- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Russia economic. Report november 2007 презентация

Содержание

- 1. Russia economic. Report november 2007

- 2. Main Messages Robust growth supported by

- 3. I. Recent Economic Developments

- 4. Rapid Output Growth Driven by Booming Domestic

- 5. Non-Tradable Sectors Continued to Boom Sectors

- 6. Manufacturing Growth: Strong But Tapering Off

- 7. The downward trend in manufacturing might be

- 8. Russia continues to experience an investment boom

- 9. Despite Investment Boom, Domestic and Foreign Investments

- 10. Inflation is Rising, Driven by Food

- 11. Food prices increased, but prices of non-tradable

- 12. Keeping inflation in check is becoming increasingly

- 13. BoP continued recording surpluses: weaker C/A

- 14. Fiscal surpluses continue, but recently fiscal policy

- 15. Prospects Growth is likely to remain

- 16. II. Productivity Growth in Russia

- 17. Russia has experienced a productivity surge, propelling

- 18. What are the drivers of the productivity

- 19. Higher capacity utilization explains part of the

- 20. The productivity surge is also explained by

- 21. Firm dynamics Decomposing total productivity growth

- 22. Productivity growth came mostly from efficiency gains

- 23. Firm turnover plays a smaller role than

- 24. Challenges Ahead In spite of the productivity

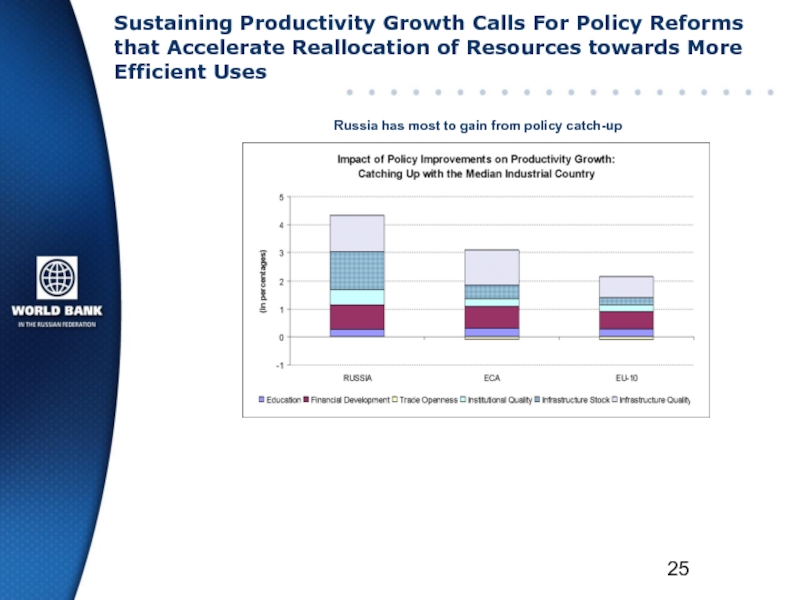

- 25. Sustaining Productivity Growth Calls For Policy Reforms

- 26. III. From Red to

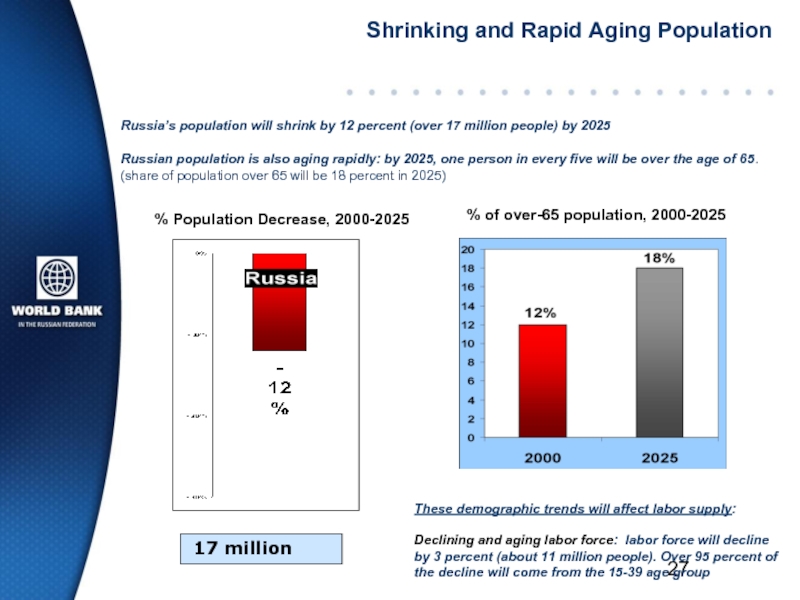

- 27. Shrinking and Rapid Aging Population

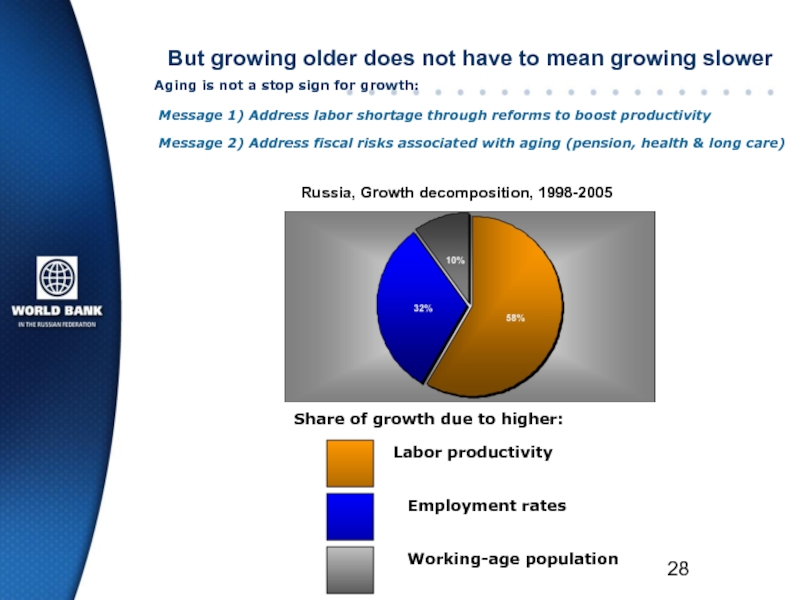

- 28. Aging is not a stop sign for

- 29. Thank you for your attention

Слайд 2Main Messages

Robust growth supported by high energy prices, large capital inflows,

Short-term challenges:

Control inflation

Limit rapid real exchange rate appreciation

Manage large capital flows

Maintain prudent fiscal policy

Medium-term challenges:

Sustain productivity growth

Close the infrastructure gap

Boost private investment

Promote economic diversification

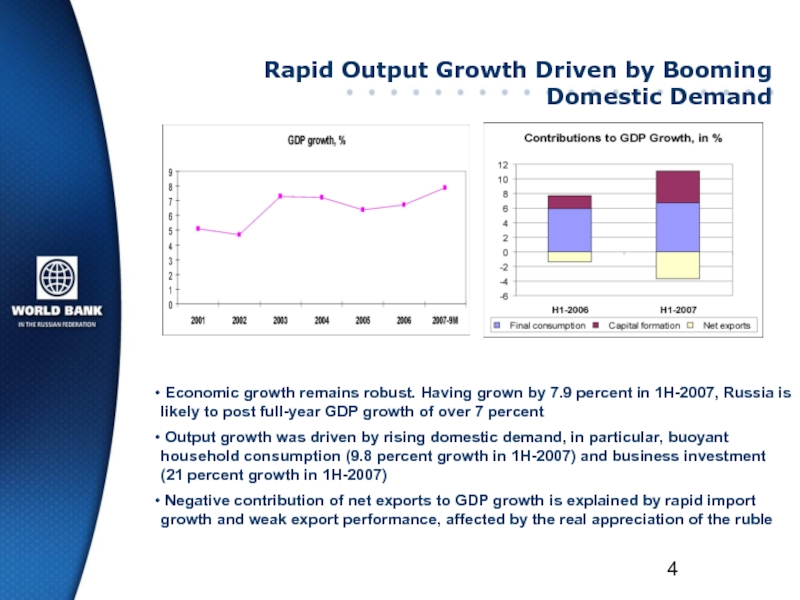

Слайд 4Rapid Output Growth Driven by Booming Domestic Demand

Economic growth remains

Output growth was driven by rising domestic demand, in particular, buoyant household consumption (9.8 percent growth in 1H-2007) and business investment (21 percent growth in 1H-2007)

Negative contribution of net exports to GDP growth is explained by rapid import growth and weak export performance, affected by the real appreciation of the ruble

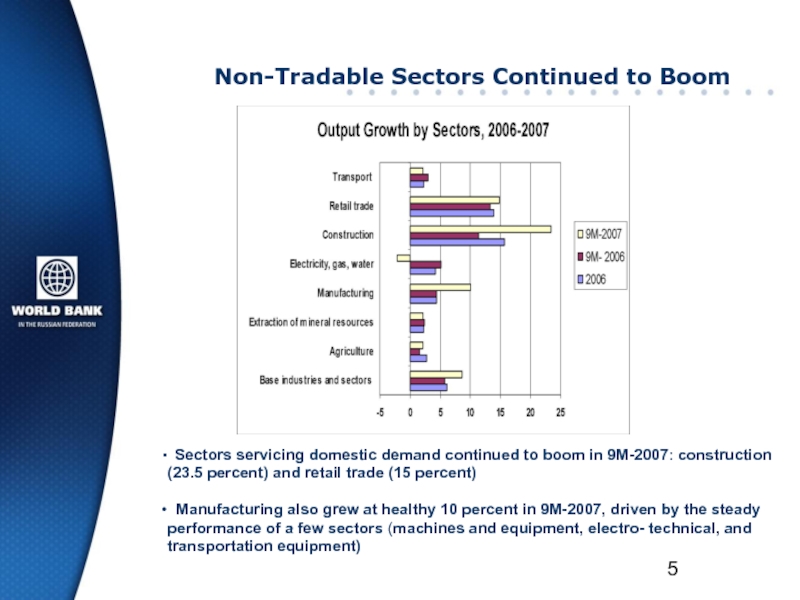

Слайд 5Non-Tradable Sectors Continued to Boom

Sectors servicing domestic demand continued to

Manufacturing also grew at healthy 10 percent in 9M-2007, driven by the steady performance of a few sectors (machines and equipment, electro- technical, and transportation equipment)

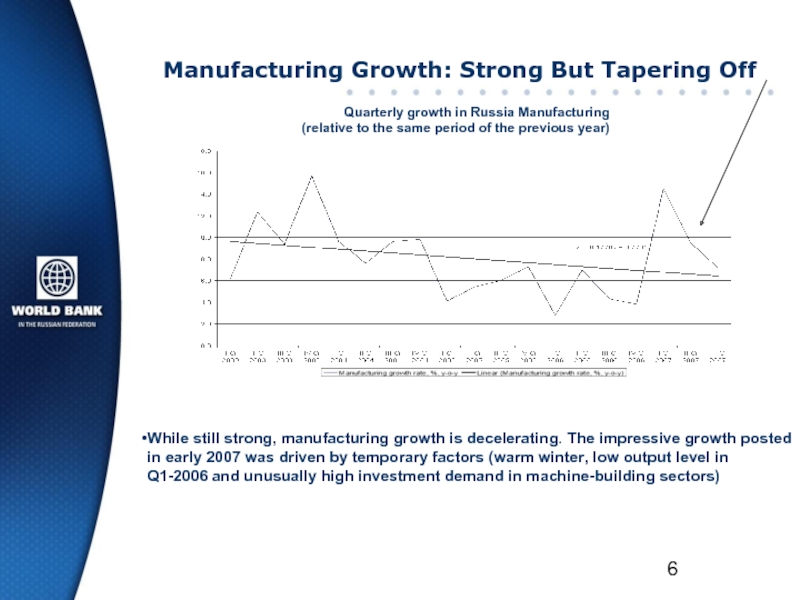

Слайд 6Manufacturing Growth: Strong But Tapering Off

While still strong, manufacturing growth is

Quarterly growth in Russia Manufacturing

(relative to the same period of the previous year)

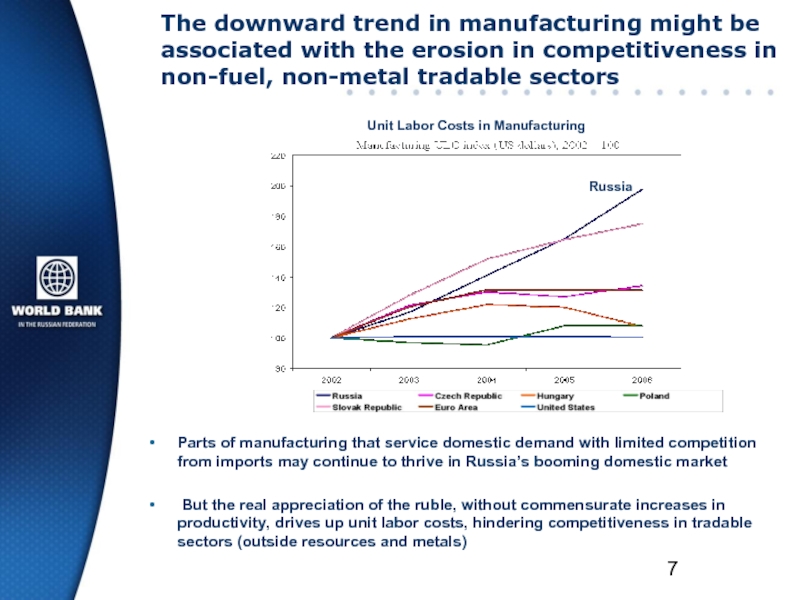

Слайд 7The downward trend in manufacturing might be associated with the erosion

Parts of manufacturing that service domestic demand with limited competition from imports may continue to thrive in Russia’s booming domestic market

But the real appreciation of the ruble, without commensurate increases in productivity, drives up unit labor costs, hindering competitiveness in tradable sectors (outside resources and metals)

Unit Labor Costs in Manufacturing

Russia

Слайд 8Russia continues to experience an investment boom

Capital investment growth, % to

The aggregate fixed capital investment grew by 21.2 percent in 9-M of 2007

(from 11.8 percent growth in the same period in 2006)

While capital investments decelerated in September 2007 they still posted

double-digit growth rates (16.1 percent, relative to the same month in 2006)

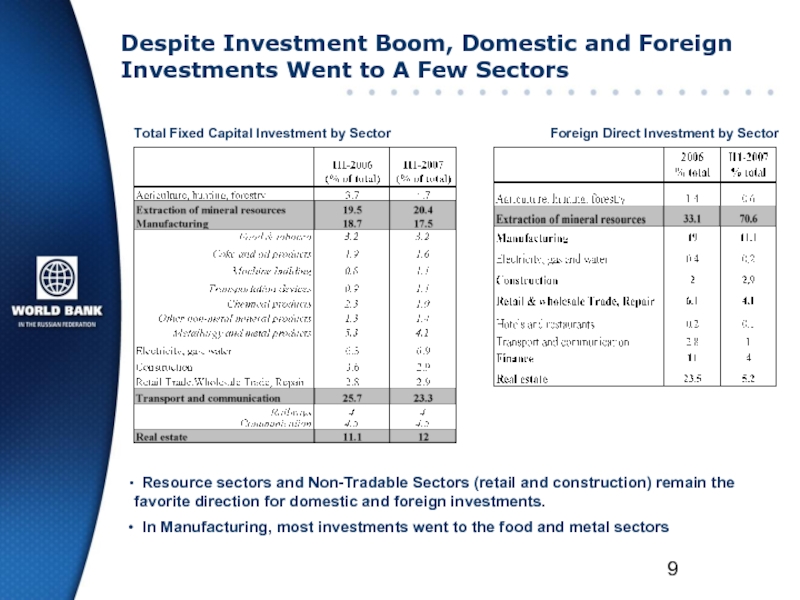

Слайд 9Despite Investment Boom, Domestic and Foreign Investments Went to A Few

Total Fixed Capital Investment by Sector

Foreign Direct Investment by Sector

Resource sectors and Non-Tradable Sectors (retail and construction) remain the favorite direction for domestic and foreign investments.

In Manufacturing, most investments went to the food and metal sectors

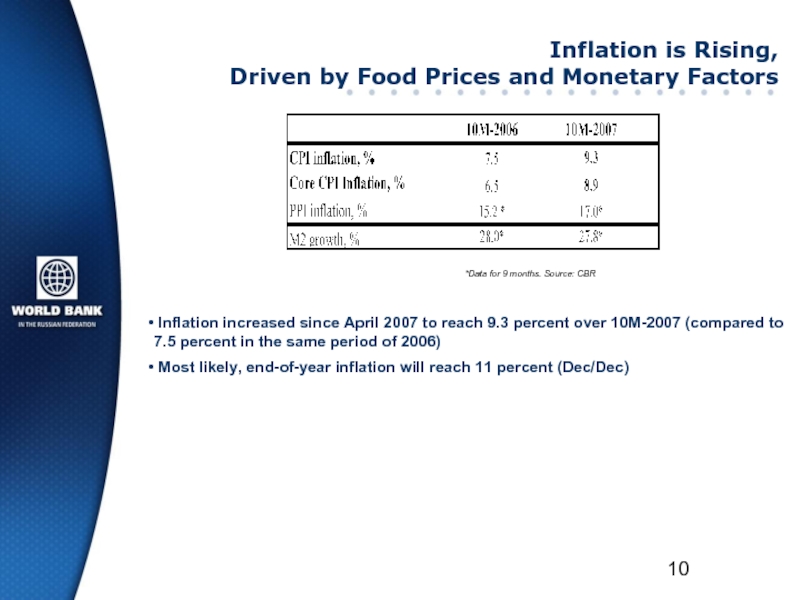

Слайд 10Inflation is Rising,

Driven by Food Prices and Monetary Factors

*Data for 9 months. Source: CBR

Inflation increased since April 2007 to reach 9.3 percent over 10M-2007 (compared to 7.5 percent in the same period of 2006)

Most likely, end-of-year inflation will reach 11 percent (Dec/Dec)

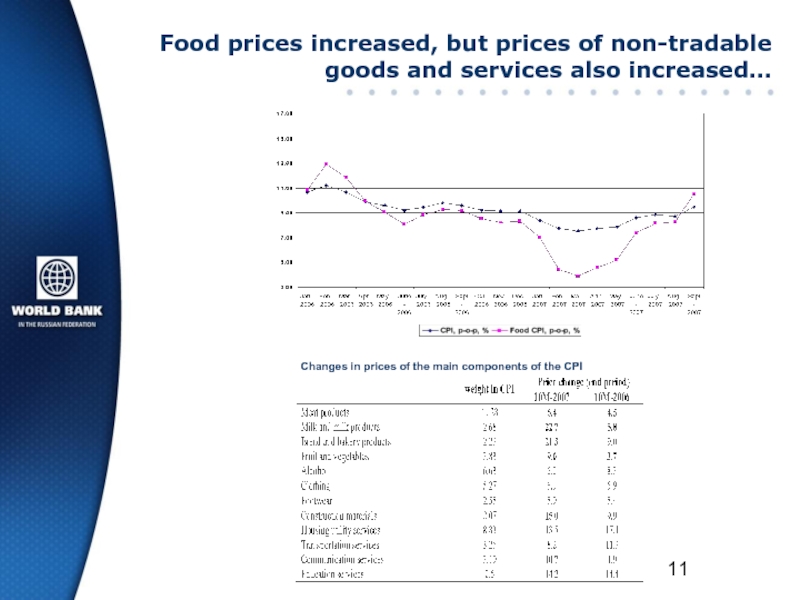

Слайд 11Food prices increased, but prices of non-tradable goods and services also

Changes in prices of the main components of the CPI

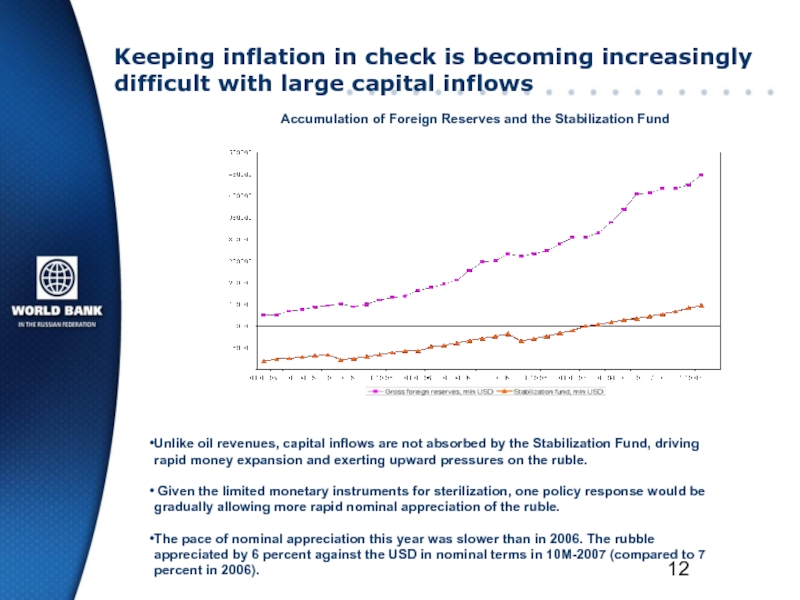

Слайд 12Keeping inflation in check is becoming increasingly difficult with large capital

Accumulation of Foreign Reserves and the Stabilization Fund

Unlike oil revenues, capital inflows are not absorbed by the Stabilization Fund, driving rapid money expansion and exerting upward pressures on the ruble.

Given the limited monetary instruments for sterilization, one policy response would be gradually allowing more rapid nominal appreciation of the ruble.

The pace of nominal appreciation this year was slower than in 2006. The rubble appreciated by 6 percent against the USD in nominal terms in 10M-2007 (compared to 7 percent in 2006).

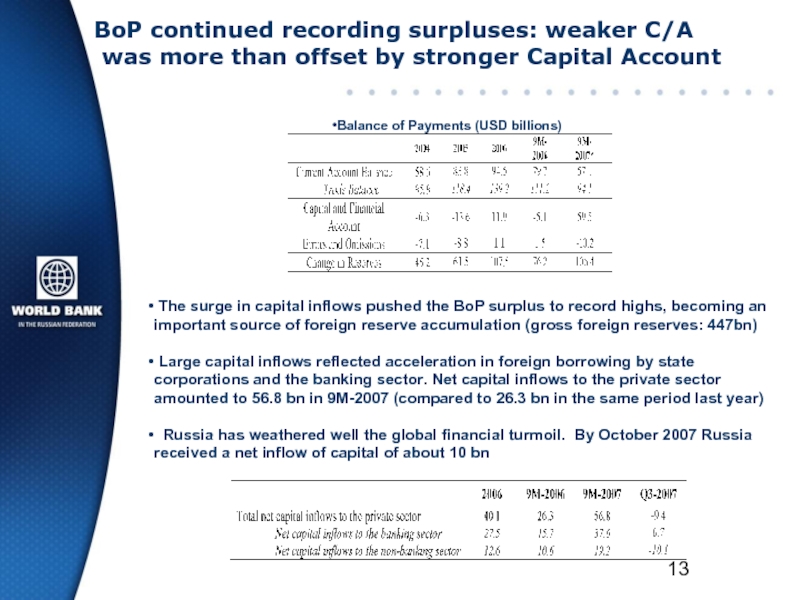

Слайд 13BoP continued recording surpluses: weaker C/A was more than offset by

Balance of Payments (USD billions)

The surge in capital inflows pushed the BoP surplus to record highs, becoming an important source of foreign reserve accumulation (gross foreign reserves: 447bn)

Large capital inflows reflected acceleration in foreign borrowing by state corporations and the banking sector. Net capital inflows to the private sector amounted to 56.8 bn in 9M-2007 (compared to 26.3 bn in the same period last year)

Russia has weathered well the global financial turmoil. By October 2007 Russia received a net inflow of capital of about 10 bn

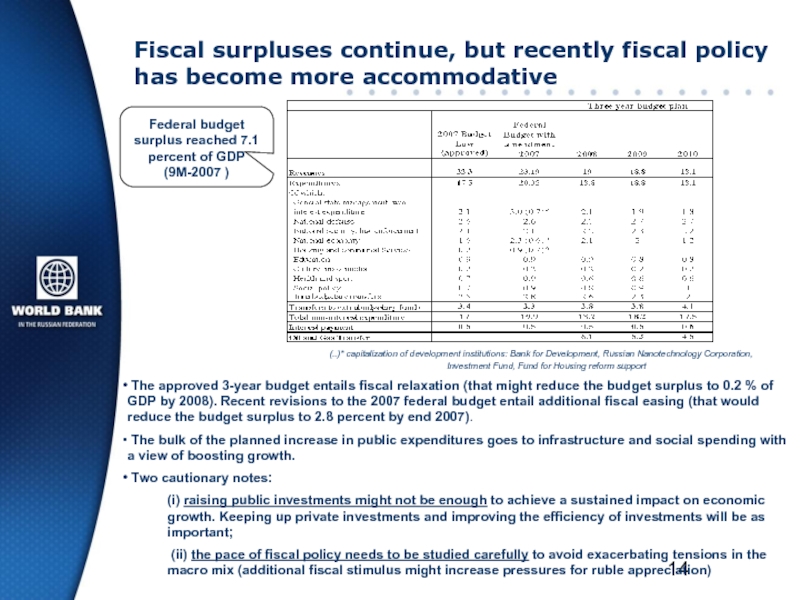

Слайд 14Fiscal surpluses continue, but recently fiscal policy has become more accommodative

The bulk of the planned increase in public expenditures goes to infrastructure and social spending with a view of boosting growth.

Two cautionary notes:

(i) raising public investments might not be enough to achieve a sustained impact on economic growth. Keeping up private investments and improving the efficiency of investments will be as important;

(ii) the pace of fiscal policy needs to be studied carefully to avoid exacerbating tensions in the macro mix (additional fiscal stimulus might increase pressures for ruble appreciation)

(..)* capitalization of development institutions: Bank for Development, Russian Nanotechnology Corporation,

Investment Fund, Fund for Housing reform support

Federal budget

surplus reached 7.1 percent of GDP (9M-2007 )

Слайд 15Prospects

Growth is likely to remain robust. With energy prices set

However, growth might slowdown if medium-term challenges are not addressed….

Sustain Productivity Growth (which can also help alleviating pressures from the real appreciation of the exchange rate)

Promote Economic Diversification

Boost Private Investment

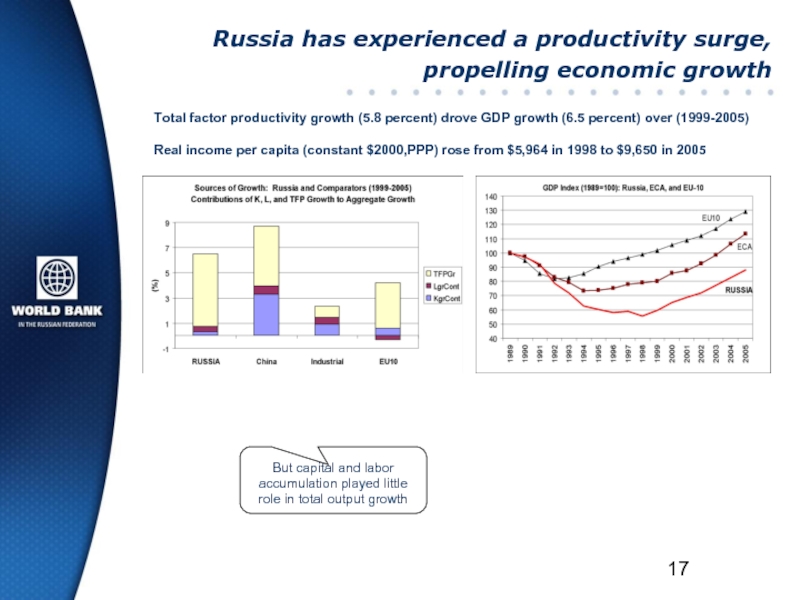

Слайд 17Russia has experienced a productivity surge, propelling economic growth

Total factor

Real income per capita (constant $2000,PPP) rose from $5,964 in 1998 to $9,650 in 2005

But capital and labor accumulation played little role in total output growth

Слайд 18What are the drivers of the productivity surge?

Capacity utilization

Sectoral shifts

Firm dynamics

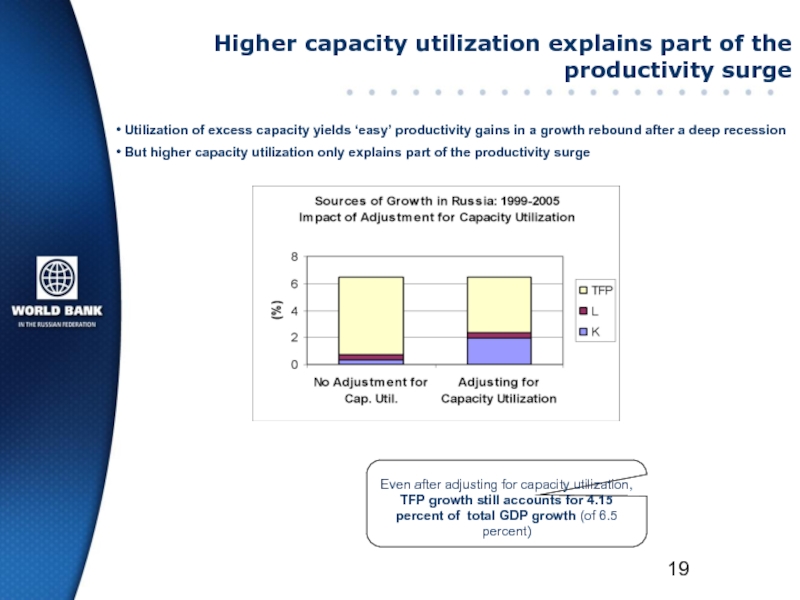

Слайд 19Higher capacity utilization explains part of the productivity surge

Utilization of

But higher capacity utilization only explains part of the productivity surge

Even after adjusting for capacity utilization, TFP growth still accounts for 4.15 percent of total GDP growth (of 6.5 percent)

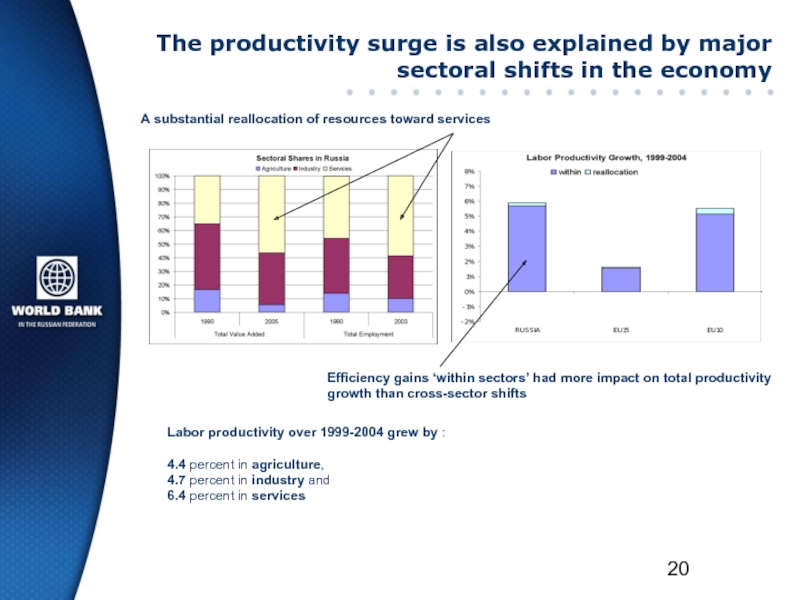

Слайд 20The productivity surge is also explained by major sectoral shifts in

A substantial reallocation of resources toward services

Efficiency gains ‘within sectors’ had more impact on total productivity growth than cross-sector shifts

Labor productivity over 1999-2004 grew by :

4.4 percent in agriculture,

4.7 percent in industry and

6.4 percent in services

Слайд 21Firm dynamics

Decomposing total productivity growth into three components:

‘within’: accounts for

‘reallocation’: reallocation of labor across existing firms

‘net entry’: entry of new firms and exit of obsolete firms

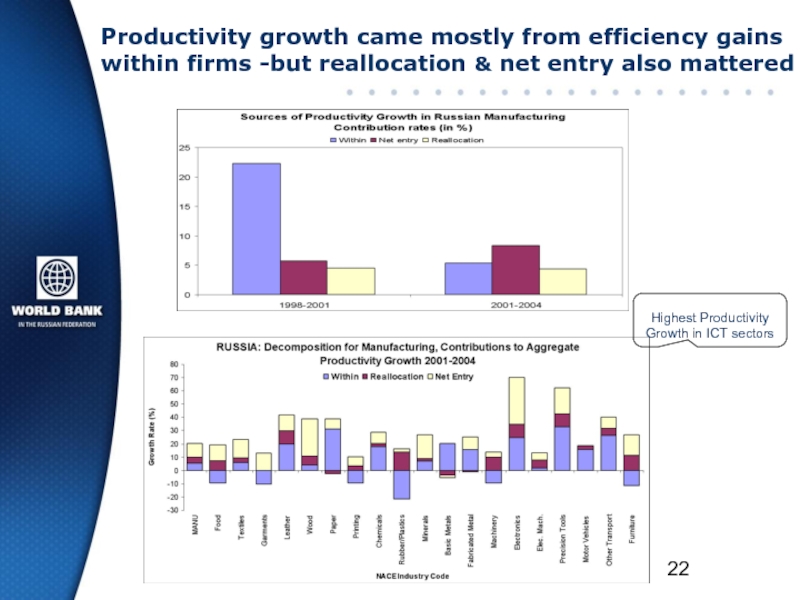

Слайд 22Productivity growth came mostly from efficiency gains within firms -but reallocation

Highest Productivity Growth in ICT sectors

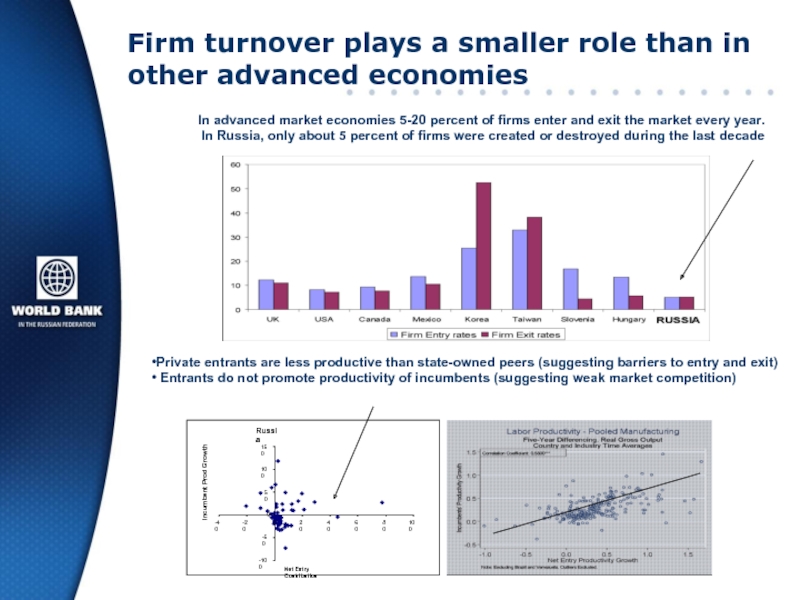

Слайд 23Firm turnover plays a smaller role than in other advanced economies

Private

Entrants do not promote productivity of incumbents (suggesting weak market competition)

In advanced market economies 5-20 percent of firms enter and exit the market every year.

In Russia, only about 5 percent of firms were created or destroyed during the last decade

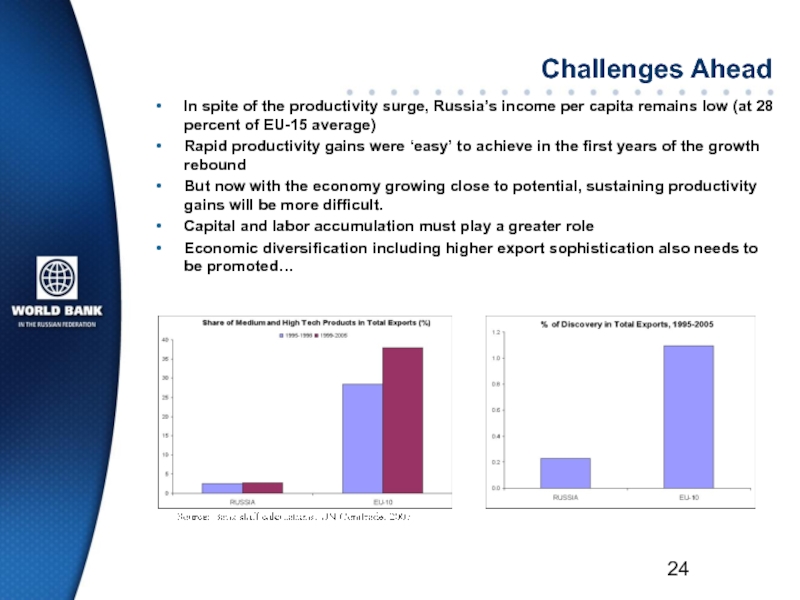

Слайд 24Challenges Ahead

In spite of the productivity surge, Russia’s income per capita

Rapid productivity gains were ‘easy’ to achieve in the first years of the growth rebound

But now with the economy growing close to potential, sustaining productivity gains will be more difficult.

Capital and labor accumulation must play a greater role

Economic diversification including higher export sophistication also needs to be promoted…

Слайд 25Sustaining Productivity Growth Calls For Policy Reforms that Accelerate Reallocation of

Russia has most to gain from policy catch-up

Слайд 27 Shrinking and Rapid Aging Population

% Population Decrease, 2000-2025

17 million

% of

These demographic trends will affect labor supply:

Declining and aging labor force: labor force will decline by 3 percent (about 11 million people). Over 95 percent of the decline will come from the 15-39 age group

Russian population is also aging rapidly: by 2025, one person in every five will be over the age of 65.

(share of population over 65 will be 18 percent in 2025)

Russia’s population will shrink by 12 percent (over 17 million people) by 2025

Слайд 28Aging is not a stop sign for growth: Message 1)

Russia, Growth decomposition, 1998-2005

Share of growth due to higher:

Labor productivity

Employment rates

Working-age population

But growing older does not have to mean growing slower