- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Options презентация

Содержание

- 1. Options

- 2. 22.1 Options Many corporate securities are similar

- 3. 22.1 Options Contracts: Preliminaries An option gives

- 4. 22.1 Options Contracts: Preliminaries Exercising the Option

- 5. Options Contracts: Preliminaries In-the-Money The exercise price

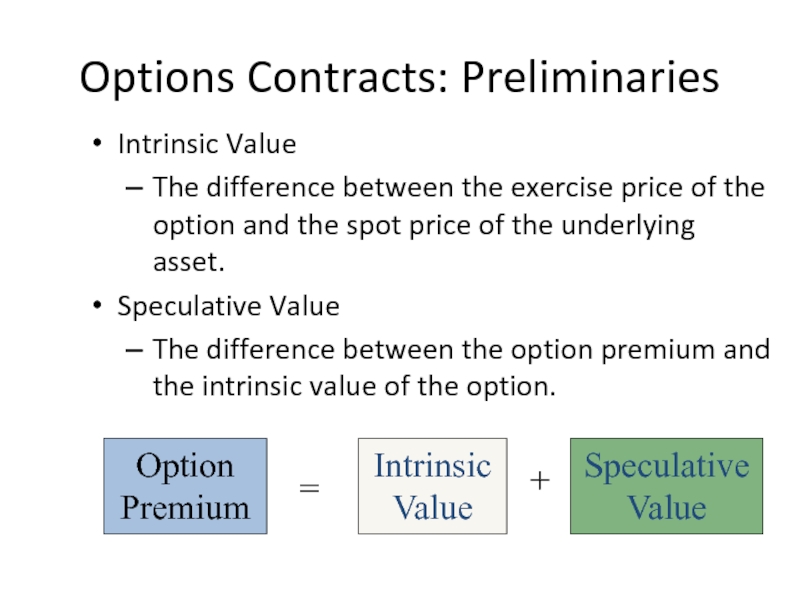

- 6. Options Contracts: Preliminaries Intrinsic Value The difference

- 7. 22.2 Call Options Call options gives the

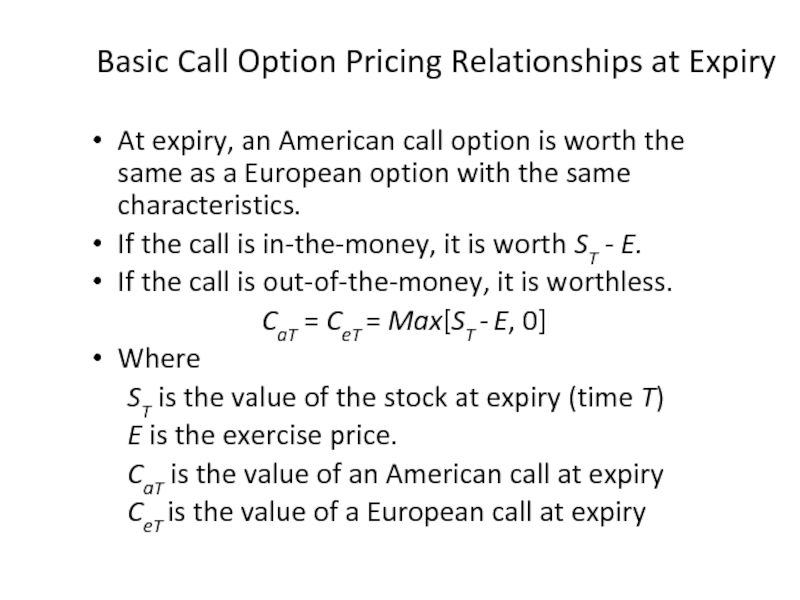

- 8. Basic Call Option Pricing Relationships at Expiry

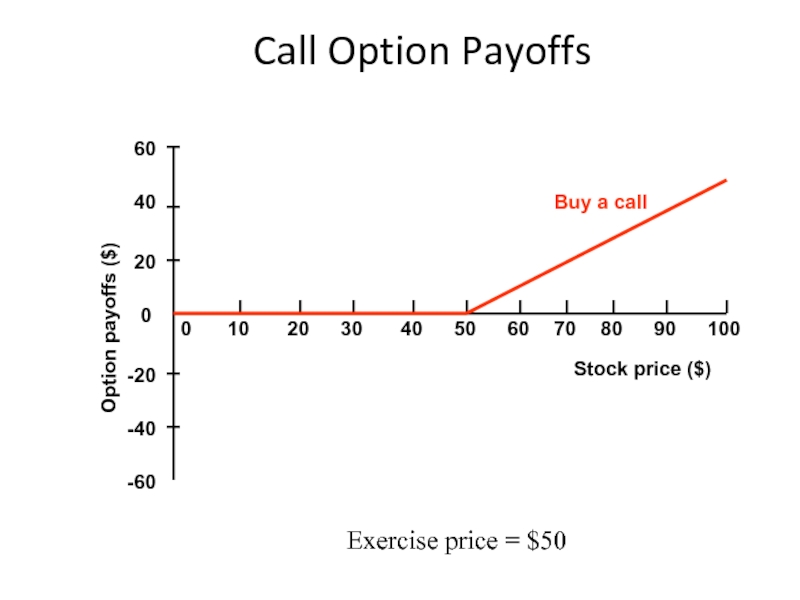

- 9. Call Option Payoffs -20 100 90 80

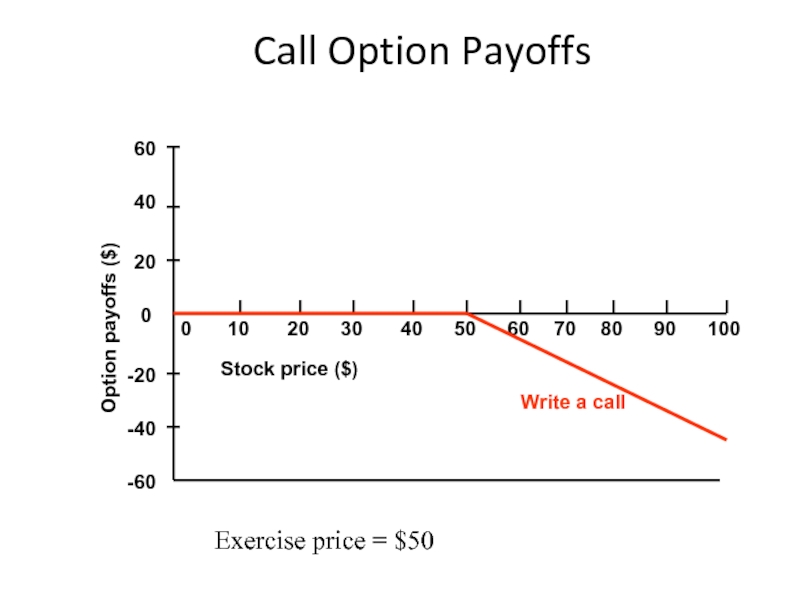

- 10. Call Option Payoffs Write a call Exercise price = $50

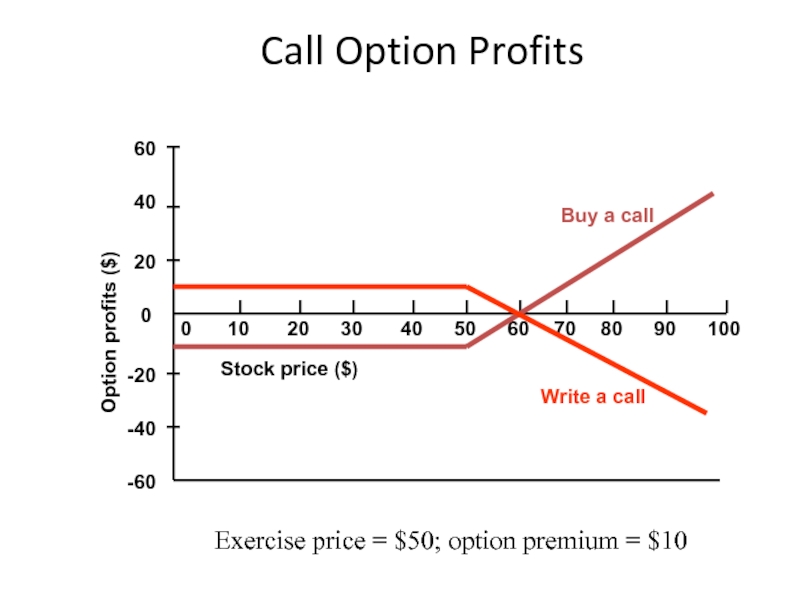

- 11. Call Option Profits Write a call Buy

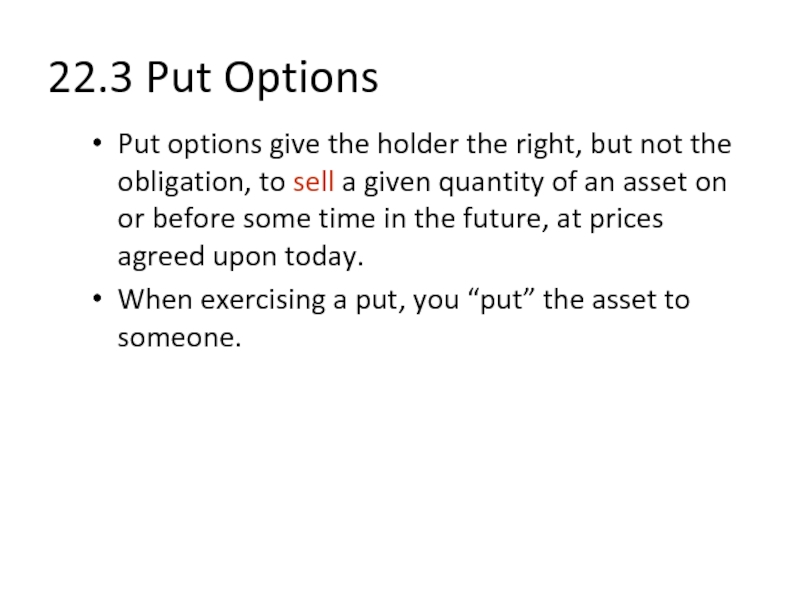

- 12. 22.3 Put Options Put options give the

- 13. Basic Put Option Pricing Relationships at Expiry

- 14. Put Option Payoffs -20 100 90 80

- 15. Put Option Payoffs -20 100 90 80

- 16. Put Option Profits -20 100 90 80

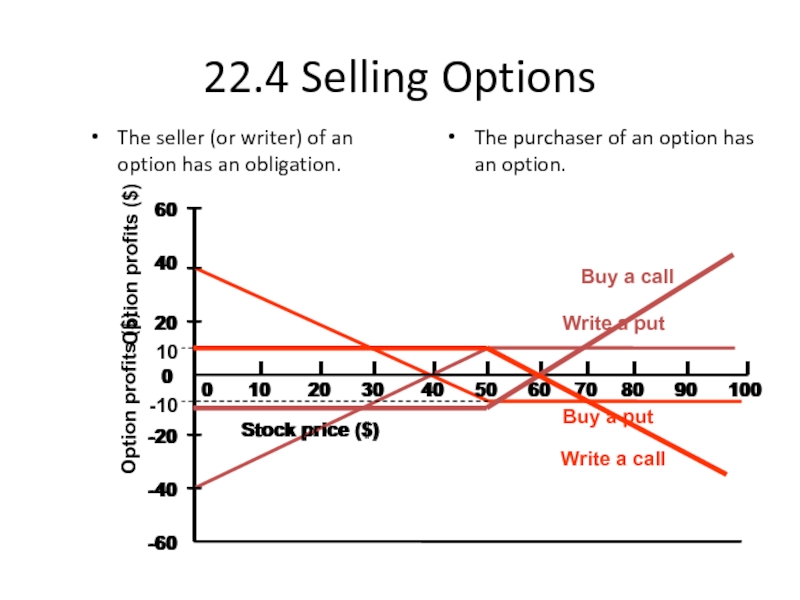

- 17. 22.4 Selling Options The seller (or writer)

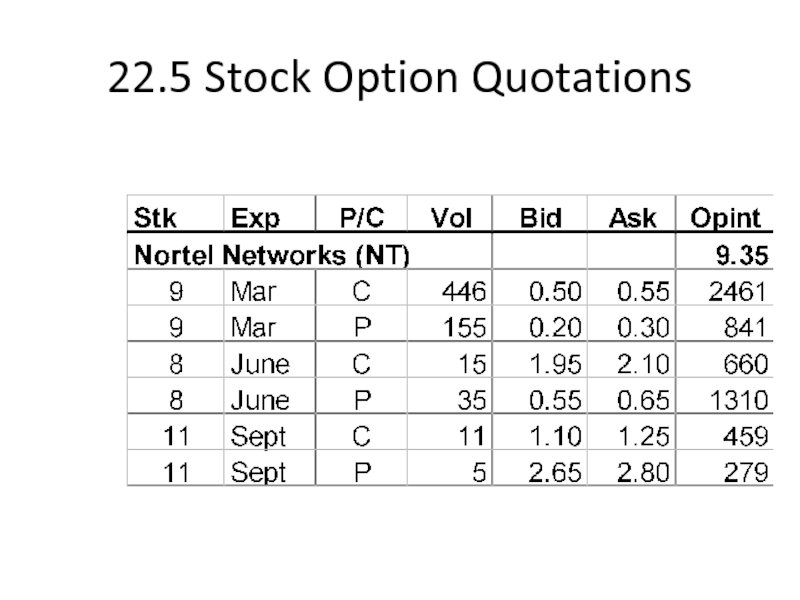

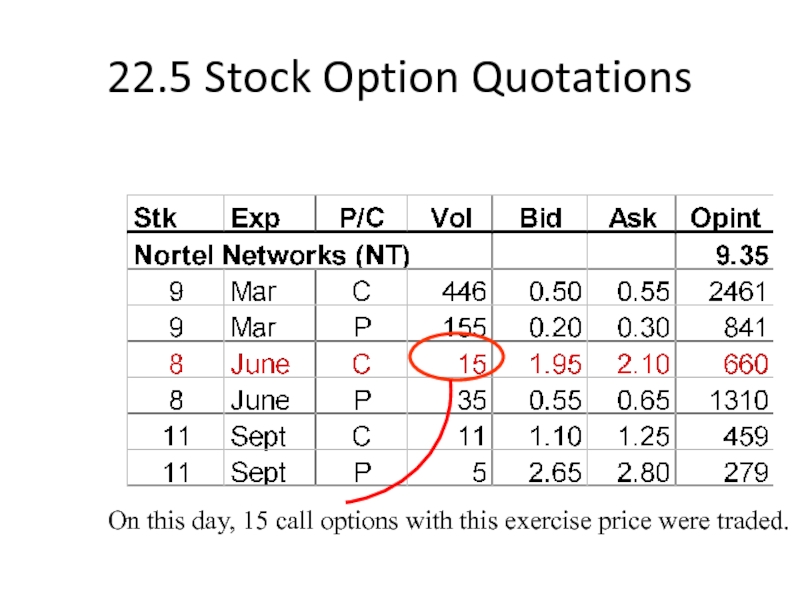

- 18. 22.5 Stock Option Quotations

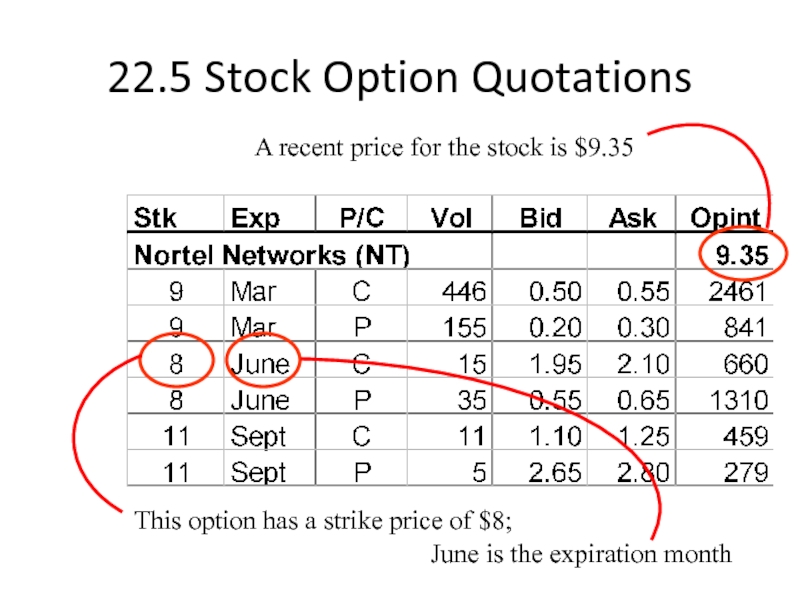

- 19. 22.5 Stock Option Quotations This option has

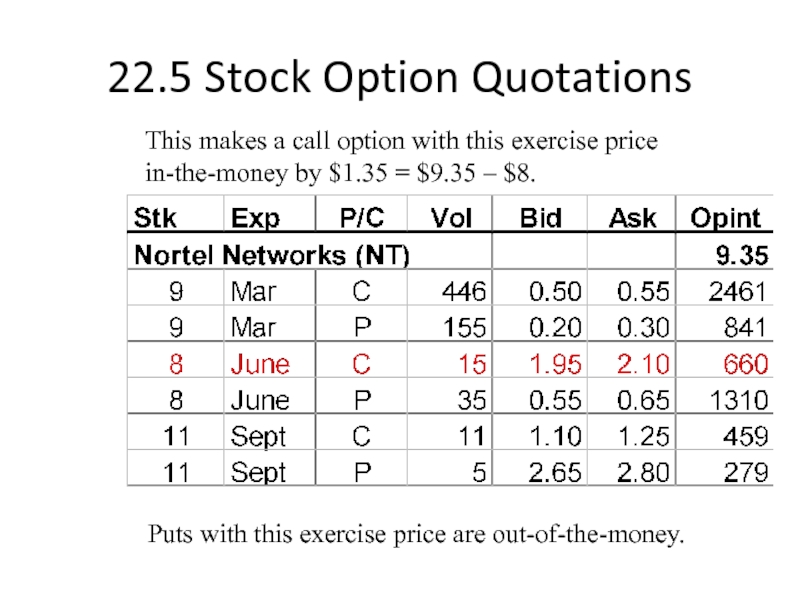

- 20. 22.5 Stock Option Quotations This makes a

- 21. 22.5 Stock Option Quotations On this

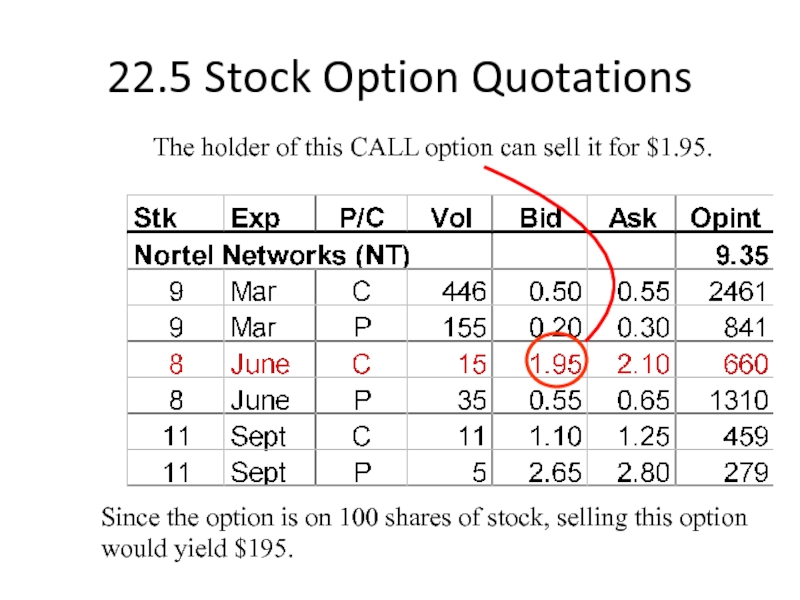

- 22. 22.5 Stock Option Quotations The holder of

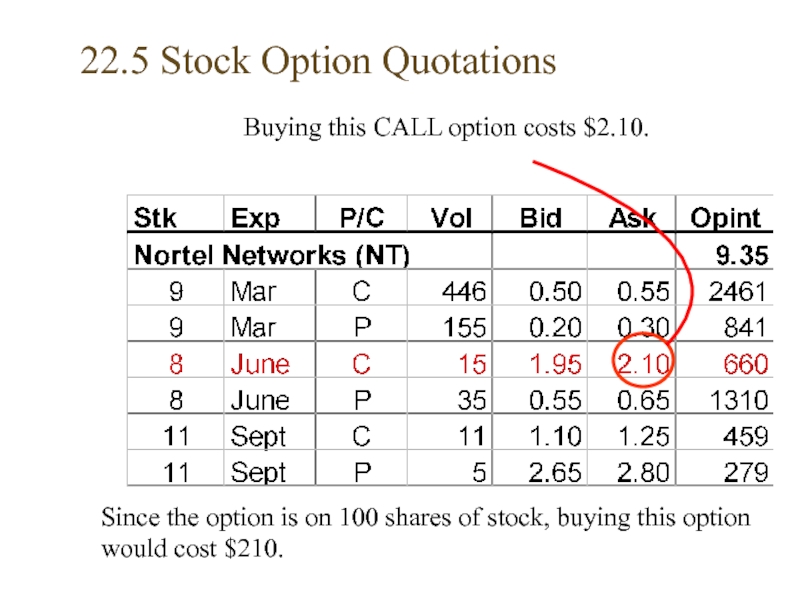

- 23. 22.5 Stock Option Quotations Buying this CALL

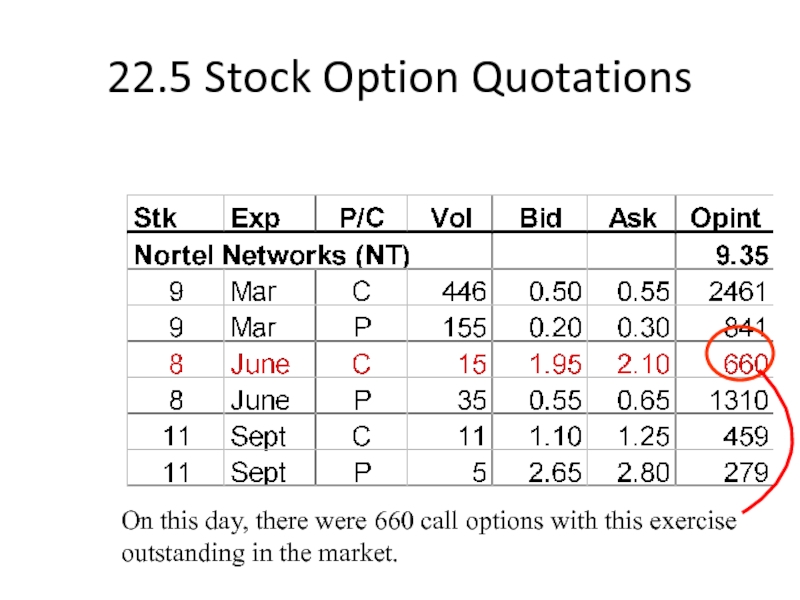

- 24. 22.5 Stock Option Quotations On this

- 25. 22.6 Combinations of Options Puts and calls

- 26. Protective Put Strategy: Buy a Put

- 27. Protective Put Strategy Profits Buy a put

- 28. Covered Call Strategy Sell a call with

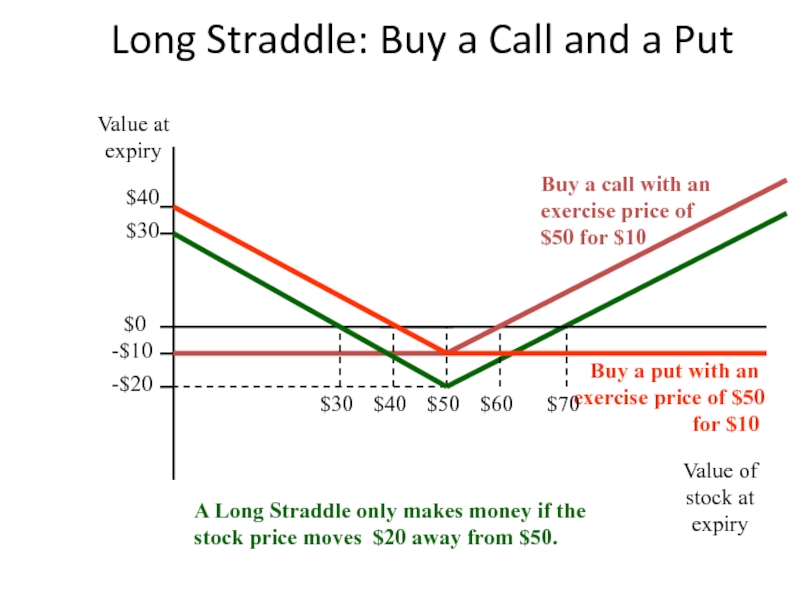

- 29. Long Straddle: Buy a Call and a

- 30. Short Straddle: Sell a Call and a

- 31. Long Call Spread Sell a call with

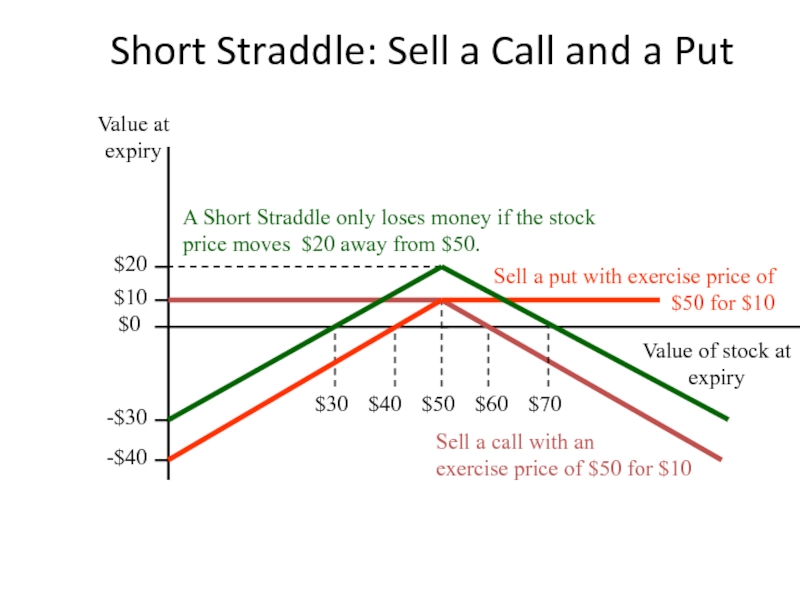

- 32. Put-Call Parity Sell a put with an

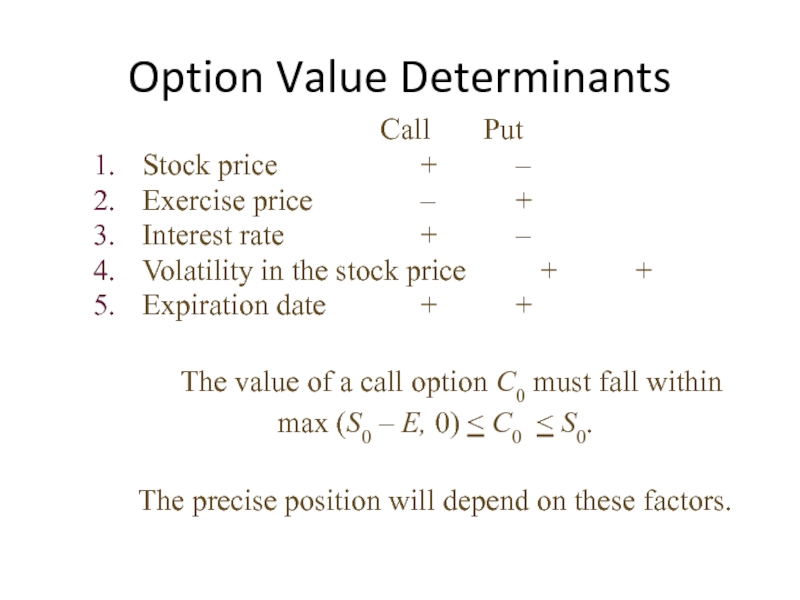

- 33. 22.7 Valuing Options The last section concerned

- 34. Option Value Determinants Call Put Stock

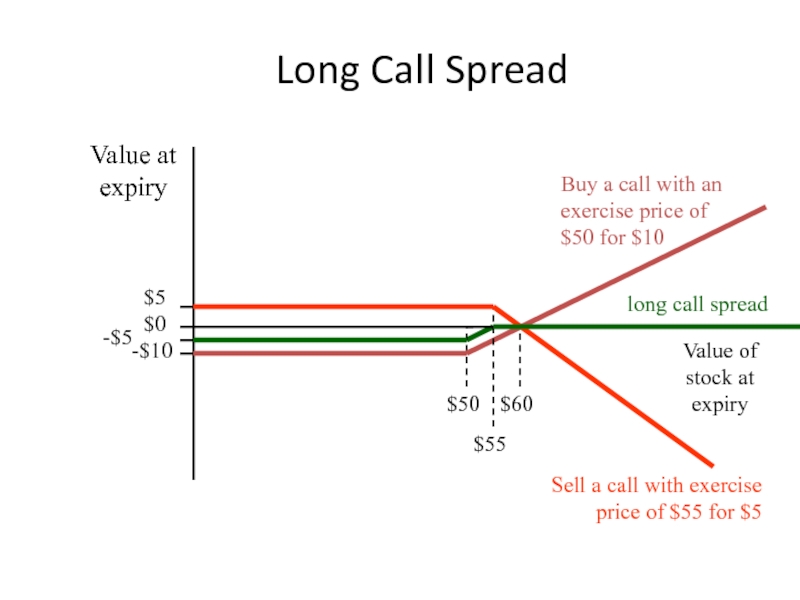

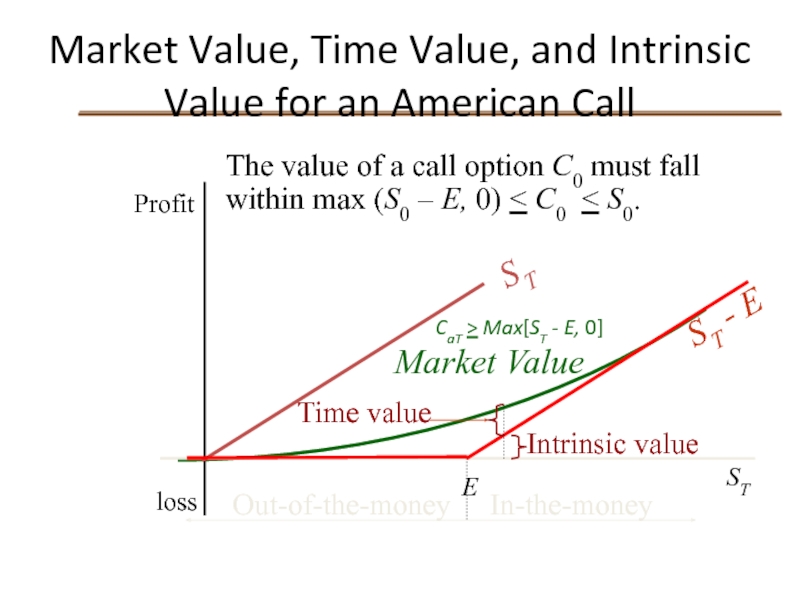

- 35. Market Value, Time Value,

- 36. 22.8 An Option‑Pricing Formula We will start

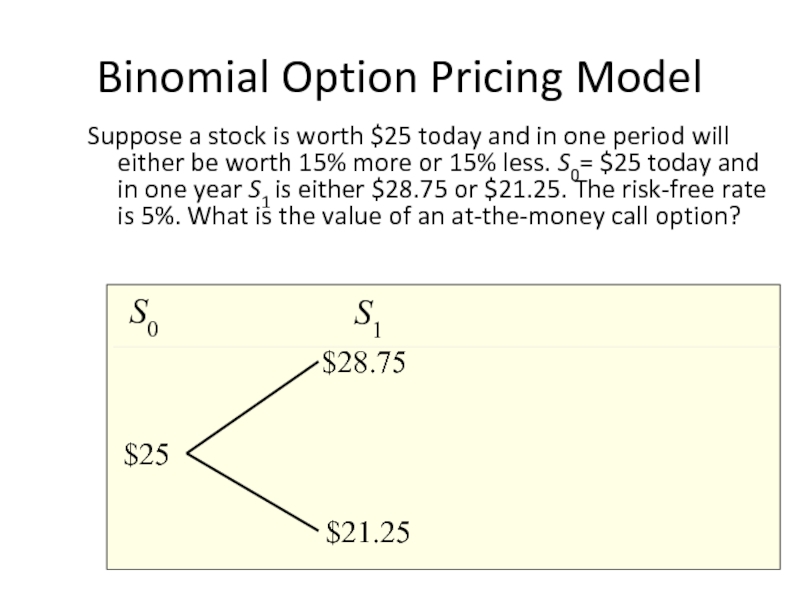

- 37. Binomial Option Pricing Model Suppose a

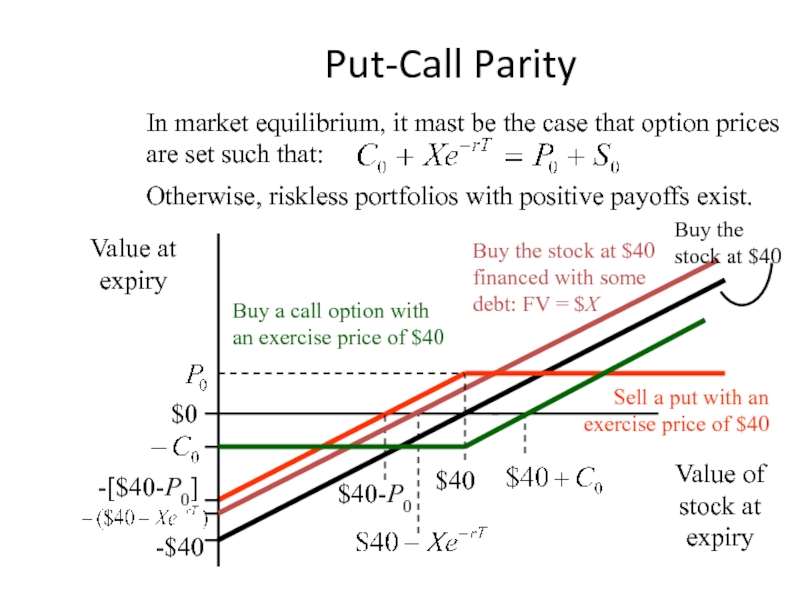

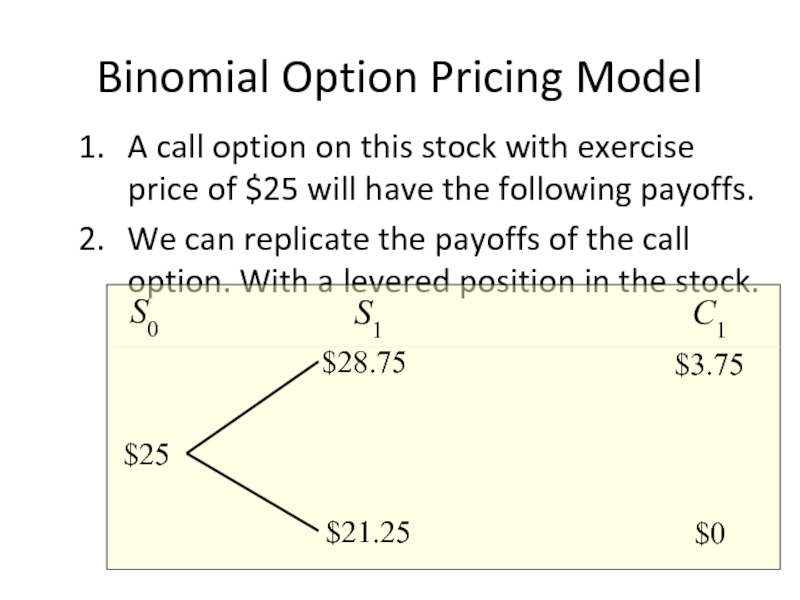

- 38. Binomial Option Pricing Model A call option

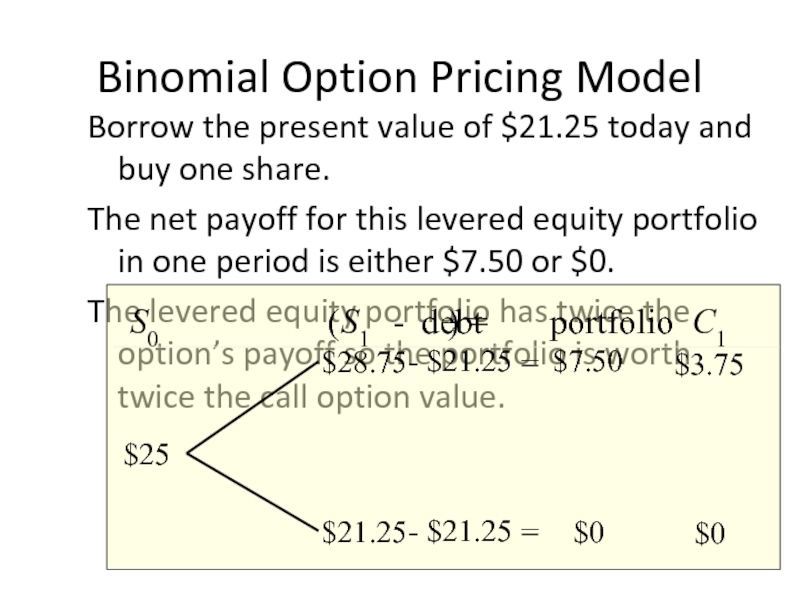

- 39. Binomial Option Pricing Model Borrow the present

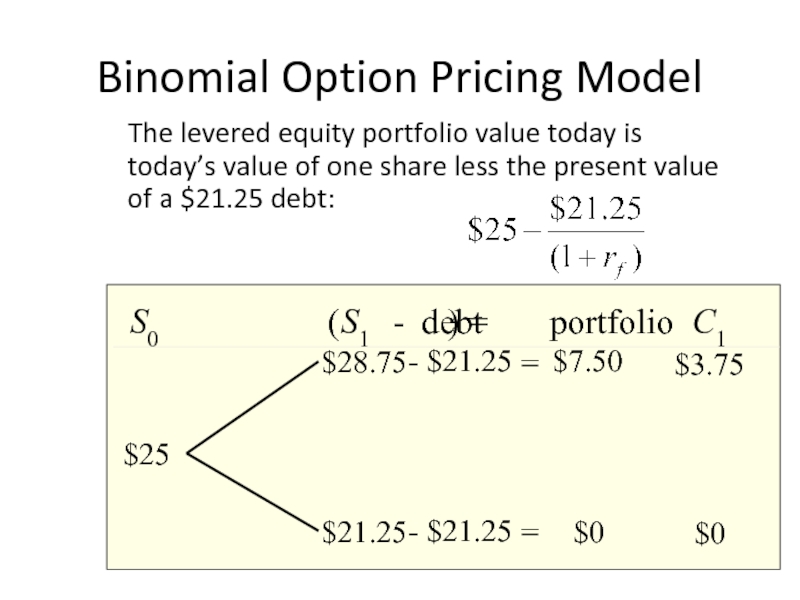

- 40. Binomial Option Pricing Model The

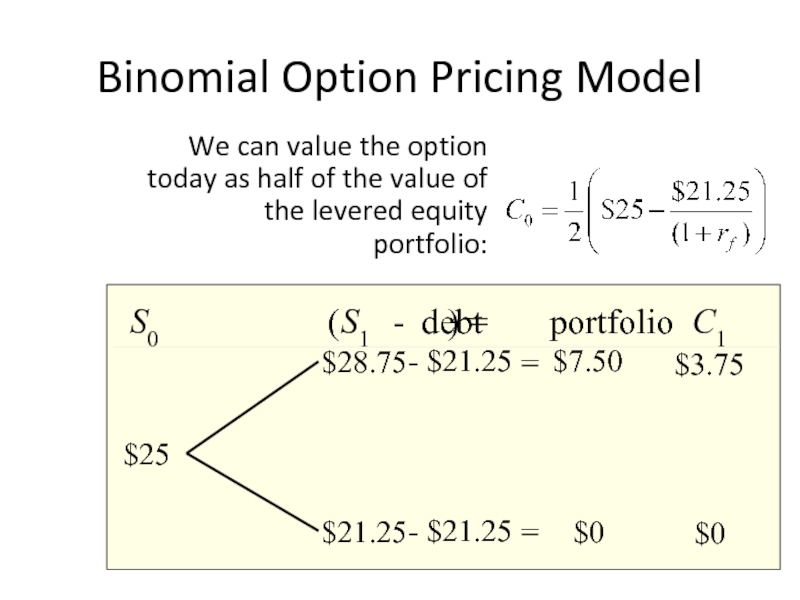

- 41. Binomial Option Pricing Model We can value

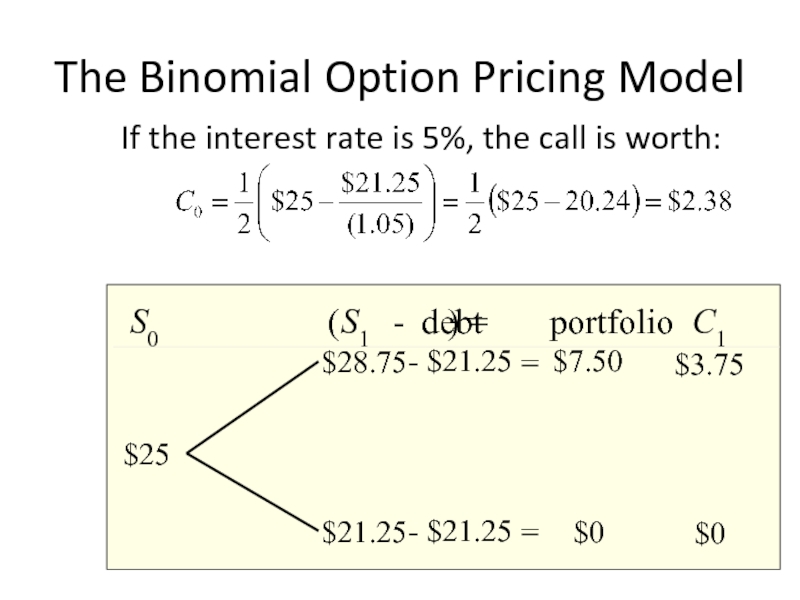

- 42. The Binomial Option Pricing Model If the

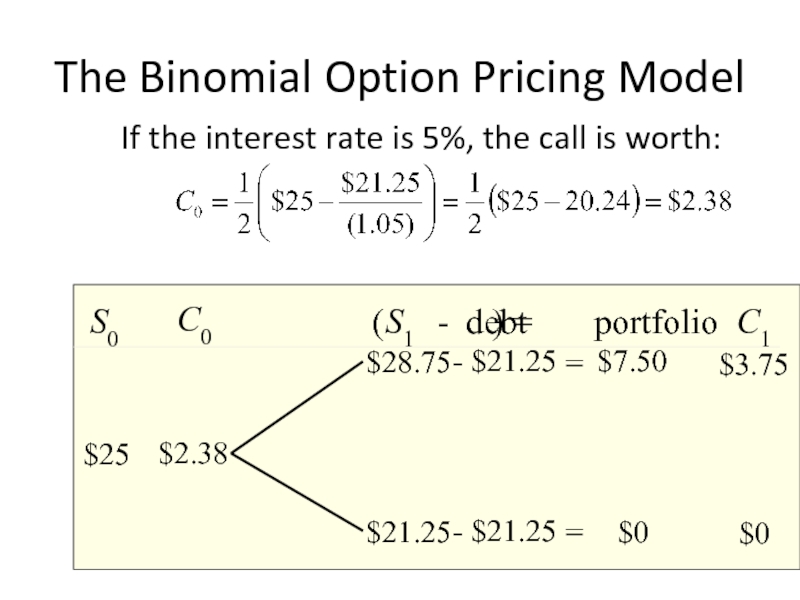

- 43. The Binomial Option Pricing Model If the

- 44. Binomial Option Pricing Model the replicating portfolio

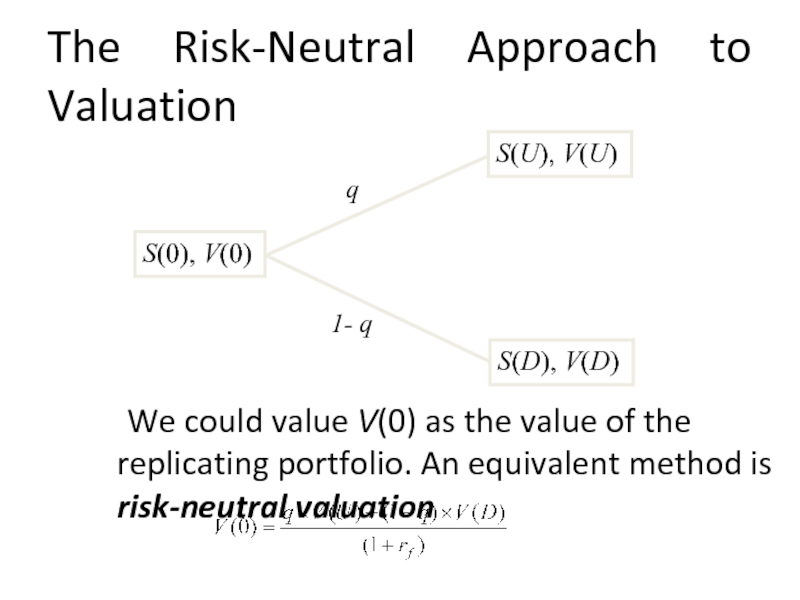

- 45. The Risk-Neutral Approach to Valuation We could

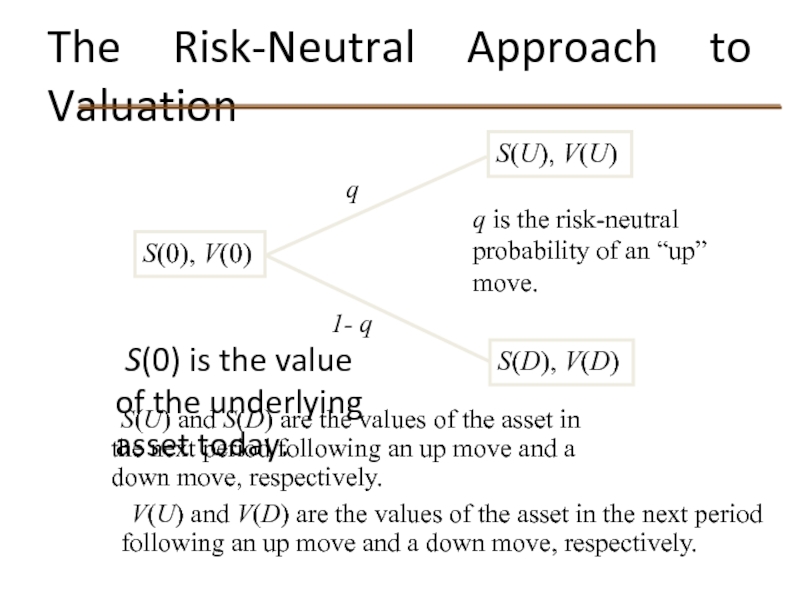

- 46. The Risk-Neutral Approach to Valuation S(0)

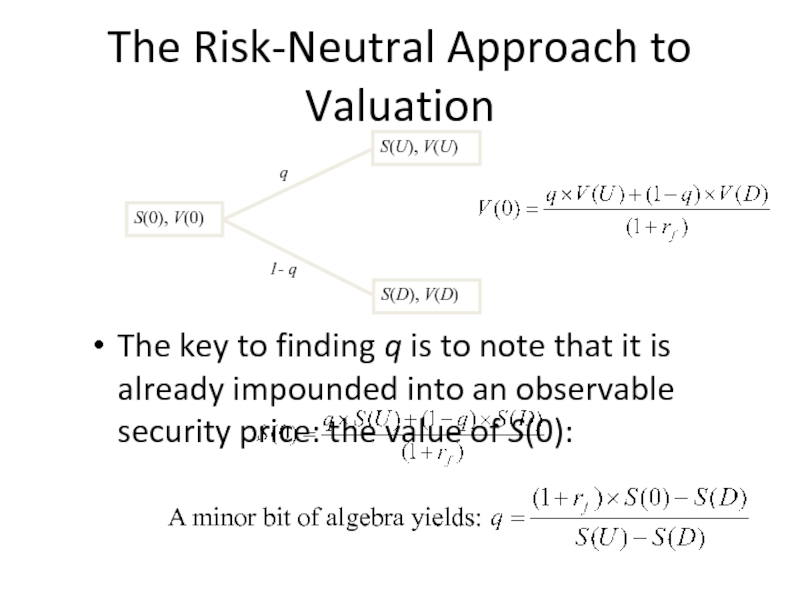

- 47. The Risk-Neutral Approach to Valuation The key

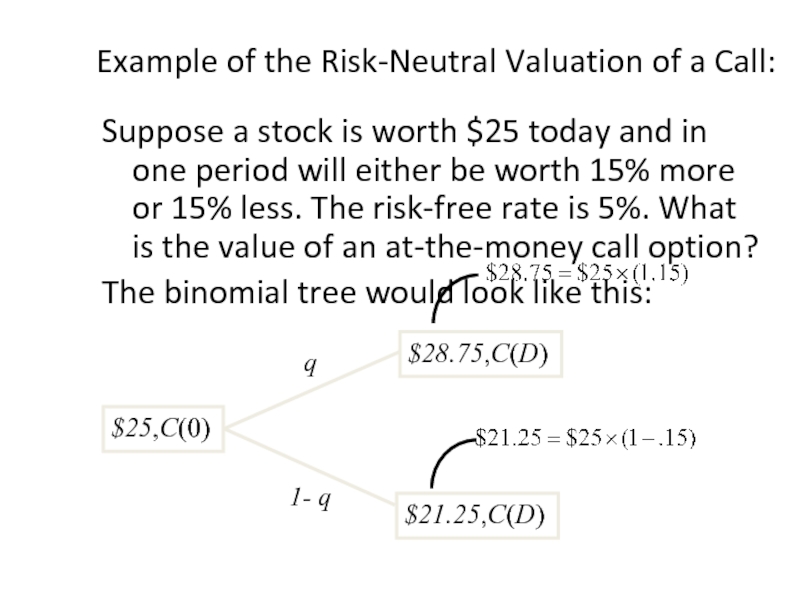

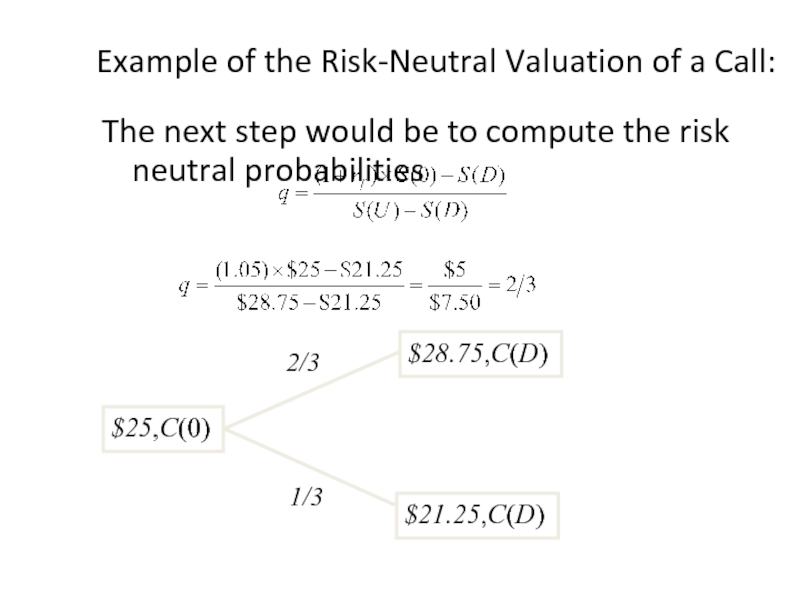

- 48. Example of the Risk-Neutral Valuation of a

- 49. Example of the Risk-Neutral Valuation of a

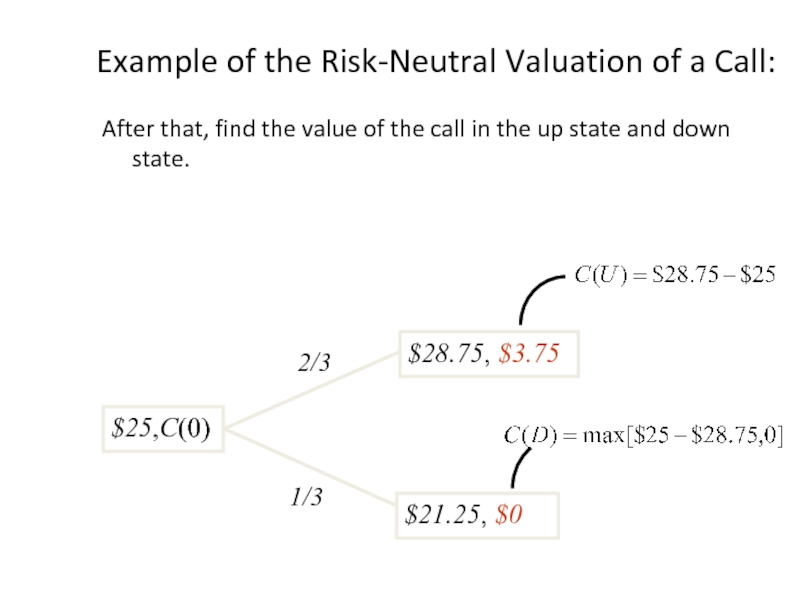

- 50. Example of the Risk-Neutral Valuation of a

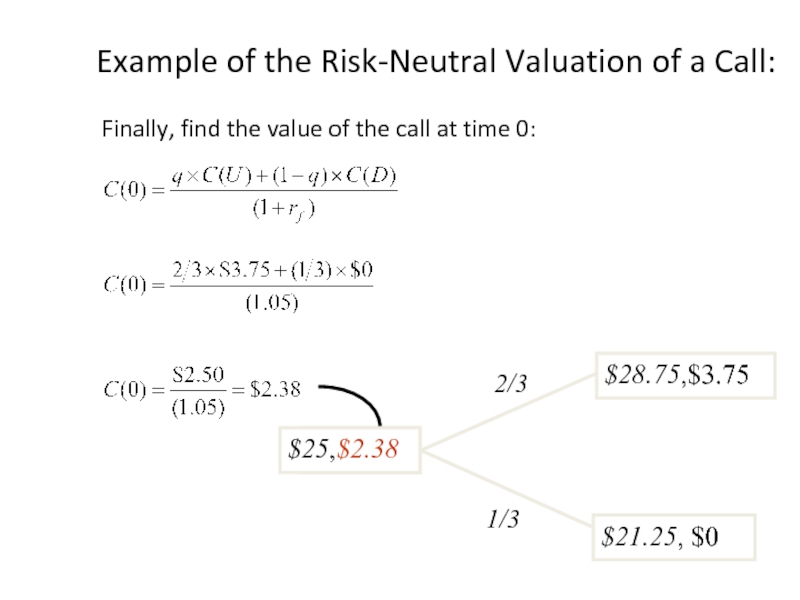

- 51. Example of the Risk-Neutral Valuation of a

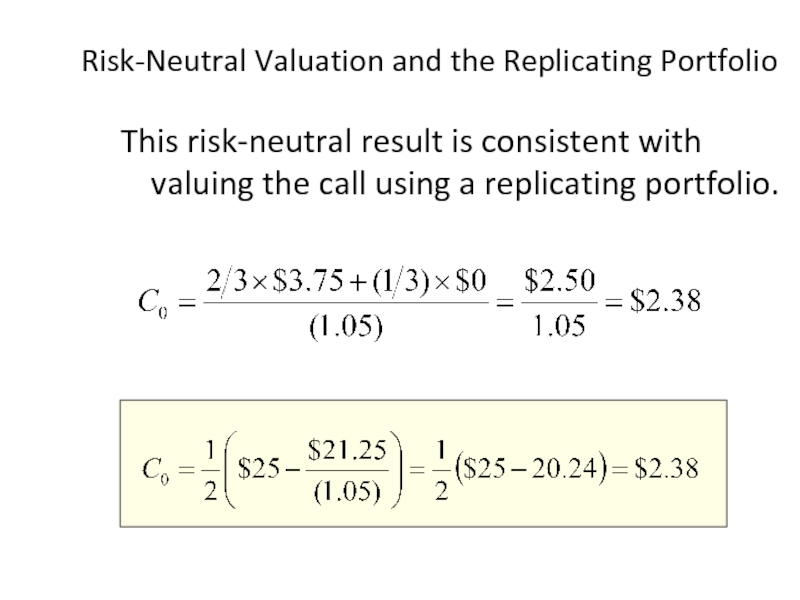

- 52. Risk-Neutral Valuation and the Replicating Portfolio This

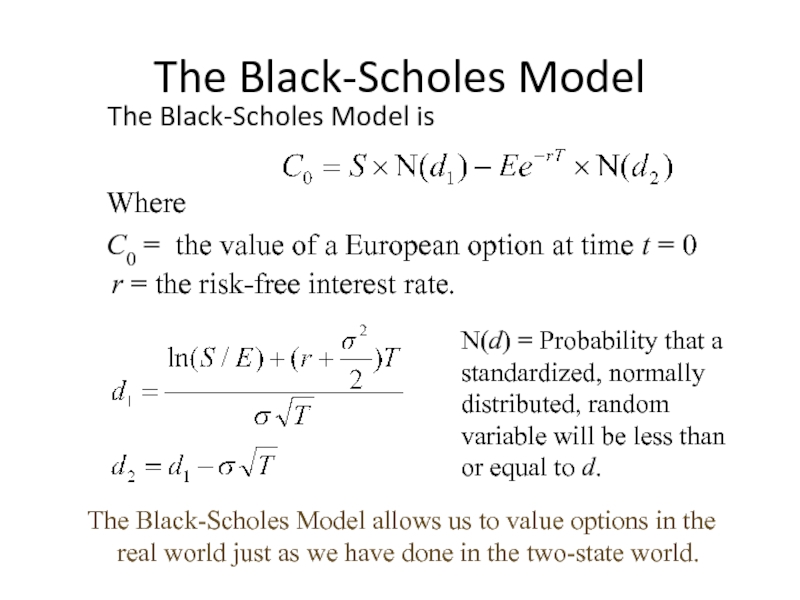

- 53. The Black-Scholes Model The Black-Scholes Model is

- 54. The Black-Scholes Model Find the value of

- 55. The Black-Scholes Model Let’s try our hand

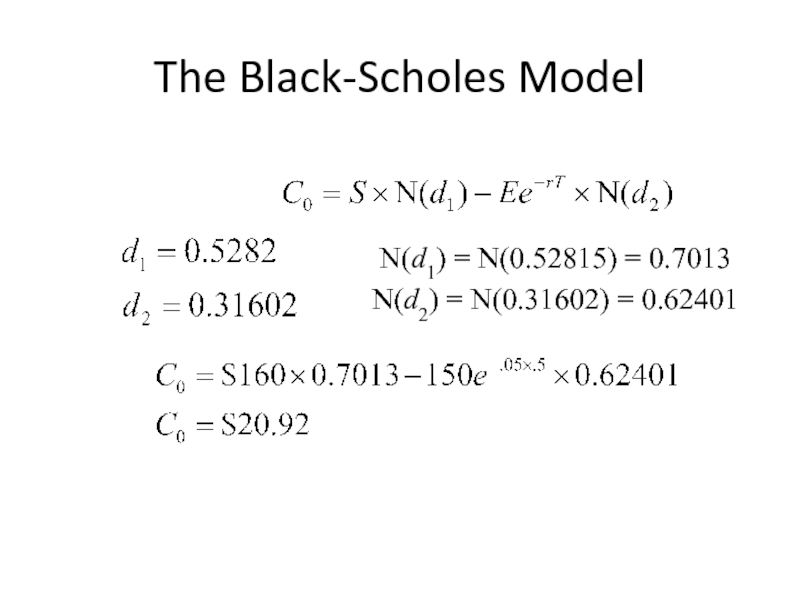

- 56. The Black-Scholes Model N(d1) = N(0.52815) = 0.7013 N(d2) = N(0.31602) = 0.62401

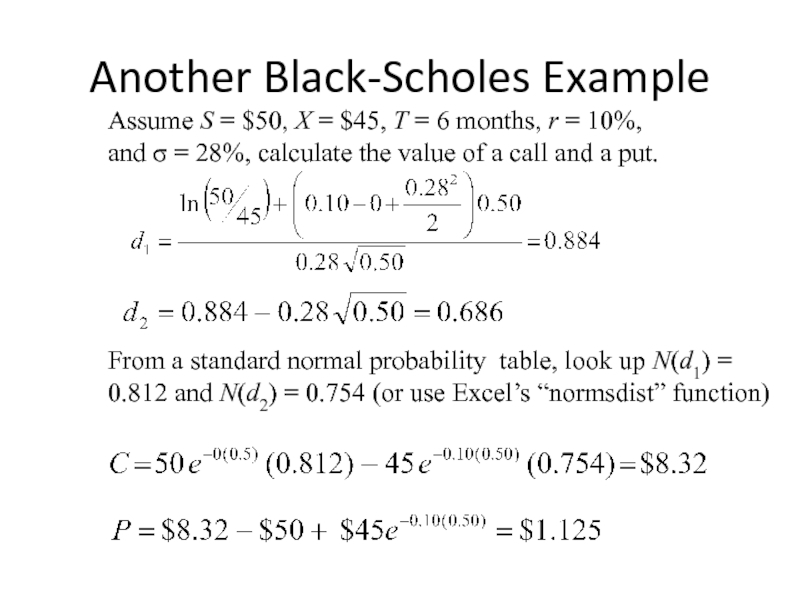

- 57. Assume S = $50, X = $45,

- 58. 22.9 Stocks and Bonds as Options Levered

- 59. 22.9 Stocks and Bonds as Options Levered

- 60. 22.9 Stocks and Bonds as Options It

- 61. 22.10 Capital-Structure Policy and Options Recall some

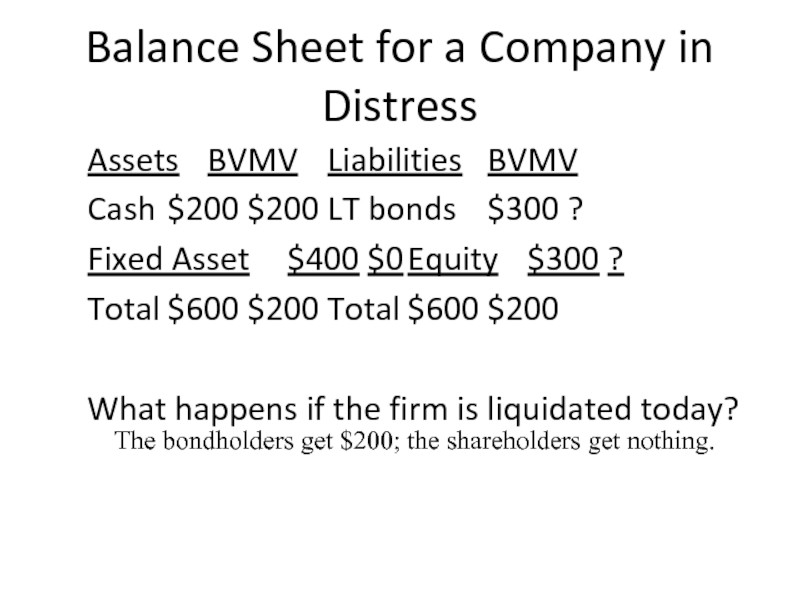

- 62. Balance Sheet for a Company in Distress

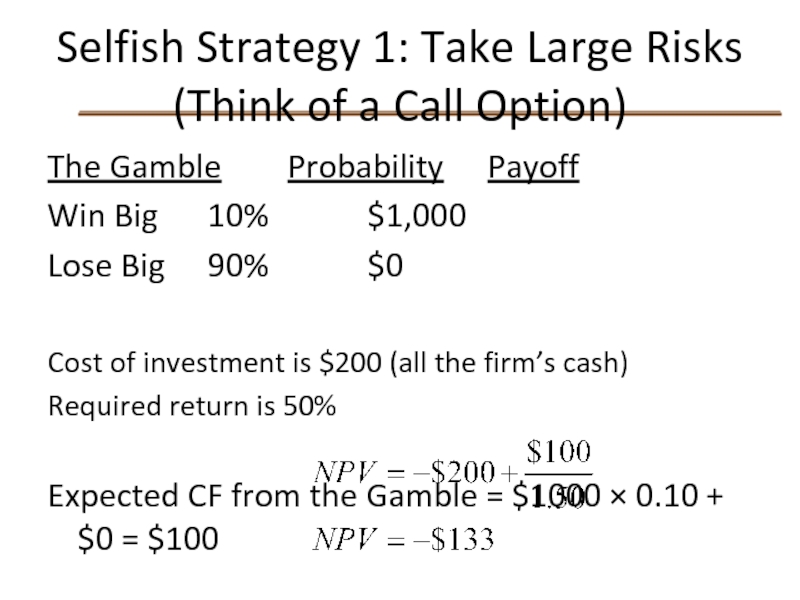

- 63. Selfish Strategy 1: Take Large Risks

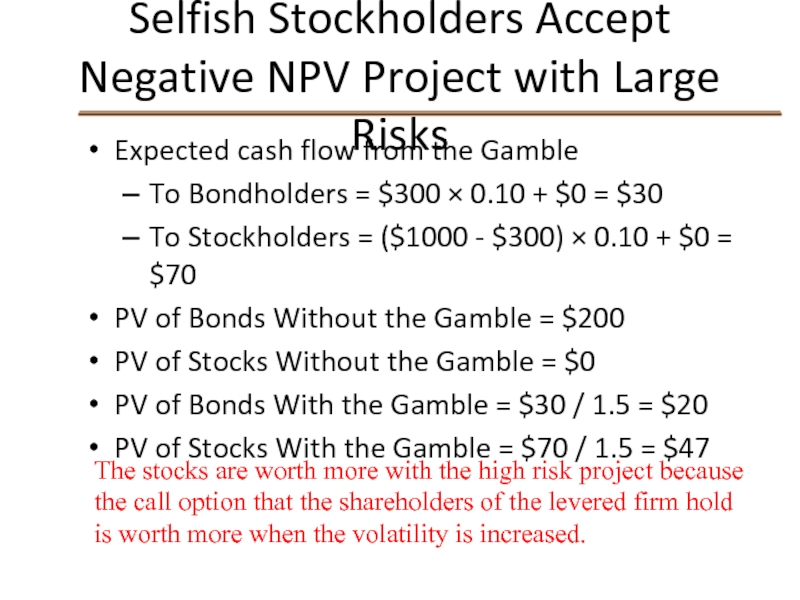

- 64. Selfish Stockholders Accept Negative NPV Project

- 65. 22.11 Mergers and Options This is an

- 66. 22.12 Investment in Real Projects & Options

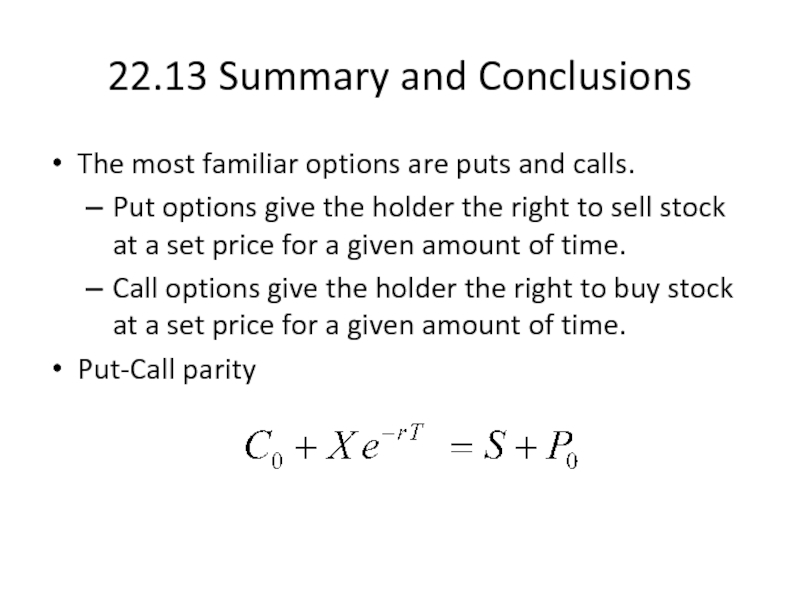

- 67. 22.13 Summary and Conclusions The most familiar

- 68. 22.13 Summary and Conclusions The value of

Слайд 122.1 Options

22.2 Call Options

22.3 Put Options

22.4 Selling Options

22.5 Stock Option Quotations

22.6

22.7 Valuing Options

22.8 An Option‑Pricing Formula

22.9 Stocks and Bonds as Options

22.10 Capital-Structure Policy and Options

22.11 Mergers and Options

22.12 Investment in Real Projects and Options

22.13 Summary and Conclusions

Слайд 222.1 Options

Many corporate securities are similar to the stock options that

Almost every issue of corporate stocks and bonds has option features.

In addition, capital structure and capital budgeting decisions can be viewed in terms of options.

Слайд 322.1 Options Contracts: Preliminaries

An option gives the holder the right, but

Calls versus Puts

Call options gives the holder the right, but not the obligation, to buy a given quantity of some asset at some time in the future, at prices agreed upon today. When exercising a call option, you “call in” the asset.

Put options gives the holder the right, but not the obligation, to sell a given quantity of an asset at some time in the future, at prices agreed upon today. When exercising a put, you “put” the asset to someone.

Слайд 422.1 Options Contracts: Preliminaries

Exercising the Option

The act of buying or selling

Strike Price or Exercise Price

Refers to the fixed price in the option contract at which the holder can buy or sell the underlying asset.

Expiry

The maturity date of the option is referred to as the expiration date, or the expiry.

European versus American options

European options can be exercised only at expiry.

American options can be exercised at any time up to expiry.

Слайд 5Options Contracts: Preliminaries

In-the-Money

The exercise price is less than the spot price

At-the-Money

The exercise price is equal to the spot price of the underlying asset.

Out-of-the-Money

The exercise price is more than the spot price of the underlying asset.

Слайд 6Options Contracts: Preliminaries

Intrinsic Value

The difference between the exercise price of the

Speculative Value

The difference between the option premium and the intrinsic value of the option.

Option Premium

=

Intrinsic Value

Speculative Value

+

Слайд 722.2 Call Options

Call options gives the holder the right, but not

When exercising a call option, you “call in” the asset.

Слайд 8Basic Call Option Pricing Relationships at Expiry

At expiry, an American call

If the call is in-the-money, it is worth ST - E.

If the call is out-of-the-money, it is worthless.

CaT = CeT = Max[ST - E, 0]

Where

ST is the value of the stock at expiry (time T)

E is the exercise price.

CaT is the value of an American call at expiry

CeT is the value of a European call at expiry

Слайд 9Call Option Payoffs

-20

100

90

80

70

60

0

10

20

30

40

50

-40

20

0

-60

40

60

Stock price ($)

Option payoffs ($)

Buy a call

Exercise price =

Слайд 1222.3 Put Options

Put options give the holder the right, but not

When exercising a put, you “put” the asset to someone.

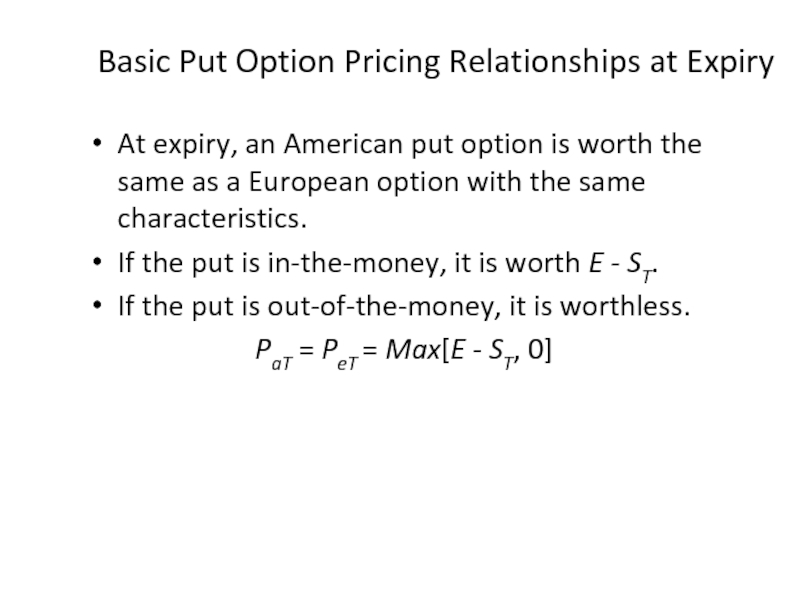

Слайд 13Basic Put Option Pricing Relationships at Expiry

At expiry, an American put

If the put is in-the-money, it is worth E - ST.

If the put is out-of-the-money, it is worthless.

PaT = PeT = Max[E - ST, 0]

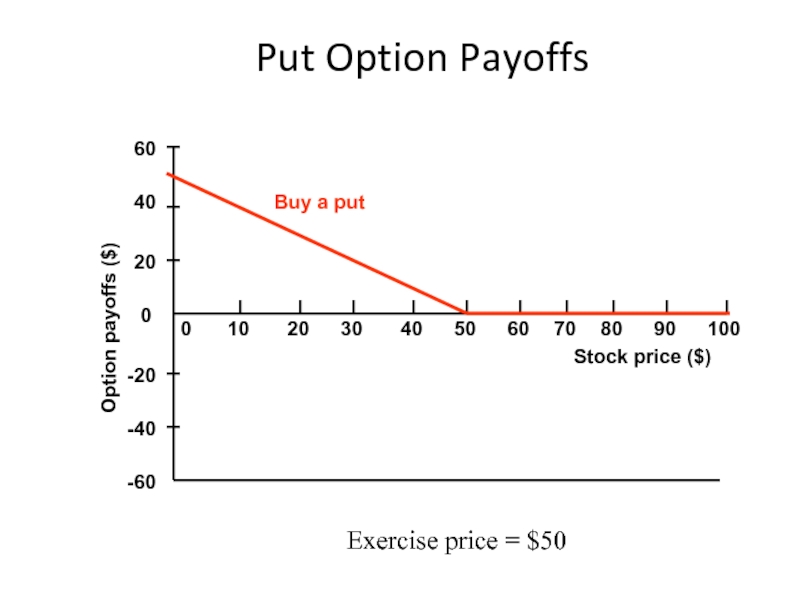

Слайд 14Put Option Payoffs

-20

100

90

80

70

60

0

10

20

30

40

50

-40

20

0

-60

40

60

Stock price ($)

Option payoffs ($)

Buy a put

Exercise price =

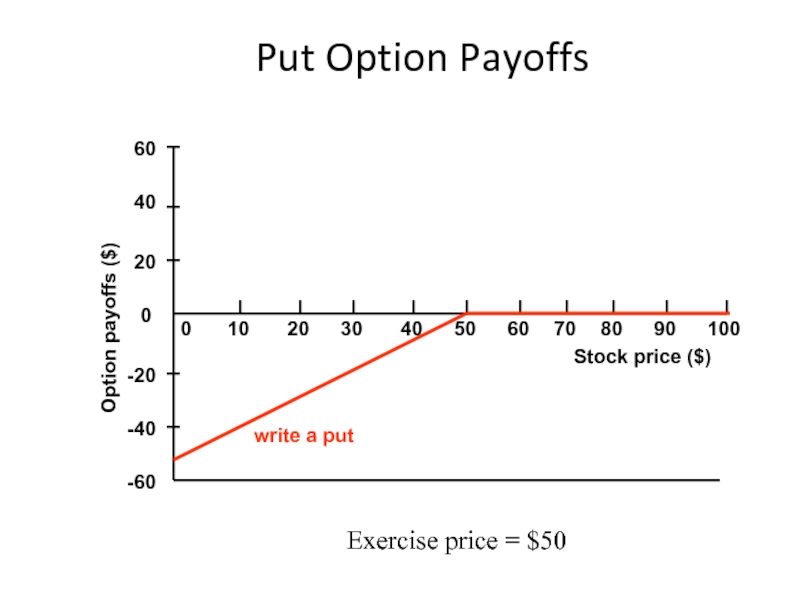

Слайд 15Put Option Payoffs

-20

100

90

80

70

60

0

10

20

30

40

50

-40

20

0

-60

40

60

Option payoffs ($)

write a put

Exercise price = $50

Stock price

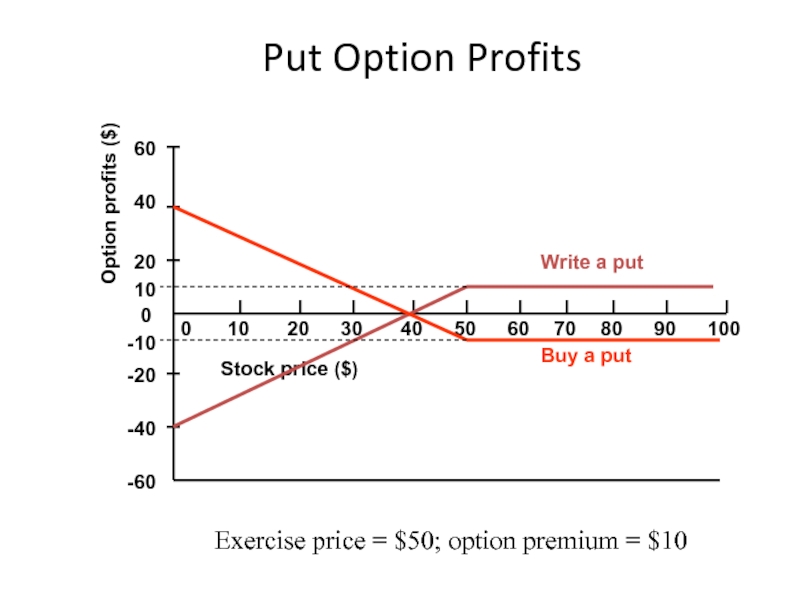

Слайд 16Put Option Profits

-20

100

90

80

70

60

0

10

20

30

40

50

-40

20

0

-60

40

60

Stock price ($)

Option profits ($)

Buy a put

Write a put

Exercise

10

-10

Слайд 1722.4 Selling Options

The seller (or writer) of an option has an

The purchaser of an option has an option.

Слайд 1922.5 Stock Option Quotations

This option has a strike price of $8;

A

June is the expiration month

Слайд 2022.5 Stock Option Quotations

This makes a call option with this exercise

Puts with this exercise price are out-of-the-money.

Слайд 2122.5 Stock Option Quotations

On this day, 15 call options with this

Слайд 2222.5 Stock Option Quotations

The holder of this CALL option can sell

Since the option is on 100 shares of stock, selling this option would yield $195.

Слайд 2322.5 Stock Option Quotations

Buying this CALL option costs $2.10.

Since the option

Слайд 2422.5 Stock Option Quotations

On this day, there were 660 call options

Слайд 2522.6 Combinations of Options

Puts and calls can serve as the building

If you understand this, you can become a financial engineer, tailoring the risk-return profile to meet your client’s needs.

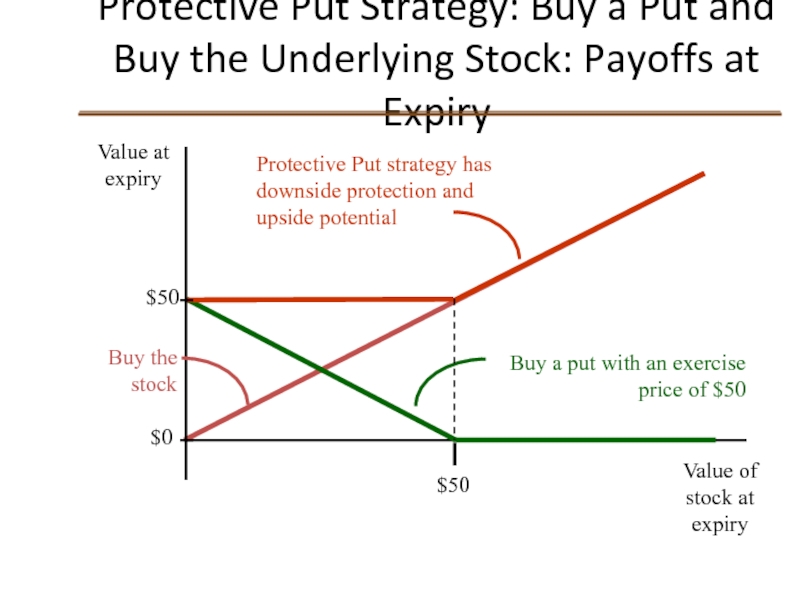

Слайд 26

Protective Put Strategy: Buy a Put and Buy the Underlying Stock:

Buy a put with an exercise price of $50

Buy the stock

Protective Put strategy has downside protection and upside potential

$50

$0

$50

Value at expiry

Value of stock at expiry

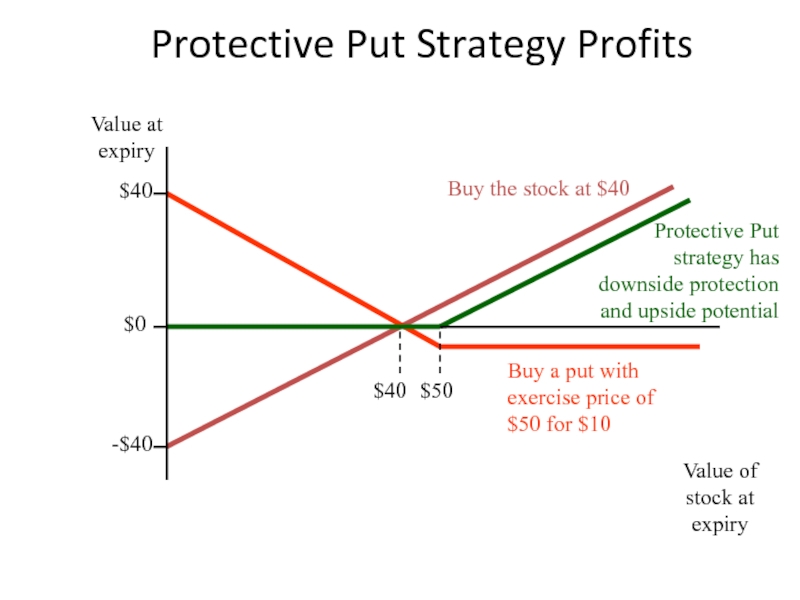

Слайд 27Protective Put Strategy Profits

Buy a put with exercise price of $50

Buy the stock at $40

$40

Protective Put strategy has downside protection and upside potential

$40

$0

-$40

$50

Value at expiry

Value of stock at expiry

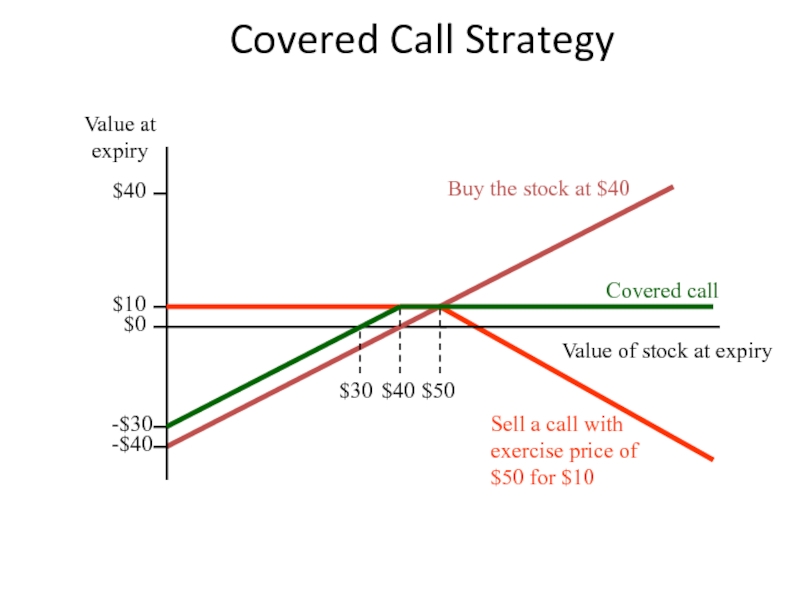

Слайд 28Covered Call Strategy

Sell a call with exercise price of $50 for

Buy the stock at $40

$40

Covered call

$40

$0

-$40

$10

-$30

$30

$50

Value of stock at expiry

Value at expiry

Слайд 29Long Straddle: Buy a Call and a Put

Buy a put with

$40

A Long Straddle only makes money if the stock price moves $20 away from $50.

$40

$0

-$20

$50

Buy a call with an exercise price of $50 for $10

-$10

$30

$60

$30

$70

Value of stock at expiry

Value at expiry

Слайд 30Short Straddle: Sell a Call and a Put

Sell a put with

$50 for $10

$40

A Short Straddle only loses money if the stock price moves $20 away from $50.

-$40

$0

-$30

$50

Sell a call with an

exercise price of $50 for $10

$10

$20

$60

$30

$70

Value of stock at expiry

Value at expiry

Слайд 31Long Call Spread

Sell a call with exercise price of $55 for

$55

long call spread

$5

$0

$50

Buy a call with an exercise price of $50 for $10

-$10

-$5

$60

Value of stock at expiry

Value at expiry

Слайд 32Put-Call Parity

Sell a put with an exercise price of $40

Buy the

Buy a call option with an exercise price of $40

$0

-$40

$40-P0

$40

Buy the stock at $40

-[$40-P0]

In market equilibrium, it mast be the case that option prices are set such that:

Otherwise, riskless portfolios with positive payoffs exist.

Value of stock at expiry

Value at expiry

Слайд 3322.7 Valuing Options

The last section concerned itself with the value of

This section considers the value of an option prior to the expiration date.

A much more interesting question.

Слайд 34Option Value Determinants

Call Put

Stock price + –

Exercise price – +

Interest rate +

Volatility in the stock price + +

Expiration date + +

The value of a call option C0 must fall within

max (S0 – E, 0) < C0 < S0.

The precise position will depend on these factors.

Слайд 35

Market Value, Time Value, and Intrinsic Value for an American Call

CaT

Profit

loss

E

ST

Market Value

Intrinsic value

ST - E

Time value

Out-of-the-money

In-the-money

ST

The value of a call option C0 must fall within max (S0 – E, 0) < C0 < S0.

Слайд 3622.8 An Option‑Pricing Formula

We will start with a binomial option pricing

Then we will graduate to the normal approximation to the binomial for some real-world option valuation.

Слайд 37

Binomial Option Pricing Model

Suppose a stock is worth $25 today and

$25

$21.25

$28.75

S1

S0

Слайд 38Binomial Option Pricing Model

A call option on this stock with exercise

We can replicate the payoffs of the call option. With a levered position in the stock.

$25

$21.25

$28.75

S1

S0

C1

$3.75

$0

Слайд 39Binomial Option Pricing Model

Borrow the present value of $21.25 today and

The net payoff for this levered equity portfolio in one period is either $7.50 or $0.

The levered equity portfolio has twice the option’s payoff so the portfolio is worth twice the call option value.

$25

$21.25

$28.75

S1

S0

debt

- $21.25

portfolio

$7.50

$0

( - ) =

=

=

C1

$3.75

$0

- $21.25

Слайд 40Binomial Option Pricing Model

The levered equity portfolio value today

$25

$21.25

$28.75

S1

S0

debt

- $21.25

portfolio

$7.50

$0

( - ) =

=

=

C1

$3.75

$0

- $21.25

Слайд 41Binomial Option Pricing Model

We can value the option today as half

$25

$21.25

$28.75

S1

S0

debt

- $21.25

portfolio

$7.50

$0

( - ) =

=

=

C1

$3.75

$0

- $21.25

Слайд 42The Binomial Option Pricing Model

If the interest rate is 5%, the

$25

$21.25

$28.75

S1

S0

debt

- $21.25

portfolio

$7.50

$0

( - ) =

=

=

C1

$3.75

$0

- $21.25

Слайд 43The Binomial Option Pricing Model

If the interest rate is 5%, the

$25

$21.25

$28.75

S1

S0

debt

- $21.25

portfolio

$7.50

$0

( - ) =

=

=

C1

$3.75

$0

- $21.25

Слайд 44Binomial Option Pricing Model

the replicating portfolio intuition.

Many derivative securities can be

The most important lesson (so far) from the binomial option pricing model is:

Слайд 45The Risk-Neutral Approach to Valuation

We could value V(0) as the value

S(0), V(0)

S(U), V(U)

S(D), V(D)

q

1- q

Слайд 46

The Risk-Neutral Approach to Valuation

S(0) is the value of the underlying

S(0), V(0)

S(U), V(U)

S(D), V(D)

S(U) and S(D) are the values of the asset in the next period following an up move and a down move, respectively.

q

1- q

V(U) and V(D) are the values of the asset in the next period following an up move and a down move, respectively.

q is the risk-neutral probability of an “up” move.

Слайд 47The Risk-Neutral Approach to Valuation

The key to finding q is to

A minor bit of algebra yields:

Слайд 48Example of the Risk-Neutral Valuation of a Call:

Suppose a stock is

The binomial tree would look like this:

$21.25,C(D)

q

1- q

$25,C(0)

$28.75,C(D)

Слайд 49Example of the Risk-Neutral Valuation of a Call:

The next step would

$21.25,C(D)

2/3

1/3

$25,C(0)

$28.75,C(D)

Слайд 50Example of the Risk-Neutral Valuation of a Call:

After that, find the

$21.25, $0

2/3

1/3

$25,C(0)

$28.75, $3.75

Слайд 51Example of the Risk-Neutral Valuation of a Call:

Finally, find the value

$25,$2.38

Слайд 52Risk-Neutral Valuation and the Replicating Portfolio

This risk-neutral result is consistent with

Слайд 53The Black-Scholes Model

The Black-Scholes Model is

Where

C0 = the value of a

r = the risk-free interest rate.

N(d) = Probability that a standardized, normally distributed, random variable will be less than or equal to d.

The Black-Scholes Model allows us to value options in the real world just as we have done in the two-state world.

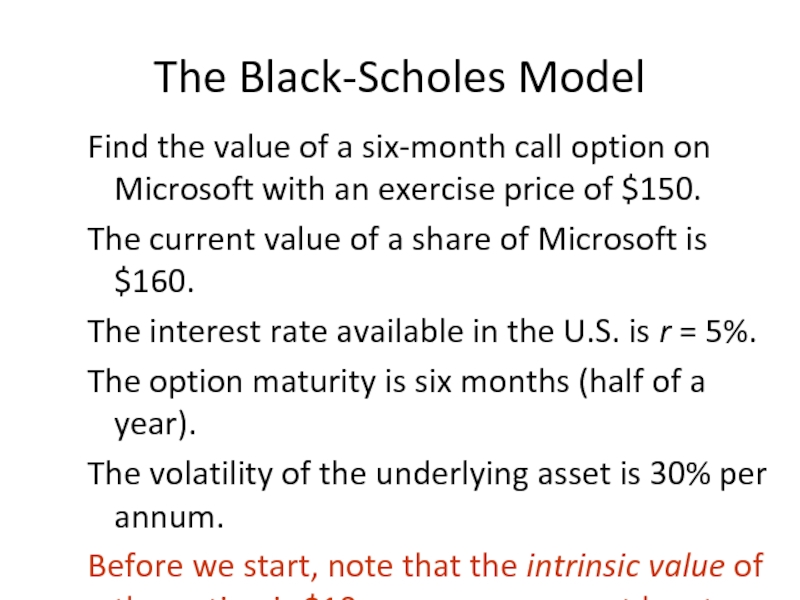

Слайд 54The Black-Scholes Model

Find the value of a six-month call option on

The current value of a share of Microsoft is $160.

The interest rate available in the U.S. is r = 5%.

The option maturity is six months (half of a year).

The volatility of the underlying asset is 30% per annum.

Before we start, note that the intrinsic value of the option is $10—our answer must be at least that amount.

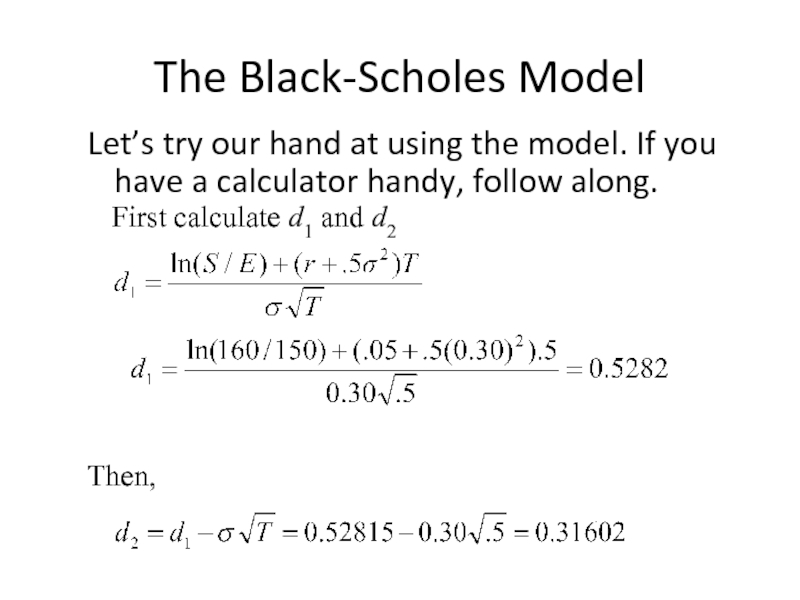

Слайд 55The Black-Scholes Model

Let’s try our hand at using the model. If

Then,

First calculate d1 and d2

Слайд 57Assume S = $50, X = $45, T = 6 months,

and σ = 28%, calculate the value of a call and a put.

From a standard normal probability table, look up N(d1) = 0.812 and N(d2) = 0.754 (or use Excel’s “normsdist” function)

Another Black-Scholes Example

Слайд 5822.9 Stocks and Bonds as Options

Levered Equity is a Call Option.

The

The strike price is the payoff of the bond.

If at the maturity of their debt, the assets of the firm are greater in value than the debt, the shareholders have an in-the-money call, they will pay the bondholders, and “call in” the assets of the firm.

If at the maturity of the debt the shareholders have an out-of-the-money call, they will not pay the bondholders (i.e., the shareholders will declare bankruptcy), and let the call expire.

Слайд 5922.9 Stocks and Bonds as Options

Levered Equity is a Put Option.

The

The strike price is the payoff of the bond.

If at the maturity of their debt, the assets of the firm are less in value than the debt, shareholders have an in-the-money put.

They will put the firm to the bondholders.

If at the maturity of the debt the shareholders have an out-of-the-money put, they will not exercise the option (i.e., NOT declare bankruptcy) and let the put expire.

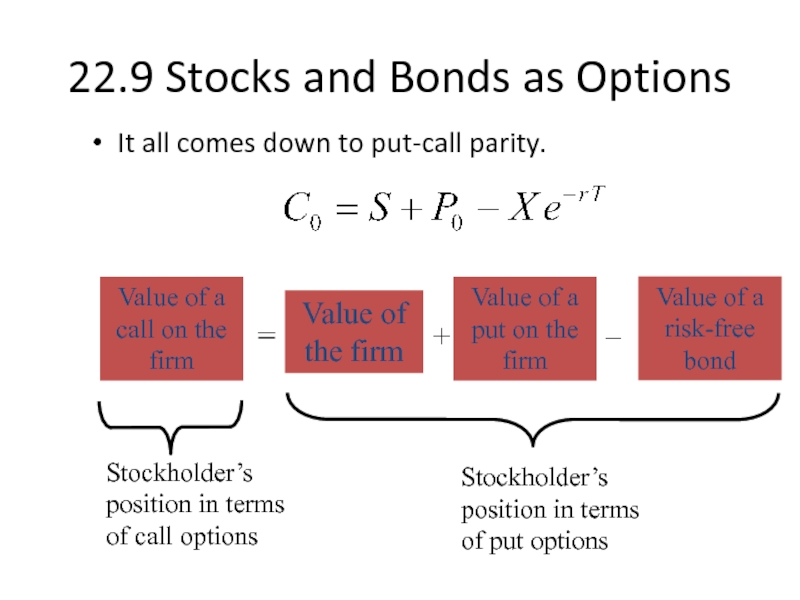

Слайд 6022.9 Stocks and Bonds as Options

It all comes down to put-call

Stockholder’s position in terms of call options

Stockholder’s position in terms of put options

Слайд 6122.10 Capital-Structure Policy and Options

Recall some of the agency costs of

For example, recall the incentive shareholders in a levered firm have to take large risks.

Слайд 62Balance Sheet for a Company in Distress

Assets BV MV Liabilities BV MV

Cash $200 $200 LT bonds $300 ?

Fixed Asset $400 $0 Equity $300 ?

Total $600 $200 Total $600 $200

What happens if

The bondholders get $200; the shareholders get nothing.

Слайд 63

Selfish Strategy 1: Take Large Risks

(Think of a Call Option)

The

Win Big 10% $1,000

Lose Big 90% $0

Cost of investment is $200 (all the firm’s cash)

Required return is 50%

Expected CF from the Gamble = $1000 × 0.10 + $0 = $100

Слайд 64

Selfish Stockholders Accept Negative NPV Project with Large Risks

Expected cash flow

To Bondholders = $300 × 0.10 + $0 = $30

To Stockholders = ($1000 - $300) × 0.10 + $0 = $70

PV of Bonds Without the Gamble = $200

PV of Stocks Without the Gamble = $0

PV of Bonds With the Gamble = $30 / 1.5 = $20

PV of Stocks With the Gamble = $70 / 1.5 = $47

The stocks are worth more with the high risk project because the call option that the shareholders of the levered firm hold is worth more when the volatility is increased.

Слайд 6522.11 Mergers and Options

This is an area rich with optionality, both

Слайд 6622.12 Investment in Real Projects & Options

Classic NPV calculations typically ignore

The next chapter will take up this point.

Слайд 6722.13 Summary and Conclusions

The most familiar options are puts and calls.

Put

Call options give the holder the right to buy stock at a set price for a given amount of time.

Put-Call parity

Слайд 6822.13 Summary and Conclusions

The value of a stock option depends on

1. Current price of underlying stock.

2. Dividend yield of the underlying stock.

3. Strike price specified in the option contract.

4. Risk-free interest rate over the life of the contract.

5. Time remaining until the option contract expires.

6. Price volatility of the underlying stock.

Much of corporate financial theory can be presented in terms of options.

Common stock in a levered firm can be viewed as a call option on the assets of the firm.

Real projects often have hidden options that enhance value.