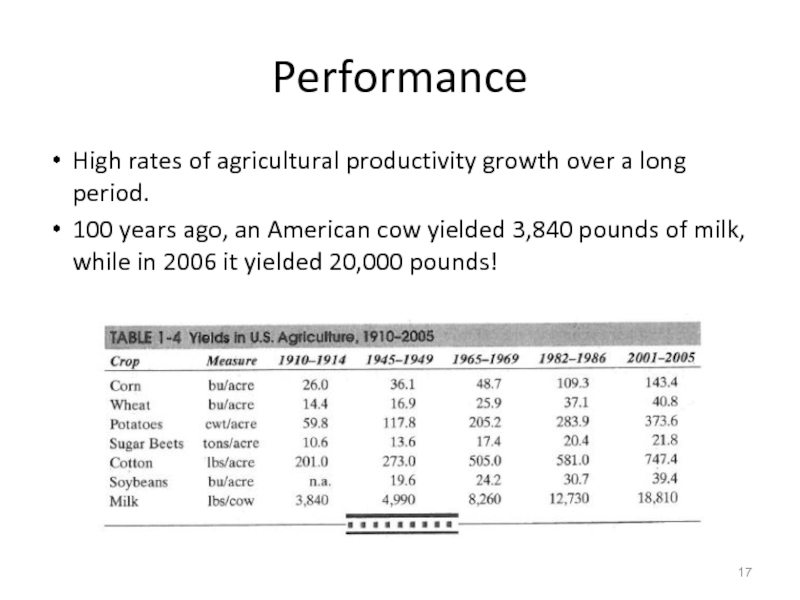

Слайд 17Performance

High rates of agricultural productivity growth over a long period.

100 years

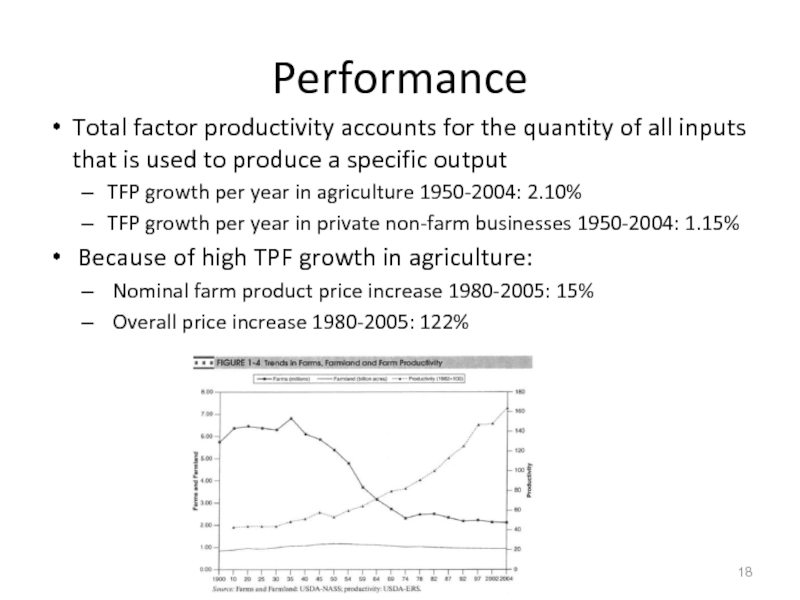

Слайд 18Performance

Total factor productivity accounts for the quantity of all inputs that

TFP growth per year in agriculture 1950-2004: 2.10%

TFP growth per year in private non-farm businesses 1950-2004: 1.15%

Because of high TPF growth in agriculture:

Nominal farm product price increase 1980-2005: 15%

Overall price increase 1980-2005: 122%

Слайд 19Sources of technological change/innovations in agriculture

Equipment: mechanical power replaced human/animal power;

Chemicals: Chemical fertilizers replaced pesticides, herbicides and fungicides improved the control of weeds and diseases …

Genetics: Plant breeding research created higher-yielding plants with better survival traits; livestock and poultry genetics have caused increased meat yields per animal …

Слайд 20Sources of technological change/innovations in agriculture

Farmers rarely develop the innovations themselves.

Early adopters of a technology derive only temporary benefits. Cost reductions increase supply, driving down prices.

Слайд 21Overall performance over time

More efficient production over time.

Larger farms have tended

The real prices of most food products have decreased over time, which is partly due to process innovation in farming

Слайд 23Module structure

Structure ? Conduct

Market definition

Concentration measures

Concentration determinants

Testing SCP, NEIO

Advertising

R&D

Market power & welfare

Product Differentiation

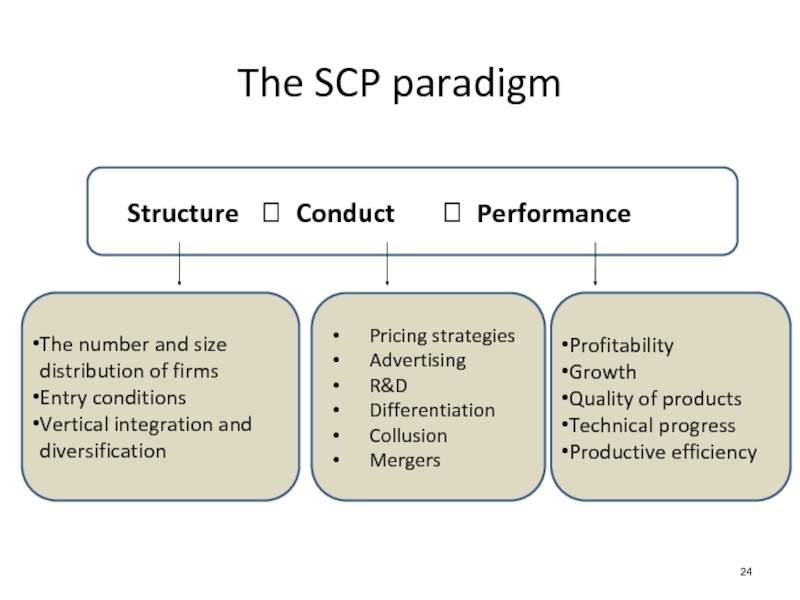

Слайд 24

Structure ? Conduct ? Performance

The SCP paradigm

The number

Entry conditions

Vertical integration and diversification

Pricing strategies

Advertising

R&D

Differentiation

Collusion

Mergers

Profitability

Growth

Quality of products

Technical progress

Productive efficiency

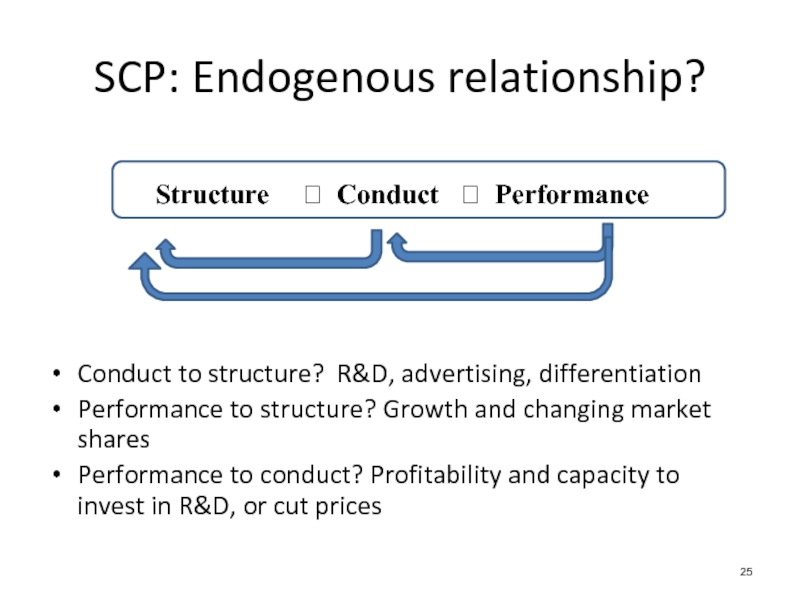

Слайд 25

Structure ? Conduct ? Performance

Conduct to structure? R&D,

Performance to structure? Growth and changing market shares

Performance to conduct? Profitability and capacity to invest in R&D, or cut prices

SCP: Endogenous relationship?

Слайд 28Market power and welfare

Application to internet monopolies

Does the internet favour such

Are digital monopolies less harmful than traditional monopolies?

Слайд 30Market definition

Relevant geographic market

CED and CES analysis

Limitations of market definition

Market definition

Critical values of CED, CES?

Importance of market definition

Слайд 31Measures of concentration

Hannah –Kay criteria

CRn

HH

HK

Gini

Advantages?

General Limitations?

Specific Limitations?

Слайд 32Determinants of concentration

More concentration

Less

concentration

Sunk costs: endogenous or exogenous

Industry life cycle

Gibrat’s

Entry barriers:

Economies of scale

Absolute cost advantages

Product differentiation

Switching costs

Network effects

Regulations

Слайд 34Views on SCP

Abuse of market

power

Concentration

Profits

Efficiency

Profitability

Firm

Growth

Concentration

SCP:

Chicago:

school

Issue 1: Measurement of profitability

Tobin’s

Issue 2: Testing the two paradigms

Слайд 38Market structure and advertising

Dorfman-Steiner condition

Monopoly advertising

Empirical evidence: inverted U-shaped relationship between advertising and concentration

Слайд 39Market structure and advertising

Concentration

Advertising

Dorfman-Steiner

Entry barriers, sunk costs,

Informative vs. persuasive advertising

Слайд 40Welfare and advertising

Persuasive advertising

Which preferences to consider?

Advertising can increase/decrease welfare

New

Most cases: higher quantity, lower consumer surplus, higher producer surplus

Informative advertising

Reduced search costs

Welfare effects through market structure

Informative vs. persuasive advertising

Слайд 41R&D and market structure

Schumpeter hypothesis

Prospect of monopoly power

Arrow

Replacement effect

High concentration

Perfect competition

Potential

Efficiency effect

Monopoly

Слайд 42R&D and market structure

Development time

Incentive to accelerate innovation

Oligopoly?

Dasgupta & Stiglitz

Aggregate R&D

Monopoly

Importance

Empirical evidence: Aghion et al 2005

Слайд 43Innovation protection

Patents

Optimal patent system

Trade-off:

R&D expenditures and DWL

Length vs. breadth

Side effects of

Hurt innovation?

Excessive R&D

Do patents matter?

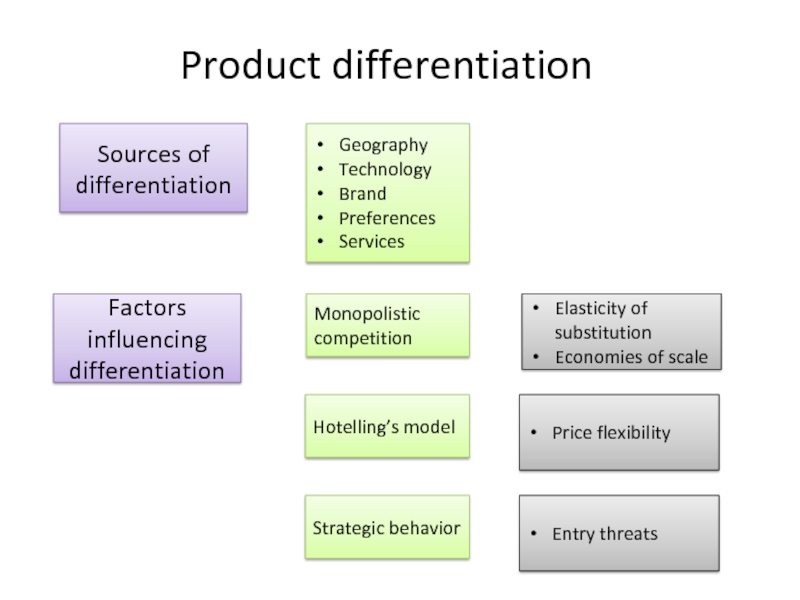

Слайд 44Product differentiation

Sources of differentiation

Geography

Technology

Brand

Preferences

Services

Factors influencing differentiation

Monopolistic competition

Elasticity of substitution

Economies of scale

Hotelling’s

Price flexibility

Strategic behavior

Entry threats

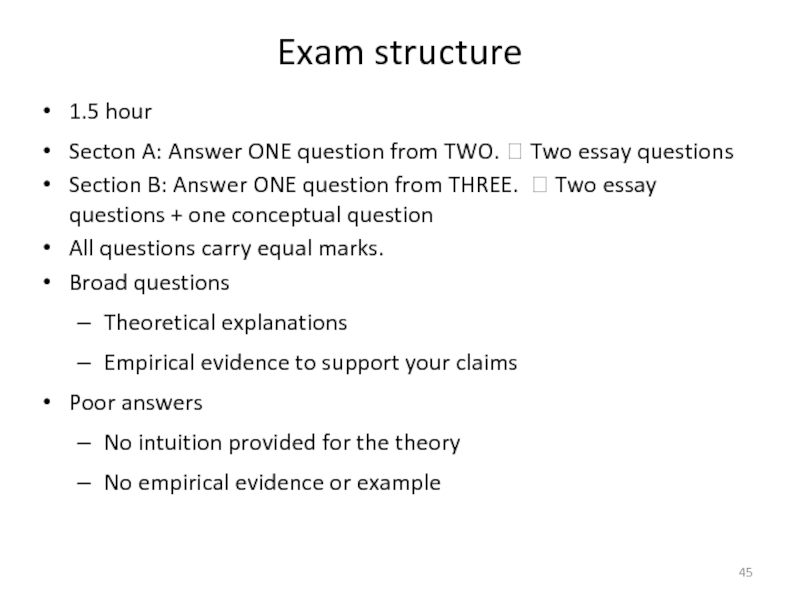

Слайд 45Exam structure

1.5 hour

Secton A: Answer ONE question from TWO. ? Two

Section B: Answer ONE question from THREE. ? Two essay questions + one conceptual question

All questions carry equal marks.

Broad questions

Theoretical explanations

Empirical evidence to support your claims

Poor answers

No intuition provided for the theory

No empirical evidence or example

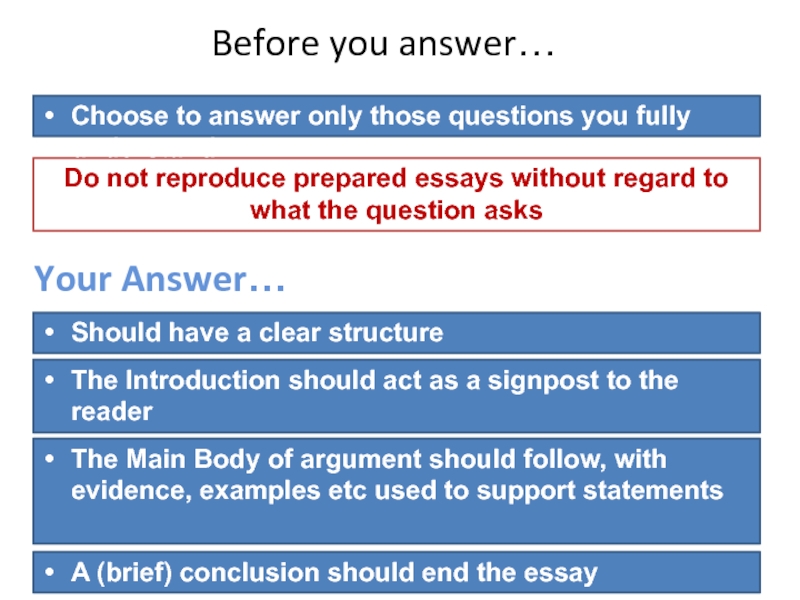

Слайд 46Do not reproduce prepared essays without regard to what the question

Before you answer…

Choose to answer only those questions you fully understand

Your Answer…

The Main Body of argument should follow, with evidence, examples etc used to support statements

Should have a clear structure

The Introduction should act as a signpost to the reader

A (brief) conclusion should end the essay

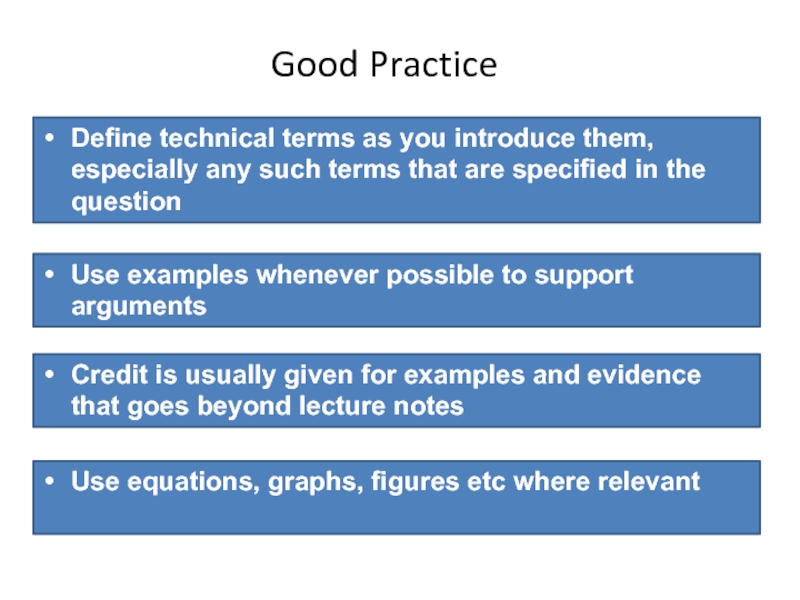

Слайд 47Good Practice

Use examples whenever possible to support arguments

Define technical terms as

Credit is usually given for examples and evidence that goes beyond lecture notes

Use equations, graphs, figures etc where relevant

Слайд 48More Good Practice

Label graph axes etc.

Explain diagrammes or figures

Equations/figures etc that

There is no need to do a list of references

Слайд 49Bullet Points Answers?

Reproducing bullet points does not constitute a good answer,

Try to write a coherent explanation

If you really run out of time on the last question, brief notes indicating how the answer should have developed may help.

Слайд 50Final Considerations

Where contradictory arguments exist, it may be useful to indicate

Personal opinions are fine, but cover the received views first.

![Structure – Supply and demandFarmers must make substantial investments before production starts [sunk costs]Investments cannot](/img/tmb/3/256829/bffb33676e9bbb4368779e1f44e6f22a-800x.jpg)